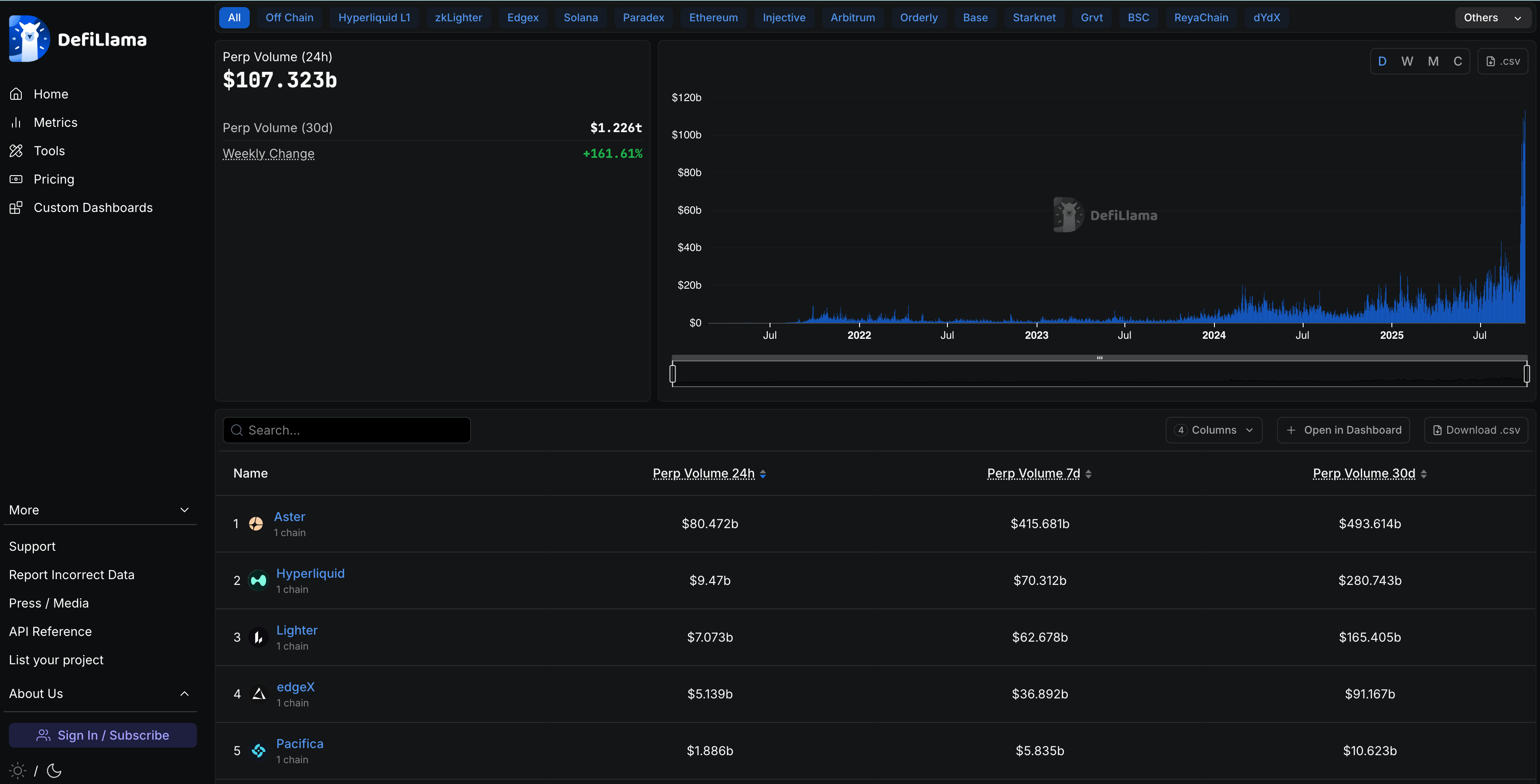

The decentralized perpetual exchange (Perp DEX) landscape has evolved dramatically in 2024, with trading volumes surging to unprecedented levels. According to CoinGecko, the top 10 Perp DEXs collectively processed $1.5 trillion in trading volume over the year, a staggering 138.1% increase from 2023. This explosive growth has been driven by the relentless demand for high-speed, low-latency derivatives trading, as well as the maturation of DeFi infrastructure. In this environment, a handful of platforms have risen to dominate the market, reshaping the competitive landscape and setting new standards for liquidity, execution, and innovation.

Market Leaders: Hyperliquid, Lighter, and Aster

Among the top-tier contenders, Hyperliquid, Lighter, and Aster stand out as the primary engines behind the sector’s record-breaking volume. Hyperliquid captured over 55% market share in Q4 2024, peaking at 66% in December, and remains a reference point for low-latency execution and deep liquidity. By October 2025, Aster overtook its rivals in daily trading volume, posting an impressive $41.78 billion in 24-hour turnover and $13.44 million in fees generated, according to recent data from xt. com. Hyperliquid, meanwhile, continues to lead in open interest with $14.68 billion and retains a robust $9.02 billion in daily trading volume.

Lighter has also carved out a significant presence, consistently ranking in the top three by both volume and user activity. Its streamlined interface and efficient risk engine have attracted both professional and retail traders seeking alternatives to centralized venues.

The Top 10 Perpetual DEXs by Trading Volume (2024)

Top 10 Perpetual DEXs by 2024 Trading Volume

-

Aster — The current market leader, Aster posted a 24-hour trading volume of $41.78 billion and an open interest of $4.86 billion in October 2025, generating $13.44 million in fees. Its rapid rise is attributed to deep liquidity and a robust trading engine.

-

Hyperliquid — Dominating much of 2024 with over 55% market share in Q4 and peaking at 66% in December, Hyperliquid recorded a 24-hour trading volume of $9.02 billion and the highest open interest at $14.68 billion. Renowned for its high-speed, low-latency trading.

-

Lighter — A significant contender, Lighter achieved a trading volume of $7.719 billion in recent periods, offering innovative features and a growing user base among professional DeFi traders.

-

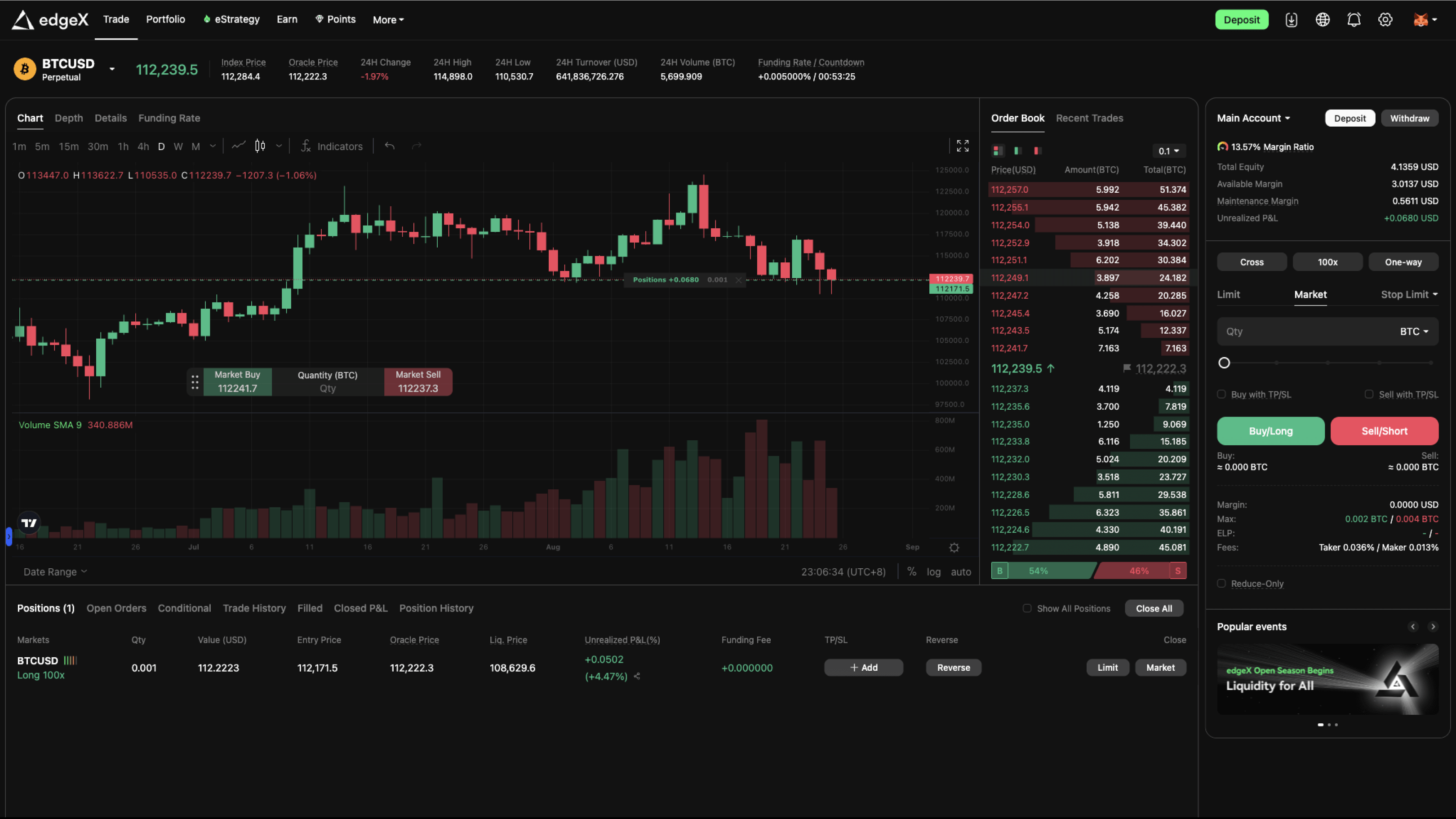

edgeX — edgeX stands out for its advanced risk management tools and reported a trading volume of $4.748 billion, cementing its place among the top perpetual DEXs in 2024.

-

ApeX Protocol — With a trading volume of $2.594 billion, ApeX Protocol is recognized for its user-friendly interface and broad asset support, appealing to both new and experienced traders.

-

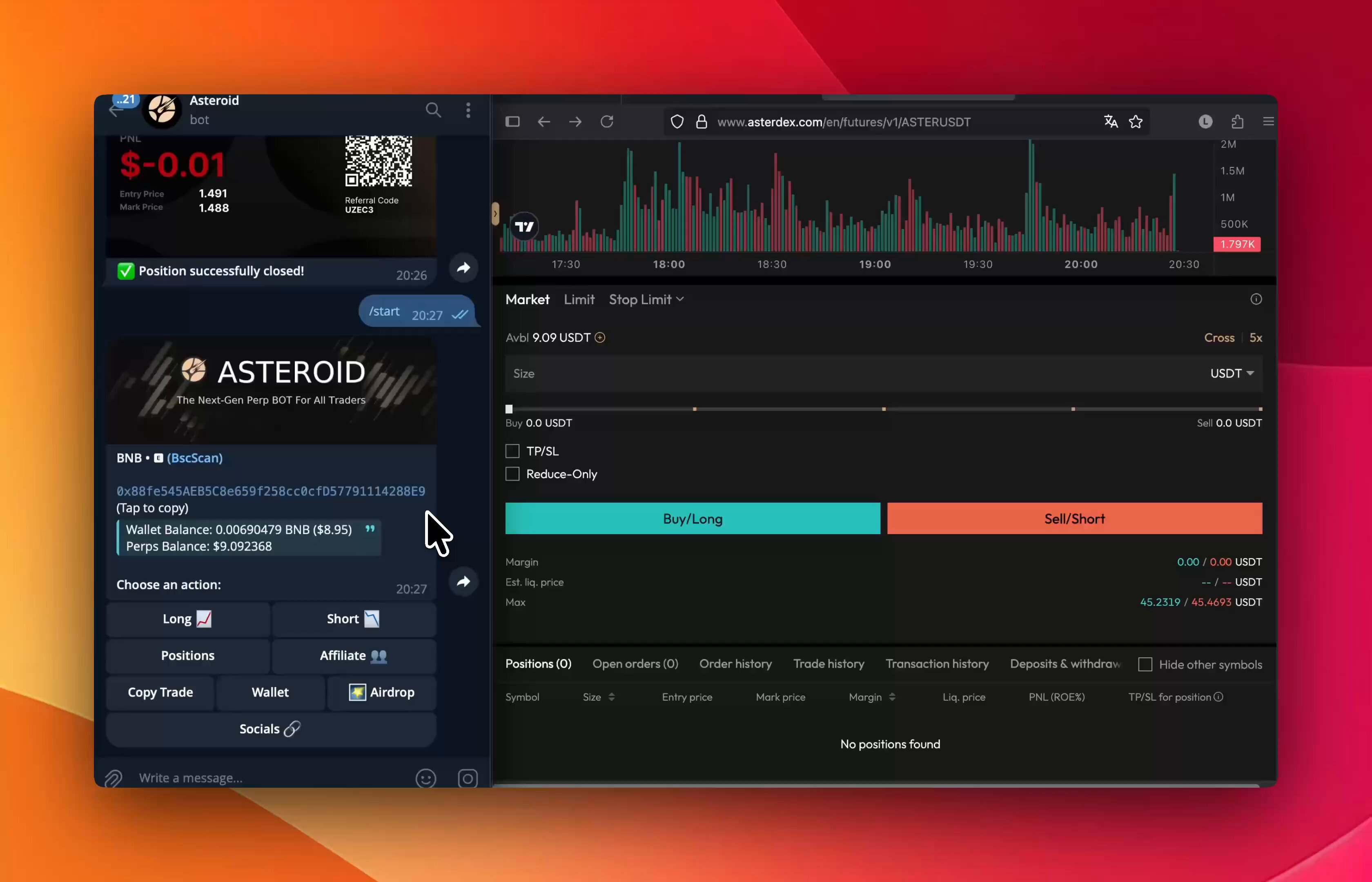

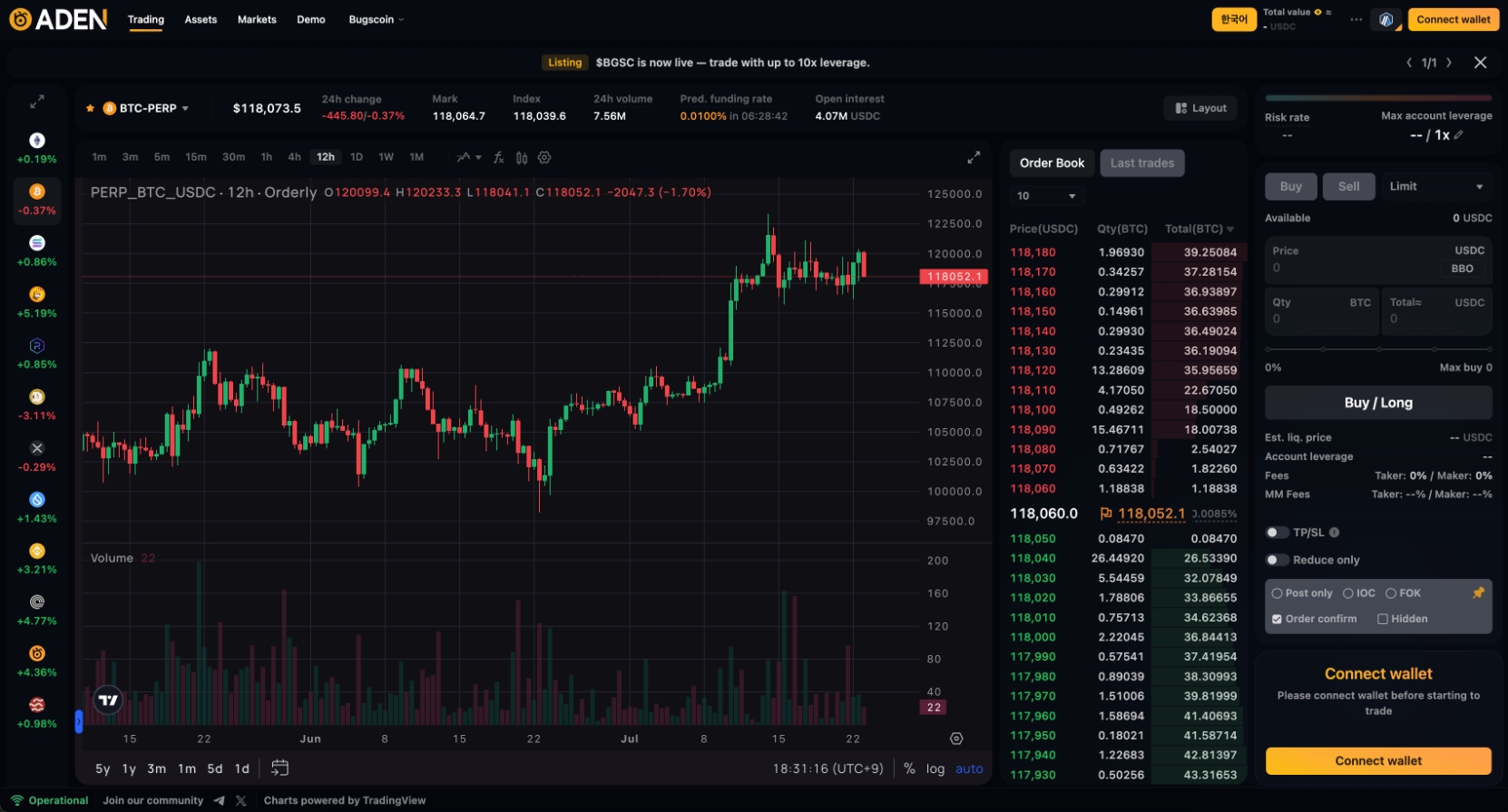

ADEN — ADEN posted a trading volume of $1.511 billion, leveraging a unique liquidity model and rapid order execution to attract a dedicated trading community.

-

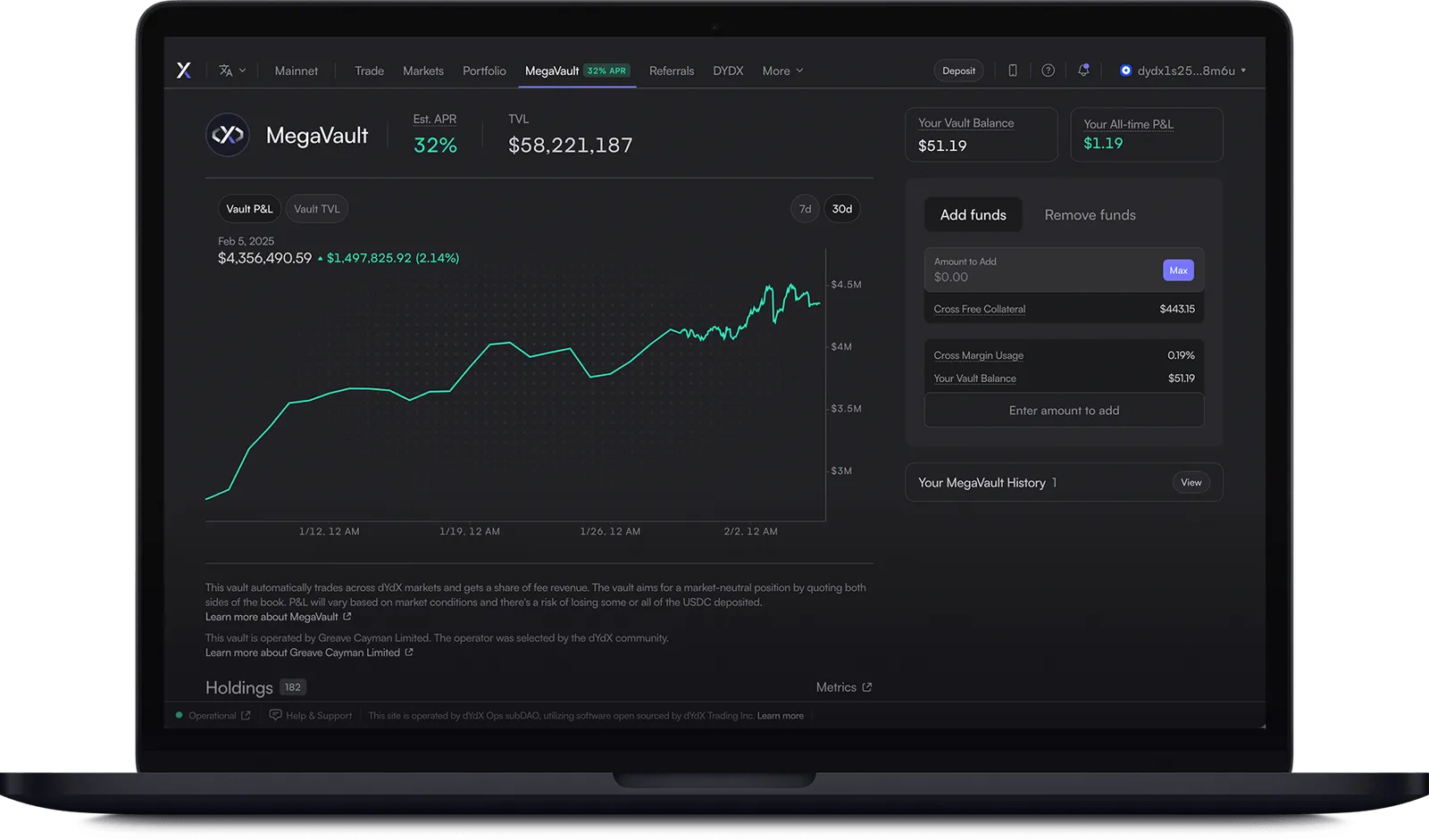

dYdX — As one of the most established names, dYdX continues to innovate, maintaining high trading volumes and a reputation for reliability and security in decentralized perpetual trading.

-

GMX — GMX is known for its decentralized spot and perpetual trading, with deep liquidity pools and a transparent fee structure that have kept it among the most trusted platforms in DeFi.

-

Kwenta — Built on Optimism, Kwenta offers seamless perpetual futures trading with low fees and fast execution, making it a favorite among advanced DeFi users.

-

Level Finance — Level Finance rounds out the top 10, providing a comprehensive suite of perpetual trading products and risk management tools for the DeFi ecosystem.

This year’s perpetual DEX tier list 2024 is shaped by trading activity, liquidity depth, and platform reliability. Here’s how the top DeFi perps exchanges stack up:

- Hyperliquid: The undisputed leader for most of 2024, Hyperliquid has set benchmarks for both latency and order book depth. Its dominance is reflected in sustained high open interest and a loyal trader base.

- Lighter: Noted for its user-centric design and rapid execution speeds, Lighter has become a preferred venue for sophisticated DeFi traders looking for alternatives to legacy DEXs.

- Aster: Surging to the top by late 2025, Aster’s high fee generation and daily turnover underscore its appeal among high-frequency traders and institutions.

- edgeX: With $4.748 billion in protocol volume according to DefiLlama, edgeX combines innovative risk controls with a growing ecosystem of supported assets.

- ApeX Protocol: ApeX continues to attract traders with its unique incentive programs and robust trading infrastructure.

- ADEN: Recording $1.511 billion in volume, ADEN has steadily increased its market share through aggressive onboarding campaigns and cross-chain support.

- dYdX: The veteran among DEXs, dYdX remains influential due to its established reputation and advanced perpetual contract features.

- GMX: GMX’s innovative liquidity model and transparent fee structure keep it relevant despite fierce competition from newer entrants.

- Kwenta: Kwenta leverages synthetic asset markets to provide diverse exposure for traders seeking non-traditional pairs.

- Level Finance: Rounding out the top 10, Level Finance maintains steady growth by focusing on community-driven governance and sustainable incentives.

Volume Trends: Record-Breaking Growth in DeFi Derivatives

The sector’s momentum is unmistakable: September 2025 marked the first time monthly Perp DEX trading volume topped $1 trillion, representing a 48% surge over August’s already robust $707.6 billion (source). This acceleration is not just a function of speculative fervor but also reflects a structural shift in trader preferences away from centralized exchanges toward decentralized alternatives that offer greater transparency and self-custody.

The continued rise of protocols like Hyperliquid and Aster signals that DeFi-native perpetuals are now integral to crypto market structure. For traders seeking to optimize for speed, liquidity, and security in 2024 and beyond, these platforms offer compelling value propositions that rival or exceed their centralized counterparts.

As the perpetual DEX landscape matures, the performance and innovation among the top 10 projects have become increasingly differentiated. Traders are now scrutinizing not only trading volume and open interest, but also execution quality, fee structures, and the breadth of supported assets. This competitive pressure has accelerated upgrades and new product launches across the sector, with each leading DEX vying to capture a larger share of the surging DeFi derivatives market.

Platform Deep Dive: Strengths and Innovations Across the Tier List

Hyperliquid remains the benchmark for low-latency order execution and deep liquidity, consistently commanding high open interest provides $14.68 billion as of October 2025. Its robust trading engine and transparency have made it the destination of choice for high-frequency traders and institutions. Lighter, while not matching Hyperliquid’s scale, excels with a user-friendly interface and a risk management system that appeals to sophisticated DeFi participants. Aster, now leading in daily trading volume at $41.78 billion, has captured the attention of active traders through aggressive fee incentives and flexible margining, propelling it to the forefront of the perpetual DEX sector.

Other contenders, such as edgeX, have carved out a niche by supporting a diverse range of synthetic assets and prioritizing risk controls. ApeX Protocol and ADEN have both adopted innovative airdrop and rewards programs to drive user engagement, while dYdX continues to leverage its reputation for reliability and advanced order types. GMX, known for its transparent, community-driven model, and Kwenta, which specializes in synthetic markets, both maintain loyal followings. Level Finance rounds out the list, focusing on sustainable growth and governance-led development.

Key Metrics: Comparing The Top 10 Perpetual DEXs

| DEX | 24h Volume (Oct 2025) | Open Interest | Notable Feature |

|---|---|---|---|

| Hyperliquid | $9.02B | $14.68B | Ultra-low latency, deep liquidity |

| Lighter | $7.72B | N/A | User-centric risk controls |

| Aster | $41.78B | $4.86B | High fee incentives, flexible margin |

| edgeX | $4.75B | N/A | Synthetic asset support |

| ApeX Protocol | $2.59B | N/A | User rewards programs |

| ADEN | $1.51B | N/A | Cross-chain onboarding |

| dYdX | N/A | N/A | Advanced order types, reputation |

| GMX | N/A | N/A | Transparent fee structure |

| Kwenta | N/A | N/A | Synthetic markets focus |

| Level Finance | N/A | N/A | Community-driven governance |

Price Performance Comparison: Top Perpetual DEX Assets (2025)

6-Month Price Change for Hyperliquid, Aster, and Lighter

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Hyperliquid (HYPER) | $39.13 | $37.67 | +3.9% |

| Aster (ASTR) | $1.89 | $1.92 | -1.6% |

| Lighter (LIGHT) | $0.7971 | $0.7844 | +1.6% |

Analysis Summary

Among the leading perpetual DEX assets, Hyperliquid (HYPER) posted a moderate 3.9% price increase over the past six months, while Lighter (LIGHT) saw a smaller gain of 1.6%. In contrast, Aster (ASTR) experienced a slight decline of 1.6% during the same period. This reflects a mixed performance among top DEX tokens, despite the sector’s overall trading volume growth.

Key Insights

- Hyperliquid (HYPER) outperformed its peers with a 3.9% price increase over six months.

- Aster (ASTR) was the only asset among the three to decline in price, dropping 1.6%.

- Lighter (LIGHT) achieved a modest 1.6% gain, reflecting stable but limited appreciation.

- These price trends contrast with the explosive trading volume growth in the perpetual DEX sector, highlighting that volume leadership does not always translate to price outperformance.

This comparison uses real-time price data for each asset as provided, with historical prices from exactly six months ago. Only the specified real-time data sources were used, ensuring accuracy and consistency in the comparison.

Data Sources:

- Main Asset: https://coinmarketcap.com/currencies/hyperliquid/

- Aster: https://coinmarketcap.com/academy/article/aster-dex-tops-dollar25m-daily-fees-surpasses-hyperliquid

- Lighter: https://www.coingecko.com/en/coins/bitlight

- dYdX: https://www.coingecko.com/en/coins/dydx

- GMX: https://coinmarketcap.com/currencies/gmx/

- Perpetual Protocol: https://www.coingecko.com/en/coins/perpetual-protocol

- Bitcoin: https://www.coingecko.com/en/coins/bitcoin

- Ethereum: https://www.coingecko.com/en/coins/ethereum

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

What Sets The Leaders Apart?

The clear separation between the top three, Aster, Hyperliquid, and Lighter, and the rest of the field comes down to scale, execution, and innovation. Aster’s surge in daily volume and fee generation signals a shift toward platforms that can accommodate both large institutional flows and retail traders without sacrificing performance. Hyperliquid’s focus on latency and liquidity continues to attract algorithmic traders and market makers, while Lighter’s user experience and risk management keep it relevant in an increasingly crowded market.

Meanwhile, edgeX and ApeX Protocol are rapidly iterating to capture emerging demand for synthetic assets and creative incentive models. dYdX’s legacy and GMX’s transparency remain differentiators, but the pace of innovation from newer entrants is forcing all players to adapt or risk obsolescence.

Looking Ahead: The Next Phase for Perpetual DEXs

The record-breaking volumes and market share shifts of 2024-2025 are not mere anomalies, they reflect a deeper structural transformation in crypto trading. With perpetual swaps now comprising 56% of DEX derivatives volume (up from 50% last year), and monthly volumes exceeding $1 trillion for the first time in September 2025, DeFi-native derivatives are firmly entrenched in the market’s core infrastructure. Platforms like Hyperliquid and Aster are setting new standards for performance and transparency, while up-and-comers like edgeX and Kwenta continue to push the boundaries of product design and market access.

For traders evaluating where to deploy capital in this rapidly evolving landscape, the top 10 perpetual DEXs offer a compelling mix of liquidity, innovation, and risk management. As competition intensifies, expect further differentiation in product offerings, governance models, and incentive structures, making this an essential sector to watch for both professional and retail participants seeking exposure to the next wave of DeFi growth.