Perpetual DEX aggregators are rapidly redefining the landscape of on-chain leverage trading. In the last two years, the emergence of platforms like VOOI has addressed a central challenge for decentralized finance (DeFi) traders: fragmented liquidity and complex cross-chain execution. By integrating over 17 blockchain networks and unifying access to leading perpetual DEXs such as Hyperliquid, Orderly, KiloEx, and SynFutures, VOOI demonstrates how chain abstraction is no longer just a concept but a powerful engine for capital efficiency and user experience.

Chain Abstraction: The Backbone of Cross-Chain Perpetual Trading

The concept of chain abstraction is pivotal to understanding this transformation. Traditionally, on-chain traders faced operational friction when navigating between different blockchains – each with its own wallet infrastructure, bridging requirements, and native assets. VOOI’s chain abstraction technology eliminates these hurdles by enabling users to deposit funds from any supported blockchain, then trade seamlessly across all integrated networks without manual asset transfers or wallet juggling.

This unified approach is not only user-friendly but also critical for institutional-grade leverage trading. By abstracting away the underlying chains, VOOI allows traders to focus on execution strategy rather than logistics. The result is a more streamlined workflow that reduces both latency and operational risk – two factors that have historically limited DeFi’s appeal for high-frequency or high-leverage participants.

Liquidity Aggregation: Deepening Markets and Reducing Slippage

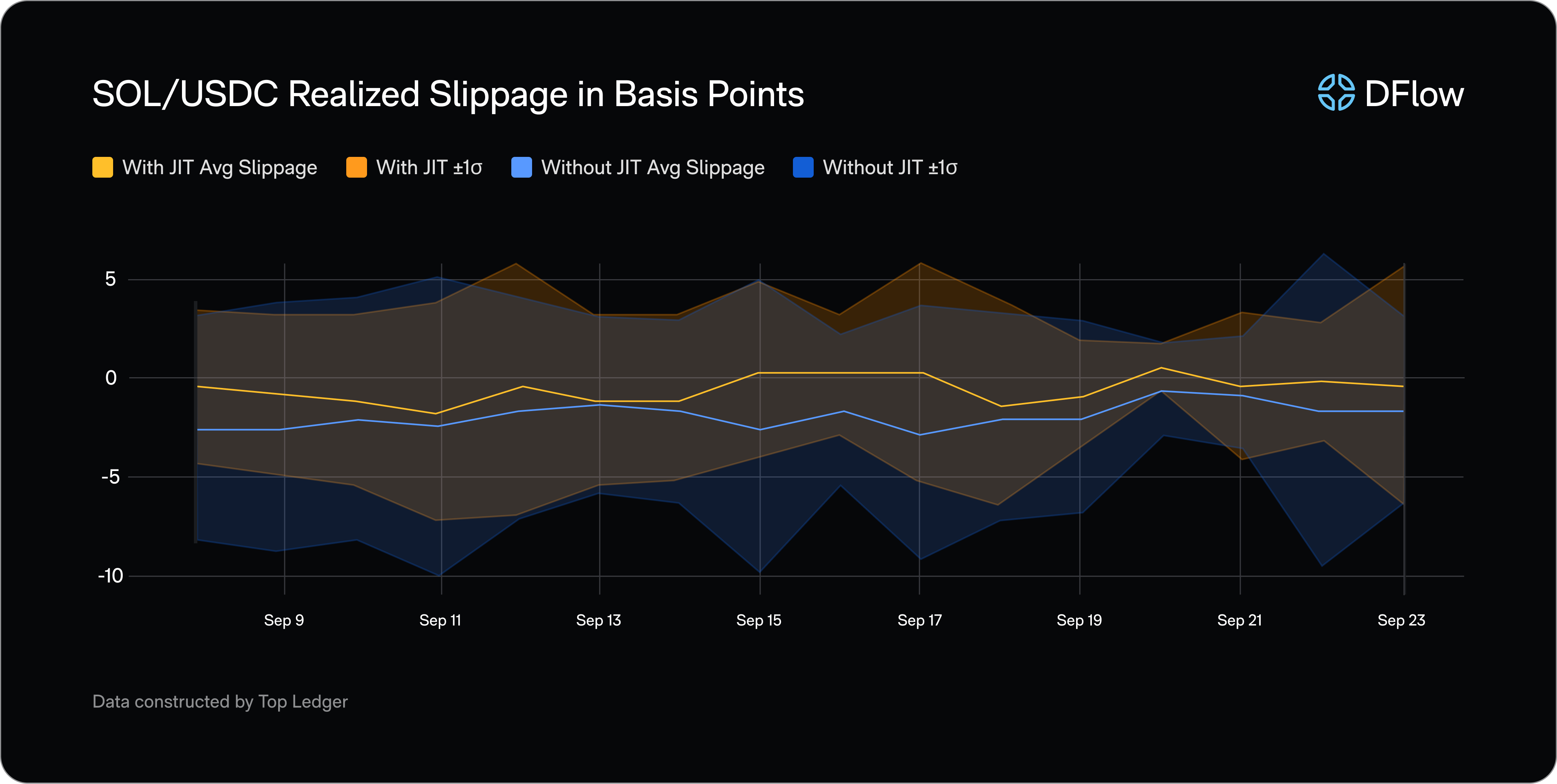

One of the most significant advantages of perpetual DEX aggregators like VOOI lies in liquidity aggregation. Instead of being restricted to the order book or AMM pool of a single protocol, traders can now tap into the combined depth of multiple DEXs across several chains. This aggregation ensures that large orders can be executed with minimal slippage and at tighter spreads – a crucial consideration for leveraged positions where every basis point matters.

VOOI’s smart routing engine evaluates real-time order book data, bid/ask spreads, funding rates, and available liquidity across its network of integrated protocols. It then automatically selects the most efficient execution path for each trade. For example, if KiloEx offers better depth on an ETH-PERP pair but Hyperliquid has lower funding costs at that moment, VOOI can route portions of an order accordingly to optimize outcomes for the trader.

Simplifying On-Chain Leverage: Non-Custodial Access with Institutional Tools

The non-custodial nature of platforms like VOOI remains central to their appeal in DeFi circles. Users maintain control over their assets at all times while benefiting from features previously reserved for centralized exchanges – such as advanced order types, portfolio margining across protocols, and unified dashboards tracking positions in real time. This blend of security and sophistication is particularly attractive in an era where counterparty risk remains top-of-mind following high-profile CEX failures.

Moreover, by supporting both EVM-compatible and non-EVM chains (including Solana), VOOI future-proofs its utility against evolving market trends. As new perpetual DEXs launch or existing ones migrate liquidity to alternative chains, users can continue accessing best-in-class trading venues without changing their operational setup or learning new workflows.

The result is a trading environment where on-chain leverage becomes genuinely competitive with centralized alternatives – not only in terms of transparency but also speed, depth, and flexibility. For further insights into how chain abstraction powers these next-generation aggregators, explore our detailed analysis at this link.

As the ecosystem matures, perpetual DEX aggregators are also driving a wave of composability within DeFi. By abstracting away the technical barriers associated with cross-chain trading, platforms like VOOI enable developers and traders alike to build and execute more sophisticated strategies. Cross-protocol arbitrage, dynamic hedging across multiple venues, and even automated liquidity provision become not just possible but practical for a broader user base.

For instance, a trader might simultaneously manage positions on Hyperliquid for deep liquidity, SynFutures for exotic pairs, and Orderly for granular order book control, all from a single unified interface. This level of integration was previously unimaginable without significant manual intervention or custodial risk. Now, thanks to chain abstraction DeFi frameworks, capital flows fluidly wherever opportunity arises.

Risk Management and Transparency: Raising the Bar in Decentralized Trading

Advanced risk management features are quickly becoming table stakes for on-chain leverage trading. VOOI and similar aggregators provide real-time analytics on funding rates, open interest across connected DEXs, and portfolio health metrics, empowering users to respond rapidly to market shifts. Crucially, all transactions remain verifiable on-chain, preserving the transparency that underpins DeFi’s ethos.

This transparency extends to liquidation protocols as well. Because each trade is executed directly on integrated DEXs rather than through an opaque intermediary layer, users can independently verify margin requirements and execution logic at any time. For institutional participants managing significant capital or regulatory obligations, this level of auditability is essential.

Key Benefits of Perpetual DEX Aggregators Like VOOI

-

Unified Liquidity Access: Aggregators like VOOI consolidate liquidity from leading perpetual DEXs—including Orderly, KiloEx, Hyperliquid, and SynFutures—across 17+ blockchains, enabling traders to access deep, diverse markets through a single interface.

-

Non-Custodial Security: Platforms such as VOOI operate in a non-custodial manner, meaning users retain full control over their assets without the need to deposit funds into a centralized entity, significantly reducing counterparty risk and aligning with DeFi best practices.

-

Smart Routing Efficiency: VOOI’s smart routing engine analyzes order book depth, bid/ask spreads, and funding rates across multiple DEXs to ensure optimal trade execution, minimizing slippage and maximizing pricing efficiency for leveraged trades.

-

Seamless Cross-Chain Trading: Through chain abstraction, VOOI enables users to deposit from any supported blockchain and trade seamlessly, eliminating the need for manual bridging or managing multiple wallets, and greatly simplifying the trading workflow.

-

Expanded Market Access: Integration with platforms like SynFutures and support for both EVM and non-EVM networks provide users with access to a broader range of trading pairs and liquidity pools, enhancing flexibility and opportunity in perpetual trading.

The Road Ahead: What’s Next for Perpetual Aggregators?

The rapid adoption of perpetual DEX aggregators signals a paradigm shift in how leverage is accessed and managed within DeFi. As more protocols embrace chain abstraction and liquidity aggregation models, we can expect further compression of spreads between centralized and decentralized venues, particularly as latency drops and capital efficiency improves.

However, challenges remain. Ensuring robust oracle infrastructure across chains is critical to prevent manipulation in thinly traded markets. Likewise, maintaining seamless UX as new blockchains emerge will require ongoing investment in abstraction layers and wallet integrations.

Despite these hurdles, the trajectory is clear: on-chain leverage trading is evolving beyond its fragmented roots toward a unified marketplace where best execution prevails regardless of underlying protocol or network. Platforms like VOOI are not only making this vision tangible but also accelerating its arrival by pushing boundaries on both technology and user experience.

For those seeking deeper analysis into how perpetual aggregator models differ from legacy DEXs, and what this means for your trading strategy, see our comprehensive breakdown here.