Low-latency trading is the new battleground for S-tier perpetual decentralized exchanges (Perp DEXs), and two names dominate the arena: Hyperliquid and Lighter. For professional crypto traders, shaving milliseconds off execution times and accessing deep liquidity are more than technical bragging rights, they are the difference between capturing alpha and getting caught in slippage. But which platform truly delivers the best low-latency trading experience in 2025?

Hyperliquid vs Lighter: The Race for Real-Time Execution

Both Hyperliquid and Lighter have engineered their platforms from the ground up to address the latency, throughput, and transparency challenges that have historically plagued decentralized finance. Let’s break down how each stacks up on speed, architecture, and market depth.

Top S-Tier Perp DEXs for Low-Latency Pro Trading

-

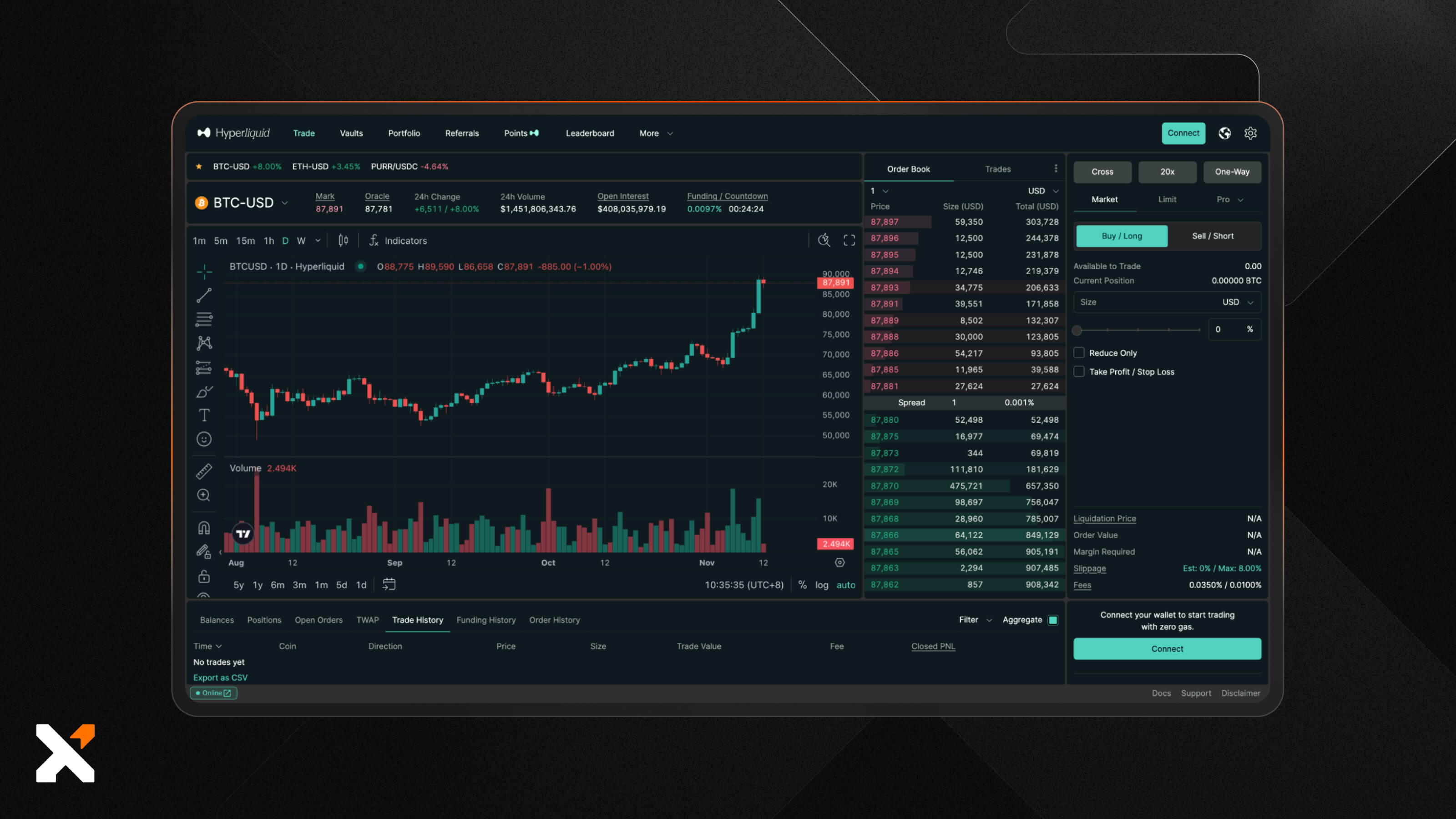

Hyperliquid: Built on a proprietary Layer 1 blockchain, Hyperliquid delivers median transaction latency of 0.2 seconds and supports up to 200,000 transactions per second. Its deep liquidity and high trading volumes make it a top choice for whales and institutional traders seeking minimal slippage, even on large orders. The fully on-chain CLOB architecture ensures a trading experience rivaling leading centralized exchanges.

-

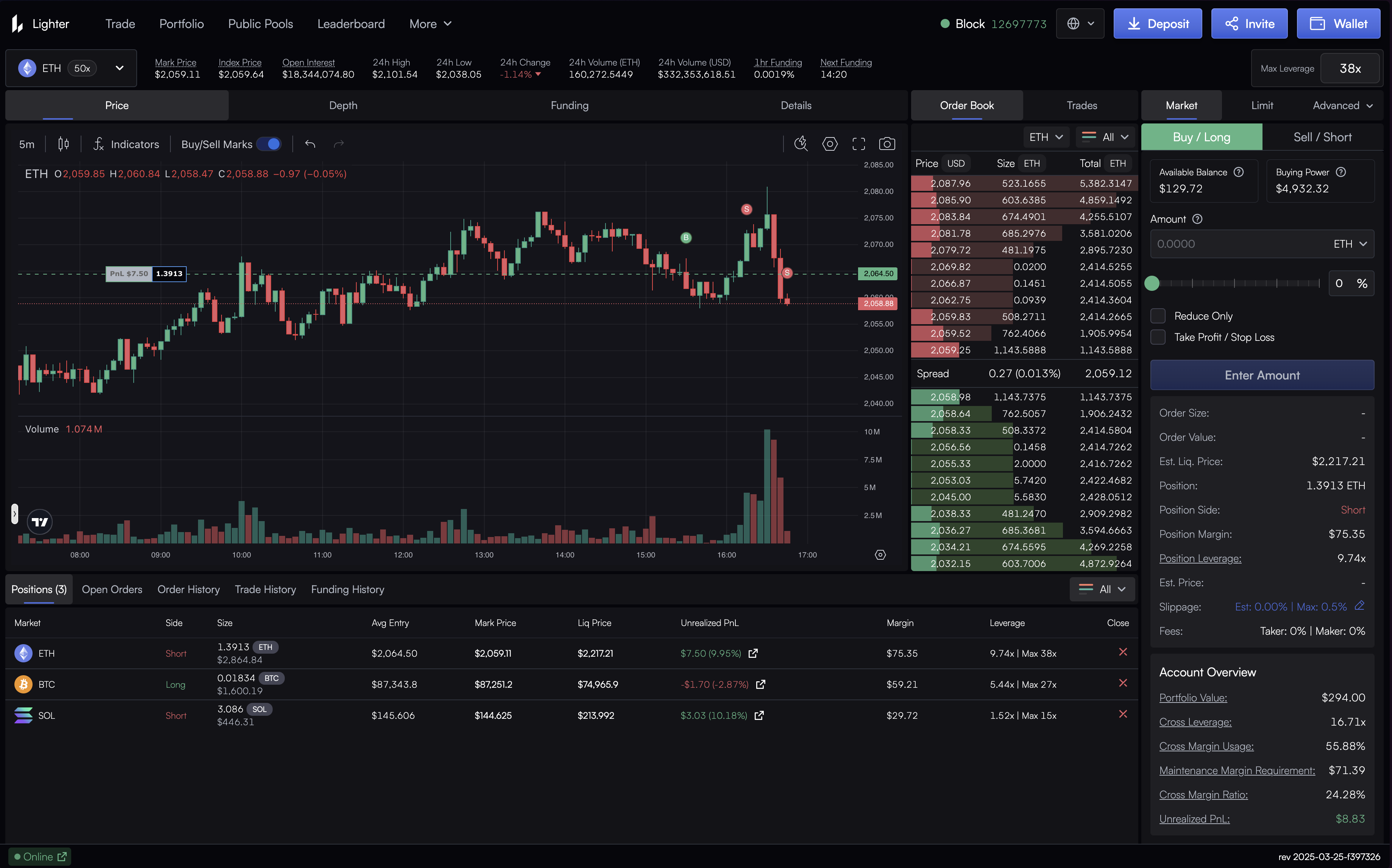

Lighter: Leveraging zk-rollup technology, Lighter achieves soft trade confirmations in 5–15 milliseconds and on-chain finality in under a second. Its matching engine operates at sub-5 millisecond speeds, with throughput between 10,000 and 50,000 orders per second. Lighter’s focus on ultra-low latency and scalable infrastructure makes it ideal for pro traders prioritizing rapid confirmations and efficient altcoin markets.

Hyperliquid operates on a custom Layer 1 blockchain with a proprietary full on-chain central limit order book (CLOB). This design isn’t just marketing hype, it translates to a median transaction latency of 0.2 seconds, with 99% of trades finalizing in less than 0.9 seconds. With throughput clocking in at up to 200,000 transactions per second, Hyperliquid provides a CEX-like experience but with full DeFi transparency. Large trades benefit from extremely low spreads and minimal slippage, an edge that has made Hyperliquid the go-to venue for whales and high-frequency trading desks.

Lighter, by contrast, leverages zk-rollup technology for its matching engine. The result? Soft confirmations hit wallets in an eye-popping 5, 15 milliseconds, while on-chain finality lands in under one second. Its matching engine operates at sub-5 millisecond speeds, handling between 10,000 and 50,000 orders per second. For traders who crave instant feedback and rapid-fire scalping across volatile pairs, Lighter’s ultra-low latency is hard to ignore, even if its overall throughput trails Hyperliquid’s by an order of magnitude.

Diving Into Liquidity: Depth Matters More Than Ever

No matter how fast your trade executes, it means little without deep liquidity behind it. Here’s where the differences become stark:

- Hyperliquid: Leads all Perp DEXs with deep liquidity pools across both major coins (BTC, ETH) and altcoins. Large block trades encounter minimal slippage, making it ideal for whales moving significant size.

- Lighter: While competitive on majors like BTC/ETH, its altcoin liquidity is still catching up provides “good enough” but not yet at Hyperliquid’s level according to top DeFi analysts (source). That said, for small- to mid-sized trades under $6M (BTC), Lighter offers surprisingly robust depth thanks to its efficient rollup design.

User Experience and Trader Workflow: Where Every Millisecond Counts

The best S-tier perp DEX isn’t just about raw numbers, it’s about how those numbers translate into real-world trading workflow. Both platforms have invested heavily in UI/UX:

- Hyperliquid: Intuitive interface designed for speed; pro tools like advanced charting, API access for bots/algos; supports both spot and perp contracts.

- Lighter: Sleek UI focused on rapid trade entry; soft confirmations provide instant feedback; strong mobile support; emerging integrations with third-party analytics tools.

The bottom line? If you’re running latency-sensitive strategies or executing large block orders where every microsecond matters, both platforms deliver, but their strengths cater to slightly different trader profiles.

When the rubber meets the road, Hyperliquid and Lighter each bring distinct advantages to the low-latency trading table. Let’s break down the key differentiators that matter most for professional crypto traders pushing the limits of decentralized execution.

Advanced Features: What Sets Each Platform Apart?

Hyperliquid doesn’t just win on raw throughput. Its advanced risk engine, granular order types (including post-only and reduce-only), and full transparency of its on-chain order book make it a powerhouse for high-frequency strategies. The platform’s ability to handle 200,000 transactions per second is more than a technical flex, it means even during peak volatility, order flow remains smooth and fills are consistent. For algo traders and institutional desks, this reliability is non-negotiable.

Lighter, meanwhile, is laser-focused on user experience for rapid scalping and quick pivots across pairs. The sub-5 millisecond matching engine delivers near-instant soft confirmations, traders see feedback almost as quickly as they would on a top-tier CEX. Lighter’s zk-rollup architecture also means lower gas costs per trade, making it attractive for active retail participants and those running automated grid or market-making bots at scale.

Hyperliquid vs. Lighter: Key Trading Metrics Comparison

| DEX | Trading Fees | Latency ⚡️ | Liquidity Depth 💧 |

|---|---|---|---|

| Hyperliquid | Very Low (~0.01% taker) | 0.2s median (99% < 0.9s) | Deepest on majors & altcoins |

| Lighter | Low (~0.02% taker) | 5–15ms soft confirm (<1s final) | Strong on majors, less deep on alts |

The platforms’ fee structures reflect their target audiences: Hyperliquid tends toward competitive maker-taker models optimized for high-volume players; Lighter often features dynamic fee rebates to attract retail flow and incentivize liquidity provision across emerging altcoin pairs.

Security and Transparency: Trustless Execution in DeFi

No discussion of best S-tier perp DEXs is complete without addressing security. Hyperliquid’s fully on-chain CLOB ensures all activity is auditable in real time, there’s no opaque matching or hidden reordering of trades. Lighter leverages zk-proofs to guarantee trade integrity while keeping costs low; every batch processed by its rollup can be independently verified by any participant.

This commitment to transparency isn’t just academic. During recent periods of extreme market volatility (see BTC above $100,000), both platforms maintained orderly books and fast settlement while several competitors lagged or even halted trading, a testament to robust engineering under fire.

Bitcoin Technical Analysis Chart

Analysis by Marcus Fletcher | Symbol: BINANCE:BTCUSDT | Interval: 1h | Drawings: 4

Technical Analysis Summary

Start with a bold downtrend line from the peak on September 25, 2025, near $113,900, down to the base at $109,000 on September 26, 2025. Mark the tight consolidation zone between $108,900 and $109,800 from late September 26 through the 28th. Highlight support at $108,900 and resistance at $110,000. Draw a rectangle to indicate the sideways accumulation just below $110,000. Use horizontal lines for key levels and a trend line for the major bearish move. Add callouts for the possible breakout setup as price coils tighter. For aggressive trading, suggest potential breakout entries above $110,000 and breakdowns below $108,900 with tight stops.

Risk Assessment: high

Analysis: Price is compressed after an aggressive downtrend, setting up for a volatility expansion. The tight range is likely to break soon, but direction is uncertain until triggered.

Marcus Fletcher’s Recommendation: Take aggressive breakout trades with tight stops and leverage up on confirmation. Avoid overcommitting before breakout direction is clear—wait for volume confirmation.

Key Support & Resistance Levels

📈 Support Levels:

-

$108,900 – Recent consolidation lows; previous reaction zone.

strong

📉 Resistance Levels:

-

$110,000 – Psychological and price cluster resistance—top of current range.

moderate

Trading Zones (high risk tolerance)

🎯 Entry Zones:

-

$110,050 – Aggressive breakout entry above resistance, targeting volatility expansion.

high risk -

$108,880 – Breakdown entry below strong support for possible trend continuation.

high risk

🚪 Exit Zones:

-

$110,800 – First profit target after breakout above $110,000.

💰 profit target -

$108,700 – First profit target after breakdown below $108,900.

💰 profit target -

$109,400 – Tight stop loss for breakout long to manage aggressive risk.

🛡️ stop loss -

$109,200 – Tight stop loss for breakdown short.

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Volume is compressed during the current sideways range, suggesting accumulation and primed for expansion on breakout.

Watch for a clear volume surge to confirm breakout direction.

📈 MACD Analysis:

Signal: Likely flattening, as price consolidates after a strong downtrend. Watch for MACD cross on the hourly as a trigger.

MACD cross up from oversold could front-run a bullish breakout; cross down confirms trend continuation.

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Marcus Fletcher is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (high).

Which Perp DEX Wins? Tailoring Your Choice to Your Strategy

The verdict? There’s no one-size-fits-all answer in the Hyperliquid vs Lighter debate, each platform shines based on your trading style:

- If you’re a whale or institutional desk: Hyperliquid’s unmatched throughput, deep liquidity across majors/altcoins, and full transparency make it the clear favorite for block trades and latency-sensitive algorithms.

- If you’re a speed-obsessed scalper or active retail trader: Lighter’s ultra-fast soft confirmations, low gas costs, and mobile-first UX offer an edge when milliseconds mean money, especially for small- to mid-size positions.

The best S-tier perp DEX for low-latency trading isn’t about picking a winner, it’s about matching your execution needs with the right architecture. In 2025’s DeFi landscape, both Hyperliquid and Lighter are setting new standards, and forcing every other platform to play catch-up.

Which S-tier Perp DEX do you prefer for low-latency trading?

Both Hyperliquid and Lighter are leading perpetual DEXs offering lightning-fast trading speeds and deep liquidity. As a pro trader, which platform gives you the best low-latency trading experience?