Integrating Hyperliquid-style perpetual contracts (perps) into DeFi portfolio management tools is rapidly becoming a game-changer for active traders and sophisticated asset managers. As DeFi matures, the need for real-time, high-leverage trading instruments to be seamlessly tracked alongside spot holdings is no longer a luxury but a necessity. Hyperliquid’s architecture, offering up to 50x leverage, deep liquidity, and advanced order types, unlocks new strategies, but also introduces unique risks that demand robust monitoring and dynamic risk controls.

![]()

Why Integrate Hyperliquid-Style Perps into Portfolio Management?

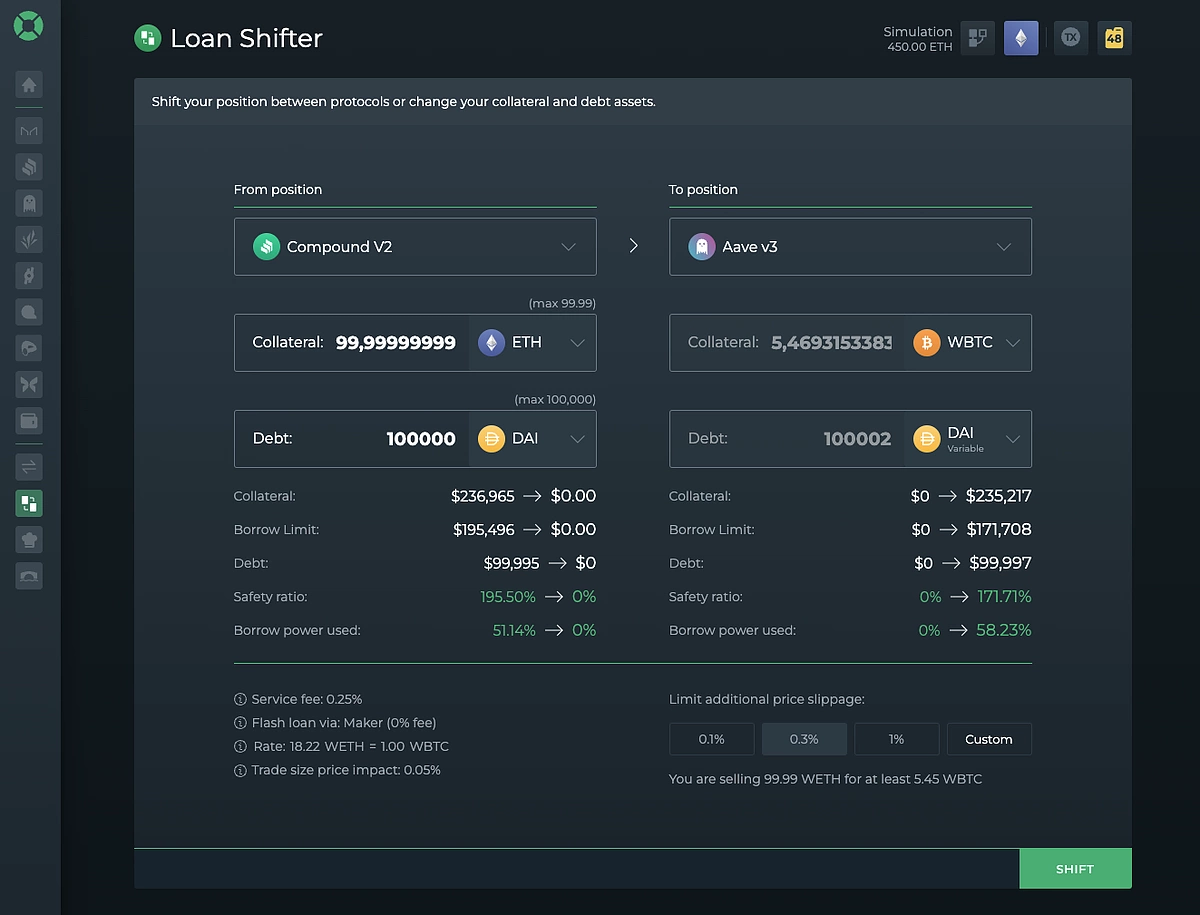

Hyperliquid-Style Perps integration empowers traders to monitor leveraged positions, funding rates, unrealized P and L, and margin health alongside spot assets, all within a single dashboard. This holistic view is essential for managing risk exposure in volatile markets and capitalizing on cross-market opportunities. Platforms like Gunbot have already demonstrated the benefits of automating both spot and perps trades using unified strategies (Gunbot.com), while custom dashboards built on the Hyperliquid API enable real-time monitoring of positions and collateral (Oodles Blockchain).

Key Features for Seamless Integration

The next generation of portfolio tools DEX-side are prioritizing several advanced features to support leveraged trading:

Essential Features for Hyperliquid Perps Integration

-

Dynamic Collateral Management: Integrate systems like the DeFi Anti-Liquidation Bot to automatically rebalance collateral across protocols and margin accounts, reducing liquidation risk by up to 90%.

-

Cross-Protocol Hedging: Enable mechanisms that leverage flash loans and cross-exchange arbitrage, allowing users to hedge Hyperliquid perp positions on major centralized exchanges such as Binance or Bybit.

-

Volatility-Adjusted Leverage: Employ algorithms that dynamically adjust leverage based on real-time market volatility, optimizing risk and enabling strategies like funding rate arbitrage on Hyperliquid.

-

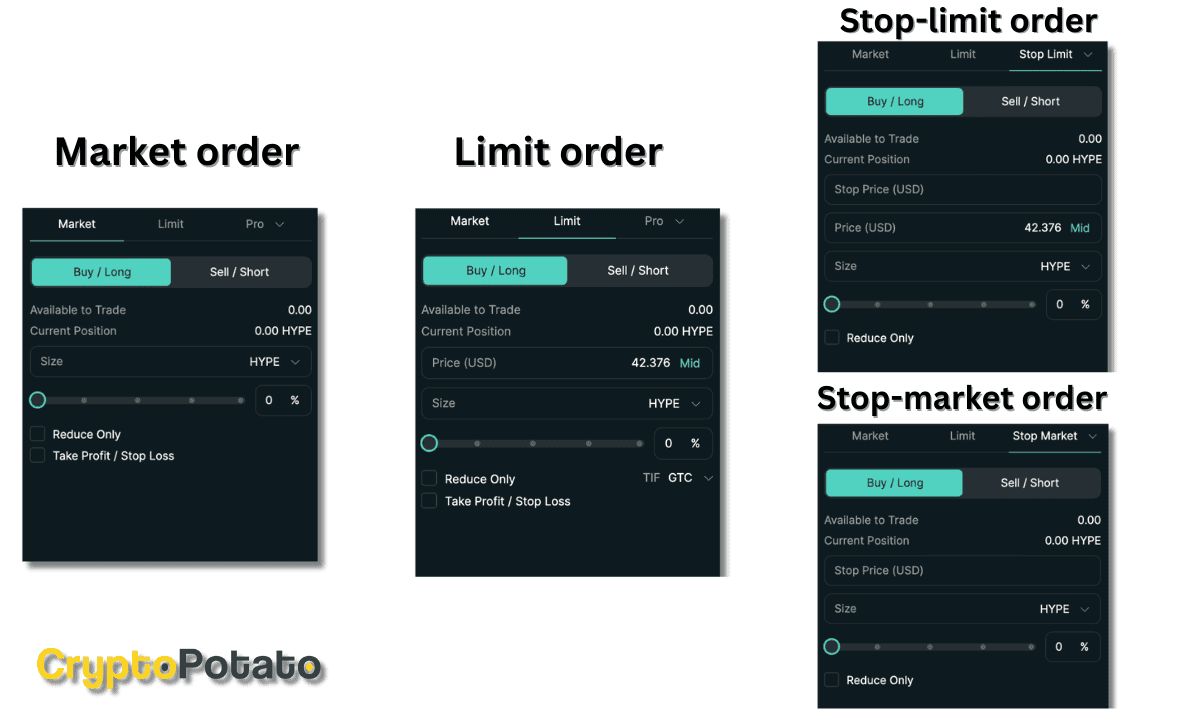

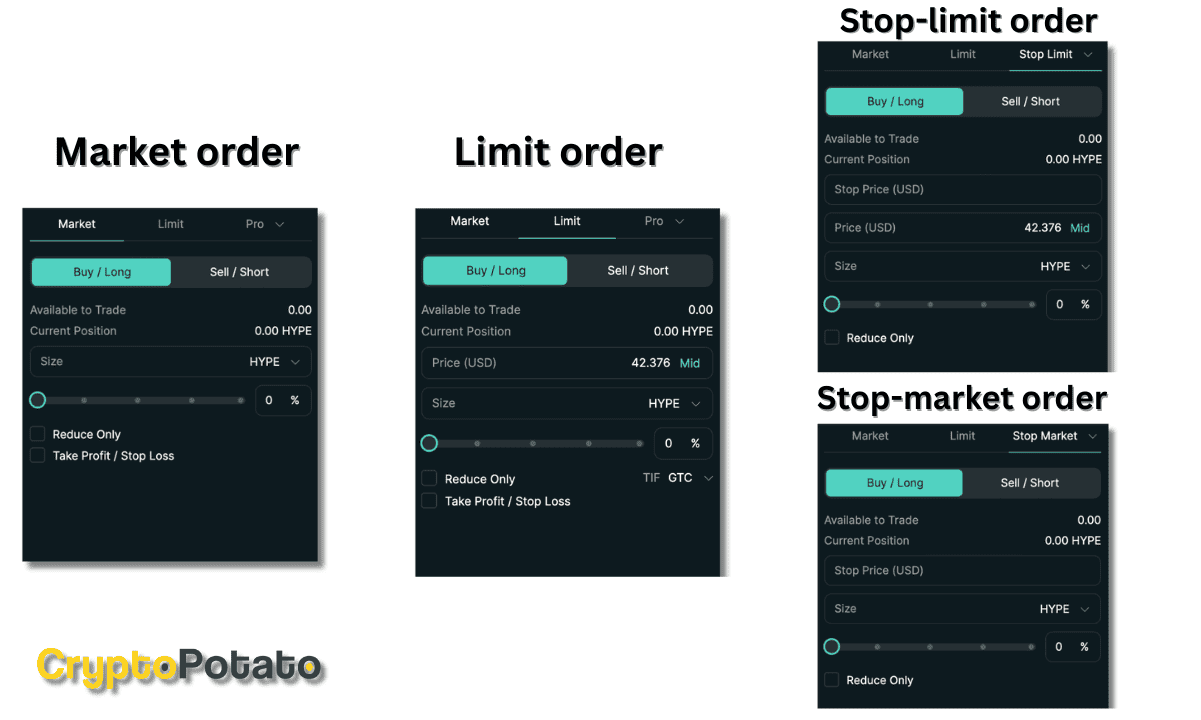

Liquidity-Aware Stop-Loss Orders: Develop stop-loss tools that factor in order book liquidity, ensuring optimal execution and minimizing slippage or manipulation on Hyperliquid perps.

-

Cross-Protocol Risk Dashboards: Build comprehensive dashboards that monitor collateral and liquidity across DeFi pools, with features for automatic withdrawal during high-risk scenarios, providing a unified risk overview.

- Dynamic Collateral Management: Automated systems rebalance collateral as market conditions shift. For example, bots like the DeFi Anti-Liquidation Bot use oracles (Chainlink, Pyth) to reduce liquidation risk by up to 90% without closing positions.

- Cross-Protocol Hedging: Mechanisms that execute hedges across both centralized and decentralized venues, think flash loans or arbitrage between Binance and Hyperliquid, to offset risk from high leverage.

- Volatility-Adjusted Leverage: Algorithms that dynamically reduce leverage during periods of heightened volatility help protect against rapid liquidations while optimizing funding rate arbitrage.

- Liquidity-Aware Stop-Loss Orders: Smart stop-losses that account for order book depth ensure better execution prices and help avoid slippage or manipulation.

- Risk Dashboards: Real-time monitoring of collateral across pools with auto-withdrawal triggers in critical scenarios gives traders proactive control over their exposures.

Tackling Real-Time Risk: The Power of Automation

The integration process isn’t just about displaying numbers, it’s about actionable automation. For instance, incorporating bots that automatically rebalance margin accounts or trigger stop-losses based on liquidity conditions can dramatically reduce manual workload and mitigate risks in fast-moving markets. With APIs like those from Hyperliquid (Oodles Blockchain) enabling direct data feeds into custom dashboards, traders can build tailored solutions where every perp trade is monitored in context with their entire portfolio.