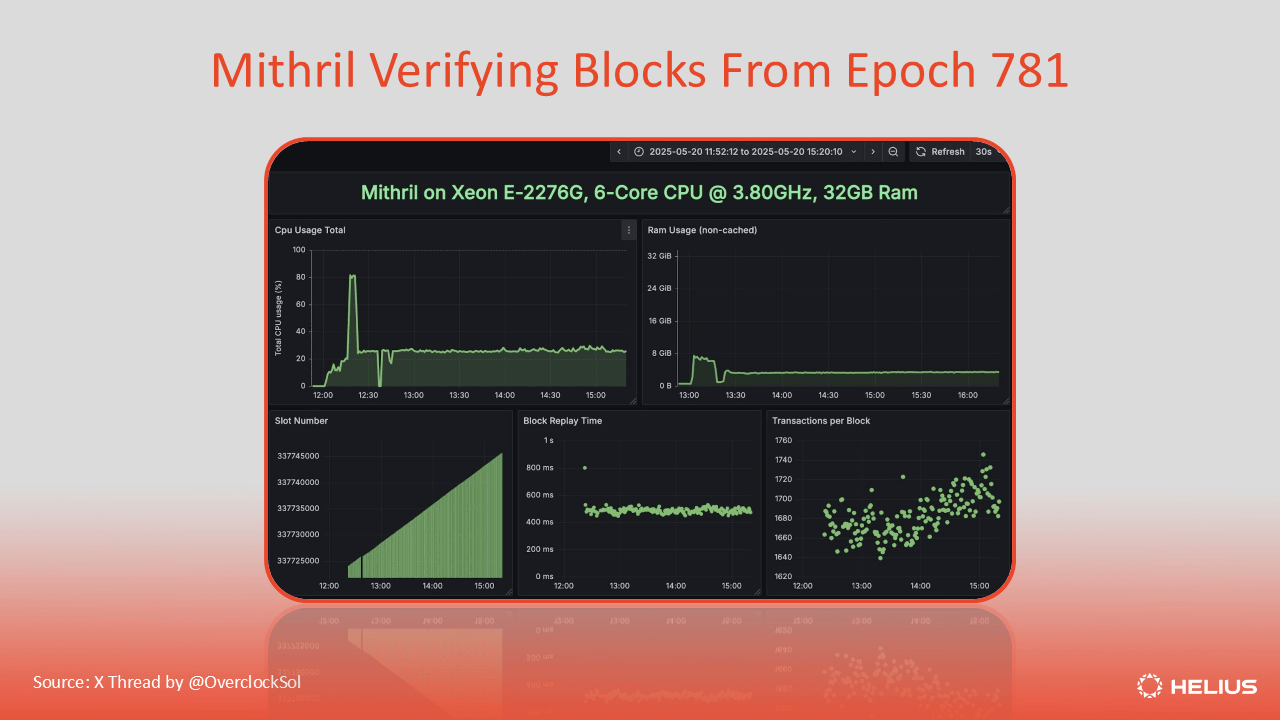

On-chain trading is experiencing a seismic shift, driven by the emergence of perpetual DEX aggregators like Ranger and 1perp. These platforms are dissolving the silos that have long fragmented liquidity, execution quality, and user experience in decentralized finance. In 2025, with perpetual DEX volumes soaring past $100B and the competitive landscape heating up among titans like Hyperliquid, Aster, and Lighter, the need for next-level execution has never been more acute. Enter the perpetual DEX aggregator: a game-changer for traders who demand speed, depth, and seamless cross-chain access.

Breaking Down Perpetual DEX Aggregators: Why They Matter Now

Traditional on-chain perpetual trading has been plagued by fragmented liquidity and inconsistent execution. Each DEX operates as its own island, forcing traders to manually compare prices, bridge assets, and hop between interfaces. This friction leads to missed opportunities, increased slippage, and suboptimal fills, unacceptable for any serious trader.

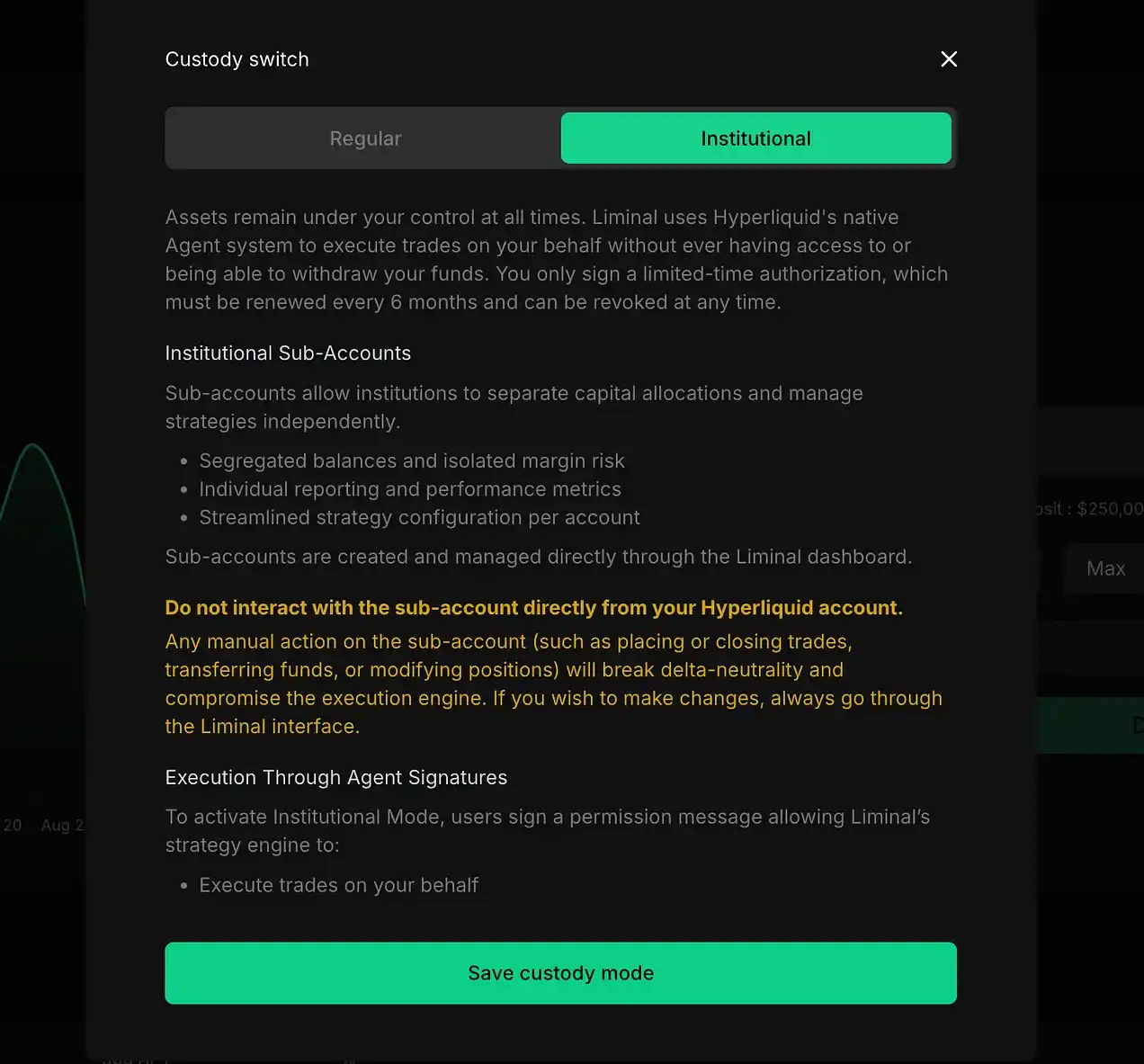

Perpetual DEX aggregators like Ranger Finance are rewriting the playbook. By unifying liquidity across multiple venues and deploying smart order routing (SOR) algorithms, these platforms deliver best execution perps DEX trading without the operational headaches. The result? Tighter spreads, lower slippage, and the ability to route large orders with minimal market impact. For high-frequency and institutional traders, this is the infrastructure upgrade DeFi has been waiting for.

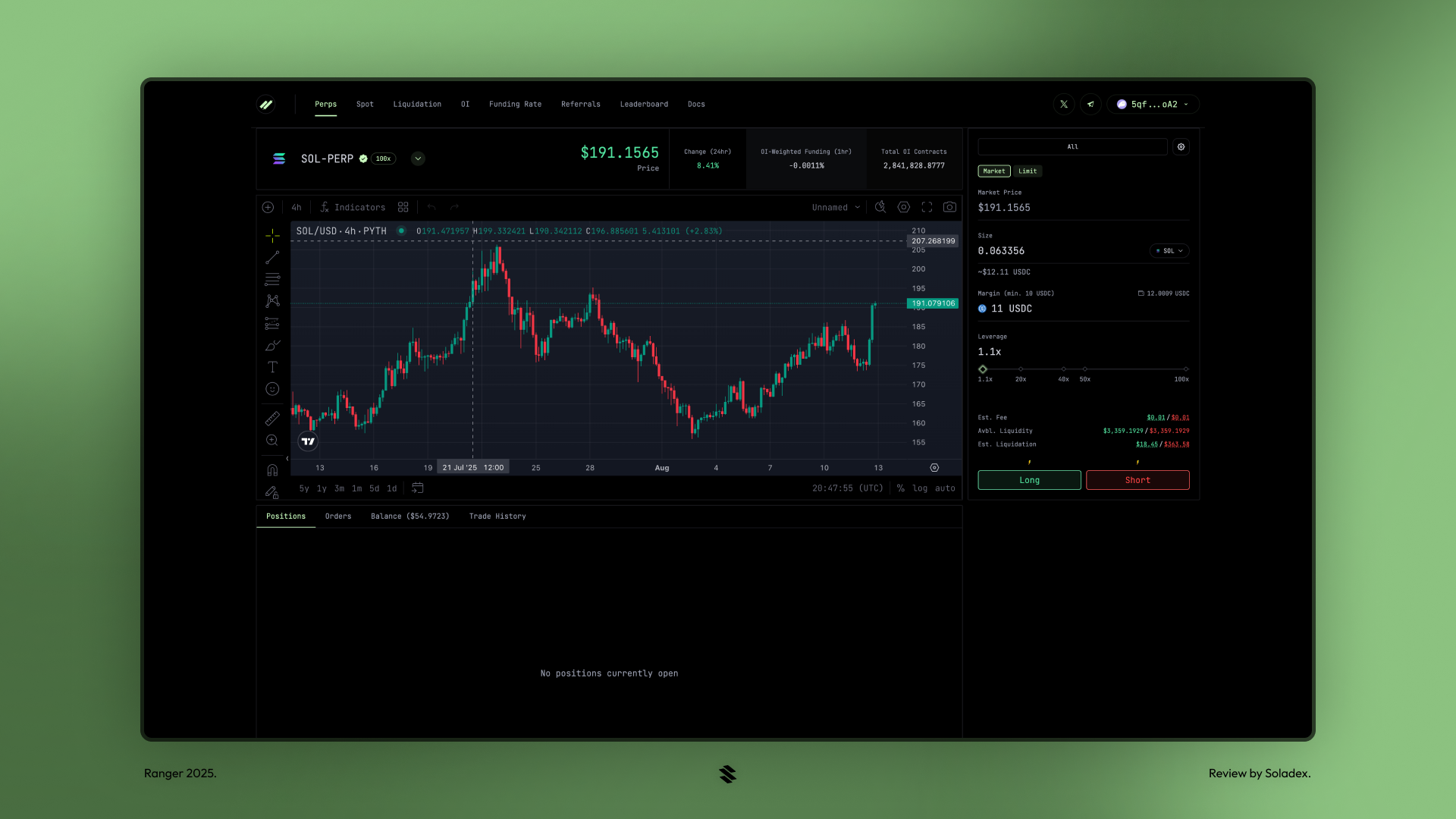

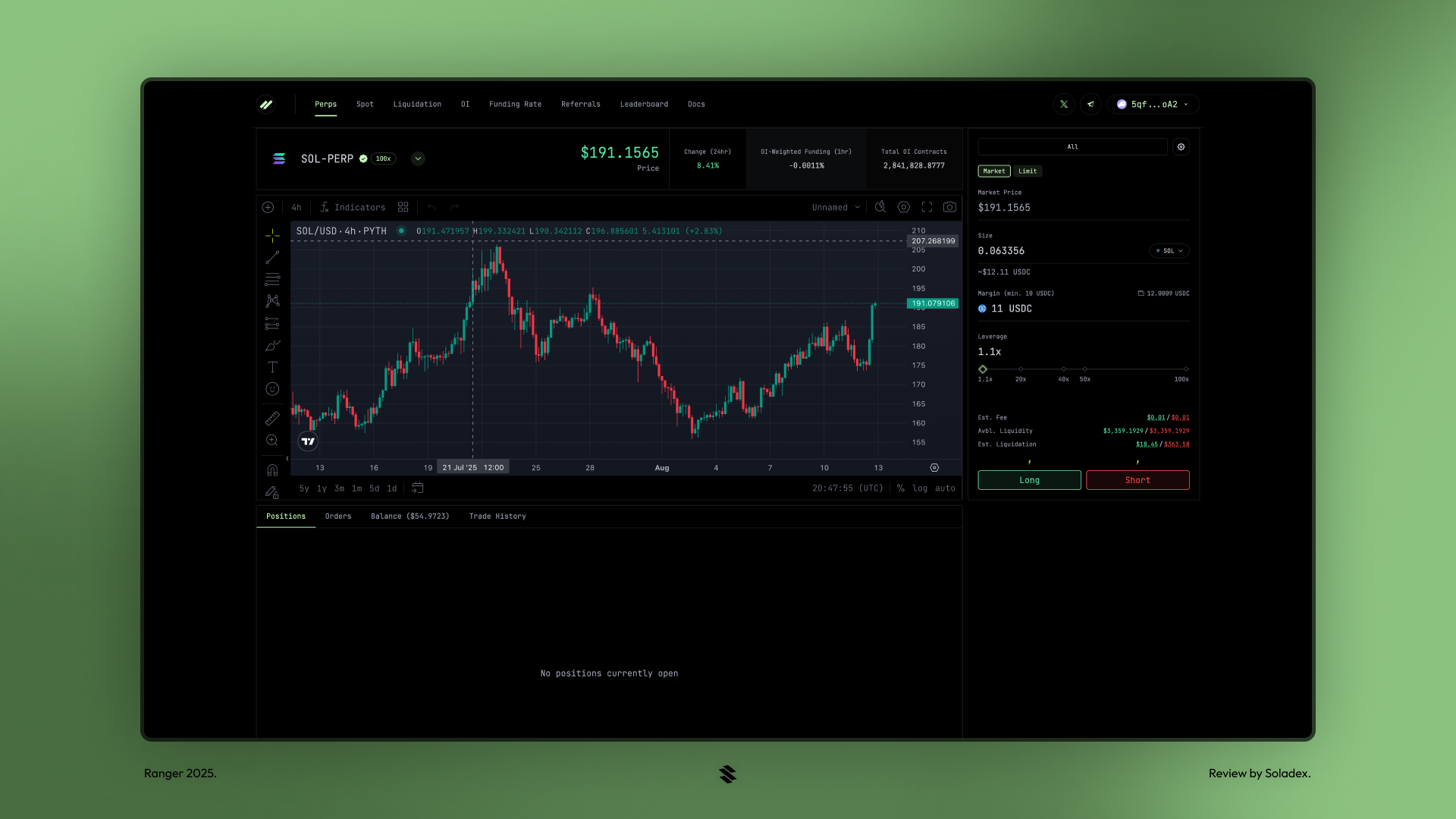

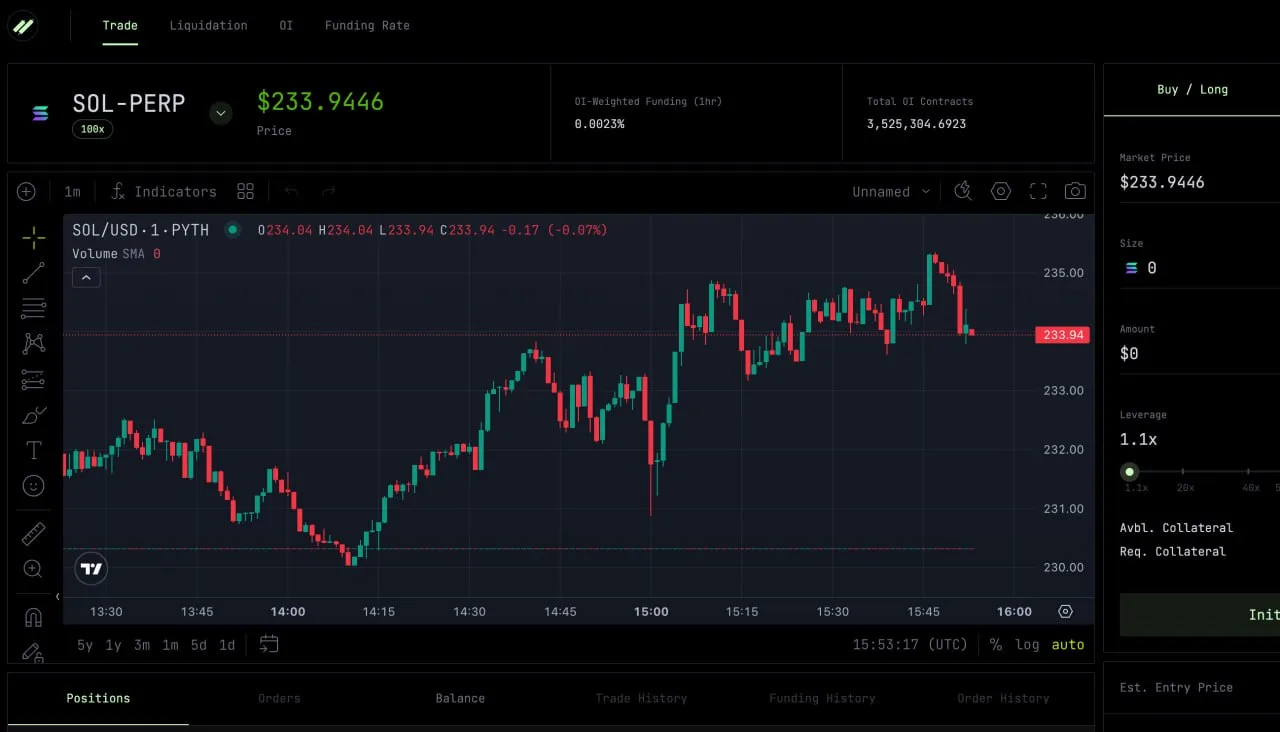

Ranger Perps Solana: The First True Aggregator

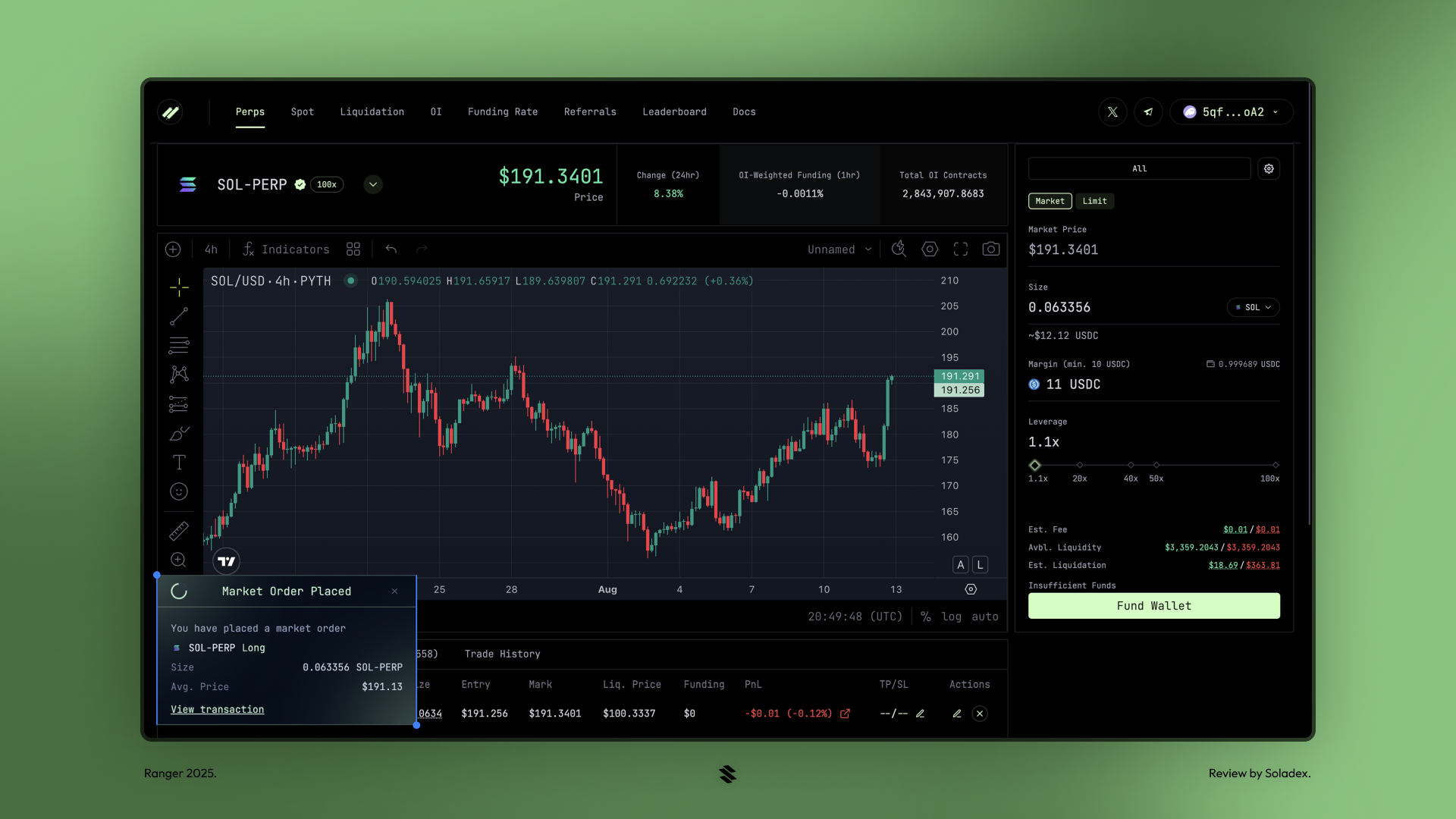

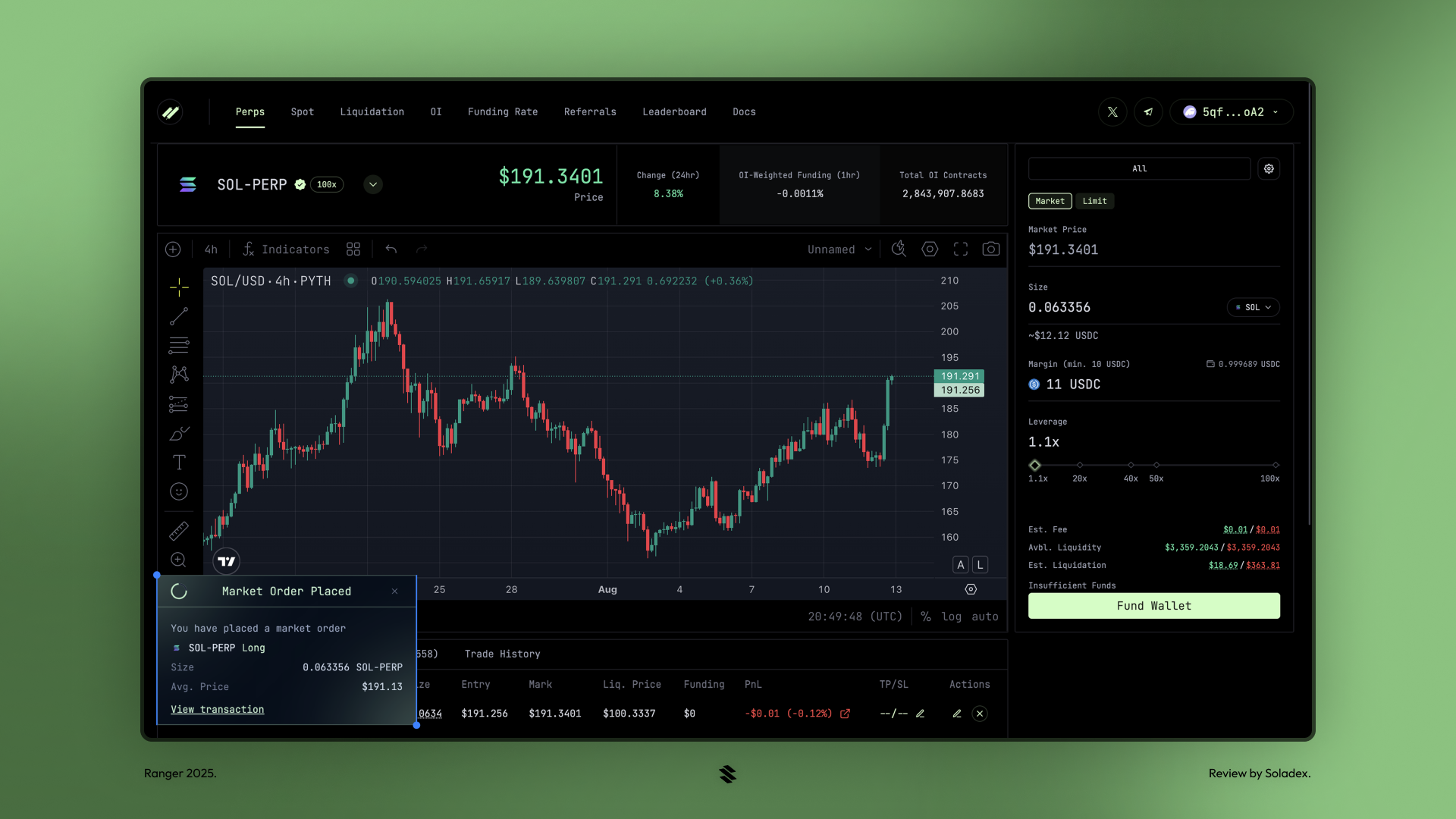

Ranger Finance has positioned itself as the default execution primitive for the perpetual DEX ecosystem on Solana. What sets Ranger apart? Its SOR engine dynamically scans available liquidity across integrated venues, including Hyperliquid (now live on Ranger), and automatically routes orders for optimal price and fill quality. No more manual bridging or managing multiple wallets, traders gain one-click access to cross-chain perpetual trading, even on non-native markets.

This architecture is already delivering tangible benefits:

Top Benefits of Using Ranger Perps Solana

-

Aggregated Liquidity Across Multiple DEXs: Ranger Perps unifies fragmented liquidity from various Solana-based and non-native perpetual markets, enabling traders to access deeper order books and better pricing without manually searching different platforms.

-

Smart Order Routing for Optimal Execution: Powered by an advanced Smart Order Router (SOR), Ranger Perps automatically finds the best execution paths, minimizing slippage and fees for every trade.

-

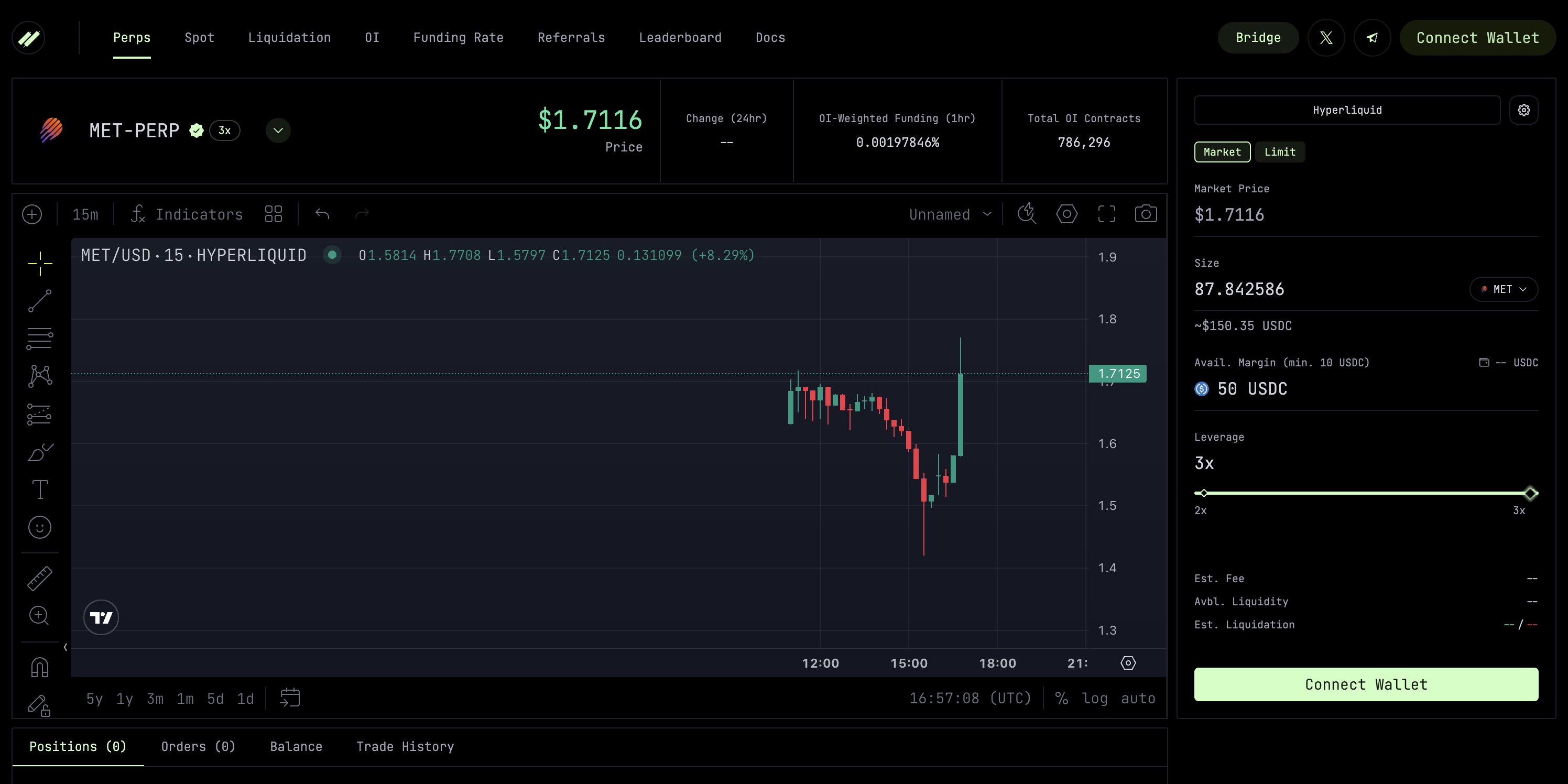

Seamless Cross-Chain Trading: With Hyperliquid now integrated, users can route orders to non-native perpetual markets without bridging funds or creating new accounts, simplifying cross-chain trading workflows.

-

Unified Multi-Asset Trading Experience: Ranger Perps supports spot, perpetuals, and OTC trading within a single, intuitive interface, streamlining access to diverse asset classes including tokenized equities and RWAs.

-

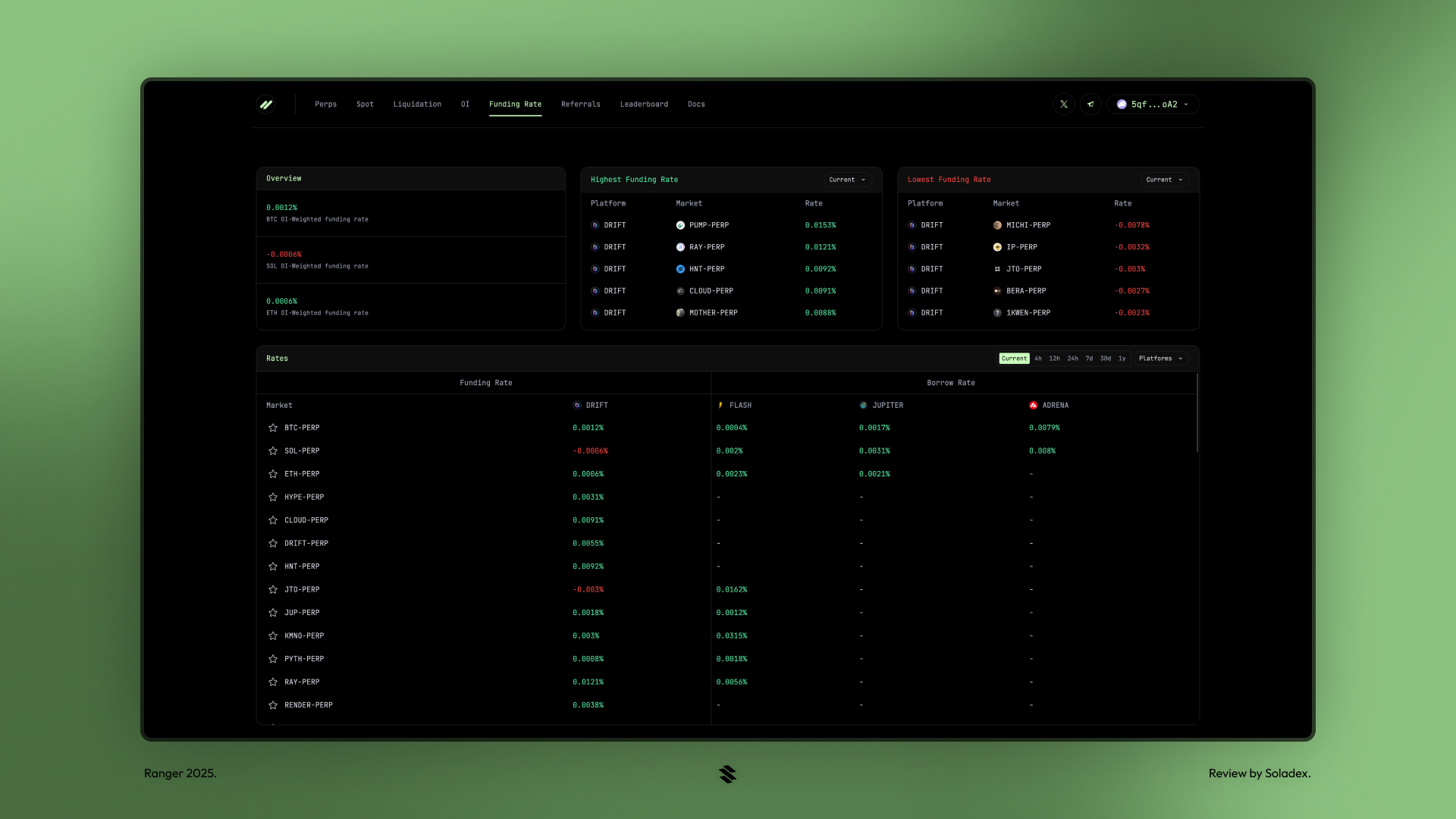

Real-Time Analytics and Data Insights: The platform provides robust analytics tools and real-time market data, empowering traders to make informed decisions and monitor performance efficiently.

-

Accessible for U.S. Traders Without VPN: Ranger Perps allows U.S. users to access its full suite of trading tools without the need for VPNs, expanding decentralized trading accessibility.

With the integration of HyperliquidX, Ranger users now tap into deeper liquidity pools and enjoy faster execution speeds, an edge that’s especially critical in volatile market conditions. As noted by analysts, even as Hyperliquid’s market share slipped from 45% to 8%, its integration with Ranger cements its status as the most investment-attractive perp DEX (Yahoo Finance).

Smart Order Routing and Data Transparency: The New Standard

At the core of every leading perpetual DEX aggregator is a smart order router. Ranger’s SOR doesn’t just hunt for the best price, it factors in depth, latency, fees, and slippage across all connected venues. This means that even large trades can be executed with minimal market impact, a game-changer for whales and funds operating in size.

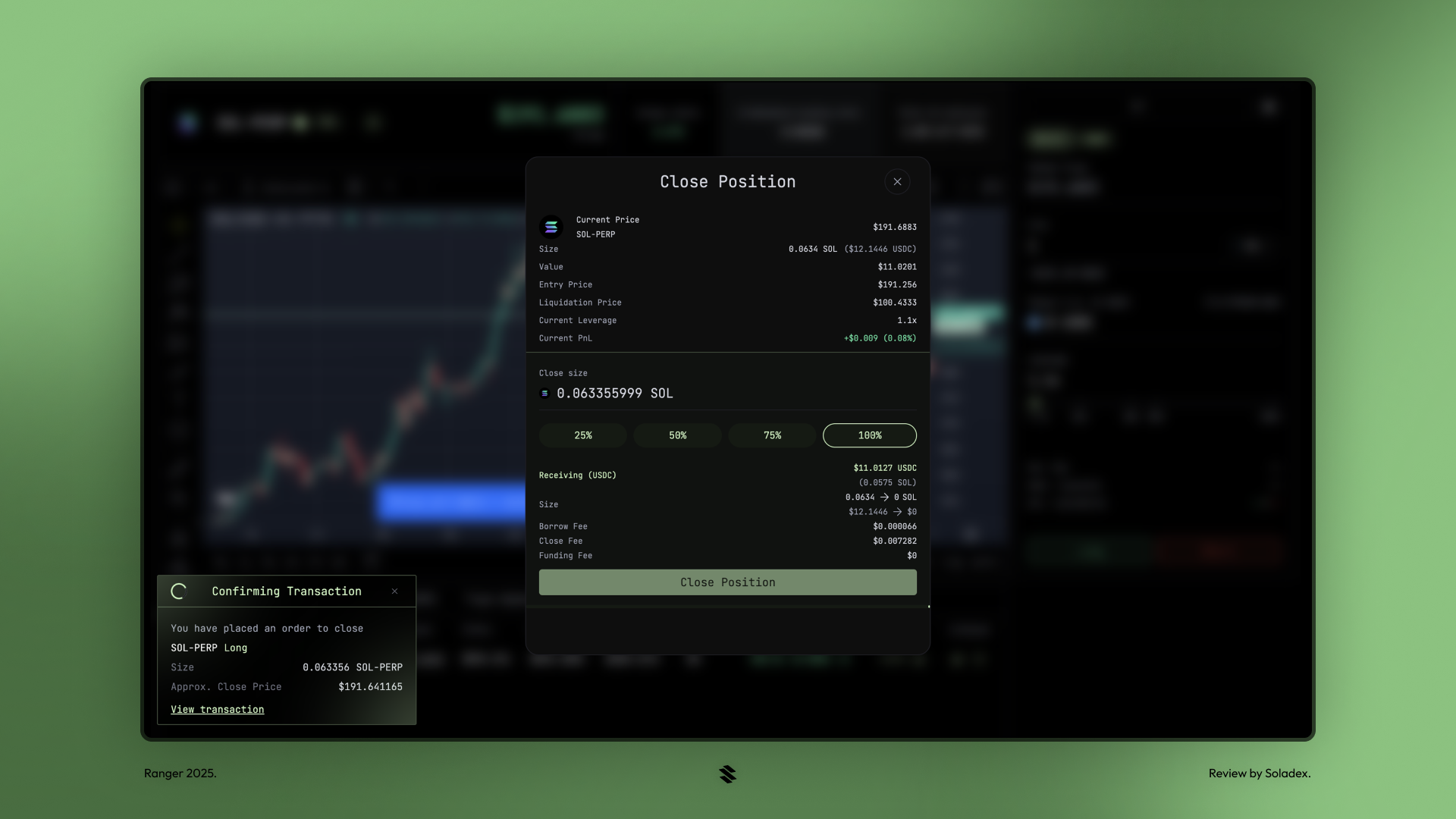

But it’s not just about execution. Platforms like Ranger deliver real-time analytics, advanced charting, and actionable insights directly within their interface. Traders can analyze liquidity trends, monitor funding rates, and make data-driven decisions without leaving the platform. This transparency and control are rapidly becoming table stakes in the race to build the best execution perps DEX.

Cross-Chain Perpetual Trading: One-Click, No Bridging Required

The days of manual bridging and fragmented user experiences are numbered. With Hyperliquid now live on Ranger, users can route orders to non-native perpetual markets without ever moving funds or setting up new wallets. This frictionless access is redefining what’s possible in DeFi, enabling true cross-chain perpetual trading that rivals even the best centralized exchanges in terms of speed and user experience.

The broader trend is clear: as aggregators like Ranger and 1perp mature, they’re not just improving execution, they’re fundamentally transforming how liquidity flows across DeFi. In this new paradigm, being first to market or having the deepest order book isn’t enough; seamless aggregation, data transparency, and user-centric design are now the key differentiators.

For sophisticated traders, the implications are profound. No longer constrained by the boundaries of individual DEXs, users can deploy capital where it’s most effective, without operational drag. The rise of perpetual DEX aggregators is also democratizing access: retail traders now benefit from the same best execution logic and deep liquidity that institutions demand. The result? A more level playing field and a surge in on-chain activity as barriers to entry fall away.

Ranger’s expansion into spot aggregation and support for real-world assets (RWAs) like tokenized equities signals an even broader ambition. By integrating these new asset classes into its unified interface, Ranger is positioning itself as a one-stop shop for all things DeFi, spot, perpetuals, OTC, and beyond. Notably, U. S. traders can now access these features without resorting to VPNs or complicated workarounds (source), further eroding the moat that centralized exchanges once enjoyed.

The Road Ahead: Aggregators as the New DeFi Powerhouses

Looking forward, expect the arms race among perpetual DEX aggregators to intensify. As volumes swell and new protocols enter the fray, platforms like Ranger and 1perp will compete on speed, transparency, and user experience. Hyperliquid’s integration with Ranger is just the opening salvo in what’s shaping up to be a multi-chain liquidity war, where smart order routing and real-time analytics will define the winners.

The data-driven trader should keep a close eye on how these aggregators evolve their algorithms and expand their venue coverage. With perpetual DEX volumes already topping $100B in 2025, the market is hungry for tools that offer both alpha generation and risk management at scale. The platforms that can deliver seamless cross-chain execution, granular data insights, and frictionless onboarding will capture outsized mindshare, and flow.

Top Features in Next-Gen Perpetual DEX Aggregators

-

Aggregated Liquidity Across Multiple Venues: Next-gen aggregators like Ranger Finance unify liquidity from leading perpetual DEXs—including Hyperliquid—delivering deeper order books and minimizing slippage for traders.

-

Smart Order Routing (SOR): Platforms such as Ranger deploy advanced SOR algorithms to automatically route trades for the best available price, lowest fees, and minimal price impact across supported markets.

-

Real-Time Analytics and Data Tools: Comprehensive analytics dashboards provide traders with actionable insights, including live order flow, funding rates, and market depth, empowering data-driven decision-making.

-

Multi-Asset and Cross-Market Support: Leading aggregators now enable seamless trading across spot, perpetuals, and OTC markets—sometimes even supporting real-world assets like tokenized equities within the same interface.

-

Cross-Chain and Non-Native Market Access: With integrations like Hyperliquid going live on Ranger, users can access non-native perpetual markets without bridging funds or setting up new wallets, streamlining the DeFi trading experience.

-

Unified User Experience with One-Click Execution: Modern DEX aggregators focus on intuitive interfaces and one-click trade execution, reducing friction and making advanced DeFi trading accessible to a broader audience.

The bottom line: perpetual DEX aggregators are rewriting the rules of on-chain trading. By abstracting away complexity and delivering institutional-grade execution to everyone, they’re not just changing the game, they’re building an entirely new arena for DeFi innovation. As smart routing becomes ubiquitous and liquidity walls crumble, expect a future where on-chain trading is faster, deeper, and more transparent than ever before.