Fast, reliable order execution is the lifeblood of any trading platform, but achieving ultra-low latency in a decentralized environment has historically been a major challenge. With on-chain transactions often measured in seconds, traders accustomed to the speed of centralized exchanges (CEXs) have long viewed decentralized perpetual contract trading as slow and inefficient. Hyperliquid-Style Perps is fundamentally rewriting this narrative by delivering sub-second finality, seamless order matching, and deep liquidity, all without sacrificing decentralization or transparency.

Hyperliquid’s Custom Layer 1: The Engine Behind Ultra-Low Latency

The cornerstone of Hyperliquid-Style Perps’ performance is its purpose-built Hyperliquid L1 blockchain. Unlike general-purpose blockchains, Hyperliquid L1 is architected from the ground up for high-frequency trading applications. Its proprietary HyperBFT consensus mechanism enables the network to process up to 100,000 transactions per second while maintaining sub-second block times. This technical foundation ensures that trades are confirmed with a median latency of just 0.2 seconds, a dramatic leap forward compared to most DEXs.

This breakthrough in decentralized exchange speed is not theoretical. According to recent analysis (QuickNode Blog), Hyperliquid’s architecture consistently delivers near-instant settlement and robust throughput, even during periods of peak market volatility. For active traders pursuing arbitrage or scalping strategies, these improvements can be the difference between capturing an opportunity and missing out entirely.

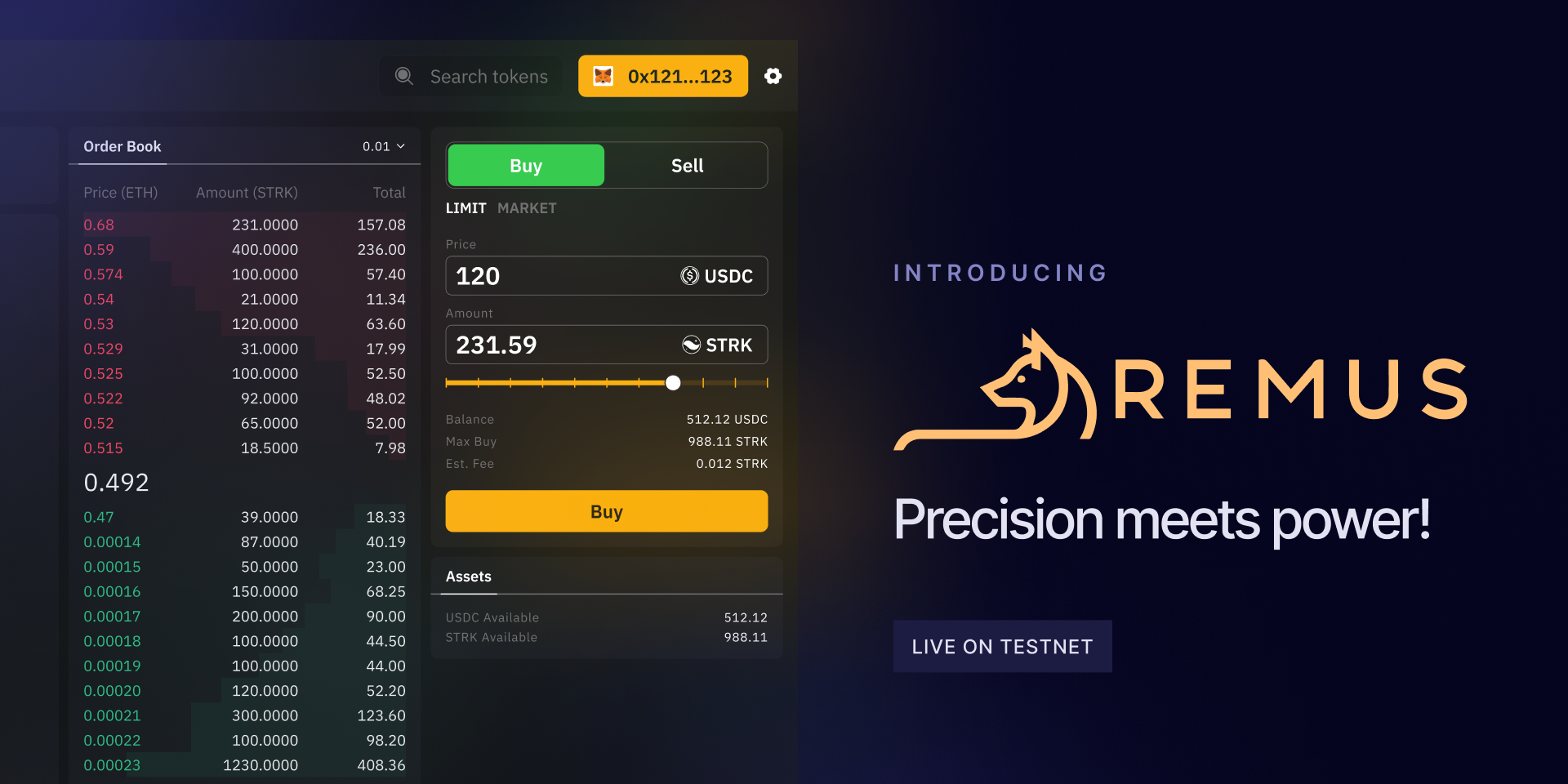

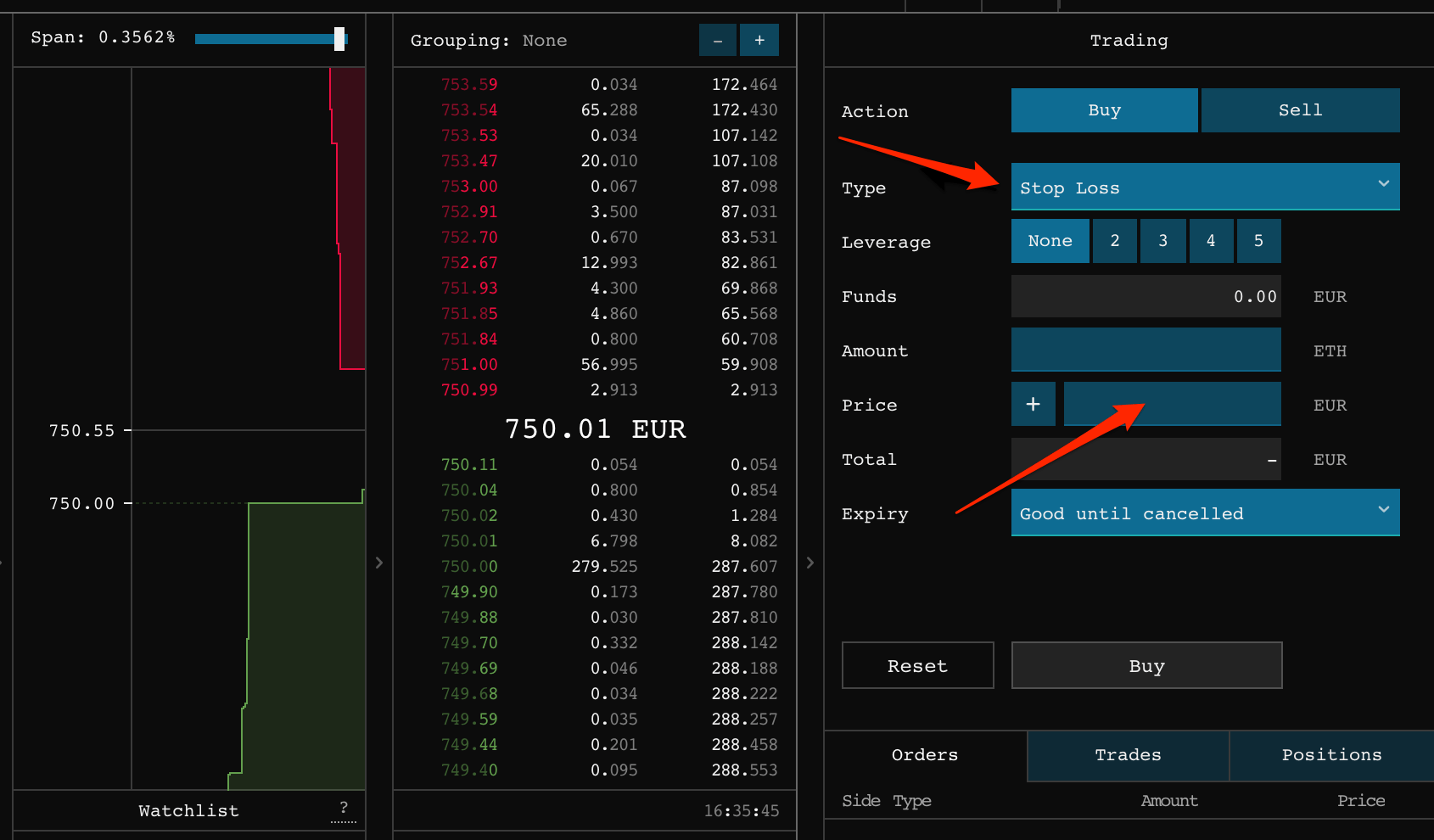

On-Chain Order Book and Matching Engine: No More Centralized Bottlenecks

A defining feature of Hyperliquid-Style Perps is its fully on-chain order book and matching engine. Traditionally, most DEXs have relied on automated market makers (AMMs) or hybrid models due to the perceived latency overhead of processing every order directly on-chain. However, this approach can introduce slippage, front-running risks, and shallow liquidity at scale.

Hyperliquid sidesteps these issues by implementing a high-performance matching engine directly within its Layer 1 protocol. Every trade, whether it’s a market order or a complex limit instruction, is executed transparently on-chain with deterministic settlement times. This design not only eliminates reliance on off-chain components but also aligns with DeFi’s ethos of open access and auditability.

Competitive Edge in the $898 Billion Perp DEX Market

The impact of these innovations is evident in current market data: perpetual DEX volumes reached $898 billion in Q2 2025 (BeInCrypto), with Hyperliquid leading the pack. This surge reflects strong trader confidence in platforms that combine fast perpetual contract trading with robust risk controls and transparent operations.

The ability to process orders at scale, while keeping latency under 0.5 seconds, has made Hyperliquid-Style Perps especially attractive for professional traders seeking an edge over slower platforms. As more institutional participants enter DeFi markets, demand for ultra-low latency DEX infrastructure will only intensify.

Hyperliquid-Style Perps’ technical superiority is not just about speed in isolation. The platform’s architecture delivers a holistic experience where latency, throughput, and transparency reinforce each other. By maintaining a median order execution time of 0.2 seconds, Hyperliquid offers a trading environment that rivals, and in some cases surpasses, leading centralized exchanges, without the trade-offs of custodial risk or opaque matching algorithms.

This commitment to performance is underscored by the platform’s ability to handle extreme market conditions. During periods of high volatility, when price discovery accelerates and order flow surges, Hyperliquid’s on-chain matching engine continues to process up to 100,000 orders per second without degradation. This consistency is essential for traders deploying algorithmic strategies or managing leveraged positions, as even minor execution delays can erode profitability.

User Experience: Fast Trading Meets Radical Transparency

Speed alone does not guarantee trader trust or platform adoption. Hyperliquid-Style Perps complements its ultra-low latency with a radically transparent trading model. Every order, fill, and cancellation is recorded on-chain in real time, enabling both users and third-party analysts to audit market activity without relying on proprietary APIs or delayed data feeds.

This transparency is particularly valuable for institutional traders who require independent verification of execution quality and for retail users wary of hidden fees or unfair practices endemic to some CEXs. The result is an ecosystem where all participants operate on a level playing field, backed by cryptographic guarantees rather than corporate promises.

Why Latency Matters More Than Ever

The competitive landscape for decentralized perpetual exchanges has never been fiercer. With Binance and Tron entering the fray alongside rising stars like Aster (BeInCrypto), only platforms that deliver measurable advantages in speed and reliability will retain market share as volumes push past $898 billion per quarter. For high-frequency traders, arbitrageurs, and institutions alike, latency isn’t just a technical metric, it’s a direct driver of strategy viability and risk-adjusted returns.

Top Reasons Ultra-Low Latency DEXs Attract Institutional Capital

-

Sub-Second Trade Execution: Platforms like Hyperliquid achieve median order latency of just 0.2 seconds thanks to their custom-built Layer 1 blockchain and HyperBFT consensus, enabling near-instantaneous trading that rivals centralized exchanges.

-

Deep On-Chain Liquidity: By utilizing a fully on-chain order book and matching engine, ultra-low latency DEXs provide deep liquidity and low slippage, making large trades feasible and attractive for institutional investors.

-

High Throughput for Institutional Scale: Hyperliquid L1 processes over 100,000 transactions per second, supporting the high-frequency trading strategies favored by professional and institutional traders.

-

Transparency and Security: All trades and order book activities are recorded on-chain, offering full transparency and non-custodial security—key requirements for compliance-focused institutions.

-

No Gas Fees on Trades: Platforms like Hyperliquid eliminate gas fees for trading, reducing operational costs and enabling more efficient capital deployment for institutions.

-

Advanced Order Types and Features: Support for advanced order types (e.g., limit, stop, and conditional orders) and robust APIs allows institutions to implement sophisticated trading strategies similar to those used on leading centralized exchanges.

Looking forward, the innovations pioneered by Hyperliquid-Style Perps set new standards for what traders can expect from decentralized infrastructure. As DeFi matures beyond its experimental phase, platforms that combine fast perpetual contract trading with uncompromising transparency will define the next era of financial markets, one where every millisecond counts but no trade happens in the dark.