In the fast-evolving DeFi landscape of 2026, Hyperliquid stands out by empowering builders to launch custom perpetuals without gatekeepers, thanks to its HIP-3 upgrade. Platforms like Perpsdotfun simplify this process, turning bold ideas into live markets with just a 500,000 HYPE token stake. January’s on-chain volumes for traditional asset perpetuals soared to $31.0 billion, a 162% jump from December, signaling explosive demand for niche exposures like OpenAI or SpaceX via tools such as Ventuals. If you’ve traded hyperliquid style perps trading basics, launching your own via perpsdotfun hyperliquid unlocks unprecedented control.

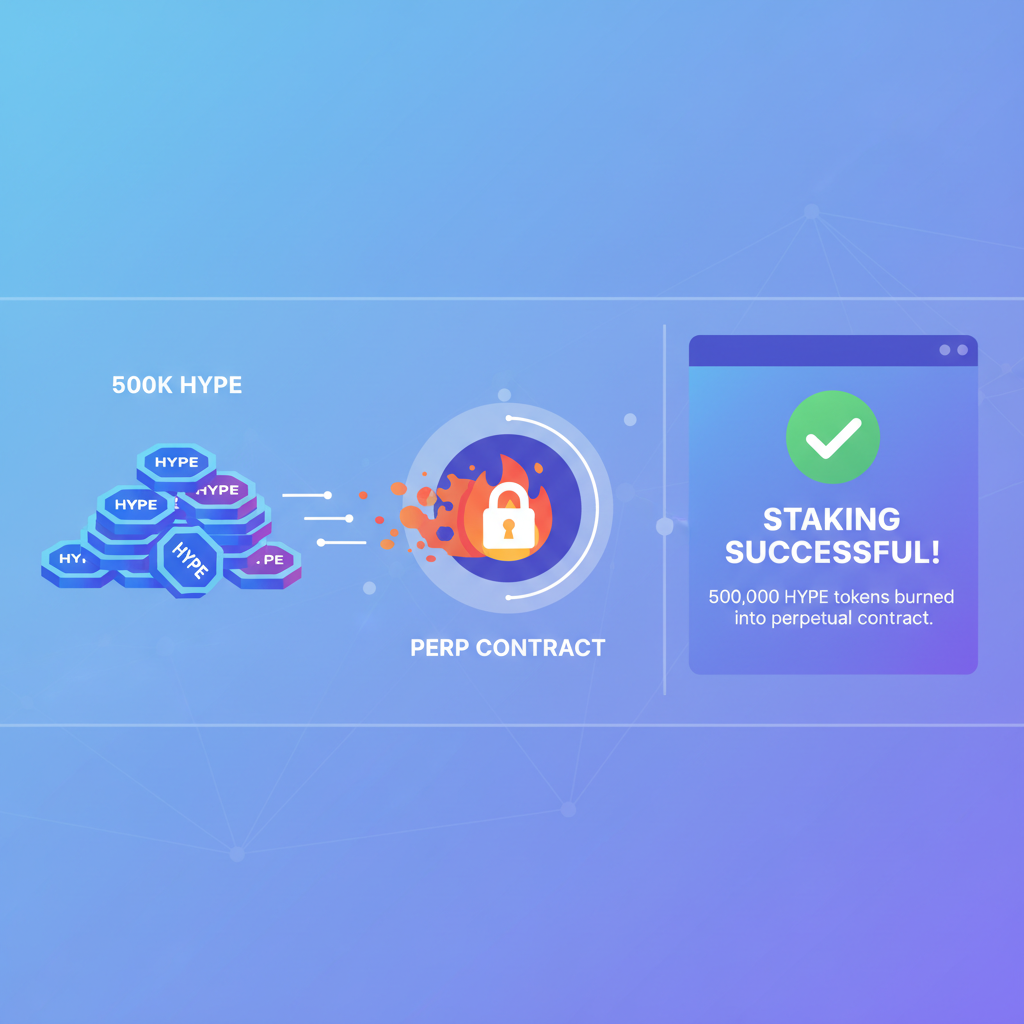

This permissionless model democratizes market creation. No more waiting for exchange approvals; stake HYPE, define parameters, and deploy. Hyperp contracts add oracle-free innovation, relying on exponentially weighted moving averages of on-chain marks for pre-launch synthetics. Yet success demands more than tech savvy; it requires grasping risks like liquidation cascades in illiquid markets or oracle manipulations, even if minimized here.

HIP-3 Unlocks Permissionless Perps on Hyperliquid

HIP-3 marks Hyperliquid’s pivotal shift toward full decentralization. Builders now deploy perpetuals directly, staking 500,000 HYPE to bootstrap liquidity and credibility. This isn’t mere hype; it’s proven by $31.0 billion in January volumes, dwarfing prior months. Traditional assets dominate, but custom perps for private equities via Ventuals show the potential for exotic markets.

Practically, HIP-3 integrates seamlessly with Hyperliquid’s Arbitrum-based order book, delivering sub-millisecond executions. No KYC hurdles mean global access, ideal for permissionless perps hyperliquid 2026. I appreciate the balance: high stakes deter spam, while rewards incentivize quality. Traders benefit from deeper liquidity pools as markets proliferate.

From my nine years charting crypto volatility, this feels like 2017’s ICO boom, but matured. Hyperliquid’s architecture, with modular components for matching engines and risk layers, scales effortlessly. Yet caution: early custom perps can swing wildly without volume, amplifying leverage pitfalls for beginners versed only in standard futures.

Perpsdotfun: Streamlining Custom Perp Launches

Enter Perpsdotfun, the intuitive hyperliquid perps launchpad abstracting HIP-3 complexities. This frontend handles staking, parameter setup, and deployment in minutes, no code required for most users. Think of it as Uniswap for perpetuals: deposit HYPE, specify underlying asset, leverage caps, and funding rates, then go live.

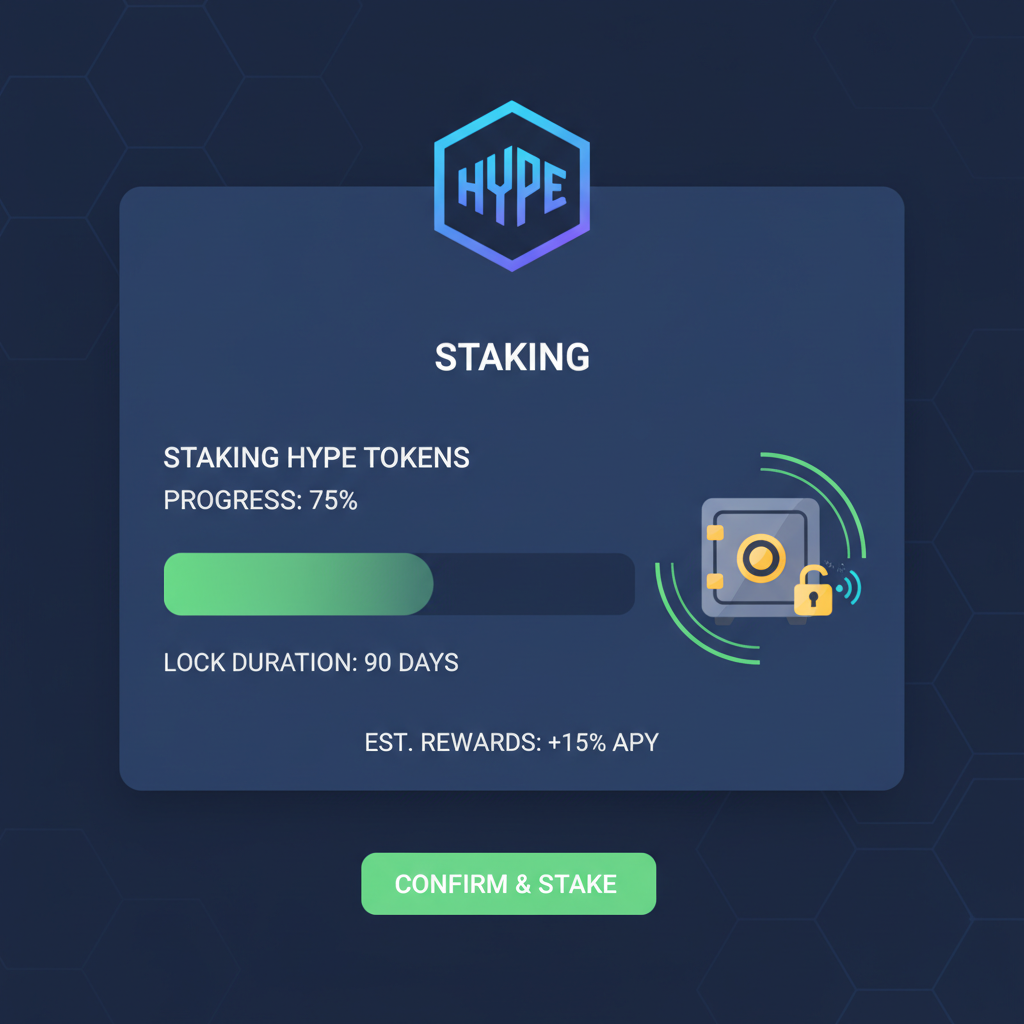

Why it shines? User-friendly wizards guide oracle selection or Hyperp mode toggles, crucial for synthetic assets. Recent adopters launched perps on niche tokens, drawing traders seeking alpha outside BTC or ETH. Balanced view: while revolutionary for launch custom perps hyperliquid, staked HYPE locks capital; slashing risks for manipulation add gravity.

Setup mirrors Hyperliquid trading: bridge USDC via Arbitrum-compatible wallets like those supporting no-KYC flows. Acquire HYPE on ramps or DEXs, then stake via Perpsdotfun. My take? Perfect for analysts spotting untapped pairs, like forex crosses in crypto wrappers, but test small to gauge adoption.

Gearing Up: Essential Prep for Your Perp Launch

Before diving in, assemble prerequisites. Secure an Arbitrum wallet; popular ones handle Hyperliquid’s chain effortlessly. Fund with USDC for fees, though minimal, and amass 500,000 HYPE; at current valuations, that’s a serious commitment signaling skin in the game.

Analyze your market: competitor scans reveal gaps, like underserved commodities or memecoins. Perpsdotfun’s dashboard previews simulations, estimating initial liquidity needs. Pro tip: pair with community polls on Farcaster for demand validation, avoiding flops.

Once validated, simulate trades on testnets if available, ensuring your perp’s funding rates and oracle feeds align with market realities. This prep phase, often overlooked, separates thriving markets from ghosts towns.

Step-by-Step: Deploying via Perpsdotfun

With prep complete, Perpsdotfun’s dashboard takes over. Connect your wallet, approve the 500,000 HYPE stake, and input core specs: asset ticker, max leverage (say 50x for volatiles), tick size, and maintenance margins. Toggle Hyperp for oracle-free synthetics if targeting pre-launch tokens, leveraging on-chain price averages for stability. Deployment triggers instantly, listing your perp on Hyperliquid’s order book for global traders.

In practice, I’ve seen launches for memecoin pairs explode within hours, mirroring January’s $31.0 billion volume surge. But balance excitement with realism: initial spreads widen without bootstrap liquidity, so seed your own book or rally communities. Perpsdotfun tracks post-launch metrics, like open interest and funding accrual, helping iterate fast.

Post-deployment, monitor slashing risks; Hyperliquid penalizes manipulators by burning staked HYPE, preserving integrity. Traders flock to fresh perps for hyperliquid style perps trading, chasing edges in illiquid niches. My charts show custom markets maturing quicker than expected, thanks to HIP-3’s incentives.

Navigating Risks: Balanced Approach to Permissionless Launches

Permissionless doesn’t mean risk-free. Illiquid perps amplify liquidations during volatility spikes, potentially cascading if leverage creeps high. Oracle disputes, though rare with Hyperp alternatives, demand vigilant parameter tuning. Stake commitment ties capital, but yields from fees offset this for hits. Opinion: this friction weeds out weak ideas, fostering quality amid 162% volume growth.

Mitigate by starting narrow: low leverage, tight oracles, and transparent comms. Ventuals exemplifies success, piping private equity perps like OpenAI onto Hyperliquid. As volumes hit $31.0 billion, such innovations draw institutions, blurring TradFi-DeFi lines. Yet for retail builders, scale gradually; I’ve traded enough swings to know hype fades without utility.

FAQs: Launching on Hyperliquid Perpsdotfun

Answering trader queries upfront saves headaches. Expect 0.02% maker fees post-launch, with stakers earning from taker flows. Recovery of HYPE stake hinges on no-slash periods, typically after proving stability. For permissionless perps hyperliquid 2026, this setup evolves DeFi toward true composability.

Trading your launched perp follows Hyperliquid norms: deposit USDC, select leverage, and execute via the CLOB. No KYC keeps it fluid, but grasp funding rates to avoid erosion. Platforms like Perpsdotfun now integrate analytics, forecasting adoption curves based on similar launches.

Looking ahead, as builders flood in, expect hyper-specialized perps: AI indices, climate tokens, even forex perpetuals wrapped on-chain. Hyperliquid’s modular DEX architecture supports this without choking, per industry breakdowns. My nine years affirm: adaptability wins. Stake wisely on hyperliquid perps launchpad, validate demand, and watch your market thrive amid DeFi’s next wave.