In the rapidly evolving landscape of decentralized finance, speed is more than a luxury – it is a necessity. For professional traders and crypto enthusiasts alike, the difference between profit and loss can be measured in milliseconds. Hyperliquid-Style Perps has emerged as a frontrunner in this arena by achieving ultra-low latency for perpetual trading on its decentralized exchange (DEX). But how does this platform deliver sub-second execution in an environment historically plagued by slow block times and network congestion?

The Foundation: Purpose-Built Layer 1 Blockchain

At the heart of Hyperliquid-Style Perps’ performance is its custom Layer 1 blockchain, meticulously engineered for high-speed trading. Unlike traditional DEXs that rely on general-purpose chains such as Ethereum – notorious for block times around 12 seconds – Hyperliquid’s chain boasts block times as low as 70 milliseconds. This radical reduction enables the platform to process up to 200,000 transactions per second, setting a new benchmark for decentralized infrastructure.

This architectural decision is not just about raw speed. By building its own Layer 1 rather than layering on top of existing solutions, Hyperliquid eliminates many bottlenecks that constrain other platforms. The result? Median order latency clocks in at just 0.2 seconds, rivaling even centralized exchanges. For traders seeking the fastest decentralized perpetual trading experience, this approach is transformative.

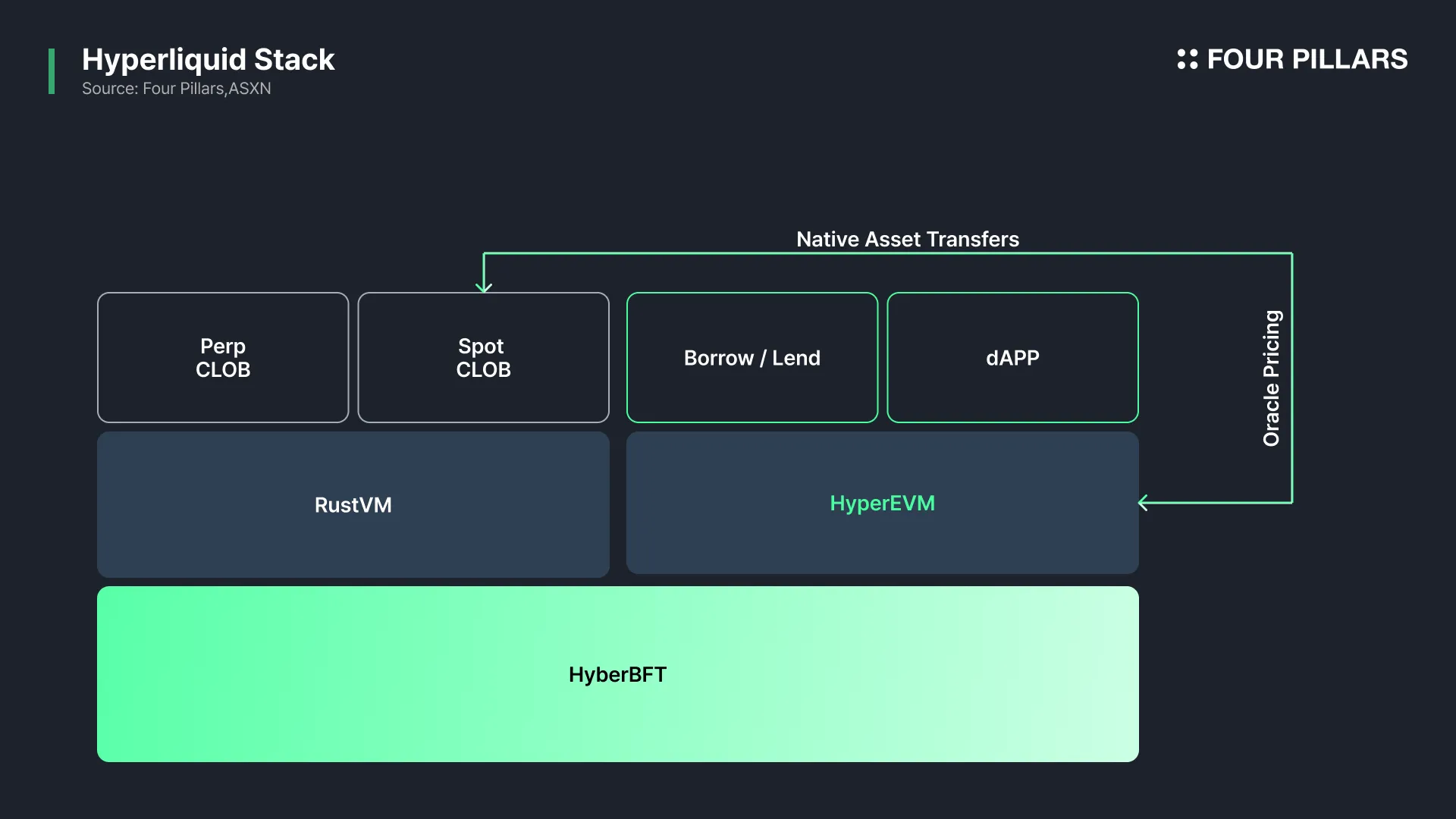

Dual-Block Architecture: HyperCore and HyperEVM

The backbone of Hyperliquid’s low-latency system lies in its innovative dual-block architecture. It separates core trading functions from smart contract execution via two distinct modules:

- HyperCore: Dedicated to managing order matching, trade settlement, and risk controls with maximum efficiency.

- HyperEVM: Handles smart contract logic, ensuring flexibility without sacrificing transaction speed.

This separation allows each module to be optimized for its specific function. Trading operations remain lightning-fast and deterministic, while developers retain the freedom to innovate with complex smart contracts. The synergy between these modules underpins both performance and flexibility – two pillars essential for modern DeFi applications.

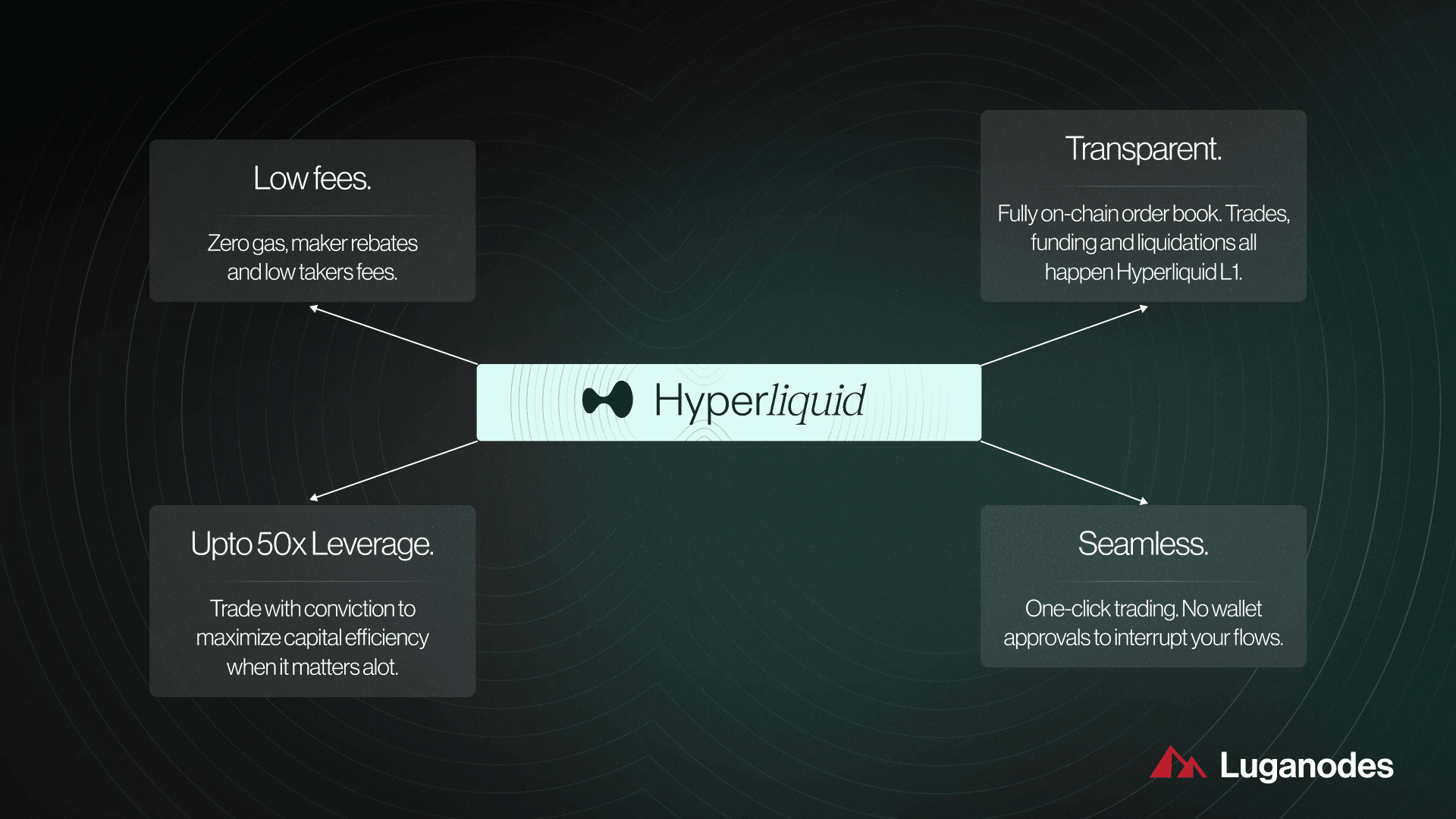

A Fully On-Chain Order Book Model

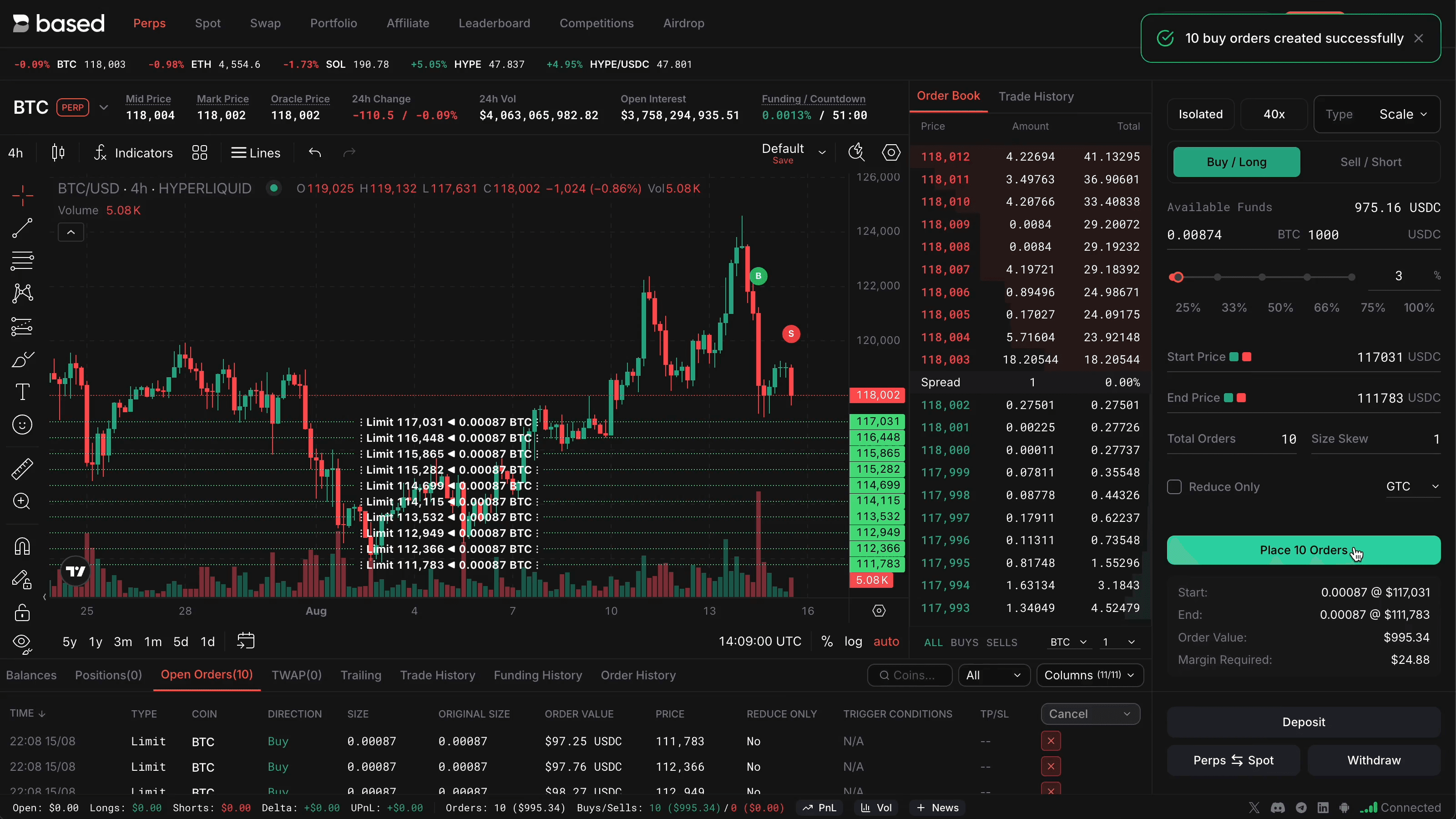

Diverging from the Automated Market Maker (AMM) model that dominates much of DeFi, Hyperliquid employs a fully on-chain order book system. This design gives traders granular control over their orders: limit, market, stop-loss, and advanced strategies are all natively supported without intermediaries or off-chain components.

The benefits are significant for those seeking low latency DeFi trading. An on-chain order book means all actions are transparent and verifiable in real time while maintaining the responsiveness required by high-frequency strategies. It also minimizes slippage and enables tighter spreads, particularly important during periods of heightened volatility or large trades in mainstream coins.

The Role of Consensus: HyperBFT Mechanism

No discussion of ultra-low latency DEX architecture would be complete without examining consensus mechanisms. Here again, Hyperliquid sets itself apart by deploying the HyperBFT consensus protocol, an optimized variant of Tendermint designed specifically for high-throughput environments.

This protocol achieves sub-second finality across every transaction – meaning orders are confirmed almost instantaneously after submission. The impact is profound: traders can rely on deterministic settlement times without fear of network congestion or reorgs delaying their strategies.

Together, these innovations position Hyperliquid-Style Perps at the forefront of professional crypto trading platforms where speed meets transparency.

Beyond the technological breakthroughs, what truly distinguishes Hyperliquid-Style Perps is its unwavering commitment to trader experience. The platform’s infrastructure is purpose-built not only for speed but also for reliability under real-world trading conditions. This means that even during periods of extreme market volatility, when transaction queues and slippage can cripple other DEXs, Hyperliquid maintains its hallmark sub-second execution and deep liquidity.

Why Ultra-Low Latency Matters for Professional Traders

For active participants in the perpetual futures market, latency is more than a technical metric, it’s a core component of strategy execution and risk management. Ultra-low latency DEX environments like Hyperliquid-Style Perps empower market makers, high-frequency traders, and arbitrageurs to operate with confidence that their orders will be filled at expected prices. This minimizes adverse selection and enables tighter risk controls, which are critical when leveraging positions in a 24/7 global market.

Moreover, the fully on-chain order book model ensures that every action is transparent and auditable. Traders can verify settlement times and order matching on-chain, reinforcing trust in a landscape where transparency has too often been sacrificed for speed. These capabilities are especially attractive to institutions and professional desks seeking fastest decentralized perpetual trading without compromising on auditability or security.

Key Benefits of Ultra-Low Latency DeFi Trading on Hyperliquid-Style Perps

-

Sub-Second Trade Execution: Hyperliquid’s custom Layer 1 blockchain enables median order latency of just 0.2 seconds, allowing traders to enter and exit positions almost instantly, even during periods of high volatility.

-

On-Chain Order Book Precision: By operating a fully on-chain order book (instead of an AMM), Hyperliquid gives traders granular control over order placement, resulting in tighter spreads and reduced slippage for large trades.

-

Sub-Second Finality with HyperBFT: The HyperBFT consensus mechanism delivers sub-second finality, ensuring trades are confirmed rapidly and reliably—crucial for high-frequency and institutional traders.

-

High Throughput for Peak Demand: Capable of processing up to 200,000 transactions per second, Hyperliquid’s infrastructure prevents network congestion and maintains performance during market surges.

-

Dual-Block Architecture Efficiency: The separation of HyperCore (trading operations) and HyperEVM (smart contracts) optimizes both speed and flexibility, enabling fast execution without sacrificing programmability.

Comparing Hyperliquid-Style Perps to Legacy DEXs

The leap from legacy decentralized exchanges to platforms like Hyperliquid cannot be overstated. Where traditional solutions struggle with multi-second block times, often leading to missed opportunities or front-running, Hyperliquid’s architecture delivers median order latency of just 0.2 seconds. This dramatic performance edge has accelerated the migration of trading volume from centralized venues to decentralized alternatives, as evidenced by surging daily volumes in 2025.

If you’re interested in understanding more about how these innovations enable ultra-low latency, see our comprehensive analysis at How Hyperliquid-Style Perps Achieves Ultra-Low Latency in Decentralized Perpetual Trading.

The Future: Scaling Without Compromise

Looking ahead, the implications of Hyperliquid’s approach extend far beyond perpetual futures contracts. Its dual-block architecture and consensus optimizations create a blueprint for scalable DeFi applications that don’t force users to choose between speed and decentralization. As more protocols adopt similar models, or integrate directly with Hyperliquid’s infrastructure, the broader DeFi ecosystem could finally achieve parity with centralized exchanges on both performance and user experience.

The evolution toward low latency DeFi trading isn’t just about milliseconds saved; it’s about unlocking new strategies, reducing systemic risk, and making advanced financial tools accessible without barriers or gatekeepers. For traders who demand the best from their platforms, Hyperliquid-Style Perps offers a compelling vision, and delivers on it today.