Imagine placing a trade on a decentralized exchange and getting filled in less time than it takes to blink. In 2025, this isn’t just a dream for DeFi power users, it’s the new standard, thanks to sub-second execution on perpetual DEXs. The transformation is seismic: we’re seeing on-chain trading engines rivaling centralized exchanges (CEXs) not just on transparency and custody, but now on pure speed. For traders who demand the tightest spreads and lowest latency, this is a game-changer.

The Rise of Sub-Second Execution: From Niche to Norm

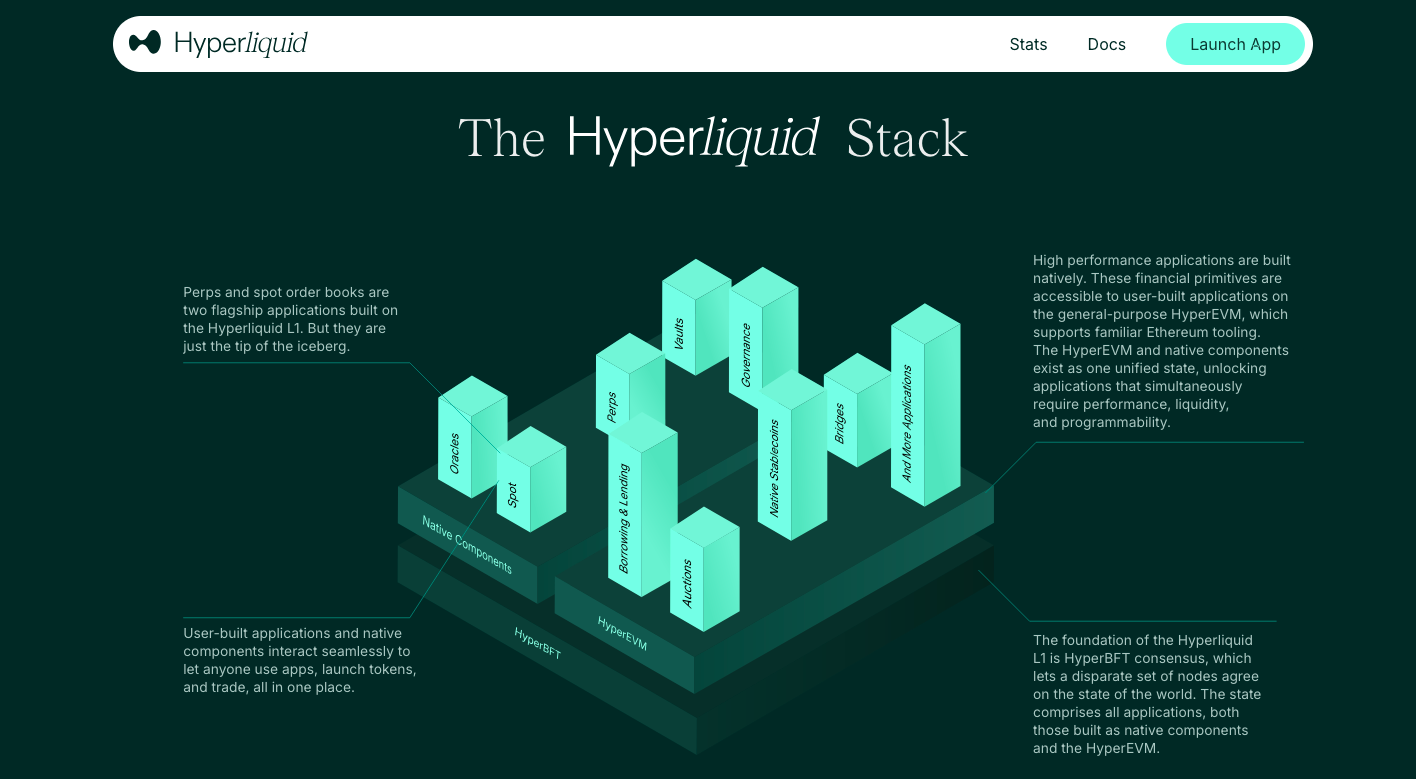

Just two years ago, most traders saw CEXs as the only viable option for lightning-fast order fills, especially during periods of high volatility. But with innovations like Hyperliquid’s custom Layer-1 blockchain and its HyperBFT consensus, we’ve entered a new era. Median order execution times are now clocking in at 0.2 seconds, with support for up to 100,000 orders per second. This isn’t marketing hype; it’s reshaping market structure from the ground up.

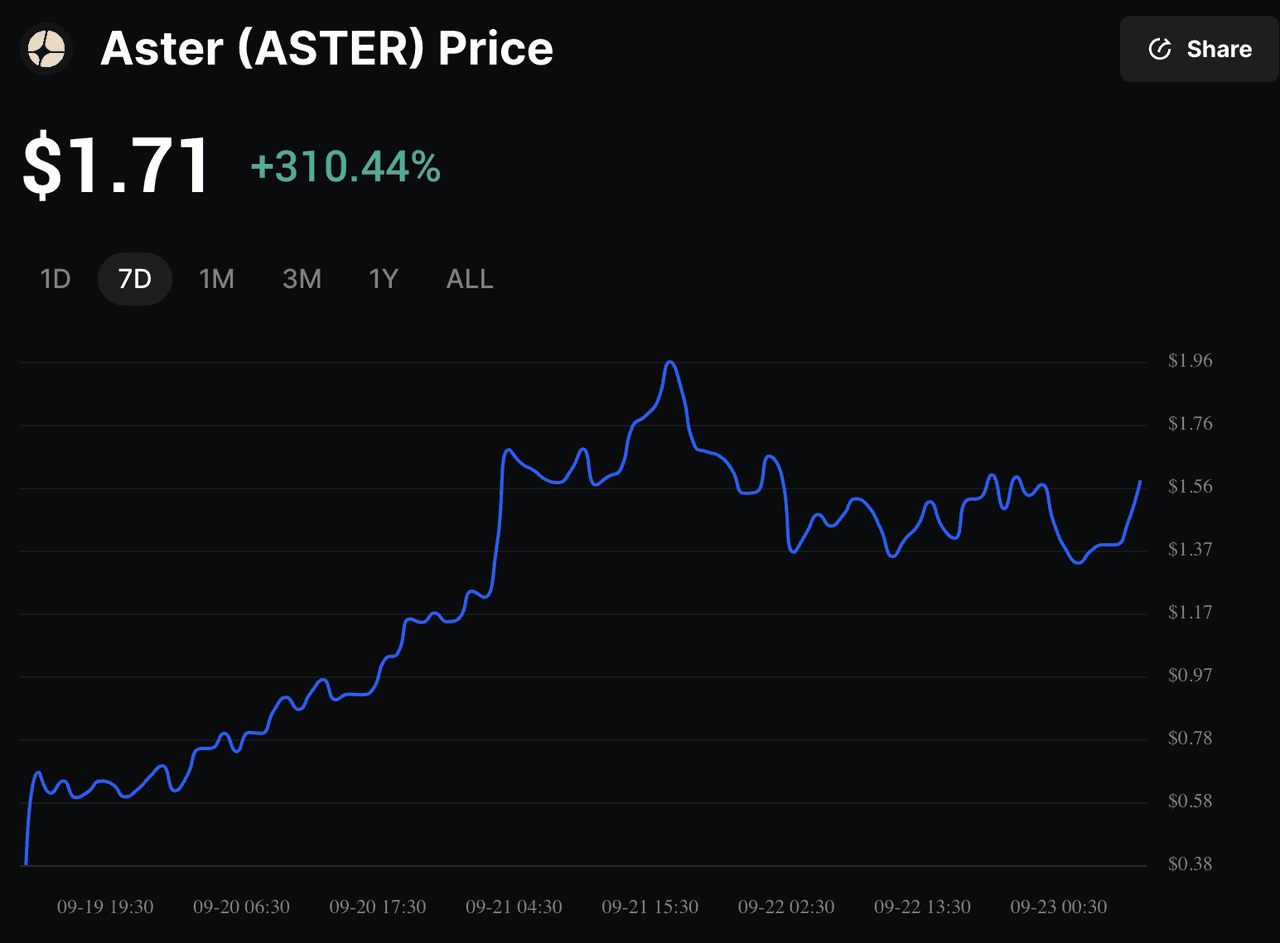

The impact? Perpetual DEXs have captured between 20% and 26% of global derivatives trading volume by mid-2025, up from single digits barely two years prior (see deep dive here). Monthly trading volumes have soared past $12 trillion, with platforms like Aster boasting TVLs over $1.14 billion. As liquidity deepens and slippage shrinks, even in wild markets, traders are migrating en masse to these next-gen platforms.

How Low-Latency DeFi Trading Is Changing the Game

The core driver behind this shift is simple: speed equals edge. In traditional finance, milliseconds can mean millions; DeFi is catching up fast. Sub-second execution reduces slippage dramatically, improves fill rates during volatile swings, and unlocks advanced strategies like arbitrage and scalping that were previously limited by on-chain lag.

This tech leap isn’t just about shaving off milliseconds for bragging rights, it’s about fundamentally changing who can compete in crypto markets. Retail traders now enjoy execution quality previously reserved for institutional desks. Meanwhile, innovative fee models, like Avantis’s zero-fee/profit-sharing or Paradex’s $0 taker fees, further sweeten the deal for active participants.

The Tech Behind Ultra-Fast Perpetual DEXs

So how are platforms like Hyperliquid doing it? The answer lies in purpose-built infrastructure:

- Custom Layer-1 blockchains: Designed specifically for high-throughput trading (not general-purpose smart contracts)

- HyperBFT consensus mechanisms: Achieving sub-second order finality without sacrificing decentralization or security

- Encrypted mempools: Preventing MEV front-running while preserving low-latency access

- Advanced risk engines: On-chain liquidation systems that manage leverage (up to 40x!) at speeds rivaling top-tier CEXs

This blend of speed and transparency has set off an arms race among perpetual DEXs, and traders are reaping the rewards. Platforms that can’t keep up risk losing users to those offering true real-time execution and deep liquidity pools.

If you want to explore more about how these technical breakthroughs work under the hood, check out our detailed breakdown of Hyperliquid-style perps architecture here.

As the dust settles on this new landscape, we’re witnessing a massive behavioral shift among traders. No longer are users content to wait for slow confirmations or risk outsized slippage on legacy DEXs. Instead, they’re demanding, and receiving, experiences that feel indistinguishable from top-tier centralized exchanges. The numbers speak volumes: with total value locked (TVL) in perpetual DEXs surpassing $1.85 billion and monthly trading volumes above $12 trillion, the credibility gap between DeFi and CeFi has never been smaller.

But it’s not just about speed or volume. The user experience has evolved in tandem with the technology. Modern interfaces now offer granular control over order types, real-time analytics, and seamless portfolio management, all secured by self-custody wallets. This empowers both professional and retail traders to execute sophisticated strategies without ceding control of their assets.

Top Features Traders Love About Sub-Second Perpetual DEXs

-

Lightning-Fast Order Execution: Platforms like Hyperliquid and dYdX deliver sub-second execution speeds (as low as 0.2 seconds), letting traders capture opportunities instantly—even during peak volatility.

-

Ultra-Low Slippage & High Fill Rates: Thanks to rapid order matching and deep liquidity, traders on platforms such as Paradex and Aster experience minimal slippage and consistently high fill rates, even in turbulent markets.

-

Zero or Ultra-Low Trading Fees: Innovative models like Avantis’s Zero-Fee/Profit Sharing and Paradex’s $0 taker fees make trading more profitable by reducing costs for active users.

-

Institutional-Grade Performance: With custom Layer-1 blockchains and consensus mechanisms like HyperBFT, DEXs now rival centralized exchanges in speed and reliability—supporting up to 100,000 orders per second and maintaining 99.99% uptime.

-

Explosive Growth in TVL and Market Share: The sector’s total value locked (TVL) has soared past $1.85 billion in 2025, with Aster alone reaching $1.14 billion, reflecting surging trader confidence and adoption.

What Sets 2025’s Low-Latency DeFi Trading Platforms Apart?

The competitive edge goes beyond raw throughput. Here’s what’s setting apart the leaders in today’s market:

- Zero/Low-Fee Models: Innovative pricing structures are making high-frequency trading more accessible and cost-effective than ever before.

- Unified Collateral Systems: Traders can deploy capital efficiently across multiple markets without having to shuffle funds between isolated pools.

- On-Chain Risk Management: Transparent liquidation engines and insurance funds reduce systemic risks while maintaining lightning-fast response times during volatility spikes.

- Global Accessibility: Permissionless access ensures anyone can participate, regardless of geography or account size, no KYC bottlenecks required.

This relentless innovation is also driving cross-chain compatibility, enabling seamless swaps and arbitrage opportunities across ecosystems like Aptos, Solana, Ethereum L2s, and beyond. If you’re curious about how unified collateral and sub-second finality work together to optimize your edge, our deep dive on evolving on-chain perpetual DEX trading is a must-read (see details).

The Next Frontier: Where Does Sub-Second Execution Take Us?

The arms race isn’t slowing down. As more capital flows into these platforms, Aster’s TVL alone reached $1.14 billion by late 2025, the pressure mounts for even faster execution, deeper liquidity, and smarter risk controls. We’re already seeing experiments with encrypted mempools that further minimize MEV exposure without sacrificing latency, as well as advanced hybrid orderbooks combining the best of both on-chain transparency and off-chain speed.

This all points toward a future where “decentralized” doesn’t mean “slow” or “clunky. ” Instead, the best DeFi trading platforms are setting new standards for performance while keeping user empowerment at their core. Whether you’re an algorithmic trader chasing microsecond arbitrage or a retail user seeking fair fills during volatile swings, sub-second execution is leveling the playing field like never before.

If you haven’t yet explored what low-latency DeFi can do for your strategy, or if you want to see how Hyperliquid-style perps stack up against other next-gen options, now is the time to dive in. The next wave of perpetual DEX innovation is already here; don’t let it pass you by.