Perpetual DEX aggregators are rapidly rewriting the playbook for on-chain leveraged trading. In an environment where fragmented liquidity and complex cross-chain processes have long been barriers to efficient DeFi participation, platforms like Vooi are emerging as pivotal solutions. By unifying liquidity across decentralized exchanges and blockchains, Vooi is delivering a trading experience that rivals centralized platforms in speed and depth – all while preserving the core benefits of self-custody and transparency.

Solving Fragmented Liquidity: The Aggregator Advantage

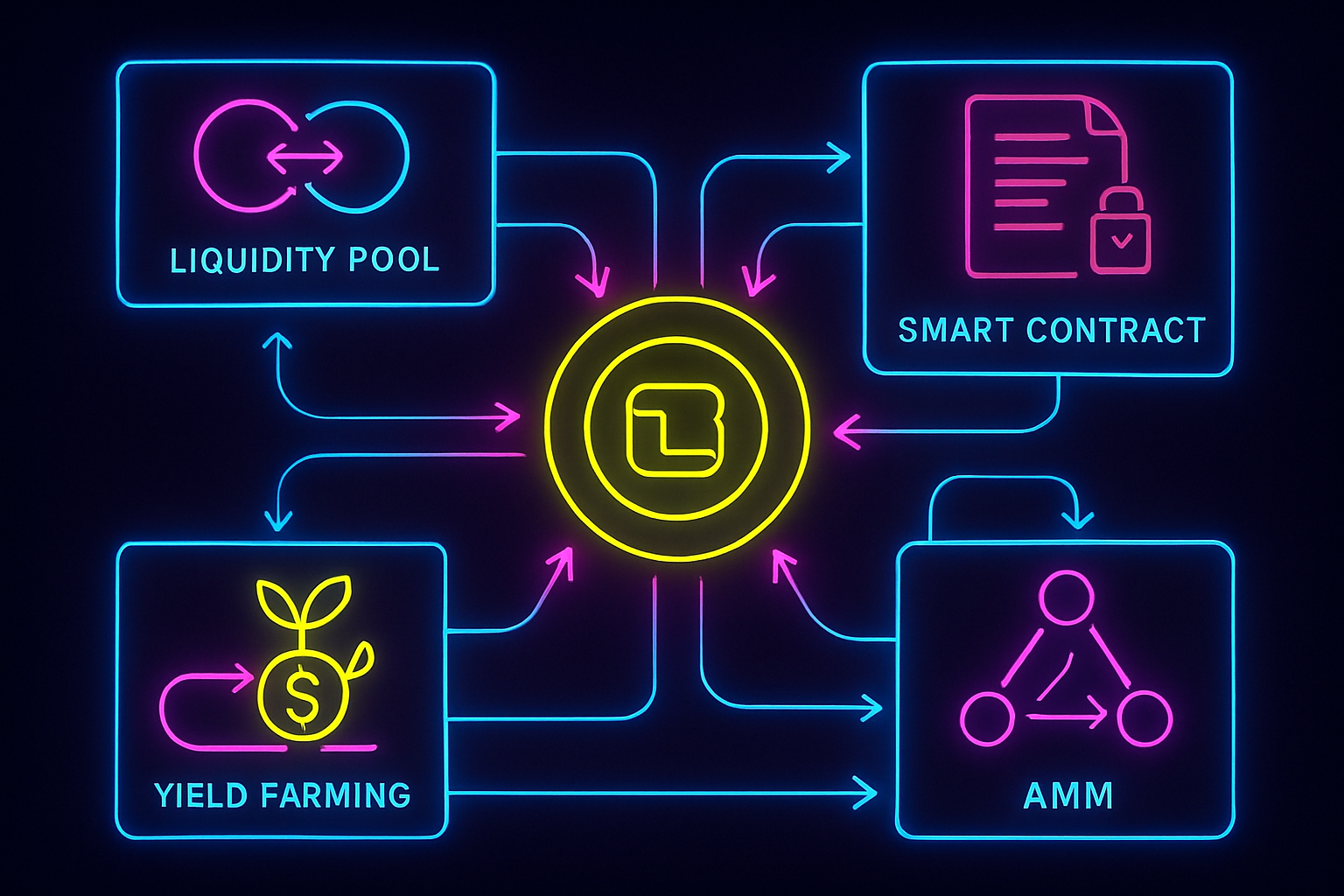

The perpetual DEX ecosystem has exploded with innovation over the past two years, but this growth has come at the cost of liquidity fragmentation. Traders seeking optimal execution have often been forced to juggle multiple wallets, interfaces, and networks just to access the best prices or pairs. Enter Vooi aggregator: by consolidating order books and liquidity from leading on-chain perpetuals like Hyperliquid, Lighter, Ostium, Orderly, KiloEx, and SynFutures across both EVM chains and Solana, Vooi creates a single point of access for leveraged trading.

This model not only improves price discovery but also enables larger trades with less slippage – a critical factor for both retail and professional participants. Real-time net exposure, margin utilization, and liquidation risk are abstracted into a unified portfolio view, giving traders a practical edge in volatile markets.

Chain Abstraction: Gasless Cross-Chain Trading Becomes Reality

Perhaps the most transformative innovation underpinning Vooi’s success is its implementation of chain abstraction. Traditionally, moving capital between blockchains has been a slow and costly process involving bridges or manual asset swaps. Chain abstraction removes these hurdles by enabling seamless cross-chain settlement under the hood. The result? Traders can open or close positions on any supported chain – including Ethereum-compatible networks and Solana – without ever leaving the Vooi interface or managing multiple wallets.

This technology also powers gasless transactions, allowing users to execute trades without paying network fees out-of-pocket. For active traders or high-frequency strategies, this represents a substantial reduction in operational friction and costs. It’s no surprise that this approach is setting new standards for what’s possible in perpetual trading DeFi.

The Power of Interoperability: Expanding Market Access

The ability to tap into diverse sources of liquidity isn’t just about better pricing; it’s about unlocking entirely new markets. Through integrations with protocols like SynFutures (and more than 17 blockchain networks), Vooi ensures that users aren’t limited by siloed ecosystems or protocol-specific offerings. This interoperability is already catalyzing broader adoption among sophisticated traders who demand flexibility without sacrificing efficiency.

For those interested in a deeper dive into how these mechanisms work under the hood – from smart routing systems to unified margin management – this detailed analysis explores why cross-chain perpetual aggregators are quickly becoming indispensable tools in the modern DeFi stack.

Interoperability also means that traders can respond to market opportunities as they arise, without waiting for slow asset transfers or worrying about network congestion. For example, if a price dislocation appears on a Solana-based perp DEX while the majority of your collateral is on an EVM chain, Vooi’s chain abstraction enables you to seize the opportunity instantly, no need to bridge assets or run multiple wallets. This is a fundamental shift from the fractured user experience that has long plagued DeFi leverage trading.

Vooi Aggregator: Standout Features Shaping DeFi Trading

-

Unified Portfolio View: Vooi consolidates all your perpetual trading positions across multiple DEXs and blockchains, providing a real-time, unified dashboard for net exposure, margin utilization, and liquidation risk—all in one place.

-

Gasless Trading: Thanks to Vooi’s chain abstraction technology, users can execute trades without paying gas fees. This dramatically reduces trading costs and operational friction, making DeFi more accessible.

-

Cross-Chain Support: Vooi seamlessly aggregates liquidity from 17+ blockchain networks, including EVM chains and Solana, letting users trade perpetual contracts across ecosystems without switching wallets or networks.

-

Deep Liquidity Integrations: Vooi connects to leading perpetual DEXs like Orderly, KiloEx, Hyperliquid, and SynFutures, ensuring traders always access the best prices and deepest liquidity available on-chain.

Beyond convenience, these advancements provide tangible risk management benefits. By abstracting positions into a single portfolio and showing real-time net exposure and margin utilization across all connected DEXs, Vooi makes it easier for traders to monitor and manage liquidation risk. In volatile markets, where price swings can be sudden and severe, this kind of holistic oversight is not just useful; it’s essential for survival.

It’s also worth noting that perpetual DEX aggregators like Vooi are helping to level the playing field between retail traders and institutions. The combination of deep liquidity pools, efficient routing algorithms, and transparent self-custody structures means that even smaller players can access execution quality once reserved for large desks on centralized platforms. And with gasless transactions reducing costs further, active trading strategies become more viable at all account sizes.

What Comes Next: The Road Ahead for Perpetual DEX Aggregators

The pace of innovation in this space shows no signs of slowing down. As more blockchains come online and DeFi protocols continue to evolve, aggregators will need to maintain their edge by rapidly integrating new sources of liquidity and refining their smart routing systems. We’re likely to see even greater emphasis on advanced portfolio analytics, automated risk controls, and perhaps most importantly, user experience enhancements that make complex cross-chain strategies accessible to everyone.

For those tracking the future of decentralized leverage trading, the rise of platforms like Vooi signals a clear direction: seamless interoperability, cost efficiency through gasless execution, and unified portfolio management are fast becoming table stakes for serious traders in DeFi. If you’re looking for a deeper technical dive into how chain abstraction is powering this next generation of perpetual DEX aggregators, including practical examples from Hyperliquid-style perps, you’ll find valuable insights in this breakdown.

The bottom line? Perpetual DEX aggregators are not just patching over old problems, they’re reimagining what’s possible in on-chain leverage trading. As these platforms mature, expect them to play an increasingly central role in shaping both market structure and trader behavior across the entire DeFi landscape.