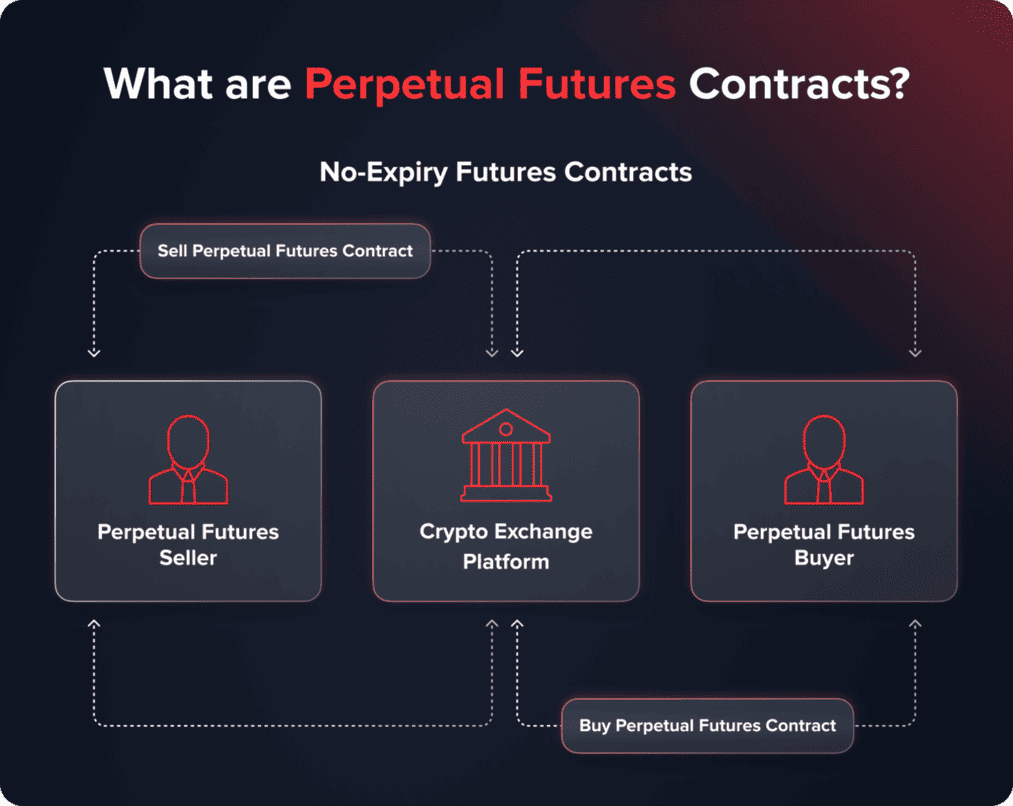

Perpetual DEX airdrop points and volume calculators have become the hottest tools for crypto traders looking to maximize rewards on platforms like Hyperliquid. With the rise of decentralized perpetual trading, understanding how these systems work is as crucial as having a solid trading strategy. If you’re aiming for the next big airdrop or simply want to optimize your trading incentives, it pays to know exactly what drives your point totals and how you can leverage every feature the platform offers.

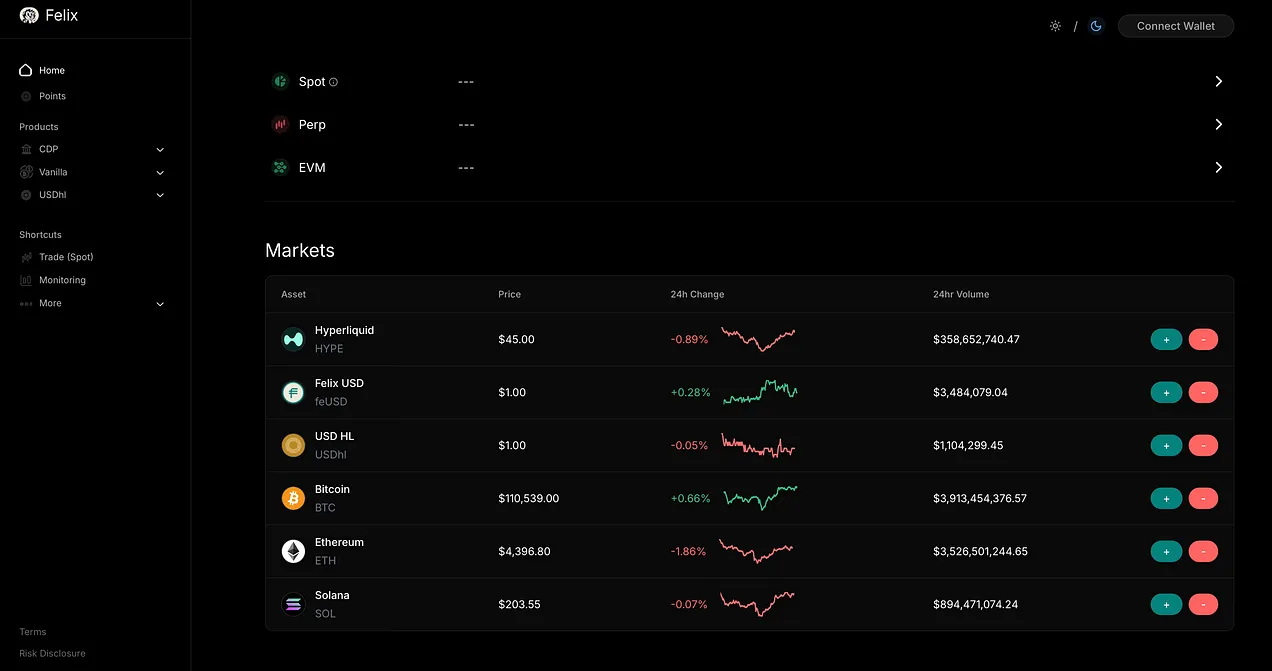

Hyperliquid has emerged as one of the leading perpetual DEXs in 2025, contributing over $316.4 billion in 30-day perp volume and holding more than $7.5 billion in open interest. This explosive growth is being fueled not just by deep liquidity and fast execution but also by innovative incentive programs that reward active users through airdrop points. These points are more than just bragging rights – they’re your ticket to future HYPE token distributions and other ecosystem rewards.

Inside the Perpetual DEX Airdrop Points System

The heart of Hyperliquid’s user rewards mechanism is its airdrop points system. Unlike traditional exchanges where loyalty programs are opaque or limited, perpetual DEXs like Hyperliquid make every action count toward your total potential rewards:

Top Ways to Earn Airdrop Points on Hyperliquid Perps

-

Trade Perpetual Contracts: Earn airdrop points directly proportional to your trading volume. For example, every $1 traded on Hyperliquid can equal 1 point, making active trading the core way to accumulate rewards.

-

Provide Liquidity (Maker Orders): Place and maintain maker orders on the order book. Keeping these orders open for a set duration earns you extra points, rewarding users who help deepen market liquidity.

-

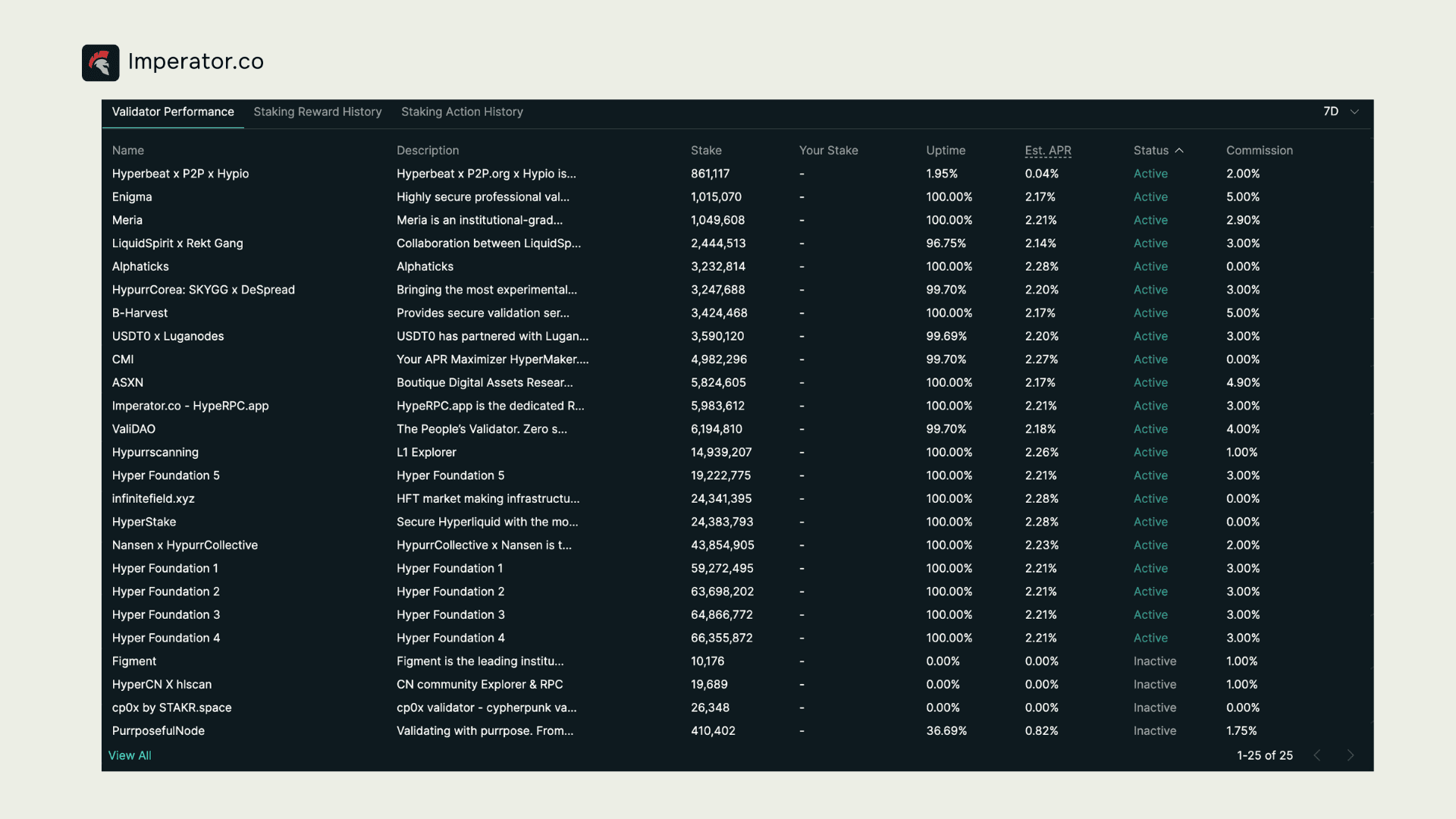

Stake Native Tokens: Stake Hyperliquid’s native tokens to receive daily airdrop points. The more tokens you stake, the higher your daily point accrual.

-

Engage With HyperEVM Ecosystem Projects: Interact with projects within the Hyperliquid ecosystem—such as deploying contracts or supplying liquidity—to unlock bonus points and maximize your rewards.

-

Refer New Traders: Use the referral program to invite new users. When your referrals actively trade, you earn a percentage of their points as a bonus.

-

Hold Platform-Specific NFTs: Acquire and hold certain Hyperliquid NFTs to receive flat point bonuses, adding another layer to your airdrop strategy.

- Trading Volume: The core driver. For every $1 traded, you typically earn 1 point. High-frequency traders or those who scale up their size see exponential benefits here.

- Liquidity Provision: Placing maker orders that stay open for longer periods can rack up extra points, especially during high-volume sessions.

- Staking Native Tokens: By staking HYPE or related tokens, you earn daily points based on your staked amount – an attractive passive strategy for long-term holders.

- Ecosystem Engagement: Participating in protocol launches, deploying contracts on HyperEVM, or supplying liquidity to ecosystem projects can unlock bonus multipliers.

- Referral Rewards: Bringing new active traders onto the platform means you get a percentage of their earned points – creating powerful network effects.

- NFT Bonuses: Holding specific NFTs associated with Hyperliquid can provide flat point boosts, stacking with other activities for even greater returns.

The Role of Volume Calculators: Estimating Your Edge

If you’ve ever wondered how much your activity might be worth in future airdrops, volume calculators are indispensable tools. These calculators help you project your expected rewards based on current trading habits and planned activities. They factor in not just raw trading volume but also multipliers from special events (like promotional periods), pair diversification bonuses, and additional activities such as liquidity provision or staking.

The best calculators update frequently to reflect changes in platform rules or reward structures – so staying informed is key if you want to stay ahead of other traders competing for top-tier rewards.

Tactics for Maximizing Your Rewards on Hyperliquid-Style Perps

Savvy traders know that maximizing perpetual DEX trading incentives isn’t just about grinding volume. It’s about engaging strategically across all available channels. Here’s what top performers are doing right now:

- Diversifying Trading Pairs: Some pairs offer higher multipliers during promotional windows or when newly listed; spreading out trades can boost overall point totals.

- Consistently Providing Liquidity: Maintaining maker orders through volatile sessions earns ongoing rewards without actively day-trading every move.

- Tapping Ecosystem Bonuses: Early involvement in new protocol launches within HyperEVM often comes with unique point opportunities not available elsewhere.

- Piling Up Referrals and NFTs: Combining referral earnings with NFT-based bonuses creates compounding effects over time, especially as community engagement grows.

If you want more actionable tips on how to calculate airdrop rewards on DEX platforms like Hyperliquid, check out this comprehensive guide for early DeFi traders.

To truly excel in the current landscape of perpetual DEX airdrop points, it’s essential to treat every platform interaction as a potential multiplier for your rewards. Many traders make the mistake of focusing solely on trading volume, but the real leaders in this space are those who layer multiple activities, staking, referrals, liquidity provision, and NFT holding, to unlock compounding benefits. The difference between a good and a great airdrop allocation often comes down to these incremental optimizations.

Practical Checklist: Steps to Boost Your Hyperliquid Airdrop Rewards

As you work through the checklist above, pay special attention to promotional periods. Hyperliquid is known for rolling out time-limited campaigns where certain pairs or activities yield double or even triple points. Setting up alerts or following official announcement channels ensures you never miss these windows. Additionally, don’t overlook the synergy between staking and liquidity provision, staking HYPE tokens can unlock access to exclusive pools or higher-yield maker incentives.

The competitive nature of perpetual DEX trading incentives means that staying ahead requires both strategy and adaptability. For example, if you notice new ecosystem projects launching on HyperEVM, consider engaging early. These projects often offer unique point bonuses or early adopter multipliers that can significantly boost your overall standing in the rewards leaderboard.

Community Insights: Real-World Results from Active Traders

Nothing beats learning from those who have already navigated the process successfully. Community-driven strategies, such as pooling resources with friends for referral chains or sharing insights about high-multiplier pairs, can accelerate your path toward top-tier rewards. Social platforms are filled with traders openly discussing their approaches and even sharing screenshots of their volume calculator projections.

For those new to perpetual DEXs or looking for more nuanced strategies beyond the basics, curated guides can offer an edge. If you want an in-depth breakdown, including mistakes to avoid and advanced tactics for stacking multipliers, explore this guide for early DeFi traders. It covers everything from optimizing trade timing to leveraging ecosystem partnerships.

Why Calculators Matter More Than Ever

The rapid evolution of reward structures means that manual tracking is no longer sufficient for serious participants. Perpetual DEX volume calculators not only save time but also expose hidden opportunities by modeling how changes in your activity could impact future token distributions. As platforms like Hyperliquid continue innovating with new incentive layers, think NFT integrations or cross-chain bonuses, the ability to simulate different scenarios becomes invaluable.

Common Mistakes in Calculating Perp DEX Airdrop Rewards

-

Ignoring Activity Multipliers: Many users overlook special multipliers for trading new pairs or participating in promotional periods, leading to underestimated point totals.

-

Counting Only Trading Volume: Focusing solely on trading volume and neglecting liquidity provision, staking, or ecosystem engagement means missing out on significant bonus points.

-

Not Factoring in Staking Rewards: Forgetting to include daily points from staking native tokens like HYPE can result in lower projected rewards.

-

Overlooking Time-Based Bonuses: Failing to track promotional windows or bonus periods can cause users to miss extra points available for a limited time.

-

Ignoring Referral and NFT Bonuses: Not accounting for referral program earnings or NFT point boosts leads to incomplete calculations and missed opportunities.

-

Using Outdated Calculators: Relying on old or unofficial volume calculators can give inaccurate estimates if point formulas or reward structures have changed.

Ultimately, maximizing your rewards on Hyperliquid-style Perps is about more than just raw numbers, it’s about understanding the interplay between platform mechanics and your personal trading habits. By proactively leveraging every available incentive and regularly recalibrating your approach using up-to-date calculators, you’ll be well-positioned not just for current airdrops but also for whatever innovations come next in decentralized trading incentives.