High-leverage crypto trading has always demanded speed, deep liquidity, and a frictionless user experience. Yet, until recently, traders seeking exposure to perpetual contracts across decentralized exchanges (DEXs) faced a fragmented landscape riddled with operational headaches: juggling multiple wallets, bridging assets, and paying unpredictable gas fees. The emergence of perpetual DEX aggregators like VOOI is rapidly changing this paradigm.

Unified Trading Terminals: Aggregating Liquidity for the Modern Trader

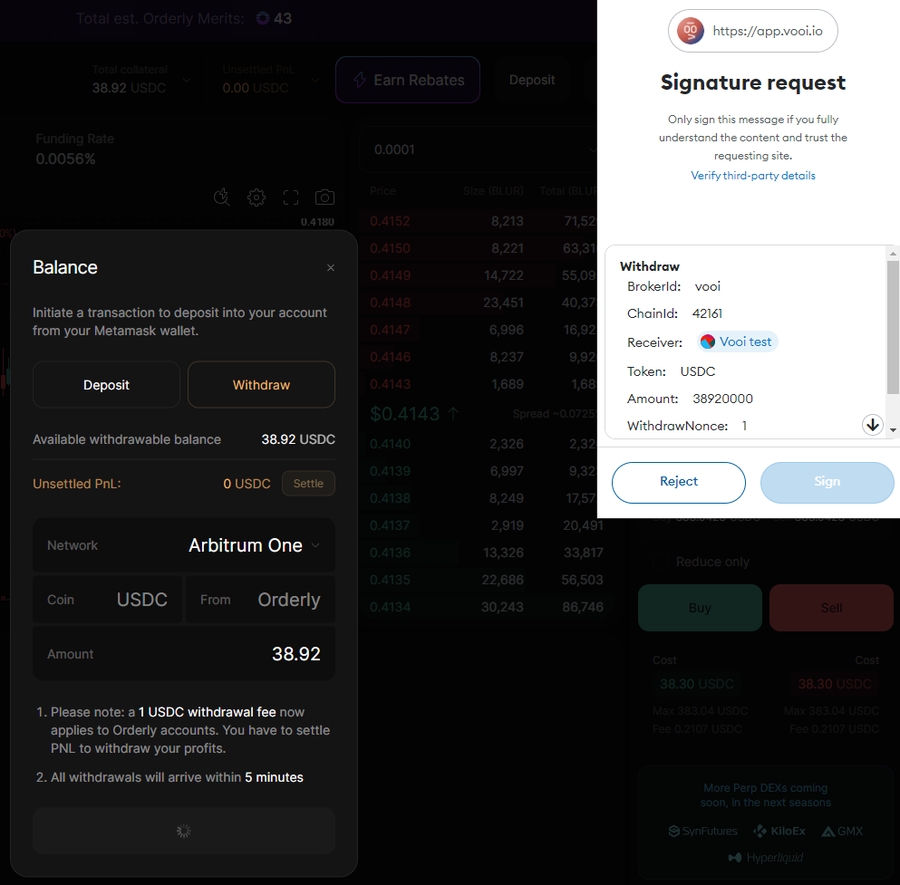

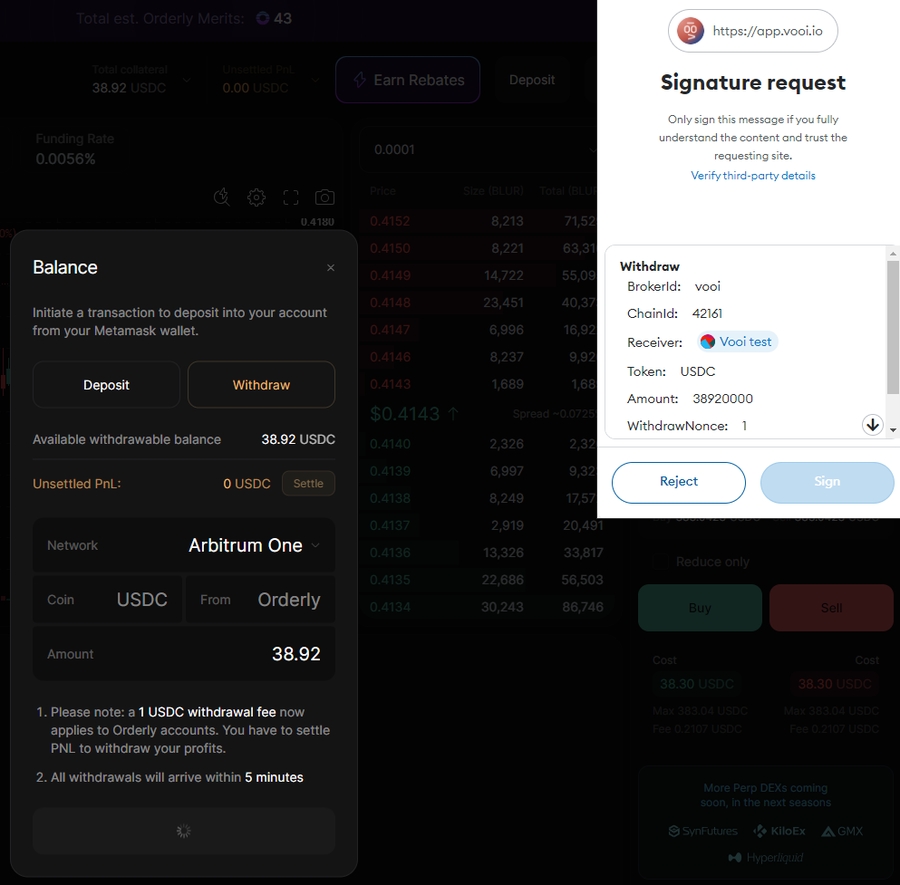

At the heart of the perpetual DEX aggregator model is liquidity aggregation. Platforms like VOOI unify order books from leading perps DEXs such as Hyperliquid, Orderly, and SynFutures, presenting traders with a single, consolidated interface. This means users no longer need to split capital across multiple platforms or manually hunt for the best price and lowest slippage. Instead, they can access a wide array of markets, including crypto, stocks, and even real-world assets (RWAs), with one balance and a consistent trading experience.

Efficiency and speed are not just buzzwords for VOOI, they are foundational to its architecture. By integrating multiple sources of liquidity, the platform reduces order execution times and helps traders maximize potential gains, especially when using high leverage.

Chain Abstraction: The End of Cross-Chain Complexity

One of the most significant innovations powering this new wave of DeFi is chain abstraction. VOOI leverages OneBalance’s chain abstraction toolkit, allowing users to trade perps across different blockchain networks without ever needing to bridge assets, swap wallets, or even hold native gas tokens. This is a substantial leap forward for multi-chain perp trading, as it eliminates the friction and risk often associated with moving funds between blockchains.

With VOOI V2, the trading process is distilled to its essentials: select your market, set your leverage (up to 50x on supported assets), and execute, no matter which chain the underlying liquidity resides on. The platform handles the complexity in the background, giving traders a seamless, CEX-grade experience while preserving the self-custody and transparency DeFi is known for.

Key Differences: VOOI Pro vs. VOOI Light for Traders

-

Target User Profile: VOOI Pro is tailored for advanced and high-frequency traders seeking granular control, advanced analytics, and deeper market access. VOOI Light is optimized for casual and beginner traders who prioritize simplicity and ease of use.

-

Feature Set & Tools: VOOI Pro offers advanced order types, real-time analytics, and customizable dashboards for in-depth strategy execution. VOOI Light provides streamlined trading with basic order types and simplified charts for quick, intuitive trades.

-

User Interface: VOOI Pro features a multi-panel, data-rich interface designed for desktop and power users. VOOI Light delivers a mobile-first, minimalist interface for trading on the go and easy navigation.

-

Cross-Chain & Market Access: Both versions leverage chain abstraction and unified balance technology, but VOOI Pro provides deeper integration with multiple perpetual DEXs (like Hyperliquid, Orderly, SynFutures) and access to a broader range of markets. VOOI Light focuses on core markets and essential cross-chain functionality for straightforward trading.

-

Customization & Automation: VOOI Pro supports customizable trading bots, API access, and advanced automation for sophisticated strategies. VOOI Light emphasizes manual trading with minimal configuration, ideal for users preferring simplicity over automation.

Gasless Trades and Intent-Based Execution: Lowering Barriers for High-Leverage Strategies

Another major pain point for DeFi traders, especially those executing high-frequency or high-leverage strategies, has been unpredictable gas costs. VOOI’s gasless trading model is a game changer. By abstracting away gas fees, the platform removes a significant source of friction and cost variability. Traders can open, close, or adjust positions across supported DEXs without worrying about ETH or other native tokens in their wallets.

Moreover, VOOI introduces intent-based trading, enabling users to specify desired outcomes (e. g. , open a 20x BTC/USD long when price hits a certain level) rather than micromanaging every transaction. This not only streamlines the user experience but also opens the door to more sophisticated, automated trading strategies previously reserved for centralized exchanges.

Why Perpetual DEX Aggregators Matter in the Current Market

The drive toward unified, cross-chain perps trading is more than a technical achievement, it is a response to a maturing market where traders demand both performance and simplicity. As explored in depth here, platforms like VOOI are not just iterating on existing models; they are reimagining what is possible in decentralized finance.

For traders, the implications are profound. The perpetual DEX aggregator model not only reduces operational overhead but also levels the playing field between professional and retail participants. With features like gasless trades, a unified trading terminal, and intent-based execution, even less-experienced users can deploy advanced, high-leverage strategies across a diverse set of markets, without the technical obstacles that once kept DeFi out of reach for many.

Risk Management and Capital Efficiency: New Tools for a New Era

High-leverage crypto trading, by its nature, amplifies both potential returns and risks. Perpetual DEX aggregators like VOOI are acutely aware of this dynamic. Their platforms are designed to help users manage risk more effectively, offering real-time margin monitoring, cross-exchange portfolio views, and robust liquidation engines. The chain abstraction layer also means that users’ collateral can be deployed more efficiently, no more idle balances trapped on isolated chains or platforms.

For risk-first traders, the ability to instantly rebalance or close positions across multiple DEXs is invaluable. VOOI’s system ensures that capital is always working, while also providing the transparency and auditability that DeFi promises. Advanced users can even leverage on-chain analytics tools to monitor market depth, funding rates, and volatility across the aggregated venues, making more informed decisions in fast-moving environments.

The Future of Multi-Chain Perp Trading: What Comes Next?

The rapid adoption of chain abstraction and perpetual DEX aggregators signals a shift in DeFi’s center of gravity. As platforms like VOOI continue to innovate, expect to see even deeper integrations, think AI-powered trade routing, native support for RWAs, and more granular intent-based automation. The end goal is clear: a unified, high-speed trading layer that operates seamlessly across any blockchain or asset class, all while keeping users in control of their funds.

For those navigating the evolving world of high-leverage crypto trading, the perpetual DEX aggregator is quickly becoming not just an option, but a necessity. The days of scattered liquidity and cumbersome cross-chain workflows are fading. In their place is a new standard: gasless trades, unified balances, and instant access to hundreds of markets, all from a single terminal.

“VOOI isn’t just a tool, it’s a new way to think about decentralized trading. The unified experience lets me focus on strategy, not logistics. ”

To learn more about how perpetual DEX aggregators are transforming DeFi trading and to explore cross-chain perps in depth, see this comprehensive guide.