Speed and reliability are the holy grail for traders in the world of perpetual contracts. For years, centralized exchanges dominated this space by offering lightning-fast trades and deep liquidity, but at the cost of transparency and custody. Hyperliquid-Style Perps is changing the equation, delivering ultra-low latency perpetual trading on decentralized exchanges (DEXs) without compromising on-chain security or user control.

Why Low-Latency Matters for Perpetual Trading

If you’ve ever tried to scalp a fast-moving market or execute a high-frequency strategy, you know that every millisecond counts. Traditional DEXs often lag behind their centralized counterparts due to blockchain confirmation times and clunky wallet approvals. This delay can mean missed opportunities, slippage, or even liquidations during volatile swings.

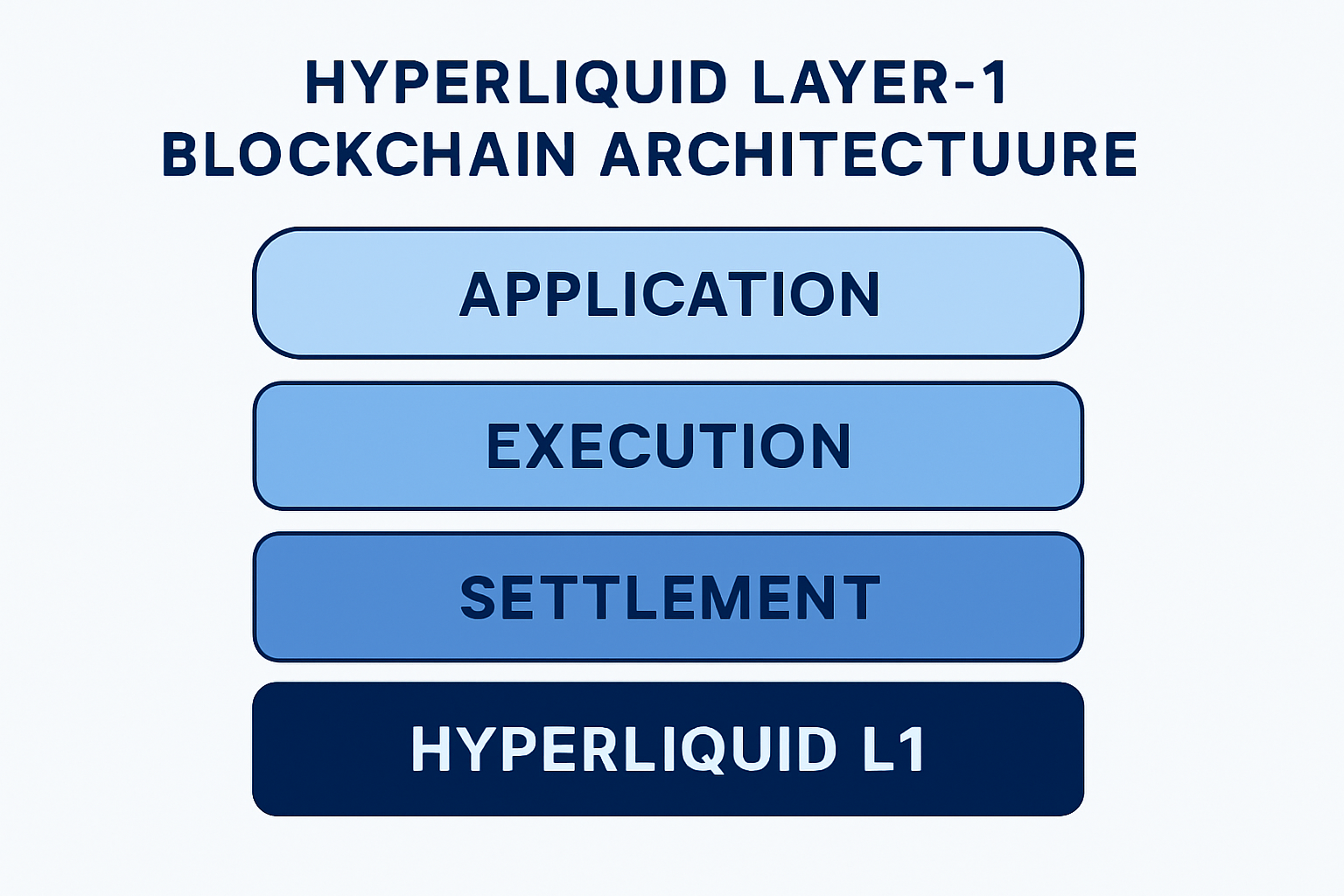

Hyperliquid-Style Perps directly addresses these pain points by leveraging a custom Layer-1 blockchain designed from the ground up for high-frequency derivatives trading. The result? The platform processes up to 200,000 orders per second, with sub-second execution times that rival top-tier CEXs. That’s not marketing hype – it’s a fundamental shift in what’s possible for DeFi traders who demand real-time execution in crypto markets.

The Tech Stack Behind Hyperliquid’s Speed

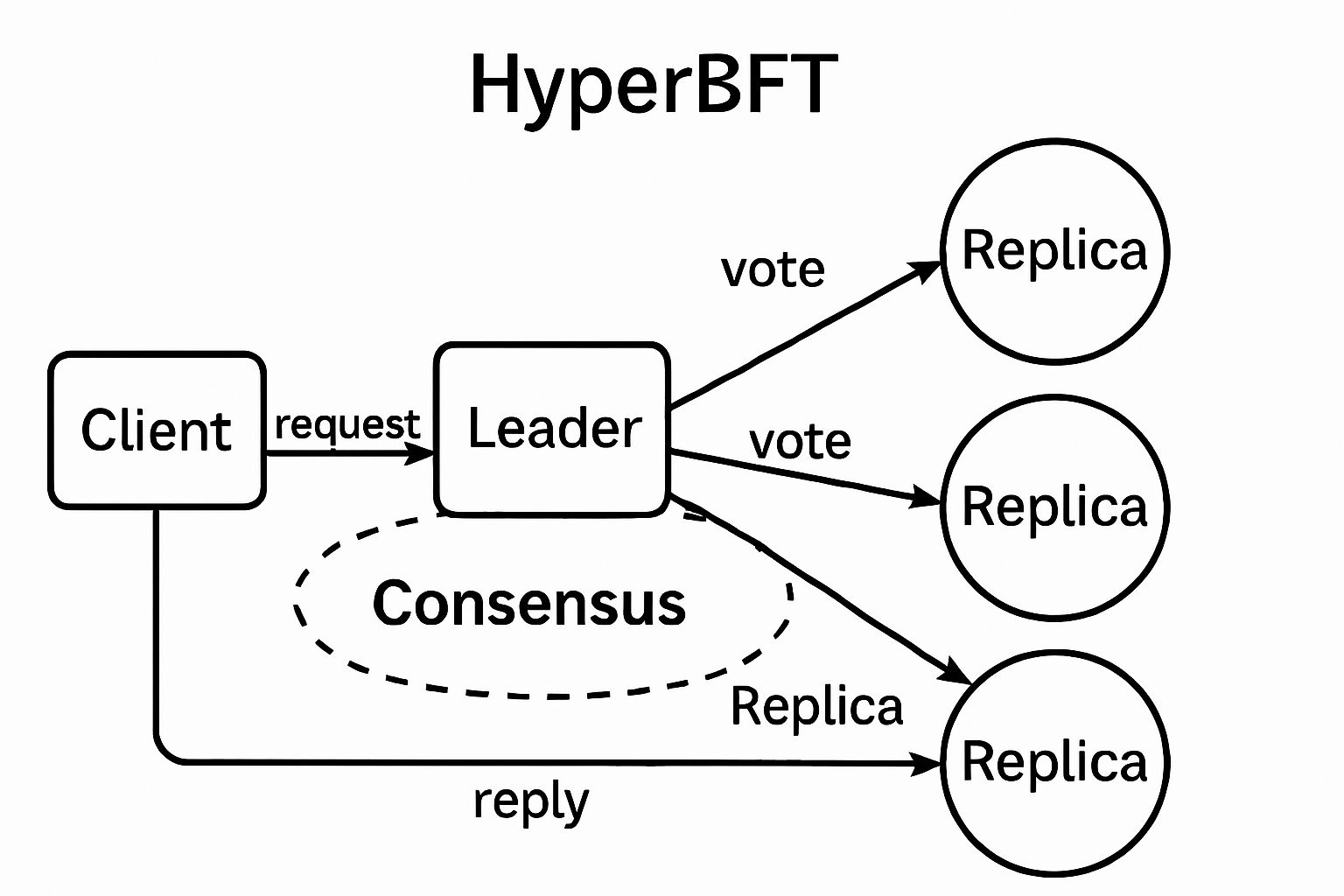

The magic behind Hyperliquid-Style Perps starts with its proprietary consensus protocol: HyperBFT. This isn’t just another fork or tweak of existing blockchains – it’s an entirely new approach tailored for throughput and instant finality. Every trade is settled on-chain in less than one second, ensuring both speed and transparency.

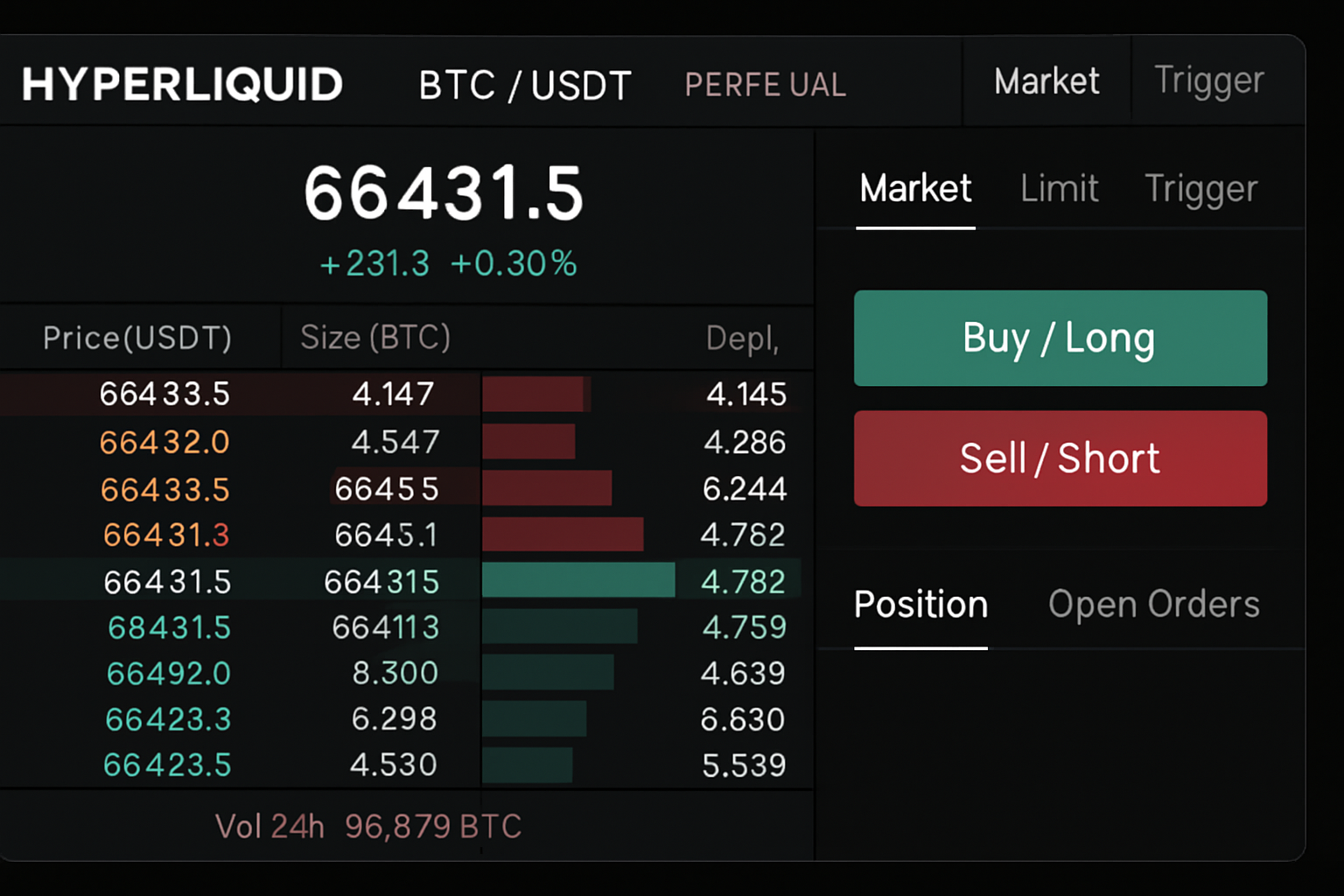

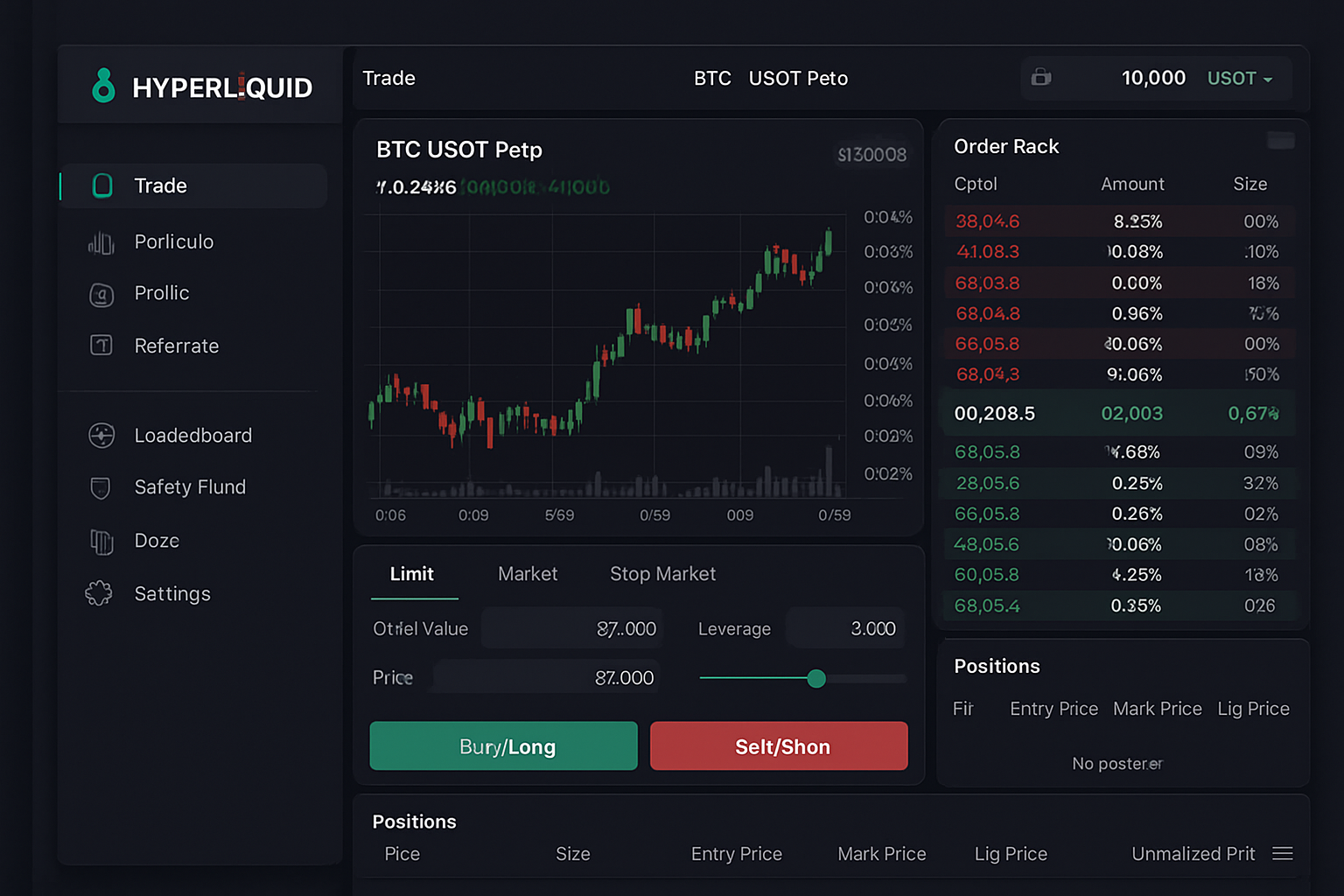

But it doesn’t stop there. The platform features an on-chain order book with a matching engine capable of handling substantial order volumes during peak volatility. Unlike most DEXs that require wallet approval for every trade (a killer for active traders), Hyperliquid eliminates this friction point entirely. Once you’re connected, you can execute trades as seamlessly as you would on a centralized exchange – but with all the benefits of DeFi.

Top 5 Ways Hyperliquid-Style Perps Enable Ultra-Low Latency Trading

-

Custom Layer-1 Blockchain for High-Frequency Trading: Hyperliquid operates on its own purpose-built Layer-1 blockchain, engineered specifically for high-frequency derivatives trading. This infrastructure enables the platform to process up to 200,000 orders per second with sub-second execution, rivaling centralized exchanges in speed while maintaining on-chain transparency.

-

On-Chain Order Book and Matching Engine: Unlike many DEXs that use automated market makers, Hyperliquid features a fully on-chain order book and a high-performance matching engine. This design allows for instant order matching and execution, reducing latency to less than one second and supporting advanced trading strategies.

-

HyperBFT Consensus Protocol for Sub-Second Finality: Hyperliquid’s proprietary HyperBFT consensus protocol delivers sub-second transaction finality and high throughput. This ensures that trades are settled almost instantly, minimizing slippage and enabling real-time trading experiences.

-

Seamless User Experience Without Wallet Approvals: Hyperliquid eliminates the need for wallet approvals on every trade, allowing users to execute trades directly and efficiently. This creates a frictionless experience comparable to centralized exchanges, further reducing trading latency.

-

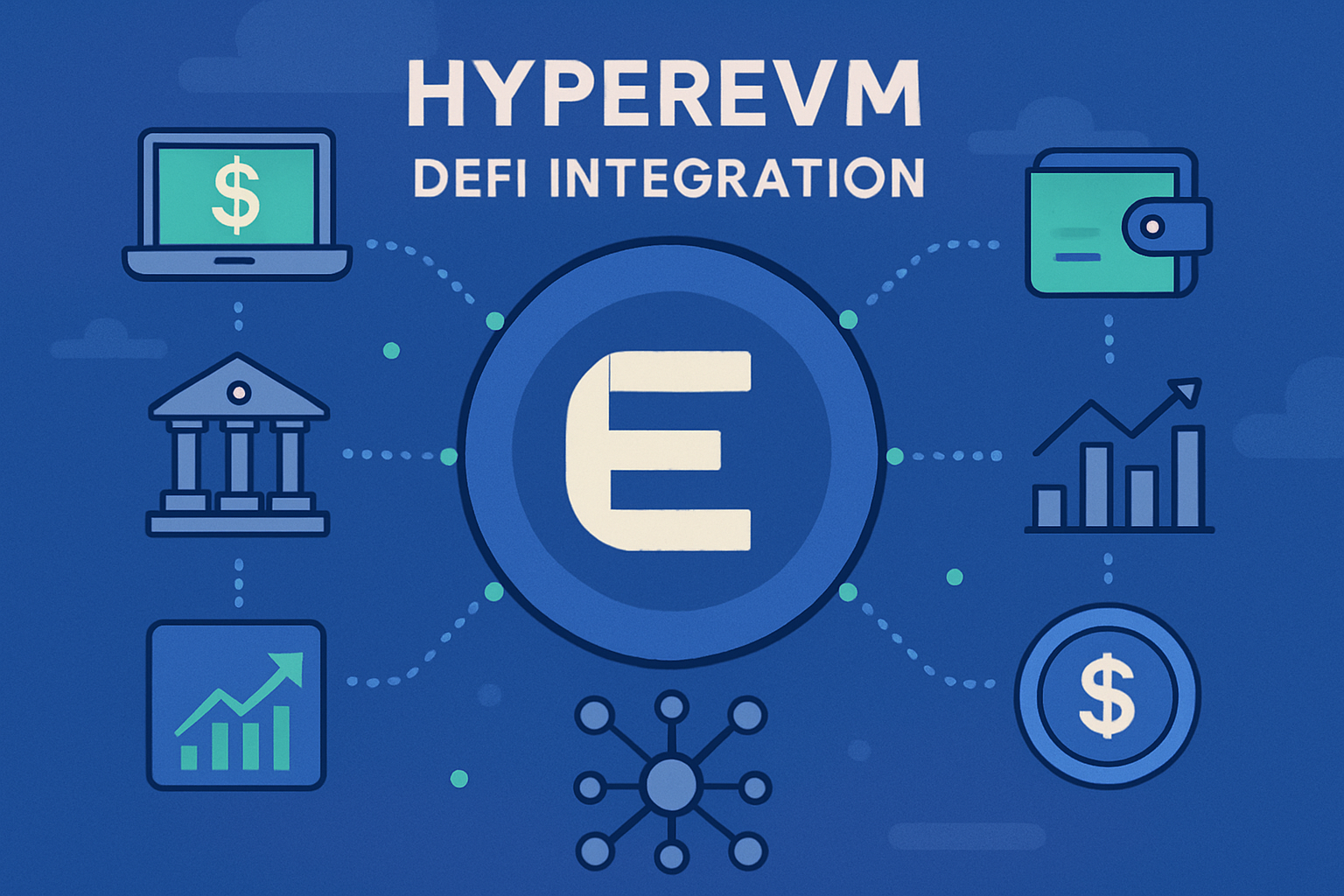

Ethereum-Compatible HyperEVM for Integrated DeFi Apps: With HyperEVM, Hyperliquid supports Ethereum-compatible smart contracts and DeFi applications within its ecosystem. This integration enables developers and traders to leverage advanced features and liquidity without sacrificing speed or decentralization.

Deep Liquidity Meets Decentralized Security

A fast matching engine is only half the story; without deep liquidity, even the quickest trades fall flat. Hyperliquid-Style Perps has engineered its liquidity pools (HLP) to support significant position sizes without excessive slippage or price impact. This design not only supports retail traders but also attracts institutional players looking for scalable on-chain exposure.

The integration of HyperEVM, an Ethereum-compatible environment within the same ecosystem, further expands possibilities by allowing smart contract deployment and composability with other DeFi protocols. This means you get advanced trading features and programmability alongside unmatched speed, all while your assets remain non-custodial.

If you want to dive deeper into how these innovations are reshaping decentralized perpetual trading, check out our detailed guide: How Hyperliquid-Style Perps Achieves Ultra-Low Latency on Decentralized Perpetual Exchanges.

What truly sets Hyperliquid-Style Perps apart is how it bridges the gap between the transparency of decentralized exchanges and the performance traders expect from centralized venues. By maintaining an on-chain order book with instant finality, Hyperliquid ensures that every transaction is both auditable and irreversible in under a second. This combination of speed and trust is rare in the DeFi landscape, especially for perpetual contracts where latency can mean the difference between profit and loss.

For traders who thrive on volatility and require split-second execution, this architecture unlocks new strategies previously reserved for CEXs. The ability to enter and exit positions at will, without waiting for block confirmations or juggling wallet pop-ups, means you can actually capitalize on real-time market movements instead of reacting after the fact. As perpetual DEX trading volume now accounts for over 20% of global activity (up from just 2% in 2022), platforms like Hyperliquid are clearly leading this paradigm shift.

User Experience: Fast, Intuitive, and Secure

Speed isn’t just about backend performance, it’s also about how quickly users can interact with the platform. Hyperliquid-Style Perps has invested heavily in UX design, offering a clean interface that displays deep liquidity, up-to-the-moment funding rates, and risk metrics front-and-center. Whether you’re hedging with perpetual contracts or deploying complex strategies across multiple pairs, everything is designed to minimize friction while maximizing control.

Security remains non-negotiable. With assets held non-custodially on-chain and all trade data verifiable via public ledgers, users never have to sacrifice safety for speed. The integration of programmable smart contracts through HyperEVM also opens doors for automated trading bots and risk management tools, all within a single ecosystem.

Why Traders Are Making the Switch

The migration from centralized to decentralized platforms isn’t just ideological, it’s increasingly practical. Here’s why more high-frequency traders are choosing low-latency perpetual DEXs like Hyperliquid-Style Perps:

Why Top Traders Choose Low-Latency Perp DEXs

-

Ultra-Low Latency Execution: Platforms like Hyperliquid leverage custom Layer-1 blockchains and proprietary consensus protocols (HyperBFT) to achieve sub-second trade finality, rivaling the speed of leading centralized exchanges.

-

On-Chain Transparency & Security: Unlike centralized exchanges, perpetual DEXs such as Hyperliquid and dYdX settle trades directly on-chain, ensuring full transparency and non-custodial control over funds.

-

Seamless User Experience: Innovations like instant order matching and no wallet approval requirements for each trade provide a frictionless trading flow, making DEXs as easy to use as CEXs.

-

Deep Liquidity Pools: Leading perp DEXs now offer deep liquidity, supporting high-frequency trading and large order sizes without significant slippage, which is crucial for professional traders.

-

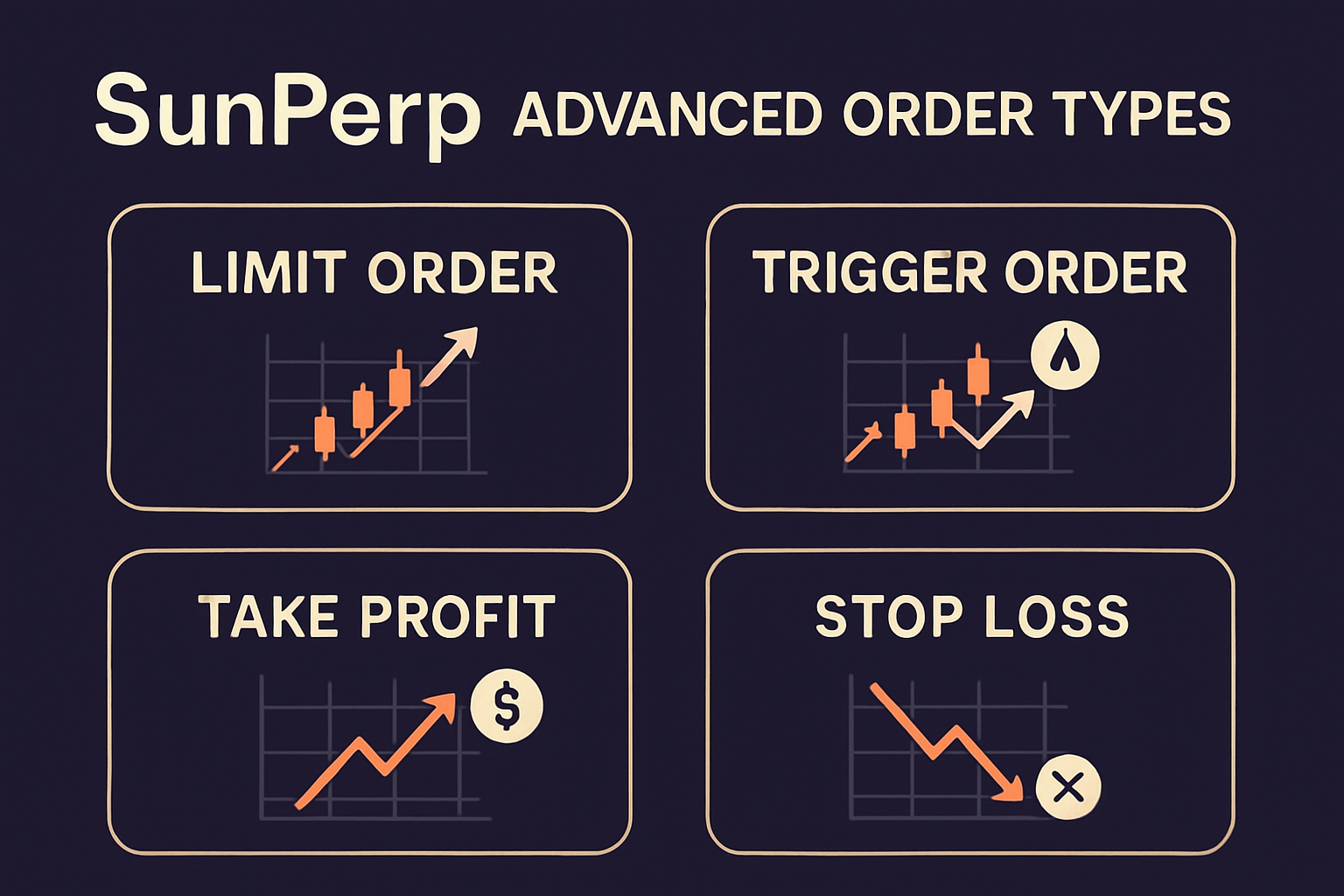

Advanced Trading Features: Platforms such as Hyperliquid and SunPerp provide sophisticated order types, on-chain margin, and robust risk management tools, empowering traders with the flexibility and control they expect from CEXs.

-

Integration with DeFi Ecosystems: With environments like HyperEVM, traders can access DeFi apps and smart contracts directly within the trading platform, unlocking new strategies and composability.

As competition heats up between platforms like Aster and dYdX, Hyperliquid continues to set itself apart by delivering a unique blend of real-time execution, deep liquidity, and programmable composability. These aren’t just buzzwords, they’re core features that let you stay ahead of the curve in an ever-evolving market.

If you’re ready to experience next-generation trading firsthand or want to learn more about what makes low-latency DeFi possible, explore our technical deep dive at How Hyperliquid-Style Perps Achieves Ultra-Low Latency in Decentralized Perpetual Trading.