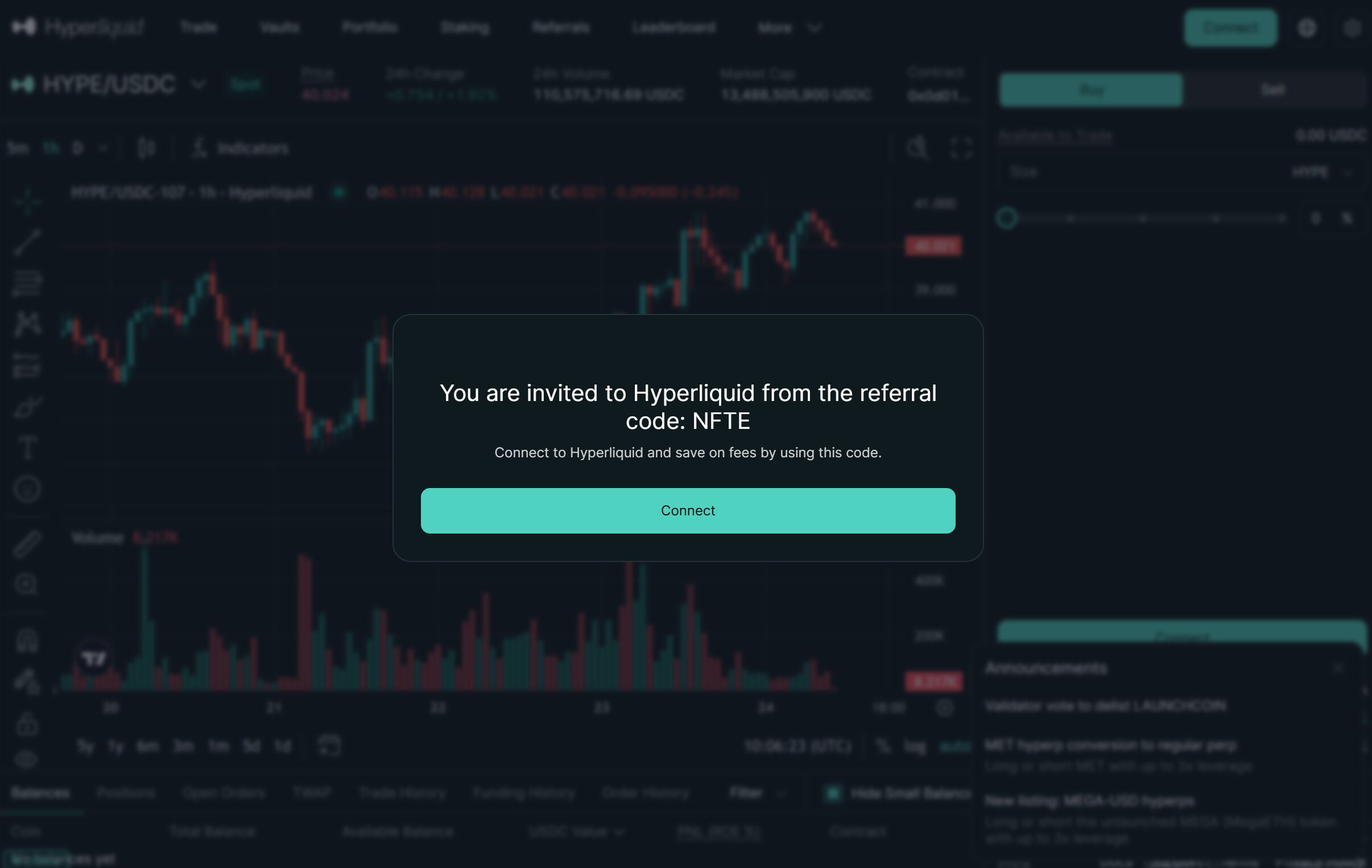

In 2025, the landscape of crypto trading has undergone a dramatic transformation. The rise of decentralized perpetual exchanges (DEXs) like Hyperliquid is not just a passing trend – it’s a fundamental shift in how traders access, execute, and secure their trades. With Bitcoin (BTC) holding steady at $91,480.00, the market’s appetite for transparency, speed, and control has never been stronger.

Unprecedented Growth: Hyperliquid Trading Volume Breaks Records

Hyperliquid’s explosive growth is rewriting the rulebook for decentralized perpetual exchange in 2025. In July alone, the platform processed $319 billion in trades, a record for DeFi perpetual futures platforms. By May, Hyperliquid commanded over 73% of the on-chain perpetual futures market – far outpacing competitors on Sui, Tron, and Avalanche.

This surge isn’t just about numbers; it’s about liquidity depth and reliability that rival even the largest centralized exchanges (CEXs). As traders increasingly pursue efficient execution and deep order books without sacrificing custody or transparency, platforms like Hyperliquid have become their destination of choice.

Cryptocurrency 6-Month Price Comparison: Hyperliquid vs. Top DEX and CEX Assets (2025)

Comparing Hyperliquid (HYPER) and leading DeFi tokens with Bitcoin and Ethereum to highlight 6-month price performance amid the rise of decentralized perpetual DEXs.

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Hyperliquid (HYPER) | $38.64 | $35.00 | +10.4% |

| GMX (GMX) | $8.80 | $9.50 | -7.4% |

| dYdX (DYDX) | $0.2821 | $0.3000 | -6.0% |

| Perpetual Protocol (PERP) | $0.0970 | $0.1000 | -3.0% |

| SushiSwap (SUSHI) | $0.4627 | $0.5000 | -7.5% |

| Uniswap (UNI) | $7.37 | $7.00 | +5.3% |

| Bitcoin (BTC) | $91,577.00 | $60,000.00 | +52.6% |

| Ethereum (ETH) | $3,102.87 | $2,500.00 | +24.1% |

Analysis Summary

Over the past six months, Hyperliquid (HYPER) outperformed most leading DeFi tokens, posting a +10.4% gain, while GMX, dYdX, PERP, and SushiSwap experienced modest declines. Uniswap (UNI) saw a slight increase. In contrast, major assets Bitcoin (BTC) and Ethereum (ETH) recorded substantial gains, reflecting broader market momentum. Hyperliquid’s resilience and growth highlight its strong position among decentralized perpetual DEXs in 2025.

Key Insights

- Hyperliquid (HYPER) achieved a notable +10.4% price increase, outperforming other major DeFi DEX tokens over the past six months.

- Most perpetual DEX tokens (GMX, dYdX, PERP, SUSHI) saw slight declines, indicating sector volatility despite overall DEX growth.

- Uniswap (UNI) was the only other DEX token in this group to post a positive 6-month change (+5.3%).

- Bitcoin (BTC) and Ethereum (ETH) led the market with significant gains, suggesting strong overall crypto market sentiment.

- Hyperliquid’s positive price performance aligns with its record trading volumes and rising market share among perpetual DEXs.

This comparison uses exact real-time price data for each asset, referencing both current and 6-month historical prices as provided. No estimates or external data were used; all figures are sourced directly from the specified real-time feeds.

Data Sources:

- Main Asset: https://coinmarketcap.com/currencies/hyperliquid/

- GMX: https://www.coingecko.com/en/coins/gmx

- dYdX: https://www.coingecko.com/en/coins/dydx

- Perpetual Protocol: https://www.coingecko.com/en/coins/perpetual-protocol

- SushiSwap: https://www.coingecko.com/en/coins/sushi

- Uniswap: https://www.coingecko.com/en/coins/uniswap

- Bitcoin: https://www.coingecko.com/en/coins/bitcoin

- Ethereum: https://www.coingecko.com/en/coins/ethereum

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

The End of Trade-Offs: User Experience Meets Decentralization

Historically, decentralized exchanges have struggled to match the performance and usability of their centralized counterparts. But that narrative is over. Hyperliquid’s custom Layer 1 blockchain delivers gas-free trading, fully on-chain order execution, and sub-second latency – all without compromising user control over funds.

This technological leap has drawn professional traders who once avoided DEXs due to slippage or slow fills. Now, with ultra-low latency architecture and high-throughput matching engines, decentralized perpetual DEXs are attracting both retail users seeking lower fees and institutions demanding reliable execution.

Regulatory Winds Shift Toward Decentralization

The regulatory environment has also played a pivotal role in accelerating perpetual DEX adoption. In April 2025, U. S. President Donald Trump signed legislation nullifying an IRS rule that would have classified decentralized exchanges as brokers – exempting them from certain tax reporting requirements. This policy change removed significant compliance uncertainty for both platforms and users.

The result? A flood of new capital and participants entering the DEX ecosystem with confidence that self-custody and on-chain transparency are not only technically superior but now legally protected as well.

Did regulatory clarity in 2025 influence your switch from CEX to DEX?

In April 2025, a new U.S. law exempted decentralized exchanges from certain tax reporting rules, making DEXs like Hyperliquid more attractive to many traders. We’re curious—did this regulatory change impact your decision to move from centralized exchanges (CEXs) to decentralized exchanges (DEXs)?

Security and Transparency: The New Gold Standard

If there’s one lesson traders have learned from past CEX failures, it’s the importance of security through self-custody. Decentralized perpetual exchanges like Hyperliquid allow users to retain full control over their private keys while providing transparent trade settlement on-chain. Every transaction can be audited in real time – a level of visibility simply unattainable on legacy centralized platforms.

This commitment to openness not only reduces counterparty risk but also fosters trust among a global user base increasingly wary after years of high-profile exchange breaches.

Bitcoin Price Prediction 2026-2031: Impact of Perpetual DEX Dominance

Forecasts based on Hyperliquid and DEX sector overtaking CEXs, regulatory shifts, and institutional adoption (Baseline: BTC at $91,480, Nov 2025)

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $75,000 | $108,000 | $138,000 | +18% | Volatility remains high as DEXs solidify dominance; regulatory clarity sustains upward momentum. Bearish min reflects possible global macro shocks. |

| 2027 | $88,000 | $124,000 | $160,000 | +15% | Institutional adoption accelerates; DEX innovations (e.g., cross-chain liquidity, advanced derivatives) drive growth. |

| 2028 | $104,000 | $143,000 | $190,000 | +15% | Mainstream finance integrates on-chain trading; network upgrades boost scalability. Bullish max if global ETF adoption surges. |

| 2029 | $120,000 | $165,000 | $230,000 | +15% | Cycles mature, with DEXs capturing majority of derivatives volume. Bearish min reflects potential regulatory backlash or tech flaws. |

| 2030 | $137,000 | $184,000 | $265,000 | +12% | Bitcoin benefits from new use cases (e.g., RWA tokenization). Competition from alt L1s/ETH may cap upside. |

| 2031 | $155,000 | $210,000 | $310,000 | +14% | Wider adoption in emerging economies; BTC as reserve asset narrative strengthens. High max if hyperbitcoinization gains traction. |

Price Prediction Summary

Bitcoin is poised for continued growth through 2031, fueled by the rapid ascent of decentralized perpetual DEXs like Hyperliquid, favorable regulatory shifts, and increasing institutional involvement. While volatility remains a core feature, the trend toward self-custody and transparent trading platforms underpins a robust long-term outlook. The forecast reflects both bullish and bearish scenarios, accommodating potential macroeconomic shocks and regulatory uncertainties.

Key Factors Affecting Bitcoin Price

- DEX adoption replacing CEX liquidity and volume, led by Hyperliquid and peers.

- Regulatory clarity in major markets (e.g., US nullifying IRS broker rule for DEXs).

- Ongoing technological improvements: custom L1s, gasless trading, high throughput.

- Growing institutional participation and treasury allocations to crypto assets.

- Potential for macroeconomic shocks or regulatory backlash affecting sentiment.

- Competition from alternative layer 1s and evolving DeFi landscapes.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Community Factor: Tokenomics and Institutional Adoption Fuel Growth

The momentum behind perpetual DEX migration isn’t limited to technology or regulation alone. Community-driven innovation is central to the rise of platforms like Hyperliquid-Style Perps. Over 500,000 active traders now use Hyperliquid monthly – testament to its sticky user experience and robust tokenomics model.

Institutional participation is rising as well; Nasdaq-listed Lion Group made headlines by allocating $600 million in HYPE tokens for treasury management purposes this year. This blend of grassroots enthusiasm and blue-chip endorsement signals that decentralized perpetual exchange is no longer niche – it’s becoming mainstream finance.

While the numbers are impressive, the deeper story is about user empowerment and the evolution of market structure. Hyperliquid and other decentralized perpetual exchanges are redefining what’s possible for both retail and institutional participants. The ability to trade perpetual contracts with low latency, zero gas fees, and on-chain transparency is a game-changer for anyone seeking an edge in today’s competitive markets.

As a result, we’re seeing not just a migration but a wholesale reimagining of what exchanges can be. No longer are users forced to choose between speed and self-custody or between deep liquidity and regulatory clarity. The convergence of these features on platforms like Hyperliquid-Style Perps is drawing in sophisticated traders who once viewed DEXs as secondary options.

What Sets 2025 Apart: Perpetual DEX Adoption Accelerates

The pace of perpetual DEX adoption in 2025 stands out even against previous bullish cycles. Daily trading volumes across decentralized perpetual platforms reached $96.973 billion by September, reflecting not only increased user activity but also the maturation of supporting infrastructure, from price oracles to cross-chain liquidity solutions.

This growth isn’t limited to seasoned crypto natives. As interfaces become more intuitive and educational resources proliferate, new entrants are discovering that self-custody doesn’t have to come at the cost of convenience or performance. For those interested in practical guidance, our step-by-step guide for cross-chain swaps on decentralized perpetual DEXs is a great starting point.

Looking Ahead: The Future Is Decentralized, and Fast

The rapid ascent of platforms like Hyperliquid signals that decentralized perpetual exchanges are not just keeping pace with centralized incumbents, they’re setting new standards for speed, security, and fairness. With Bitcoin (BTC) priced at $91,480.00, traders have more incentive than ever to demand robust infrastructure capable of handling institutional-grade flows without sacrificing user control.

Looking forward, expect further innovation around low-latency architecture, on-chain risk management tools, and community-driven governance, all designed to support an increasingly global and diverse trader base. As more capital flows into DEXs and regulatory frameworks solidify their legitimacy, the gap between CEXs and DEXs will only continue to shrink.

- Compare leading perpetual DEXs in our 2025 guide

- Learn how sub-second execution is achieved on Hyperliquid-Style Perps

The bottom line? In 2025, decentralized perpetual exchanges like Hyperliquid aren’t just catching up, they’re overtaking centralized platforms by delivering what modern traders truly value: speed, transparency, security, and genuine ownership over their assets.