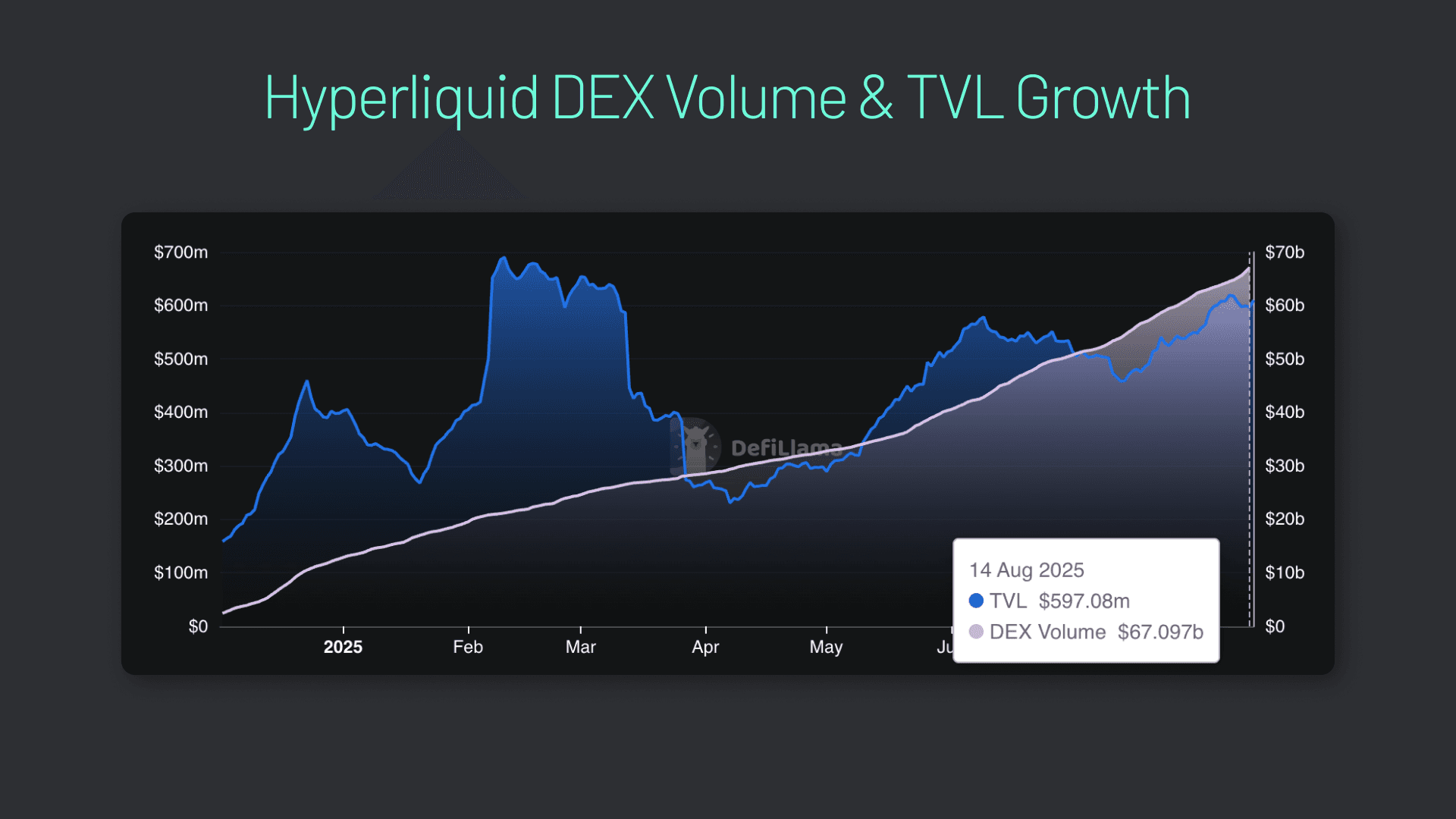

In the rapidly evolving world of decentralized perpetual trading, advanced order types are more than just nice-to-have features, they’re essential tools for any trader aiming to maximize flexibility, control, and risk management. Hyperliquid-Style Perps has quickly become a leader in this space, capturing an impressive 70% of the on-chain perpetual futures market and processing over $1.5 trillion in trading volume over the past year. This dominance isn’t just about deep liquidity and low fees; it’s about giving traders the precise instruments they need to execute sophisticated strategies in real time.

Why Advanced Order Types Matter for Pro Traders

If you’ve ever felt limited by basic buy-or-sell functionality on a DEX, you’re not alone. The ability to choose from a range of Hyperliquid-Style Perps order types is what separates casual dabblers from serious market participants. Advanced order types empower you to:

- React instantly to fast-moving markets

- Set precise entry and exit points

- Automate risk management

- Avoid slippage and minimize market impact

This level of control is crucial when you’re trading perpetuals at scale or deploying complex strategies that demand more than just “market” or “limit” options.

The Four Powerhouse Order Types on Hyperliquid-Style Perps

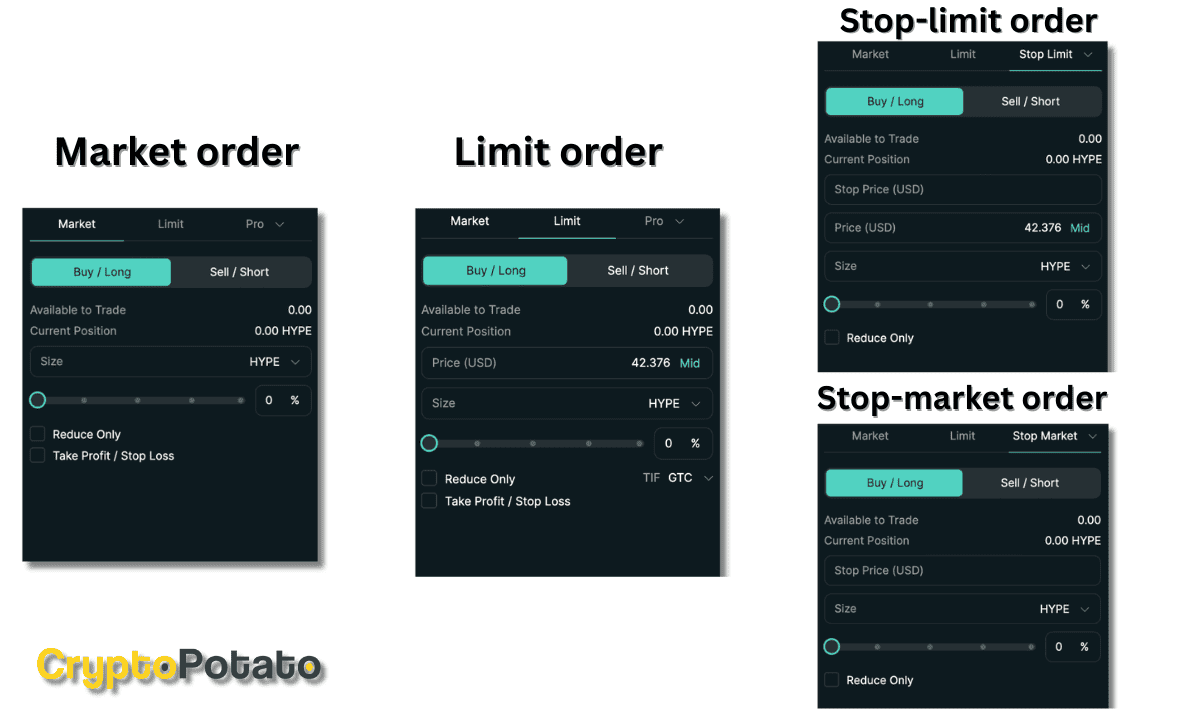

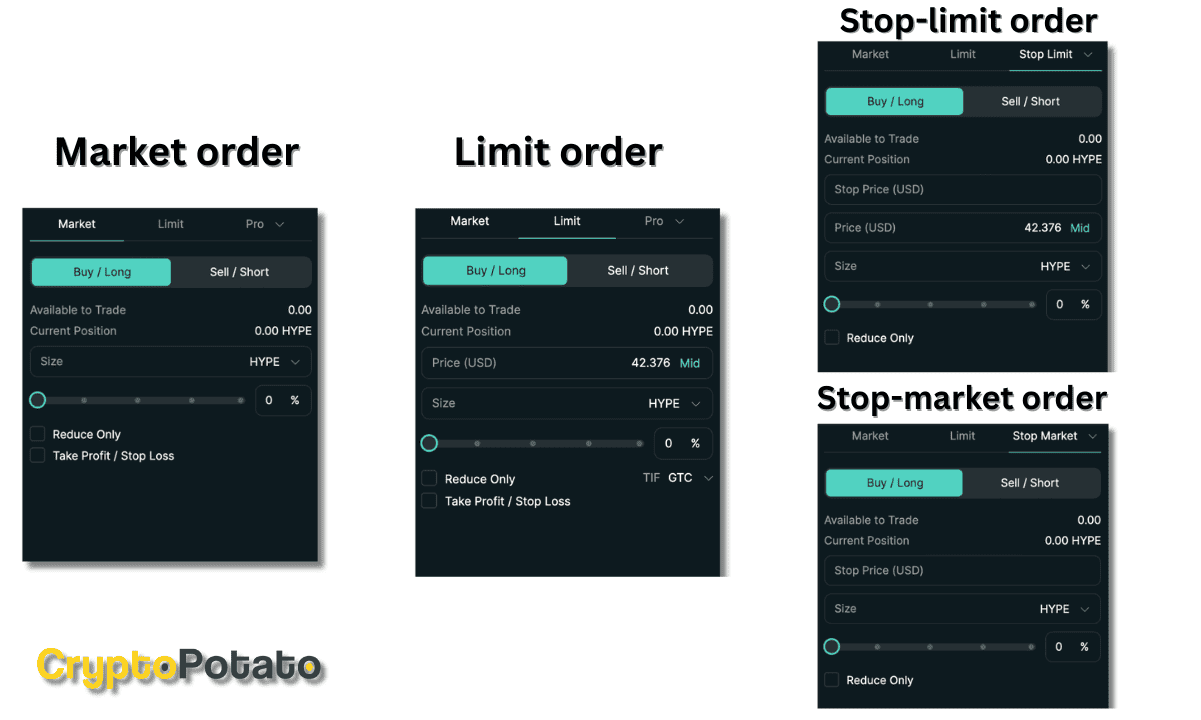

Top 4 Advanced Order Types on Hyperliquid Perps

-

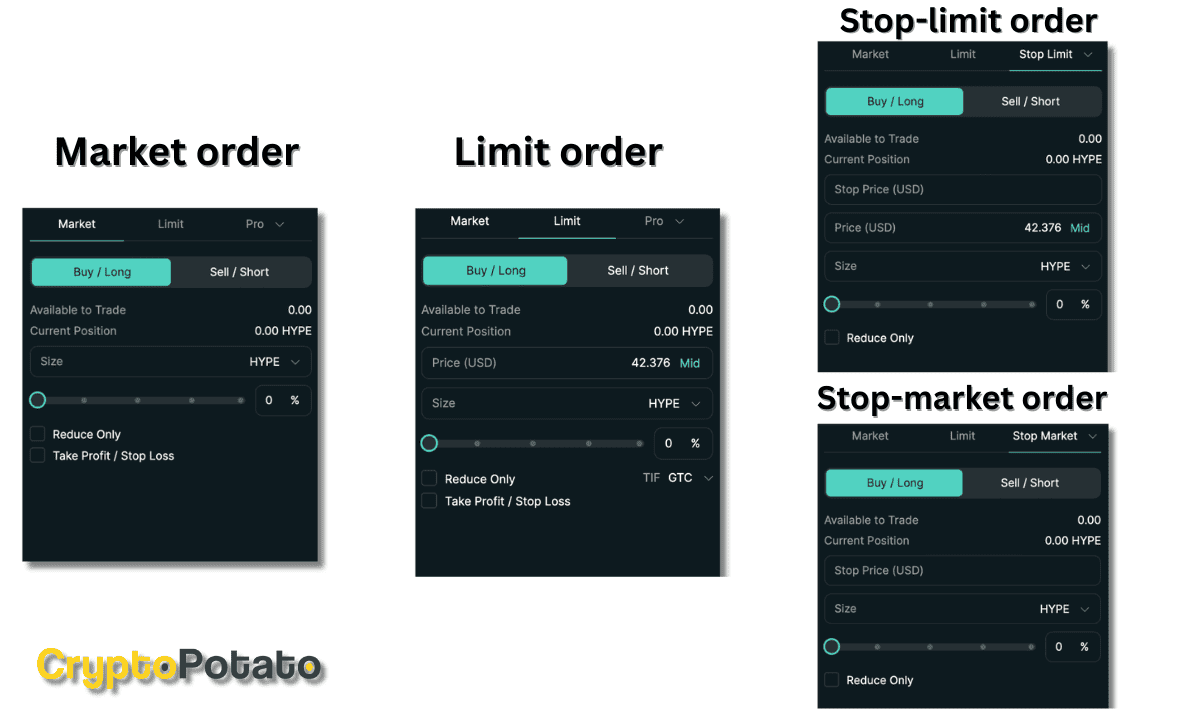

Market Order: Executes instantly at the current market price, ensuring rapid entry or exit from a position. Ideal for traders who prioritize speed and guaranteed execution over price precision.

-

Limit Order: Allows you to set a specific price at which you want your order filled. This gives you control over your entry or exit price, helping to optimize trade execution and avoid slippage.

-

Stop Market Order: Triggers a market order once a predefined stop price is reached. This is essential for risk management, as it helps automate exits during sudden market moves.

-

Take Profit/Stop Loss (TP/SL) Order: Lets you pre-set levels to automatically close your position for profit or to limit losses. TP/SL orders are key for hands-off risk management and securing gains, even when you’re away from the screen.

Let’s break down how these four core order types work, and why they’re indispensable for anyone serious about perpetual trading flexibility.

Market Orders: For Instant Execution When Speed Matters Most

The simplest yet most crucial tool in your arsenal is the Market Order. On Hyperliquid-Style Perps, placing a market order means your trade executes immediately at the current best available price. This is ideal when you need to enter or exit a position without delay, think sudden news events or rapid trend reversals where every second counts.

The platform’s high-speed matching engine ensures minimal latency and deep liquidity, so even large trades can be executed efficiently, no more waiting around or worrying about partial fills. For newer traders, this feature also removes much of the guesswork associated with timing entries and exits during volatile periods.

Limit Orders: Precision Entry and Exit Points Without Chasing Price

If you’re looking for more control over your trade execution price, Limit Orders are your go-to option. With a limit order on Hyperliquid-Style Perps, you set your desired price, and your trade will only execute if the market reaches that level or better. This allows you to buy low and sell high without constantly monitoring charts or risking unfavorable fills due to sudden price swings.

This type of advanced DEX order is especially valuable for traders who want to accumulate positions gradually or take profits at predetermined targets while minimizing slippage, a key concern in high-volatility environments like crypto perps.

The Strategic Edge: Stop Market and Take Profit/Stop Loss (TP/SL) Orders

No professional trader would dream of operating without robust risk management tools. That’s where Stop Market Orders and Take Profit/Stop Loss (TP/SL) Orders come into play:

Stop Market Orders allow you to automate your defense against rapid, unfavorable price movements. By setting a trigger price, your order instantly becomes a market order if that level is reached. This means you can step away from the screen knowing that, should the market move against you, your position will be closed at the next available price, helping prevent catastrophic losses during sudden volatility spikes.

On Hyperliquid-Style Perps, stop market orders are particularly valuable when trading highly leveraged positions or volatile assets. They act as an emergency exit, giving you peace of mind and freeing up mental bandwidth to focus on strategy rather than constant risk monitoring.

Take Profit/Stop Loss (TP/SL) Orders take automation one step further by letting you set both your upside and downside boundaries in advance. With TP/SL orders, you define the exact price at which you’d like to lock in profits or cut losses. Once the market hits either threshold, Hyperliquid-Style Perps executes your instructions automatically, no manual intervention required.

This dual-action approach is a cornerstone of professional perpetual trading flexibility. It lets traders pre-plan their exits, manage emotions, and stick to their strategies even when markets get wild. For example, if you’re long on ETH-PERP and want to secure gains if it reaches $3,000 while capping losses if it drops below $2,700, TP/SL orders make it effortless.

Integrating Advanced Order Types Into Your Strategy

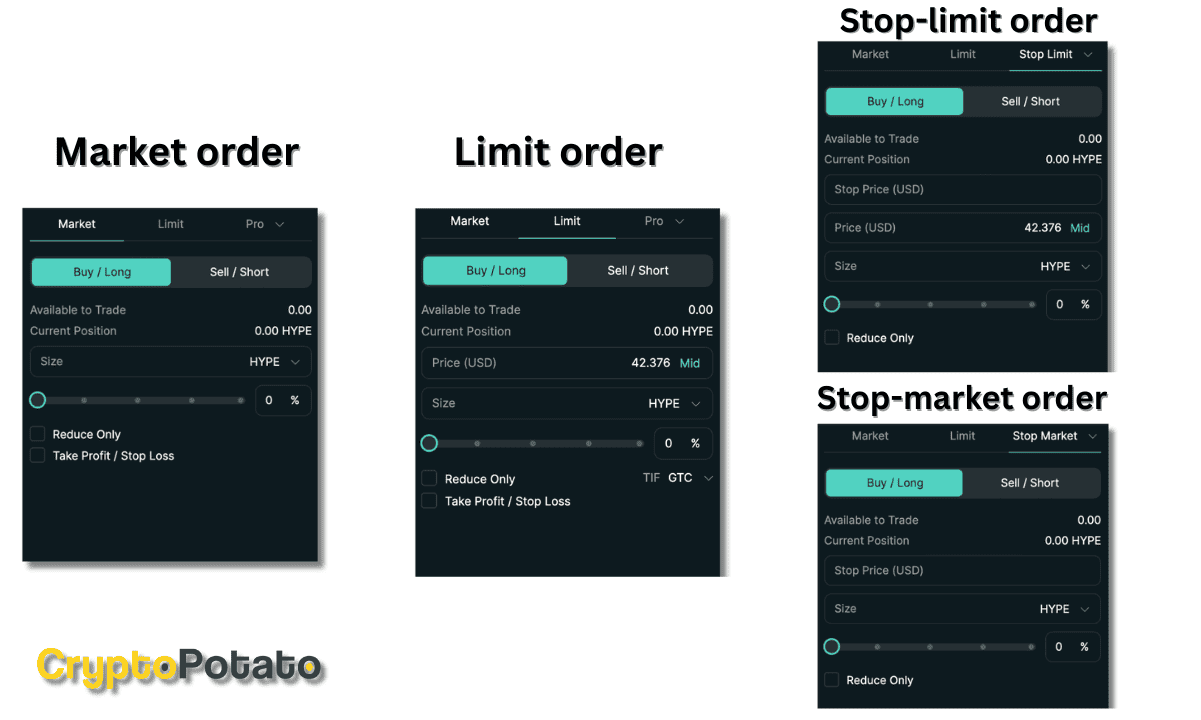

The real power of these four order types emerges when they’re used in combination. Imagine entering with a limit order at an optimal price point while simultaneously placing a stop market order for protection and a TP/SL bracket for profit-taking, all within one seamless interface. This orchestration is what turns basic trading into true capital management.

Checklist: Integrating Advanced Order Types in One Trade Plan

-

Market Order: Instantly executes your trade at the current market price, ensuring rapid entry or exit—ideal for capturing fast-moving opportunities in Hyperliquid’s deep liquidity environment.

-

Limit Order: Lets you set a specific price at which you want your trade to execute, providing precision and control over your entry or exit points. Perfect for traders aiming to optimize execution in volatile markets.

-

Stop Market Order: Automatically triggers a market order when your set stop price is reached, helping you manage risk by exiting positions if the market moves against you.

-

Take Profit/Stop Loss (TP/SL) Order: Enables you to predefine both your profit targets and maximum loss thresholds. This order type automates position management, allowing you to lock in gains or limit losses without constant monitoring.

Hyperliquid-Style Perps makes this level of sophistication accessible to everyone, not just algorithmic traders or institutional players. The platform’s intuitive design ensures that even those new to advanced DEX orders can quickly learn to deploy these tools effectively.

Why Pro Traders Choose Hyperliquid-Style Perps for Advanced Orders

What really sets Hyperliquid apart is its commitment to speed and reliability at scale. With over $1.5 trillion in annual volume and 70% on-chain perpetual futures market share (source), traders trust that their advanced orders will be executed as intended, even during peak volatility.

The deep liquidity ensures minimal slippage for market orders; the robust matching engine delivers precise fills for limit and stop market orders; TP/SL automation removes emotional bias from exits. All of this combines to create an environment where professional features are not just available, they’re optimized for real-world use.

Final Thoughts: Mastering Perpetual Trading Flexibility

Navigating perpetual futures successfully requires more than luck or intuition, it demands precision tools, strategic planning, and robust risk controls. The four advanced order types on Hyperliquid-Style Perps, Market Order, Limit Order, Stop Market Order, and Take Profit/Stop Loss (TP/SL) Order, are purpose-built for pro traders who want full control without compromise.

If you’re ready to elevate your game with features designed for today’s fast-paced DeFi landscape, explore how these powerful order types can transform your approach, and help you trade smarter every step of the way.