In the rapidly evolving world of decentralized finance, Hyperliquid-Style Perps stands out as a perpetual trading platform that combines the best of both speed and transparency. For traders who crave CEX-like execution in DeFi, Hyperliquid’s unique approach to deep liquidity and sub-second finality is reshaping what’s possible on decentralized exchanges.

The Engine Behind Sub-Second Finality: HyperBFT and Custom L1

At the heart of Hyperliquid’s performance is its proprietary Layer 1 blockchain, Hyperliquid L1, which leverages the innovative HyperBFT consensus mechanism. This technical backbone allows the platform to process up to 200,000 orders per second, with a median confirmation time of just 0.2 seconds. That means trades are finalized nearly instantly – a critical advantage for high-frequency and swing traders who rely on rapid execution.

This sub-second finality isn’t just a marketing claim; it’s become a defining feature that enables users to manage risk more precisely and avoid slippage during volatile market moves. The result? A trading experience that rivals centralized platforms while staying true to DeFi principles.

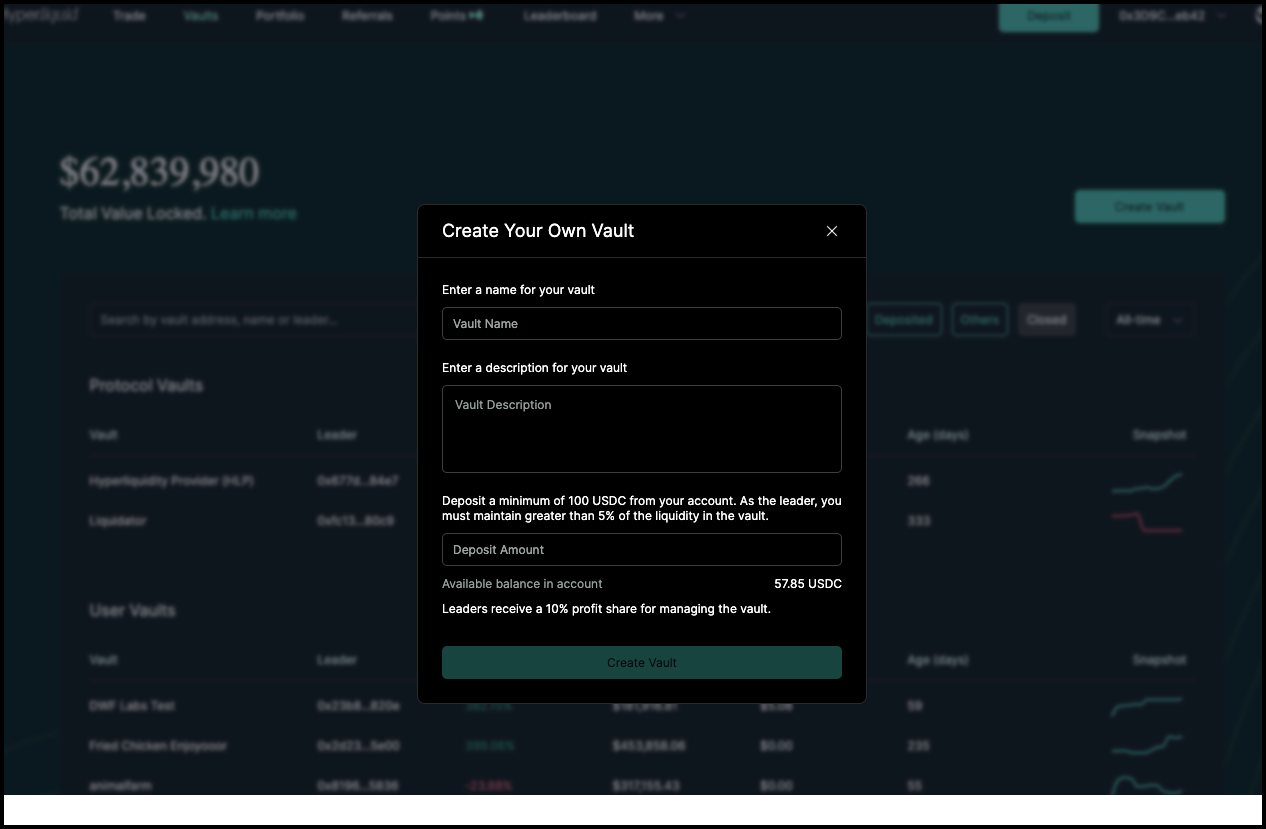

Deep Liquidity via On-Chain Orderbook and HLP Vault

While many decentralized perpetuals struggle with thin order books and fragmented liquidity, Hyperliquid attacks this problem head-on with its fully on-chain orderbook model. Every trade, quote, and fill is recorded transparently on-chain, giving traders confidence in price discovery and execution quality.

The secret weapon here is the Hyperliquidity Provider (HLP) vault. This protocol-managed liquidity pool acts as both an active market maker and a backstop for unmatched orders. If you place an order that doesn’t find an immediate counterparty, the HLP vault can step in to fill your trade – minimizing spreads and ensuring you never get stuck waiting for liquidity.

Key Features of the HLP Vault Powering Deep Liquidity

-

Protocol-Managed Liquidity Pool: The HLP vault is a protocol-controlled pool that aggregates user funds to provide consistent liquidity across all supported markets, ensuring traders can always execute orders efficiently.

-

Active Market Making: The vault algorithmically makes markets by quoting both sides of the order book, helping to minimize spreads and support deep liquidity even during high volatility.

-

Backstopping Unmatched Orders: When a trader’s order cannot find an immediate match, the HLP vault steps in to take the opposite side, ensuring every trade has a counterparty and reducing slippage.

-

Automated Liquidation Participation: The HLP vault automatically absorbs positions from liquidations, helping to prevent sudden price crashes and maintain market stability during large liquidations.

-

On-Chain Transparency: All HLP vault operations are executed transparently on-chain, allowing users to verify liquidity movements and vault performance in real time.

This dual approach not only tightens bid-ask spreads but also helps absorb large liquidations without causing cascading price crashes – a notorious issue for other perp DEXs during periods of extreme volatility.

Gasless Perps Trading: Lowering Barriers for Active Traders

An often-overlooked barrier in DeFi trading is transaction cost. Hyperliquid addresses this by offering gasless perps trading, allowing users to execute trades without worrying about fluctuating network fees eating into their profits. This feature is especially attractive for active traders who might execute dozens or even hundreds of trades per day.

Together with deep liquidity from both organic market participants and protocol-managed pools like HLP, gasless trading creates an environment where strategies once limited to centralized venues can now thrive in a transparent, trust-minimized setting.

Hyperliquid’s commitment to a seamless trading experience doesn’t stop at speed and cost-efficiency. By uniting its custom L1 architecture with a robust on-chain orderbook, the platform delivers what many in DeFi have long sought: deep liquidity decentralized exchange functionality that genuinely competes with CEXs. This is especially evident during periods of heightened volatility, when traditional DEXs often see liquidity dry up or spreads widen dramatically.

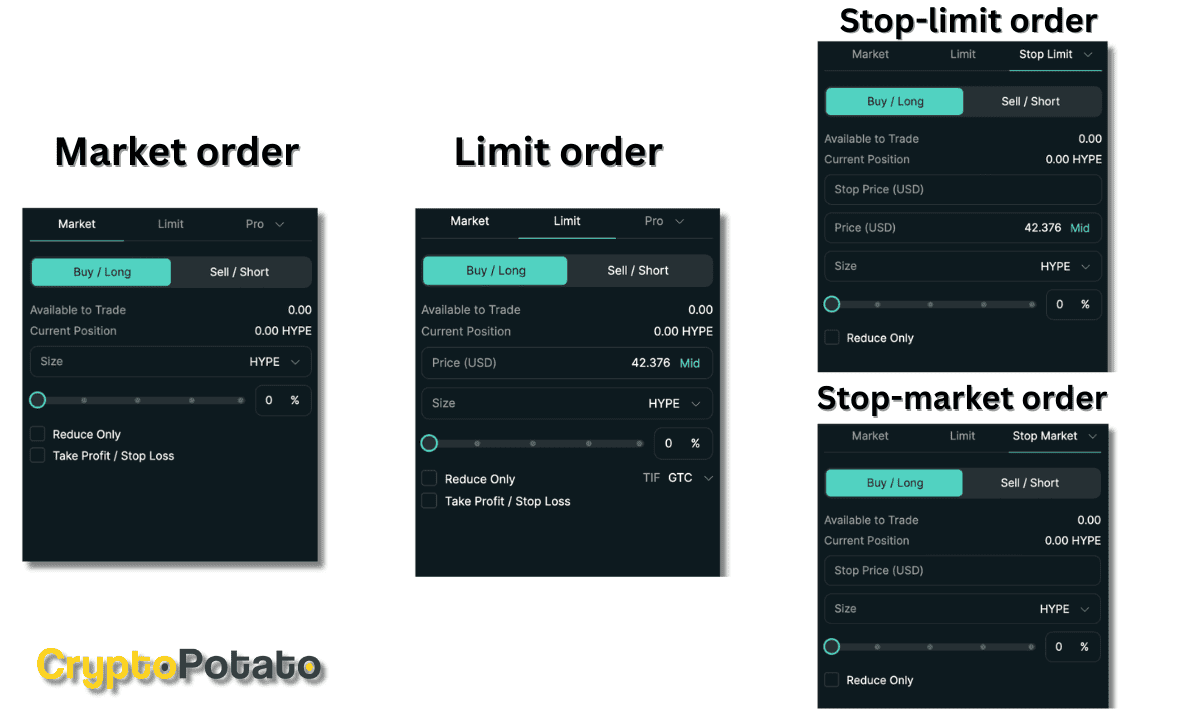

Risk Management and Real-Time Liquidations: The DeFi Risk Engine

Another pillar of Hyperliquid’s success is its comprehensive DeFi risk engine. Effective risk controls are essential for any perpetuals platform, where leverage amplifies both opportunity and danger. Hyperliquid’s system enforces position limits, circuit breakers, and real-time margin monitoring directly on-chain. The HLP vault also plays a critical role here, by automatically participating in liquidations, it can absorb large positions without triggering cascading failures across the order book.

This approach not only protects individual traders but also safeguards the broader ecosystem from systemic shocks. It’s a sophisticated blend of automation and transparency that aligns with the ethos of decentralized finance while providing the reliability professional traders expect.

Bitcoin Technical Analysis Chart

Analysis by Nadia Bennett | Symbol: BINANCE:BTCUSDT | Interval: 4h | Drawings: 7

Technical Analysis Summary

Start by marking the significant swing high near $125,500 (early October 2025) and the recent swing low around $110,900 (mid-October 2025). Draw an ascending trend line from the late September low (~$112,000) to the early October high, then a descending trend line from the top to the recent low. Highlight the sharp drop and V-shaped recovery in mid-October, and add horizontal lines at $114,000 (support) and $122,000 (resistance). Identify the current price area at $115,819 as a pivot zone. Use rectangles to show the consolidation in late September and the distribution in early October. Mark the potential reversal zone with an arrow and callout near $115,819.

Risk Assessment: medium

Analysis: Market is transitioning from high volatility to a potential new trend; liquidity and transparency remain strong due to improved DEX infrastructure, but the recent sharp swings suggest heightened emotional trading and possible whipsaws.

Nadia Bennett’s Recommendation: Wait for confirmation of support at $114,000 before entering new positions. If price reclaims and holds above $115,819 with volume, consider a swing long targeting $122,000, but keep stops tight below $111,000 to manage downside risk.

Key Support & Resistance Levels

📈 Support Levels:

-

$114,000 – Recent base after V-shaped recovery; should hold if bulls remain in control.

moderate -

$111,000 – Major support—recent swing low and psychological level.

strong

📉 Resistance Levels:

-

$122,000 – Previous distribution top; sellers likely to defend aggressively.

strong -

$125,500 – Recent high; key breakout level.

moderate

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$114,000 – Potential swing-long entry on retest of support if price confirms reversal.

medium risk -

$122,000 – Aggressive breakout entry if price closes above resistance with volume.

high risk

🚪 Exit Zones:

-

$122,000 – First profit target for long entries near support.

💰 profit target -

$111,000 – Stop loss for long entries if support fails.

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Volume likely surged during the sharp selloff and recovery, but not shown on this chart.

Look for volume confirmation at support/resistance; high volume on bounce or breakout improves reliability.

📈 MACD Analysis:

Signal: Likely forming a bullish crossover after the V-shaped recovery, but confirmation needed.

MACD should be monitored for momentum confirmation—watch for cross above zero line.

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Nadia Bennett is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

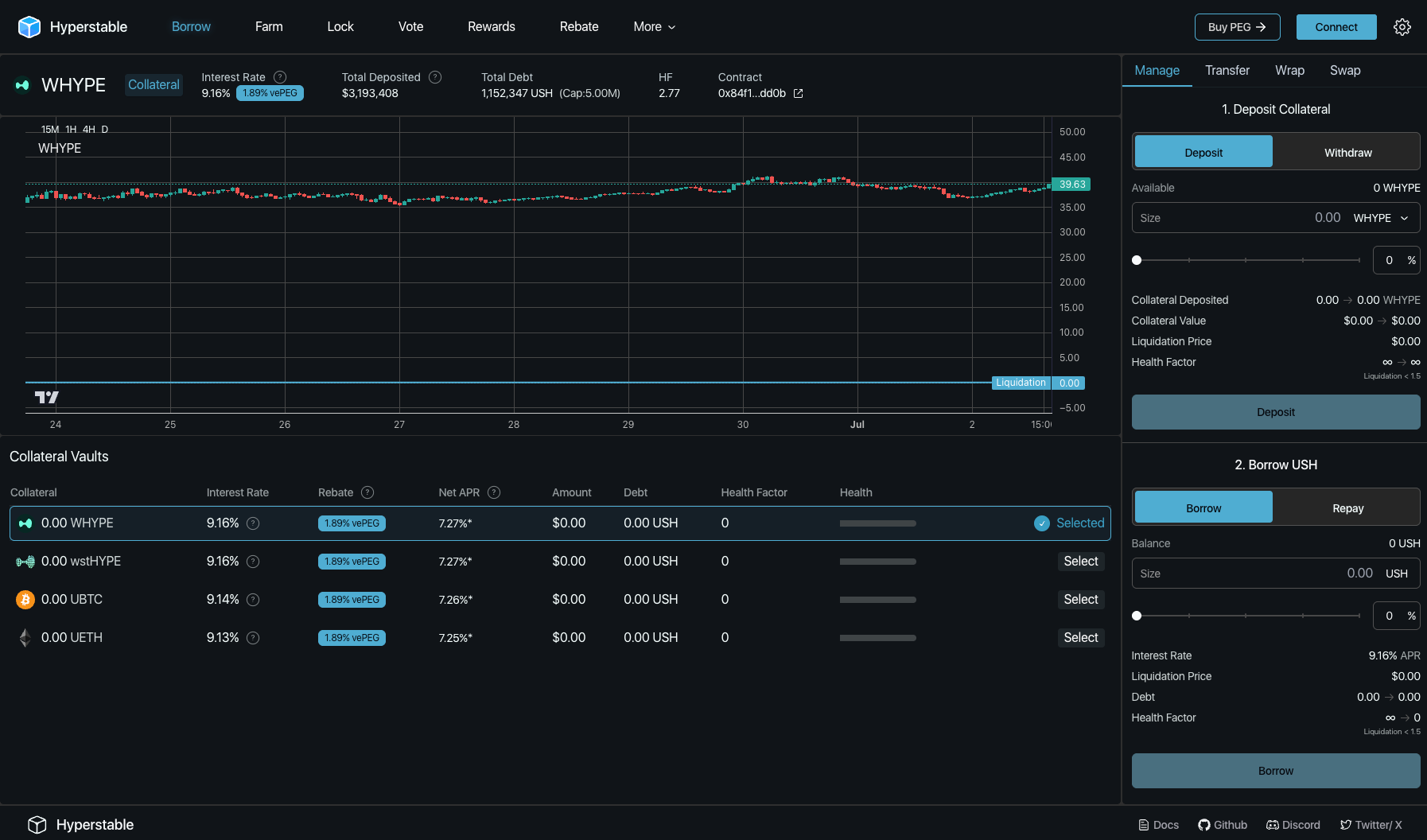

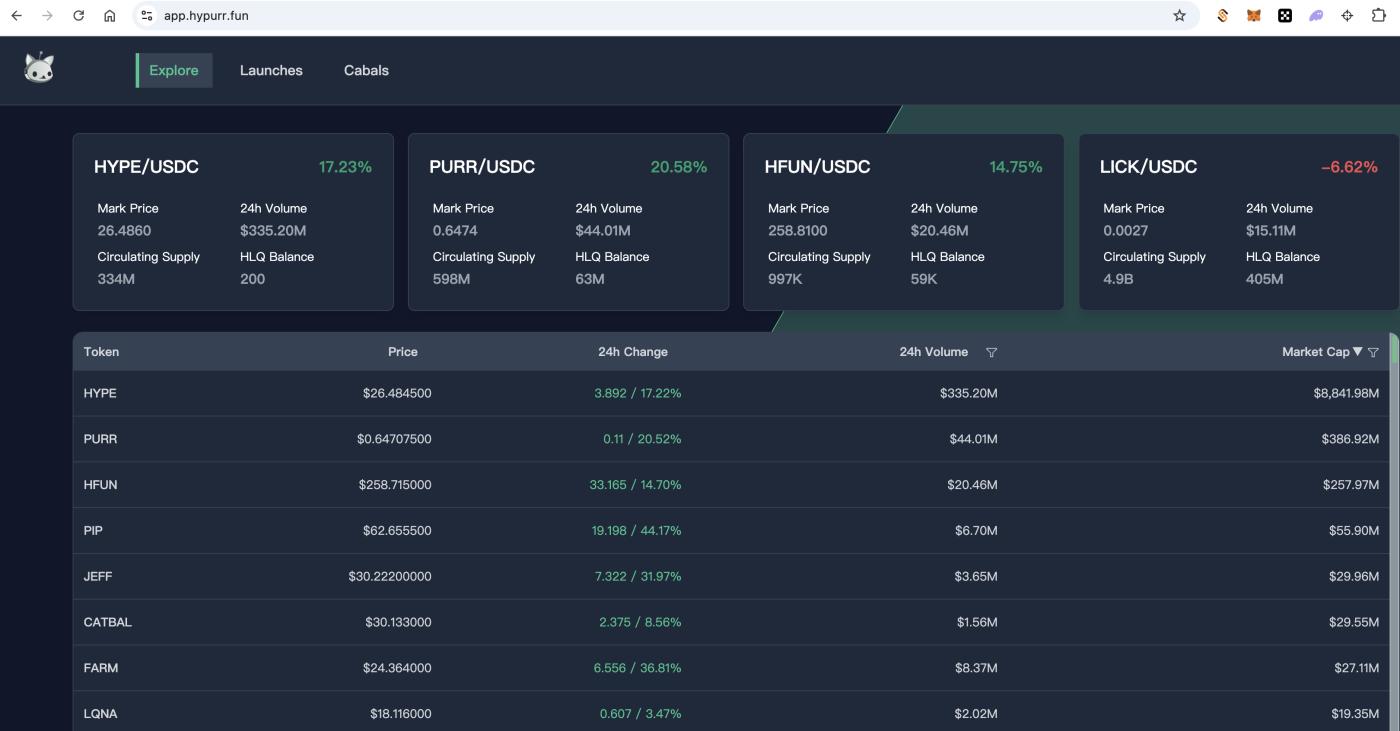

A Diverse Trading Universe: 130 and Tokens and Custom Perp Markets

Liquidity isn’t just about depth, it’s also about breadth. Hyperliquid currently supports trading on over 130 tokens, including major assets and emerging narratives like Layer 2 tokens, RWA baskets, and AI x DeFi indexes. This diversity means traders can express nuanced views or hedge complex portfolios without hopping between multiple platforms.

The introduction of index and basket perps further sets Hyperliquid apart from legacy DEXs. Traders can gain exposure to entire sectors or themes in a single trade, a feature that previously required bespoke solutions or centralized intermediaries.

Key Advantages of Trading Diverse Perp Markets on Hyperliquid

-

Extensive Market Selection: Hyperliquid supports trading perpetual contracts on over 130 tokens, including major cryptocurrencies, trending altcoins, and innovative index perps like ‘Top 10 RWAs’ and custom baskets such as ‘AI x DeFi plays.’ This diversity lets traders access a wide range of strategies from a single platform.

-

Deep On-Chain Liquidity: The Hyperliquidity Provider (HLP) vault acts as an on-chain market maker, ensuring there is always a counterparty for trades and helping to maintain tight spreads, even in less liquid or emerging markets.

-

Sub-Second Trade Finality: Thanks to its custom Layer 1 blockchain and HyperBFT consensus, Hyperliquid achieves median confirmation times of 0.2 seconds, enabling fast and reliable execution across all listed perp markets.

-

Transparent and Secure Trading: All orders and trades are processed on-chain via a transparent order book, giving users full visibility into market depth and execution, while benefiting from the security of decentralized infrastructure.

-

Robust Risk Management: Hyperliquid integrates protocol-level risk controls, including position limits and automated liquidations via the HLP vault, which helps absorb liquidations and protects market integrity across all supported perp markets.

Transparency Without Compromise

All trades, liquidations, and orderbook updates are immutably recorded on-chain via Hyperliquid L1. This full auditability empowers users to verify execution quality themselves, no more taking an exchange’s word for it. For builders and power users alike, this level of transparency is foundational for trust in DeFi protocols.

The result? A platform where speed meets security, deep liquidity meets transparency, and gasless perps trading unlocks new levels of strategy for retail and institutional participants alike. As decentralized perpetual orderbooks evolve beyond their early limitations, Hyperliquid-Style Perps stands at the forefront, delivering sub-second finality DEX performance without compromise.