High-frequency crypto trading has long been the domain of sophisticated players with access to premium infrastructure on centralized exchanges. But the rise of low-latency perpetual DEXs like Hyperliquid-Style Perps is rapidly shifting this landscape, delivering the speed, transparency, and reliability that pro traders demand, without sacrificing the core principles of decentralization. In today’s market, where milliseconds can define profitability, platforms bridging the latency gap are rewriting what’s possible in professional DeFi trading.

Why Speed Matters: The Latency Arms Race in Crypto Trading

For high-frequency traders, execution speed isn’t a luxury, it’s a necessity. Every microsecond shaved off order processing time can mean capturing an arbitrage opportunity or avoiding costly slippage. Historically, decentralized exchanges (DEXs) have lagged behind their centralized counterparts due to blockchain bottlenecks and off-chain dependencies. However, Hyperliquid-Style Perps is changing this equation.

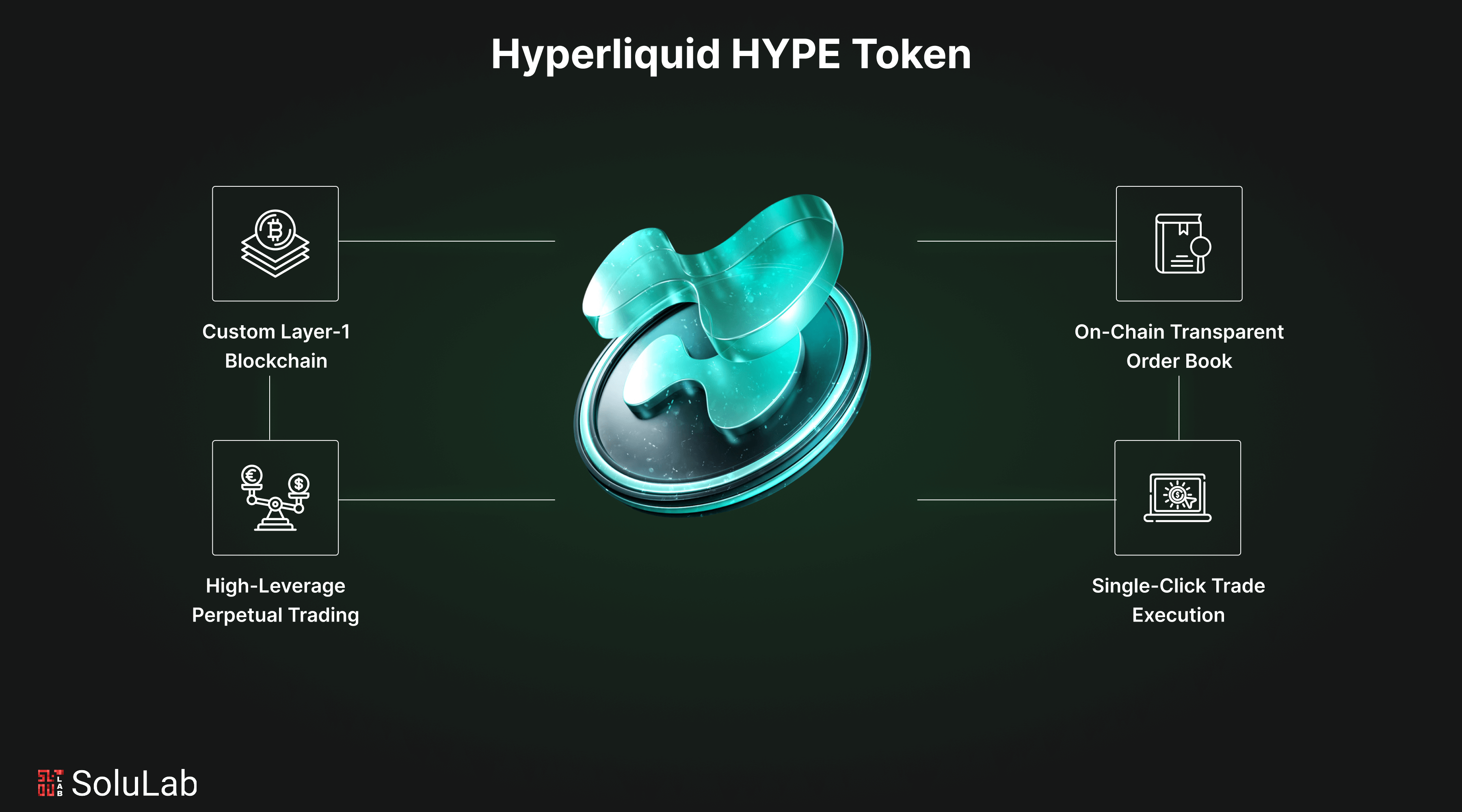

The platform’s proprietary HyperBFT consensus mechanism delivers a median end-to-end latency of just 0.2 seconds and throughput up to 100,000 transactions per second. This is not theoretical: these metrics rival top-tier CEX performance while maintaining all trades fully on-chain for unmatched transparency and security.

The Architecture Advantage: Fully On-Chain Order Book and Matching Engine

A critical differentiator for Hyperliquid-Style Perps is its commitment to a fully on-chain order book and matching engine. Unlike hybrid models that rely on off-chain sequencers or third-party relayers (often black boxes vulnerable to manipulation), every trade, order placement, and cancellation is recorded directly on the blockchain in real time.

This approach offers two key benefits for high-frequency crypto trading:

- Total Transparency: All market activity is auditable, no hidden orders or opaque routing.

- No Single Point of Failure: Decentralized infrastructure ensures resilience against outages or censorship.

The result? High-frequency traders can deploy sophisticated strategies with confidence that their trades are executed fairly and securely in a fast decentralized exchange environment.

Top Features Empowering High-Frequency Traders on Hyperliquid-Style Perps

-

Ultra-Low Latency & High Throughput: Hyperliquid’s proprietary HyperBFT consensus delivers near-instant trade execution with a median latency of 0.2 seconds and supports up to 100,000 transactions per second, rivaling centralized exchanges.

-

Fully On-Chain Order Book: Unlike many DEXs, Hyperliquid’s order book and matching engine are entirely on-chain, ensuring full transparency and robust security for every trade.

-

Cost-Effective Trading: Hyperliquid offers zero gas fees, a 0.002% maker rebate, and a 0.025% taker fee, making it highly economical for high-frequency trading strategies.

-

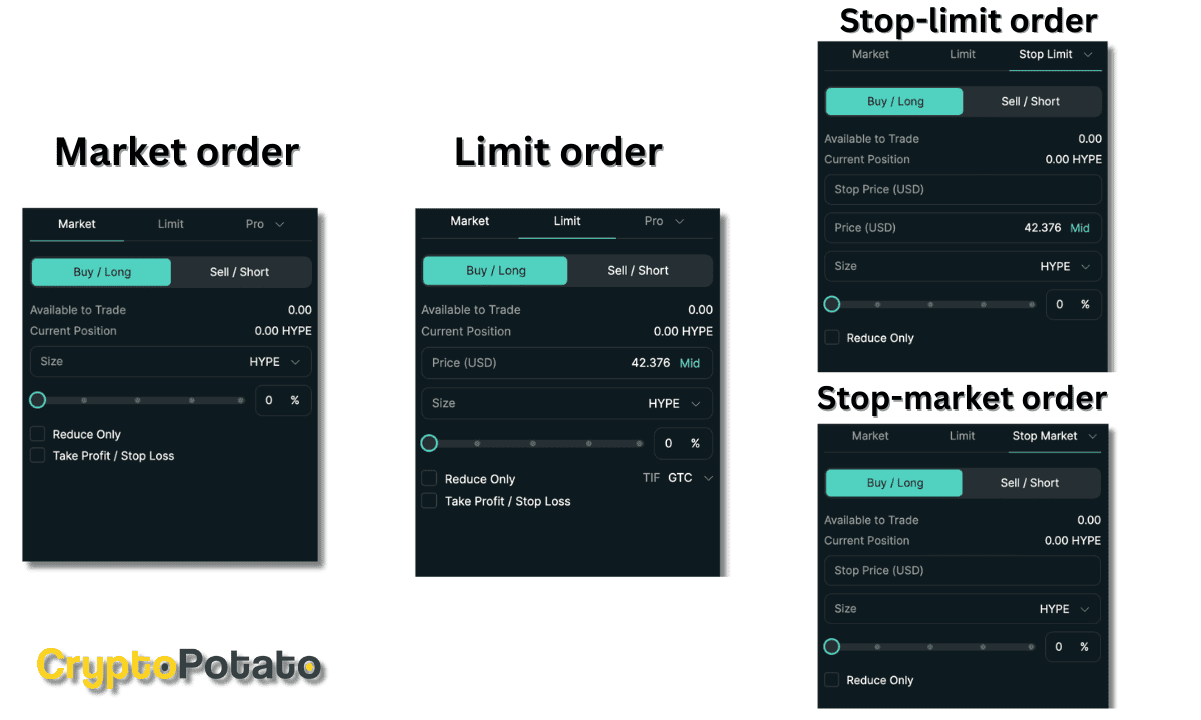

Advanced Trading Tools: Traders benefit from sophisticated features like TWAP orders, scaled orders, and Take Profit/Stop Loss (TP/SL) orders, supporting complex and automated strategies.

-

High Leverage Options: Hyperliquid provides up to 50x leverage on perpetual contracts, allowing traders to maximize capital efficiency and manage risk dynamically.

Cost Efficiency Meets Capital Agility

Pioneering speed isn’t enough if cost structures erode profits. Hyperliquid-Style Perps addresses this with an aggressive fee schedule tailored for active traders: maker rebates of 0.002%, taker fees as low as 0.025%, and zero gas fees for all trades. Combined with access to up to 50x leverage on perpetual contracts, this enables significant capital efficiency without hidden costs, an essential advantage for those running volume-intensive strategies.

The platform also supports advanced order types such as TWAP (Time-Weighted Average Price), scaled orders, and integrated Take Profit/Stop Loss functionality, tools that are indispensable for managing risk at high velocity in volatile markets.

The New Standard for Real-Time Execution in DeFi

Deep liquidity, real-time execution, and robust risk controls are converging on Hyperliquid-Style Perps to create an environment where professional DeFi trading can truly thrive. By eliminating trade-offs between speed and decentralization, and by providing institutional-grade tools natively on-chain, the platform is attracting not only individual high-frequency traders but also algorithmic funds seeking scalable alternatives to traditional venues.

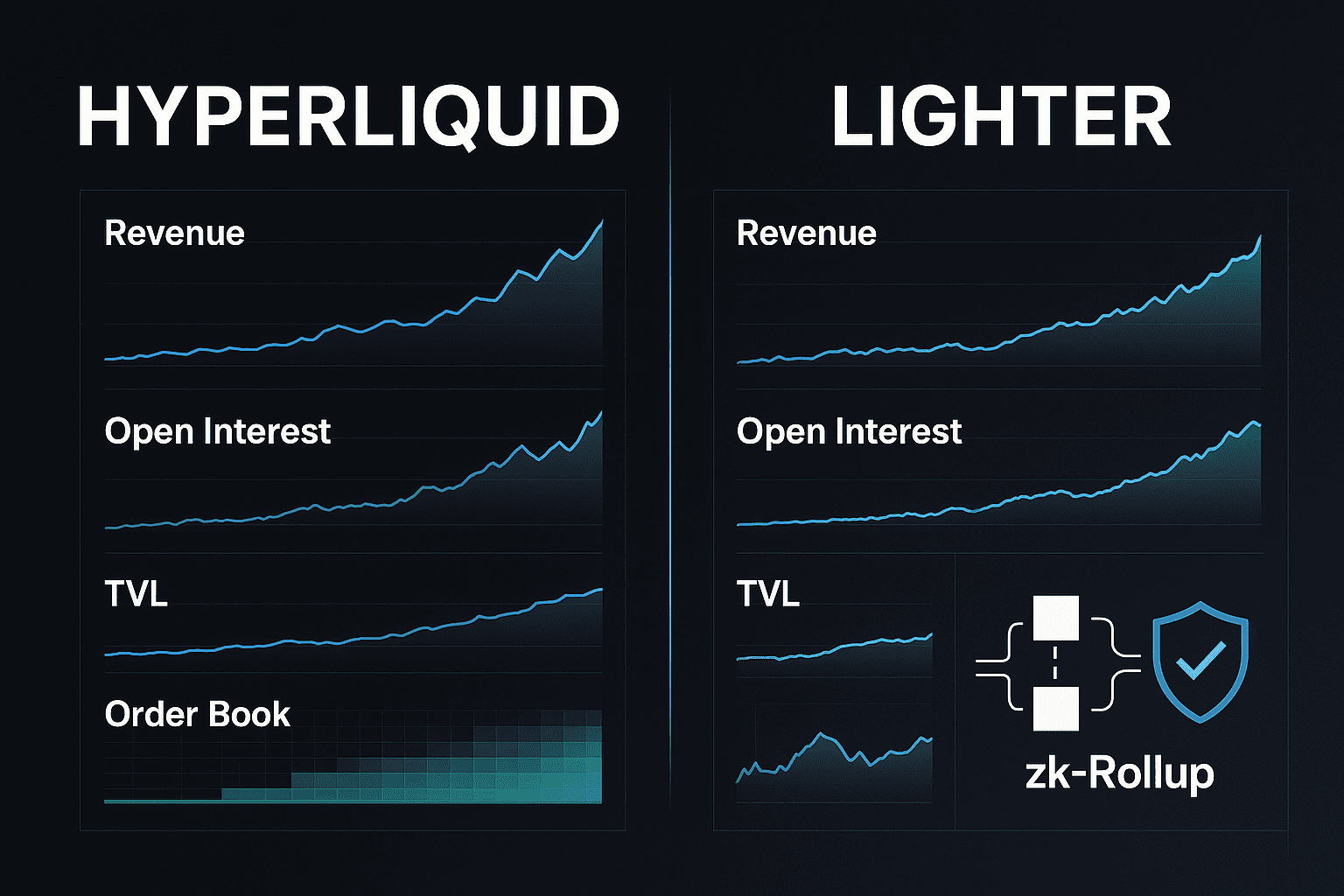

The impact of these innovations is evident in the platform’s surging trading volumes and growing market share. Recent data shows the trading volume ratio between Hyperliquid perps and Binance perps has climbed to approximately 2.8%, a testament to high-frequency traders’ confidence in the platform’s reliability and execution quality. As more liquidity migrates on-chain, the advantages of real-time execution crypto become even more pronounced: less slippage, deeper order books, and tighter spreads for all participants.

Navigating Risk in a Fast Decentralized Exchange

Speed without control is a recipe for disaster. Professional DeFi trading on Hyperliquid-Style Perps is underpinned by robust risk management features that rival those of centralized venues. The ability to set granular TP/SL orders directly on-chain, combined with transparent margining and liquidation processes, enables traders to automate exits and protect capital even during periods of extreme volatility.

Importantly, the fully on-chain architecture means there are no hidden liquidations or off-ledger adjustments, every margin call is auditable in real time. This level of transparency is critical for institutional participants who require clear audit trails and deterministic outcomes.

The Road Ahead: What Sets Hyperliquid-Style Perps Apart?

With competition intensifying among low-latency perpetual DEXs, what distinguishes Hyperliquid-Style Perps isn’t just its technical prowess but its relentless focus on trader experience:

- No Gas Fees: Every trade is frictionless, regardless of network congestion or transaction size.

- Intuitive Interface: Designed for speed and clarity, no clutter or unnecessary distractions.

- Ecosystem Upgrades: Frequent enhancements to UI/UX, vaults, APIs, and contract functionality keep the platform agile as market needs evolve.

This commitment has not gone unnoticed by the professional trading community. As one industry analyst recently noted, “Hyperliquid isn’t just matching CEX performance, it’s setting new standards for what’s possible in decentralized finance. ” For those seeking a fast decentralized exchange that doesn’t compromise on security or transparency, this is more than marketing, it’s measurable reality.

Explore Further

If you’re interested in how these latency breakthroughs are achieved at the protocol level, see our deep dive on how Hyperliquid-Style Perps achieves ultra-low latency. For insights into real-time price feeds powering these platforms, read about real-time oracle integration.

As DeFi matures into an institutionally viable ecosystem, platforms like Hyperliquid-Style Perps are not just keeping pace, they’re accelerating it. For high-frequency crypto traders demanding deep liquidity DeFi solutions with uncompromising performance metrics, the future is already here, fully transparent, blazingly fast, and entirely decentralized.