Speed is the defining edge in modern crypto markets, especially on perpetual decentralized exchanges (DEXs) where real-time execution and deep liquidity can mean the difference between profit and loss. Hyperliquid-Style Perps DEX, purpose-built for low-latency trading, empowers professional traders to seize opportunities with sub-second finality. But simply using a fast platform isn’t enough. To truly maximize your trading performance, you need to leverage every technical and strategic advantage available.

Leverage Offchain Sequencer Integration for Near-Instant Order Matching

Hyperliquid-Style Perps stands out by integrating an offchain sequencer architecture. This design removes the bottleneck of waiting for on-chain block confirmations, instead enabling orders to be matched nearly instantly offchain before being finalized on HyperEVM’s Layer 1. For high-frequency and professional traders, this means you can react to market shifts as they happen, without lag.

To capitalize on this, ensure you are routing your trades directly through Hyperliquid’s native interface or supported aggregators that utilize the sequencer. Avoid third-party layers that could introduce unnecessary latency. By doing so, you’ll reduce exposure to adverse selection and minimize the risk of slippage during volatile periods. For more detail on how Hyperliquid achieves this technical edge, see our in-depth analysis.

Utilize Direct WebSocket Connections for Real-Time Market Data Feeds

Milliseconds matter when executing trades at scale. Relying on slow or batch-updated REST APIs can introduce critical delays between price movement and order submission. Instead, connect to Hyperliquid’s direct WebSocket endpoints, which stream live order book updates and trade events as they occur.

This real-time data feed allows your trading systems, or even manual strategies, to see liquidity changes instantly. It’s essential for strategies like scalping or arbitrage that depend on micro-movements in price or depth. Most professional-grade trading bots and platforms support direct WebSocket integration; configure these connections with minimal polling intervals to keep your view of the market as current as possible.

Optimize Network Routing with Low-Latency VPNs or Dedicated Nodes

No matter how fast an exchange is internally, your own network connection can become a bottleneck, especially if you’re trading from regions far from core validators or relays. To mitigate this:

- Use low-latency VPNs: Choose providers with exit nodes geographically close to Hyperliquid validator clusters.

- Deploy dedicated nodes: If possible, run a lightweight node or relay within a cloud region optimized for latency (e. g. , AWS Tokyo if HyperEVM validators are Asia-based).

- Avoid public Wi-Fi and congested networks: Even minor packet delays can create missed fills during volatile moves.

This network optimization is especially critical during high-volatility events, such as major economic releases, where seconds can mean radically different entry prices or missed opportunities entirely.

5 Key Strategies for Low-Latency Trading on Hyperliquid

-

Leverage Offchain Sequencer Integration for Near-Instant Order Matching: Hyperliquid utilizes an offchain sequencer architecture to process orders rapidly, minimizing delays and reducing miner extractable value (MEV). By trading on platforms like Hyperliquid, you benefit from near-instant order matching, which is crucial for executing trades at optimal prices during volatile market conditions.

-

Utilize Direct WebSocket Connections for Real-Time Market Data Feeds: Connect directly to Hyperliquid’s WebSocket API or similar real-time data feeds to receive live order book updates and trade events. This ensures you act on the most current market data, reducing latency compared to polling REST APIs and enabling faster decision-making.

-

Optimize Network Routing with Low-Latency VPNs or Dedicated Nodes: Professional traders often deploy low-latency VPNs or run dedicated nodes geographically close to Hyperliquid’s infrastructure. This network optimization reduces round-trip times, ensuring your orders reach the exchange faster and improving your competitive edge in high-frequency environments.

-

Implement Automated Trading Bots with Sub-Second Reaction Times: Use established frameworks like Hummingbot or custom bots to automate your trading strategies. These bots can monitor market conditions and execute trades in milliseconds, capitalizing on fleeting opportunities that manual trading would miss.

-

Monitor and Adjust Slippage Tolerance Dynamically Based on Liquidity Conditions: Continuously assess order book depth and adjust your slippage tolerance settings in Hyperliquid’s interface. Dynamic slippage management helps prevent costly execution errors and adapts your strategy to changing liquidity, especially during high volatility.

The Professional Trader’s Checklist for Ultra-Low Latency Execution

The next steps involve automation and dynamic risk controls, core elements for any trader looking to consistently outperform in real-time DeFi markets. Continue reading for insights into building sub-second reaction bots and adapting slippage tolerance based on live liquidity conditions.

Implement Automated Trading Bots with Sub-Second Reaction Times

Manual trading simply cannot compete with the speed and precision of automated systems in a low-latency environment. By deploying automated trading bots that interface directly with Hyperliquid-Style Perps’ WebSocket feeds and offchain sequencer, you can achieve reaction times measured in milliseconds. These bots can be programmed for a variety of strategies, market making, statistical arbitrage, or momentum trading, all while instantly adapting to order book changes or price triggers.

Key to success is minimizing the logic overhead in your bot’s code. Avoid unnecessary API calls, and structure your event handlers to act immediately on relevant data. Consider implementing local risk checks and fail-safes to prevent runaway orders during periods of market instability. For a technical deep dive into building ultra-fast trading bots for decentralized perps, see our dedicated guide.

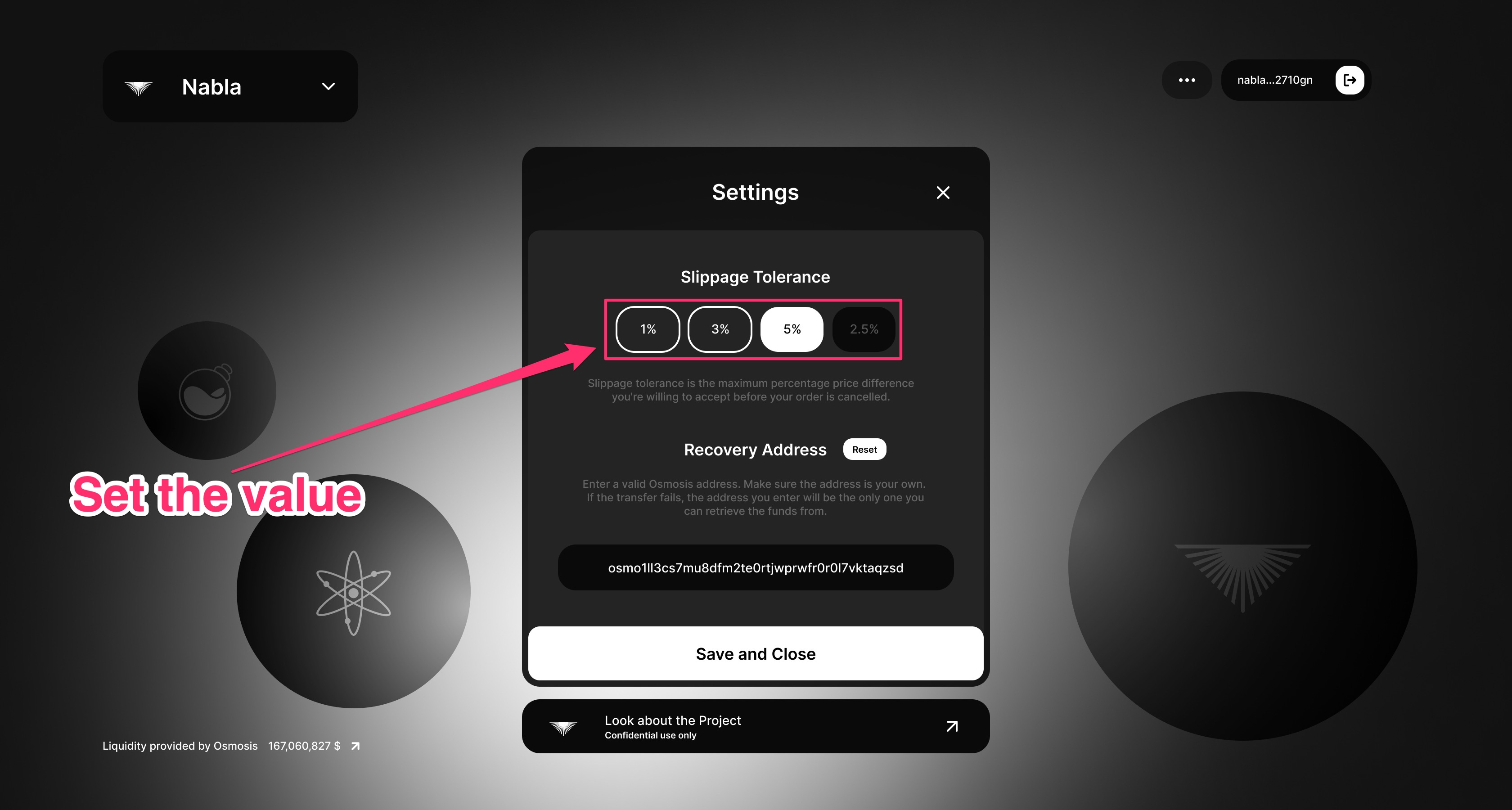

Monitor and Adjust Slippage Tolerance Dynamically Based on Liquidity Conditions

Even with top-tier execution speed, slippage remains a persistent risk, especially during sudden liquidity crunches or volatile news-driven moves. Hyperliquid-Style Perps allows traders to set slippage tolerances on each order. However, static settings can expose you to unnecessary losses or missed fills. Instead, use dynamic algorithms that monitor real-time order book depth and adjust slippage tolerance accordingly.

For example, if liquidity thins out during a major market event, your system can automatically tighten slippage thresholds to avoid adverse price impacts. Conversely, when depth is robust, you might loosen tolerance slightly to ensure timely fills. This approach reduces the risk of getting picked off in fast markets and ensures more consistent execution quality over time.

Synergize for Maximum Edge

The true advantage comes from combining these strategies into a cohesive workflow. Start by ensuring your infrastructure is optimized, low-latency network routing and direct WebSocket feeds are foundational. Layer in automation through high-speed bots that leverage offchain sequencer integration for rapid order matching. Finally, protect your edge by dynamically managing slippage tolerance based on real-time liquidity signals.

This systematic approach not only boosts fill rates and reduces adverse selection but also arms you against the unique risks of decentralized perpetual trading. As the competitive landscape of DeFi evolves, those who invest in technical optimization will consistently outperform their peers.

If you’re ready to take your execution speed and reliability to the next level, explore more advanced guides such as how Hyperliquid-Style Perps enables ultra-low latency perpetual trading on decentralized exchanges. For a broader look at how low-latency DEXs are empowering high-frequency traders in crypto, visit this resource.