In 2025, the landscape of decentralized perpetual exchanges (perp DEXs) has shifted dramatically, with Hyperliquid-Style Perps cementing its status as the leading platform by both trading volume and market share. Despite fierce competition from Aster and Lighter, Hyperliquid continues to set the pace for innovation, liquidity, and user engagement in DeFi derivatives. This article analyzes how Hyperliquid achieved and sustained dominance in a year when perp DEXs collectively smashed through the $1 trillion monthly volume barrier.

Hyperliquid-Style Perps Trading Volume: Unprecedented Scale in 2025

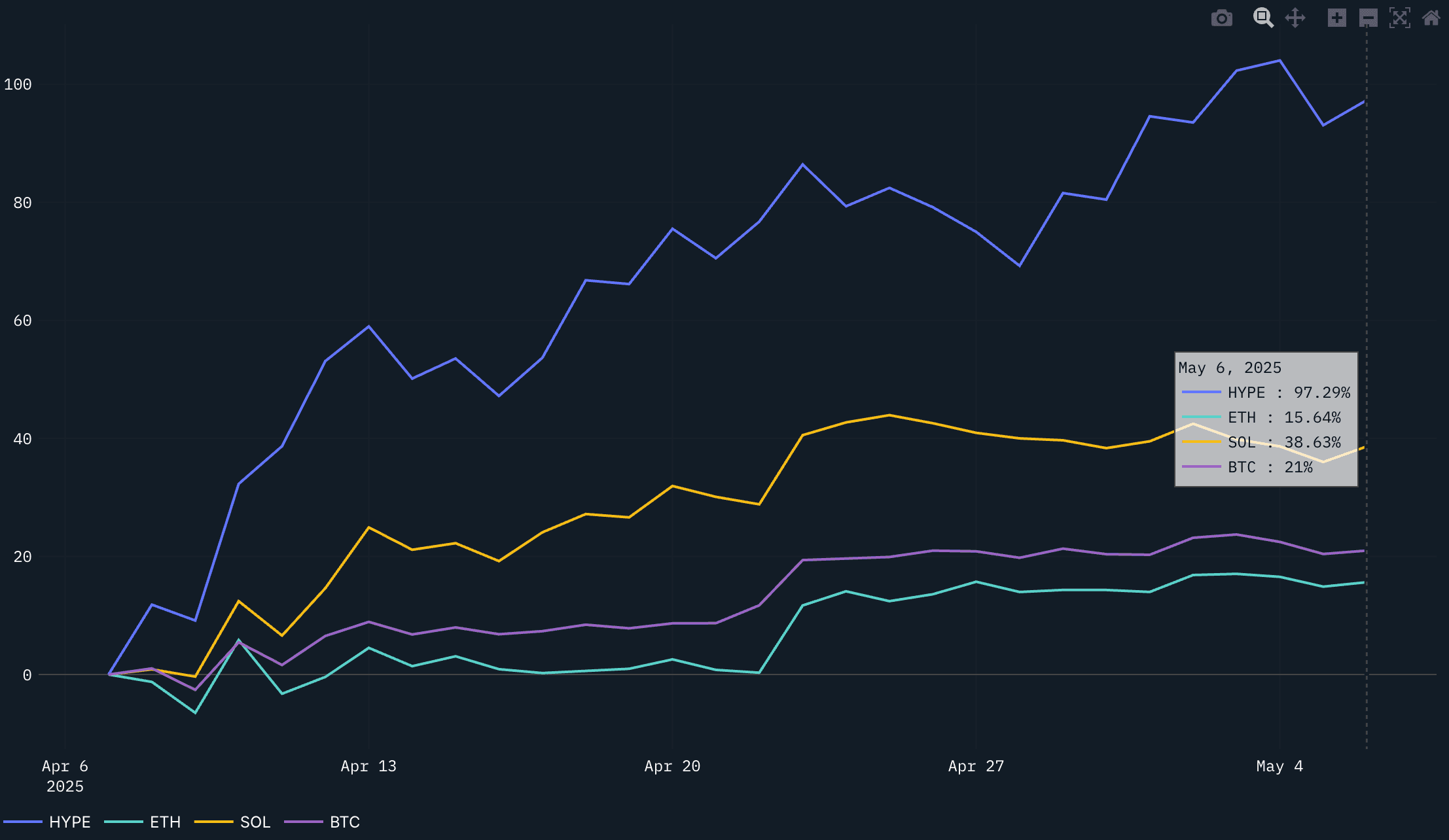

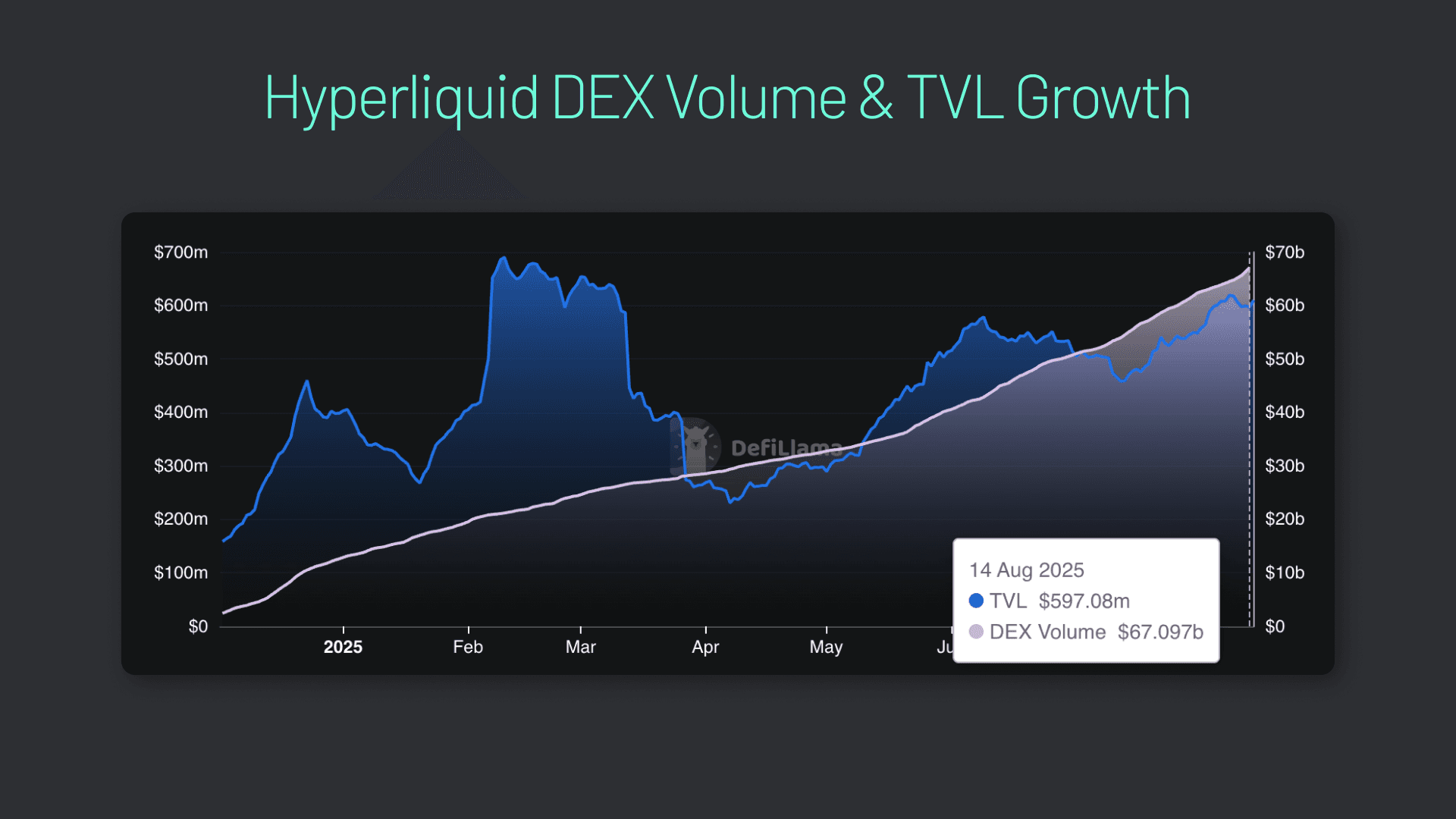

By mid-2025, Hyperliquid’s cumulative trading volume soared past $1.5 trillion, with weekly averages around $470 billion and daily peaks exceeding $100 billion during periods like the memecoin surge in May. According to BlockEden, this scale is unparalleled among DeFi platforms and even rivals some of the largest centralized exchanges globally. Notably, during these high-volatility windows, Hyperliquid handled about 6% of all global crypto trading activity, including CEXs, demonstrating both robustness and reliability under pressure.

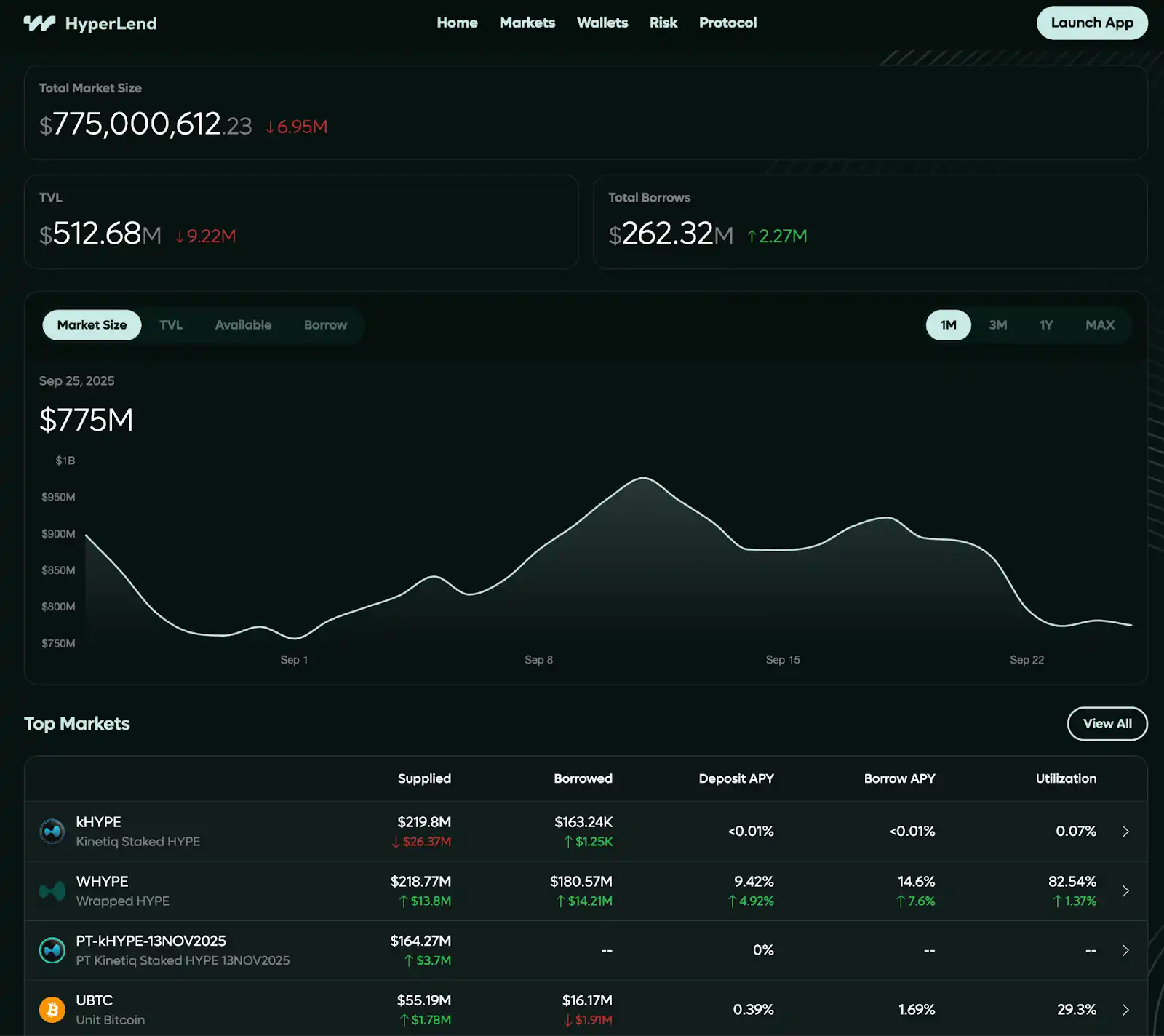

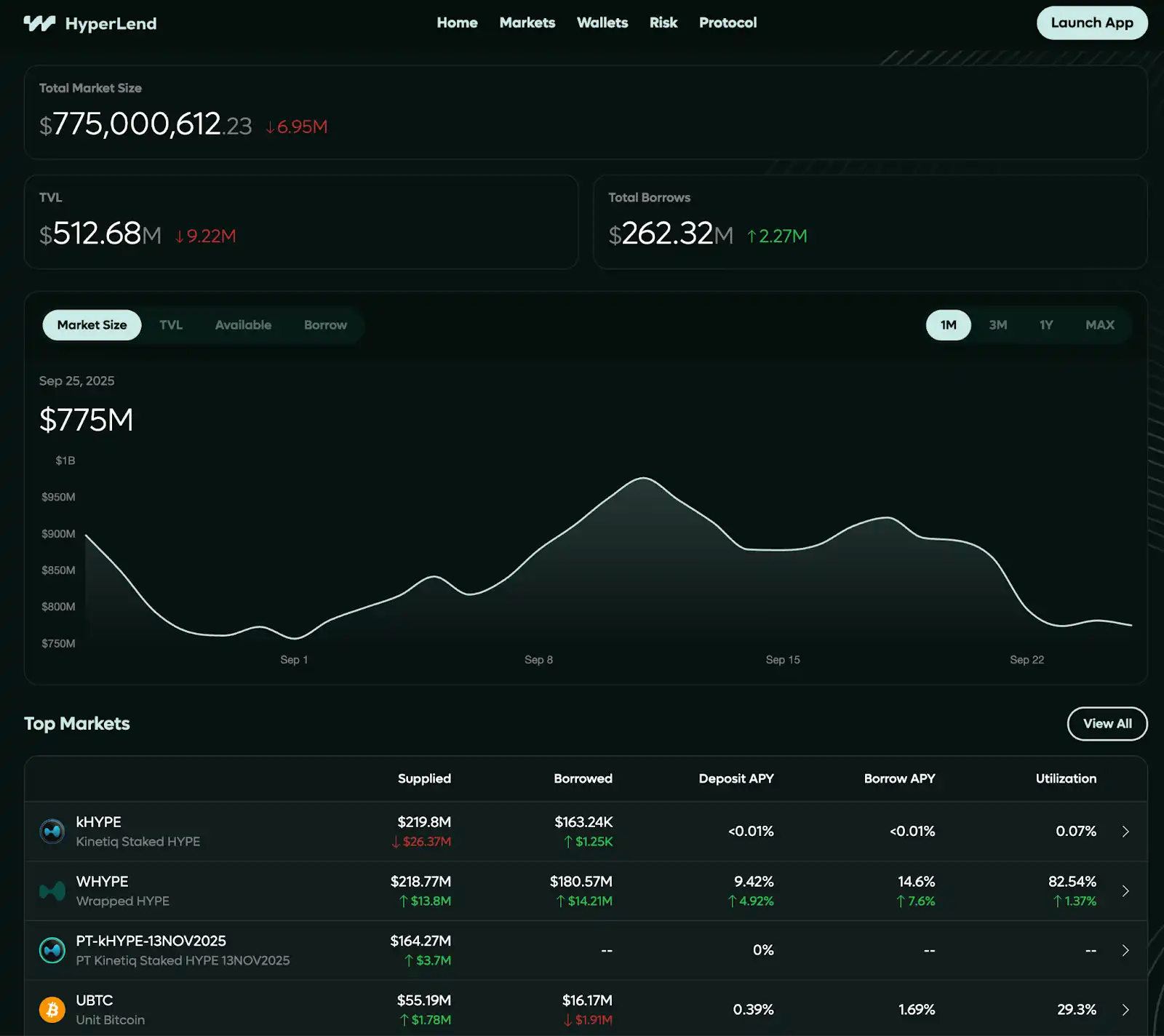

This remarkable throughput is not just a function of speculative mania; it reflects a deep pool of professional traders and institutions who have migrated from centralized venues to take advantage of Hyperliquid’s superior execution speed, lower fees, and transparent on-chain settlement. The platform’s open interest (OI) expanded from $3.3 billion at the end of 2024 to around $15 billion by mid-2025, levels comparable to Bybit or OKX, underscoring its credibility among serious market participants.

“Hyperliquid remains the most dominant platform, accounting for around 70% of the total perpetual DEX market share. ”

Perpetual DEX Market Share 2025: The Battle With Aster and Lighter

The rise of Binance-affiliated Aster has been rapid and headline-grabbing. In recent months, Aster’s share ballooned while some reports noted a short-term dip in Hyperliquid’s percentage share. However, aggregate data consistently shows that Hyperliquid commands approximately 70, 77% of total perp DEX volume, maintaining clear leadership over its rivals (source). Even as sector-wide daily volumes hover near $15.6 billion and monthly volumes surpass $1 trillion (BlockEden), no other decentralized platform matches Hyperliquid’s liquidity depth or order book resilience.

Key Differences: Hyperliquid, Aster, and Lighter in 2025

-

Trading Fees: Hyperliquid features ultra-low fees with zero gas costs and trading fees set at 0.01% maker and 0.035% taker. Aster is competitive but typically charges slightly higher taker fees (around 0.04%) and may include small network fees during high congestion. Lighter positions itself as a low-fee alternative, but its fee structure is less transparent and often varies by asset pair.

-

Liquidity Depth & Order Book: Hyperliquid boasts order book depth for BTC/ETH pairs comparable to top centralized exchanges, with open interest rising to $15 billion by mid-2025. Aster has seen a rapid influx of volume, especially after May 2025, but still trails Hyperliquid in liquidity depth for major pairs. Lighter offers decent liquidity for leading assets, but its depth and spreads are generally less competitive, especially during volatile periods.

-

User Experience & Features: Hyperliquid is praised for its zero gas fees, seamless onboarding, and community-centric features like a massive $HYPE airdrop and up to 50× leverage across 130+ markets. Aster has attracted users with aggressive incentives and a Binance-affiliated interface, but some users report higher latency during peak times. Lighter focuses on simplicity and speed, but lacks advanced features like deep analytics and community governance.

-

Community & Incentives: Hyperliquid stands out with its no VC funding model and a 31% $HYPE token airdrop to users, plus ongoing buybacks using 97% of protocol revenue. Aster leverages Binance ecosystem perks and frequent trading competitions, while Lighter offers periodic rebates but has a smaller, less engaged community.

This dominance is not static or guaranteed; it is reinforced daily by technical excellence and community trust. While Aster captured headlines with surging short-term activity, especially during isolated events, analysts argue that Hyperliquid remains fundamentally stronger due to its stickier user base and more sustainable fee structure (BingX comparison). Professional traders consistently cite tighter bid-ask spreads for BTC and ETH pairs on Hyperliquid compared to competitors, a direct result of deeper liquidity pools.

User Base Expansion and Community Ownership Model

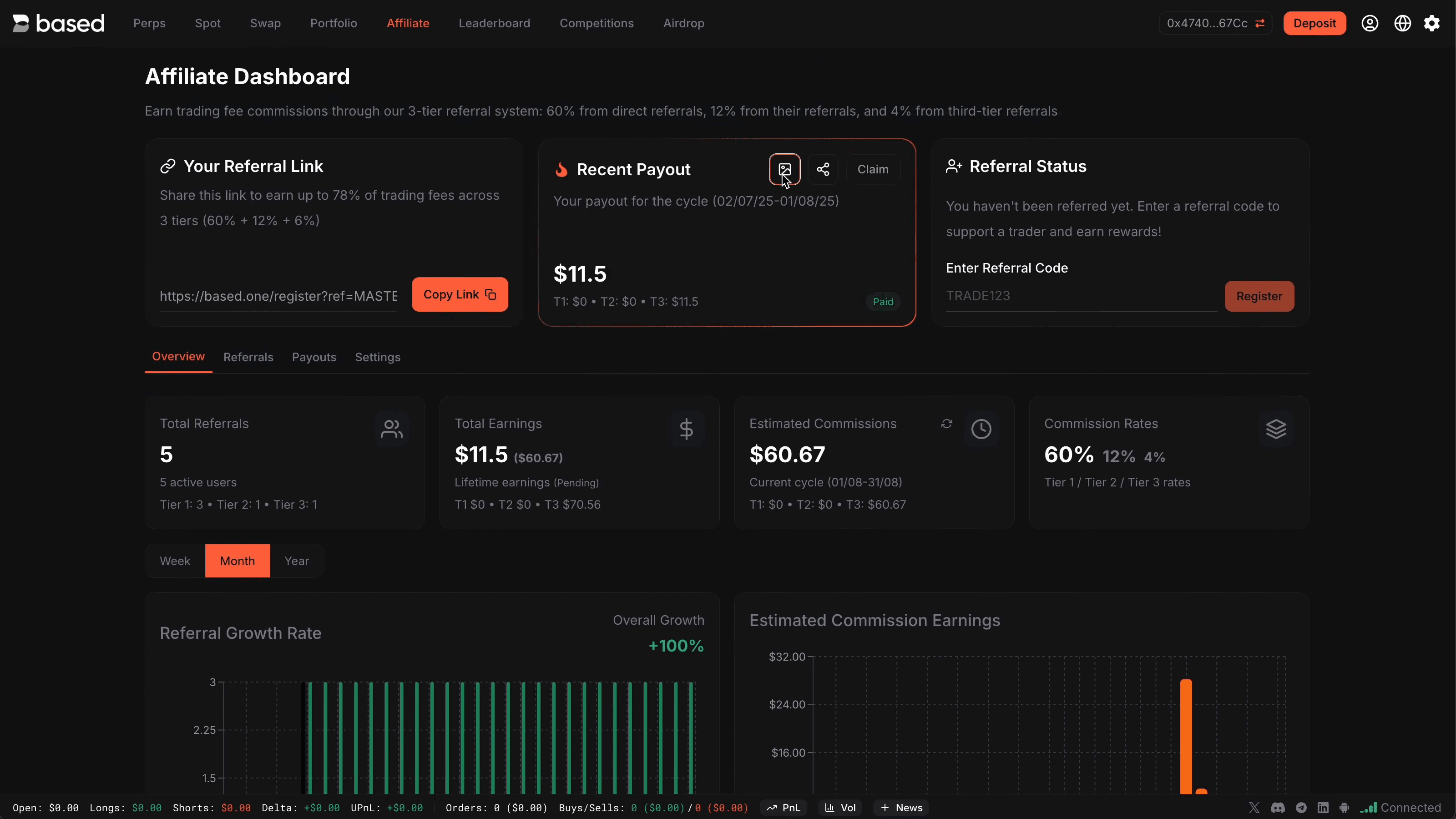

The surge in trading activity on Hyperliquid is closely tied to its rapidly growing user base. By mid-year 2025, more than 500,000 unique addresses had interacted with the protocol, a figure that nearly doubled within six months thanks to viral word-of-mouth growth campaigns and an innovative referral program. The highly anticipated $HYPE token airdrop distributed 31% of supply directly to users (valued at $1.6 billion), fueling further adoption while aligning incentives between traders and protocol health.

This community-first approach stands out among decentralized perpetual exchanges. Unlike many competitors reliant on venture capital funding or opaque governance structures, Hyperliquid operates with full transparency: over 97% of protocol revenue is used for buybacks of the native token ($HYPE), directly rewarding long-term holders while reducing circulating supply.

Hyperliquid’s meteoric growth is not just a function of incentives or marketing. The platform’s technical stack delivers what high-frequency traders and institutions require: zero gas fees, ultra-low latency, and a maker-taker fee structure that undercuts both centralized and decentralized rivals (0.01% for makers, 0.035% for takers). With up to 50× leverage across more than 130 markets, including major assets like BTC and ETH as well as deep altcoin coverage, Hyperliquid appeals to a spectrum of market participants, from retail speculators to professional desks.

Order book depth is a critical differentiator in the perpetual DEX arms race. Hyperliquid’s books for flagship pairs routinely match or exceed those on Bybit or OKX, with liquidity providers attracted by both protocol incentives and organic trading flow. This translates into consistently tight spreads and minimal slippage, even during peak volatility, a key reason why large-volume traders have migrated en masse from centralized venues.

“Despite Aster’s recent surge in volume, Hyperliquid remains the most investible perp DEX due to its robust fundamentals and community-centric model. ”

Sustaining Leadership Through Innovation

Hyperliquid’s edge goes beyond raw numbers. The platform has pioneered features now seen as industry standards: seamless on-chain settlement, transparent proof-of-reserves, and an open API that enables algorithmic trading at scale. These advances have set new expectations for what decentralized perpetual exchanges can deliver in terms of both performance and user protection.

The absence of venture capital funding has also allowed Hyperliquid to avoid the conflicts of interest plaguing some competitors. The $HYPE token’s distribution model, one of the largest DeFi airdrops to date, has fostered genuine community ownership rather than short-term speculation by insiders. Over 97% of platform revenue flows back into token buybacks, directly benefitting long-term users instead of external investors.

Key Hyperliquid-Style Perp Innovations in 2025

-

Zero Gas Fees & Ultra-Low Trading Costs: Hyperliquid introduced zero gas fees for all users, with industry-leading low maker (0.01%) and taker (0.035%) fees. This pricing structure undercuts both decentralized and centralized competitors, making high-frequency and professional trading more viable.

-

Deep Liquidity & Robust Open Interest: By mid-2025, Hyperliquid’s open interest reached $15 billion, rivaling top centralized exchanges. Its order book depth and tight bid-ask spreads for major pairs like BTC and ETH attract professional traders migrating from CEXs.

-

Expansive Market Coverage & High Leverage: Hyperliquid offers over 130 perpetual markets with up to 50× leverage, covering major assets and smaller altcoins. This breadth and leverage flexibility outpace most DEX competitors.

-

Community Ownership & Record-Breaking Airdrop: Hyperliquid operates with no venture capital funding, distributing 31% of its $HYPE token supply via a $1.6 billion airdrop—one of DeFi’s largest. This model fosters community alignment and long-term engagement.

-

Protocol Revenue Buybacks & Holder Rewards: Hyperliquid allocates 97% of protocol revenue to buying back $HYPE tokens, reducing supply and rewarding holders. This innovative approach directly links platform success to user incentives.

-

Rapid User Growth & Professional Trader Adoption: In 2025, Hyperliquid surpassed 500,000 unique user addresses, with a significant influx of professional traders and whales from centralized exchanges, driven by superior liquidity, product design, and incentives.

The result is a virtuous cycle: deep liquidity attracts sophisticated traders, which in turn draws more liquidity providers, reinforcing the platform’s dominance even as new entrants attempt to disrupt the status quo.

What Sets Hyperliquid Apart in the Perpetual DEX Meta?

While Aster has proven adept at capturing episodic surges, most notably during September’s record $1.143 trillion sector-wide volume spike, analysts maintain that Hyperliquid’s user stickiness and infrastructure resilience are unmatched (BlockEden). The protocol’s ability to consistently execute high-volume orders with minimal slippage remains its strongest moat against rivals focused on short-term growth tactics.

Ultimately, Hyperliquid-Style Perps’ sustained leadership in trading volume and perpetual DEX market share through 2025 is underpinned by a combination of technical innovation, robust community engagement, and principled tokenomics. As decentralized finance continues its rapid evolution, platforms that prioritize transparency, speed, and user alignment will remain best positioned to capture both institutional flows and retail enthusiasm.