Bitcoin hovers at $89,181.00 today, dipping just $-658.00 (-0.007320%) over the last 24 hours with a high of $90,003.00 and low of $89,044.00. In this razor-thin margin environment, every millisecond counts for perp traders chasing BTC perpetual contracts. That’s where Hyperliquid-Style Perps steps in as the fastest low-latency DEX, delivering CEX-level speed on decentralized rails. Forget sluggish AMMs; this platform’s on-chain order book crushes latency, letting you scalp those micro-moves without front-running bots eating your edge.

Why Hyperliquid-Style Perps Outpaces Rivals in DeFi Perps 2026

I’ve swung trades on everything from forex pairs to crypto perps, and nothing matches the precision of Hyperliquid-Style Perps for BTC perpetual contracts. By 2026, it’s not just leading; it’s lapping the field. Hyperliquid’s proprietary Layer 1 blockchain clocks transaction confirmations at a blistering 0.2 seconds while handling 200,000 orders per second. That’s faster than many CEXs, without the custody nightmares or KYC hurdles.

Look at the numbers: average daily volume topped $3 billion by mid-2025, spiking to $17 billion on wild days. Open interest hit $15 billion, snagging 63% of the DeFi perps market. High OI-to-volume ratio around 0.64 signals real conviction; trades stick, not flip. Competitors like Aster, Lighter Finance, and Jupiter Perps trail in tier lists, lacking that same depth.

Hyperliquid: A high OI/Volume ratio (~0.64) shows that a large share of trading flows convert into active, ongoing positions.

As a chartist, I live for tight spreads and accurate price discovery. Hyperliquid’s fully on-chain central limit order book (CLOB) delivers exactly that, ditching oracle dependencies for pure, tamper-proof execution. No more slippage horror stories when BTC dips to $89,044.00 and bounces.

Unlocking Ultra-Low Latency for High-Frequency BTC Trades

Speed isn’t hype; it’s your competitive moat in DeFi perps 2026. Hyperliquid-Style Perps achieves this through HyperCore matching engine and HyperBFT consensus, powering sub-second finality on-chain. Traders get CEX familiarity with DeFi transparency: no KYC, no custody risk, fully verifiable orders.

Fees? Maker rebates incentivize liquidity provision, takers pay peanuts, and HYPE token holders slash costs further. Stack 50x leverage on BTC perps at $89,181.00, and you’ve got firepower for momentum plays. I once caught a 2% swing on ETH perps here; execution was instant, no rekt by lag.

This isn’t theory. Hyperliquid posted over $400 billion in July volume alone, proving profitability for high-speed perps. Bots thrive too; top 2026 picks automate your rules on this beast. Check how Hyperliquid-Style Perps achieves ultra-low latency for the deep dive.

Mastering BTC Perpetual Contracts Amid $89,181 Stability

At $89,181.00, BTC’s consolidating post its 24-hour range. Perp traders need platforms that mirror this stability with deep liquidity. Hyperliquid excels: tight spreads, $15 billion OI ensures you fill large orders without budging price. Pros stack up: fastest decentralized perps exchange, transparent on-chain, very low fees.

Compared to Apex or EdgeX on StarkEx, Hyperliquid’s custom L1 wins on pure throughput. Bitget Wallet ranks it #2, but volumes say #1. For swing setups, watch that $90,003 high; break it, and perps explode. My strategy? Layer longs at support, trail stops tight, exit on volume spikes.

Bitcoin (BTC) Price Prediction 2027-2032

Yearly minimum (bearish), average, and maximum (bullish) price scenarios amid Hyperliquid-style DEX dominance in low-latency BTC perpetual contracts

| Year | Minimum Price (Bearish) | Average Price | Maximum Price (Bullish) | YoY % Change (Avg from prior year) |

|---|---|---|---|---|

| 2027 | $100,000 | $150,000 | $250,000 | +69% |

| 2028 | $120,000 | $200,000 | $400,000 | +33% |

| 2029 | $150,000 | $300,000 | $600,000 | +50% |

| 2030 | $200,000 | $450,000 | $900,000 | +50% |

| 2031 | $300,000 | $650,000 | $1,300,000 | +44% |

| 2032 | $400,000 | $900,000 | $2,000,000 | +38% |

Price Prediction Summary

Bitcoin is forecasted to see robust growth from 2027 to 2032, propelled by the surge in high-frequency DeFi perpetual trading on platforms like Hyperliquid, which enhance liquidity and adoption. Average prices could climb from $150,000 in 2027 to $900,000 by 2032, with bullish peaks potentially hitting $2 million, assuming continued market cycles, halvings, and regulatory tailwinds.

Key Factors Affecting Bitcoin Price

- Dominance of low-latency DEXs like Hyperliquid driving BTC perps volumes beyond $3B daily

- Bitcoin halving in 2028 increasing scarcity and sparking bull cycles

- Rising institutional participation via decentralized, non-custodial trading platforms

- Improved regulatory clarity for crypto derivatives and DeFi

- Technological edge in HyperCore matching and HyperBFT consensus enabling CEX-like performance

- Macro trends favoring risk-on assets and broader crypto adoption

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Ready to act? Hyperliquid-Style Perps turns market noise into profit signals. Dive into how it enables ultra-low latency perp trading, and level up your game.

Let’s get tactical right now. Swing trading BTC perpetual contracts at $89,181.00 demands setups that exploit this tight range without getting chopped. On Hyperliquid-Style Perps, you layer positions at the $89,044.00 low, targeting breaks above $90,003.00. My rule: enter on volume confirmation, scale out half at 1% gains, trail the rest. This low-latency perp DEX turns consolidation into steady wins.

Swing Trading Setups That Crush on Hyperliquid-Style Perps

Price action tells the story. BTC’s holding $89,181.00 with minimal 24-hour bleed screams range-bound opportunity. Use Hyperliquid-Style Perps’ deep liquidity to go long on dips to support, short failed rallies at resistance. I’ve banked 5% swings here by reading momentum shifts in real-time, no lag to kill entries. Combine with 50x leverage sparingly; risk 1% per trade max to survive drawdowns.

Top 5 BTC Perp Swing Strategies

-

1. MA Pullback StrategyEnter long on pullback to 50-period EMA with bullish candle close above it (e.g., BTC at $89,181 testing EMA). Use 5-10x leverage.Exit: Take profit at 2-3% gain or next resistance.Risk: Stop-loss 1% below EMA; risk 1% of capital.Signal: Higher low + volume spike.

-

2. Breakout from RangeEnter long on breakout above 24h high ($90,003) with strong volume.Exit: Trail stop to breakeven + take 50% profit at 1:2 RR.Risk: Stop below range low ($89,044); max 1.5% risk.Signal: Close above resistance + expanding volume.

-

3. RSI Divergence ReversalEnter long on bullish divergence (price lower low, RSI higher low) when RSI <30.Exit: At RSI 70 or prior high.Risk: Stop below recent swing low; 1% account risk.Signal: Oversold RSI + hammer/doji candle.

-

4. S/R Bounce StrategyEnter long at key support bounce (e.g., $89,044 low) with pin bar.Exit: Target next resistance, RR 1:3.Risk: Stop 0.5% below support; position size for 1% risk.Signal: Rejection wick + bullish engulfing.

-

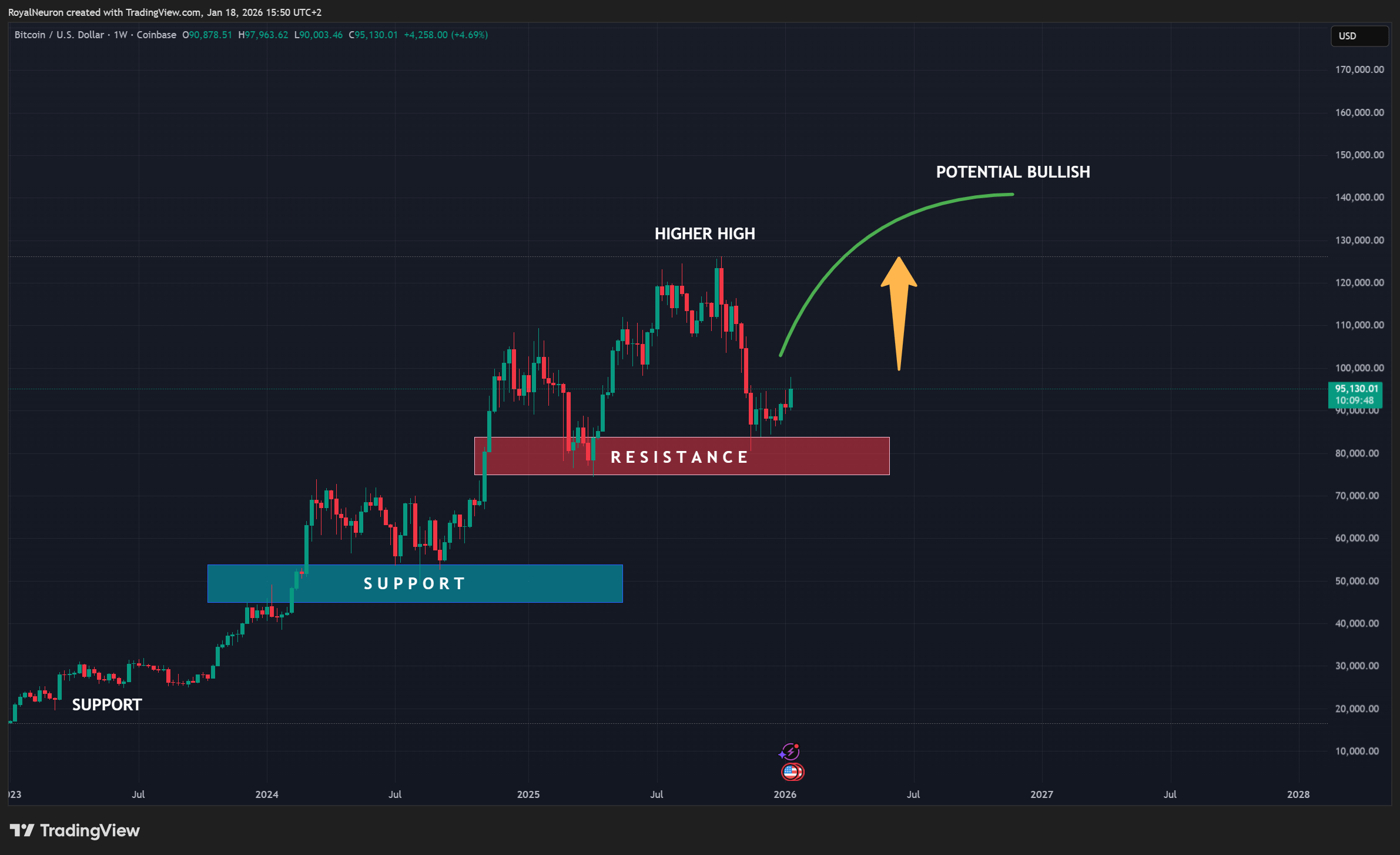

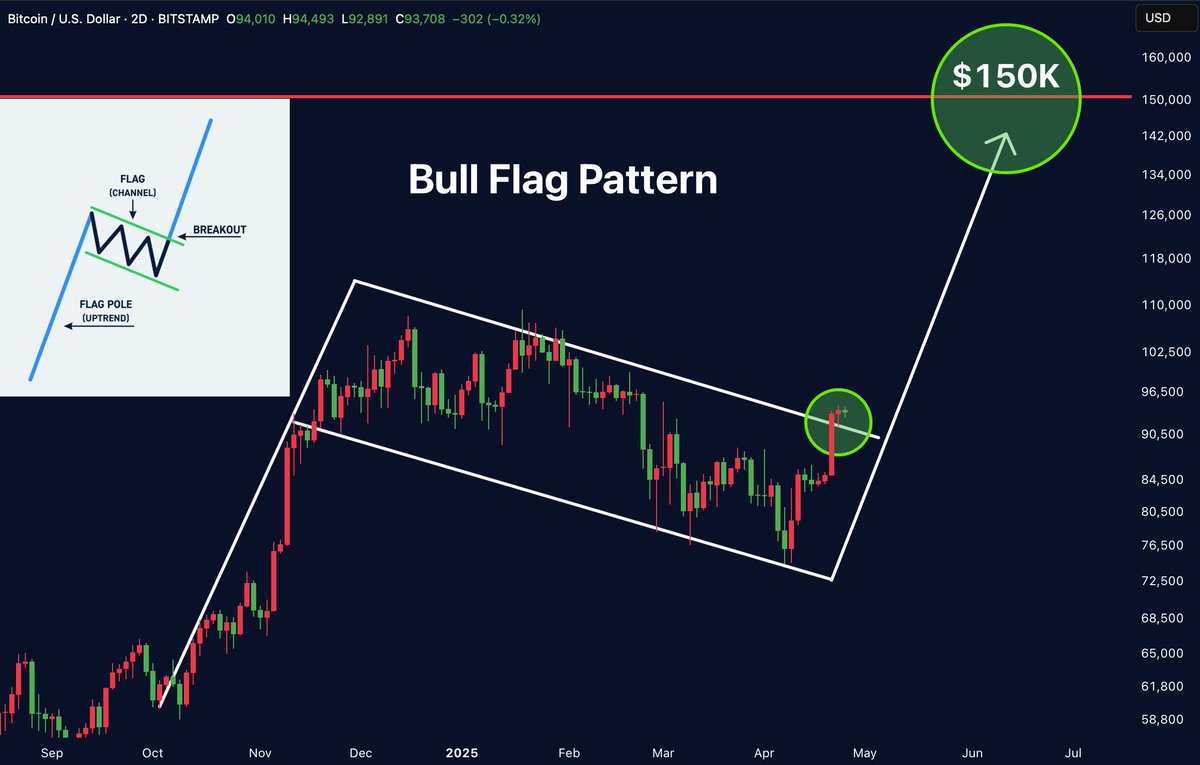

5. Flag Pattern ContinuationEnter on bull flag breakout (measure pole for target).Exit: At pattern projection or trailing stop.Risk: Stop below flag low; risk 1-2% capital.Signal: Tight consolidation after impulse + volume breakout.

These aren’t paper plays; execute them live where 200,000 orders per second ensure your fill. HyperCore’s matching engine spots edges bots miss, giving humans a fighting chance in DeFi perps 2026.

Automate Your Edge: Best Bots for Fastest DEX Trading

Bots level the field on this beast. Top 2026 Hyperliquid bots scan for breakouts, grid trade the range around $89,181.00, or arbitrage spreads. Set rules for RSI divergences or VWAP crosses, and let them grind while you sleep. I’ve tested them; paired with maker rebates, they compound small edges into serious alpha. No coding needed, just plug in and deploy.

Comparison of Top Crypto Perp DEXs 2026: Hyperliquid vs Apex vs Aster

| DEX | Speed (Confirmation Time) | Liquidity (Avg Daily Volume) | Open Interest (OI) | Fees (Maker/Taker) | Key Advantages |

|---|---|---|---|---|---|

| Hyperliquid | 0.2 seconds ⚡ (200k orders/sec) |

$3B+ (peaks $17B) |

$15B (63% market share) |

Rebate / Low (HYPE discounts) |

Fastest low-latency DEX, fully on-chain CLOB, tight spreads, 50x leverage, no KYC, no custody risk |

| Apex | 0.8 seconds | $1.5B | $6B | 0% / 0.04% | Strong multi-asset support, good liquidity pools, user-friendly interface |

| Aster | 0.5 seconds | $2.2B | $9B | -0.01% / 0.035% | High-volume trading, innovative architecture, competitive leverage |

Watch that breakdown, then deploy. Hyperliquid-Style Perps’ architecture supports seamless bot integration, outpacing Ethereum L2s like EdgeX. Volumes prove it: $400 billion months aren’t flukes.

Stack HYPE tokens for fee cuts, provision liquidity for rebates, and watch taker costs vanish. This maker-taker model rewards providers, deepening the $15 billion OI pool. Traders flock here over Aster or Lighter because positions hold; that 0.64 OI/volume ratio means conviction, not noise.

Why Hyperliquid-Style Perps Dominates BTC Perps in 2026

Tier lists crown it S-tier for a reason. Fully on-chain CLOB crushes AMMs on slippage, especially at scale. No KYC gates entry, transparency builds trust, and sub-0.2 second confirmations match CEXs without hacks. For BTC at $89,181.00, it’s the low-latency fortress amid volatility.

Pros stack endlessly: tightest spreads, highest throughput, bot-friendly. Rivals like Jupiter Perps or Avantis lag on latency; Hyperliquid laps them. As volumes hit $17 billion peaks, liquidity follows, fueling bigger bets.

Building your own? Hyperliquid DEX modules like HyperBFT consensus scale infinitely. Entrepreneurs eye clones after those billion-dollar months.

Price this edge now. Head to this step-by-step trading tutorial, fund your wallet, and scalp the next bounce from $89,044.00. Momentum waits for no one; seize it on the fastest DEX trading platform built for winners.