The landscape of decentralized perpetual exchanges (Perp DEXs) in 2025 is defined by breakneck innovation, surging volumes, and a clear shift in trader preferences toward platforms that combine speed, transparency, and user-centric features. With over $1.5 trillion in aggregate trading volume processed by leading platforms this year, the competition among top Perp DEXs provides Hyperliquid, dYdX, GMX, Aster, and Apex: has never been fiercer. For professional traders and DeFi enthusiasts alike, understanding the nuances between these exchanges is critical to maximizing capital efficiency and risk-adjusted returns.

Dominance and Differentiation: Hyperliquid’s Market Leadership

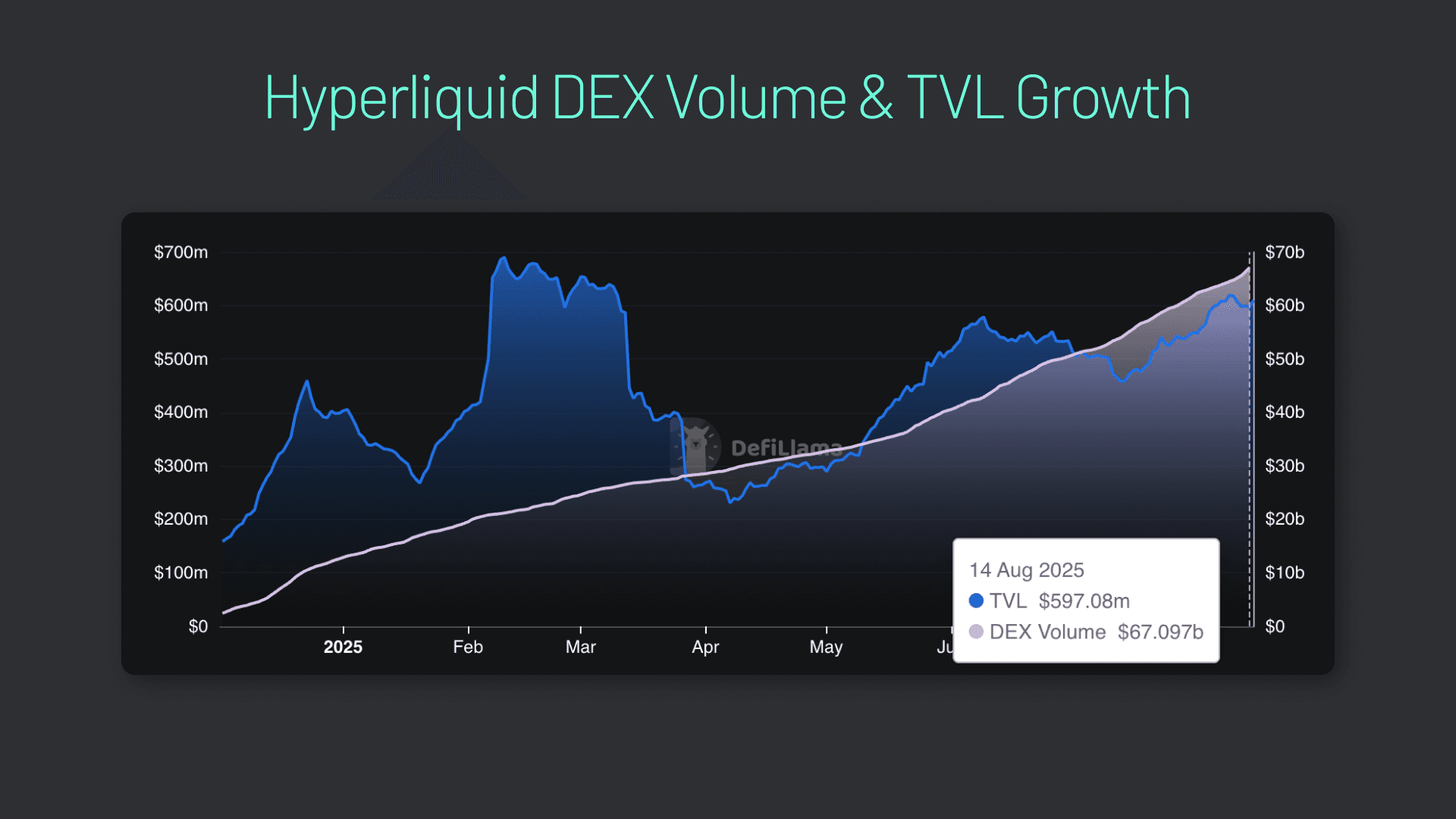

Hyperliquid has rapidly emerged as the undisputed market leader among perpetual contract trading platforms in 2025. As of September 24th, it commands approximately 80% market share, with a staggering monthly trading volume of $319 billion. This dominance is underpinned by its custom Layer-1 blockchain utilizing HyperBFT consensus, a design that enables sub-second trade execution and deep on-chain liquidity rivaling centralized venues.

Traders benefit from access to 150 and assets, up to 50x leverage, and an innovative HLP vault for passive yield generation. Importantly, Hyperliquid’s on-chain order book delivers ultra-low latency without sacrificing transparency or security, an achievement that has set a new benchmark for decentralized derivatives exchanges.

dYdX and GMX: Legacy Platforms Evolve Amidst New Competition

dYdX, once synonymous with decentralized perpetuals, has seen its market share retreat to around 7%. Still, it remains a formidable player with over $1.49 trillion cumulative volume, powered by its Cosmos SDK-based chain. dYdX offers more than 200 markets, up to 50x leverage, advanced order types, and robust community governance, a combination that appeals to experienced traders who value decentralization as a core principle.

GMX, operating across Arbitrum, Avalanche, and now Solana, processes approximately $250 million in daily volume. Its GLP liquidity pool model allows providers to earn a share of protocol fees while Chainlink oracles ensure fair pricing. Although supporting fewer contracts (21 and ) than its peers, GMX’s fee-sharing structure and focus on security continue to attract both retail traders and liquidity providers seeking stable yield opportunities.

Aster and Apex: New Entrants Reshape the Competitive Landscape

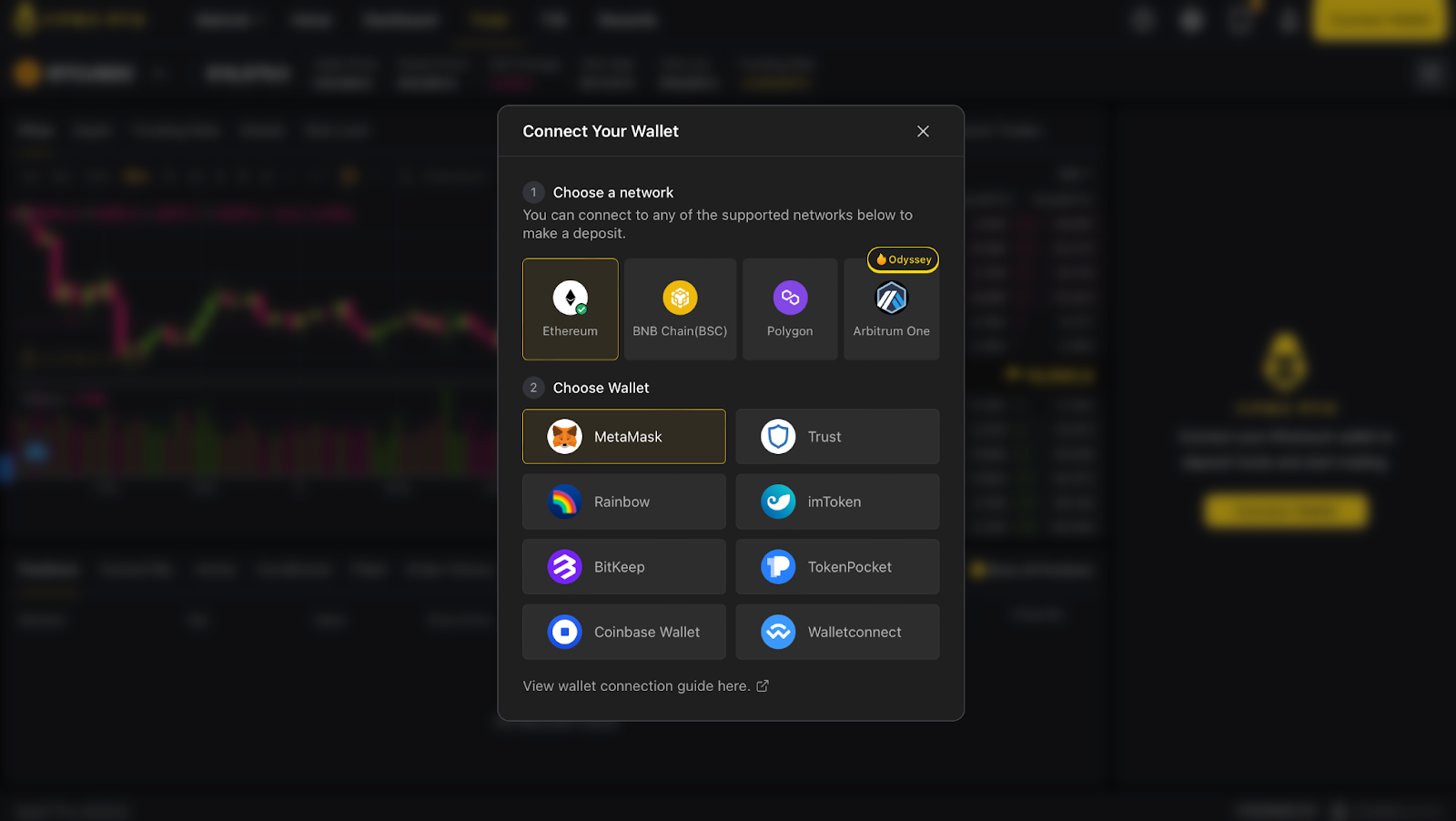

The competitive dynamics shifted again in late 2025 with the rapid ascent of Aster. Launched just weeks ago yet already boasting over $1 billion TVL and $1.5 billion in day-one volume, Aster leverages a multi-chain approach spanning BNB Chain, Ethereum, Solana, and Arbitrum. Its unique features, such as hidden orders for strategic execution and dual-margin systems, are designed for sophisticated traders seeking both privacy and flexibility.

Aster’s value accrual mechanisms include protocol revenue buybacks and aggressive community incentives via airdrops, a strategy aimed at accelerating adoption while capturing long-term loyalty from power users. For an in-depth comparison of hidden orders across Aster versus established players like Hyperliquid or GMX, this analysis provides granular detail on execution models.

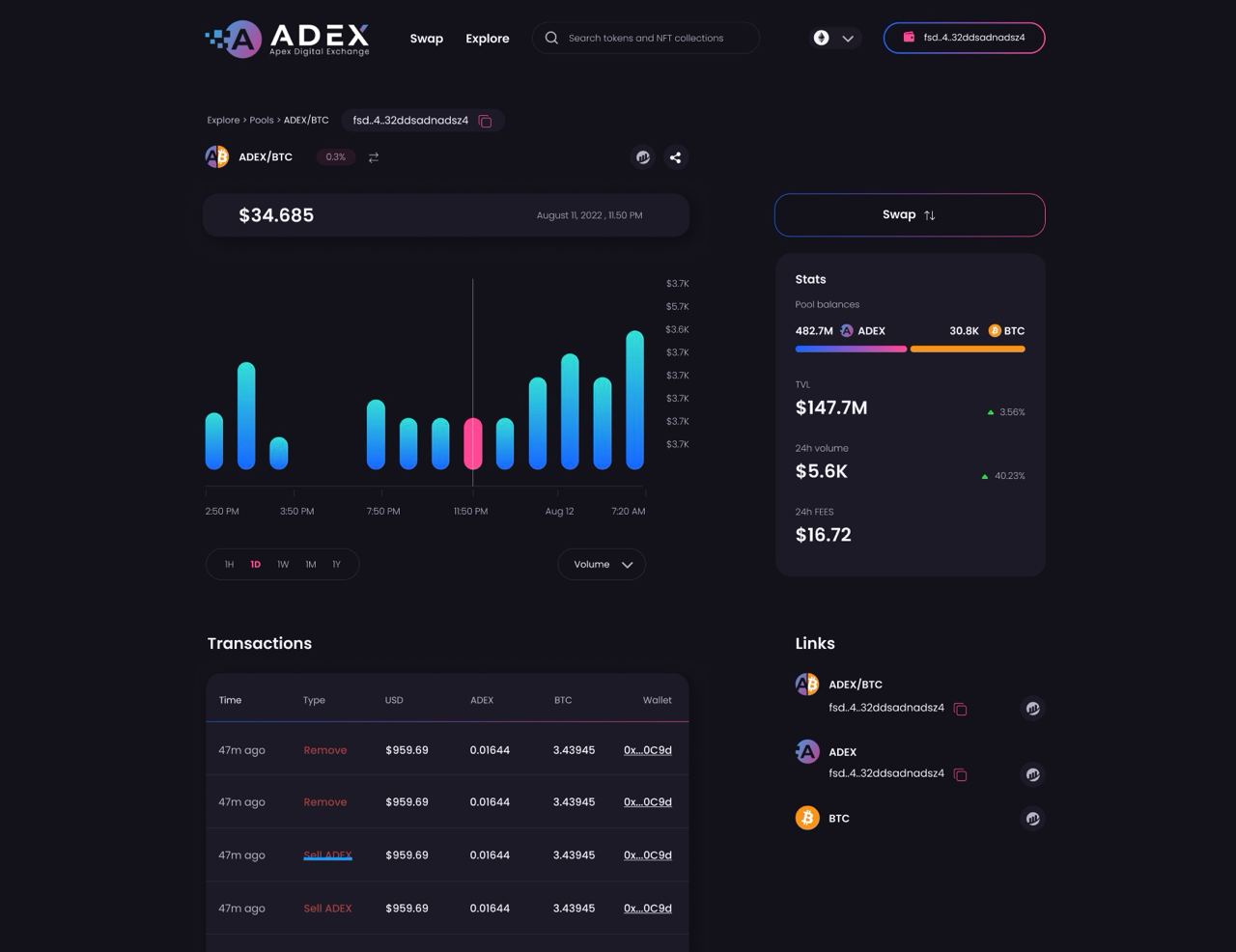

Apex, while less dominant by raw volume compared to Hyperliquid or Jupiter (the latter contributing 15% of all Perp DEX activity), remains highly relevant among professional traders thanks to advanced copy trading tools and integration with leading DeFi protocols. Its reputation for reliability positions it as a preferred alternative when platform diversification is required for risk management.

Key Advantages of Leading Perpetual DEXs in 2025

-

Hyperliquid: Market leader with approximately 80% market share and over $319 billion in monthly trading volume (July 2025). Built on a custom Layer-1 with HyperBFT consensus, it delivers sub-second trade execution, supports 150+ trading pairs with up to 50x leverage, and offers deep on-chain liquidity rivaling centralized exchanges. The HLP vault provides passive yields for liquidity providers.

-

dYdX: A mature, established platform with $1.49 trillion in cumulative trading volume and around $1 billion in daily trades. Built on Cosmos SDK, dYdX features over 200 markets, up to 50x leverage, advanced order types, and robust community governance. It remains a trusted choice for professional traders.

-

GMX: Known for its fee-sharing model via the GLP liquidity pool, GMX operates on Arbitrum, Avalanche, and now Solana. It processes around $250 million in daily volume, supports 21+ perpetual contracts, and leverages Chainlink oracles for accurate pricing. Its low-fee structure and reliable execution attract both liquidity providers and active traders.

-

Aster: A rapidly emerging multi-chain DEX launched in September 2025, Aster achieved $1.005 billion TVL and $1.5 billion in volume within 24 hours. It offers up to 100x leverage, operates across BNB Chain, Ethereum, Solana, and Arbitrum, and features hidden orders, dual-margin systems, and innovative value capture with buybacks and community airdrops.

-

Apex: Recognized for its user-friendly interface and advanced trading features, Apex supports a wide range of perpetual contracts with competitive fees. It emphasizes high-speed execution and robust security, making it a popular choice among both retail and institutional DeFi traders.

Comparative Metrics at a Glance: Volume, Leverage and Unique Features

| Platform | Market Share | Daily Volume | Leverage | Main Chains Supported | Differentiators 🚀 |

|---|---|---|---|---|---|

| Hyperliquid | ~80% | $10B and | Up to 50x | Custom Layer-1 | BFT consensus, sub-second trades, on-chain order book |

| Aster | Emerging | $3.67B | Up to 100x | BNB, Ethereum, Solana, Arbitrum |

Hidden orders, dual-margin, multi-chain support |

| dYdX | ~7% | $1B | Up to 50x | Cosmos SDK | Mature governance, advanced orders, 200 and markets |

| GMX | – | $250M | Up to 50x | Avalanche, Arbitrum, Solana |

Pooled liquidity (GLP), fee sharing, oracle pricing |

| Apex | – | – | – | < td >Multi-chain

This perpetual DEX comparison highlights not only the sheer scale but also the diversity of approaches shaping today’s decentralized derivatives markets. In the second half of this guide we’ll dive deeper into fee structures, risk management tools, user experience innovations, and what sets each platform apart for different trader profiles.

Fee Structures, Risk Controls, and User Experience: Where the Top Perp DEXs Stand Out

For active traders, fee efficiency remains a decisive factor. Hyperliquid leads with the lowest costs in the sector provides 0.01% maker and 0.035% taker fees: significantly undercutting both dYdX and GMX. Over time, this fee advantage compounds for high-frequency and institutional users. dYdX’s fee model is tiered by trading volume and DYDX token holdings, offering competitive rates for power users but less so for retail participants. GMX’s structure is unique: liquidity providers share in protocol revenue, while traders pay a flat fee per trade. Aster’s model is still evolving but currently features aggressive rebates and buybacks funded by protocol revenue to catalyze growth; Apex positions itself with moderate fees but focuses on value-added services like advanced copy trading.

Risk management tools are another differentiator. Hyperliquid offers granular position controls, customizable stop-loss/take-profit triggers, and real-time liquidation engines, features that appeal to sophisticated traders managing large exposures. dYdX stands out for its community-driven risk parameters and insurance fund protections, while GMX leverages Chainlink oracles to minimize price manipulation risk on its GLP pool. Aster’s dual-margin system (cross and isolated) gives users flexibility in managing margin requirements across volatile assets; this innovation is particularly attractive for those trading on multiple chains simultaneously.

User Experience Innovations: Speed Versus Flexibility

User experience (UX) continues to evolve rapidly across these platforms. Hyperliquid’s custom Layer-1 delivers near-instant order matching without sacrificing transparency or composability, a key reason for its outsized market share among professional traders who cannot tolerate latency or downtime. dYdX invests heavily in a clean interface with advanced order types (including trailing stops), but onboarding can be complex due to Cosmos wallet integrations.

Aster’s multi-chain UX is fluid, allowing seamless asset bridging between supported networks, a major benefit for DeFi-native users seeking cross-chain arbitrage opportunities. GMX prioritizes simplicity: its swap-like interface lowers the barrier to entry for newcomers, while Apex distinguishes itself through social trading features and robust analytics dashboards that help users replicate winning strategies from top performers.

Which Perpetual DEX Is Best For You?

The optimal choice depends on your priorities:

Best Perpetual DEXs for Different Trader Profiles (2025)

-

Hyperliquid: Ideal for high-frequency and professional traders. With approximately 80% market share and over $10 billion daily volume, Hyperliquid offers sub-second execution, an on-chain order book rivaling centralized exchanges, and supports 150+ trading pairs with up to 50x leverage. Its custom Layer-1 blockchain and lowest fee structure (0.01% maker, 0.035% taker) make it the go-to choice for traders seeking speed, liquidity, and efficiency.

-

dYdX: Best for DeFi natives and governance-focused users. Built on the Cosmos SDK, dYdX remains a mature and trusted platform with over 200 markets and up to 50x leverage. It processes around $1 billion in daily volume and emphasizes community governance and advanced order types, appealing to experienced DeFi participants seeking robust features and decentralization.

-

GMX: Preferred by risk-averse investors and liquidity providers. Operating on Arbitrum, Avalanche, and Solana, GMX features a GLP liquidity pool that shares fee revenue and uses Chainlink oracles for reliable pricing. With $250 million daily volume and up to 50x leverage, GMX is a top choice for those prioritizing transparency, passive income, and stable trading conditions.

-

Aster: Excellent for multi-chain and copy traders seeking innovation. Launched in September 2025, Aster rapidly achieved $1.005 billion TVL and $3.67 billion daily volume. Its multi-chain support (BNB, Ethereum, Solana, Arbitrum), hidden orders, and dual-margin systems cater to advanced strategies and social trading, while protocol revenue buybacks and airdrops incentivize community engagement.

-

Apex: Best for copy traders and social trading enthusiasts. Apex offers a user-friendly interface with integrated copy trading and portfolio management tools, making it popular among traders who wish to follow top strategies. Its focus on community-driven features and low-latency execution positions it as a leading platform for collaborative and automated trading in 2025.

If you demand speed, deep liquidity, and the lowest possible fees at scale, Hyperliquid sets the standard in 2025. For those who value decentralization, mature governance systems, or access to niche markets beyond majors, dYdX remains compelling despite declining market share. GMX‘s model attracts yield-focused liquidity providers as well as retail traders seeking transparent pricing mechanisms.

Aster‘s rapid ascent proves there’s appetite for innovation around cross-chain execution and privacy-centric order types, a dynamic worth monitoring closely as it matures (further analysis here). Meanwhile, Apex‘s focus on social trading tools makes it a natural fit for those looking to leverage collective intelligence or diversify platform risk as part of a broader portfolio strategy.

Looking Ahead: The Future of Decentralized Perpetual Trading

The perpetual DEX market will continue to be shaped by fierce competition between incumbents like Hyperliquid and dYdX versus agile upstarts such as Aster and Apex. As more capital migrates from centralized venues into DeFi protocols offering transparent execution and self-custody controls, expect further innovations in cross-chain settlement speed, capital efficiency mechanisms (such as unified margin), and user-driven governance models.

The next wave of growth will likely hinge on platforms’ ability to balance low-latency execution with robust risk controls, and deliver an intuitive user experience that accommodates both institutional needs and retail accessibility.