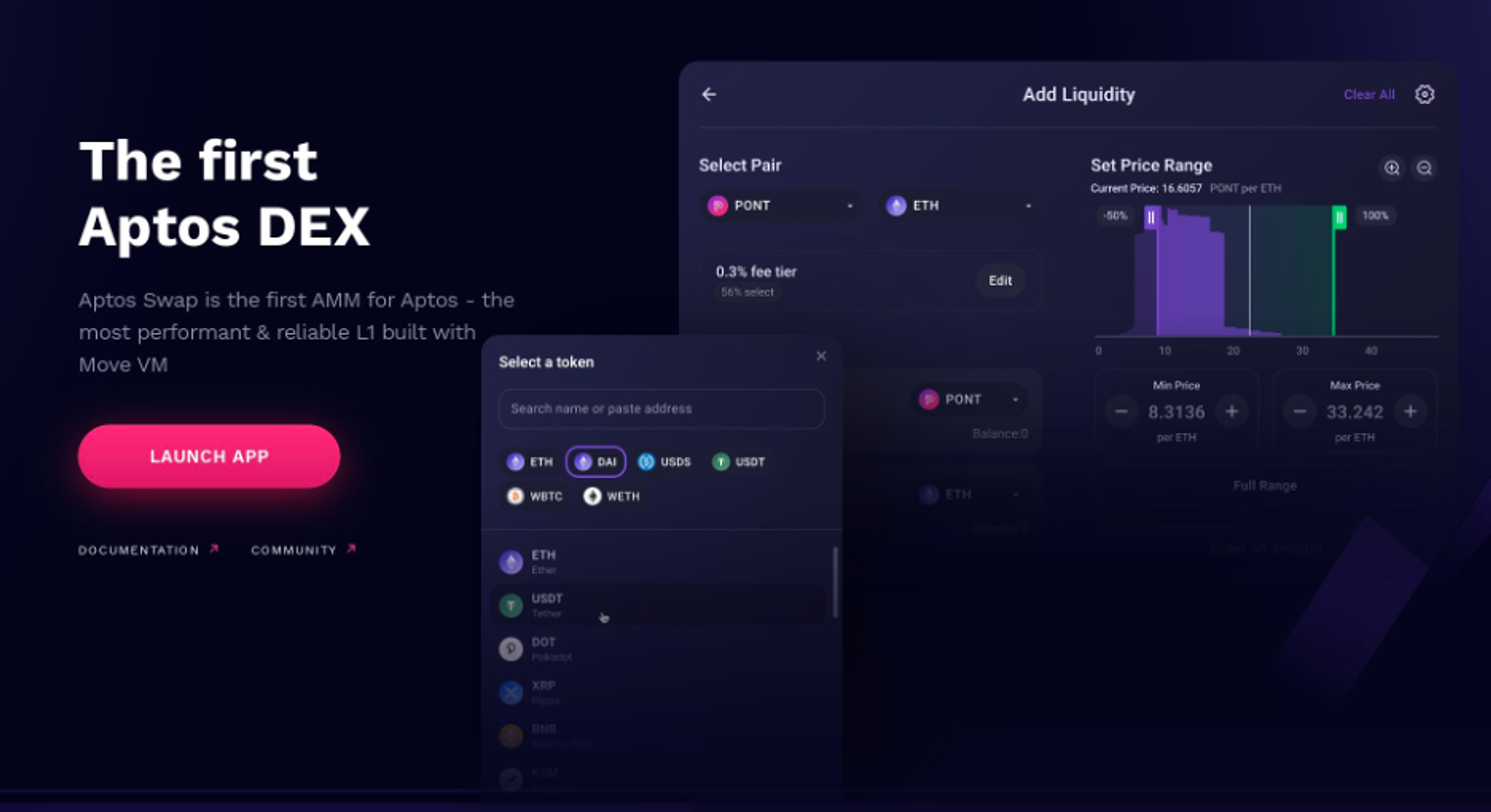

Unified collateral accounts (UCAs) are rapidly changing the game for traders on perpetual DEXs built on Aptos. The days of juggling multiple wallets, transferring assets between isolated margin pools, and missing out on capital efficiency are fading fast. Today’s leading protocols, like Aries Markets and DecibelTrade, offer something much more powerful: the ability to deploy your APT, USDC, BTC, ETH, SOL, and more as seamless margin in a single account. The result? Faster trades, smarter risk management, and real-time DeFi composability, all crucial for anyone serious about perpetual contracts.

Why Unified Collateral Accounts Matter for Aptos Perpetual DEX Traders

Let’s get practical. On traditional DEXs or even some legacy DeFi platforms, you’re forced to segment your assets. Want to trade SOL perps but all your margin is in USDC? You’d need to swap or transfer before you can even open a position. This slows you down and fragments your capital, two things no active trader can afford.

With unified collateral accounts on Aptos-based DEXs like DecibelTrade and Aries Markets, every supported asset you deposit becomes instantly available as cross-margin collateral. This means if you’re holding $3.19 APT (today’s exact price), 0.1 BTC, and some USDC in one account, all of it can be used together to back leveraged trades or earn yield through lending protocols, without manual transfers or missed opportunities.

The Technology Powering Real-Time On-Chain Perpetual Trading

Aptos has emerged as a leader in modular blockchain infrastructure, its high throughput and upgradable modules make it ideal for next-gen trading engines like DecibelTrade. These platforms don’t just unify spot and perp trading; they also automate settlement and liquidity management at the protocol level.

This composability unlocks powerful features:

- Programmable automation: Set vault strategies that auto-rebalance assets or optimize yield while doubling as collateral.

- Multi-collateral support: Use APT, USDC, BTC, ETH, SOL, and more, as interchangeable margin assets.

- Real-time settlement: Enjoy sub-second execution speeds with transparent on-chain order books.

The result is a trading experience that rivals centralized exchanges in speed but stays true to DeFi’s ethos of transparency and self-custody.

Aptos (APT) Price Prediction 2026-2031

Forecast based on current price of $3.19 and evolving DeFi innovations on the Aptos blockchain

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg, YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $2.85 | $3.75 | $5.20 | +17.5% | Continued DeFi growth, but market volatility and regulatory uncertainty keep price range wide |

| 2027 | $3.20 | $4.60 | $6.80 | +22.7% | Increased adoption of unified collateral accounts and cross-chain integrations drive demand |

| 2028 | $3.90 | $5.45 | $8.50 | +18.5% | Aptos ecosystem matures; more institutions participate, but competition from other L1s intensifies |

| 2029 | $4.10 | $6.25 | $10.00 | +14.7% | Bullish scenario: Major DEXs achieve high TVL; Bearish: Regulatory headwinds slow DeFi expansion |

| 2030 | $4.30 | $7.00 | $12.00 | +12.0% | Global DeFi adoption accelerates, but market cycles introduce corrections |

| 2031 | $4.80 | $7.80 | $14.00 | +11.4% | Aptos solidifies its place in top DeFi chains; cyclical market peak possible |

Price Prediction Summary

Aptos (APT) is positioned for steady growth through 2031, leveraging innovative DeFi infrastructure and unified collateral account adoption. While the ecosystem shows promise for increased capital efficiency and user engagement, price performance will be shaped by broader crypto market cycles, regulatory clarity, and competition from other smart contract platforms.

Key Factors Affecting Aptos Price

- Adoption of unified collateral accounts and composable DeFi protocols on Aptos

- Expansion of on-chain trading, cross-margin, and multi-collateral features

- Potential for increased institutional involvement and TVL growth

- Market cycles typical of the cryptocurrency sector (bull/bear phases)

- Regulatory developments impacting DeFi and smart contract platforms

- Competition from Ethereum, Solana, and other layer-1 blockchains

- Macro-economic factors and investor risk appetite

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Capital Efficiency: The Trader’s Edge with Unified Collateral

The biggest win with UCAs is capital efficiency, a concept every trader must master to maximize returns while managing risk. Instead of idle funds scattered across multiple protocols or wallets, your entire portfolio works for you at once.

This isn’t just theory; it’s already live across the Aptos ecosystem:

- Aries Markets: Earn interest on deposits while using them as margin for leveraged swaps, all within one account.

- mirage protocol: Deploy mUSD stablecoin as universal margin across both cross-margin and isolated positions without extra steps.

This unified approach simplifies portfolio management dramatically, and lets you react instantly when market conditions shift around key levels like today’s APT price of $3.19.

How have unified collateral accounts changed your approach to perpetual DEX trading on Aptos?

Unified collateral accounts (UCAs) on Aptos platforms like Aries Markets and mirage protocol now let you use assets like APT ($3.19), USDC, BTC, ETH, and SOL as margin in a single account. This means you can trade, lend, and earn interest without moving funds between different accounts. Has this new approach affected how you trade perps on Aptos?

For active traders, the flexibility to instantly shift margin between positions or protocols is a game changer. No more waiting for asset transfers or losing precious seconds during volatile moves. When Aptos (APT) sits at $3.19, and BTC or SOL are rapidly moving, you want every dollar of your capital working together, not stranded in isolated silos.

But the benefits go beyond just speed. Unified collateral accounts on Aptos-based perpetual DEXs help traders:

Top 5 Advantages of Unified Collateral Accounts on Aptos DEXs

-

1. Enhanced Capital Efficiency: Unified collateral accounts (UCAs) let users deploy assets like APT ($3.19), USDC, BTC, ETH, and SOL as margin within a single account. This maximizes capital utilization by allowing the same assets to support multiple trades and strategies simultaneously, as seen on Aries Markets and mirage protocol.

-

2. Streamlined Asset Management: With UCAs, traders can deposit, trade, lend, and borrow from one account without shuffling funds between separate wallets or protocols. Platforms like Aries Markets offer a unified margin system, reducing operational complexity and saving users time.

-

3. Cross-Margin and Multi-Collateral Support: UCAs enable cross-margining, letting users leverage all supported assets as collateral for perpetual trading. For example, mirage protocol uses mUSD as a protocol-native stablecoin for margin, supporting both cross and isolated margin accounts.

-

4. Improved Risk Management: By consolidating collateral, UCAs help traders manage liquidation risks more effectively. Losses in one position can be offset by gains or collateral in another, reducing the chance of unnecessary liquidations across platforms like Decibel and USDTONE.

-

5. Seamless User Experience: Unified accounts provide a frictionless trading journey. Traders on Aptos DEXs like Decibel and USDTONE benefit from real-time settlement, unified liquidity, and easy access to multiple DeFi activities—all from a single, intuitive interface.

Risk management also gets a major upgrade. With cross-margining, liquidations are less likely to cascade across positions since your entire asset base can absorb volatility. This lowers the risk of sudden wipeouts and lets you size trades with greater confidence, especially when using volatile assets like BTC or SOL as margin alongside stablecoins like USDC.

Unlocking New Trading Strategies and Yield Opportunities

The composable nature of Aptos protocols means your assets aren’t just sitting idle as margin. Platforms like DecibelTrade enable programmable automation, so you can earn yield in vaults while those same assets serve as collateral for leveraged trades or on-chain order book activity.

This opens the door to advanced strategies:

- Delta-neutral vaults: Earn passive yield without directional risk while maintaining instant access to margin for trading.

- Automated rebalancing: Protocol-level automation can optimize your portfolio composition based on real-time market conditions.

- Omnichain liquidity: As Aptos integrates with cross-chain solutions, UCAs are positioned to tap into global liquidity pools, amplifying both opportunity and efficiency.

If you’re still managing multiple wallets and manual swaps for each perp trade, you’re leaving money, and opportunity, on the table. The new wave of unified collateral account DEXs on Aptos is built for traders who demand more: more speed, more flexibility, and more capital efficiency.

If you want to see how these innovations fit into the broader evolution of DeFi trading infrastructure, check out our deep dive at /how-on-chain-perpetual-dex-trading-is-evolving-with-unified-collateral-and-sub-second-finality.

The bottom line: Unified collateral accounts are not just a feature, they’re becoming a necessity for anyone aiming to stay competitive in today’s fast-paced perpetual DEX markets on Aptos. With real-time execution, integrated risk management, and seamless access to all your assets at once, traders now have the tools to turn every market move into an opportunity, without compromise.