In the relentless race for DeFi alpha, airdrop rewards on perpetual DEXs have become a major battleground for ambitious traders. Early participation in platforms like Hyperliquid, Aster, and Avantis can yield life-changing token allocations, but only if you know how to play the game with precision. If you’re hungry to maximize your share of the next big airdrop, it’s time to get tactical and pragmatic. Let’s break down the five essential strategies every early DeFi trader should master right now.

1. Maximize Trading Volume with Rotational Perp Pairs

Most perpetual DEXs allocate airdrop rewards based on cumulative trading volume. That means it’s not just about making one big trade, it’s about staying active and rotating through high-liquidity, trending pairs like BTC, ETH, and SOL. Platforms such as Hyperliquid reward users who consistently contribute volume across their most popular perp contracts. By keeping your trades focused on these pairs, you align yourself with the metrics that matter most for eligibility.

Top Rotational Perp Pairs & Strategies for Airdrop Farming

-

Maximize Trading Volume with Rotational Perp Pairs: Focus your trades on high-liquidity and trending pairs like BTC, ETH, and SOL. These assets are consistently among the most active on leading perpetual DEXs such as Hyperliquid, Aster, and Avantis. Most airdrop programs reward cumulative trading volume, so rotating between these pairs can help you rack up points efficiently.

-

Leverage Optimization for Reward Multiplication: Use moderate leverage (typically 10x-25x) on volatile assets like BTC or SOL to amplify your notional trading volume. This strategy is essential for maximizing airdrop eligibility on platforms like Aster and Hyperliquid, but always manage your risk to avoid liquidation.

-

Participate in Platform-Specific Incentive Programs: Engage in liquidity mining, trading competitions, and early-bird campaigns on DEXs such as Hyperliquid and Avantis. These programs often offer bonus multipliers or exclusive airdrop allocations for active participants.

-

Maintain Continuous Wallet Activity and Cross-Chain Engagement: Regularly interact with the DEX—trade, provide liquidity, and participate in governance. Bridging assets across supported chains (like Ethereum, Solana, and others) can increase your eligibility score and unlock multi-chain airdrop opportunities.

-

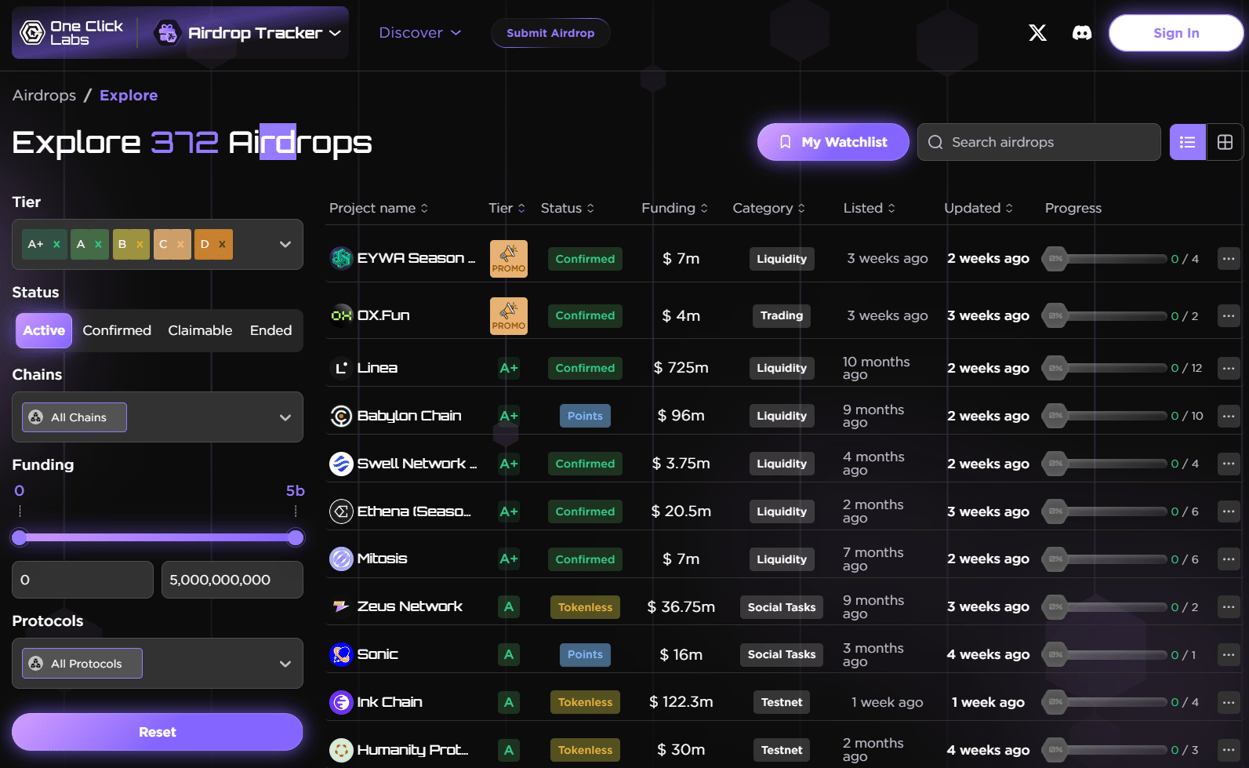

Monitor Snapshot Dates and Claim Periods Closely: Stay updated on official announcements for snapshot timings and claim windows. Missing these key dates can result in lost rewards, so set reminders and check community channels frequently.

This is where disciplined traders stand out: set aside time each week to review which assets are trending or have upcoming catalysts. Rotate your positions accordingly to keep your volume high without getting stuck in illiquid markets. Remember provides volume is king, but smart rotation is how you stay in the game when volatility spikes.

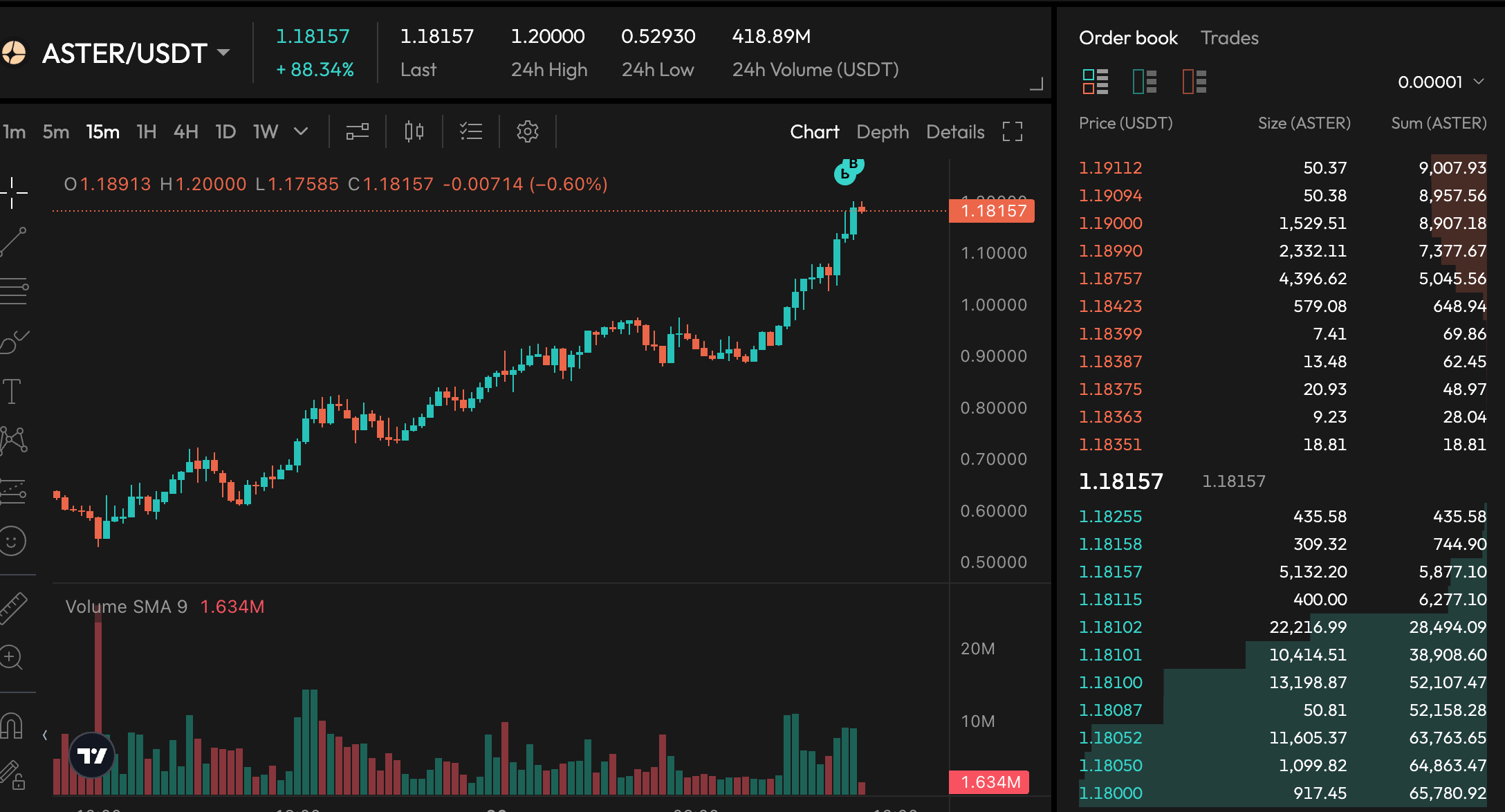

2. Leverage Optimization for Reward Multiplication

If you want to boost your notional trading volume without risking instant liquidation, leverage is your tool, but only when used wisely. Platforms like Aster and Hyperliquid often calculate airdrop eligibility based on notional value traded rather than just wallet activity. Using moderate leverage (think 10x-25x) on volatile assets lets you scale up your eligible volume while still controlling risk.

The key? Avoid going overboard. While some guides suggest 25x-50x leverage for maximum points (see this Medium guide), seasoned traders know that a single liquidation can erase weeks of progress. Instead, size your positions carefully and use stop-losses religiously, your goal is steady accumulation of trading points over time.

3. Participate in Platform-Specific Incentive Programs

Airdrops are just one layer of rewards; many DEXs run concurrent campaigns like liquidity mining, trading competitions, or early-bird bonuses. For instance, Hyperliquid frequently offers bonus multipliers for users who join their trading contests or provide liquidity during special events. Avantis has rolled out exclusive allocations for early governance voters and liquidity providers.

The advantage here is twofold: not only do you rack up extra points towards the main airdrop pool, but you also gain access to unique rewards that may never be repeated after launch windows close. Always monitor official announcements and jump into these programs as soon as they go live, timing can be everything when it comes to bonus multipliers or limited-time pools.

4. Maintain Continuous Wallet Activity and Cross-Chain Engagement

Your eligibility score isn’t just about raw volume; it’s also about consistency and breadth of engagement. Many leading DEXs now track regular wallet activity, trading weekly, providing liquidity periodically, or voting in governance proposals, as part of their criteria for top-tier rewards.

If the platform supports multiple chains (like Solana and Ethereum), bridge assets back and forth using official tools rather than third-party bridges whenever possible; this often triggers extra eligibility flags for cross-chain participants. The more integrated your activity across supported networks, the higher your chance at multi-chain airdrops, and these can stack fast if you’re methodical about staying active every week.

It’s easy to overlook the impact of sustained wallet activity, but platforms like Hyperliquid and Aster have made it clear: passive wallets rarely get top allocations. Active engagement, whether you’re trading, staking, or voting, demonstrates your value as a community member and can unlock additional reward tiers. Don’t let your eligibility slip through the cracks by going dormant between campaigns.

5. Monitor Snapshot Dates and Claim Periods Closely

The final stretch in maximizing perpetual DEX airdrop rewards is all about timing. Every major airdrop is tied to snapshot dates, specific moments when your trading volume, wallet activity, and on-chain participation are recorded for eligibility. Missing these windows means missing out on potentially life-changing rewards, no matter how active you’ve been.

Essential Strategies to Maximize Perpetual DEX Airdrops

-

Maximize Trading Volume with Rotational Perp Pairs: Focus on high-liquidity and trending pairs like BTC, ETH, and SOL to boost your trading volume. Most Perpetual DEX airdrops, including those on Hyperliquid, Aster, and Avantis, reward active traders based on cumulative volume. Rotating between popular pairs can help you reach higher tiers and maximize rewards.

-

Leverage Optimization for Reward Multiplication: Use moderate leverage (10x-25x) on volatile assets to increase your notional trading volume without overexposing yourself to liquidation risk. This strategy is essential for maximizing airdrop eligibility on platforms like Aster and Hyperliquid, where higher leverage can amplify your rewards if managed prudently.

-

Participate in Platform-Specific Incentive Programs: Engage in liquidity mining, trading competitions, and early-bird campaigns offered by DEXs such as Hyperliquid and Avantis. These programs often provide bonus multipliers or exclusive airdrop allocations, giving proactive users an edge in earning more rewards.

-

Maintain Continuous Wallet Activity and Cross-Chain Engagement: Regularly interact with the DEX by trading, providing liquidity, and voting in governance. Bridge assets across supported chains to increase your eligibility score and capture multi-chain airdrop opportunities, especially as platforms like Aster expand their cross-chain presence.

-

Monitor Snapshot Dates and Claim Periods Closely: Stay updated on official announcements for snapshot timings and claim windows. This ensures you qualify for rewards and don’t miss out due to inactivity or late participation—timely action is crucial for airdrops on Hyperliquid, Aster, and Avantis.

Set calendar alerts for every major DEX you’re engaging with. Double-check official channels for last-minute changes or surprise extensions. When claim periods open, act swiftly: unclaimed tokens often revert to the protocol treasury or are redistributed among more diligent participants. If you’re unsure about your eligibility status or how to claim, refer directly to the project’s official guides or support channels.

Bringing It All Together: The Perpetual DEX Edge

The early DeFi trader who thrives in this environment is not just lucky, they’re methodical. By rotating through high-volume perp pairs, using leverage strategically, stacking points in incentive programs, maintaining cross-chain activity, and never missing a snapshot deadline, you put yourself at the front of every airdrop line.

This isn’t just theory, it’s proven by traders who’ve already banked outsized rewards from platforms like Hyperliquid and Aster. As competition heats up and new protocols emerge almost monthly (see recent case studies here), these five strategies remain your best blueprint for consistent airdrop success.

If you’re serious about building wealth in DeFi, don’t treat these tactics as optional extras, they’re essential habits. Stay plugged into community channels for real-time updates, keep refining your approach as protocols evolve, and above all else: show up early and often.

The next big airdrop won’t wait for passive observers, it will reward those who trade with intent and precision.