As perpetual decentralized exchanges (DEXs) surge in popularity, professional crypto traders are laser-focused on one metric above all: latency. With Bitcoin currently trading at $113,934.00 as of September 30,2025, and market volatility driving demand for real-time execution, even milliseconds can spell the difference between profit and missed opportunity. Platforms like Hyperliquid have redefined the landscape by offering sub-second transaction finality and deep liquidity for over 130 assets, but maximizing your edge requires more than just picking the right DEX. It’s about methodically tuning every variable in your trading stack.

1. Utilize Direct RPC Endpoints and Low-Latency Nodes for Order Submission

The foundation of low-latency trading on DEXs like Hyperliquid-Style Perps is minimizing the time it takes for your orders to reach the blockchain. By connecting directly to dedicated RPC endpoints and strategically located low-latency nodes, traders can bypass congested public infrastructure and route orders with minimal delay. This is especially critical during periods of heightened volatility or major price moves – when order book competition intensifies around key levels such as Bitcoin’s current $113,934.00.

Deploying your infrastructure geographically closer to core network nodes further reduces round-trip times. Professional setups often leverage virtual private servers (VPS) in proximity to Hyperliquid’s custom Layer-1 nodes or use services that offer prioritized API access. The result: faster order placement, improved fill rates, and a measurable reduction in slippage.

2. Leverage Hyperliquid’s Prioritized Order Types (Post-Only and Cancel Orders)

Hyperliquid has implemented a unique order book logic that prioritizes post-only and cancel orders above Good-Til-Cancelled (GTC) and Immediate-Or-Cancel (IOC) types (source). For latency-sensitive strategies – such as market making or high-frequency scalping – this prioritization is not just a technical detail; it’s a tactical advantage.

The implication is clear: by structuring your trades around post-only entries or rapid cancels, you can ensure your orders are processed ahead of standard GTC/IOC flows during congestion events. This approach lets you defend spreads more effectively or pull liquidity before adverse price movements sweep through the book.

Hyperliquid’s Prioritized Order Types Explained

-

Utilize Direct RPC Endpoints and Low-Latency Nodes for Order SubmissionConnect directly to Hyperliquid’s RPC endpoints or deploy trading infrastructure close to low-latency nodes. This minimizes network hops and reduces order transmission delays, ensuring your trades are among the first processed on the on-chain order book.

-

Leverage Hyperliquid’s Prioritized Order Types (Post-Only and Cancel Orders)Hyperliquid prioritizes post-only and cancel orders over GTC (Good-Til-Cancelled) and IOC (Immediate-Or-Cancel) orders. Using these prioritized order types increases the likelihood of optimal placement and cancellation, reducing slippage and execution risk in volatile markets.

-

Optimize Network and Hardware Setup for Real-Time ExecutionInvest in high-speed internet connections, low-latency hardware, and proximity hosting (such as VPS near Hyperliquid’s data centers). These steps reduce execution lag and improve the consistency of order placement and cancellation.

-

Employ Automated Trading Bots with Adaptive Gas ManagementUse automated trading bots that dynamically adjust gas fees based on network conditions. This ensures your orders are processed quickly, even during periods of high congestion, maximizing execution speed on Hyperliquid’s order book.

-

Pre-Fund Wallets and Use Fast Bridging Protocols to Minimize Onboarding DelaysKeep your trading wallets pre-funded and utilize fast, reputable bridging protocols like Jumper Exchange to quickly move assets onto Hyperliquid. This minimizes downtime and enables immediate participation in trading opportunities.

3. Optimize Network and Hardware Setup for Real-Time Execution

Your hardware and network environment are just as important as software optimizations when competing in the low-latency arena. Professional traders routinely invest in high-performance machines with fast CPUs, low-latency RAM, and SSD storage dedicated solely to trading operations. Network-wise, wired gigabit Ethernet connections consistently outperform WiFi in stability and speed.

Additionally, employing redundant internet connections or failover setups prevents downtime from ISP outages – a critical factor when markets move rapidly around major price milestones like Bitcoin holding steady above $100k at its current level of $113,934.00. Every microsecond counts; shaving milliseconds off order submission time can be decisive.

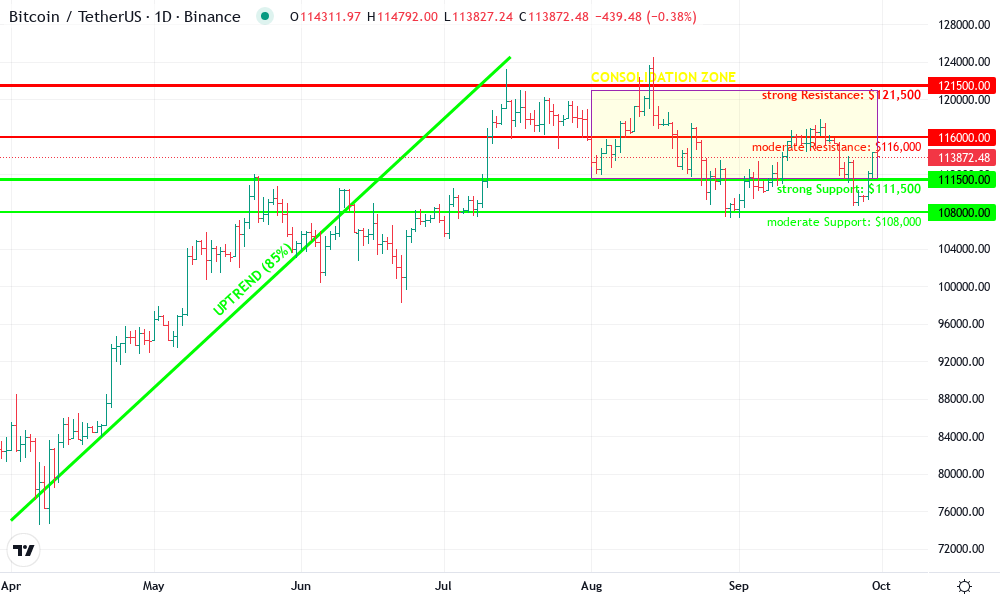

Bitcoin Technical Analysis Chart

Analysis by Lily Grant | Symbol: BINANCE:BTCUSDT | Interval: 1D | Drawings: 6

Technical Analysis Summary

The current Bitcoin (BTCUSDT) chart on Binance displays a strong uptrend from April through July 2025, followed by a period of distribution and consolidation between $111,500 and $121,500. In recent weeks, price action has been range-bound, with failed attempts to break above $116,000 and downside support holding near $111,500. Draw a primary uptrend line from April’s low near $75,000 to July’s high above $124,000. Use horizontal lines to mark significant support at $111,500 and resistance at $116,000 and $121,500. Mark the consolidation range from August through September. Annotate recent local lows and highs to highlight swing points. Use rectangle tools to denote the current sideways trading range. Avoid aggressive breakout projections; instead, focus on identifying risk-managed entry/exit points within the current range.

Risk Assessment: medium

Analysis: While the major uptrend is intact, the market is currently stuck in a choppy, uncertain range. Upside is limited without a confirmed breakout, and downside risk increases if $111,500 fails. Volatility can be high around range boundaries. My conservative risk profile calls for reduced sizing, clear stops, and avoidance of leverage.

Lily Grant’s Recommendation: Wait for a confirmed breakout or breakdown before making directional bets. If trading the range, use tight stops and scale out profits quickly. Prioritize capital preservation over aggressive positioning in this environment.

Key Support & Resistance Levels

📈 Support Levels:

-

$111,500 – Recent local low and base of current range.

strong -

$108,000 – Deeper support from September’s consolidation lows.

moderate

📉 Resistance Levels:

-

$116,000 – Recent swing high and midpoint of consolidation.

moderate -

$121,500 – Upper boundary of the post-July range.

strong

Trading Zones (low risk tolerance)

🎯 Entry Zones:

-

$111,800 – Low-risk entry near solid support; tight stop required.

low risk

🚪 Exit Zones:

-

$116,000 – First resistance/partial profit area within the range.

💰 profit target -

$108,000 – Protective stop if support fails.

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Not visible on the chart, but typically volume contracts during sideways ranges and expands on breakouts. Watch for a volume surge to confirm any range breaks.

Volume likely declining in this consolidation—wait for a clear expansion before acting.

📈 MACD Analysis:

Signal: Neutral/sideways—MACD likely converging with price in a range-bound market.

MACD would confirm a new trend only on a decisive range breakout.

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Lily Grant is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (low).

The Importance of Adaptive Infrastructure in Volatile Markets

The perpetual DEX landscape is unforgiving to those who let their technical edge slip. As liquidity deepens on platforms like Hyperliquid-Style Perps and advanced features become industry standard (see detailed analysis here), only those who adapt their infrastructure will consistently capitalize on fleeting opportunities.

Bitcoin (BTC) Price Prediction 2026-2031

Professional outlook based on current volatility, perpetual DEX adoption, and evolving DeFi infrastructure

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (%) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $95,000 | $125,000 | $155,000 | -16% to +36% | Potential regulatory tightening could trigger volatility; continued DEX growth supports resilience |

| 2027 | $108,000 | $142,000 | $178,000 | +14% to +21% | Bullish cycle likely as institutional adoption of DEXs grows; macro headwinds may limit upside |

| 2028 | $120,000 | $159,000 | $205,000 | +11% to +15% | Layer-1 upgrades and interoperability boost DeFi activity; global regulation remains a risk |

| 2029 | $135,000 | $177,000 | $235,000 | +13% to +15% | Wider mainstream adoption and ETF approvals drive demand; competition from other assets rises |

| 2030 | $152,000 | $195,000 | $270,000 | +14% to +15% | Bitcoin matures as digital gold; high volatility persists around halving cycle |

| 2031 | $170,000 | $215,000 | $310,000 | +13% to +15% | Advanced DEX infrastructure and tokenization expand use cases; external shocks could test resilience |

Price Prediction Summary

Bitcoin is projected to maintain a strong upward trajectory through 2031, supported by rapid innovation in decentralized trading platforms, increasing institutional participation, and maturing regulatory clarity. While periods of volatility and correction are expected, the overall trend remains positive, with both minimum and maximum price ranges reflecting bullish and bearish scenarios.

Key Factors Affecting Bitcoin Price

- Adoption of high-performance perpetual DEXs (e.g., Hyperliquid, Drift) enabling new trading strategies and liquidity.

- Regulatory developments in major markets (US, EU, Asia) impacting capital flows and institutional involvement.

- Technological advancements in Layer-1 and Layer-2 scaling, reducing transaction costs and latency.

- Integration of AI and algorithmic trading, increasing market efficiency and arbitrage.

- Global macroeconomic trends, including inflation, monetary policy, and digital asset regulation.

- Potential competition from emerging Layer-1 blockchains and alternative digital assets.

- Market cycles, including Bitcoin halving events and shifts in investor sentiment.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

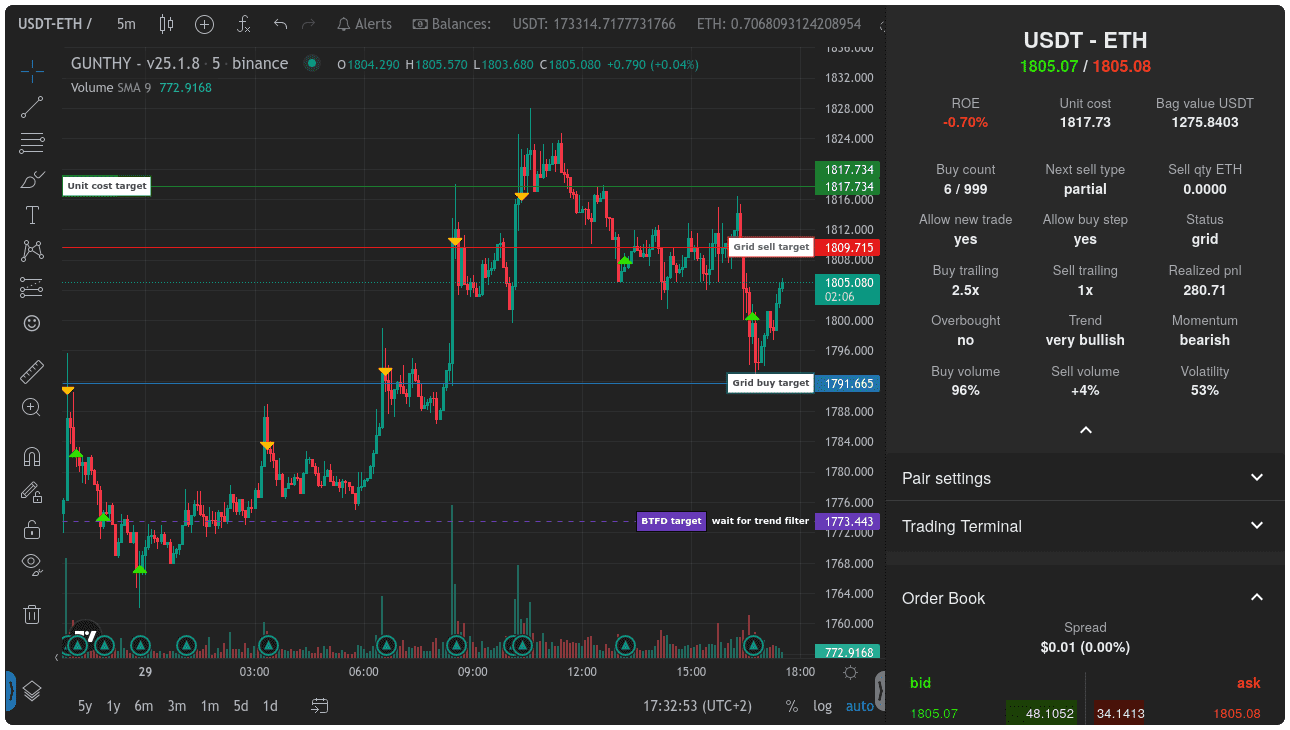

4. Employ Automated Trading Bots with Adaptive Gas Management

Manual execution is no match for the speed and consistency of automated trading bots, especially in the context of low-latency trading on DEXs. Modern bots can be programmed to monitor order book depth, latency metrics, and network congestion in real time. A critical feature for Hyperliquid-Style Perps is adaptive gas management. By dynamically adjusting gas fees based on network conditions, your bots can prioritize urgent transactions during periods of high activity, such as when Bitcoin surges to its current price of $113,934.00: without overspending during quieter intervals.

Integrating adaptive gas logic not only ensures timely order inclusion but also optimizes operational costs over the long run. This is particularly advantageous on platforms where blockspace competition can spike abruptly, causing transaction delays or failed fills for less responsive systems.

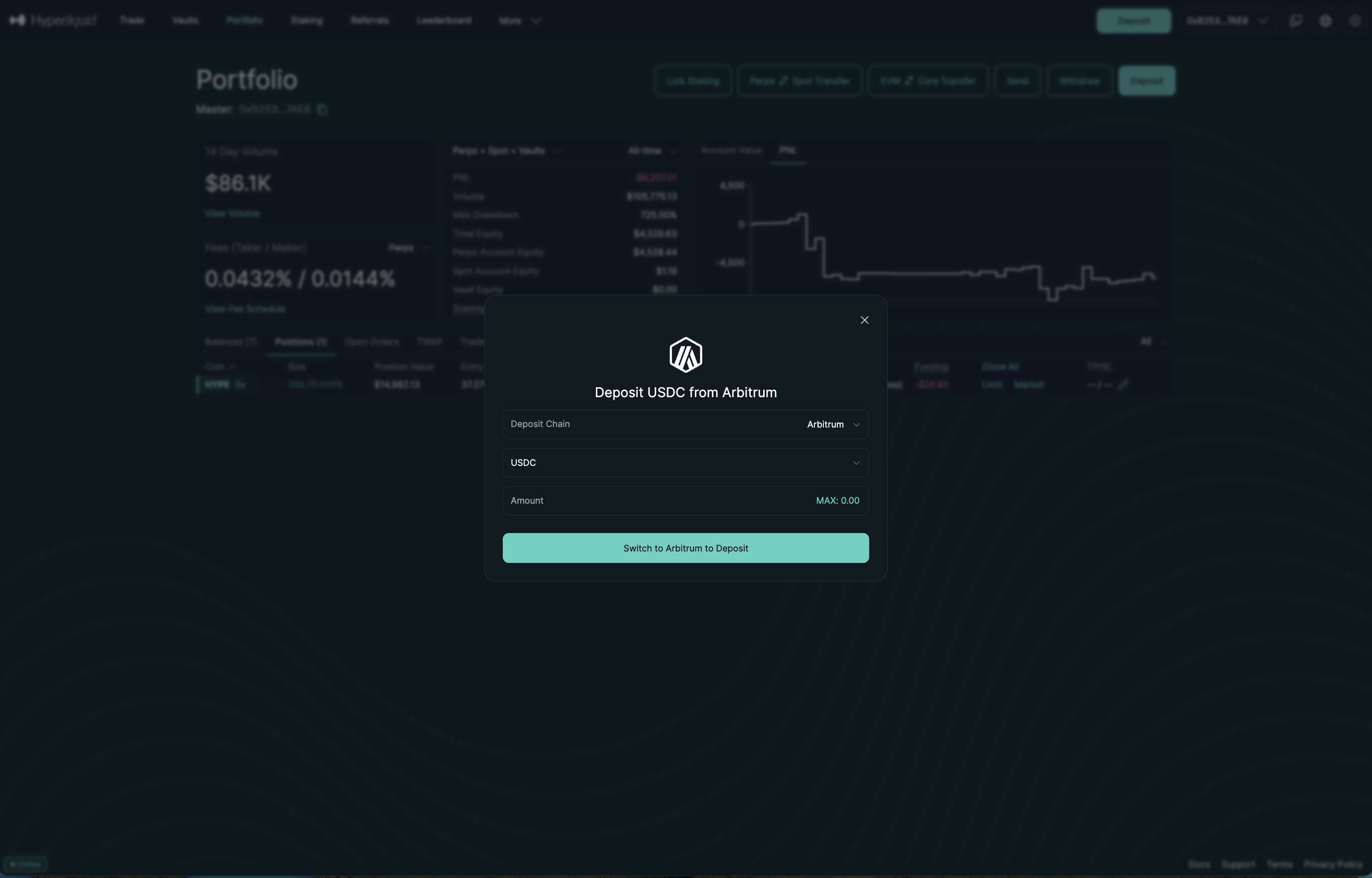

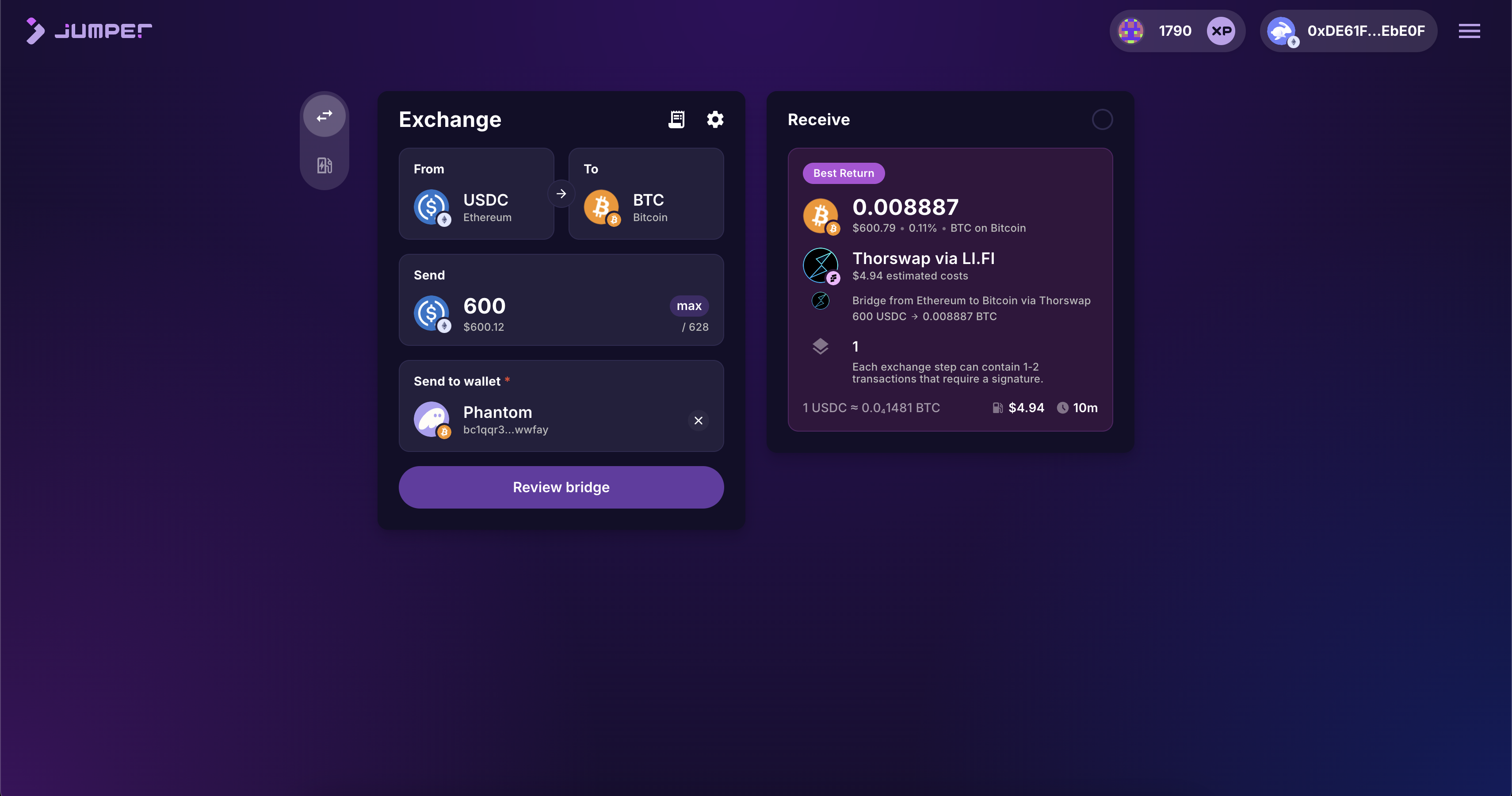

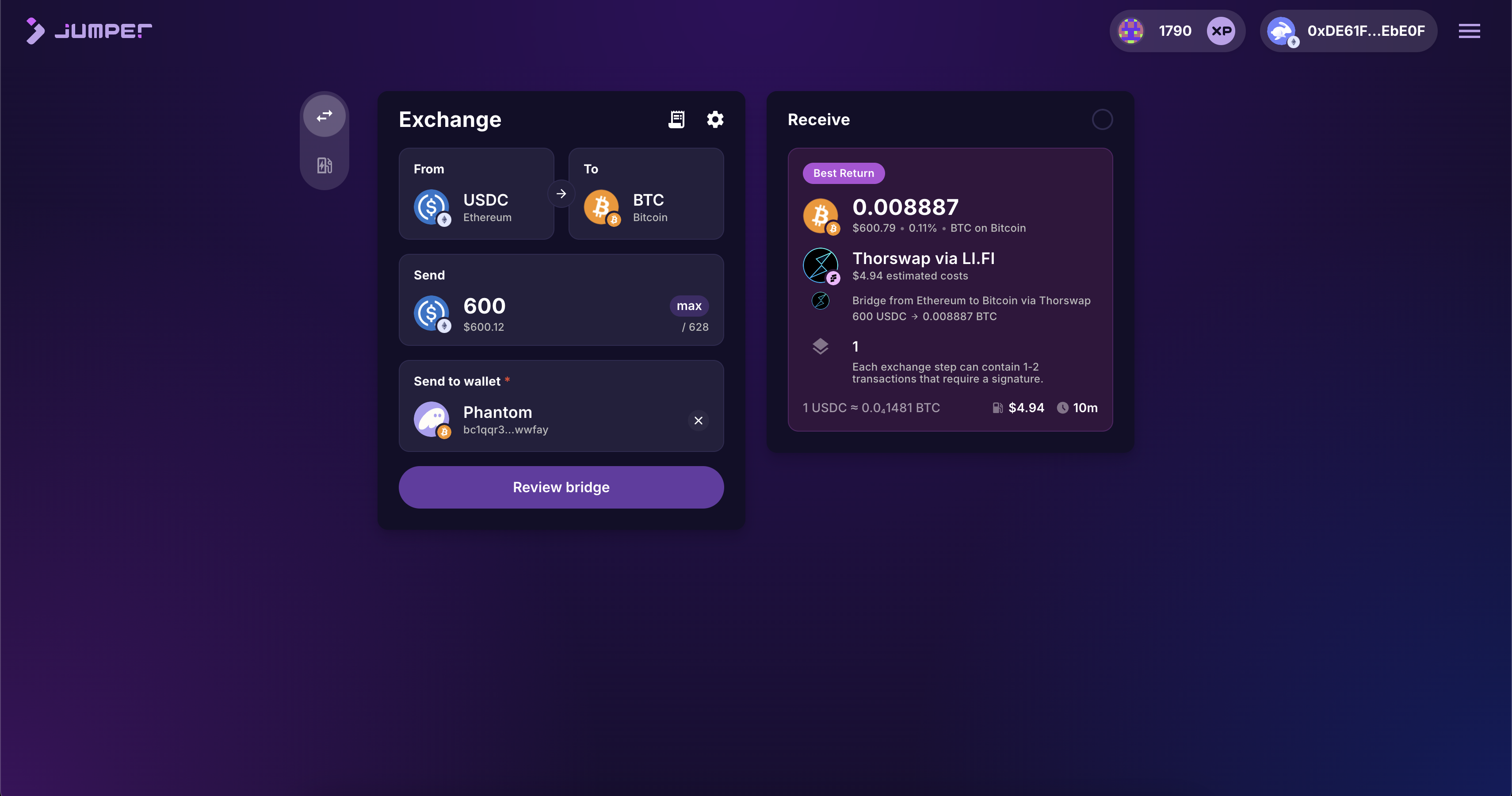

5. Pre-Fund Wallets and Use Fast Bridging Protocols to Minimize Onboarding Delays

Even the most sophisticated strategy falters if capital isn’t ready when opportunity knocks. To eliminate onboarding friction, always pre-fund your wallets with ample collateral before anticipated volatility events or major economic releases. In fast-moving markets, where Bitcoin’s price can swing thousands of dollars in minutes, waiting for a slow bridge or confirmation could mean missing the trade entirely.

Leverage fast bridging protocols like Jumper Exchange, which have been highlighted by traders for their ability to quickly move funds onto Hyperliquid and similar platforms (see Reddit discussion). By minimizing onboarding delays, you maintain continuous access to trading opportunities across multiple chains and DEXs without operational bottlenecks.

Checklist for Low-Latency Perpetual DEX Trading

-

Utilize Direct RPC Endpoints and Low-Latency Nodes for Order SubmissionConnect directly to Hyperliquid or other DEXs’ official RPC endpoints and select geographically proximate, low-latency nodes. This minimizes network hops and reduces the time to submit, modify, or cancel orders, ensuring your trades are processed as close to real-time as possible.

-

Leverage Hyperliquid’s Prioritized Order Types (Post-Only and Cancel Orders)Take advantage of Hyperliquid’s unique order book logic, where post-only and cancel orders are prioritized over GTC and IOC orders. Use these order types to improve execution speed and reduce slippage, especially during volatile market conditions.

-

Optimize Network and Hardware Setup for Real-Time ExecutionDeploy trading infrastructure on high-performance hardware with dedicated, high-speed internet connections. Consider using cloud servers located near the DEX’s primary nodes and regularly monitor latency to ensure consistently low response times.

-

Employ Automated Trading Bots with Adaptive Gas ManagementImplement trading bots capable of adjusting gas fees dynamically based on current network congestion. This ensures your transactions are prioritized for inclusion in the next block, reducing execution delays on platforms like Hyperliquid and Drift.

-

Pre-Fund Wallets and Use Fast Bridging Protocols to Minimize Onboarding DelaysMaintain sufficient balances in your trading wallets and utilize fast, reputable bridging solutions such as Jumper Exchange to quickly move assets onto your target DEX. This enables immediate participation in trading opportunities without waiting for slow cross-chain transfers.

Staying Ahead in the Fastest Decentralized Perpetual Exchange Era

The landscape of decentralized perpetual trading is more competitive than ever. Platforms like Hyperliquid-Style Perps have set a new benchmark for speed and reliability, but true edge comes from a holistic approach: combining direct node connections, prioritized order types, robust hardware setups, intelligent automation, and seamless capital mobility. Every detail counts when milliseconds mean money.

As the market continues to evolve, with Bitcoin holding firm at $113,934.00 and perpetual DEX volume climbing, professional traders who systematically implement these five strategies will be best positioned to thrive in both calm and chaotic conditions. Stay methodical, stay adaptive, and let technology work as your force multiplier in the pursuit of alpha.