Hyperliquid’s equity perpetuals have rapidly ascended to occupy 9.25% of the platform’s total perpetuals volume, a testament to the transformative momentum unleashed by the HIP-3 upgrade. Activated on October 13,2025, this protocol enhancement introduced permissionless market creation, where deployers stake 500,000 HYPE tokens to launch custom perpetual futures. This mechanism, coupled with the November 2025 rollout of ‘Growth Mode’ slashing taker fees by over 90% to 0.0045%-0.009%, has catalyzed explosive adoption among traders seeking onchain equity perpetuals. Assets like TradeXYZ, mimicking major U. S. equities, have driven this surge, positioning Hyperliquid as a frontrunner in stock perps DEX innovation.

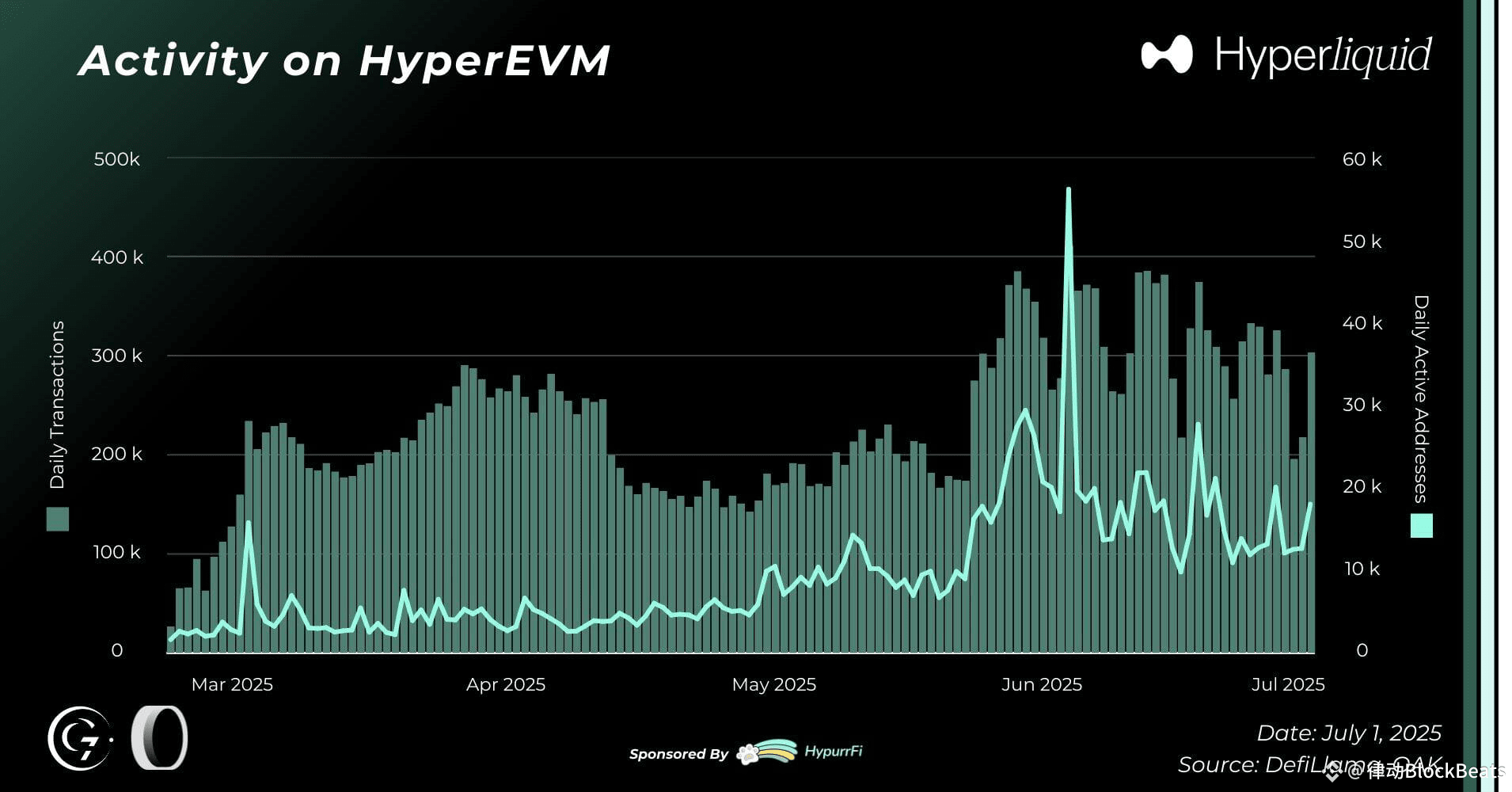

The broader context reveals Hyperliquid’s dominance in decentralized futures, with recent weekly volumes hitting $40.7 billion per CryptoRank and DefiLlama data. Yet, within this ecosystem, HIP-3 markets stand out, amassing over $10 billion in cumulative volume per Hyperzap, underscoring sustained trader interest in HIP-3 Hyperliquid offerings.

Record $1 Billion Volume Milestone in HIP-3 Markets Driven by TradeXYZ Assets

The pinnacle of this growth materialized when HIP-3 markets shattered the $1 billion daily volume barrier for two consecutive days, propelled primarily by TradeXYZ assets. These synthetic instruments, tracking equity indices and individual stocks, have resonated with traders accustomed to traditional markets but drawn to DeFi’s 24/7 accessibility and leverage. Phemex reports underscore how this milestone reflects not fleeting hype, but structural demand for low-latency Hyperliquid equity perps.

From a macro perspective, this surge aligns with broader market cycles where equities regain prominence amid stabilizing interest rates. Hyperliquid’s infrastructure, optimized for high-frequency execution, captures this flow efficiently, outpacing centralized counterparts in transparency and cost. The TradeXYZ suite, including proxies for tech giants and indices like XYZ100 – now the platform’s sixth-most traded market – exemplifies how HIP-3 democratizes access to global equities onchain.

Open Interest Surpasses $500 Million Reflecting Strong Trader Commitment

Complementing the volume explosion, open interest in HIP-3 markets has eclipsed $500 million, signaling deep conviction among participants. This metric, often a leading indicator of sustained activity, surpasses initial projections and hints at maturing liquidity pools. In volatile crypto environments, such levels indicate risk-managed positions rather than speculative froth, a pattern I’ve observed across 18 years in commodities and bonds.

Builders launching equity-style perps under HIP-3 contribute to this depth. Strategic moves, like Hyperion DeFi’s HAUS partnership with Felix providing 500,000 HYPE for custom markets, illustrate institutional buy-in. This staking requirement aligns incentives, ensuring only committed deployers enter, which fosters quality and longevity in commodity perps Hyperliquid extensions.

HIP-3 vs Total Platform Metrics 🚀

| Metric 🎯 | HIP-3 / Equity Perps 💹 | Details & Share 📈 |

|---|---|---|

| Cumulative Volume | $1B Milestone | Driven by TradeXYZ Assets; Part of Surge to 9.25% Equity Share 🚀 |

| Open Interest | > $500M | Reflecting Strong Trader Commitment 💪 |

| Equity Share | 9.25% | Of Total Platform Perps Volume 📊 |

| Daily Volume | > $80M | For Key HIP-3 Perps Weeks Post-Launch ⚡ |

Equity Perps Achieve 9.25% Share of Total Platform Perps Volume

Perhaps most telling is the ascension of equity perps to 9.25% of Hyperliquid’s total perps volume, up from negligible levels post-HIP-3 launch. This share, derived from DefiLlama’s volume breakdowns, positions equities as a core pillar alongside crypto natives. HIP-3’s permissionless framework, with economic hooks like staking, auctions, and fee shares, morphs Hyperliquid into an ‘exchange-of-exchanges, ‘ per MONOLITH analysis.

Growth Mode’s fee compression has been pivotal, drawing volume from higher-cost venues. The XYZ100 index’s rapid climb to top-tier status exemplifies this, as traders arbitrage traditional market hours with perpetuals’ nonstop trading. Conservative estimates from Perplexity suggest HIP-3 open interest could hit $1 billion by 2026 with 93.5% probability, potentially $4 billion at 60.5% odds, reinforcing long-term viability.

HIP-3 Growth Drivers

-

Record $1 Billion Volume Milestone in HIP-3 Markets Driven by TradeXYZ Assets: Hyperliquid’s HIP-3 markets exceeded $1 billion in trading volume for two consecutive days, propelled by TradeXYZ assets such as equity indices, according to Phemex data. This milestone underscores the explosive demand for permissionless equity-style perpetuals post-HIP-3 activation on October 13, 2025.

-

Open Interest Surpasses $500 Million Reflecting Strong Trader Commitment: Open interest in HIP-3 markets has climbed above $500 million, signaling robust trader confidence and positioning for leveraged exposure. This growth aligns with HIP-3’s staking mechanism requiring 500,000 HYPE tokens per market launch, fostering committed deployers and liquidity.

-

Equity Perps Achieve 9.25% Share of Total Platform Perps Volume: Equity perpetuals now represent 9.25% of Hyperliquid’s total perp trading volume, a sharp rise driven by diverse markets like the XYZ100 index, which ranks as the platform’s sixth highest traded asset.

-

Daily Volume Exceeds $80 Million for Key HIP-3 Perps Just Weeks Post-Launch: Leading HIP-3 perpetuals have sustained over $80 million in daily volume within two weeks of launch, amplified by November 2025’s ‘Growth Mode’ slashing taker fees by over 90% to 0.0045%–0.009%, per FalconX and Tekedia analyses.

Daily volumes exceeding $80 million for flagship HIP-3 perps, mere weeks after inception, further validate this trajectory. FalconX notes one live perp alone achieving this, with Unchained Crypto reporting $500 million synthetic volumes from new equity markets. These drivers collectively propel Hyperliquid perps volume share upward, blending DeFi efficiency with equity familiarity.

Builders and deployers, incentivized by HIP-3’s stake-and-auction model, have rapidly expanded the equity perps roster, fueling this $80 million daily volume benchmark. FalconX highlights how a single live HIP-3 perp achieved this threshold within two weeks, a pace that rivals established crypto perps. This isn’t mere speculation; it’s a function of Hyperliquid’s low-latency architecture meeting real demand for onchain equity perpetuals that mirror TradFi instruments without the gatekeepers.

Daily Volume Exceeds $80 Million for Key HIP-3 Perps Just Weeks Post-Launch

Unchained Crypto’s reporting of $500 million in synthetic trading volume on a single day post-upgrade further amplifies this narrative. Equity-style markets, launched permissionlessly, tapped into pent-up interest from traders bridging crypto and stocks. The TradeXYZ assets, central to the $1 billion milestone, continue to anchor daily flows, with XYZ100’s ascent to sixth place underscoring product-market fit. From my vantage in macro cycles, this mirrors commodity perps expansions during equity bull phases, where diversification drives platform stickiness.

Yet, sustainability hinges on liquidity maturation. Open interest at over $500 million provides a buffer against volatility, but deployers must navigate auction dynamics and fee shares judiciously. HIP-3’s ‘exchange-of-exchanges’ ethos, as MONOLITH terms it, rewards quality over quantity, weeding out undercapitalized markets through the 500,000 HYPE stake barrier.

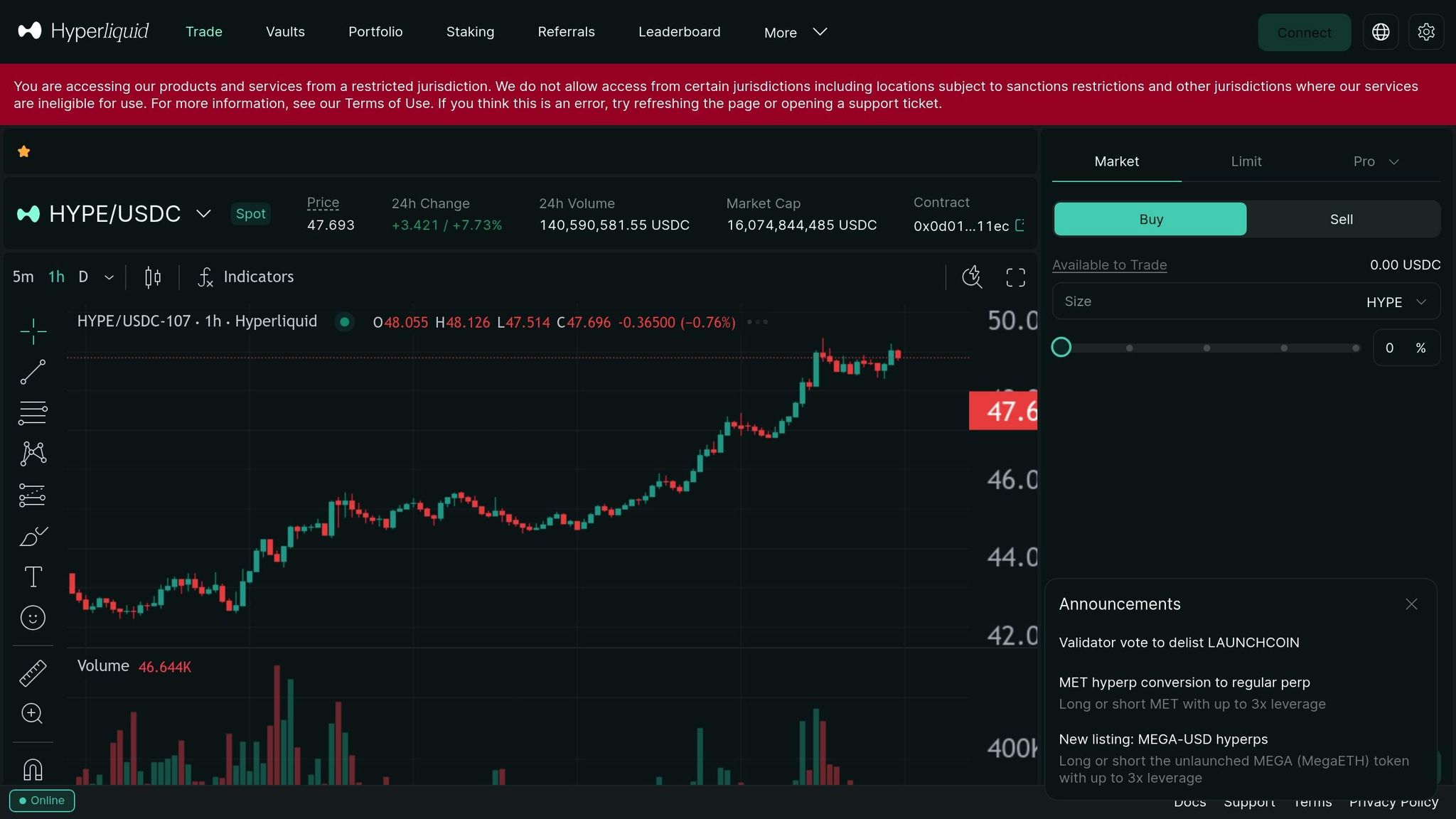

Hyperliquid Technical Analysis Chart

Analysis by Trevor Walsh | Symbol: BYBIT:HYPEUSDT | Interval: 1W | Drawings: 6

Technical Analysis Summary

As Trevor Walsh, apply conservative trend lines highlighting the dominant downtrend from the October 2026 peak, using ‘trend_line’ from high at 2026-10-15 (~$58) to recent low at 2026-03-10 (~$28). Draw horizontal lines for key support at $28-$30 and resistance at $40-$45. Use ‘rectangle’ for late consolidation zone Feb-Mar 2026 between $28-$35. Mark volume decline with ‘callout’ on diminishing bars post-Dec 2026. Add ‘text’ annotations for macro context tying HIP-3 volume surge to price caution. Fib retracement from peak to trough for potential pullback levels. Vertical line at 2026-12-01 for breakdown. Entry zone ‘long_position’ at $29 support with tight stop.

Risk Assessment: medium

Analysis: Bearish technicals clash with bullish HIP-3 fundamentals ($10B volume, OI growth); low conviction reversal without higher lows/volume. Volatility high in crypto despite macro parallels to commodities.

Trevor Walsh’s Recommendation: Hold cash, monitor for support hold and MACD flip. Small position only on confirmation—preserve capital first.

Key Support & Resistance Levels

📈 Support Levels:

-

$28.5 – Strong volume cluster low from Feb-Mar 2026, aligns with 61.8% fib retracement.

strong -

$25 – Psychological round number and chart bottom, potential panic support.

weak

📉 Resistance Levels:

-

$40 – Mid-Dec 2026 swing high, now overhead barrier with moderate volume.

moderate -

$50 – November 2026 consolidation lid, key reclaim level for bull reversal.

strong

Trading Zones (low risk tolerance)

🎯 Entry Zones:

-

$29 – Bounce from strong support $28.5 amid HIP-3 fundamental tailwinds, low-risk dip buy if volume picks up.

low risk

🚪 Exit Zones:

-

$35 – Initial profit target at minor resistance ahead of $40 hurdle.

💰 profit target -

$27 – Tight stop below key support to preserve capital per low tolerance.

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: declining on downside

High volume exhaustion at peak, now fading red bars signal weakening sellers—potential base forming.

📈 MACD Analysis:

Signal: bearish crossover persisting

MACD histogram contracting negative, line below signal—confirms downtrend but watch for bullish divergence.

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Trevor Walsh is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (low).

These four pillars – the $1 billion volume milestone via TradeXYZ, $500 million open interest, 9.25% equity share, and $80 million daily volumes – interlock to elevate Hyperliquid perps volume share. They reflect not just tactical wins, but a strategic pivot toward hybrid assets blending DeFi speed with equity depth. Growth Mode’s fee slash to 0.0045%-0.009% amplified this, compressing spreads and inviting arbitrageurs who previously shunned onchain venues.

Looking ahead, Perplexity’s consensus points to $1 billion HIP-3 open interest by 2026 at 93.5% likelihood, with $4 billion plausible at 60.5%. Conservative positioning favors the lower bound, accounting for potential macro headwinds like renewed rate hikes or regulatory scrutiny on synthetic equities. Institutional plays, such as Hyperion DeFi’s Felix partnership, signal deeper capital inflows, potentially stabilizing thinner tails of the order book.

Institutional adoption merits scrutiny. HAUS agreements, mandating HYPE provision for custom perps, align deployer and platform incentives, mitigating rug-pull risks endemic to permissionless systems. This economic flywheel – stake to launch, capture fees, share revenue – fortifies Hyperliquid against volume cannibalization seen in fragmented DEX landscapes. My 18-year lens on bonds and commodities reveals parallels: durable protocols thrive on aligned skin-in-the-game, much like collateralized debt obligations weathered cycles through overcollateralization.

Equity perps’ 9.25% slice, while impressive, leaves ample runway. Crypto natives still dominate, but as TradFi liquidity pools into DeFi amid tokenization waves, this share could double. Traders leveraging 10x on stock perps DEX offerings gain 24/7 exposure sans settlement delays, a boon in gapped overnight moves. Hyperliquid’s edge lies in execution: sub-millisecond orders on a fully onchain L1, audited for resilience.

Risk management remains paramount. Leverage amplifies drawdowns; I’ve counseled clients through commodity squeezes where OI spikes preceded liquidations. HIP-3 markets, buoyed by $500 million open interest, exhibit nascent resilience, but position sizing below 5% portfolio allocation suits conservative mandates. Volatility metrics, implied from perp bases, hover at equity-like levels, underscoring the asset class fusion.

Hyperliquid’s HIP-3 trajectory positions it as a DeFi bellwether, where equity perps catalyze broader adoption. TradeXYZ’s volume leadership, coupled with OI depth and fee incentives, forges a virtuous cycle. Platforms ignoring such innovations risk obsolescence in the perpetuals arena, as traders prioritize composability and capital efficiency. This surge to 9.25% share marks a maturation point, inviting measured capital deployment for those attuned to long-horizon cycles.