Speed is the name of the game in today’s decentralized finance landscape. For traders chasing every microsecond of edge on perpetual DEXs, optimizing for low latency isn’t just a technical pursuit, it’s a competitive necessity. As platforms like Hyperliquid-Style Perps push the boundaries of decentralized trading, understanding and deploying the right strategies can put you several steps ahead of the pack.

Why Low-Latency Trading Matters in DeFi

Low-latency trading in DeFi means executing trades at lightning speed, minimizing slippage, and capitalizing on fleeting arbitrage opportunities. Unlike centralized exchanges with proprietary matching engines, DEXs bring unique challenges, network congestion, block confirmation times, and unpredictable miner extractable value (MEV) events. Yet, thanks to next-gen architectures like offchain sequencers and direct WebSocket feeds, platforms are now closing the gap between decentralized and traditional markets.

“The fastest traders on perpetual DEXs are those who master both infrastructure and strategy. It’s about more than code, it’s about making every millisecond count. “

Top 5 Strategies for Ultra-Low Latency Execution

5 Actionable Strategies for Ultra-Low Latency DEX Trading

-

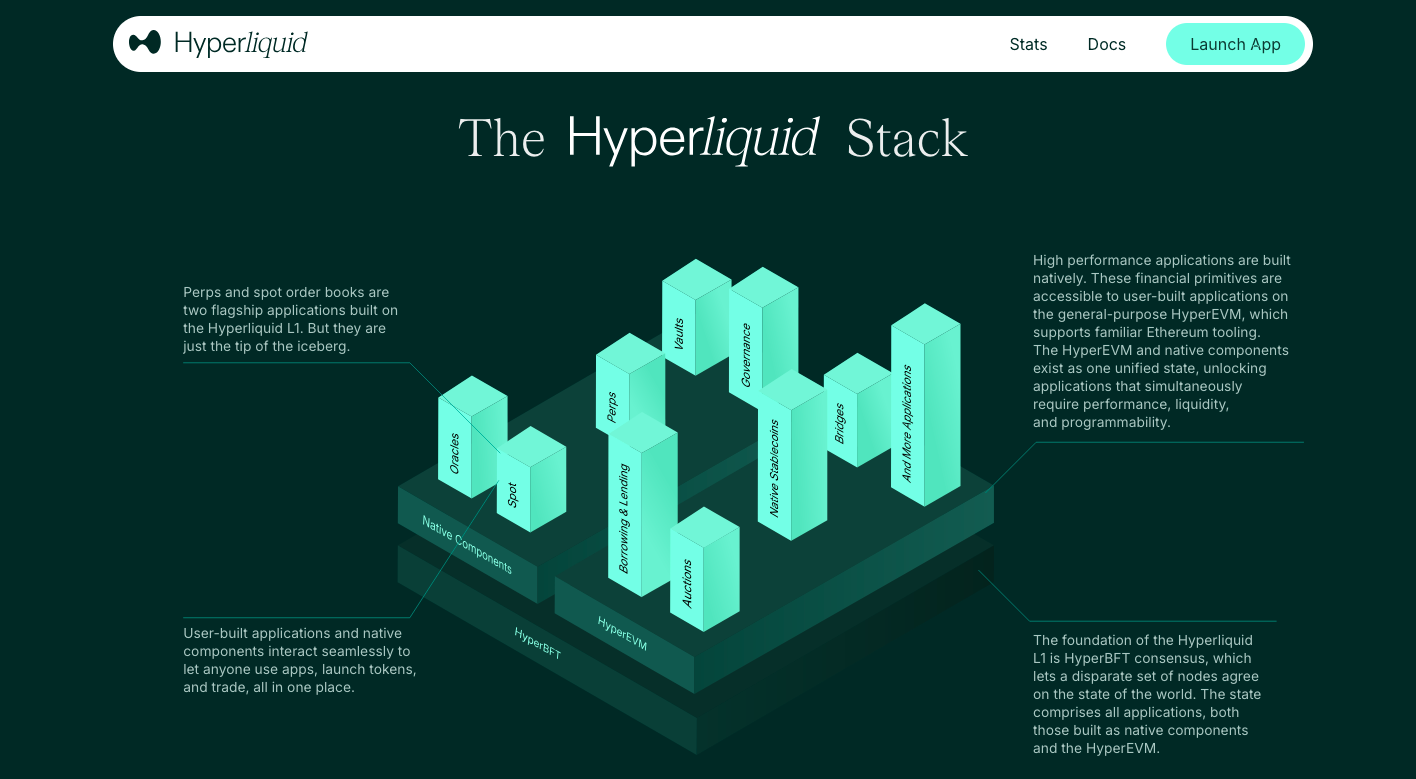

Leverage Offchain Sequencer Architecture for Ultra-Fast Order Matching: Choose DEXs like Hyperliquid that utilize offchain sequencer architectures. These systems process and match orders offchain before settling onchain, dramatically reducing confirmation times and minimizing miner extractable value (MEV). This technology brings execution speeds on par with leading centralized exchanges.

-

Utilize Direct WebSocket Connections for Real-Time Market Data Feeds: Connect to DEXs offering robust WebSocket APIs, such as Hyperliquid and dYdX. Direct WebSocket feeds deliver tick-by-tick market data with minimal delay, enabling traders to react instantly to price changes and market depth updates.

-

Optimize Network Settings and Use Low-Latency VPNs or Colocation Services: Reduce your physical and network distance to DEX nodes by using low-latency VPNs, dedicated servers, or colocation services near the exchange’s infrastructure. Platforms like BSO Network and Amazon Web Services (AWS) offer solutions tailored for high-frequency crypto trading, ensuring your orders reach the market as quickly as possible.

-

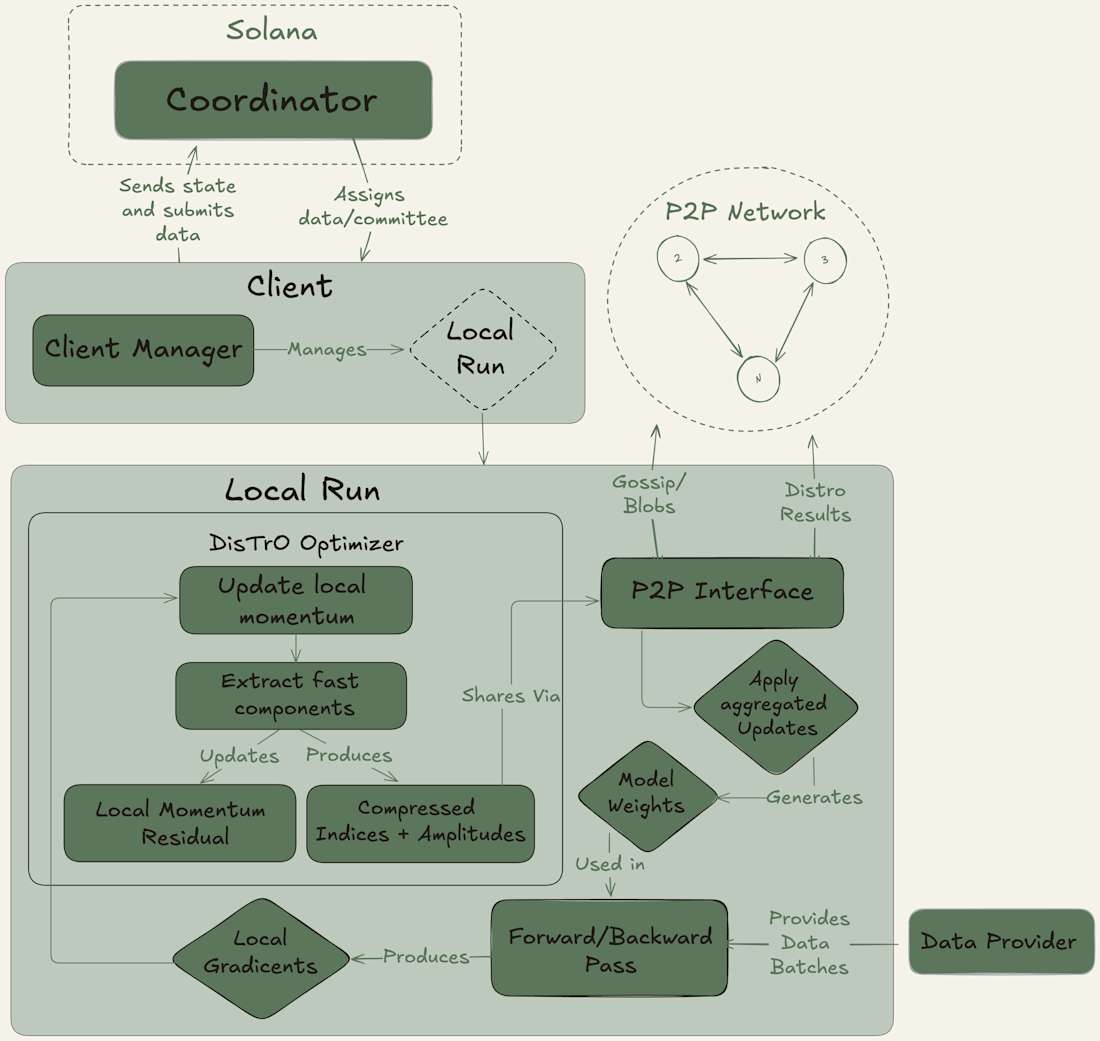

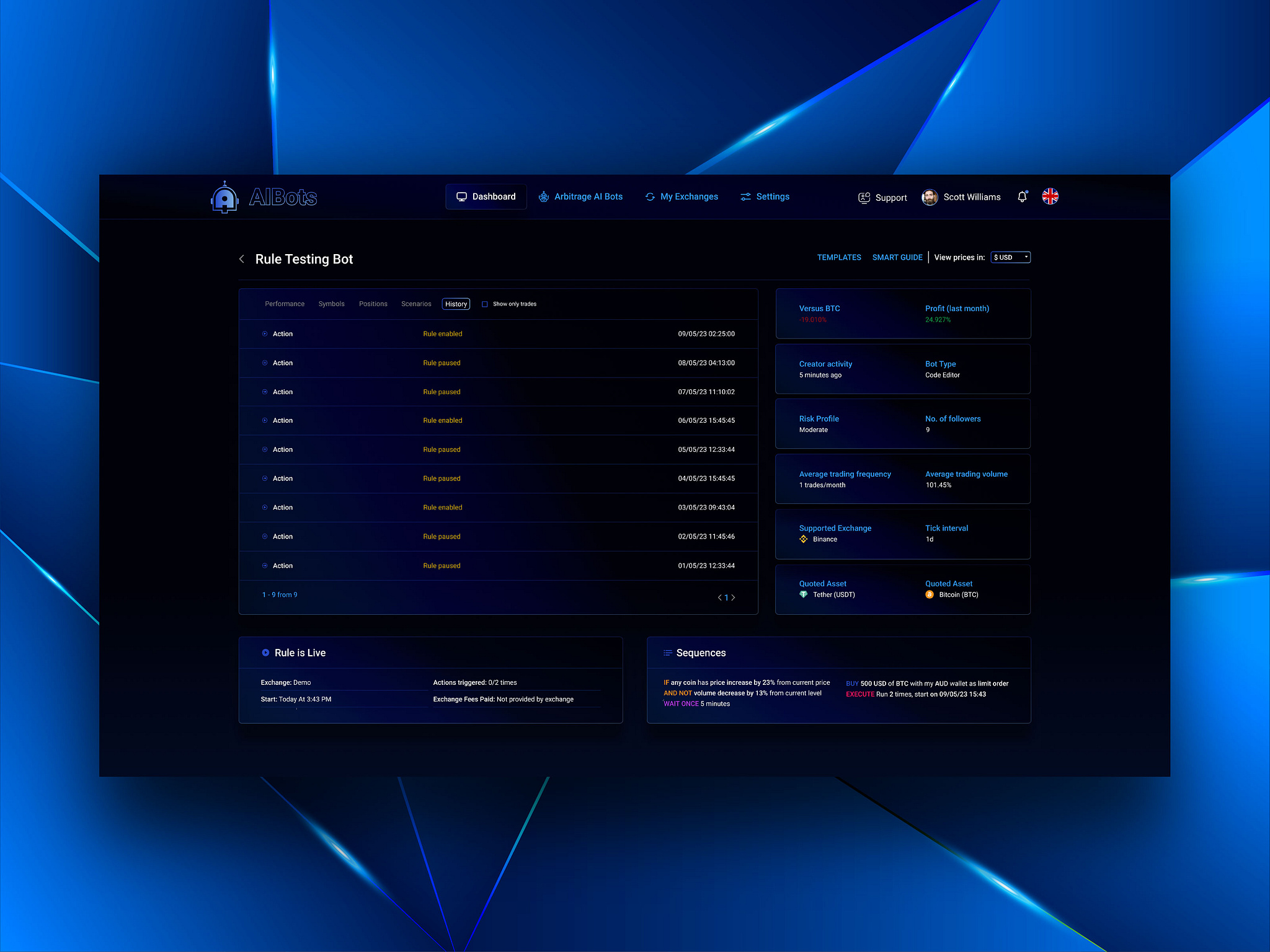

Implement Automated Trading Bots with Fast Order Routing Logic: Deploy trading bots that are optimized for speed, using efficient algorithms and direct API integrations. Open-source frameworks like Hummingbot and custom bots built for platforms such as Hyperliquid can execute trades in milliseconds, capitalizing on fleeting market opportunities.

-

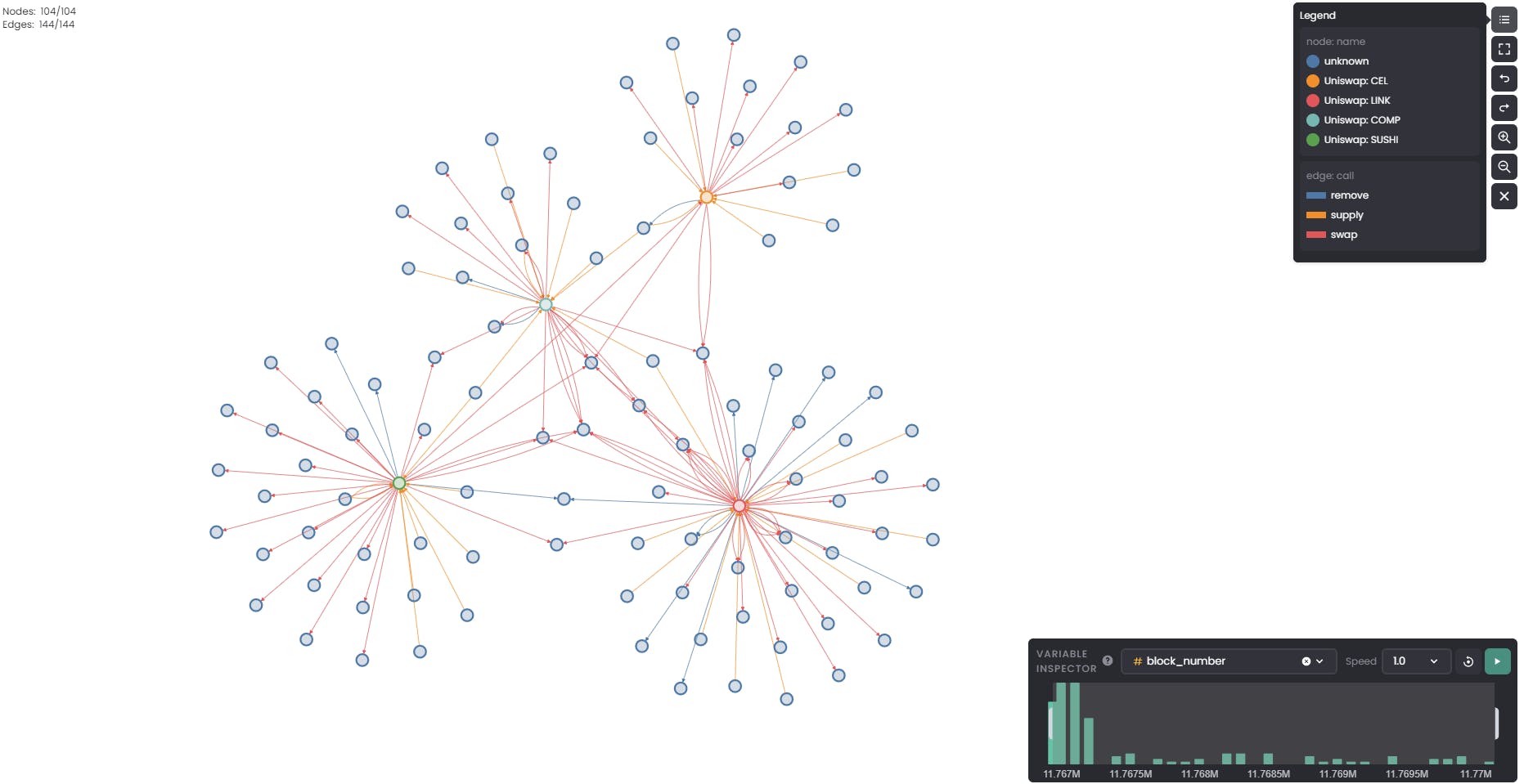

Prioritize Platforms with Deep Liquidity Pools and MEV Protection Mechanisms: Trade on DEXs that maintain substantial liquidity and have built-in protections against MEV, such as Uniswap v4 (with hooks) and Hyperliquid. Deep liquidity ensures minimal slippage, while MEV protection helps secure fair and predictable execution for all participants.

Let’s break down each strategy so you can see exactly where to focus your efforts:

1. Leverage Offchain Sequencer Architecture for Ultra-Fast Order Matching

The latest generation of DEXs, like Hyperliquid, have adopted offchain sequencer architectures to sidestep blockchain bottlenecks. Instead of waiting for block confirmations, trades are matched instantly offchain then settled securely onchain. This dramatically reduces latency and cuts down on MEV risks since transactions are processed in strict order without miners reordering them for profit.

Curious how this works under the hood? Check out our deep dive into offchain sequencing.

2. Utilize Direct WebSocket Connections for Real-Time Market Data Feeds

If you’re still relying on REST APIs or slower polling methods for price feeds and order book updates, it’s time to upgrade. Direct WebSocket connections deliver live market data streams with minimal delay, crucial when milliseconds make or break your entry or exit point.

With platforms like Hyperliquid-Style Perps offering robust WebSocket endpoints, you can subscribe to tick-level data changes and react instantly as liquidity shifts or spreads tighten.

3. Optimize Network Settings and Use Low-Latency VPNs or Colocation Services

Your local network setup matters more than you think. Even if your algorithms are lightning-fast, network lag can undermine everything. Consider running your bots or terminals from servers close to exchange nodes, or use specialized low-latency VPNs designed for crypto trading.

Some advanced traders even colocate their infrastructure in data centers near DEX gateways to shave off precious milliseconds. The result? Consistently faster order placement and fills compared to remote competitors.

The Building Blocks of Fastest DEX Trading Strategies

The above tactics are only as effective as your execution stack allows. In the next section, we’ll explore how automated bots with smart routing logic, and choosing platforms with deep liquidity plus MEV protection, can further amplify your edge in low latency trading DeFi environments.

4. Implement Automated Trading Bots with Fast Order Routing Logic

Manual trading just can’t keep up when every millisecond counts. That’s where automated trading bots come in, especially those designed with optimized order routing for decentralized perpetual exchanges. The best bots monitor multiple liquidity pools in real time, dynamically route orders to the most favorable venues, and adapt instantly to shifting spreads or slippage risks.

For Hyperliquid-Style Perps users, integrating custom bots via API unlocks a powerful toolset: you can automate strategy execution, set conditional triggers, and even backtest latency-sensitive tactics before deploying capital. Just remember that your bot’s efficiency is only as good as your code, minimize computational overhead and network hops for best results.

5. Prioritize Platforms with Deep Liquidity Pools and MEV Protection Mechanisms

No matter how fast your orders hit the books, thin liquidity or rampant MEV attacks can erode your edge. That’s why it’s vital to choose DEXs that not only offer deep liquidity pools but also deploy robust MEV protection mechanisms. Platforms like Hyperliquid-Style Perps are engineered to minimize front-running and sandwich attacks by enforcing fair ordering through offchain sequencing and advanced anti-MEV protocols.

Deep liquidity ensures tighter spreads and less slippage even at higher trade sizes, key for both scalpers and swing traders aiming for optimal fills. Always check a platform’s 24-hour volume, average spread size, and published MEV mitigation strategies before committing significant capital.

Comparison of Top Perpetual DEXs: Latency, Liquidity, and MEV Protection

| DEX Platform | Latency Metrics | Liquidity Depth | MEV Protection Features |

|---|---|---|---|

| Hyperliquid | Sub-millisecond trade confirmations (offchain sequencer) | Very deep liquidity pools; supports large order sizes with minimal slippage | Advanced MEV protection via custom consensus and sequencer architecture |

| dYdX v4 | ~1 second (offchain orderbook on Cosmos chain) | High liquidity, especially for major pairs | Partial MEV protection through offchain order matching |

| GMX | On-chain execution (~5-10 seconds, Arbitrum/AVAX) | Moderate liquidity; relies on GLP pool for trades | No explicit MEV protection; subject to on-chain frontrunning |

| Aevo | Milliseconds (custom rollup with offchain orderbook) | Deep liquidity for top assets | MEV reduction via offchain matching and batch settlement |

| Kwenta | Seconds (Optimism L2, on-chain settlement) | Good liquidity for select pairs | Basic MEV protection via L2 sequencing |

Staying Ahead: Real-Time Monitoring and Adaptive Strategies

The landscape of low latency trading DeFi is always shifting. Even after implementing these five core strategies, offchain sequencers, direct WebSockets, optimized network setups, automated bots with smart routing logic, and platforms with deep liquidity plus MEV protection, you’ll need to stay agile. Use real-time analytics dashboards to monitor fill rates, latency spikes, and market anomalies as they happen.

If you notice changing network congestion or liquidity patterns (for example during major news releases), be ready to adjust your bot parameters or switch between DEX nodes for better performance. The most successful traders treat low-latency optimization as an ongoing process, not a one-time setup.

Ready to Maximize Your Edge?

Pushing the limits of speed on decentralized perpetual exchanges is no longer just for institutions, it’s accessible to any trader willing to master both technology and tactics. By focusing on these five actionable steps specific to platforms like Hyperliquid-Style Perps, you can achieve real-time execution that rivals centralized venues while enjoying the transparency and security of DeFi.

If you want more technical details on how leading platforms achieve these speeds, or step-by-step guides for integrating bots, explore our resource hub starting with how-to-achieve-ultra-low-latency-trading-on-hyperliquid-style-perps-dex.