Decentralized finance is evolving at a breakneck pace, and the emergence of chain abstraction is setting the stage for a new era of cross-chain perpetual trading. For active traders, the friction of bridging assets, juggling multiple wallets, and chasing liquidity across fragmented networks is more than just an inconvenience – it’s a barrier to speed, opportunity, and scale. The latest breakthroughs in chain abstraction are bulldozing these barriers, especially for those seeking the agility of perpetual DEX aggregators that span multiple blockchains.

Chain Abstraction: The Unifying Force for Cross-Chain Perps

At its core, chain abstraction is about making blockchain boundaries invisible to users and applications. It’s the secret sauce behind platforms like Vooi, Nekodex, and Chainge Finance, which are leading the charge in delivering a unified trading experience across 17 and chains and counting. By abstracting away the technical complexity of cross-chain interactions, these platforms empower traders to focus on what matters most: execution, leverage, and results.

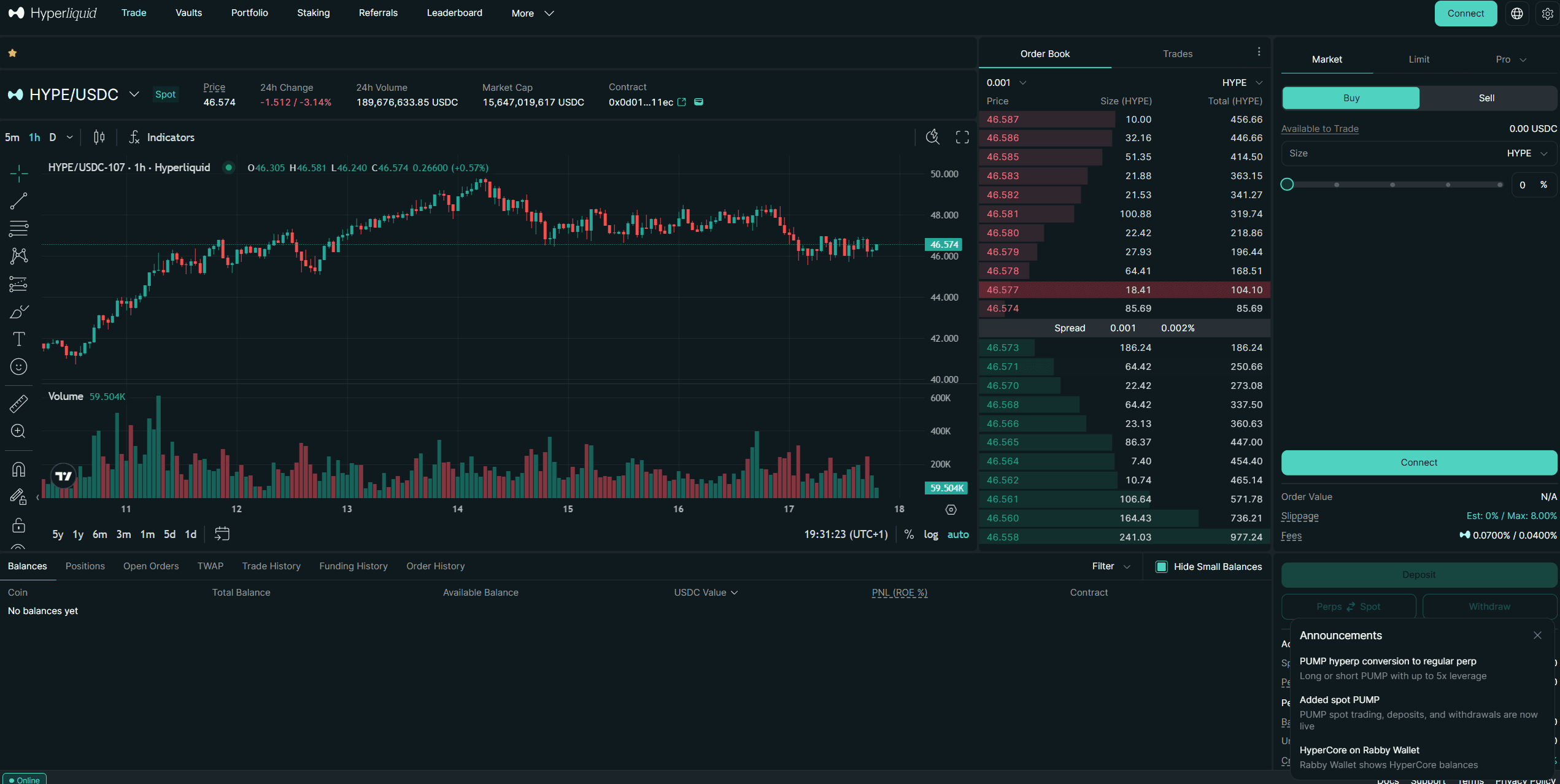

Imagine placing a leveraged trade on an asset living on a different chain – and having it settle instantly, without ever touching a bridge or switching wallets. That’s not just a vision; it’s live today with solutions like Vooi’s chain abstracted perp DEX aggregator. According to OneBalance and Binance research, Vooi orchestrates multi-chain trades by handling all the behind-the-scenes routing, settlement, and collateral management. The result? Instant cross-chain leverage with deep liquidity and minimal slippage.

Why Perpetual DEX Aggregators Need Chain Abstraction

The perpetual DEX aggregator landscape is fiercely competitive. Platforms like Nekodex and GreenGold are leveraging chain abstraction to deliver:

Top Advantages of Chain Abstraction for Perpetual DEX Aggregators

-

Unified Liquidity Access: Chain abstraction enables perpetual DEX aggregators to tap into liquidity pools across multiple blockchains, ensuring deeper liquidity and reduced slippage for traders. Platforms like Chainge Finance aggregate liquidity from over 20 DEXs on nine chains, delivering optimal pricing and execution.

-

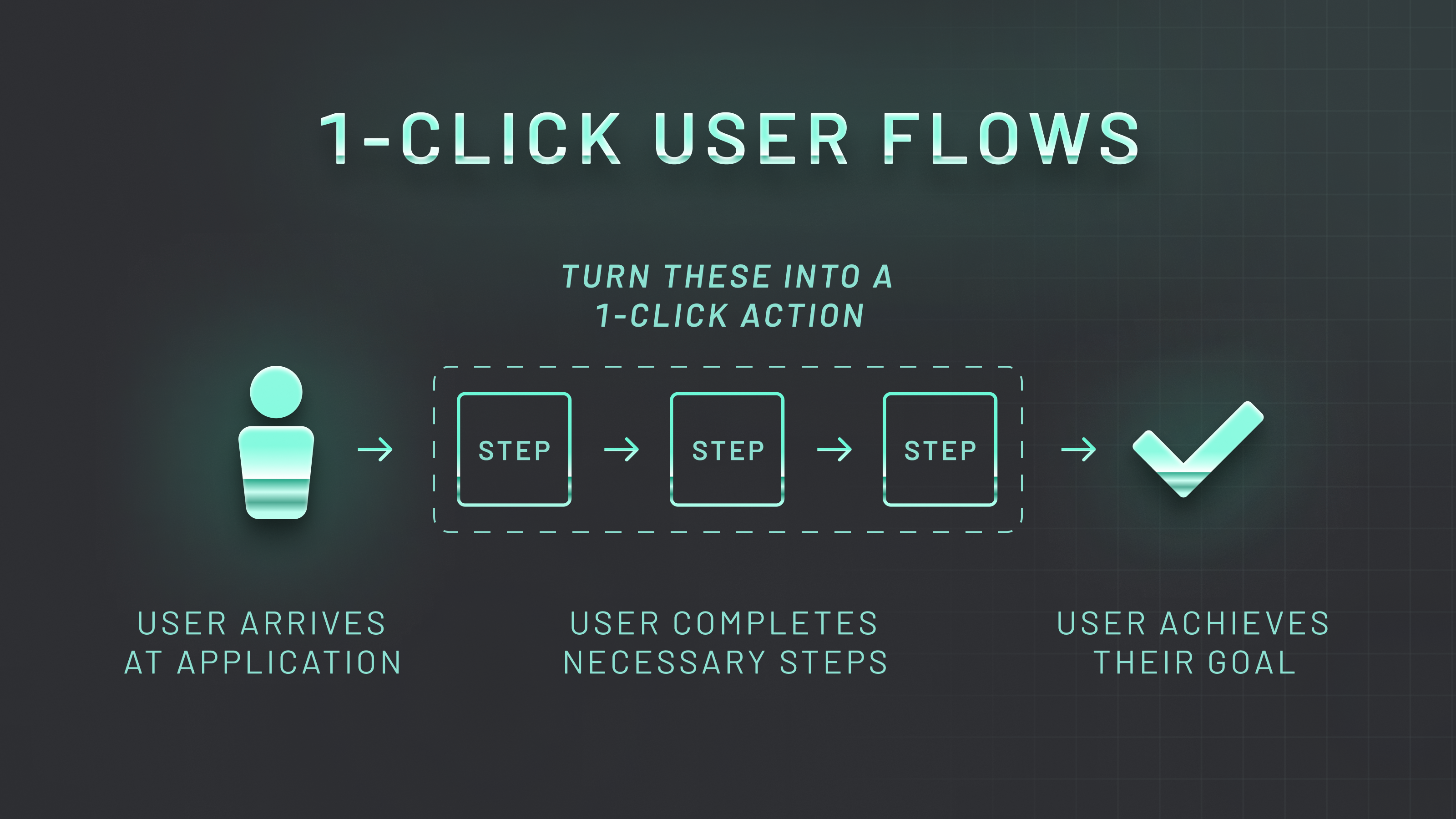

Simplified User Experience: By abstracting the complexities of multiple chains, users can trade perpetual contracts across networks without managing multiple wallets or bridging assets. Nekodex leverages chain abstraction to offer seamless, intuitive cross-chain trading for all users.

-

Cost Efficiency: Chain abstraction intelligently routes trades through the most cost-effective paths, minimizing gas fees and transaction costs. This is especially valuable for high-frequency traders seeking efficient and affordable executions across chains.

-

Enhanced Security: By reducing reliance on traditional cross-chain bridges—which are often vulnerable to exploits—chain abstraction enables direct, secure interactions between blockchains. This significantly lowers the risk of hacks and asset loss during cross-chain trades.

-

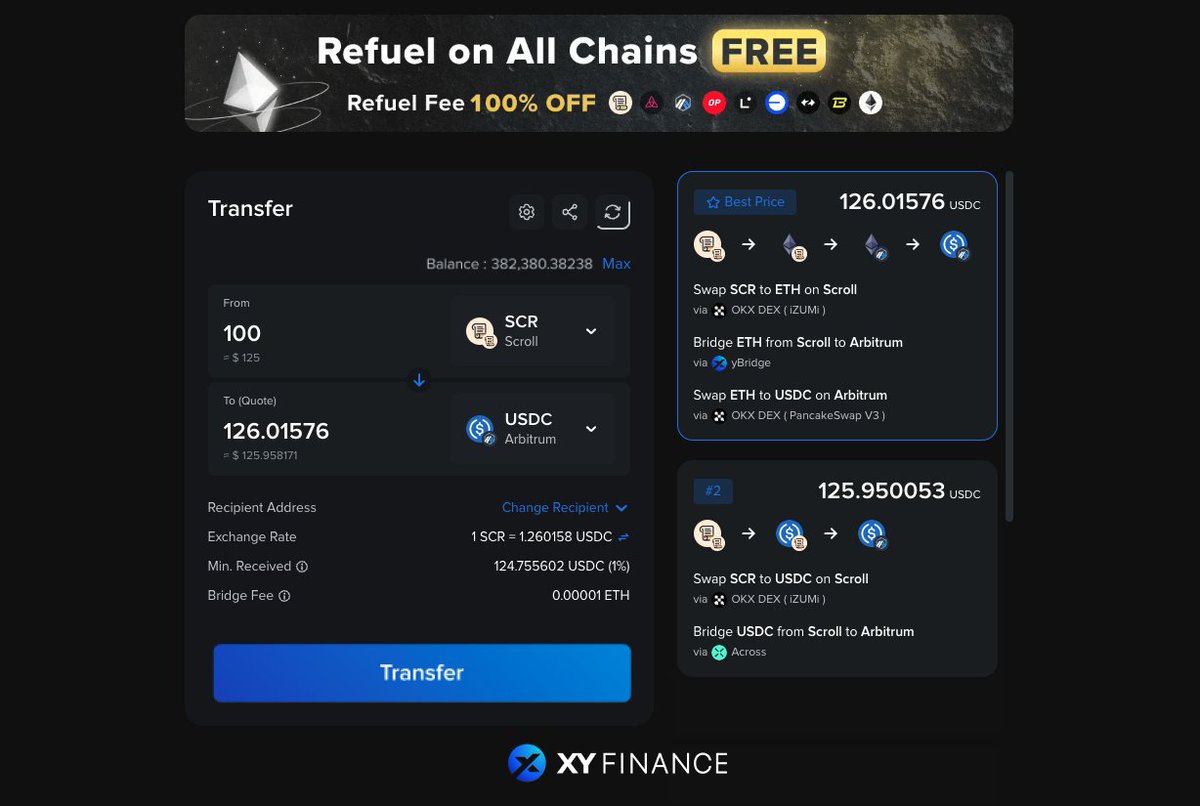

Broader Market Access: Chain abstraction empowers platforms like XY Finance to support diverse aggregators and protocols, giving traders access to a wider range of assets and perpetual contracts across EVM and non-EVM chains.

This isn’t just about convenience. It’s about unlocking access to the best price execution and liquidity pools across every EVM and non-EVM chain you care about – without sacrificing self-custody or security. As perpetual DEXs evolve from niche venues to full-fledged trading ecosystems, chain abstraction is becoming non-negotiable for anyone who wants to stay ahead of the curve.

Real-World Innovations: Vooi, Nekodex and Beyond

Let’s get specific. Vooi stands out as the first non-custodial perp DEX aggregator to truly deliver seamless cross-chain leverage trading. Spanning over 17 chains, Vooi removes the need for manual bridging or network switching. Their approach? Chain abstraction coordinates liquidity aggregation, order routing, and settlement in one cohesive flow – so traders can chase momentum wherever it emerges.

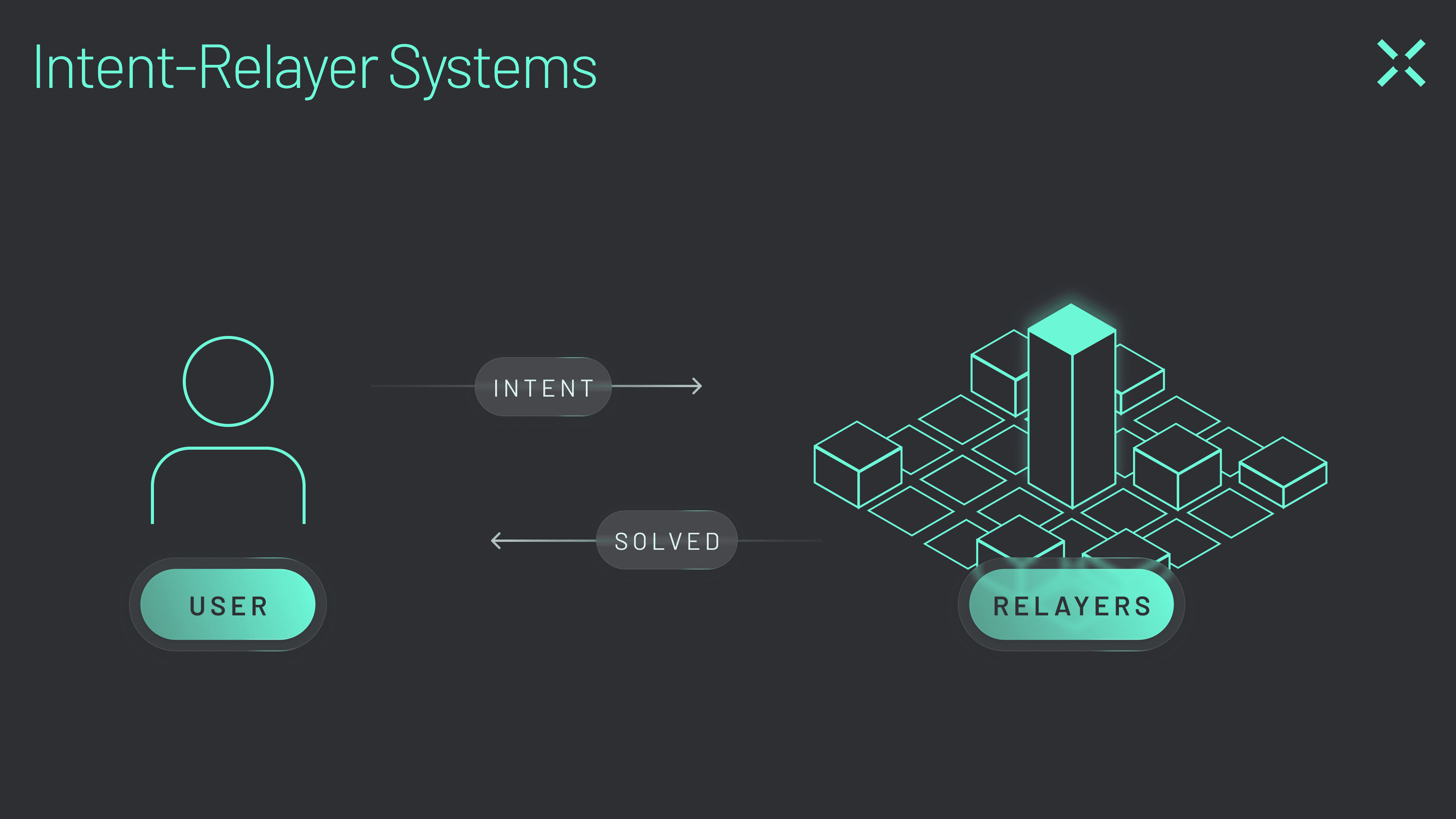

Nekodex is another powerhouse. Built atop Perpetual Protocol and integrating Across for intents-based cross-chain execution, Nekodex leverages both account and chain abstraction to deliver gasless perpetual trading and effortless onboarding. Whether you’re trading from your phone or desktop, you’re interacting with a self-custodial DEX aggregator that feels as smooth as a single-chain experience – but with all the reach of multi-chain DeFi perps.

The Mechanics: How Chain Abstraction Powers Cross-Chain Perpetuals

Diving into the technicals, chain abstraction works by integrating smart contract protocols that handle:

- Real-time cross-chain messaging for order execution

- Unified collateral management across networks

- Automated liquidity sourcing from multiple DEXs and bridges

- Account abstraction for seamless user authentication and gasless transactions

This is more than just a backend upgrade – it’s a paradigm shift for anyone trading perp contracts at scale. Solutions like Chainge Finance aggregate liquidity from over 20 DEXs across nine chains, ensuring users get optimal fills with minimal slippage. Meanwhile, XY Finance supports routing through top aggregators like 1inch and OpenOcean for maximum flexibility and cost efficiency.

For traders, the impact is immediate: cross-chain perps aggregators are eliminating the old trade-offs between speed, price, and security. The days of waiting for slow bridges or watching gas fees eat into your PnL are fading fast. Instead, chain abstraction lets you deploy capital where it’s most effective, move collateral seamlessly, and execute strategies that were previously impossible in a fragmented DeFi landscape.

A New Standard: Gasless, Self-Custodial, and Always On

What’s truly game-changing is the shift toward gasless perpetual trading and self-custodial DEX aggregators. By leveraging account abstraction alongside chain abstraction, platforms like Nekodex and Vooi allow users to sign transactions with passkeys or simple wallet approvals, no more fumbling for native gas tokens on every chain. This means you can stay focused on the trade itself, while the underlying infrastructure handles the complexity.

Security is also getting a major upgrade. Traditional bridges have been prime targets for exploits, but with direct chain-to-chain messaging and unified account management, the attack surface shrinks dramatically. Your funds remain under your control at all times, no matter where you’re trading or what chain you’re using. This is the future for anyone who values both agility and safety in DeFi.

Key Features of Next-Gen Cross-Chain Perpetual DEX Aggregators

-

Chain Abstraction for Seamless Interoperability: Platforms like Vooi harness chain abstraction to enable instant cross-chain leveraged trading, letting users interact across 17+ blockchains without manual bridging or wallet switching.

-

Unified Liquidity Aggregation: Next-gen aggregators, such as Chainge Finance, pool liquidity from multiple DEXs and blockchains, reducing slippage and offering optimal trade execution for perpetual contracts.

-

Simplified User Experience: Platforms like Nekodex leverage chain abstraction and account abstraction to deliver a frictionless trading experience, eliminating the need for users to manage multiple wallets or networks.

-

Cost-Efficient Trade Routing: Aggregators intelligently route trades through the most economical paths across chains, minimizing gas fees and transaction costs—vital for high-frequency and leveraged traders.

-

Enhanced Security via Direct Cross-Chain Interactions: By reducing reliance on traditional bridges, platforms like XY Finance enable secure, direct cross-chain transactions, mitigating common bridge vulnerabilities.

-

Support for Both EVM and Non-EVM Chains: Advanced aggregators, such as GreenGold, are built to streamline DeFi trading across a wide range of blockchain architectures, expanding asset and market access.

Trading Without Borders: The Future of Multi-Chain DeFi Perps

We’re entering an era where cross-chain leverage trading is as simple as trading on a single network. Whether you want to hedge exposure on one chain or chase momentum across several, the infrastructure is finally catching up to trader ambition. As more protocols embrace chain abstraction, expect to see:

- Even deeper unified liquidity pools

- Lower latency and faster settlements

- More advanced order types and automation

- Increased composability with other DeFi primitives

This evolution isn’t just a technical milestone, it’s a massive expansion of what’s possible for traders. If you want to see these principles in action, check out how chain abstraction makes cross-chain swaps as simple as single-chain transactions or dig deeper into how perpetual DEX aggregators are changing on-chain trading.

For those ready to take the leap, the tools are here. Embrace platforms that are built for speed, security, and cross-chain scale, because the most profitable trades of tomorrow will be made by those who can move fastest across every network. The next wave of DeFi isn’t just interoperable; it’s unstoppable.