Decentralized finance is in the midst of a paradigm shift, and few innovations illustrate this better than the rise of the perpetual DEX aggregator. By merging advanced cross-chain technology with the relentless demand for capital efficiency, these platforms are transforming how traders access, execute, and manage perpetual contracts across the fragmented DeFi landscape.

What Sets Perpetual DEX Aggregators Apart?

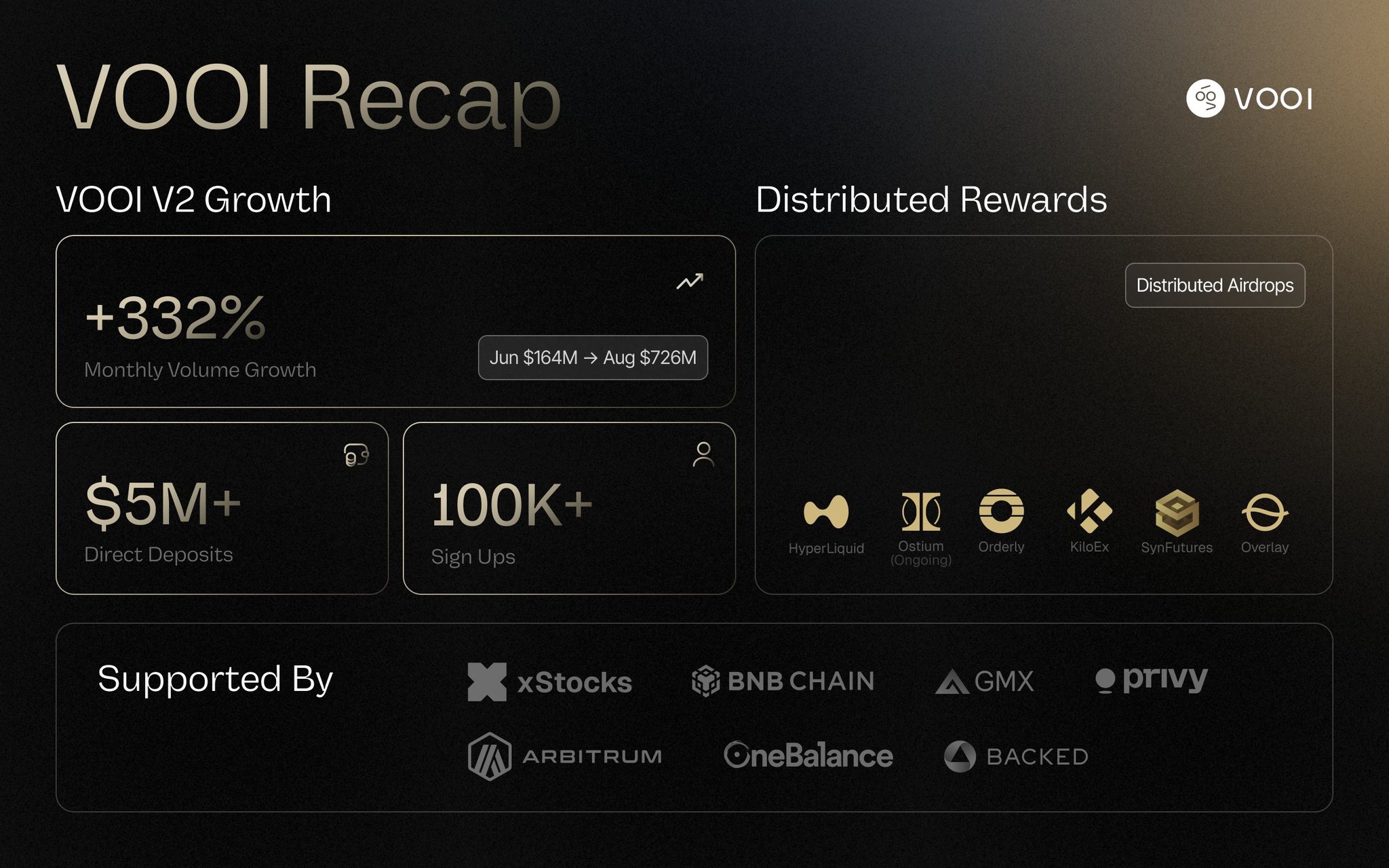

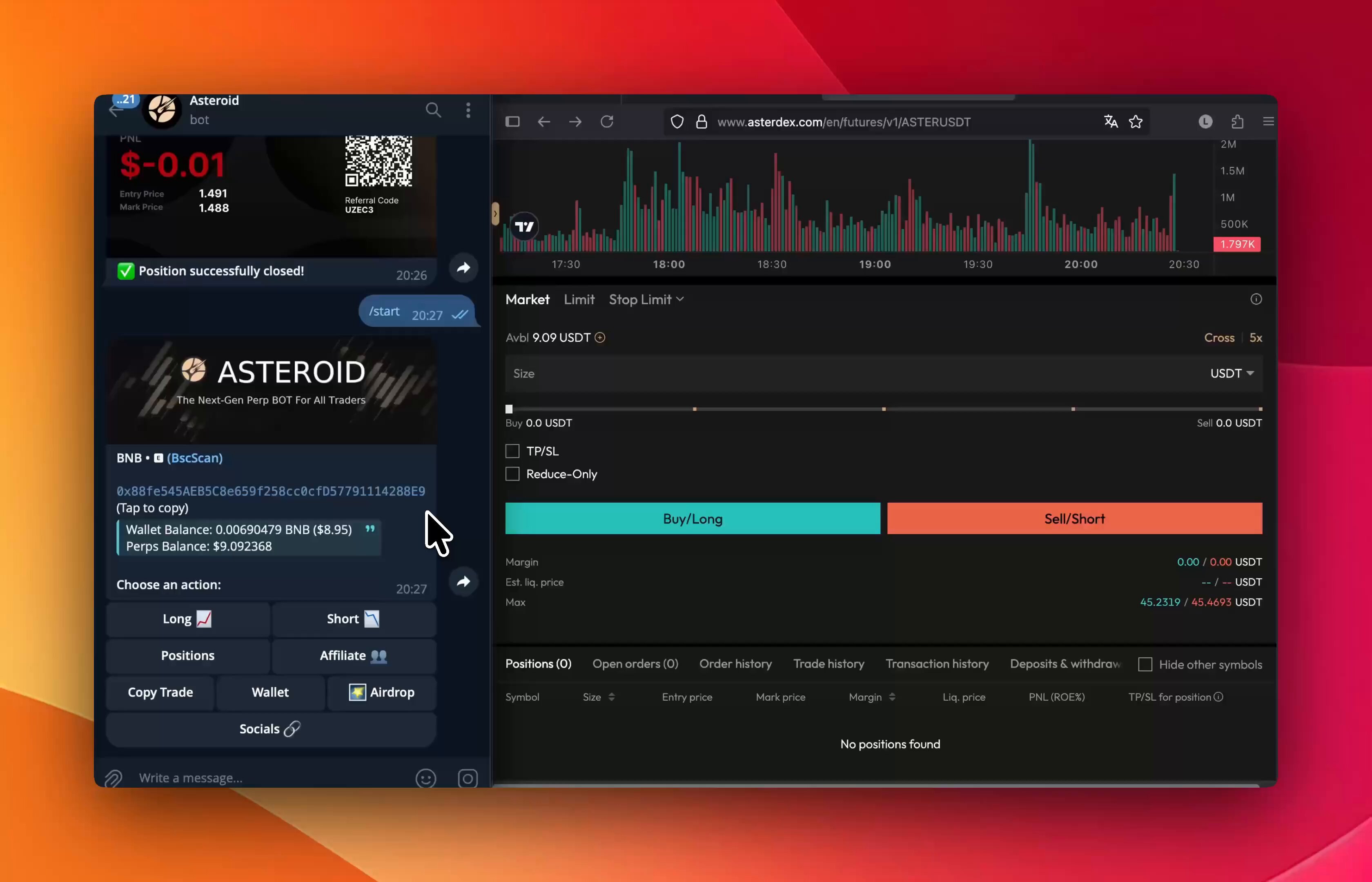

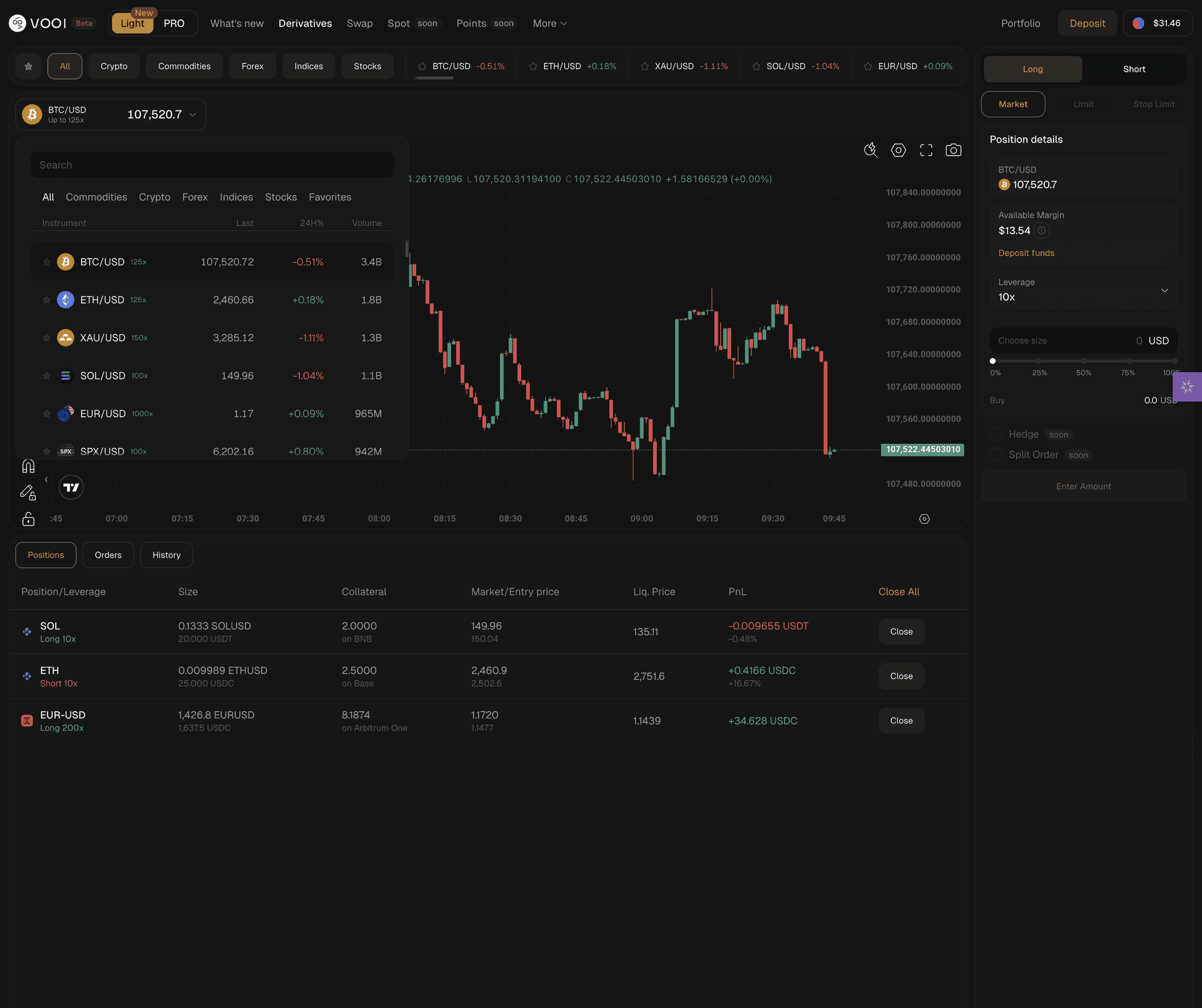

Traditional DeFi trading platforms often force users to navigate multiple blockchains, manage separate wallets, and bridge assets manually. This not only increases friction but also exposes traders to additional risks and costs. In contrast, perpetual DEX aggregators like Hyperliquid, VOOI, and AsterDEX have reimagined the user journey. These platforms consolidate liquidity from leading DEXs across various chains, enabling seamless cross-chain perpetual contracts DeFi trading without the need for clunky asset transfers.

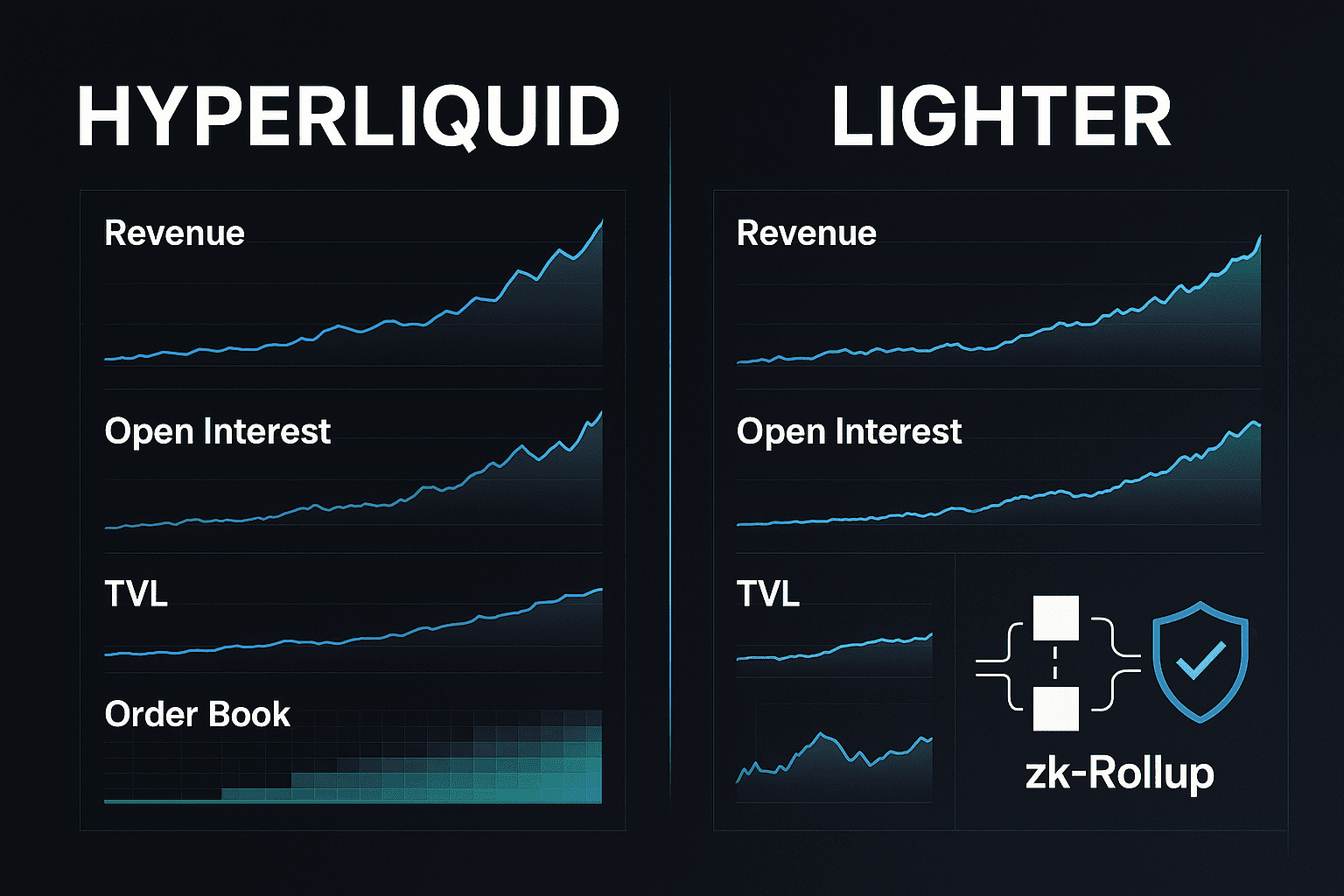

Take Hyperliquid, for example, which has amassed a staggering $254.81 billion in 30-day trading volume and supports 130 trading pairs on Arbitrum. Or consider AsterDEX, which provides up to 1001x leverage and yield-generating collateral, all while abstracting away the complexities of multi-chain execution. These are not minor UX tweaks – they’re foundational shifts in how on-chain trading works.

Key Innovations: Cross-Chain, Unified Margin, and Beyond

The most compelling perpetual DEX aggregators share several technical hallmarks:

Key Features of Modern Perpetual DEX Aggregators

-

Aggregated Deep Liquidity: By consolidating order books and liquidity pools from various decentralized exchanges, aggregators like Hyperliquid and GMX minimize slippage and enable efficient execution of large trades. Hyperliquid, for example, boasts a 30-day trading volume of $254.81 billion.

-

Advanced Trading Tools: Modern aggregators offer features such as customizable leverage (up to 1001x on AsterDEX), hidden orders, and MEV-resistant execution, giving traders professional-grade tools and enhanced protection against front-running.

-

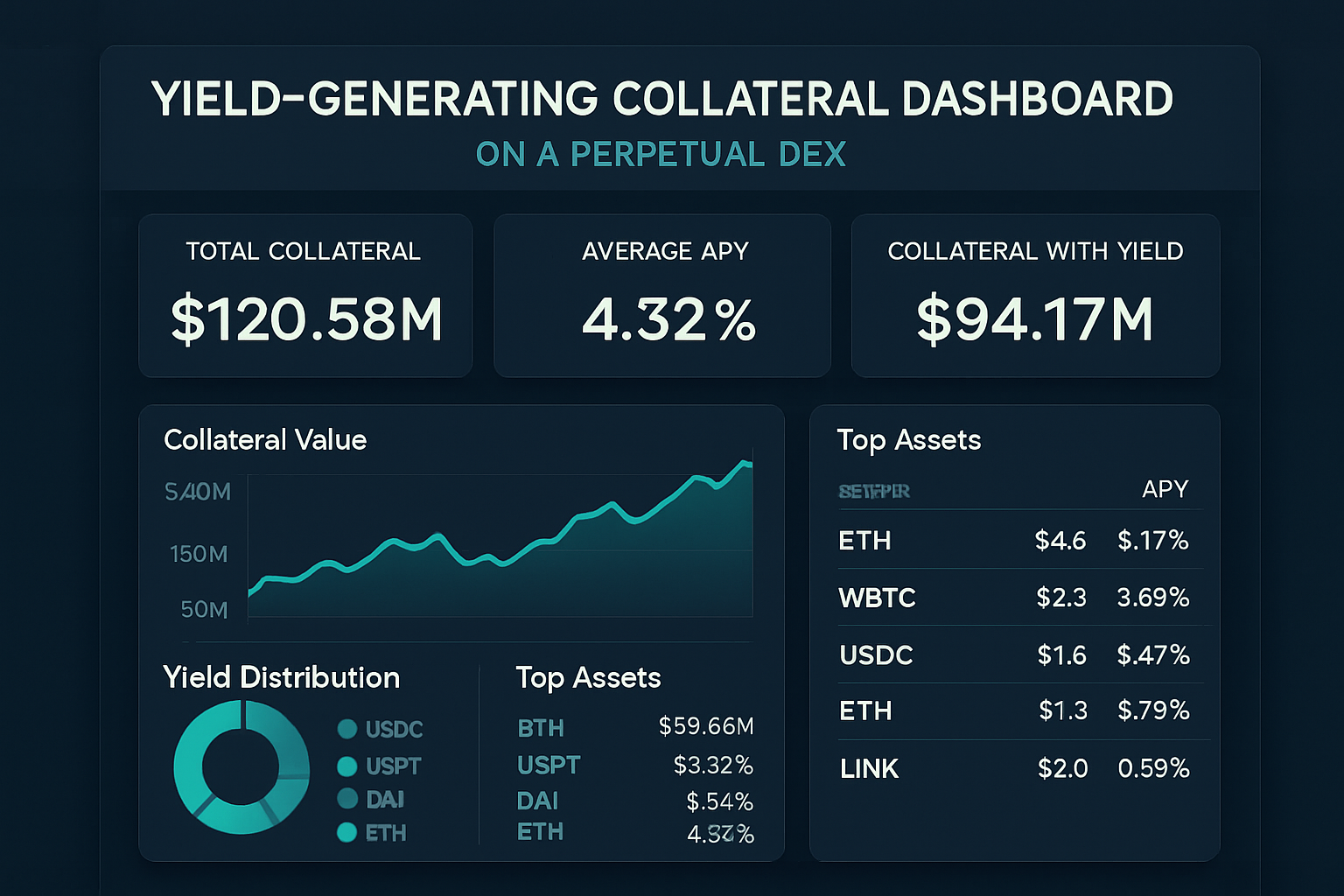

Yield-Generating Collateral: Some platforms allow users to use yield-bearing assets as collateral, letting traders earn passive income while maintaining active positions, thereby improving capital efficiency.

-

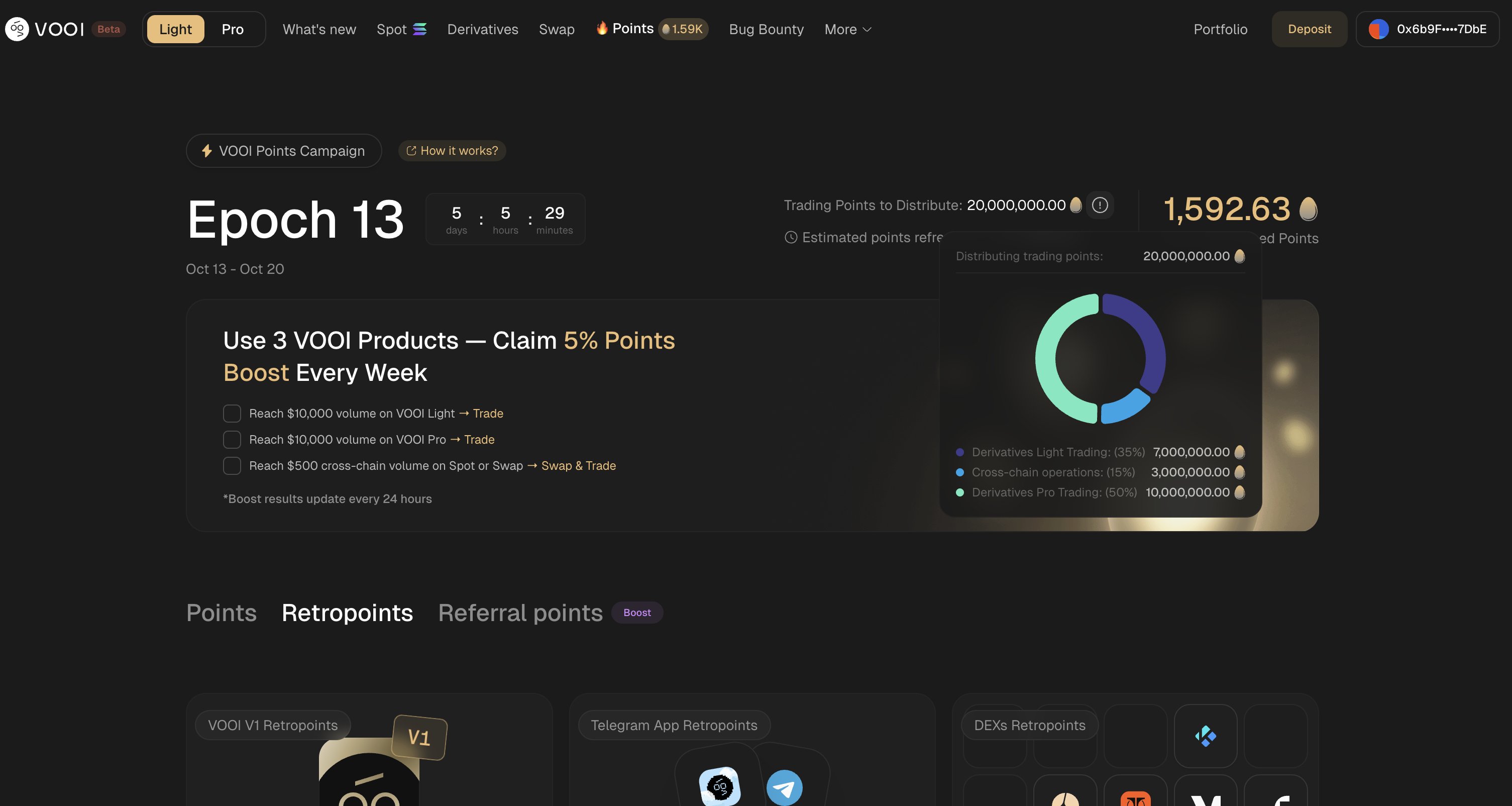

Unified, Gasless User Experience: Innovations like chain abstraction and account abstraction, as seen in VOOI V2, let users trade perps and RWAs across chains with a single balance and zero gas fees, closely mirroring the ease of centralized exchanges.

-

Robust Security and Transparency: Operating on decentralized protocols, platforms like GMX and Hyperliquid provide transparent, on-chain trading activity and non-custodial asset management, reducing risks associated with centralized exchanges.

1. Multi-Chain Support: Platforms like VOOI V2 leverage chain abstraction to enable trading across EVM and non-EVM networks, eliminating the need for bridges and allowing users to manage all assets with a single balance. This is crucial for traders seeking exposure to emerging assets across the DeFi ecosystem without operational headaches.

2. Unified Margin Trading: By pooling collateral across chains and protocols, users can access higher leverage and improved capital efficiency. For instance, VOOI’s unified margin system means you can trade both crypto and real-world asset (RWA) perps with zero gas and no manual bridging, mirroring the experience of centralized exchanges. (theblock.co)

3. MEV-Resistant Execution and Hidden Orders: Aggregators such as AsterDEX and Hyperliquid are deploying advanced order types and execution logic to protect traders from front-running and slippage, further narrowing the gap between DeFi and CEX-grade performance.

Impact on Liquidity, Pricing, and Capital Efficiency

Aggregating liquidity across multiple protocols has a measurable impact on trade execution and market health. Deeper combined pools reduce slippage, particularly for large orders, and deliver more competitive pricing. This is evidenced by the explosive growth in trading volumes on platforms like Hyperliquid, which has surpassed $1.5 trillion in cumulative volume, signaling robust user trust and deep liquidity. (aicoin.com)

Yield-generating collateral is another game-changer. Instead of idle margin, traders can post assets that accrue yield, maximizing total returns and optimizing risk-adjusted performance. This approach is quickly becoming the new standard for capital efficiency DeFi protocols.

Why Traders Are Migrating: The UX Revolution

Perhaps the most underappreciated aspect of cross-chain perpetual DEX aggregators is the dramatic improvement in user experience. Platforms like VOOI V2 bring a CEX-grade interface to decentralized markets, where traders can open, close, and manage positions in real time, free from the friction of gas fees or manual asset transfers. The result is a trading environment that is not only more efficient, but also more accessible to a broader range of participants.

This leap forward in user experience is not just about convenience; it has direct implications for trading performance and risk management. By abstracting away the complexities of cross-chain execution, perpetual DEX aggregators allow traders to focus on strategy and market dynamics rather than operational hurdles. The reduction in transaction costs, thanks to gasless trading and unified balances, means that active traders can scale their activity without being penalized by network congestion or fee volatility.

Moreover, the introduction of intent-based trading, where platforms like VOOI interpret and execute user intents across multiple liquidity sources, further reduces the cognitive load and technical barriers for participants. This is especially valuable for professional traders who rely on speed and reliability to capture fleeting opportunities in the market.

Risks and Considerations: What to Watch For

While the benefits are substantial, it’s important to approach these innovations with a clear-eyed view of the associated risks. Cross-chain aggregation introduces new layers of smart contract complexity, and while platforms like Hyperliquid and VOOI have demonstrated strong security records to date, the attack surface inevitably expands as more protocols and chains are integrated.

Liquidity fragmentation, though mitigated by aggregation, can still be a concern during periods of extreme volatility. Traders should remain vigilant about slippage and execution quality, especially when deploying high leverage. Additionally, the reliance on advanced routing algorithms and MEV-resistant order types means that platform robustness and transparency should be scrutinized before committing significant capital.

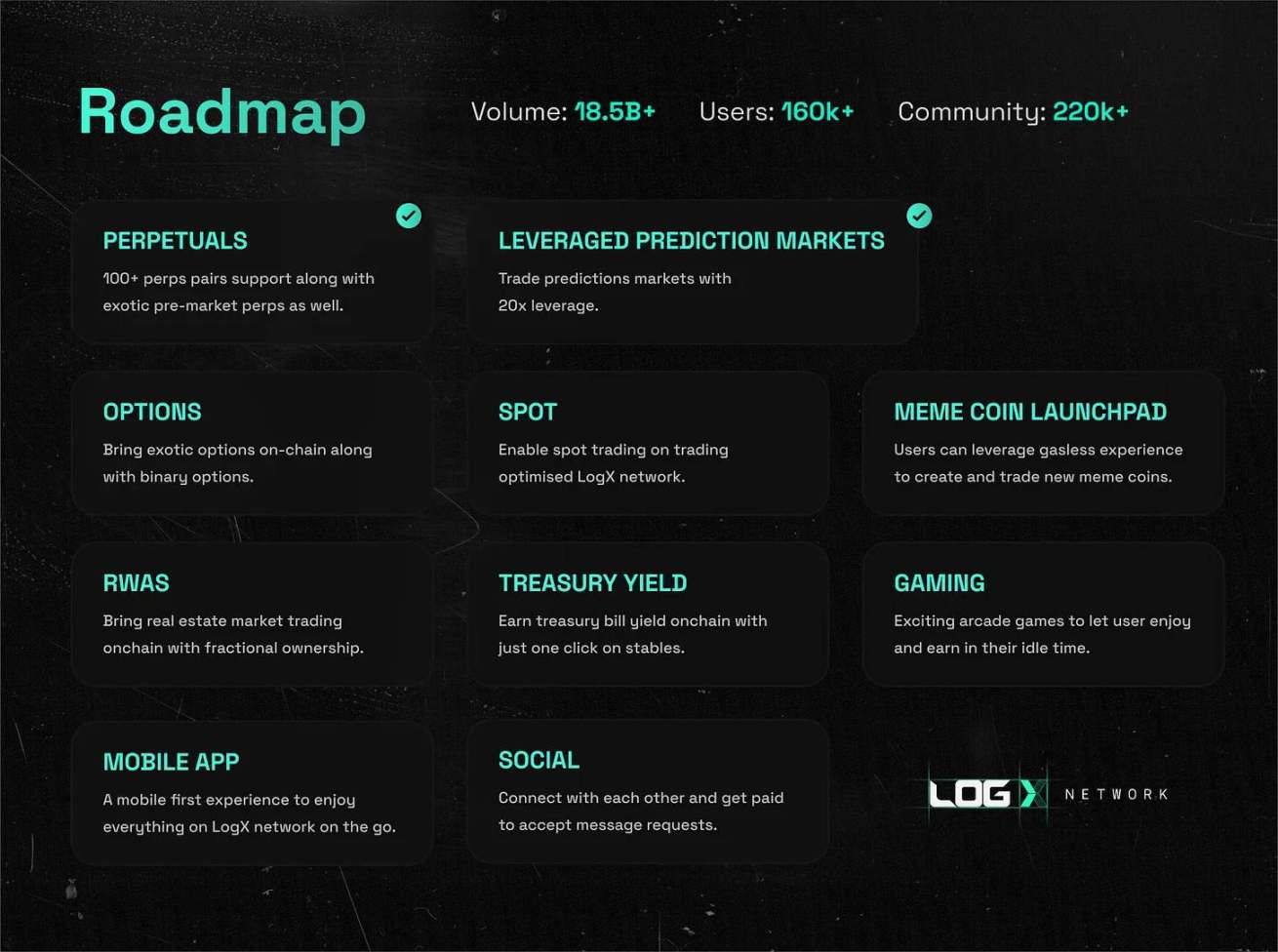

The Road Ahead: Perpetual DEX Aggregators as DeFi Infrastructure

Looking forward, the trajectory for perpetual DEX aggregators is clear: deeper integrations, more chains, and richer trading features are on the horizon. As these platforms continue to mature, we can expect even greater convergence between DeFi and traditional trading infrastructure. The ability to trade perps, RWAs, and other derivatives across any blockchain, with unified collateral and real-time execution, is rapidly becoming the new baseline.

How Perpetual DEX Aggregators Will Shape DeFi Trading

-

Seamless Cross-Chain Trading: Perpetual DEX aggregators like VOOI V2, Hyperliquid, and AsterDEX enable users to trade perpetual contracts across multiple blockchains without manual bridging, dramatically simplifying the trading process and expanding access to diverse assets.

-

Deeper Liquidity and Lower Slippage: By uniting liquidity from various decentralized exchanges, aggregators such as Hyperliquid (with a recent 30-day trading volume of $254.81 billion) and GMX provide traders with deeper liquidity pools, which reduces slippage and improves trade execution for both large and small orders.

-

Advanced Trading Features: Modern aggregators offer sophisticated tools like customizable leverage (up to 1001x on AsterDEX), hidden orders, and MEV-resistant execution, giving traders professional-grade capabilities in a decentralized environment.

-

Improved Capital Efficiency: Platforms now allow the use of yield-bearing assets as collateral, so traders can earn passive income while maintaining open positions—optimizing capital usage and enhancing returns.

-

Unified, User-Friendly Experience: With innovations like VOOI V2‘s chain abstraction and gasless trading, users benefit from a centralized exchange (CEX)-like experience while retaining full control of their assets, increasing DeFi adoption among mainstream traders.

-

Enhanced Security and Transparency: By operating on decentralized, transparent protocols, perpetual DEX aggregators reduce counterparty risk and ensure all trades are verifiable on-chain, addressing long-standing trust issues in crypto trading.

Platforms like VOOI and Hyperliquid are already setting benchmarks for what is possible: high throughput, robust liquidity, and an intuitive UX that rivals (and in some cases surpasses) centralized exchanges. As capital continues to flow into DeFi, the role of perpetual DEX aggregators as both liquidity engines and risk management tools will only grow more critical.

For traders, the message is simple: the tools are evolving, and those who adapt to this new paradigm stand to benefit from unprecedented efficiency, flexibility, and access. The era of fragmented, high-friction DeFi trading is ending, replaced by a seamless, cross-chain future where opportunity and capital efficiency are no longer limited by technical silos.