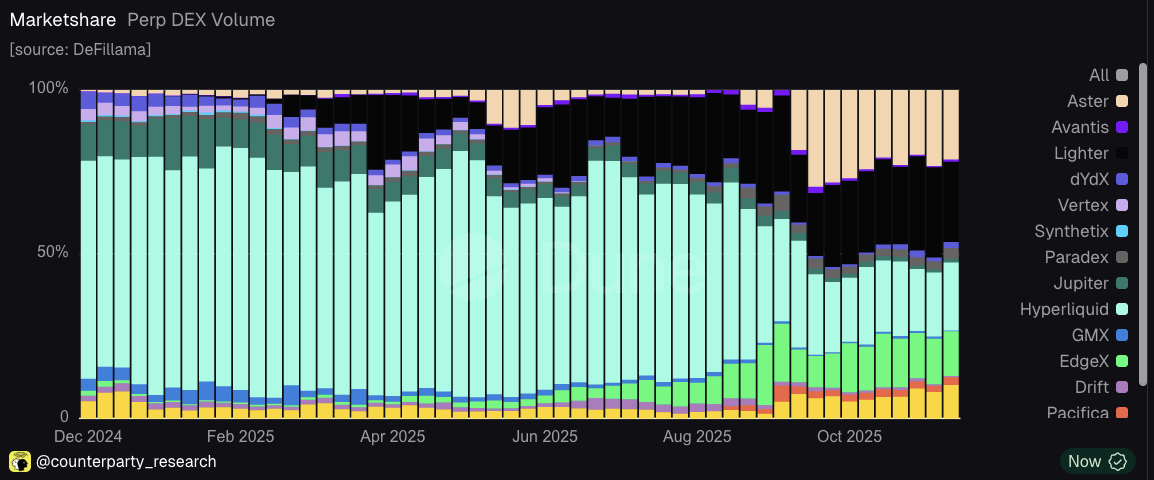

Hyperliquid’s grip on the perp DEX market has loosened dramatically, sliding from a commanding 65% market share to just 17% in a matter of months. This hyperliquid perps volume drop isn’t just numbers on a chart; it’s a seismic shift in DeFi trading dynamics, fueled by fierce competition and evolving trader preferences. Once the undisputed leader processing billions daily, Hyperliquid now battles for relevance against agile newcomers like Aster and Lighter. Yet, amid the chaos, signs of a rebound emerge, hinting at tactical recoveries that could redefine perps dex market share 2026.

Perps DEX Market Share Table: Hyperliquid Drop from 65% to 17% vs Competitors

| DEX | Peak Market Share | Current Market Share | Change (percentage points) | Recent Volume Sample | |

|---|---|---|---|---|---|

| Hyperliquid | 65% | 17% | -48 | $3.76B (24h) | 🔻📉 |

| Aster | ~10% | ~27% | +17 | $544M | 🔺📈 |

| Lighter | ~5% | ~25% | +20 | Growing (surpassing Hyper) | 🔺📈 |

Bitcoin Hyper (HYPER) trades at $0.000026, a modest 0.0568% uptick over 24 hours, reflecting cautious optimism in Hyperliquid’s ecosystem token amid broader market turbulence.

Dissecting the Plunge: 73% to 18% in Under a Year

Early 2025 painted Hyperliquid as invincible, holding 73% of the perp DEX pie according to Cointelegraph reports. Traders flocked to its low-latency execution and deep liquidity, pushing monthly volumes into the hundreds of billions. Fast-forward to December 2025, and that dominance crumbled to around 18%. Sources like SignalPlus pinpoint this erosion to the explosive entry of Aster and Lighter, who lured volume with aggressive incentives and slick interfaces.

What stings most? Hyperliquid’s daily volumes dipped sharply. A Coinglass snapshot captured $3.76 billion in 24-hour trading, trailing rivals in key metrics. Bankless noted a 29% drop from August peaks, with Hyperliquid slipping to second place at $282.5 billion cumulative. This isn’t mere fluctuation; it’s a structural challenge in a sector where perps DEXs now claim 26% of global derivatives, per BlockEden, processing over $1 trillion monthly.

Hyperliquid’s share plummeted from 66% to 16.7% as Lighter and Aster surged ahead.

Opinion: Hyperliquid’s early complacency handed rivals the keys. In perp trading, speed and yields win battles; resting on laurels invites defeat.

Head-to-Head Volume Wars: Hyperliquid vs Lighter and Aster

Hyperliquid vs Lighter volume comparisons reveal brutal realities. Phemex data shows Hyperliquid at 16.7%, eclipsed by competitors. Aster hit $544 million in spots versus Hyperliquid’s $1.3 billion, but perps tell a tighter story. Coinglass ignited debates with discrepancies: Hyperliquid’s reported $3.76 billion 24h volume clashed with on-chain realities, underscoring data opacity in DEX wars.

Binance analyses from late 2025 flagged November’s plunge to 20%, as newcomers carved niches with superior incentives. KuCoin’s February 2026 update shows slight volume dips across majors, Hyperliquid’s open interest holding steady yet volumes lagging. Yahoo Finance flipped the script temporarily, with Hyperliquid pulling ahead, but sustainability remains questionable.

| Platform | 24h Volume (Recent Snapshot) | Market Share |

|---|---|---|

| Hyperliquid | $3.76B | 17% |

| Aster | $544M and | Rising |

| Lighter | Competitive | Gaining |

This table underscores the squeeze. Hyperliquid’s tech edge provides 200,000 orders per second at 0.2s latency via HyperCore, shines on paper, but user migration prioritizes rewards over raw speed.

Unraveling the Culprits: Incentives, Tech Gaps, and Market Saturation

Why the fall? Competitors wielded airdrop blitzes and yield boosts, siphoning liquidity. Aster and Lighter’s aggressive programs captured traders chasing short-term gains, per AInvest. Meanwhile, Coinglass exposed volume inflation debates, eroding trust in Hyperliquid’s metrics.

Market saturation amplified woes. As perp DEXs ballooned, total volumes fragmented. Hyperliquid’s pivot lagged; rivals iterated faster on user experience. Yet, nuance matters: CoinDesk lauded Hyperliquid’s $40.7 billion surges, proving resilience in spikes.

Hyperliquid (HYPER) Price Prediction 2027-2032

Forecasts incorporating HIP-3 recovery, perp DEX market share rebound to 33%, technological upgrades, and crypto market cycles

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

|---|---|---|---|

| 2027 | $0.000030 | $0.000080 | $0.000150 |

| 2028 | $0.000060 | $0.000200 | $0.000400 |

| 2029 | $0.000150 | $0.000500 | $0.00100 |

| 2030 | $0.000300 | $0.00120 | $0.00250 |

| 2031 | $0.000800 | $0.00250 | $0.00500 |

| 2032 | $0.00150 | $0.00450 | $0.0100 |

Price Prediction Summary

Hyperliquid (HYPER) shows strong recovery potential post-market share decline, with average prices forecasted to grow over 56x from 2027 ($0.00008) to 2032 ($0.0045). Bullish maxima reflect perp DEX expansion and HIP-3 success; minima account for competition and bear markets. YoY avg growth: ~150% early, tapering to ~80% later amid adoption.

Key Factors Affecting Hyperliquid Price

- HIP-3 upgrade expanding to equity/commodity perps, driving volume resurgence

- Perp DEX sector growth to 26% of global derivatives market ($1T+ monthly)

- HyperCore tech enabling 200k orders/sec at 0.2s latency

- Market share stabilization at 33% vs. rivals like Aster and Lighter

- Crypto bull cycles, Bitcoin halvings, and DeFi adoption trends

- Regulatory clarity for decentralized exchanges

- Competitive landscape requiring ongoing innovation and incentives

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

HYPER at $0.000026 sits at a crossroads. Predictions hinge on execution, but history favors adapters. Hyperliquid’s HIP-3 upgrade introduced equity and commodity perps, sparking a climb to 33% share by January 2026. Diversification drew forex pros, blending crypto with tradfi assets seamlessly.

That rebound to over 33% market share by late January 2026 signals Hyperliquid’s tactical pivot is gaining traction. Traders now access perpetuals on equities like S and amp;P 500 components and commodities such as gold, all settled on-chain with sub-second finality. This move bridges DeFi and traditional finance, pulling in sophisticated players who previously stuck to CEXs.

Hyperliquid Recovery Tactics: Diversification and Tech Overhaul

Hyperliquid recovery tactics center on two pillars: product expansion via HIP-3 and infrastructure supremacy through HyperCore. The upgrade rolled out non-crypto perps, instantly broadening appeal. Volume snapshots post-launch show spikes, with Hyperliquid processing billions more than pre-dip averages. ChainCatcher highlights HyperCore’s prowess: 200,000 orders per second at 0.2-second latency crushes competitors’ throughput, enabling high-frequency strategies without slippage.

These upgrades address core pain points. Where Aster and Lighter leaned on incentives, Hyperliquid doubled down on utility. Open interest stabilized per KuCoin’s February data, even as spot volumes softened industry-wide. The result? A platform resilient to fads, primed for sustained perps dex dominance analysis.

Yet balance tempers optimism. Rivals aren’t standing still. Aster’s token slumped 75% per Yahoo Finance, but its perp volumes hold firm through targeted rewards. Lighter pushes zk-proof scaling for cheaper trades. Hyperliquid must match aggression with substance, lest shares erode again.

| Metric | Pre-HIP-3 (Dec 2025) | Post-HIP-3 (Jan 2026) | Competitors Avg |

|---|---|---|---|

| Market Share | 18% | 33% | 20-25% |

| 24h Volume | $3.76B | $40.7B peaks | $1-5B |

| Open Interest | Stable | Growing | Volatile |

This snapshot, drawn from aggregated sources like CoinDesk and Phemex, illustrates the rebound’s bite. Hyperliquid’s volumes ballooned during rallies, outpacing Aster’s $544 million benchmarks and Lighter’s gains. Data discrepancies noted by Coinglass persist, but on-chain verification favors Hyperliquid’s transparency edge.

Looking ahead to perps dex market share 2026, decentralized perps could hit 30% of global derivatives, building on BlockEden’s $1 trillion monthly benchmark. Hyperliquid’s path involves relentless iteration: deeper liquidity pools, cross-chain bridges, and AI-driven risk tools. For traders, this means betting on platforms like Hyperliquid-Style Perps, which mirror these strengths with unmatched low-latency access.

HYPER’s steady $0.000026 price, up 0.0568% daily, mirrors this quiet momentum. No fireworks, just methodical climbs. Traders eyeing hyperliquid vs lighter volume matchups should watch HIP-3 adoption rates; they dictate if 33% holds or climbs higher. In perp DEX wars, adaptability crowns kings. Hyperliquid, battle-tested, seems poised to reclaim throne status, rewarding patient liquidity providers and sharp executors alike.

Fragmented volumes demand diversified strategies. Pair Hyperliquid’s speed with rivals’ yields for optimal setups. As DeFi matures, platforms blending both win. Hyperliquid’s arc from 65% peak to 17% trough and back teaches that volume drops are opportunities in disguise – for those with the tactics to seize them.