In 2025, the landscape of on-chain derivatives trading is undergoing a profound transformation, driven by the rapid ascent of perpetual DEX aggregators. These platforms are not only reshaping how liquidity is sourced and deployed but also redefining the standards for execution speed, user accessibility, and risk management in decentralized finance (DeFi). As the perpetual DEX boom accelerates, traders and institutions alike are gravitating toward aggregators that promise deep liquidity, cross-chain flexibility, and seamless execution, ushering in a new era for decentralized derivatives markets.

The Rise of Perpetual DEX Aggregators: From Fragmentation to Unified Liquidity

Historically, on-chain derivatives markets have suffered from fragmented liquidity and inconsistent user experiences. Traders were forced to navigate multiple exchanges, each with its own order book depth, fee structure, and supported assets. The emergence of perpetual DEX aggregators like Ranger, 1perp, and Hyperliquid has fundamentally altered this dynamic. These aggregators employ sophisticated Smart Order Routing (SOR) algorithms that automatically scan across dozens of decentralized exchanges to secure optimal pricing and minimize slippage.

Smart Order Routing, once exclusive to high-frequency trading desks in traditional finance, now empowers DeFi participants to access best-in-class execution with a single click. By routing trades across chains, including Ethereum L2s, Tron-based venues like Sunperp, and emerging multichain protocols, aggregators ensure that users benefit from aggregated liquidity pools previously siloed by network boundaries.

Cross-Chain Liquidity Aggregation: Breaking Down Barriers

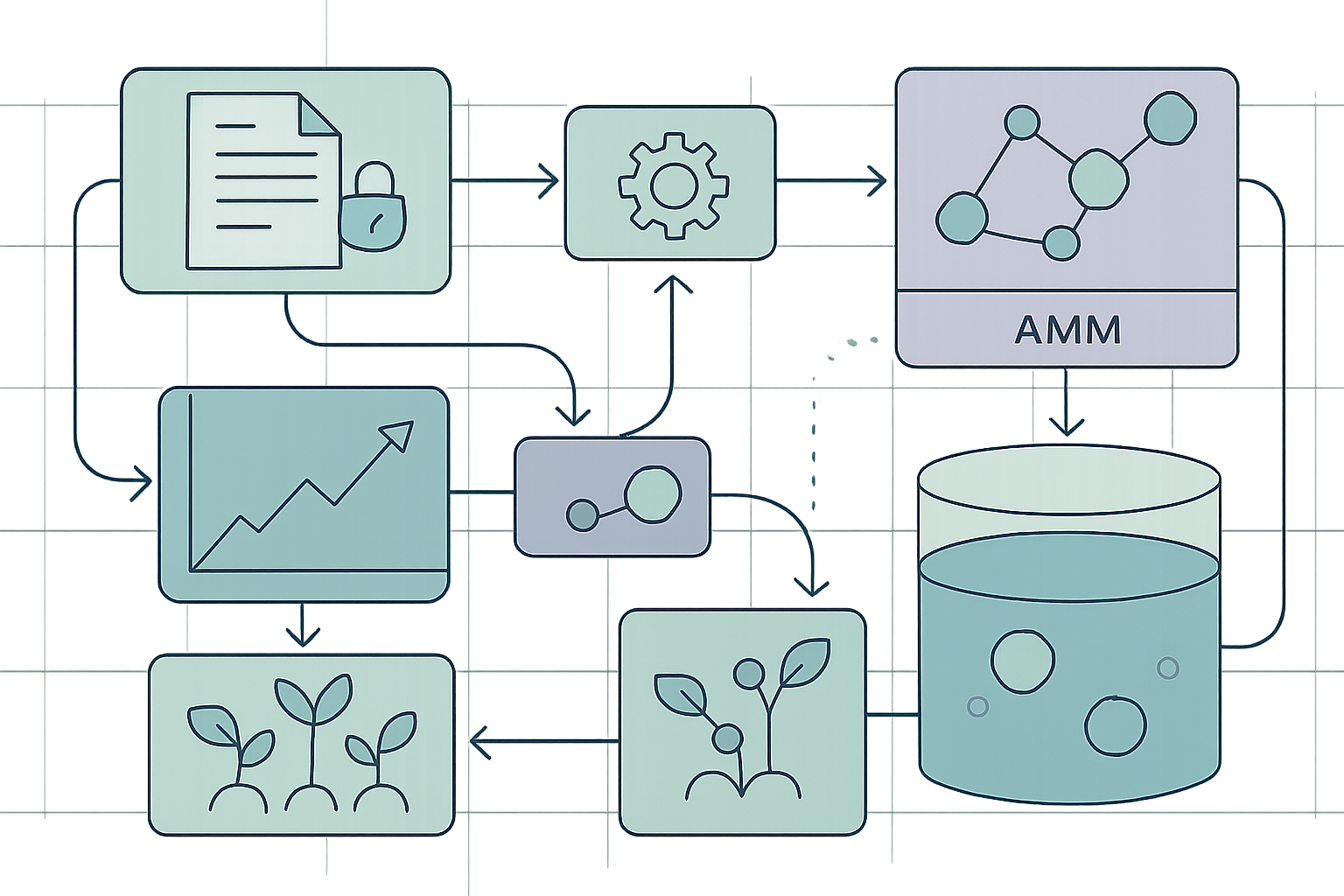

The technical leap forward in 2025 has been the successful implementation of cross-chain liquidity aggregation. This innovation is achieved through three primary models:

- Native Multi-Chain Deployment: Protocols launch natively across several blockchains to pool liquidity directly at the source.

- Cross-Chain Bridging Protocols: Bridges facilitate asset movement and synchronized state between chains.

- Chain Abstraction Layers: Abstract away chain-specific complexities so users can interact with any market without manual bridging or wallet switching.

This evolution means traders can open or close positions on non-native perpetual markets, such as accessing Hyperliquid’s order book from an L2 wallet or routing stablecoin collateral through Eco Portal, without operational friction. Notably, platforms like Vooi_io have pushed boundaries further by introducing zero gas fee trading combined with AI-powered smart routing. The result is a frictionless experience where capital efficiency is maximized across networks without sacrificing security or transparency.

The Data Revolution: Real-Time Analytics and Competitive Edge

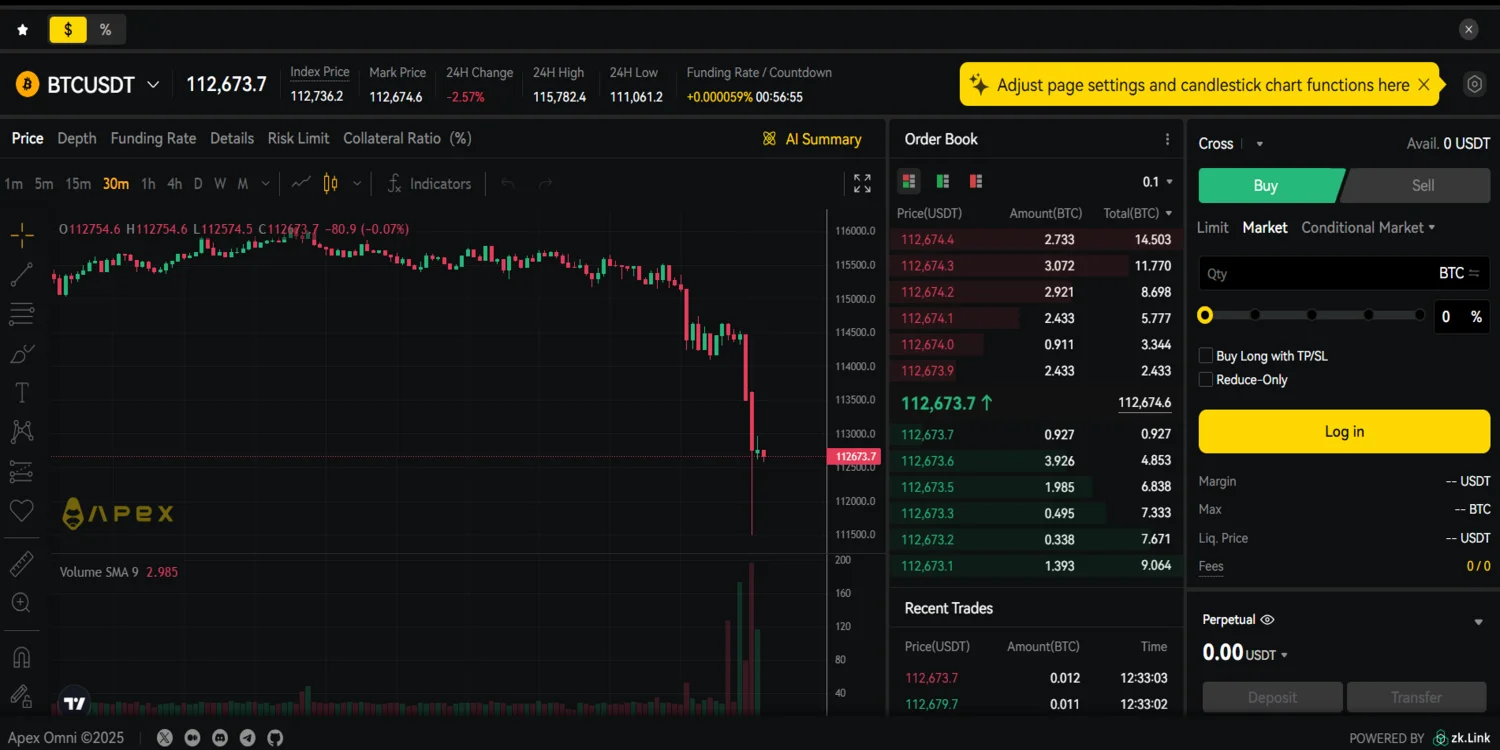

The proliferation of perpetual DEX aggregators has also sparked a revolution in data transparency and analytics. Modern platforms now offer comprehensive dashboards displaying live order flow metrics, funding rates, open interest breakdowns, and market depth visualizations, features once reserved for centralized exchanges. For example, Hyperliquid’s analytics suite provides institutional-grade insights that inform both discretionary traders and systematic strategies alike.

This real-time data arms participants with actionable intelligence for risk management and alpha generation. In tandem with unified interfaces supporting spot-perpetual-OTC workflows, and even tokenized real-world assets, the best perpetual DEX aggregator solutions are rapidly closing the gap between DeFi infrastructure and professional trading standards seen in legacy markets.

A Surge in Market Activity: On-Chain Derivatives Volumes Reach New Highs

The impact of these innovations is reflected in explosive growth metrics. As highlighted by recent market data:

- Hyperliquid commands 70% of on-chain perpetual market share, processing over $22 billion in daily volume, a testament to its deep liquidity pools and sub-second execution capabilities.

- Total on-chain perpetual futures volumes hit $2.6 trillion in 2025, marking a staggering 138% year-over-year increase as more traders migrate from centralized venues to decentralized alternatives (source).

This surge underscores not just increased adoption but also growing confidence among both retail users and institutional players in the reliability of decentralized derivatives infrastructure.

With this dramatic uptick in activity, the competitive landscape for decentralized derivatives platforms is undergoing rapid reshuffling. The emergence of new players like Sunperp on Tron, Vooi_io with its zero gas fee model, and established leaders such as Hyperliquid and Jupiter, has intensified innovation cycles. These platforms are racing to differentiate through advanced liquidity routing, AI-powered trade execution, and seamless cross-chain interoperability. The result is a market environment where execution latency is measured in milliseconds and users can access any major perpetual market without ever leaving their aggregator’s unified interface.

Yet, the true breakthrough in 2025 has been the maturation of chain abstraction layers. By abstracting away the complexities of blockchain infrastructure, next-gen aggregators now enable traders to interact with multiple networks as if they were a single venue. This eliminates the need for manual bridging or juggling multiple wallets, an advancement that not only streamlines user experience but also significantly reduces operational risk. For professional traders seeking cross-market arbitrage or sophisticated hedging strategies, these capabilities have become indispensable (deep dive here).

User Experience and Accessibility: Lowering Barriers for All Traders

The democratization of sophisticated derivatives trading tools is another defining theme of this cycle. Modern perp DEX aggregator benefits include one-click execution, intuitive risk dashboards, and integrated funding rate calculators, features that previously required bespoke solutions or institutional-grade terminals. By lowering these barriers to entry, aggregators are unlocking participation from a much broader spectrum of users: from algorithmic funds to individual DeFi enthusiasts.

This accessibility is further enhanced by AI-driven smart routing engines that dynamically optimize trade paths based on real-time liquidity conditions. Platforms like Vooi_io have demonstrated how zero gas fees and seamless cross-chain routing can bring institutional-grade performance to everyday traders, catalyzing even greater migration from centralized exchanges (more on Vooi_io’s impact).

Challenges Ahead: Security, Fragmentation and Regulatory Uncertainty

Despite their progress, perpetual DEX aggregators face ongoing challenges. Security remains paramount; as liquidity flows across chains and protocols via bridges or abstraction layers, attack surfaces expand. While most leading platforms employ robust auditing practices and real-time monitoring systems, exploits remain a non-trivial risk.

Fragmentation risk also persists as new networks launch proprietary standards or restrict interoperability for competitive advantage. Aggregators must continuously adapt their routing logic and integration frameworks to maintain comprehensive market access without compromising speed or reliability.

The regulatory outlook adds another layer of complexity. As decentralized derivatives volumes approach $2.6 trillion annually, scrutiny from global regulators intensifies, particularly around KYC/AML requirements and systemic risk controls within borderless DeFi ecosystems.

What’s Next? The Roadmap for Perpetual DEX Aggregators in 2026

The trajectory for on-chain derivatives trading 2025 suggests continued acceleration into 2026 as technical bottlenecks are resolved and user experience converges with (or surpasses) centralized alternatives. Expect further advances in:

- ZK-rollup integrations: Enabling ultra-fast settlement with reduced transaction costs across chains.

- Differentiated product offerings: Including options perps, volatility indices, funding rate derivatives (see how funding rate derivatives are evolving) and tokenized real-world assets.

- Sophisticated risk engines: Providing dynamic margining and portfolio-level analytics for both retail and institutional users.

- Community governance models: Empowering users to shape protocol upgrades and fee structures directly via on-chain voting mechanisms.

The era of fragmented DeFi trading is drawing to a close. As perpetual DEX aggregators continue to push boundaries in speed, transparency, and composability, they are cementing their role as the backbone infrastructure for next-generation digital asset markets, and making decentralized leverage trading truly accessible at global scale.