Imagine opening your MetaMask wallet and, instead of just swapping tokens or checking your balances, you’re seamlessly trading perpetual futures on over 150 assets, without ever leaving the app. That’s now a reality, thanks to the new MetaMask perpetuals trading feature powered by Hyperliquid. This integration is more than just a technical upgrade; it’s a bold step that’s reshaping how DeFi users interact with derivatives, bringing speed, control, and accessibility to the forefront.

Why MetaMask’s Hyperliquid Integration Is a Game Changer

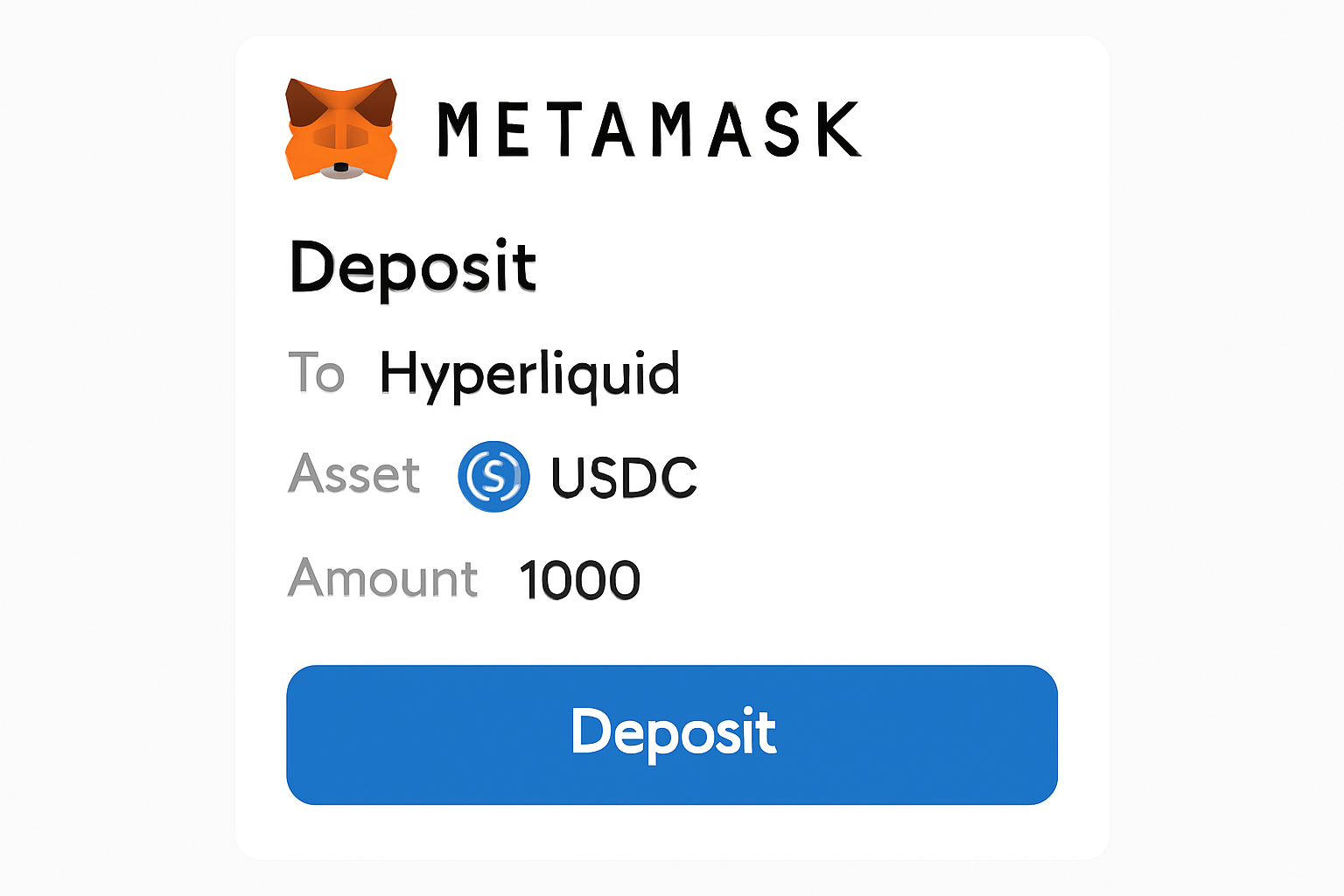

For years, decentralized derivatives trading meant juggling multiple dApps, worrying about slow transactions, and sometimes sacrificing custody for speed. Now, MetaMask’s partnership with Hyperliquid flips that script entirely. Users can fund their accounts with USDC from any EVM-compatible network, think Ethereum, Arbitrum, or Base, and instantly access lightning-fast perpetual contracts on assets like BTC, ETH, and SOL. No more copy-pasting wallet addresses or hopping between interfaces.

What truly stands out is Hyperliquid’s Layer-2 infrastructure. By leveraging this advanced tech, traders enjoy near-zero latency and remarkably low gas fees, performance that rivals centralized exchanges but with the transparency and security only DeFi can offer. And let’s not forget: users keep full custody of their funds throughout the process. That’s self-sovereignty in action.

Unpacking the Key Features

5 Standout Features of MetaMask’s In-Wallet Perpetuals

-

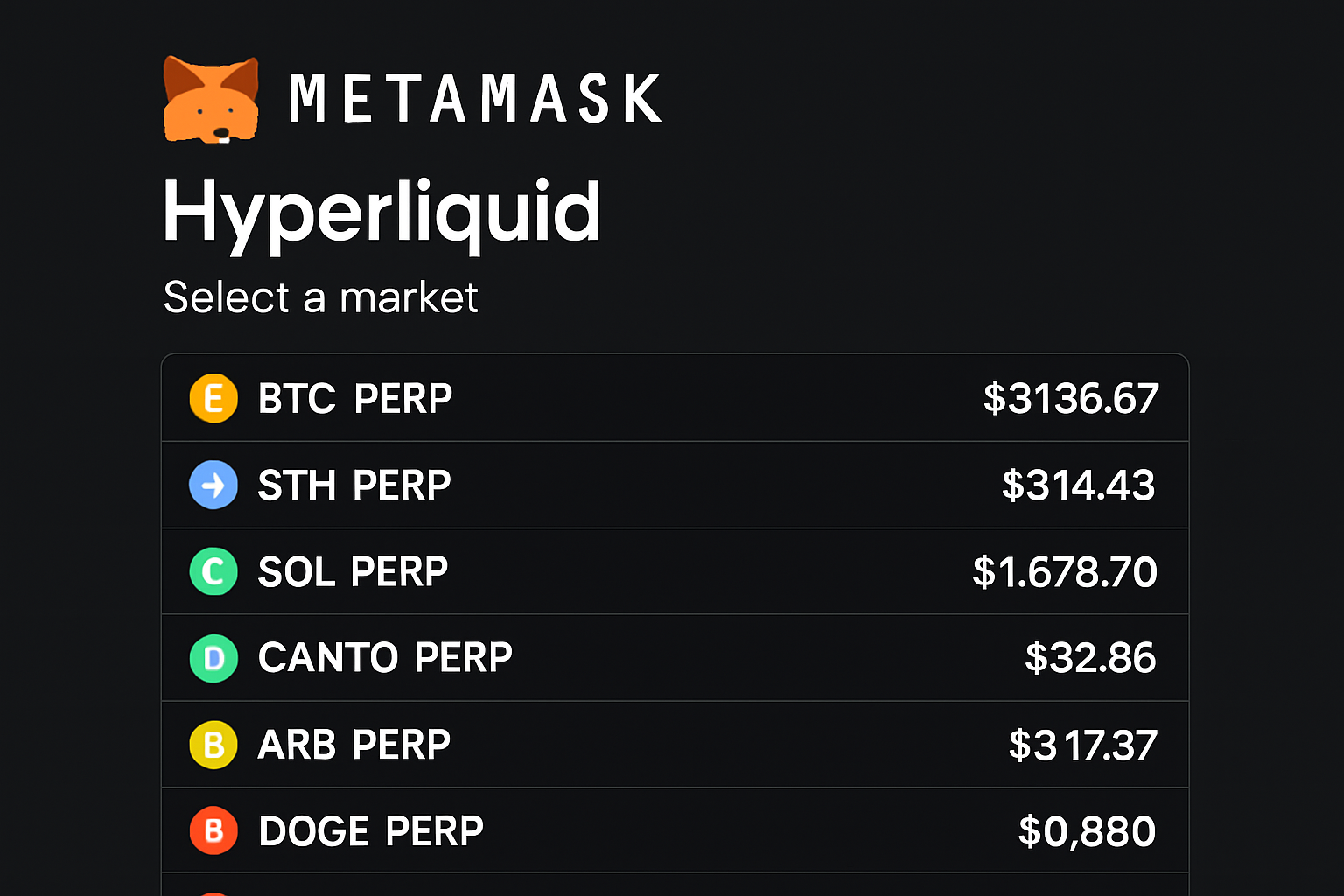

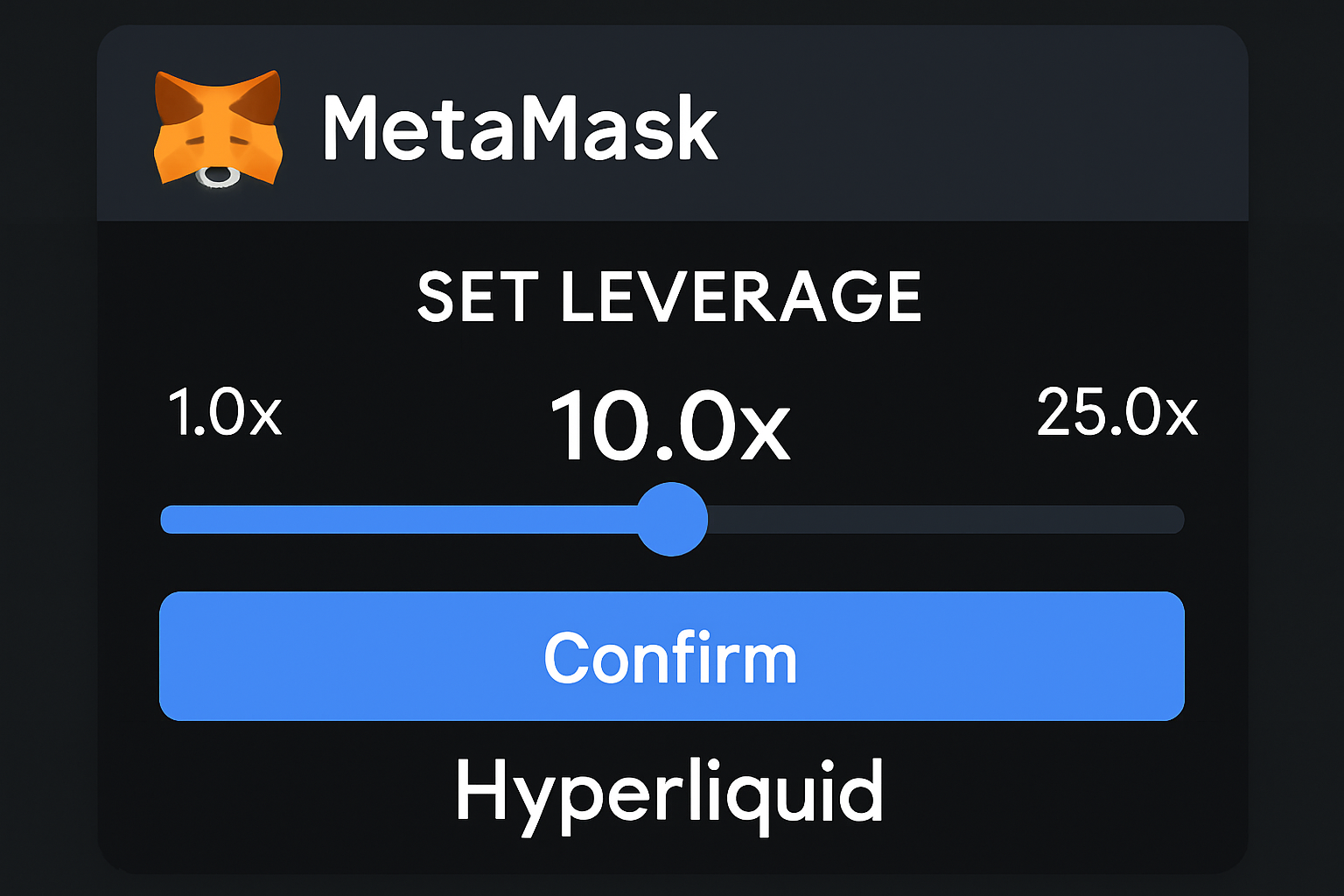

Trade 150+ Tokens with Up to 40x Leverage: MetaMask users can now long or short over 150 crypto assets—including BTC, ETH, and SOL—directly from their wallet, with leverage as high as 40x thanks to the Hyperliquid integration.

-

Instant Funding from Any EVM Chain: Seamlessly deposit USDC from any Ethereum Virtual Machine (EVM) compatible network, such as Ethereum, Arbitrum, or Base, to start trading without delays or complicated bridging.

-

Full Custody of Your Assets: Stay in control—MetaMask’s integration ensures you retain full self-custody of your funds at all times, aligning with the decentralized ethos of DeFi.

-

Near-Zero Latency Trades: Experience lightning-fast order execution with Hyperliquid’s Layer-2 infrastructure, offering trading speeds on par with centralized exchanges but with on-chain transparency.

-

Lower Gas Fees via Layer-2: Enjoy significantly reduced gas fees on trades, made possible by Hyperliquid’s efficient Layer-2 technology—making active trading more affordable.

Let’s break down what makes this so revolutionary for both seasoned traders and newcomers:

- Up to 40x Leverage: Whether you’re taking a long or short position on your favorite token, you can amplify your exposure directly within MetaMask. This is especially powerful for those looking to maximize capital efficiency without moving funds off-chain.

- Trade Over 150 Tokens: From blue chips like BTC and ETH to emerging altcoins, the selection is robust, and growing.

- Instant Cross-Chain Funding: No more waiting around for bridges or worrying about network compatibility. Fund your Hyperliquid account with USDC from any major EVM chain in seconds.

The Ripple Effect Across DeFi

This isn’t just about convenience, it’s about accessibility and market impact. By embedding perpetuals directly into its wallet, MetaMask lowers the barrier to entry for derivatives trading. You don’t need to be a power user to get started; if you can use MetaMask, you can now access advanced trading tools once reserved for centralized platforms.

The result? More participants in the market means deeper liquidity across decentralized protocols. As more users take advantage of these features, especially with perks like perps fee discounts and time-limited points boosts, the entire DeFi ecosystem stands to benefit from heightened activity and innovation.

If you want a closer look at how this works in practice or want to see it in action, check out the official details on MetaMask’s launch announcement.

MetaMask’s move to integrate Hyperliquid isn’t just another feature drop, it’s a shift in the decentralized derivatives landscape. By making advanced trading tools as accessible as sending a token, MetaMask is setting a new standard for what a crypto wallet can be. The days of toggling between interfaces, managing multiple logins, or worrying about the security trade-offs of centralized exchanges are fading fast.

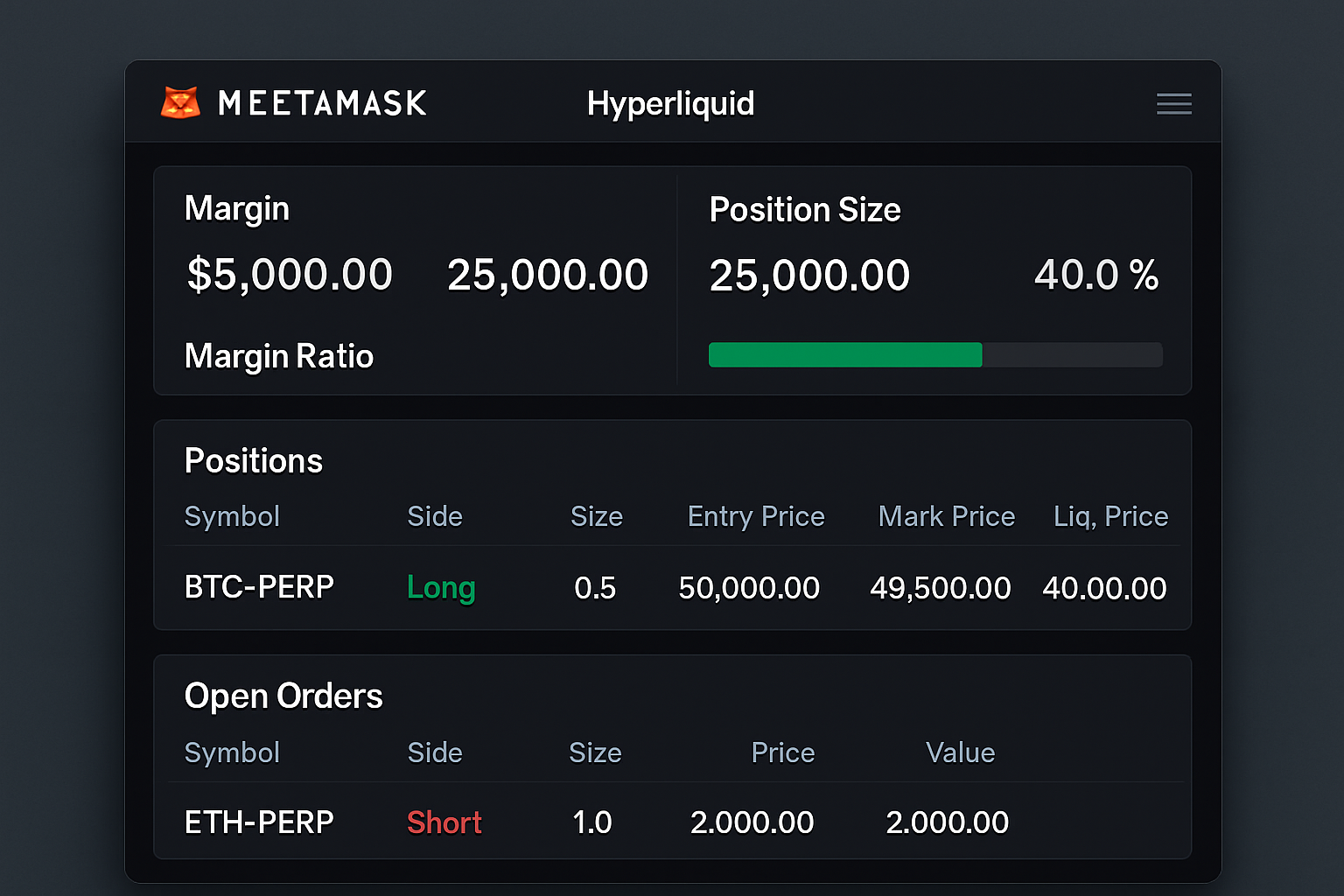

User empowerment is at the heart of this update. For the first time, traders can manage positions, monitor margin, and execute trades with up to 40x leverage, all without ever ceding control of their assets. This is a huge win for anyone who values both performance and true self-custody. And with over 150 tokens available, there’s genuine breadth for both hedging strategies and speculative plays.

What Sets In-Wallet Perpetuals Apart?

Let’s be honest: speed and cost matter. Hyperliquid’s Layer-2 tech means you get near-instant execution and lower gas fees, which is a game changer for active traders. No more worrying about slippage from slow block confirmations or watching profits evaporate due to network congestion. Everything happens in real time, with the transparency you expect from DeFi.

But the benefits go beyond just trading. By making derivatives approachable, MetaMask is opening the door for a new wave of users who might have been intimidated by complex interfaces or high minimums on centralized platforms. The result is a more inclusive DeFi landscape, where anyone with a MetaMask wallet can participate in sophisticated strategies, hedge risk, or simply explore new markets.

How It Impacts the DeFi Competitive Landscape

Centralized exchanges have dominated the derivatives space for years, but MetaMask’s Hyperliquid integration levels the playing field. The combination of deep liquidity, lightning-fast execution, and uncompromising asset custody makes in-wallet perpetual DEX trading a serious contender for your next trade. This is not just about matching what CEXs offer, it’s about surpassing them by giving users transparency, control, and flexibility.

- Liquidity Boost: As more traders use MetaMask for perpetuals, on-chain liquidity naturally deepens, reducing spreads and slippage for everyone.

- Lower Barriers: No need to KYC or create new accounts; your MetaMask wallet is your gateway to advanced trading.

- DeFi Synergy: The integration sets the stage for new DeFi primitives, think composable strategies, on-chain options, or automated hedging, all within your wallet.

With perks like perps fee discounts, priority support, and time-limited points boosts, it’s clear MetaMask wants to reward early adopters and active traders. For those looking to maximize their edge, these incentives can make a real difference in profitability and user experience.

Ready to Trade? Here’s What to Expect

If you’re eager to try it out, the process is refreshingly simple. Fund your Hyperliquid account with USDC from any EVM chain, Ethereum, Arbitrum, or Base, and you’re ready to go. The interface is intuitive, so you can focus on the market, not the mechanics.

Quick-Start Checklist: Trading Perpetuals on MetaMask

-

Fund your Hyperliquid account with USDC from any EVM-compatible network (such as Ethereum, Arbitrum, or Base) directly within the MetaMask app.

-

Select your market—choose from over 150 supported tokens including BTC, ETH, SOL, and more for perpetual futures trading.

-

Set your leverage level—adjust up to 40x leverage based on your risk preference before opening a position.

-

Monitor your margin and open positions in real time using MetaMask’s in-app portfolio and risk management tools.

-

Withdraw profits instantly back to your MetaMask wallet, maintaining full custody of your assets at all times.

For those who want to dive deeper into the mechanics or see how the integration stacks up, check out the official coverage on MetaMask’s launch announcement.

The bottom line? Decentralized derivatives are now as easy as sending a token. MetaMask’s Hyperliquid-powered perpetuals aren’t just an upgrade, they’re an invitation to participate in the next era of DeFi, where speed, security, and access all come standard. Whether you’re hedging, speculating, or just exploring, there’s never been a better time to take control of your trading journey.