Decentralized finance is in the midst of a seismic shift. For years, traders faced a tough choice: embrace the speed and seamless execution of centralized exchanges (CEXs) or settle for the slower, sometimes clunky experience of on-chain decentralized perpetuals. But that tradeoff is fading fast. Perpetual DEXs like Lighter are rewriting the rules, harnessing breakthrough zero-knowledge (ZK) technology to deliver CEX-level performance – all while staying true to DeFi’s core values of transparency and self-custody.

How Lighter’s zkLighter Rollup Unlocks Real-Time Trading

At the heart of Lighter’s innovation is its custom-built zkLighter rollup. This isn’t just another Layer 2 scaling solution – it’s a purpose-engineered engine for high-frequency, low-latency trading. Here’s how it works:

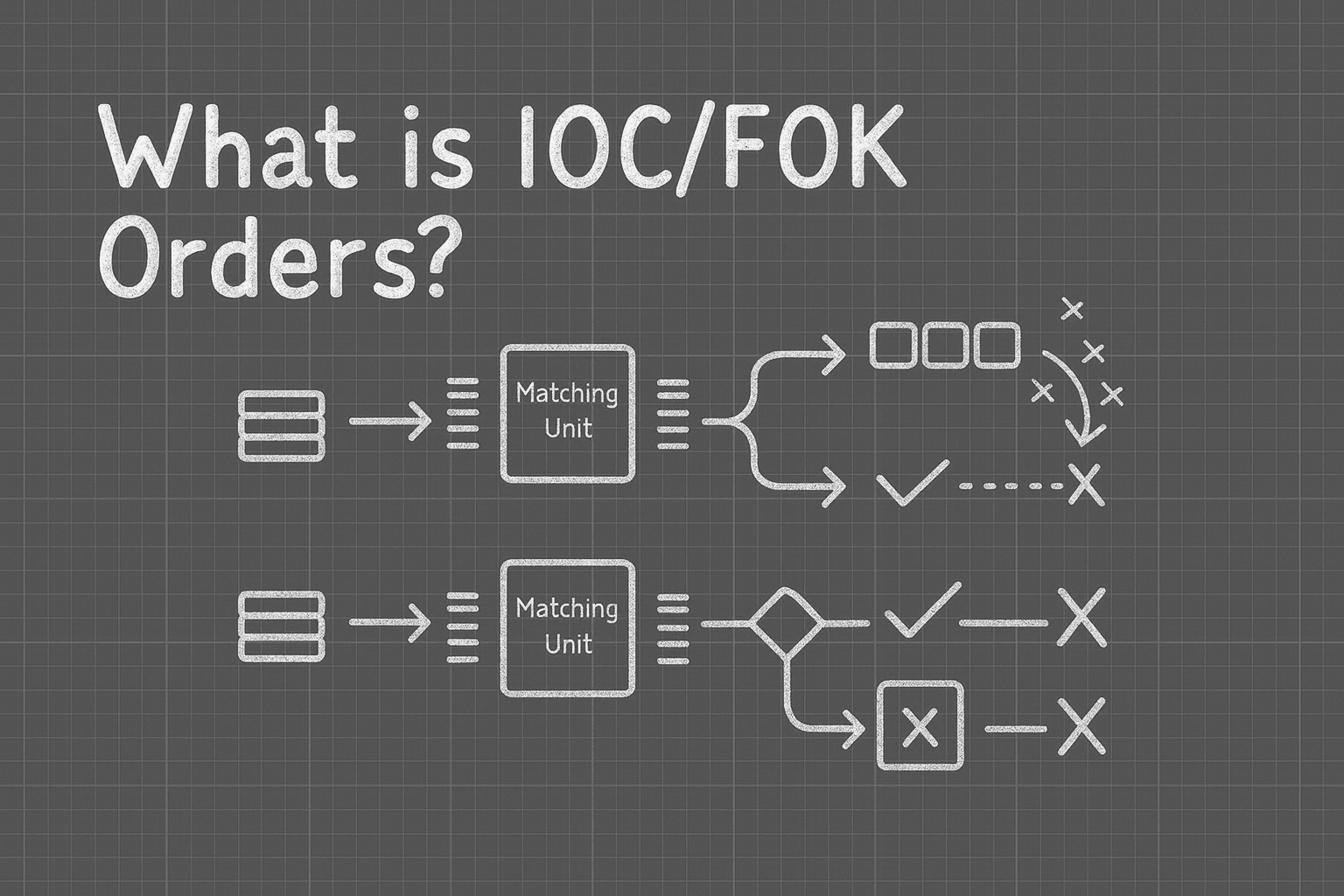

- Sub-5 Millisecond Latency: Orders are matched off-chain by a specialized sequencer, delivering an experience that rivals even the fastest CEXs.

- Tens of Thousands of Trades per Second: Scalability isn’t theoretical here. Lighter has architected its protocol to support institutional-grade throughput.

- ZK-Proofs for Every Action: Every trade, match, and liquidation generates a cryptographic proof. These proofs are then validated by Ethereum mainnet smart contracts, ensuring that every action is verifiably fair and correct.

This architecture means traders get blazing-fast execution without sacrificing transparency or control over their funds. No more wondering if your trades were front-run or if settlement was manipulated behind closed doors – every operation is provably correct on-chain.

Lighter isn’t just catching up to CEXs; it’s setting new standards for trustless speed in crypto trading.

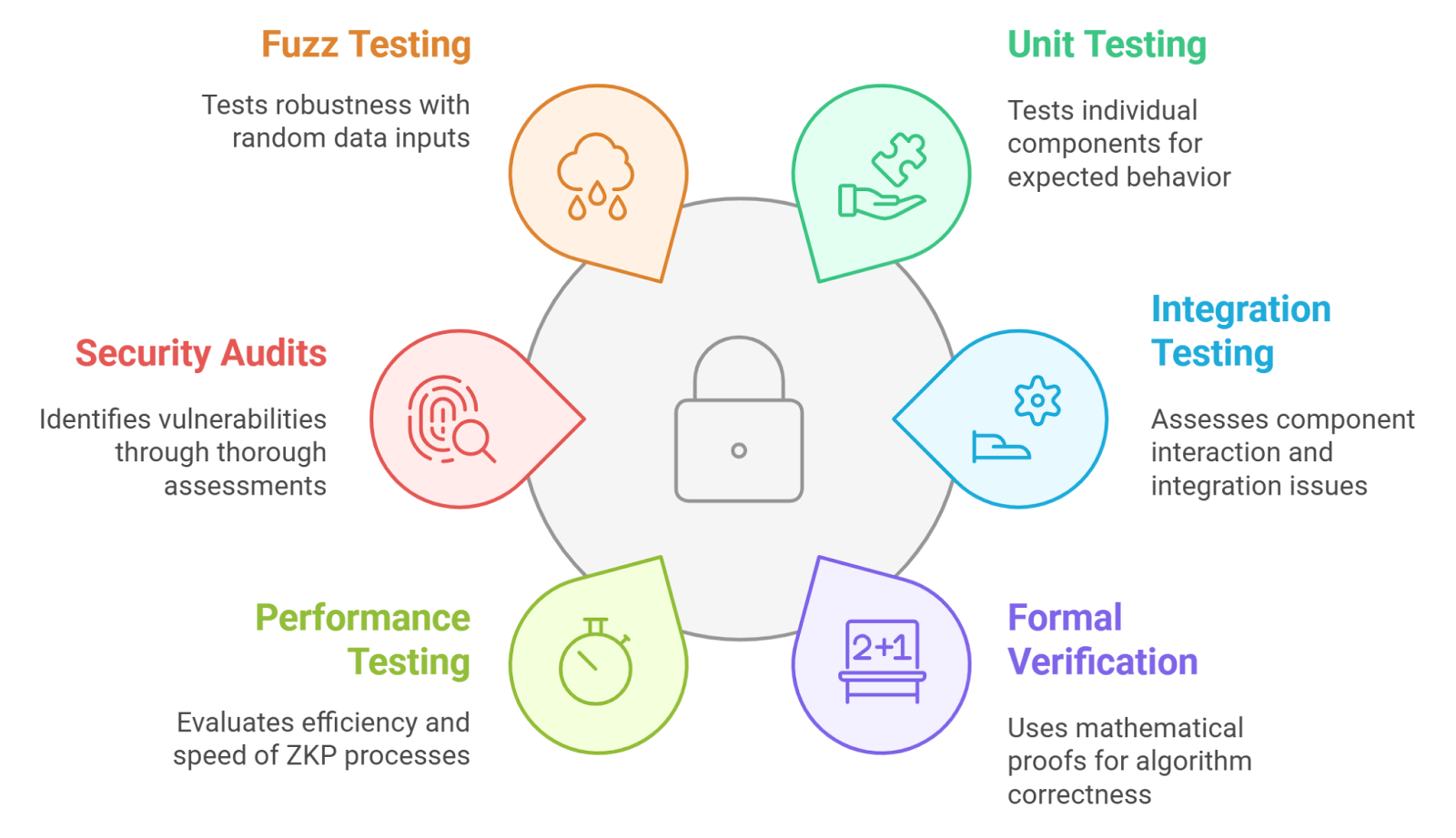

ZK-Proofs: The Engine Behind Trustless Performance

Zero-knowledge proofs have been hyped across crypto, but Lighter puts them into practical action where it matters most: order matching and liquidation. Their system works like this:

- The off-chain matching engine processes orders with sub-second latency.

- A virtual machine runs every computation and produces ZK-proofs attesting to the correctness of each step – from matching to liquidation.

- Mainnet smart contracts verify these proofs before any state change occurs on Ethereum Layer 1.

The result? Traders get ironclad guarantees that price-time priority is enforced, MEV (miner extractable value) attacks are neutralized, and no hidden tricks can slip through unnoticed. Auditors and users alike can verify that everything happened as promised – no need to trust an opaque operator ever again.

Lighter’s User Growth Signals a New Era for On-Chain Derivatives

The market has noticed. As DEX perpetual contracts surge past a 20% market share in mid-2025 (up from just 4%-6% in early 2024), platforms like Lighter are leading the charge. Their zero-fee model for retail traders has helped attract over 188,000 unique accounts during private beta alone, with daily active users hitting around 50,000. Institutional players aren’t left out either – API-driven high-frequency firms pay competitive fees for access to deep liquidity and ultra-fast execution.

This momentum proves that when you combine real-time performance with DeFi-grade security and transparency, you unlock explosive growth potential in on-chain derivatives markets.

CEX Performance Meets DeFi Security: Why This Matters Now

Lighter’s approach stands out not just for speed but also for uncompromising security. By settling all trades on Ethereum mainnet while leveraging zk-rollups for computation and proof generation, traders retain full custody of their assets at all times. There’s no centralized honeypot risk – your funds stay on-chain until you decide otherwise.

If you want to dive deeper into how ZK-rollups supercharge order book trading on platforms like Lighter, check out this detailed breakdown at zktoday.com.

What we’re witnessing isn’t just an incremental improvement. It’s a fundamental reimagining of how decentralized perpetual futures can compete head-to-head with their centralized counterparts. For traders, this means no more compromising between speed, fairness, and custody. You get all three, without the hidden risks or opaque black boxes that have plagued CEXs for years.

Consider the practical impact: With Lighter’s sub-5 millisecond latency and institutional-grade throughput, even high-frequency strategies are viable on-chain. Retail traders enjoy zero fees and transparent execution, while pro desks gain access to deep liquidity without giving up control of their assets. And because every transaction is provably correct via ZK-proofs, trust shifts from centralized intermediaries to cryptographic certainty.

Building Confidence Through Radical Transparency

The transparency enabled by ZK-proofs isn’t just a technical feat, it’s a cultural shift for DeFi. Auditors, developers, and users can independently verify every trade, match, and liquidation executed on the platform. This level of openness builds unprecedented confidence in the integrity of the system.

- No hidden backdoors: All computations are open to validation by anyone with the skill to check them.

- No MEV games: Price-time priority is enforced at the protocol level, no more worrying about front-running or sandwich attacks.

- No custodial risk: User funds remain on mainnet until withdrawn by the owner.

This is what true DeFi security looks like, no need for blind trust in any operator or third party.

What’s Next for Perpetual DEXs?

The success of Lighter signals a clear trend: CEX performance in DeFi is no longer a pipe dream. As more projects adopt similar architectures, combining custom ZK-rollups with robust Layer 1 settlement, we’ll see even greater migration of volume from centralized platforms to decentralized ones. The days when “on-chain” meant “second best” are numbered.

If you’re a trader looking to maximize your edge in this new era, now’s the time to explore what next-gen perpetual DEXs like Lighter offer. The blend of real-time execution, deep liquidity, and cryptographic guarantees is setting a new standard, and it’s only getting better as adoption accelerates across both retail and institutional segments.

Top Advantages of Trading Perpetuals on zk-Powered DEXs Like Lighter

-

CEX-Level Speed & Performance: Lighter delivers sub-5 millisecond latency and supports tens of thousands of trades per second, matching the responsiveness of leading centralized exchanges.

-

On-Chain Transparency & Verifiability: Every trade, order match, and liquidation is proven with zero-knowledge proofs and verified on Ethereum, ensuring full transparency and eliminating hidden manipulation.

-

Self-Custody & Security: User assets remain secured on Ethereum Layer 1, so traders maintain full control—unlike CEXs, which require trusting a third party with your funds.

-

Zero Trading Fees for Retail: Lighter offers no trading fees for retail users, making high-frequency and low-margin strategies more viable and cost-effective.

-

Fairness & Censorship Resistance: zk-proofs enforce price-time priority and prevent front-running or censorship, ensuring a level playing field for all traders.

-

Scalability Without Compromising Security: The custom zkLighter rollup architecture scales seamlessly while settling all transactions on Ethereum, combining high throughput with mainnet-grade security.

The momentum is undeniable: with explosive user growth, surging market share for decentralized perpetuals, and relentless innovation at the protocol layer, on-chain derivatives are poised to dominate crypto trading in 2025 and beyond. The future belongs to those who demand both speed and security, and thanks to advances like ZK-proofs on Lighter, you no longer have to choose between them.