Decentralized perpetual exchanges (DEXs) have rapidly evolved, but 2025 marks a defining moment: Hyperliquid-Style Perps now set the benchmark for low-latency trading in DeFi. As of May 2025, Hyperliquid commands an extraordinary 80% share of the DeFi perpetual market, processing over $350 billion in monthly volume. This dominance is not accidental; it’s the result of relentless innovation and a clear focus on speed, transparency, and user empowerment.

Hyperliquid’s Blueprint: Redefining Performance in Decentralized Perpetual DEXs

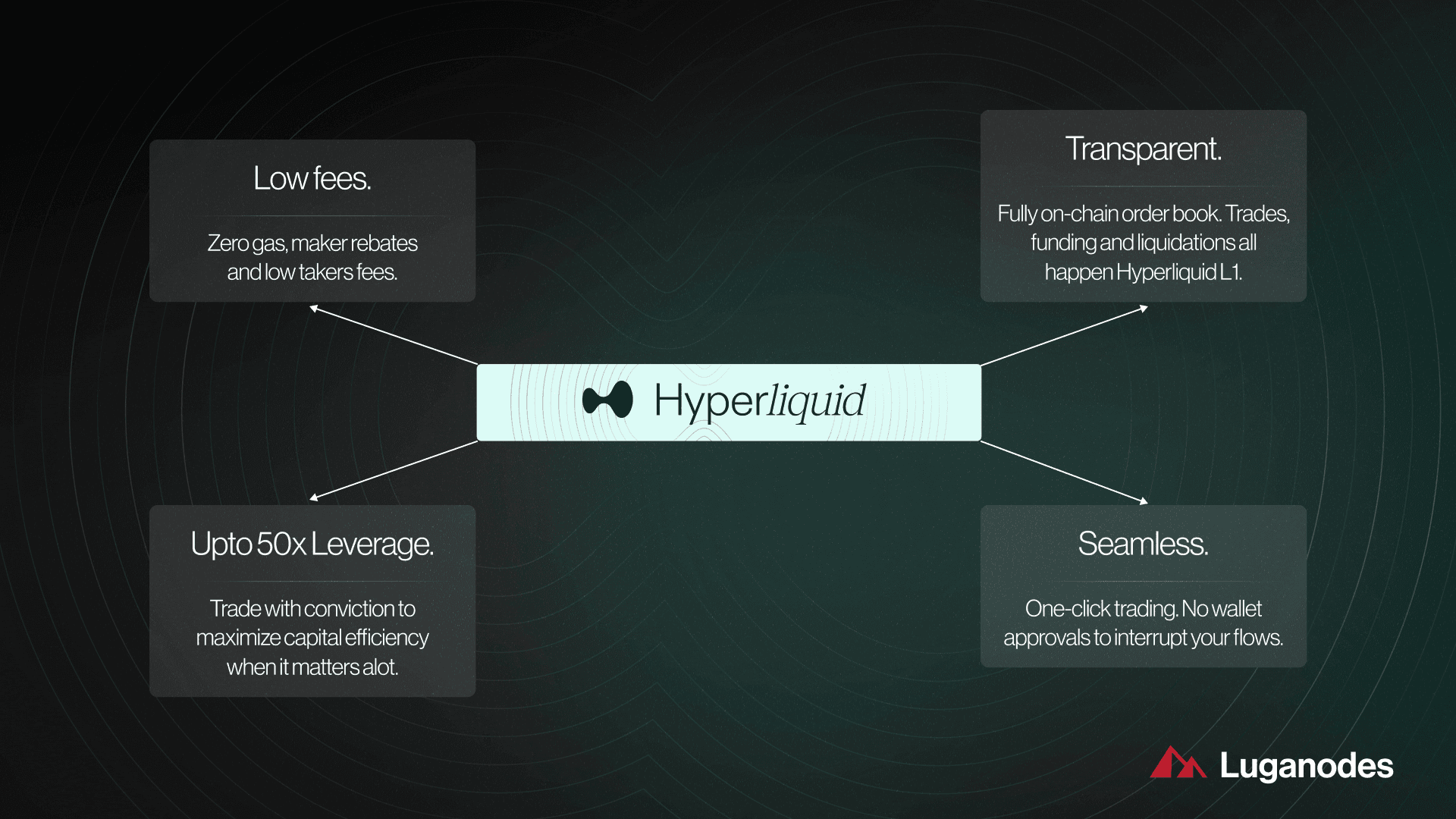

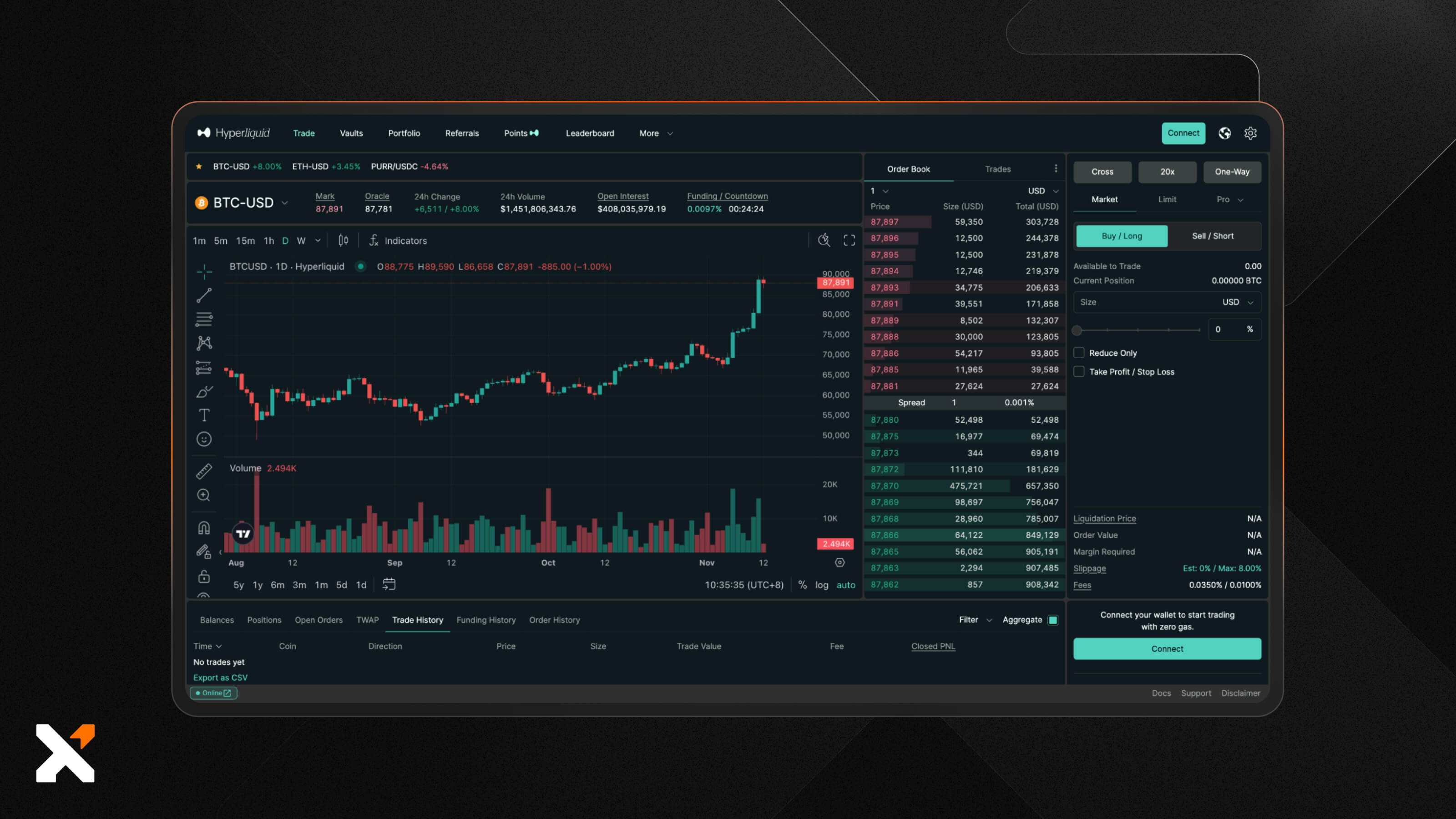

The traditional knock against decentralized exchanges has always been performance. High latency, shallow liquidity, and clunky interfaces once made centralized platforms the default for serious traders. Hyperliquid-Style Perps have shattered this narrative by building from the ground up on a custom Layer 1 blockchain, purpose-built for high-frequency derivatives trading. This architecture delivers sub-millisecond latency and full order book transparency directly on-chain, allowing traders to see every bid and offer without relying on opaque intermediaries.

Unlike most competitors who still depend on off-chain order books or hybrid models, Hyperliquid’s fully on-chain approach means every transaction is verifiable in real time. The benefits are twofold: users enjoy unmatched transparency while simultaneously reducing single points of failure, a core tenet of true decentralization.

Deep Liquidity and Seamless Cross-Chain Access

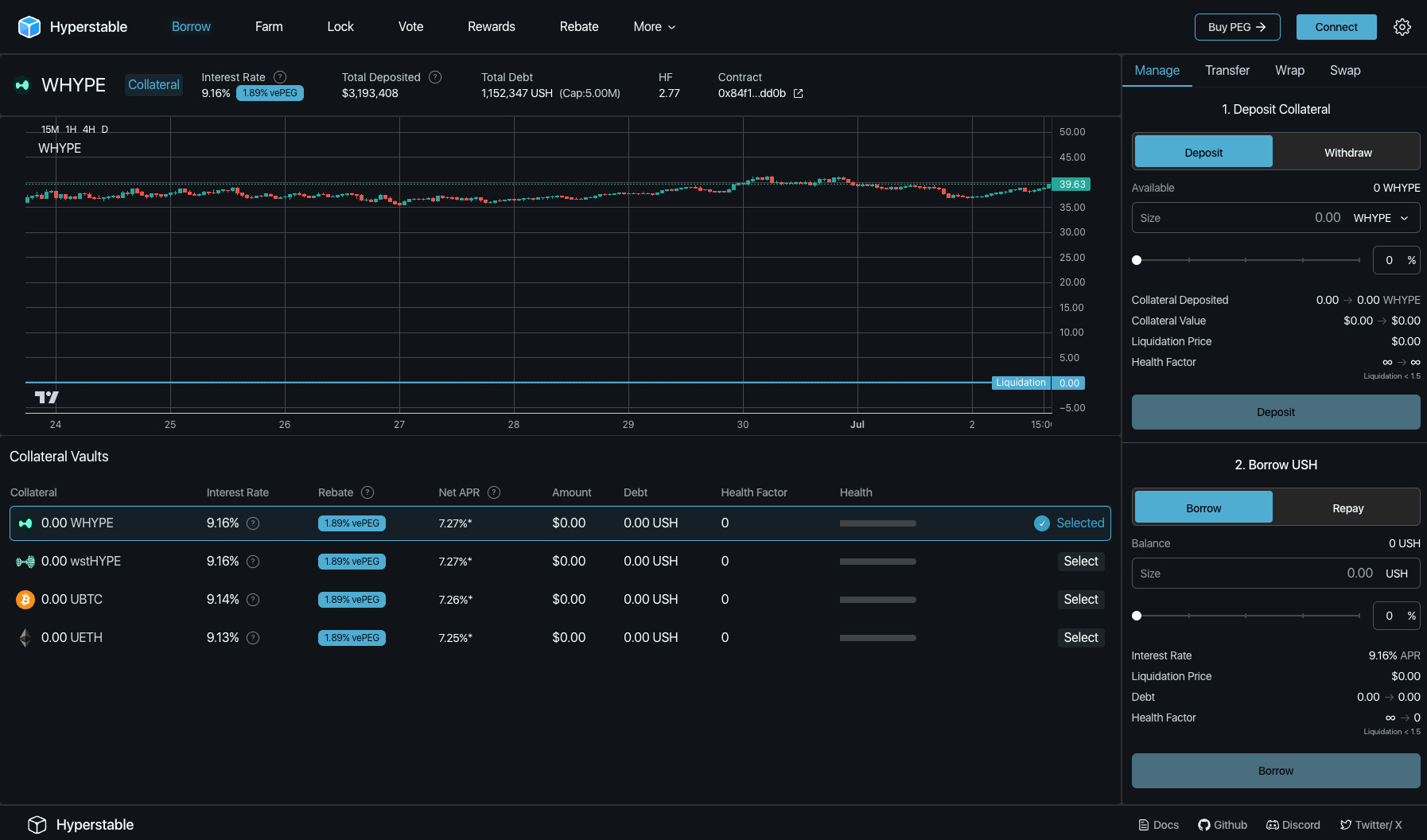

Deep liquidity is essential for efficient perpetual contracts trading. Hyperliquid’s design attracts both institutional market makers and retail traders by offering robust incentives and an open market-making mechanism (the HLP model). This ensures tight spreads even during periods of high volatility, a critical edge over rivals like Aster or dYdX.

But liquidity alone isn’t enough. Modern traders need flexibility to move assets across ecosystems without friction or risk. Hyperliquid-Style Perps enable native deposits from Ethereum, Solana, Cosmos, and other major chains through secure bridges, no centralized custodians required. This seamless cross-chain integration gives users true self-custody while enabling them to capitalize on opportunities wherever they arise.

The Competitive Landscape: Hyperliquid vs Aster

This new standard set by Hyperliquid has forced competitors to rethink their strategies. Consider Aster, a platform that quickly captured 19% market share in 2025 by offering ultra-high leverage (up to 1001x) and aggressive incentives for early adopters. However, raw leverage is no substitute for sustainable infrastructure or transparent risk management.

The real differentiator remains execution speed, deep liquidity, and robust risk controls, all areas where Hyperliquid leads decisively. The platform’s dynamic margin engine adjusts requirements based on real-time volatility and liquidity depth, protecting users from forced liquidations while enabling up to 50x leverage where conditions allow.

Key Innovations of Hyperliquid-Style Perps

-

Custom Layer 1 Blockchain: Hyperliquid operates on its own purpose-built Layer 1 blockchain, designed for high-frequency derivatives trading. This infrastructure enables sub-millisecond transaction latency and ensures on-chain order book transparency, addressing scalability and performance challenges common in DeFi.

-

Fully On-Chain Order Book Model: Unlike many DEXs that rely on off-chain order books, Hyperliquid maintains a fully on-chain order book. This approach maximizes transparency and minimizes single points of failure, reinforcing the core principles of decentralization.

-

Native Cross-Chain Integration: Hyperliquid features native bridges to major blockchain ecosystems such as Ethereum, Solana, and Cosmos. This allows users to deposit assets directly from external chains without intermediaries, while maintaining full self-custody of their funds.

-

Advanced Trading Capabilities and Dynamic Risk Engine: The platform offers up to 50x leverage on perpetual futures across diverse markets. Its dynamic risk engine adjusts margin requirements in real time based on market volatility and liquidity depth, enhancing both flexibility and safety for traders.

-

Permissionless and User-Centric Design: Hyperliquid is fully permissionless, allowing anyone to participate in trading without restrictions. Its user interface and experience are designed to rival centralized exchanges, combining decentralization with high performance and ease of use.

This competitive pressure is healthy, it pushes all players to innovate faster. Yet as it stands today, no other decentralized perpetual DEX matches the combination of speed, transparency, cross-chain access, and user-centric features offered by Hyperliquid-Style Perps.

As the perpetual DEX sector matures, the market’s appetite for low-latency trading in DeFi has only grown. Hyperliquid’s relentless focus on on-chain transparency and real-time order matching is setting a precedent that others must follow. The shift toward fully permissionless, non-custodial trading environments is not just a technical evolution, it’s a philosophical one, empowering traders to control their assets while benefiting from institutional-grade performance.

One of the most notable impacts of this innovation cycle is the rapid migration of both retail and professional traders away from centralized exchanges. With Hyperliquid-Style Perps, users no longer have to choose between speed and sovereignty. Every trade, every margin adjustment, and every liquidation event is recorded on-chain for anyone to audit. This level of transparency is unprecedented in crypto derivatives trading and speaks directly to the ethos of decentralized finance.

Risk Management, User Experience, and Community Governance

Hyperliquid’s risk engine stands out as a model for responsible leverage in DeFi. Rather than offering headline-grabbing 1001x leverage like some competitors, Hyperliquid opts for dynamic margining. This approach balances user flexibility with systemic safety, margin requirements adapt instantly to market volatility and liquidity depth. The result? Fewer forced liquidations during turbulent markets and a safer environment for all participants.

The platform’s interface also deserves mention. By focusing on intuitive design without sacrificing advanced features, Hyperliquid-Style Perps ensures that both seasoned professionals and newcomers can execute trades efficiently. In-app analytics, customizable dashboards, and integrated cross-chain bridges make it easy to monitor positions in real time across multiple ecosystems.

Community governance is another pillar shaping the future of decentralized perpetual DEXs. Hyperliquid empowers its user base with meaningful input into protocol upgrades and parameter adjustments, an essential step as DeFi platforms grow more complex and systemically important.

What’s Next for Decentralized Perpetual DEXs?

The pace of innovation shows no signs of slowing down. As competitors like Aster chase market share through high leverage or aggressive incentives, Hyperliquid continues to double down on infrastructure improvements, expanding cross-chain compatibility, reducing latency further, and exploring new asset classes for perpetual contracts.

- Institutional adoption: More hedge funds and trading firms are now entering DeFi thanks to transparent order books and robust compliance tools offered by platforms like Hyperliquid.

- Greater composability: Native integrations with wallets, portfolio trackers, and DeFi aggregators are making it easier than ever to deploy capital efficiently across protocols.

- Sustainable growth: By aligning incentives between traders, liquidity providers, and protocol governance participants, Hyperliquid-Style Perps fosters an ecosystem that rewards long-term engagement over short-term speculation.

The next generation of decentralized perpetual DEXs will be defined by their ability to combine speed with security, and transparency with usability. While rivals scramble to catch up or differentiate through niche features or extreme leverage options, Hyperliquid-Style Perps has already proven that an uncompromising commitment to performance can coexist with true decentralization.

If you’re interested in the technical details behind how this low-latency architecture works, and why it matters for your trading strategies, consider reading our deep dive here: How Hyperliquid-Style Perps Achieves Ultra-Low Latency on Decentralized Perpetual Exchanges.