Perpetual decentralized exchanges (perp DEXs) have exploded in popularity, but scaling them without sacrificing speed or transparency has been a persistent challenge. With daily trading volumes hitting $96,973 billion by September 2025, the race to create high-performance, self-custodial perp DEXs is at full throttle. The latest battleground? Sharded orderbooks – a technical innovation that’s rapidly redefining what’s possible in DeFi trading.

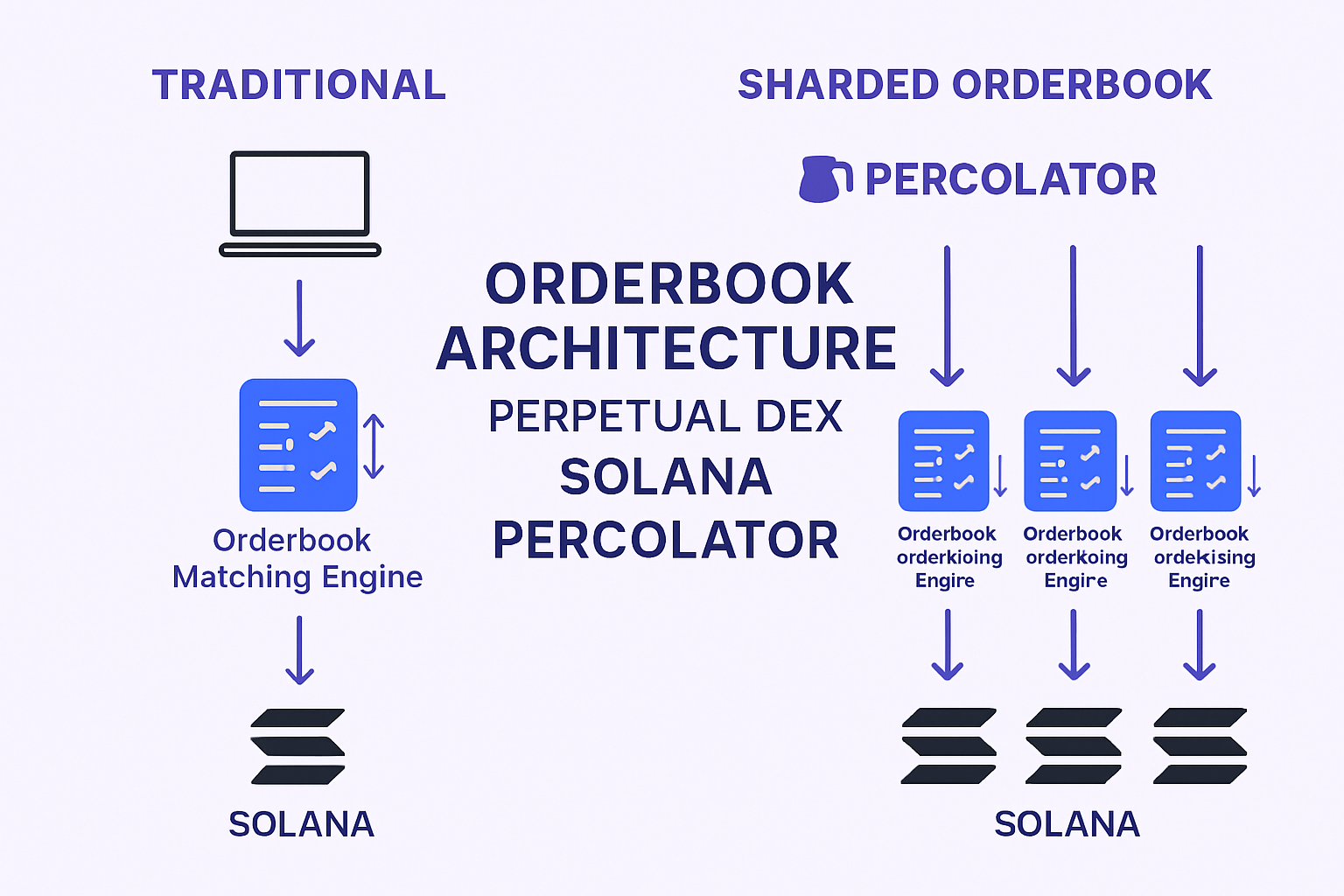

If you’re used to the clunky latency and frequent congestion of legacy on-chain orderbooks, get ready for a paradigm shift. Sharded orderbooks distribute the heavy lifting of trade matching across multiple parallel engines (shards), enabling orders to be processed simultaneously rather than bottlenecked through a single matching engine. This isn’t just an incremental upgrade; it’s a leap toward true institutional-grade trading experiences on decentralized rails.

Why Scalability Matters: The New Perpetual DEX Wars

The competition is fierce. Hyperliquid-Style Perps set the gold standard with its proprietary Layer 1 and fully on-chain central limit order book (CLOB), delivering unmatched speed and reliability for pro traders. Now, Solana co-founder Anatoly Yakovenko is throwing down the gauntlet with Percolator, a sharded perpetual futures DEX built atop Solana’s famously parallelized blockchain.

Percolator’s approach is ambitious: it leverages token-specific “slabs” and sharded matching engines so that each market can scale independently while still allowing cross-margining within portfolios. Imagine executing trades across dozens of markets at once, with each order routed through its own parallel processing lane. This isn’t science fiction – it’s happening right now on testnets.

Meanwhile, Hyperliquid-Style Perps continues to dominate by focusing on maximum throughput and deep liquidity pools, all while keeping every operation transparent and verifiable on-chain. The result? Near-instant execution times even during periods of extreme volatility – a must-have for anyone trading large size or running automated strategies.

The Mechanics Behind Sharded Orderbooks

So how do these systems actually work under the hood? Traditional CLOBs operate as single-threaded engines: every new order must wait its turn in line before being matched or filled. That’s fine when traffic is light, but as soon as volumes spike, latency creeps in and slippage increases.

Sharded orderbooks break this bottleneck by splitting markets into separate shards. Each shard runs its own matching engine independently but communicates with others when needed (for example, when calculating portfolio margin requirements). Orders are routed based on asset type or market demand, so popular pairs like BTC/USD get their own dedicated resources rather than competing with less active markets for blockspace or processing power.

This design requires robust coordination protocols to ensure atomic settlement across shards and prevent double-spending or mismatches. Innovations like the Thunderbolt Protocol introduce concurrent smart contract execution using nonblocking reconfiguration for sharded DAGs – meaning transactions can be finalized in parallel without sacrificing determinism or security.

Pushing Liquidity Boundaries: Omnichain and Cross-Chain Perps

The next frontier isn’t just about scaling within one chain – it’s about connecting liquidity pools across multiple networks. Orderly Network’s omnichain perpetual futures orderbook consolidates trades from various blockchains into a single CLOB interface. Traders from Polygon PoS (via QuickPerps: Falkor), Solana, Ethereum L2s, and beyond can interact seamlessly without worrying about fragmented liquidity or convoluted bridging processes.

This model brings tangible benefits: deeper books mean tighter spreads and less slippage during volatile swings – crucial when you’re managing risk at scale or deploying high-frequency strategies that rely on reliable fills at predictable prices.

What’s especially exciting is how these cross-chain architectures are evolving to support zero-gas leveraged trading and effortless onboarding for users from every corner of DeFi. By abstracting away the complexity of chain-to-chain interactions, omnichain sharded orderbooks let traders focus on what matters: fast execution, robust risk management, and capital efficiency.

We’re already seeing real-world impact. QuickPerps: Falkor’s integration with Orderly Network on Polygon PoS is a prime case study. Traders can now tap into global liquidity and execute perp contracts without worrying about gas spikes or network congestion. This is a direct response to the demand for liquidity scaling in DeFi perps, as platforms race to accommodate daily volumes nearing $96,973 billion.

Technical Innovations Powering the Shift

The leap in scalability isn’t just a UI facelift; it’s powered by deep technical breakthroughs. Thunderbolt Protocol’s concurrent smart contract execution and Prophet Framework’s conflict-free sharding are quietly redefining what’s possible for decentralized perpetual exchange scalability. These protocols ensure that even as trading activity explodes, settlement finality and atomicity aren’t compromised.

For developers and pro traders alike, this means more predictable system performance during market surges, and fewer edge cases where trades get stuck or settlements fail. The result? A new era where Hyperliquid-Style Perps architecture delivers both speed and trustlessness at scale.

Of course, there are challenges ahead: synchronizing shards for portfolio margining, maintaining fair sequencing across high-demand markets, and keeping user experience frictionless remain ongoing battles. But the trajectory is clear, sharded orderbooks are unlocking new ceilings for performance while keeping DeFi true to its permissionless roots.

What Traders Should Watch For Next

If you’re active in the perpetual DEX space or just DeFi-curious, keep an eye on three key trends:

- Composable liquidity: The lines between networks will continue to blur as omnichain orderbooks become standard.

- User-centric design: Expect more intuitive interfaces that hide backend complexity but expose granular control for power users.

- Programmable perps: Permissionless market creation will let anyone launch new perp contracts, fueling innovation at a pace we’ve never seen before.

The perpetual DEX wars are just heating up, with Solana’s Percolator and Hyperliquid-Style Perps leading the charge into an era of low-latency, high-throughput decentralized trading. As these architectures mature, expect trading experiences that rival (and sometimes surpass) their centralized counterparts, without ever giving up custody or transparency.