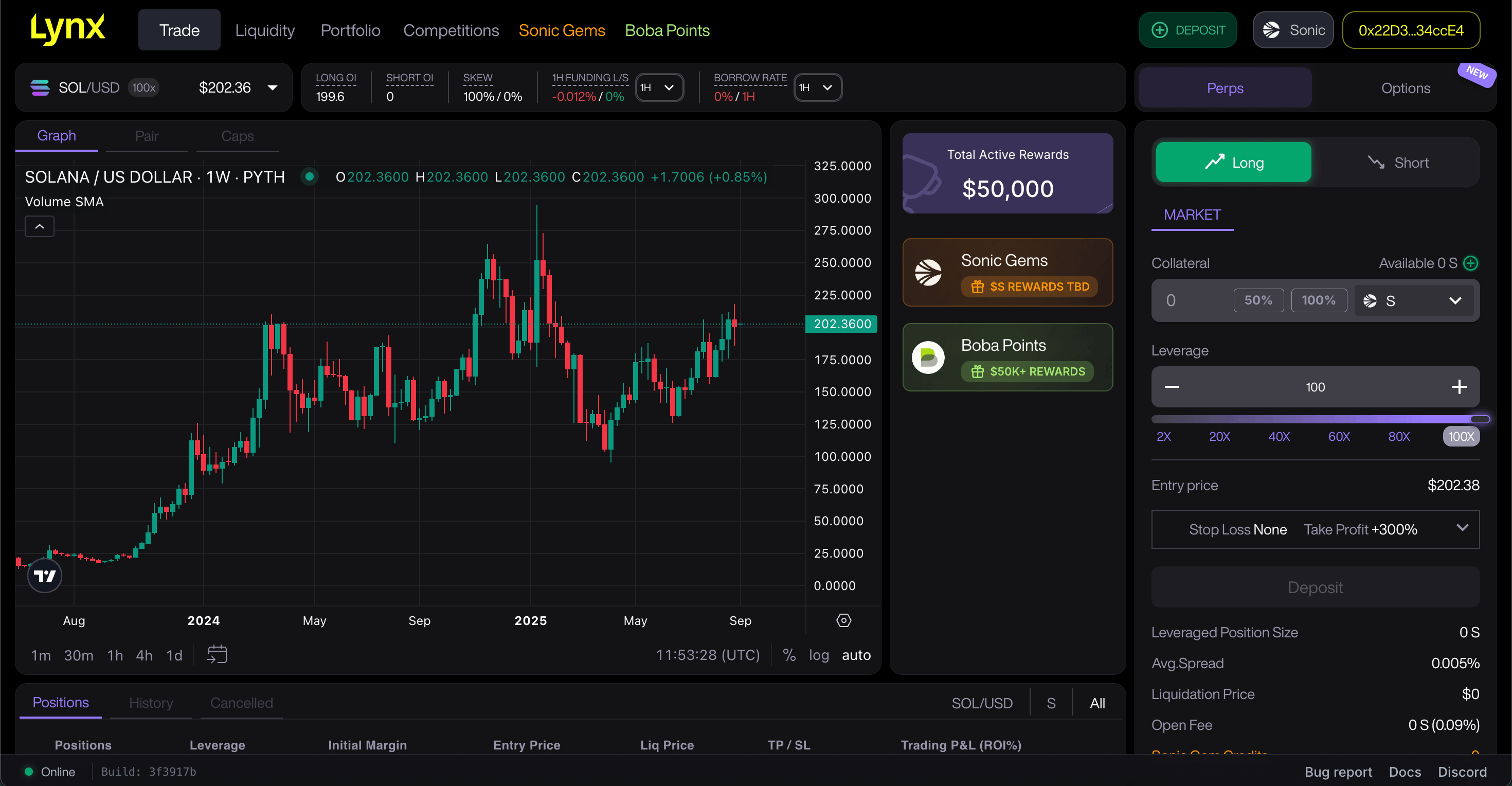

Speed, accuracy, and trust are the lifeblood of any high-performance perpetual DEX. Hyperliquid-Style Perps takes this mantra to a new level, blending real-time oracle integration with its own custom Layer 1 to deliver price feeds that are not just fast, they’re battle-tested against volatility and manipulation. The result? Perpetual contracts that mirror the true market pulse, giving traders the edge they crave in today’s hyper-competitive DeFi landscape.

Hyperliquid’s Multi-Layered Price Engine: Precision at Every Tick

Forget single-source oracles and stale pricing. Hyperliquid’s mark price isn’t plucked from thin air, it’s calculated as the median of three robust components:

- The oracle price plus a 150-second EMA of the difference between Hyperliquid’s mid price and the oracle price

- The median of best bid, best ask, and last trade on Hyperliquid itself

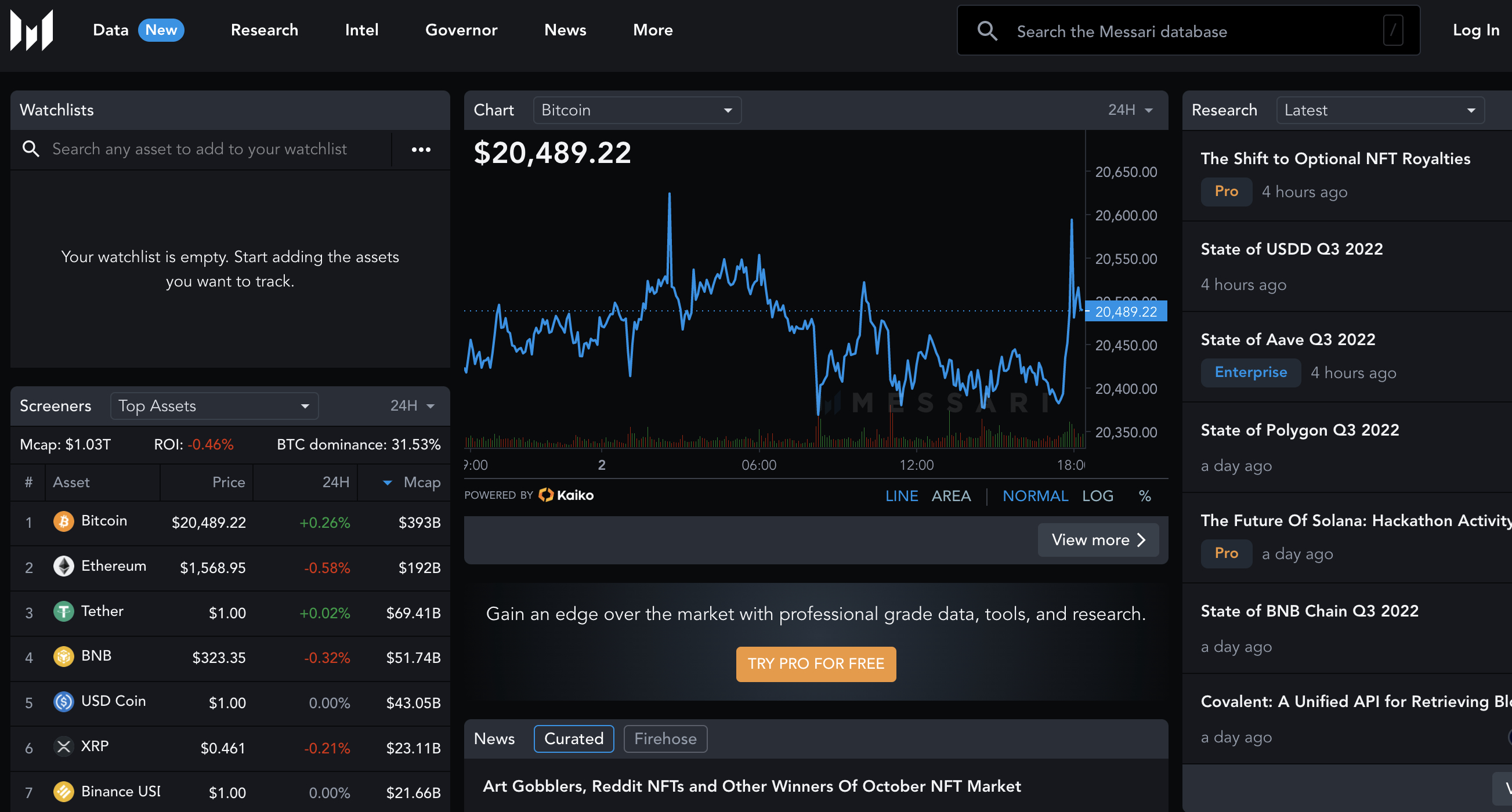

- The weighted median of perpetual mid prices from top CEXs like Binance, OKX, and Bybit

This triple-check system means no single data source can sway the market. Even during wild swings or shallow liquidity moments, Hyperliquid-Style Perps delivers real-time DEX price feeds that track global spot prices with uncanny fidelity. Traders get a clear view, no smokescreens, no surprises.

Why Real-Time Oracle Integration Matters for Perpetual Contract Price Accuracy

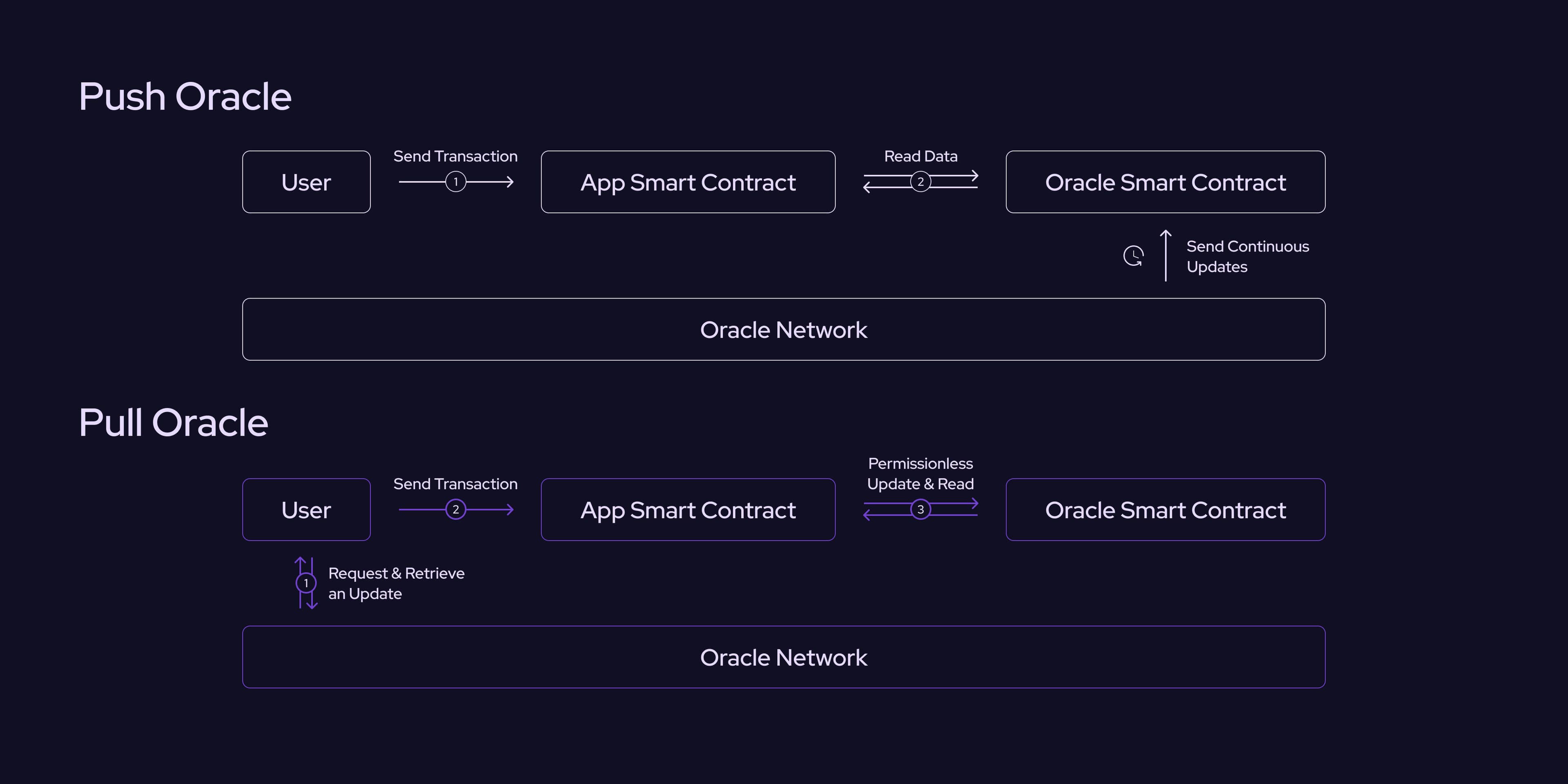

The days of relying solely on external oracles are fading fast. While protocols like Chainlink and Pyth laid essential groundwork for decentralized data feeds, Hyperliquid-Style Perps pushes further by fusing these inputs with its own high-frequency orderbook data and CEX indices. The result? A pricing mechanism that’s both transparent and resilient to manipulation.

This approach is especially critical for perpetual contracts, where even minor discrepancies in funding rates or mark prices can trigger liquidations or cascade through leveraged positions. By anchoring funding rates to an 8-hour exponentially weighted moving average (EMA) of minutely mark prices over the last day, Hyperliquid keeps funding fair while smoothing out noise from sudden spikes.

Top Benefits of Real-Time Oracle Integration for Traders

-

Instant Market Reaction: With live price updates, traders can execute strategies based on the most recent market data, minimizing slippage and maximizing opportunity during volatile swings.

-

Enhanced Risk Management: Real-time feeds enable immediate alerts for abnormal events (like price spikes or depegs), empowering traders to respond quickly and protect their positions.

-

Seamless Integration With CEX & DEX Prices: Platforms like Hyperliquid combine oracle data with on-chain order book and CEX prices (from Binance, OKX, Bybit), delivering a comprehensive view and tighter spreads for traders.

-

Uninterrupted Trading Experience: Real-time oracles support gasless trading UX and instant settlements, making DeFi trading as smooth as centralized exchanges.

Pushing Decentralized Trading Forward: Security Meets Speed

No more choosing between speed and safety. With its custom Layer 1 chain and deep on-chain orderbooks, Hyperliquid-Style Perps achieves CEX-level performance without sacrificing transparency or composability. Apps built on HyperEVM can tap directly into these orderbooks in real time, opening up new frontiers for analytics, automated strategies, and instant settlement.

This architecture doesn’t just keep pace with centralized exchanges; it sets a new benchmark for what’s possible in DeFi trading infrastructure. The fusion of robust price indices, permissionless market creation via HIP-3, and gasless UX is turning heads across the industry, and giving traders tools they simply can’t find anywhere else.