Perpetual decentralized exchanges (DEXs) are evolving rapidly, and two innovations, periodic auctions and liquidity vaults, are at the center of this transformation. Traders seeking fair execution, lower costs, and passive market making opportunities are now finding that these mechanisms are dramatically improving the DeFi landscape. Let’s examine how these advancements are reshaping the competitive dynamics of perpetual DEX trading.

Periodic Auctions: A New Paradigm for Fair Execution

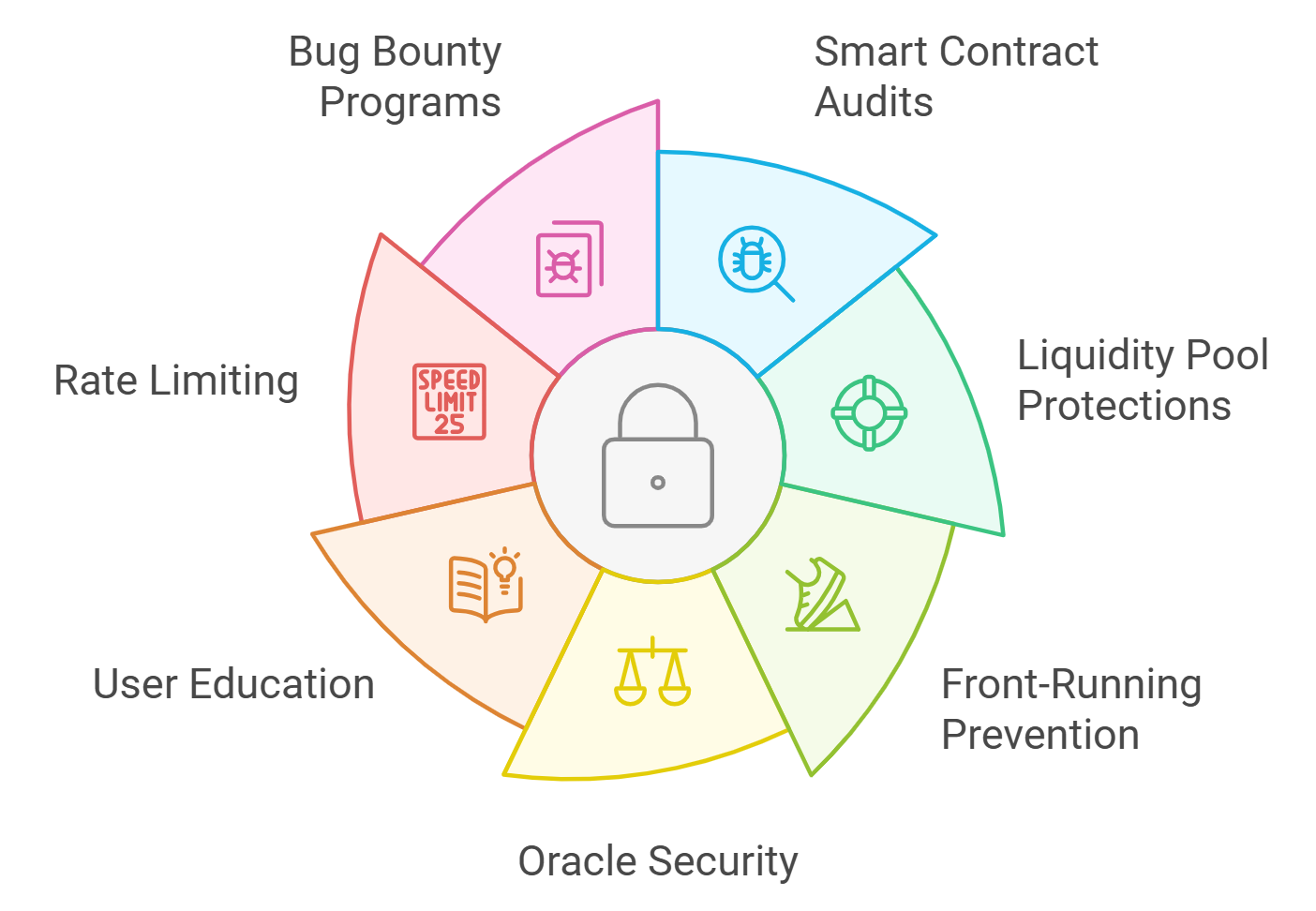

Traditional continuous order books, while familiar to many traders, present significant challenges in a decentralized context. Chief among them is the risk of front-running and maximal extractable value (MEV), where bots exploit order flow for profit at the expense of regular users. Periodic auctions, especially frequent batch auctions (FBAs): offer a compelling alternative.

In an FBA system, orders are aggregated over a fixed interval and then executed simultaneously at a uniform clearing price. This approach not only levels the playing field by batching orders but also makes it far harder for MEV actors to manipulate outcomes. According to recent research, periodic auctions can cut transaction costs by 21% to 37% compared to continuous matching models.

Dango DEX exemplifies this trend, leveraging periodic auctions to execute limit orders in a way that empowers retail traders. By decoupling order arrival from execution, Dango reduces latency advantages for predatory actors and enhances transparency across the board, a critical step toward fair execution on perpetual DEXs.

Liquidity Vaults: Automating Passive Market Making in DeFi

The other major force reshaping perpetual DEXs is the rise of liquidity vaults. Unlike traditional market making, which demands constant monitoring and sophisticated strategies, liquidity vaults allow users to passively provide capital to markets while earning a share of fees and funding payments.

Platforms like Demex have pioneered “Perp Pools, ” enabling users to deposit stablecoins such as USDC into smart contracts that automatically quote both sides of perpetual contracts. This system democratizes market making by lowering technical barriers and allowing anyone to participate in liquidity provision without active management or deep trading expertise.

A standout feature is the use of dynamic funding rate mechanisms that adjust payouts based on liquidity utilization. This protects liquidity providers during periods of high volatility or imbalanced flows, a crucial innovation for sustainable yield generation in DeFi market making. For more detail on how these pools operate, see this analysis.

Addressing Liquidity, Slippage, and MEV Protection

The combined effect of periodic auctions and liquidity vaults is already visible across several leading platforms:

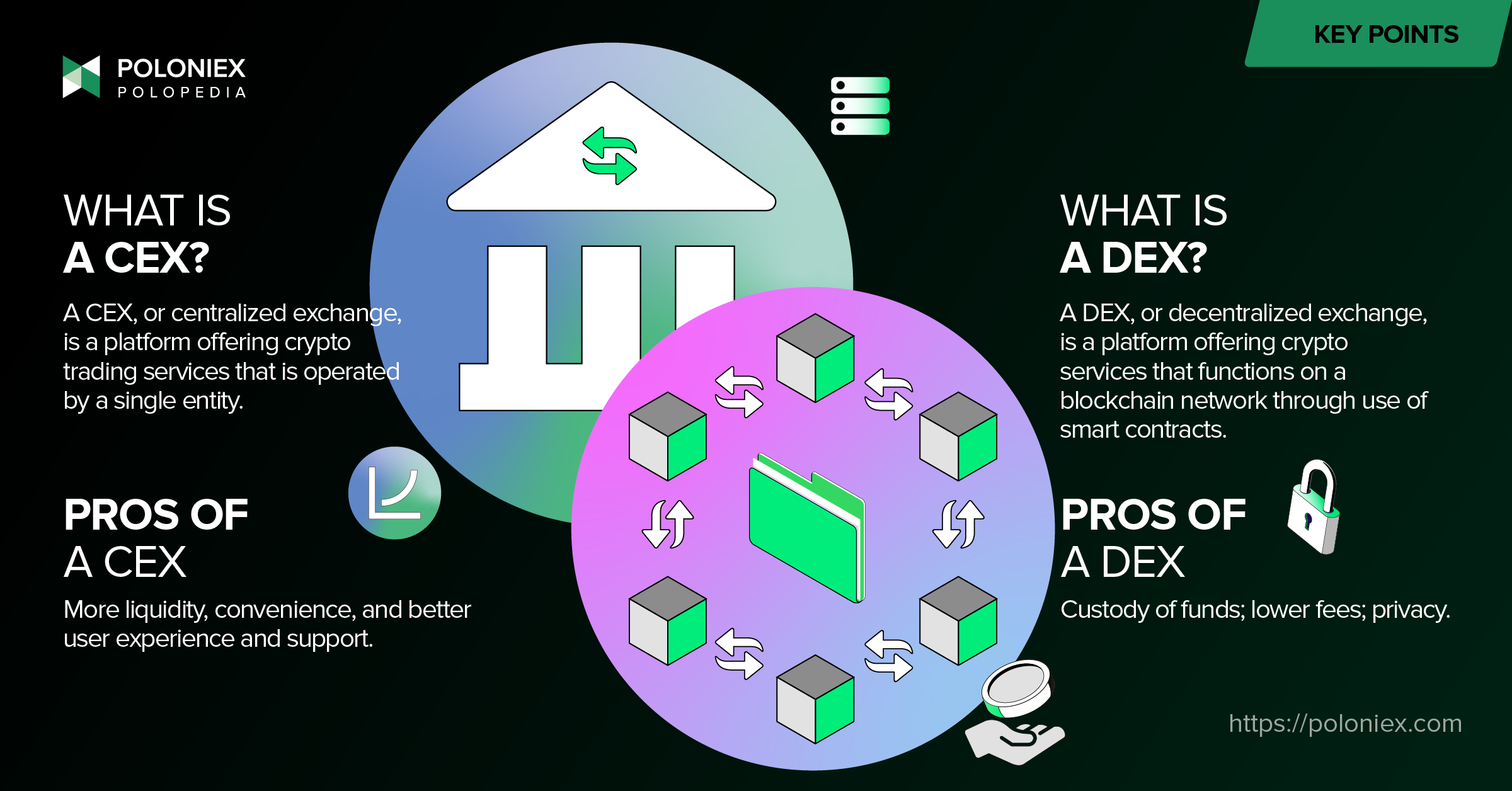

- Enhanced Liquidity: Aggregating orders via auctions ensures deeper books with less slippage, offering a user experience rivaling centralized exchanges (source).

- Fairer Pricing: Uniform clearing prices from batch auctions make it harder for malicious actors to extract value through front-running or sandwich attacks (source).

- Democratized Market-Making: Liquidity vaults open up passive income streams for all users, not just professional market makers (source).

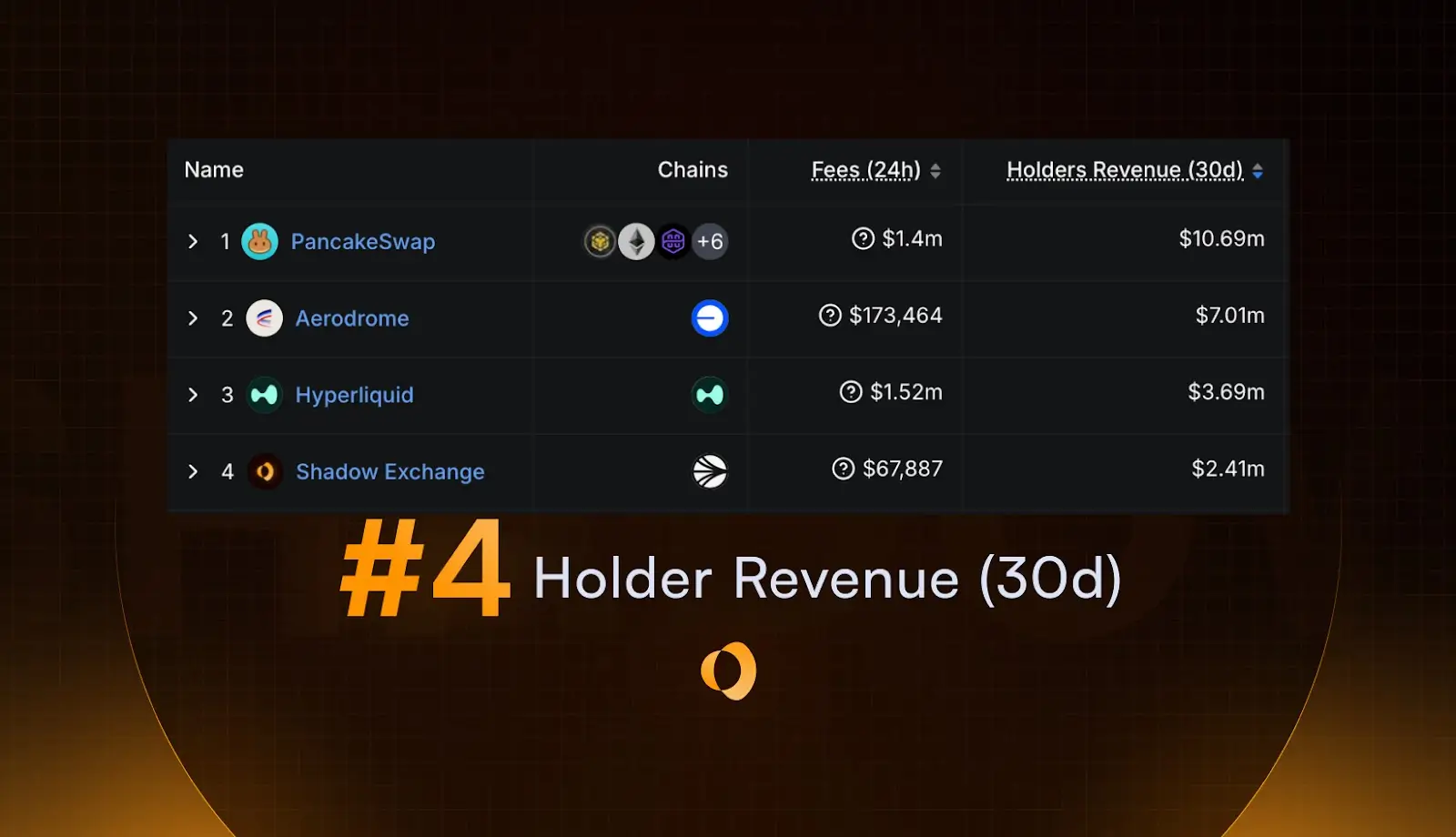

This synergy is especially important as perpetual DEX wars intensify among platforms like Hyperliquid, Aster, Lighter, and others, all competing to offer deeper liquidity, improved MEV protection, and more accessible trading tools.

For traders, the practical impact of these innovations is already tangible. Instead of worrying about predatory bots or thin order books, users can access tighter spreads and consistent execution. Periodic auctions, as implemented on platforms like Dango DEX, batch orders so that price, size, and direction are revealed only at the moment of execution. This not only curbs information leakage but also fosters a more level playing field for retail participants.

Meanwhile, liquidity vaults are quietly powering a new era of passive market making in DeFi. By pooling risk and automating pricing, these vaults allow users to benefit from market activity without the need for constant intervention. The result is a self-reinforcing cycle: as more users participate, vaults grow, deepening liquidity and further reducing slippage and volatility for everyone involved.

Competitive Differentiation: Hyperliquid and the Next Generation of Perpetual DEXs

Platforms such as Hyperliquid are at the forefront of this movement, combining advanced periodic auction models with robust liquidity vault infrastructure. This dual approach not only enhances liquidity but also enables sophisticated MEV protection strategies. As a result, traders experience fewer failed transactions, less slippage, and greater transparency.

Recent analyses show that vaults on Hyperliquid and its peers are delivering competitive returns, with risk-adjusted Sharpe ratios that rival or exceed those found on centralized venues. For a deeper dive into vault performance, including metrics like return, volatility, and TVL, see the On Chain Times report.

It’s worth noting that the competitive landscape is evolving rapidly. Platforms are racing to integrate features like Pro Mode CLOB interfaces, advanced order types, and even stock trading, as seen with Aster. The common thread: a relentless focus on fair execution, deep liquidity, and user empowerment through automation and transparency.

What This Means for the Future of Perpetual DEX Trading

Looking ahead, the adoption of periodic auctions and liquidity vaults is set to accelerate. As these systems mature, expect even greater improvements in MEV protection for perps, reduced transaction costs, and broader access to passive market making opportunities. The days when only highly skilled or well-capitalized players could profitably provide liquidity are fading fast.

For both retail traders and institutions, this means more reliable execution and a wider array of strategies. Whether you’re seeking to trade with minimal slippage or earn yield on your stablecoins through passive participation, the new wave of perpetual DEXs delivers unprecedented flexibility.

Key Advantages of Periodic Auctions DEXs Over Traditional CLOBs

-

Reduced Front-Running and MEV Risk: Periodic auctions batch orders and execute them simultaneously, which minimizes the opportunity for front-running and maximal extractable value (MEV) attacks. This leads to fairer execution compared to continuous order books, where transactions can be reordered by miners or bots. (arxiv.org)

-

Improved Price Discovery and Transparency: By aggregating orders and matching them at a single clearing price, periodic auctions provide more transparent and equitable price discovery. This uniform pricing mechanism reduces price manipulation and slippage often seen in continuous models. (arxiv.org)

-

Enhanced Liquidity and Lower Transaction Costs: Periodic auctions pool liquidity from multiple participants, resulting in deeper order books and reduced slippage. Research shows transaction costs can decrease by 21% to 37% compared to continuous order book DEXs. (arxiv.org)

-

Democratized Market-Making via Liquidity Vaults: Platforms like Demex allow users to supply liquidity through automated vaults, opening market-making to a broader audience. This inclusivity contrasts with traditional CLOBs, which often require advanced trading expertise. (thedefiant.io)

-

Trading Experience Comparable to Centralized Exchanges: By ensuring deeper liquidity and fairer pricing, periodic auction DEXs can offer a trading experience that rivals centralized exchanges, addressing a major pain point for decentralized perpetual traders. (cointelegraph.com)

The bottom line: by addressing long-standing pain points around liquidity fragmentation, MEV exploitation, and accessibility, periodic auctions and liquidity vaults are not just incremental upgrades, they represent a fundamental shift in how decentralized derivatives markets operate. The platforms that best harness these tools will define the next chapter of DeFi trading.