In the rapidly evolving world of decentralized finance, speed and reliability are not just luxuries – they are essential for traders seeking to capitalize on volatile markets. Ultra-low latency DEX platforms like Hyperliquid-Style Perps have emerged as game-changers, delivering a trading experience that rivals, and in some aspects surpasses, even the fastest centralized exchanges. But how exactly does Hyperliquid-Style Perps achieve such remarkable performance while maintaining the security and transparency inherent to DeFi?

The Foundation: Custom Layer-1 Blockchain with HyperBFT Consensus

At the heart of Hyperliquid-Style Perps’ technological edge is its proprietary Layer-1 blockchain. Unlike most DEXs that operate on generalized blockchains like Ethereum, Hyperliquid’s infrastructure is purpose-built for high-frequency, low-latency crypto trading. The HyperBFT consensus mechanism enables block times under one second, supporting sub-second finality for every transaction. This allows traders to execute perpetual contracts with near-instant confirmation – a critical advantage when milliseconds can mean the difference between profit and loss.

This architectural decision isn’t just about speed; it’s about reliability at scale. By controlling its own Layer-1 environment, Hyperliquid eliminates congestion issues common on shared networks, ensuring consistent performance even during periods of intense market activity.

Fully On-Chain Order Book: Transparency Without Compromise

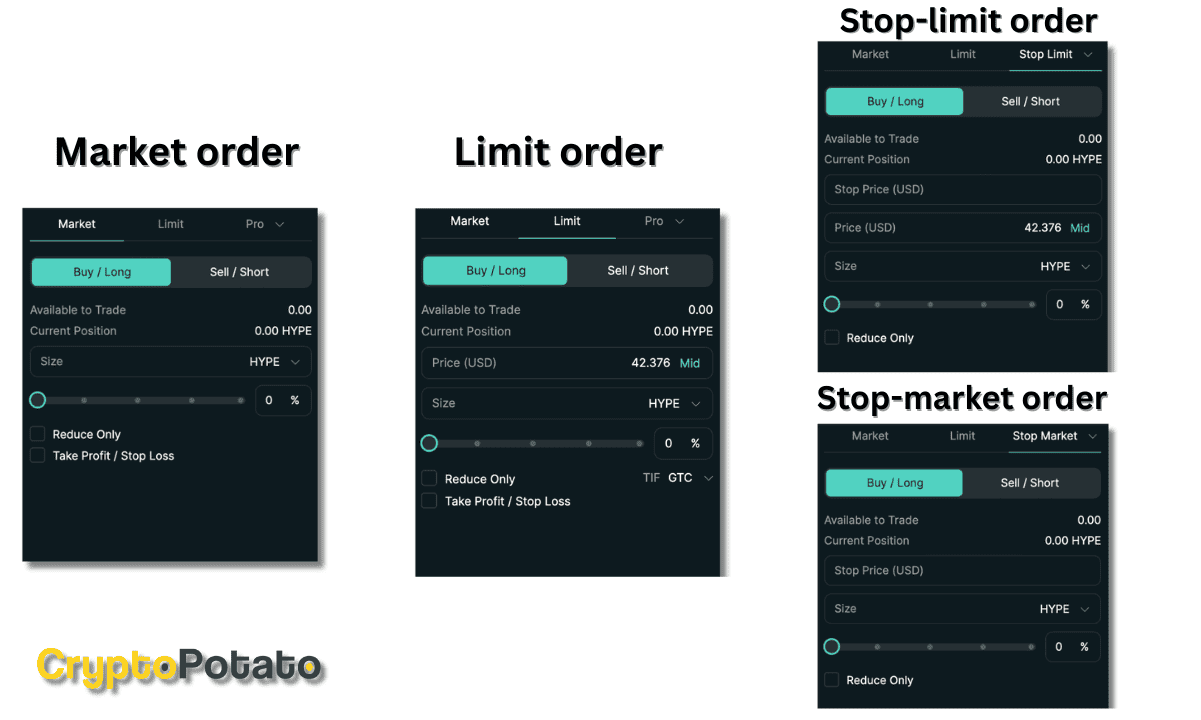

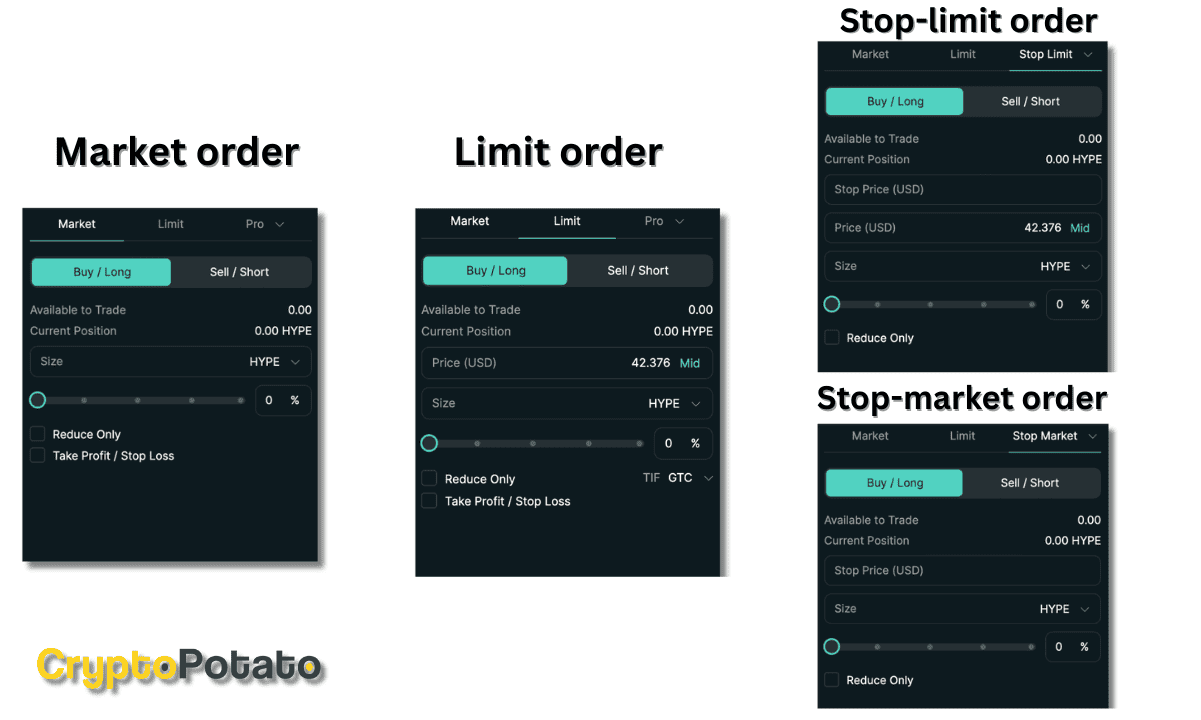

Transparency is often touted as a hallmark of DeFi, but many exchanges still rely on off-chain order matching or hybrid models that introduce latency and opacity. Hyperliquid distinguishes itself with a fully on-chain order book, allowing every order type – from market to stop-loss – to be executed directly on-chain with full auditability.

This approach not only enhances trust but also supports advanced trading strategies that demand precise control over execution. The result? Minimal spreads and negligible slippage, even for large trades on major assets – a feat previously thought possible only on centralized platforms.

Pushing Performance: High Throughput and Gasless Trading

The numbers behind Hyperliquid’s performance are striking: up to 100,000 transactions per second processed at latencies as low as 0.2 seconds. This places it squarely in competition with leading centralized exchanges while retaining all the advantages of decentralization.

Key Technologies Enabling Ultra-Low Latency on Hyperliquid

-

Custom Layer-1 Blockchain with HyperBFT Consensus: Hyperliquid operates on its own proprietary Layer-1 blockchain, utilizing the HyperBFT consensus mechanism for sub-second finality and block times under one second. This design enables rapid transaction settlement and supports high-frequency trading.

-

Fully On-Chain Order Book: Unlike many DEXs that use off-chain order matching, Hyperliquid maintains a fully on-chain order book. This ensures transparency, supports advanced order types, and enables precise, real-time trade execution.

-

High Throughput and Low Latency Infrastructure: The platform is engineered to process up to 100,000 transactions per second with median trading latencies as low as 0.2 seconds, delivering performance comparable to leading centralized exchanges.

-

Gasless Trading and Minimal Fees: Hyperliquid offers gasless trading for orders and very low withdrawal fees, reducing transaction costs and eliminating friction for active traders.

Moreover, gasless trading for orders removes one of DeFi’s biggest pain points by eliminating unpredictable transaction fees during order placement. Traders can focus purely on their strategies without worrying about gas spikes or failed transactions due to network congestion.

A New Standard for Real-Time DeFi Trading

The innovations underpinning Hyperliquid-Style Perps have set a new benchmark for what decentralized perpetual contracts can achieve. By marrying proprietary blockchain technology with an uncompromising commitment to transparency and user experience, Hyperliquid is not just closing the gap with centralized exchanges – it is redefining what’s possible in real-time DeFi trading.

For professional traders and crypto enthusiasts alike, these advancements translate into a tangible edge. The ability to execute complex strategies, hedge risk, and manage positions with sub-second precision is no longer the sole preserve of centralized venues. On Hyperliquid-Style Perps, the playing field is leveled – and in many respects, the experience surpasses what traditional platforms can offer.

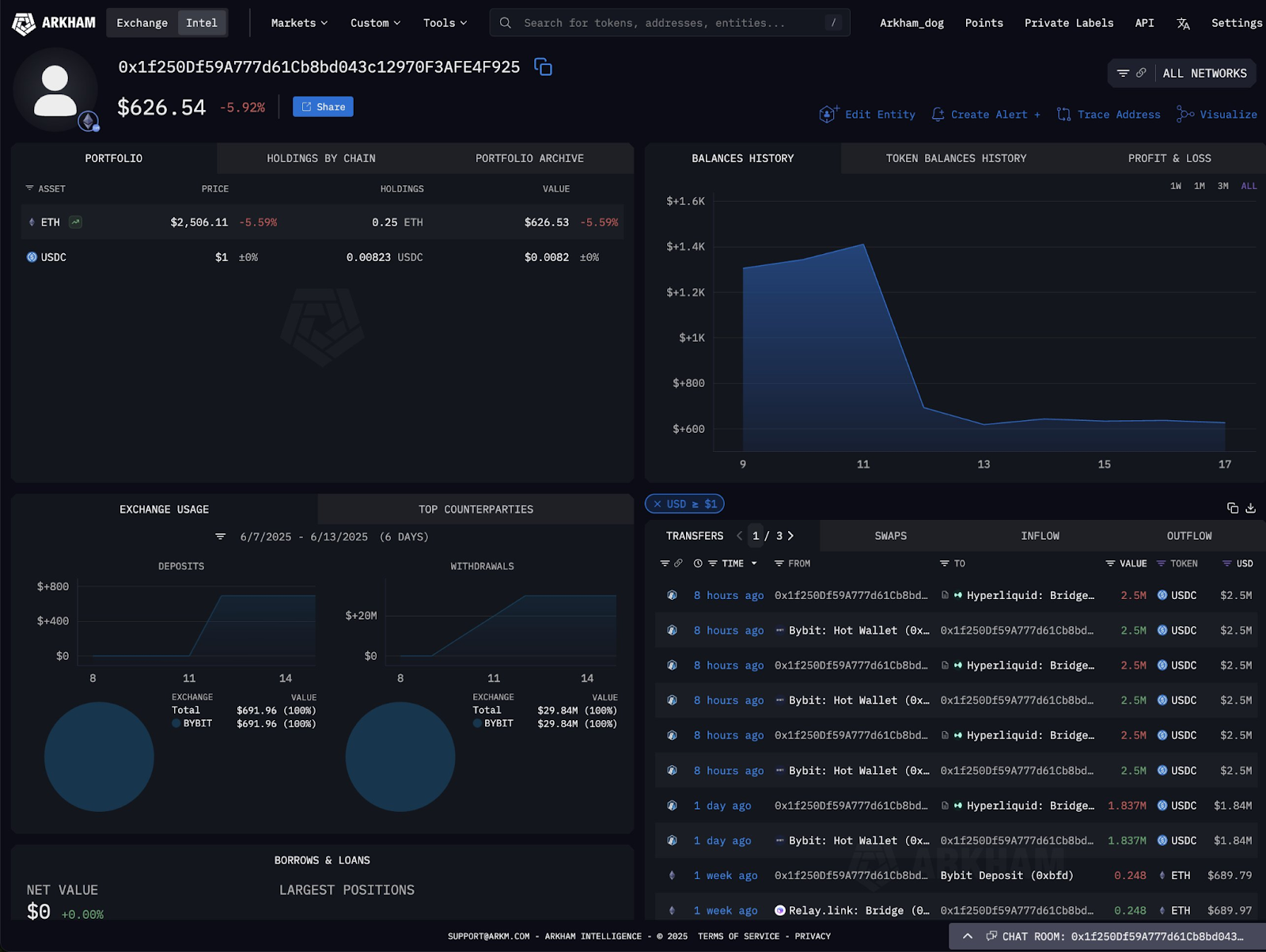

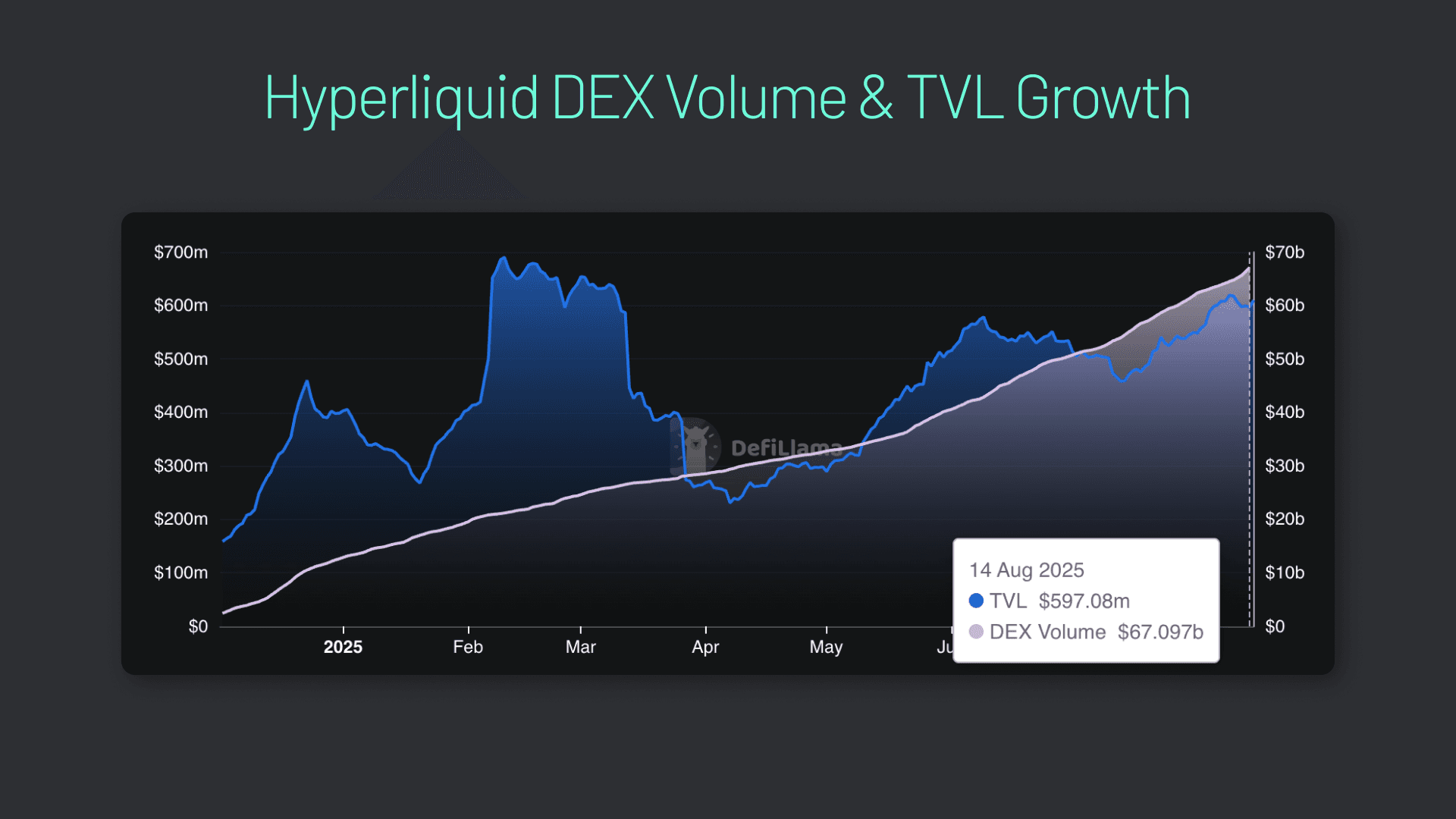

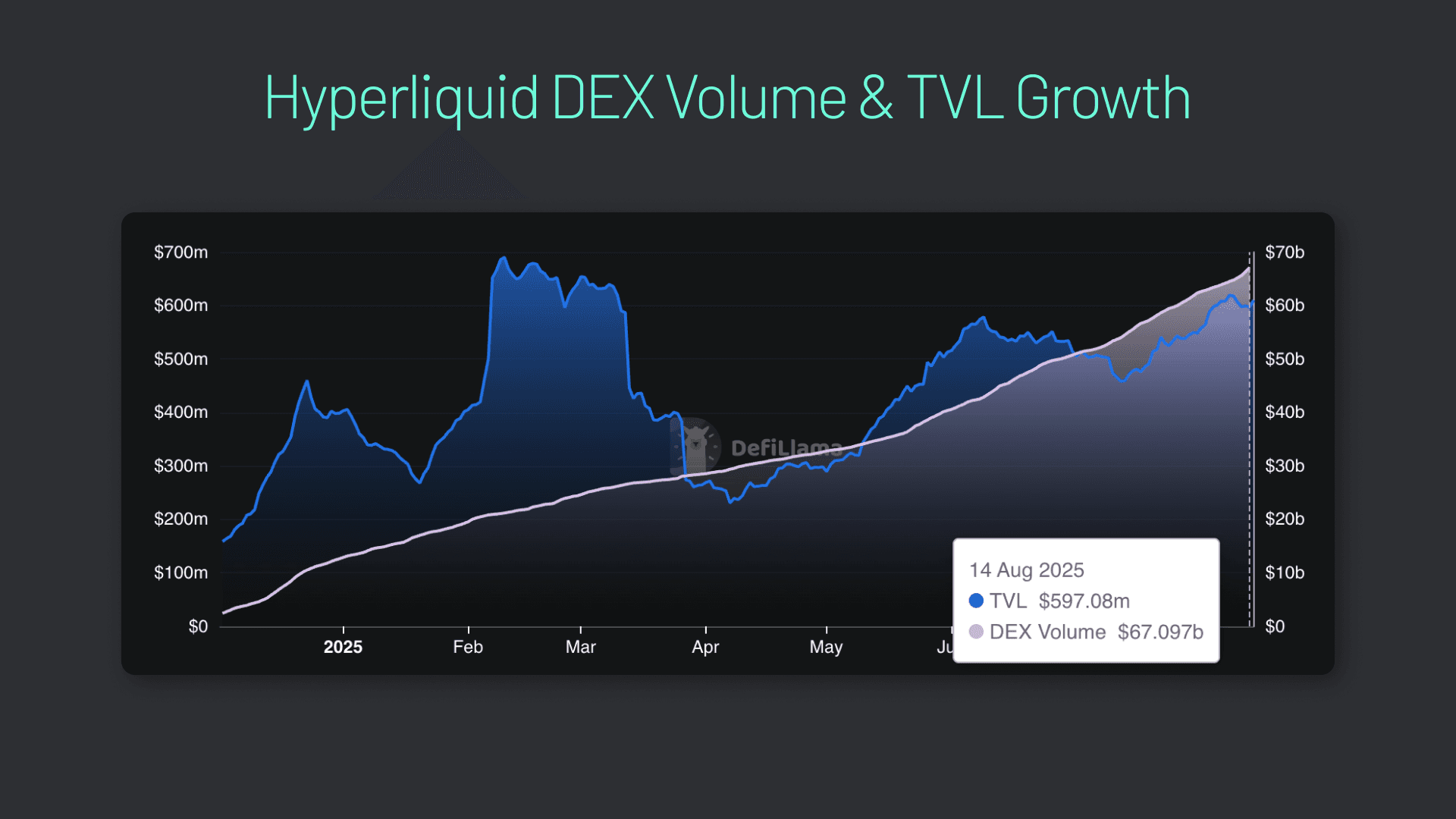

Community feedback underscores this transformation. Traders report consistently low spreads and slippage, even when executing high-volume trades on mainstream coins. This reliability has helped Hyperliquid capture a dominant share of the decentralized perpetual market, now commanding an estimated 80% market share according to recent data. Such traction is a testament to both the technical achievements of the platform and its resonance with users seeking speed without compromise.

What Sets Hyperliquid-Style Perps Apart?

While other platforms have made strides in reducing latency and improving user experience, few offer the holistic blend of features found on Hyperliquid:

Key Differentiators of Hyperliquid-Style Perps vs. Other DEXs

-

Custom Layer-1 Blockchain with HyperBFT Consensus: Hyperliquid operates on its own proprietary Layer-1 blockchain, leveraging the HyperBFT consensus mechanism for sub-second finality and block times under one second. This tailored infrastructure is purpose-built for high-frequency trading, enabling rapid and secure transaction processing unmatched by most DEXs.

-

Fully On-Chain Order Book: Unlike many decentralized exchanges that use off-chain or hybrid order books, Hyperliquid maintains a fully on-chain order book. This ensures full transparency, supports advanced order types, and allows precise trade execution directly on the blockchain.

-

High Throughput and Ultra-Low Latency: Hyperliquid’s infrastructure can process up to 100,000 transactions per second with median trading latency as low as 0.2 seconds. This performance rivals that of leading centralized exchanges and far outpaces most DEXs.

-

Gasless Trading and Minimal Fees: The platform offers gasless trading for order placement and minimal withdrawal fees, significantly reducing costs and friction for active traders compared to traditional on-chain DEXs.

-

Dominant Market Share and Ecosystem Growth: Hyperliquid has rapidly captured 80% of the decentralized perpetuals market, reflecting its strong adoption, deep liquidity, and robust trading ecosystem.

This convergence of speed, transparency, and cost efficiency means that real-time DeFi trading is finally practical for sophisticated strategies like scalping, arbitrage, or algorithmic execution – all without sacrificing decentralization or custody.

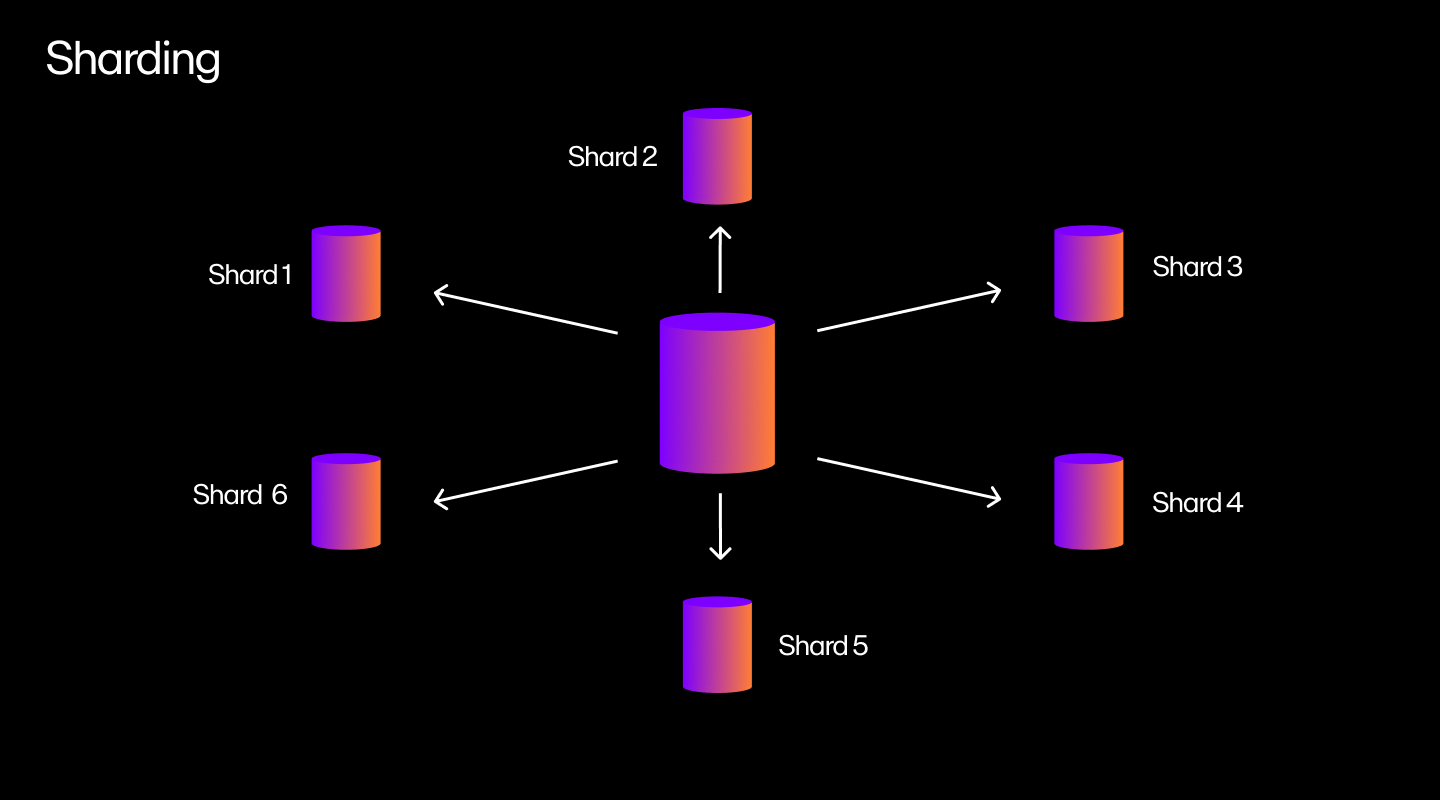

The Future: Scaling Further Without Sacrificing Decentralization

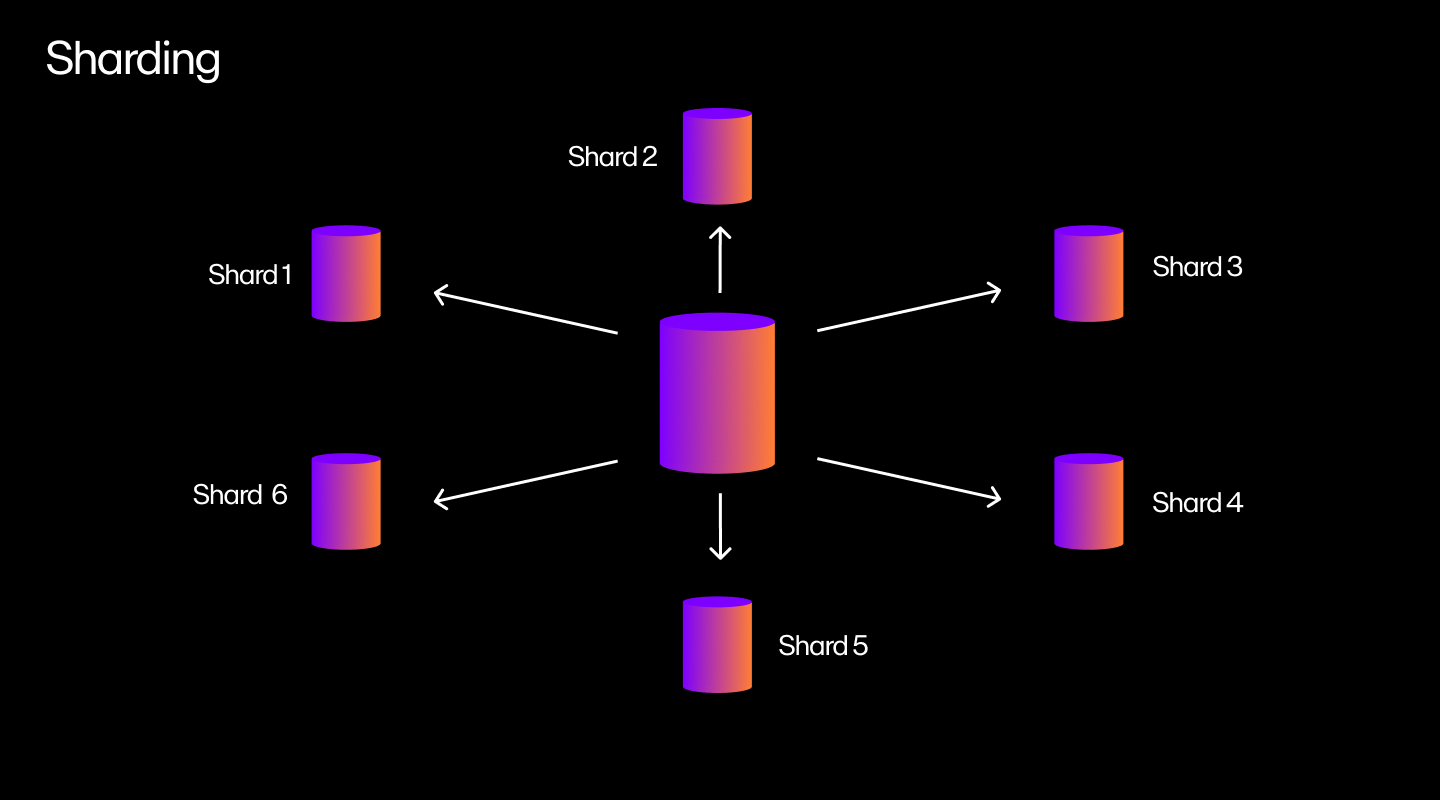

As demand for ultra-low latency DEX solutions grows alongside institutional adoption of DeFi, platforms like Hyperliquid-Style Perps are poised to lead the next wave of innovation. The focus will be on scaling throughput even further while maintaining the composability and permissionless access that define decentralized finance. Upcoming enhancements in Layer-1 performance, cross-chain interoperability, and new order types are likely to push boundaries even more.

For those looking to maximize their trading potential in this new era of decentralized perpetual contracts, understanding these technological underpinnings isn’t just academic – it’s essential for staying competitive. If you’re ready to explore how these breakthroughs can transform your approach to low-latency crypto trading, dive deeper into our detailed technical breakdown at this resource.