Imagine executing a high-leverage trade across multiple blockchains in a single click, without ever worrying about gas fees eating into your profits or slowing you down. This is the reality of gasless perpetual DEX trading, a breakthrough that’s fundamentally reshaping how traders engage with DeFi. As platforms like Hyperliquid-Style Perps and its gasless peers evolve, they’re removing friction at every step, making cross-chain leveraged trading not just possible, but seamless and cost-effective for everyone from swing traders to high-frequency strategists.

Why Gasless Matters: Breaking Down the Barriers

For years, network fees have been a hidden tax on decentralized trading. Every transaction, every adjustment to a stop-loss or take-profit order, meant another deduction from your bottom line. With gasless DeFi trading, these costs are eliminated. This isn’t just about saving a few dollars; it’s about unlocking new strategies and empowering smaller accounts to compete on equal footing with whales.

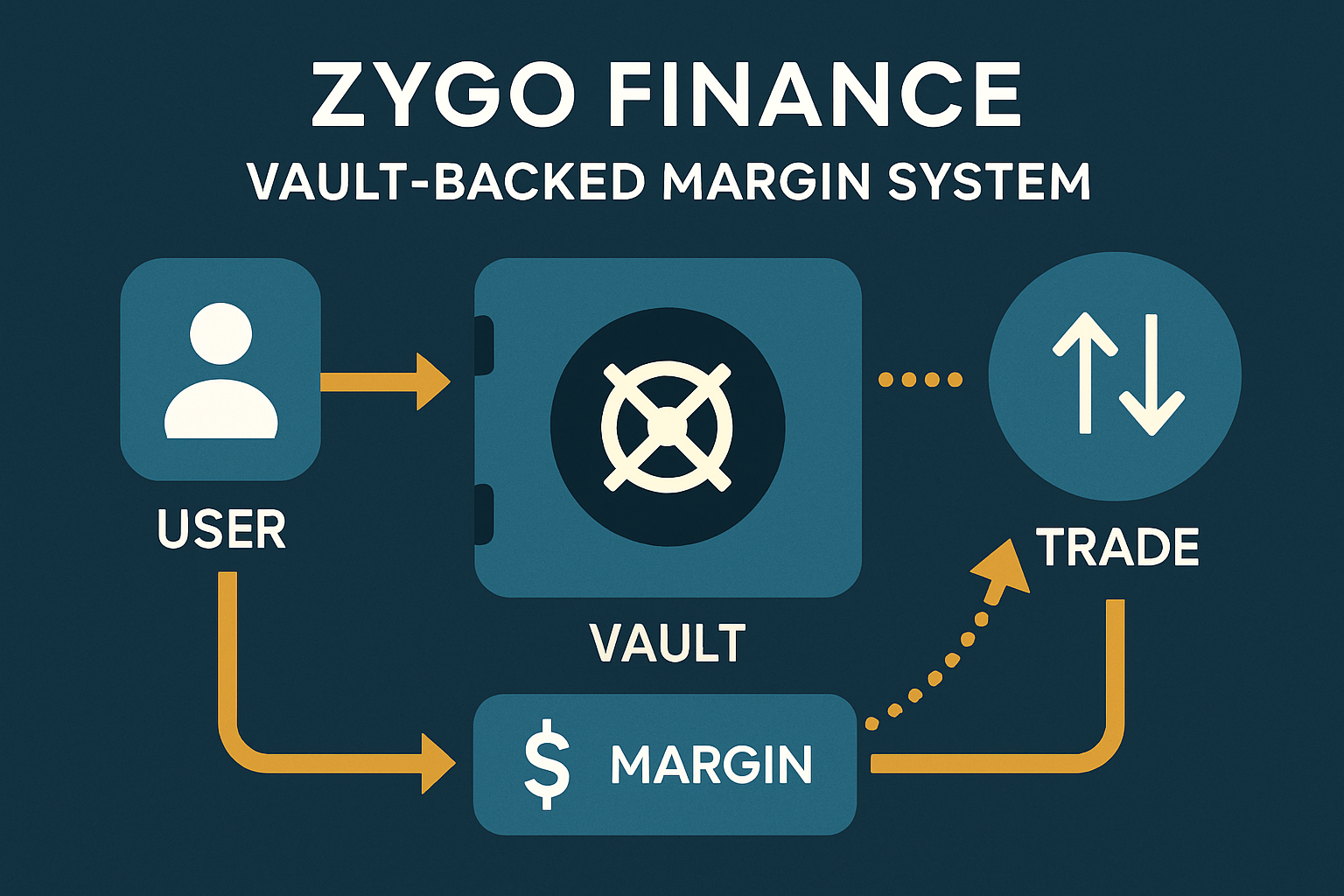

Platforms like Zygo Finance have pioneered ecosystem-owned liquidity models, where users can open and close positions without paying network fees. This is achieved by integrating with protocols like Mitosis, which abstract away gas costs entirely, making every action frictionless and accessible.

The Mechanics: How Gasless Perpetual DEXs Actually Work

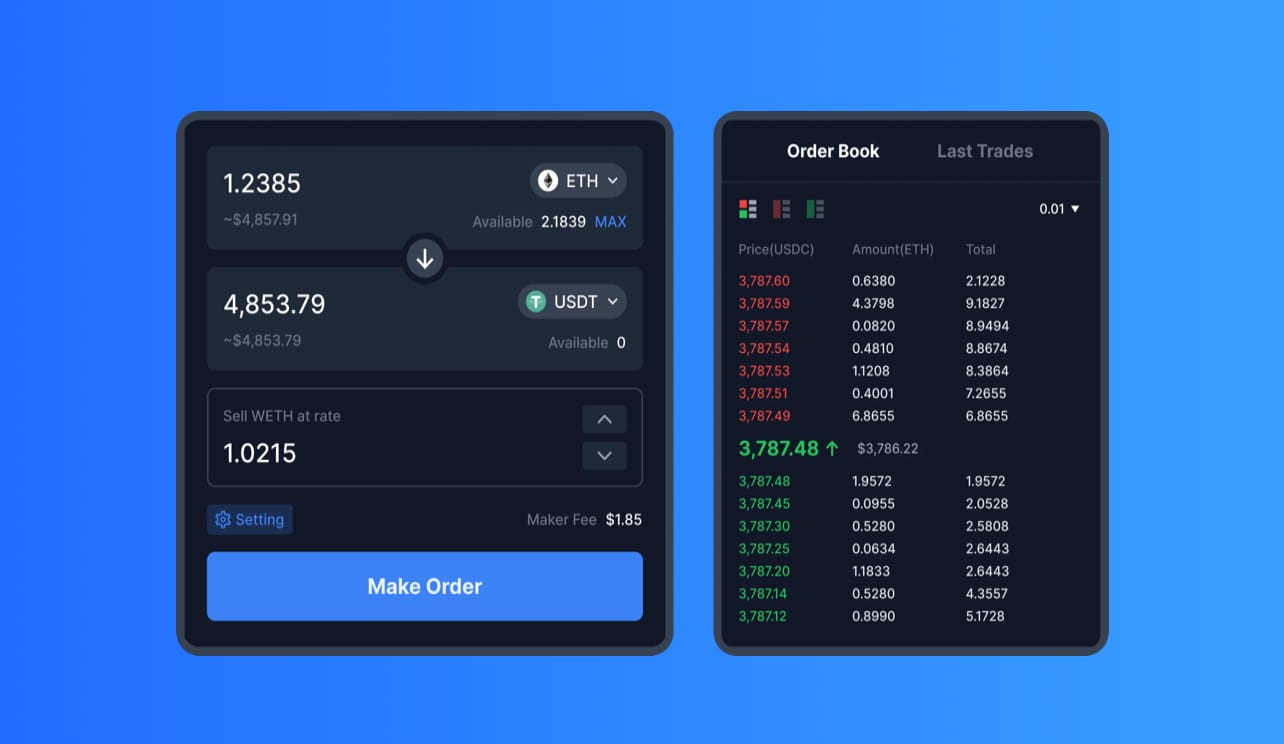

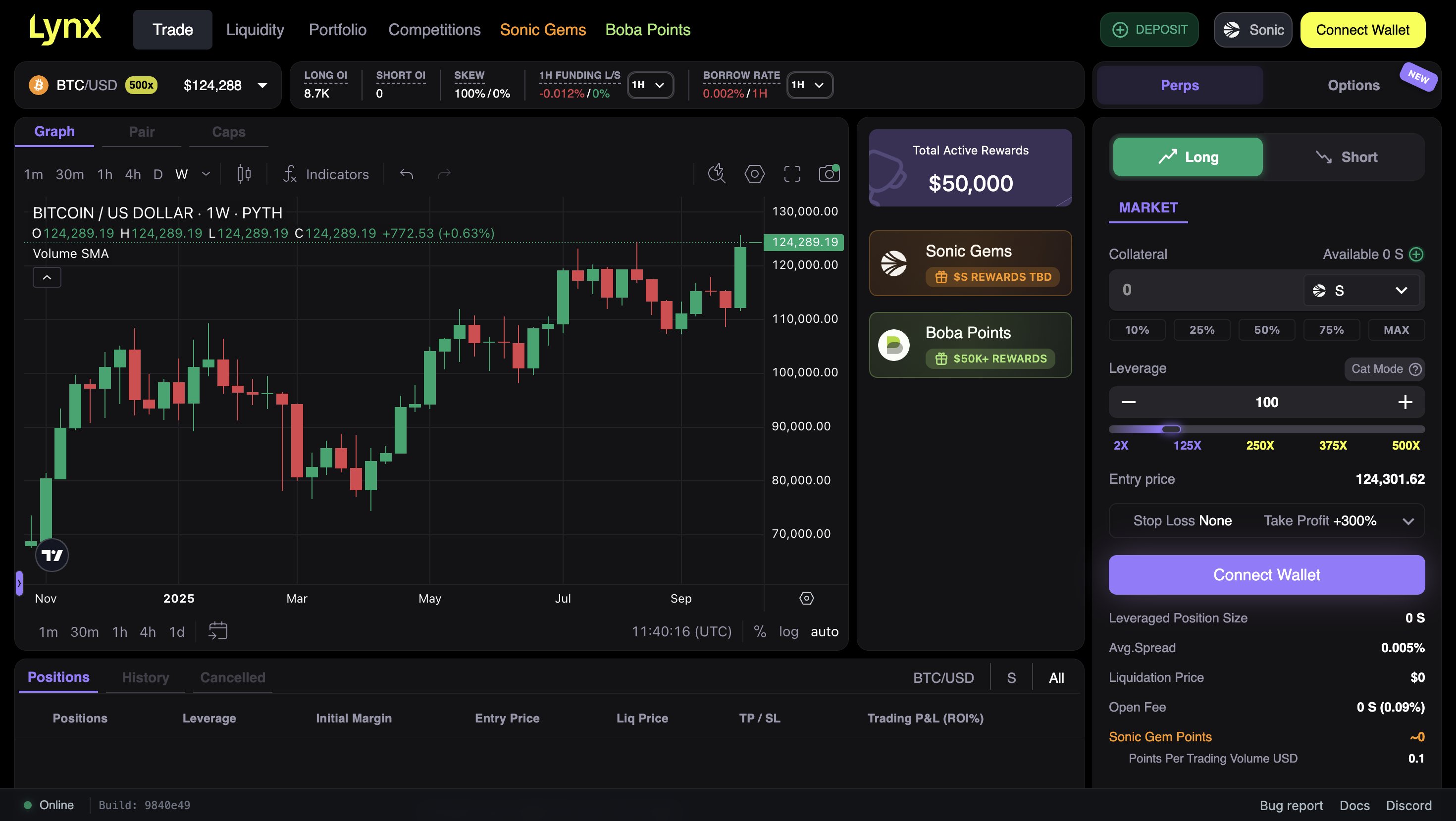

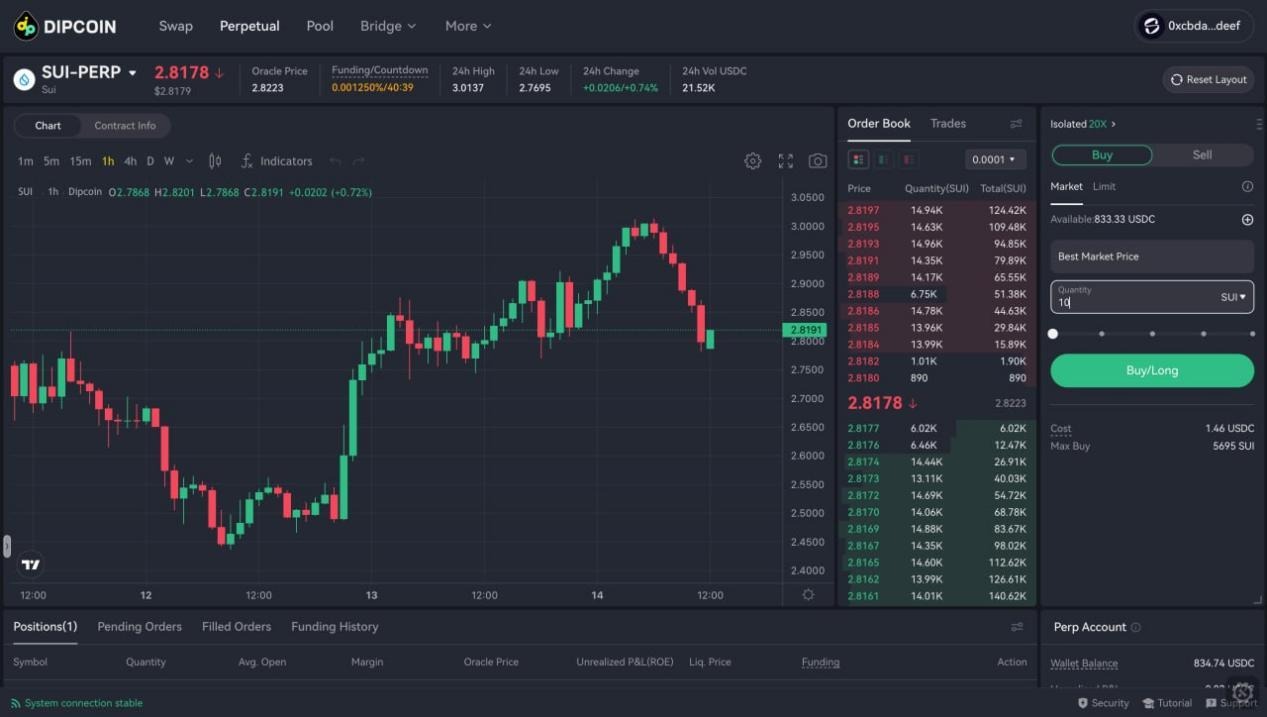

The secret sauce behind these platforms is a blend of smart contract engineering and innovative intent-based order systems. Take Lynx, for example, built on Boba Network, which lets you trade across chains using signed messages rather than direct on-chain transactions. Here’s the flow:

- Select Your Strategy Vault: Choose from various vaults tailored to different risk profiles or asset classes.

- Deposit Funds: Your capital enters a shared vault that manages margin requirements collectively.

- Open Positions Gaslessly: The vault opens leveraged positions on your behalf, with no gas fee deducted.

- Monitor and Adjust: You can tweak your exposure or exit at any time, again, without incurring fees.

This model doesn’t just save money, it also abstracts away blockchain complexity, letting you focus on strategy rather than technical hurdles.

Top Advantages of Gasless Perpetual DEXs for Traders

-

Zero Gas Fees: Platforms like Zygo Finance integrate with Mitosis to eliminate network fees, making every trade more cost-effective and accessible—especially for high-frequency and smaller-scale traders.

-

Seamless Cross-Chain Trading: Protocols such as Lynx (on Boba Network) enable users to trade leveraged perpetuals across multiple blockchains, expanding access to diverse assets and liquidity pools without switching wallets or platforms.

-

High Leverage Opportunities: Gasless DEXs like Lynx offer up to 100x leverage, empowering both pro and retail traders to amplify their strategies with minimal upfront capital.

-

Vault-Backed Margin Management: Platforms such as Zygo Finance use shared vaults to handle collateral, margin, and liquidation processes, simplifying risk management and streamlining the user experience.

-

No Expiry on Contracts: Perpetual DEXs allow traders to hold leveraged positions indefinitely, providing greater flexibility compared to traditional futures that have set expiration dates.

-

Transparent and Trustless Operations: All trades and margin logic are executed on-chain, ensuring full transparency and reducing the risk of price manipulation or hidden fees.

Pushing Limits: Cross-Chain Leverage and Multi-Asset Access

The next evolution isn’t just about fee savings, it’s about true multi-chain power. With platforms supporting up to 100x leverage (like Lynx), traders can amplify their positions across Ethereum, BNB Chain, Polygon, and more, all from one unified terminal. No more juggling wallets or swapping assets back and forth; liquidity is pooled and accessible wherever opportunity strikes.

This cross-chain approach means you’re never locked out of a trend because it’s happening on another network. Whether you’re chasing volatility in altcoins or hedging blue-chip exposure, the best perpetual DEX no fees models give you instant access, without technical barriers or added costs.

But the real breakthrough is how gasless perpetual DEXs are democratizing advanced trading tools. By removing friction, these platforms let everyone, from first-time DeFi explorers to seasoned pros, build and execute strategies that were once reserved for centralized exchanges or high-net-worth traders. Now, with a few clicks, you can deploy capital across chains, manage risk dynamically, and take advantage of market moves as they happen in real time.

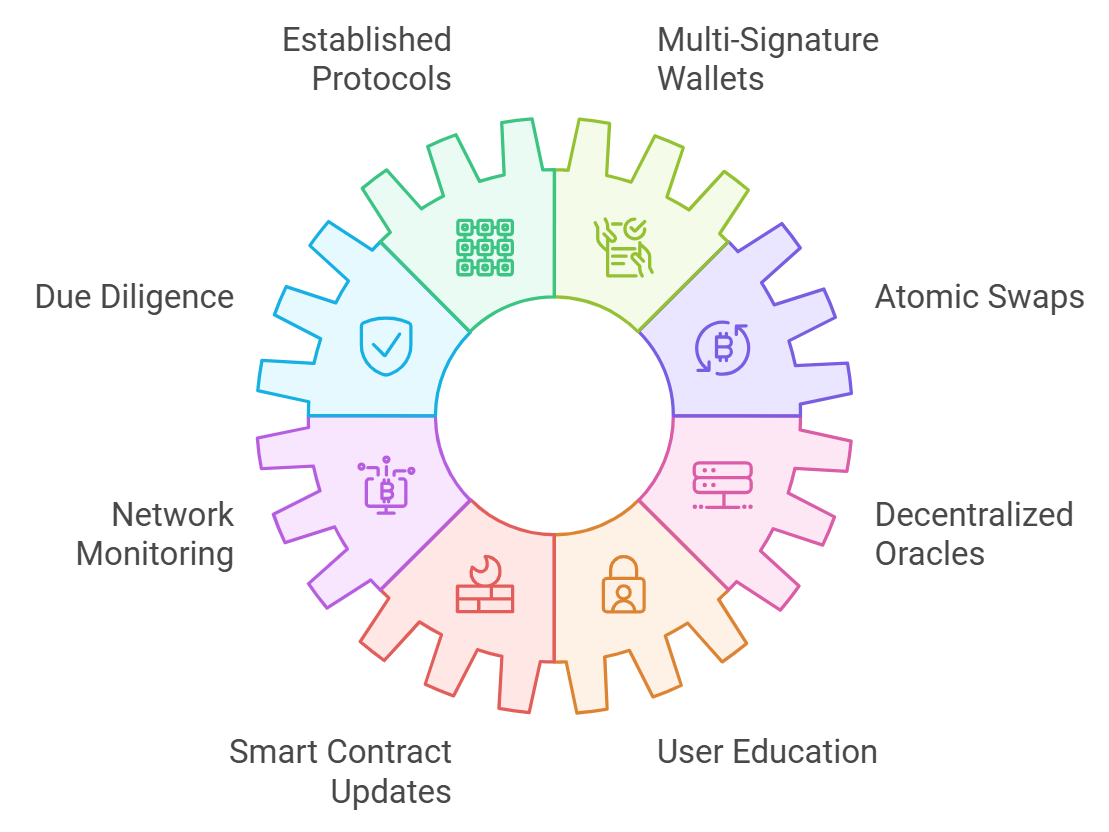

Security and transparency are front-and-center. All trades and margin calls are executed on-chain, so every action is auditable and tamper-proof. This level of openness is critical for trust, especially when you’re using high leverage or participating in community vaults.

What Traders Should Watch For: Risk, Rewards, and Real-World Impact

Of course, more power comes with more responsibility. The allure of 100x or even 2000x leverage (as some next-gen platforms are experimenting with) is massive, but so is the risk. Liquidations happen fast in volatile markets, so robust risk management isn’t optional; it’s essential.

- Set clear stop-losses and use trailing stops to lock in gains without exposing yourself to unnecessary downside.

- Diversify across vaults or assets to avoid concentration risk on a single trade or blockchain.

- Monitor platform security; always check for recent smart contract audits and active bug bounty programs before depositing significant capital.

The most successful traders treat gasless DeFi trading as a toolkit, not a lottery ticket. With costs minimized, you have more flexibility to experiment with new strategies and adapt quickly as market conditions shift.

Essential Risk Management for Cross-Chain Leverage

-

Set Strict Leverage Limits: Platforms like Lynx offer up to 100x leverage, but using high leverage increases both potential gains and losses. Define your maximum leverage based on your risk tolerance and never use the maximum unless you fully understand the risks.

-

Utilize Vault-Backed Margin Systems: On gasless DEXs such as Zygo Finance, margin is managed via shared vaults. Regularly monitor your vault positions and ensure you maintain sufficient collateral to avoid forced liquidations.

-

Monitor Cross-Chain Transaction Security: With protocols like Boba Network enabling cross-chain trades, always check for recent security audits and platform transparency. Stay updated on the latest smart contract audit reports before committing large funds.

-

Implement Stop-Loss and Take-Profit Strategies: Even with gasless, 1-click trading on platforms like Definitive, set clear stop-loss and take-profit orders to automatically manage downside risk and lock in profits.

-

Diversify Across Multiple Assets and Chains: Cross-chain DEXs let you access a broad range of assets. Spread your positions across different tokens and blockchains to reduce exposure to single-asset or single-chain risks.

-

Regularly Review Platform Updates and Governance: Platforms like GMX and KiloEx frequently update protocols and risk parameters. Stay engaged with official channels to adapt your strategies to any changes in trading rules or risk models.

The Unified Terminal Revolution: Trading Without Borders, or Fees

The rise of unified trading terminals like Hyperliquid-Style Perps means you no longer have to compromise between speed, cost, or access. Imagine managing all your perp positions, across Ethereum mainnet, L2s like Boba Network, Polygon, BNB Chain, from a single dashboard with zero gas fees on every adjustment. That’s not just convenience; it’s a competitive edge.

This isn’t hype, it’s happening now. As protocols continue integrating cross-chain bridges and intent-based order routing, expect even deeper liquidity pools and tighter spreads. The days of paying $20 per adjustment or missing out due to network congestion are fading fast.

Ready to Level Up?

If you’re serious about maximizing your edge in DeFi markets, it’s time to explore what gasless perpetual DEXs offer. Whether you’re scalping volatility spikes or building long-term hedges across multiple chains, the combination of low costs and high flexibility opens up an entirely new playbook for crypto traders at every level.

The future belongs to those who adapt fastest, and with multi-chain perp trading, there’s never been a better moment to act decisively. Start experimenting with small positions today; learn by doing and refine your approach as you go. The tools are here, the only question is how bold you’re willing to be.