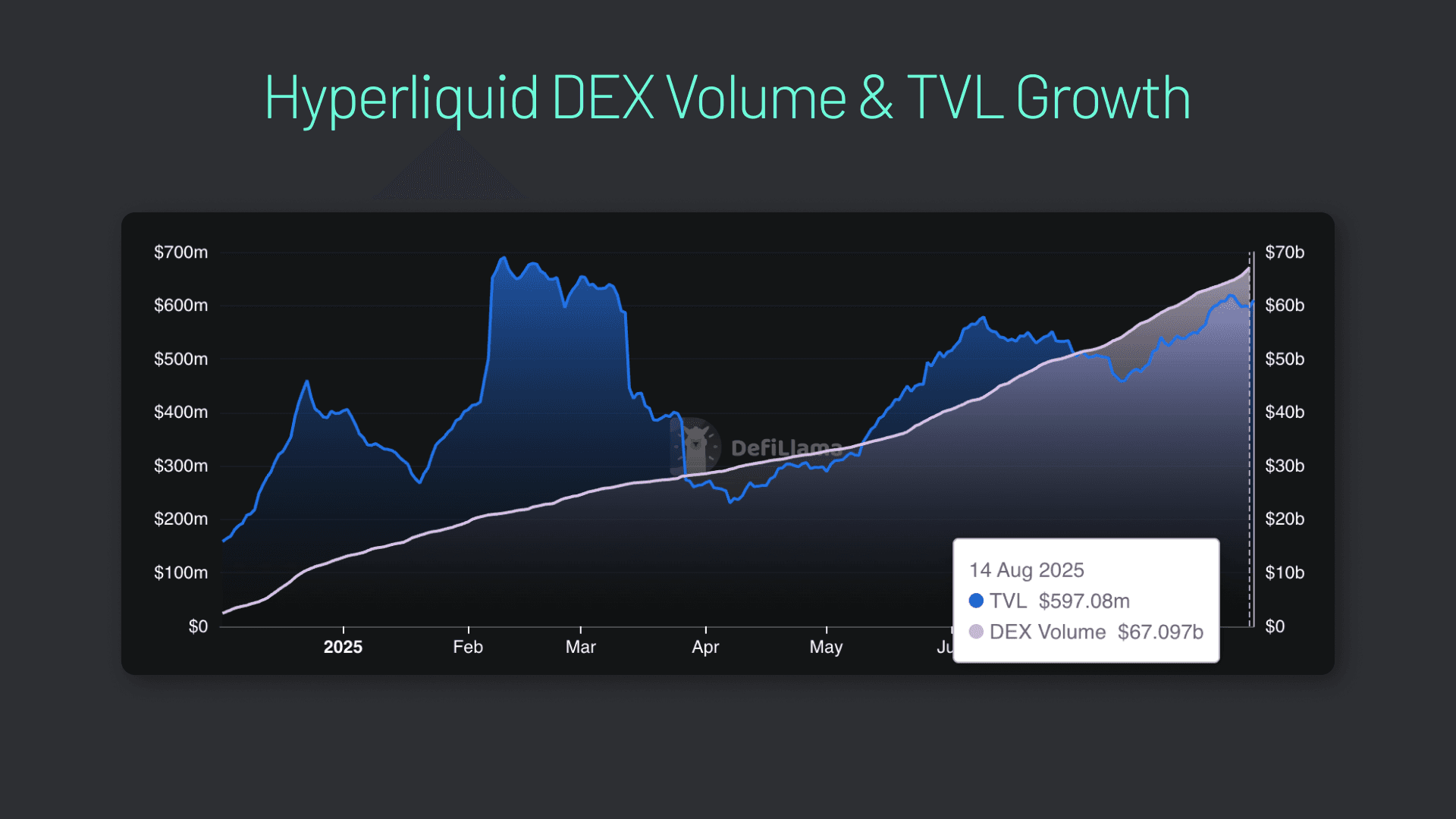

Perpetual decentralized exchanges (perps DEXs) have revolutionized crypto trading by combining the power of non-custodial, always-on blockchain infrastructure with the flexibility of perpetual futures contracts. Hyperliquid-Style Perps stands out as a premier platform in this space, offering lightning-fast execution, deep liquidity, and a seamless user experience for both beginners and seasoned traders. If you’re ready to take control of your trading journey and want a step-by-step guide to getting started, you’re in the right place.

Why Trade Perpetuals on Hyperliquid-Style Perps?

Hyperliquid’s unique architecture is built on its proprietary Layer-1 blockchain, HyperEVM, enabling up to 200,000 transactions per second. This technical backbone provides unmatched speed and reliability for perpetual contract trading. Whether you’re interested in Bitcoin (BTC), Ethereum (ETH), or other major assets, Hyperliquid allows traders to access up to 50x leverage without giving up custody of their funds. There’s no registration required, just connect your EVM-compatible wallet or use an email login to get started.

Tip: Your aggregate winning trades should ideally outpace your losing trades by at least a 2: 1 ratio. Consistent risk management is crucial for success on any perps DEX.

Step-by-Step: Setting Up Your Trading Environment

The onboarding process is refreshingly simple:

- Set Up an EVM-Compatible Wallet: Download MetaMask or another compatible wallet extension.

- Fund Your Wallet: Acquire USDC (for collateral) and ETH (for transaction fees) on the Arbitrum network.

- Bridge Assets: Use Hyperliquid’s bridge service to transfer funds from Arbitrum into your Hyperliquid account.

- Connect and Deposit: Sign into Hyperliquid by connecting your wallet or using email authentication. Deposit USDC into your trading account to begin.

This streamlined approach removes unnecessary friction while maintaining security and transparency, a hallmark of modern DeFi platforms. For more details on perpetual contract mechanics unique to Hyperliquid-only perps (“Hyperps”), visit the official documentation.

Key Benefits of Hyperliquid-Style Perps Over Centralized Exchanges

-

Non-Custodial Trading: Hyperliquid allows you to retain full control of your funds by connecting directly with a non-custodial wallet, eliminating the need to trust a centralized exchange with your assets.

-

No Registration Required: Begin trading instantly on Hyperliquid without lengthy sign-up or KYC processes—simply connect your wallet or use an email to access the platform.

-

High-Speed, Low-Latency Execution: Built on the proprietary HyperEVM Layer-1 blockchain, Hyperliquid supports up to 200,000 transactions per second, ensuring rapid order execution and minimal slippage compared to many centralized exchanges.

-

Deep Liquidity and Low Fees: Hyperliquid offers robust liquidity and competitive trading fees, providing tight spreads and cost-effective trading for both retail and professional users.

-

Advanced Risk Management Tools: Access sophisticated order types like stop-loss, trailing stop, and take-profit directly on-chain, empowering traders with greater control over their positions than many centralized platforms.

-

Transparent and Secure Environment: All trades and balances are verifiable on-chain, enhancing transparency and reducing the risk of exchange insolvency or mismanagement.

-

Innovative Perpetual Contracts: Hyperliquid’s unique Hyperps contracts do not require an underlying spot or index oracle price, offering new trading opportunities and reduced reliance on external data feeds.

Navigating the Trading Interface and Placing Your First Trade

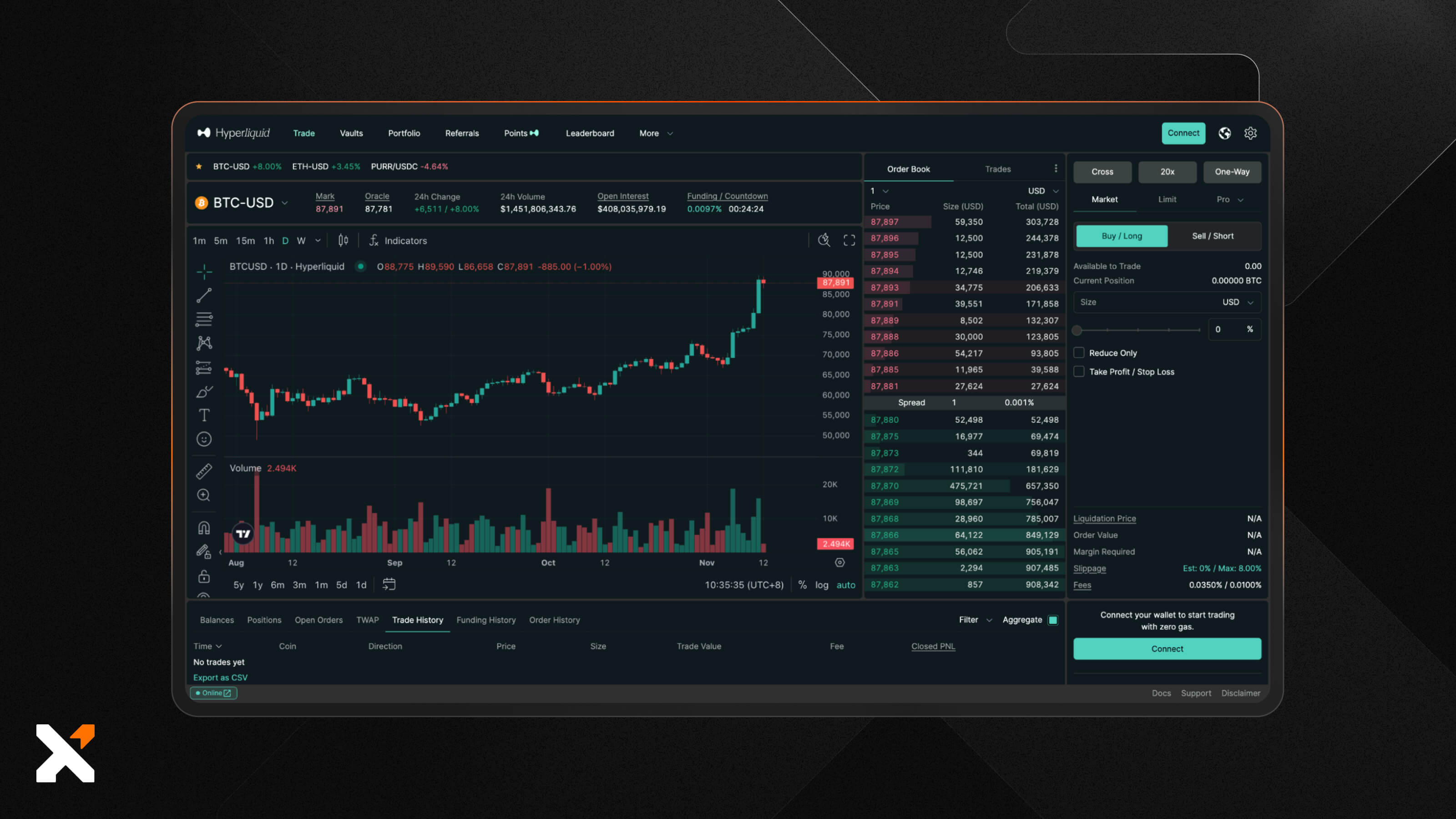

The heart of any perps DEX experience is its trading interface. Hyperliquid offers intuitive dashboards with real-time charts, live order book data, and clear position summaries. Traders can choose from various order types, market, limit, stop, trailing stop, enabling precise control over entry and exit points.

Your first trade can be broken down into these steps:

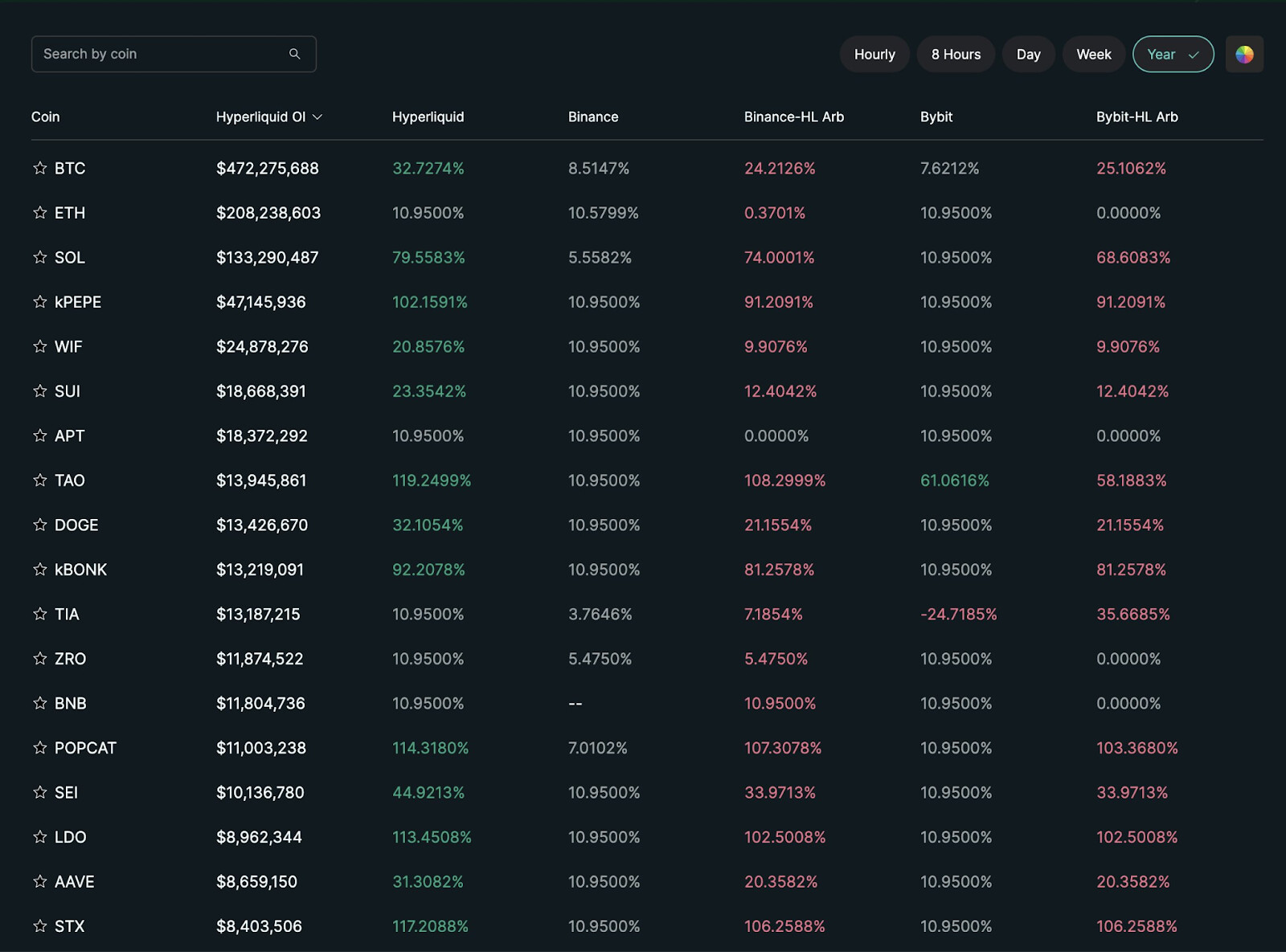

- Select a perpetual contract like BTC/USD or ETH/USD

- Adjust leverage according to your risk profile (up to 50x)

- Select order type based on strategy

- Specify position size in USDC terms

- Review all parameters carefully before confirming execution

The platform’s non-custodial model ensures you retain full control over your assets at every stage. For an in-depth tutorial with advanced strategies and interface walkthroughs, check out the official guide at hyperlliquid.trading.