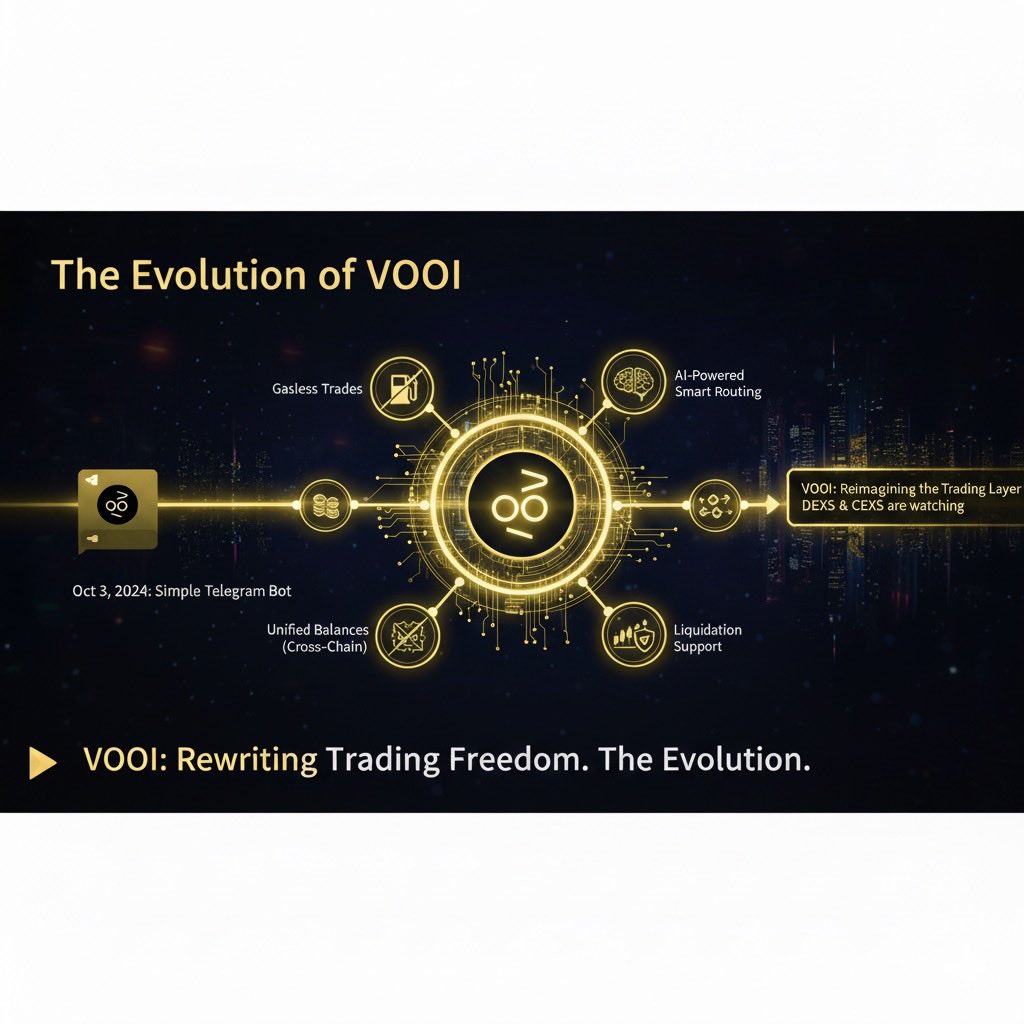

Decentralized finance has entered a new era, with perpetual DEX aggregators like VOOI at the forefront of innovation. As traders demand seamless access to leverage, deep liquidity, and cross-chain functionality, these platforms are redefining what’s possible in on-chain trading. The traditional decentralized exchange (DEX) landscape, while robust, often suffers from liquidity fragmentation and operational complexity, especially for those seeking high-leverage perpetual contracts. VOOI addresses these pain points through chain abstraction and smart liquidity routing, bringing a unified experience that rivals centralized exchanges without sacrificing self-custody or transparency.

Why Perpetual DEX Aggregators Matter

Perpetual DEX aggregators solve some of the most persistent challenges in DeFi trading. Historically, traders looking for leverage had to navigate multiple platforms across different chains, each with its own interface, gas requirements, and liquidity pools. This not only increased operational risk but also led to suboptimal pricing and frequent slippage.

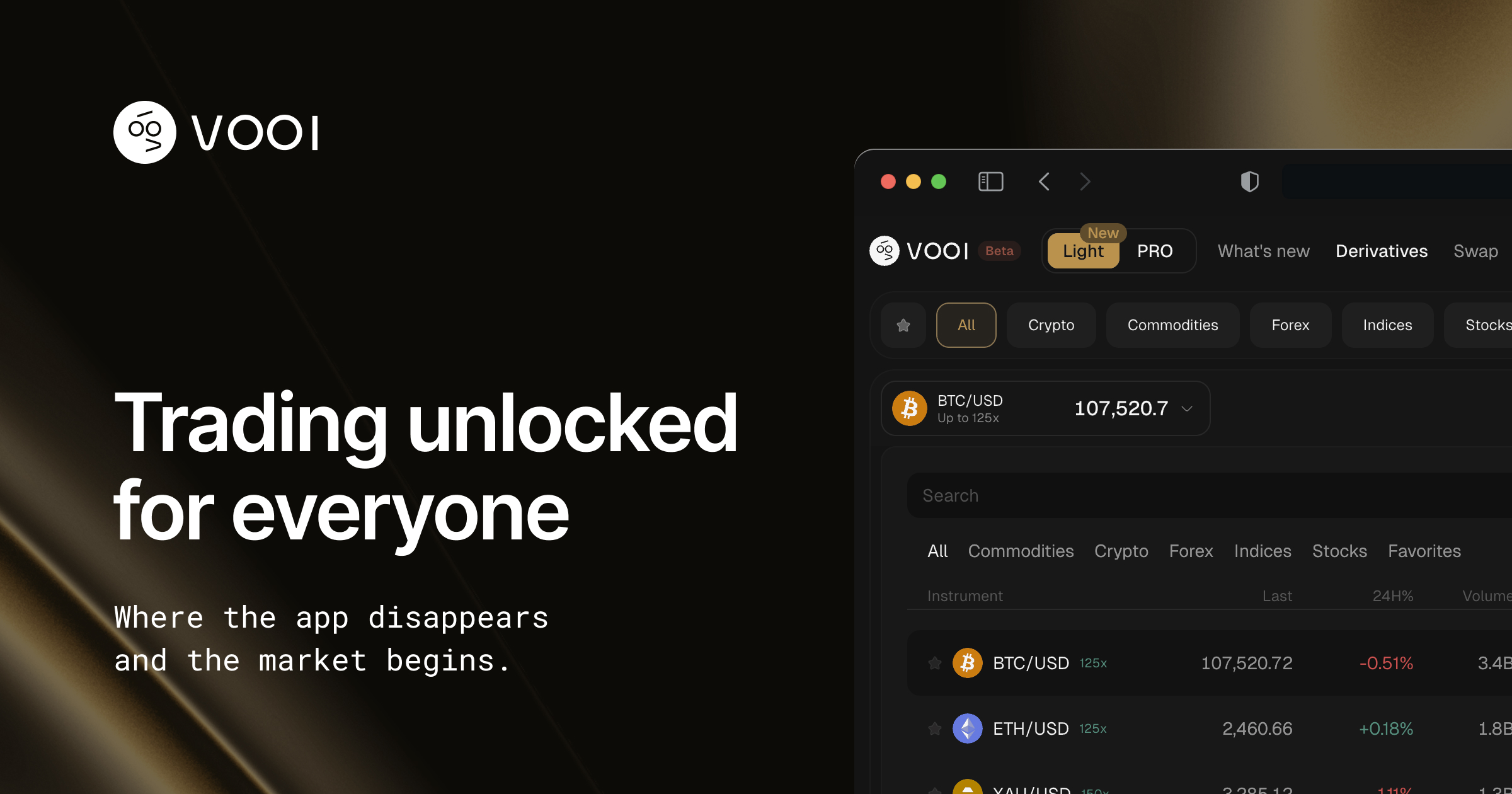

VOOI’s aggregator model abstracts away these complexities. By pooling liquidity from leading perpetual DEXs, including Hyperliquid, Orderly, KiloEx, Lighter, SynFutures, and others, VOOI presents users with a single portfolio view. Traders can monitor net exposure, margin utilization, and liquidation risks in real time without toggling between platforms or wallets.

The Power of Chain Abstraction in DeFi

Chain abstraction is more than just a technical buzzword, it’s the backbone of next-generation DeFi infrastructure. VOOI leverages this technology to enable truly cross-chain perpetual trading at scale. Instead of manually bridging assets or switching networks (a process that often introduces friction and security risks), users interact with a unified layer that seamlessly routes trades across 17 and blockchain networks.

This means you can open a leveraged position on Solana-based markets while holding collateral on an EVM chain, with no manual bridging required. The result is a frictionless experience that empowers both professional traders and DeFi newcomers to maximize their strategies without being limited by network silos or gas token logistics.

Gasless Trading: Lowering Barriers for All

One of the most transformative features introduced by VOOI is gasless trading through account abstraction. Traditionally, every blockchain transaction requires native tokens (like ETH or SOL) to pay for network fees, a hurdle that often deters new users or complicates multi-chain activity. With VOOI’s approach, users can execute trades across integrated networks without holding each chain’s native token.

This innovation doesn’t just reduce costs; it also streamlines onboarding and broadens access to decentralized leverage markets. By eliminating the need for constant asset swaps or gas top-ups, VOOI makes high-frequency trading strategies viable on-chain, an advantage previously reserved for centralized venues.

For a deeper dive into how aggregators like VOOI are transforming on-chain leverage trading through chain abstraction and unified interfaces, see this related article.

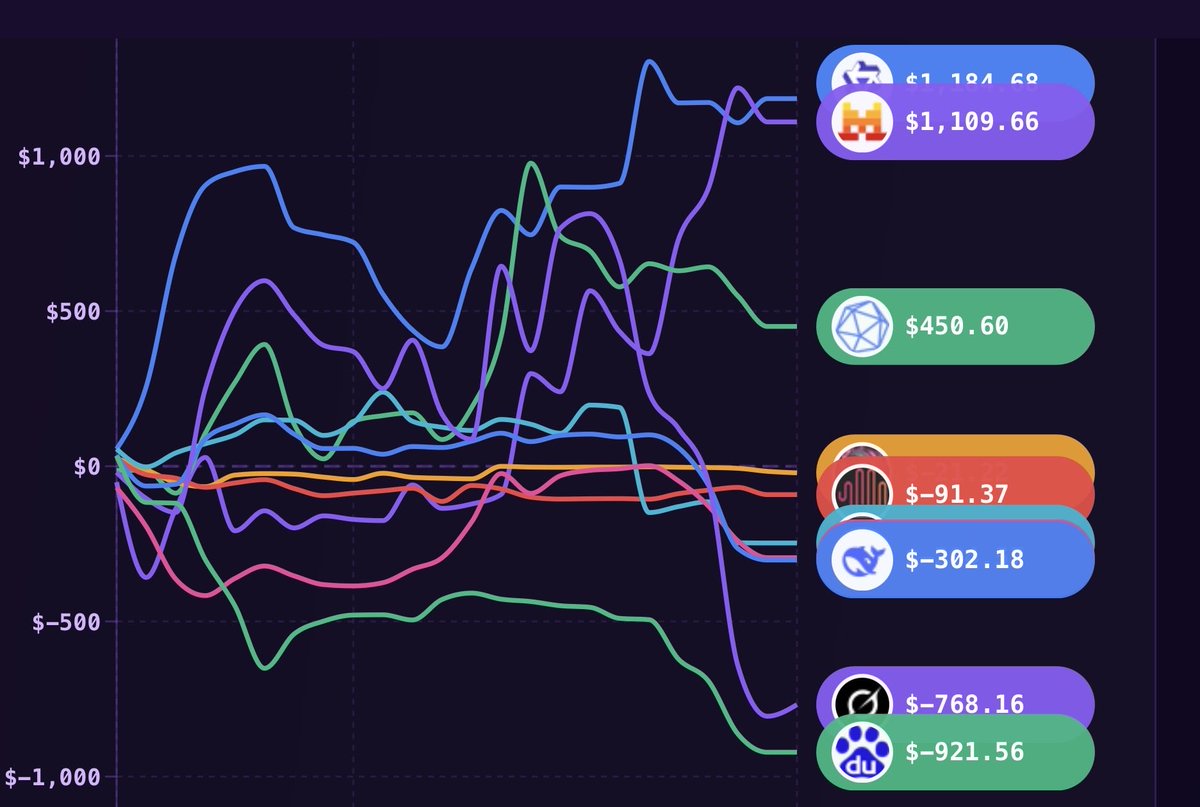

Beyond technical innovation, perpetual DEX aggregators like VOOI are fostering a new standard for transparency and risk management in decentralized leverage trading. By consolidating real-time data on margin utilization, liquidation thresholds, and net exposure across multiple DEXs, these platforms equip traders with the analytics needed to make informed decisions. The unified dashboard view not only demystifies complex positions but also reduces the likelihood of overlooked risks that can arise from juggling multiple protocols.

Another critical advantage is AI-driven smart routing. VOOI’s intelligent algorithms scan all connected liquidity pools to identify optimal trade execution routes. This minimizes slippage and ensures users consistently access the best available prices, crucial for leveraged strategies where even minor price discrepancies can have outsized impacts. The result is a trading experience that feels as seamless as a centralized exchange, but with the added benefits of non-custodial security and composability native to DeFi.

“Aggregators drive trading volume to DEXs, while DEXs supply the underlying liquidity that powers aggregators. ”

Composability and the Future of Cross-Chain Perpetuals

The rise of intent-based aggregators like VOOI signals a broader shift in DeFi: true composability across chains and protocols. With chain abstraction as its foundation, VOOI enables traders to compose strategies that leverage yield farms, lending protocols, and perpetual contracts across previously siloed ecosystems, all from a single interface. This unlocks new forms of capital efficiency and creative risk management.

Key Benefits of Using a Perpetual DEX Aggregator Like VOOI

-

Seamless Cross-Chain Trading: VOOI’s chain abstraction technology enables users to trade perpetual contracts across 17+ blockchain networks without manual bridging or network switching, vastly simplifying the trading experience.

-

Gasless Transactions: Thanks to account abstraction, VOOI offers gasless trading, letting users execute trades without holding native gas tokens for each network—significantly reducing transaction costs.

-

Unified Access to Deep Liquidity: By aggregating liquidity from multiple leading perpetual DEXs, VOOI provides the best prices and deepest liquidity pools in one intuitive interface, eliminating the need to juggle multiple platforms.

-

AI-Driven Smart Routing: VOOI employs AI-powered smart routing to intelligently direct trades across integrated DEXs, ensuring optimal pricing and minimal slippage for every order.

-

Non-Custodial Security: With its non-custodial architecture, VOOI ensures users retain full control over their assets and private keys, enhancing security and trust compared to centralized alternatives.

Security remains paramount. VOOI’s non-custodial architecture ensures users retain full control over their assets at every step. Funds are never held by the aggregator itself; instead, trades are executed directly on integrated DEXs via smart contracts. This approach mitigates counterparty risk, a persistent concern with centralized venues, and aligns with DeFi’s ethos of self-sovereignty.

The relationship between aggregators and underlying DEXs is symbiotic: as more liquidity flows through platforms like Hyperliquid or SynFutures via VOOI, it deepens order books and enhances market efficiency for all participants. In turn, this draws more sophisticated traders into the ecosystem, further reinforcing network effects.

What’s Next for Decentralized Leverage Trading?

As perpetual DEX aggregators continue to evolve, expect rapid progress in areas such as cross-chain collateralization, advanced portfolio analytics, and even deeper integrations with on-chain lending or options protocols. The endgame is clear: an open financial system where any trader can access global liquidity pools with near-instant execution, no matter which blockchain they prefer or how complex their strategy may be.

For those eager to explore how these innovations are reshaping high-leverage crypto trading at scale, our detailed analysis on perpetual DEX aggregators in high-leverage environments provides additional context.