Imagine trading perpetual contracts on a decentralized exchange and having your order executed, confirmed, and settled in less than a second. In 2025, this is not a pipe dream, it’s the reality for traders on Hyperliquid-style DEXs. As perpetual DEX daily volumes soared to $96.973 billion by September, the demand for sub-second trade execution has never been higher. But how exactly are these platforms achieving speeds that rival or even surpass their centralized counterparts? Let’s dive into the technology and design choices behind this new era of real-time crypto trading.

The Power of a Custom Layer-1 Blockchain

At the heart of Hyperliquid’s performance is its custom-built Layer-1 blockchain. Unlike legacy networks that struggle with congestion and high fees, Hyperliquid was engineered from scratch for high-frequency trading. The secret sauce: HyperBFT consensus. Building on innovations like the Hotstuff algorithm, HyperBFT can process up to 200,000 transactions per second with median finality times of just 0.2 seconds. This means your trades are not just fast, they’re finalized almost instantly, eliminating the anxiety of waiting for confirmations during volatile market moves.

This technical leap isn’t just about raw speed; it’s also about transparency and security. Every step, from order submission to settlement, takes place fully on-chain and is auditable by anyone. There are no hidden execution risks or off-chain backdoors often found in hybrid models. For those interested in how these mechanics play out in detail, check out our deeper analysis at How Hyperliquid-Style Perps Achieves Ultra-Low Latency in Decentralized Perpetual Trading.

Fully On-Chain Order Book: No Compromises

Most decentralized exchanges have historically relied on automated market makers (AMMs), which are great for simplicity but lack the nuanced features pro traders expect. Hyperliquid flips this script by implementing a fully on-chain central limit order book (CLOB). This enables true price-time priority matching and supports advanced order types like TWAP (time-weighted average price), stop-losses, take-profits, and scale orders, all natively on-chain.

The result? Traders get granular control over their positions without sacrificing decentralization or transparency. This approach also unlocks deep liquidity, crucial when you’re managing large or leveraged trades where slippage can eat into profits.

No Gas Fees: Frictionless DeFi Trading

If you’ve ever been frustrated by gas fees eating into your profits or slowing down your strategy, you’ll appreciate what Hyperliquid brings to the table: zero gas fees for trading operations. After an initial wallet connection approval, users enjoy one-click trading without constant pop-ups or extra costs. This streamlined user experience mirrors that of top-tier centralized exchanges but stays true to DeFi values.

This isn’t just about convenience, it’s fundamental to enabling high-frequency strategies and algorithmic bots that need reliable cost structures and instant execution to remain profitable in competitive markets.

High Throughput, Low Latency: Why Speed Matters in Perpetuals

Speed is more than a bragging right, it’s a necessity for anyone deploying algorithmic strategies or managing leveraged positions on decentralized exchanges. Even the smallest execution delay can mean the difference between profit and loss, especially when markets move fast. Hyperliquid’s custom Layer-1 architecture, paired with HyperBFT consensus, delivers over 200,000 transactions per second and sub-second finality. This isn’t just theoretical: traders are seeing their orders matched and settled in real time, rivaling the best centralized venues.

To illustrate how this plays out on the ground, here’s a look at how Hyperliquid-style perpetual DEXs stack up against traditional counterparts:

Comparison of Trade Execution Speeds and Features: Hyperliquid-Style Perpetual DEXs vs. Legacy Exchanges (2025)

| Feature | Hyperliquid-Style Perpetual DEXs (2025) | Legacy Decentralized Exchanges (DEXs) | Centralized Exchanges (CEXs) |

|---|---|---|---|

| Trade Execution Speed | Sub-second (median 0.2s) | 10–30 seconds | Sub-second (typically 0.1–0.3s) |

| Order Matching | Fully on-chain order book & matching engine | Automated Market Maker (AMM); off-chain or hybrid order books | Centralized order book |

| Advanced Order Types | Supported (TWAP, stop-loss, take-profit, scale orders) | Limited (mainly market/swap) | Full suite (TWAP, stop-loss, take-profit, etc.) |

| Transaction Throughput | 200,000+ TPS | Hundreds to a few thousand TPS | Up to millions TPS (proprietary infra) |

| Gas/Trading Fees | Zero gas fees; minimal trading fees | Gas fees apply; trading fees vary | Trading fees (no gas fees) |

| User Experience | One-click trading, no repeated wallet approvals | Multiple confirmations, wallet prompts | Seamless, fast UI |

| Transparency & Auditability | Fully on-chain, verifiable & auditable | Partially on-chain; some off-chain components | Opaque; internal records only |

| Community Rewards | 97% of fees to community (HYPE buybacks, HLP vault 36% APY) | Limited or no community rewards | Typically none; profits to company |

| Venture Capital Involvement | No traditional VC; organic growth | Often VC-backed | Heavily VC/corporate-backed |

Community-Driven Tokenomics: Aligning Incentives for Growth

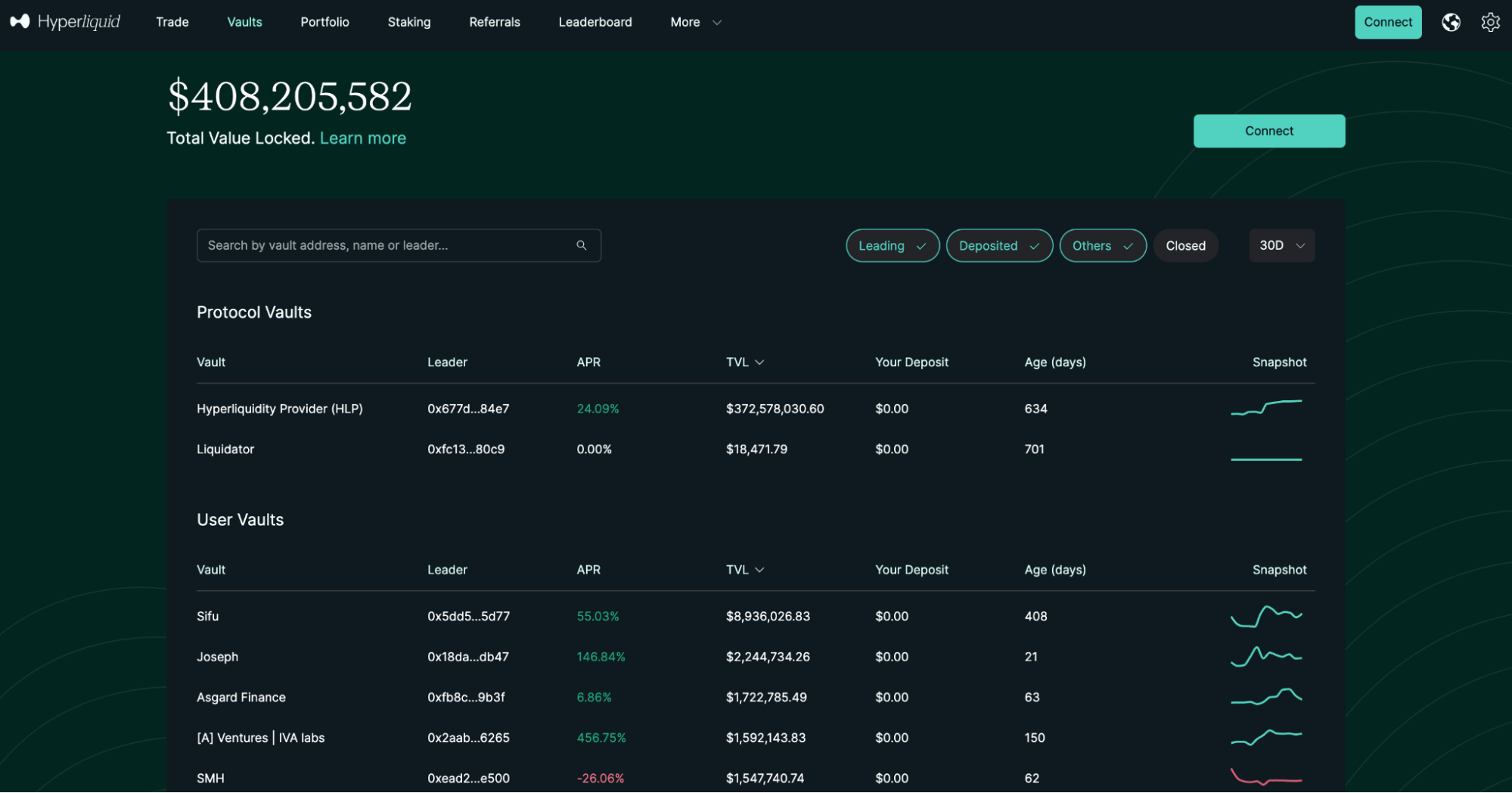

What sets Hyperliquid apart isn’t just technology, it’s the community-first approach baked into its tokenomics. A whopping 97% of protocol fees are directed back to users via HYPE token buybacks and the HLP vault, which currently offers a competitive 36% APY to liquidity providers. This model has fueled organic growth and fierce user loyalty, without relying on traditional venture capital funding or aggressive incentives that often prove unsustainable elsewhere.

This alignment of incentives means that as trading volume grows (recall September’s $96.973 billion daily volume milestone), so do rewards for active participants. It’s a feedback loop that encourages deeper liquidity, tighter spreads, and even faster execution, a virtuous cycle benefiting both new traders and seasoned professionals.

Transparency and Trust: Fully On-Chain Verification

Perhaps most importantly, every aspect of order matching and settlement is fully on-chain and auditable. There are no off-chain components or opaque processes; everything from order placement to final settlement is transparent by design. This eliminates hidden execution risks, a common pain point in hybrid models, and empowers traders with confidence that what they see is what they get.

Looking Ahead: The Future of Real-Time Crypto Trading

The emergence of platforms like Hyperliquid signals a paradigm shift for DeFi trading infrastructure. With sub-second trade execution now standard, deep liquidity pools, zero gas fees, and community-aligned incentives all working in tandem, perpetual contracts technology has never been more accessible, or competitive.

If you’re looking to maximize your edge in real-time crypto trading, there’s never been a better time to explore what next-gen decentralized exchanges have to offer. For traders who demand speed without compromise, and want their interests aligned with the protocol itself, Hyperliquid-style perp DEXs set a new benchmark for what’s possible in 2025.

Curious about how these innovations empower high-frequency strategies? Dive deeper into low-latency DeFi trading at How Low-Latency Perpetual DEXs Like Hyperliquid-Style Perps Empower High-Frequency Crypto Traders.