On-chain perpetual DEX trading is entering a new era, driven by the convergence of unified collateral systems and sub-second finality. This innovation is not just a technical milestone – it is fundamentally reshaping capital efficiency, risk management, and user experience for both retail and professional traders. As the boundaries between centralized and decentralized trading continue to blur, platforms leveraging these advancements are setting new benchmarks for speed, transparency, and flexibility in DeFi.

Unified Collateral: The Foundation of Modern On-Chain Perpetuals

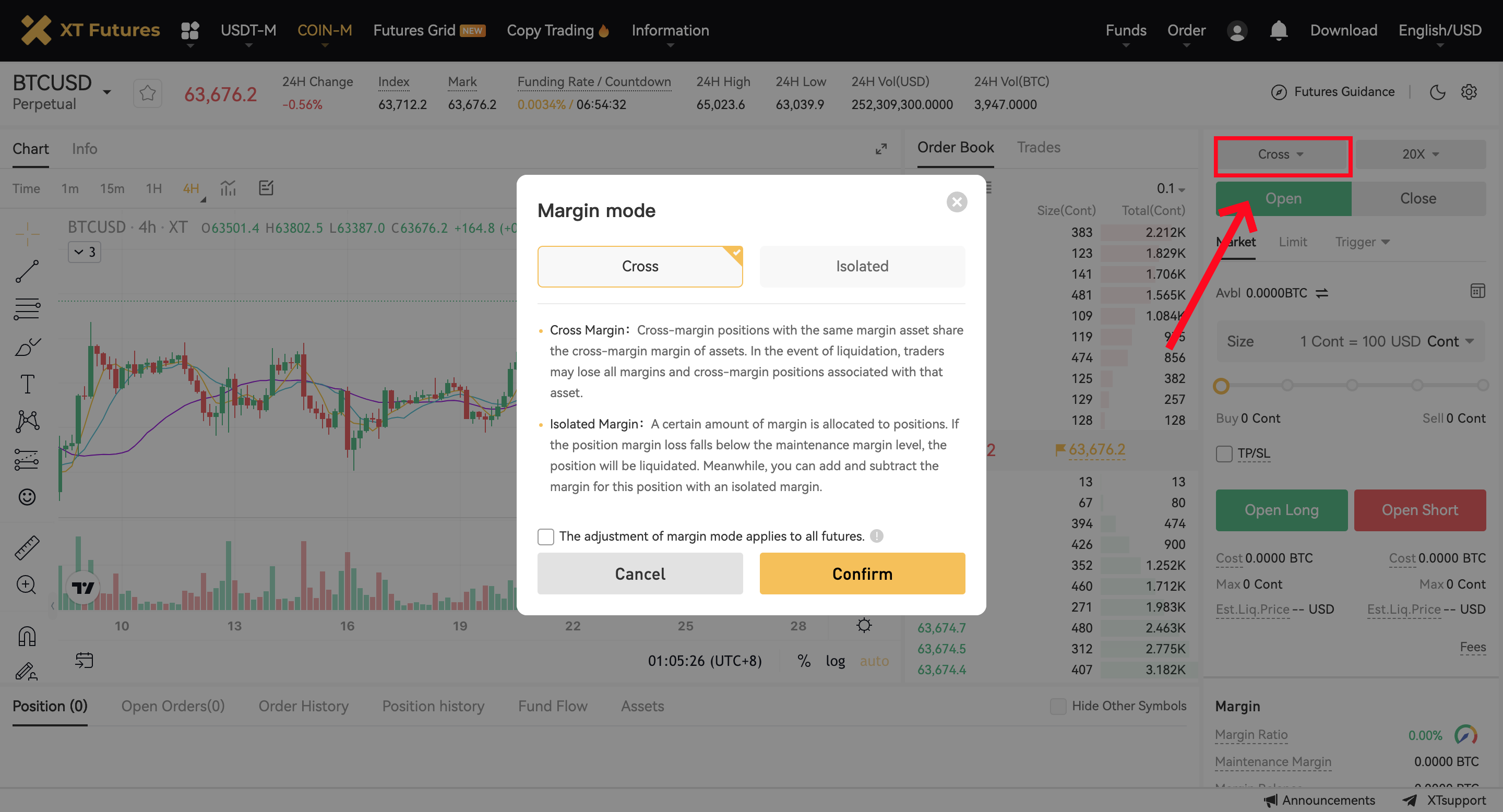

Historically, traders on decentralized exchanges faced fragmented margin systems. Each market or protocol often required isolated collateral, leading to inefficient capital allocation and unnecessary liquidation risks. The new wave of unified collateral trading changes that paradigm. By allowing users to deposit a variety of supported assets – including BTC, SOL, APT, stablecoins, or even yield-bearing tokens – as margin, platforms like Extended (read more) are unlocking true portfolio margining on-chain.

This approach offers several advantages:

Key Benefits of Unified Collateral in On-Chain Perpetual DEXs

-

Enhanced Capital Efficiency: Unified collateral systems enable traders to use a variety of assets—including stablecoins, yield-bearing tokens, and other cryptocurrencies—as margin, maximizing the utilization of deposited funds across spot, perpetual, and lending markets. Example: Extended’s unified margin framework.

-

Streamlined Trading Experience: By aggregating collateral types under one margin account, users can seamlessly manage positions across multiple trading products without the need to manually rebalance or transfer funds between isolated accounts. Example: Ethereal’s integration with Ethena’s USDe.

-

Improved Risk Management: Unified collateral allows for real-time portfolio monitoring and dynamic risk assessment, reducing the likelihood of forced liquidations and enabling more sophisticated risk mitigation strategies.

-

Reward Synergies and Yield Optimization: Traders can earn rewards or yield on their collateral assets even while using them as margin, thanks to integration with yield-generating protocols. Example: Ethereal’s reward synergy with USDe.

-

Greater Flexibility and Accessibility: Supporting a wide range of collateral types lowers barriers to entry for traders, allowing participation with diverse asset holdings and improving overall market liquidity.

Unified collateral systems also enable sophisticated risk controls. For example, the integration of Ethena’s USDe by Ethereal (see details) allows users to seamlessly switch between assets for margin requirements while benefiting from reward synergies across lending, spot, and perpetual markets. The result is a capital stack that mirrors the flexibility of centralized exchanges but preserves the self-custody and composability unique to DeFi.

Sub-Second Finality: The Latency Arms Race

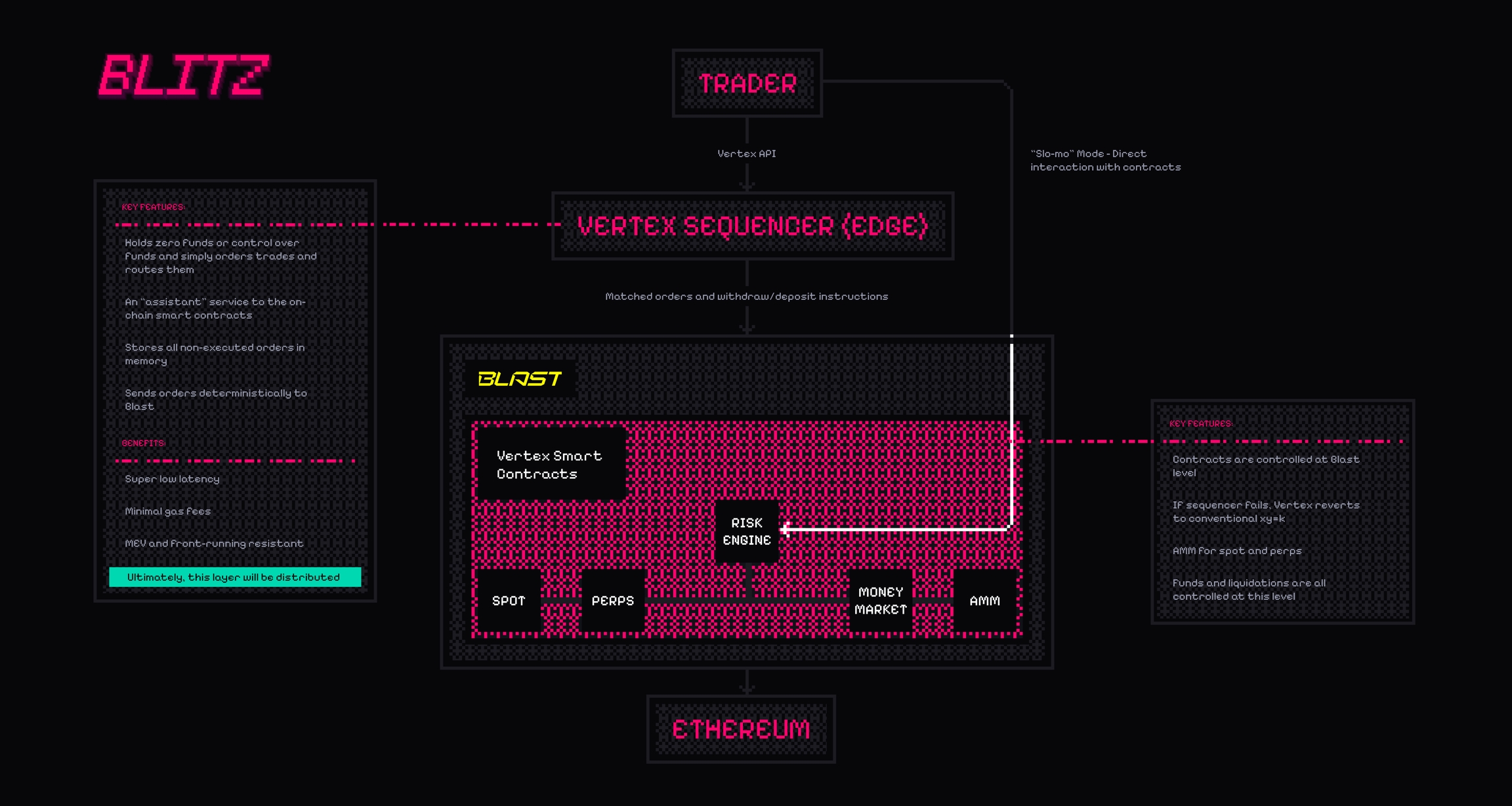

Speed matters in trading. Sub-second finality was once the exclusive domain of centralized venues. Now, platforms like Hyperliquid are delivering sub-second finality DeFi by deploying custom Layer-1 solutions with consensus mechanisms like HyperBFT. This enables the processing of up to 100,000 orders per second with finality times under one second (read more), supporting a fully on-chain order book that rivals traditional CLOBs in both speed and transparency.

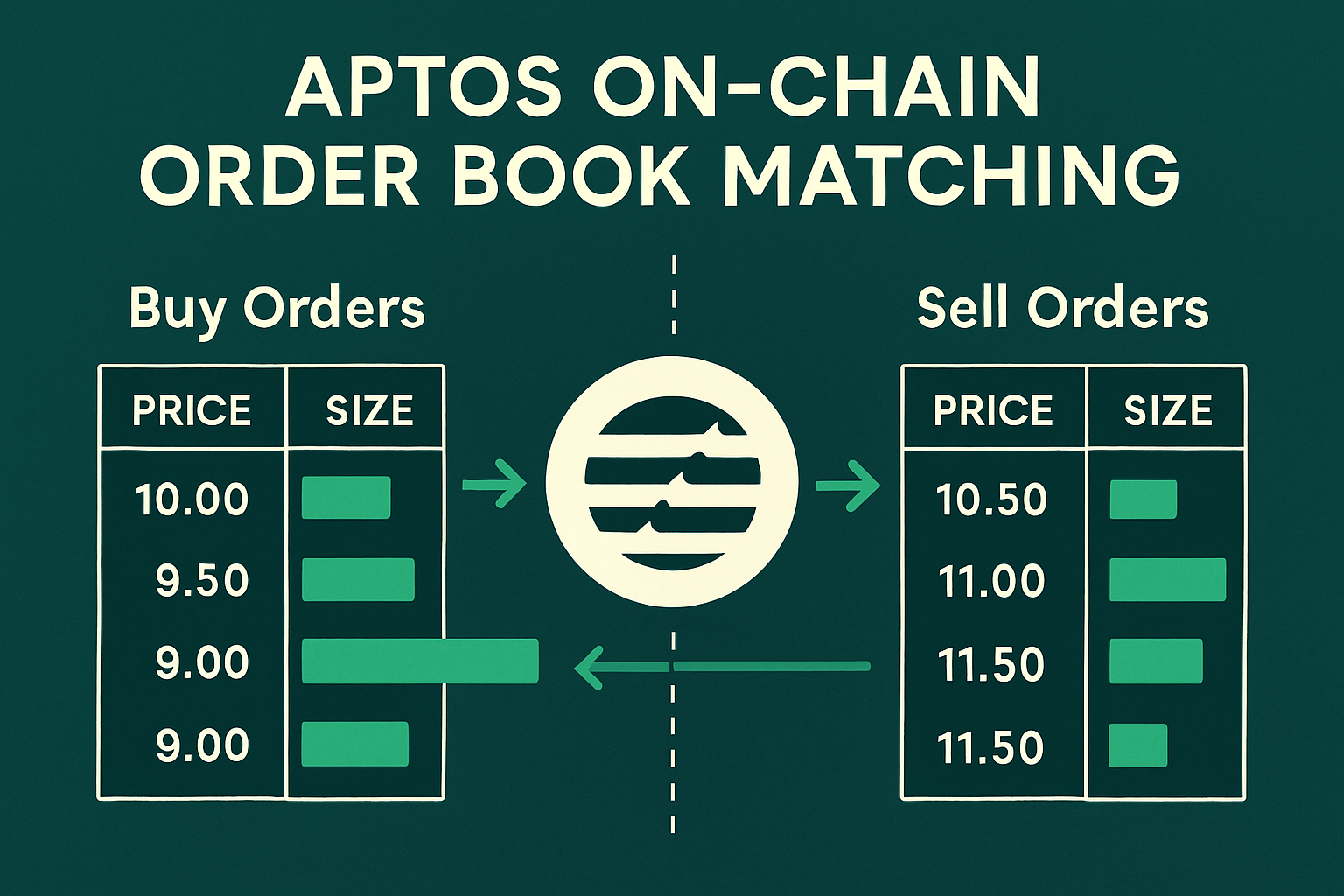

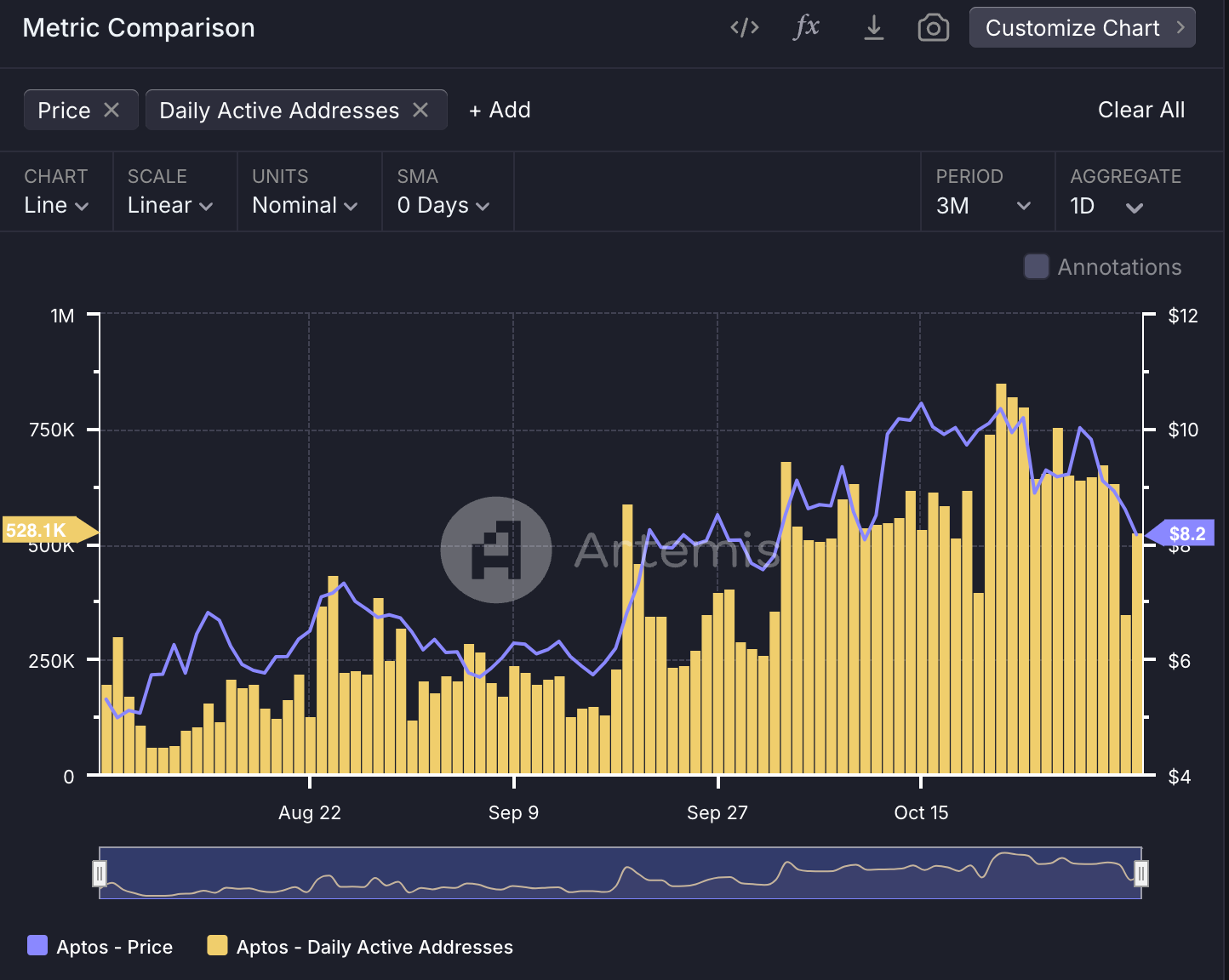

Aptos is another standout. With block times under 130ms and user finality at 650ms, Aptos-based DEXs such as Kana Perps and Decibel are pushing the envelope for low latency DeFi trading. This infrastructure empowers traders to execute strategies that were previously unthinkable on-chain – from high-frequency arbitrage to dynamic hedging across BTC, SOL, and APT collateral pairs. The combination of atomic matching engines and real-time settlement is transforming user expectations across the ecosystem.

Real-Time Execution and Privacy: The Next Competitive Edge

Beyond speed and capital efficiency, privacy and intent protection are emerging as critical differentiators. Defx’s Layer-1 dark pool DEX for perpetual futures introduces zero-knowledge proofs at the execution layer. This allows for encrypted order parameters and hidden PnL metrics while maintaining public verifiability on-chain (see announcement). For sophisticated traders, this means strategies can be executed without leaking alpha or exposing sensitive data to competitors or MEV bots.

Key Innovations Shaping Perpetual DEX Trading

-

Sub-Second Transaction Finality: Hyperliquid and Aptos leverage proprietary consensus mechanisms (HyperBFT and AptosBFT) to achieve sub-second finality, processing thousands of orders per second. This delivers a trading experience with speed and reliability comparable to centralized exchanges, while maintaining full on-chain transparency.

-

Privacy-Preserving Trading: Defx integrates zero-knowledge proofs into its execution layer, enabling encrypted order parameters and hidden profit/loss metrics. This approach protects trader intent and ensures protocol-level trust, while maintaining public verifiability on-chain.

-

Composable and Programmable Trading Engines: Platforms such as Decibel on Aptos provide unified liquidity, programmable automation, and real-time settlement. Their composable architecture allows DeFi protocols to integrate spot, perpetuals, and yield strategies within a single, high-speed interface.

The integration of these features signals a maturation of the on-chain perpetual DEX landscape. Traders are no longer forced to compromise between speed, privacy, and composability; instead, they can access real-time decentralized perps with unified margining and robust risk controls.

As these technical leaps become standard, user experience and institutional adoption are accelerating. The presence of unified collateral systems and sub-second finality is drawing liquidity providers and professional traders who demand both efficiency and trust. These advances are not just incremental; they redefine what is possible for on-chain perpetual DEXs and set the stage for the next phase of growth in decentralized finance.

Consider the broader implications for risk management and market structure. Unified collateral allows for seamless cross-margining and reduces forced liquidations during periods of volatility. Sub-second finality minimizes slippage and latency arbitrage, leveling the playing field for all participants. The result is a more resilient and efficient marketplace where capital can move freely and securely across products and protocols.

Aptos Ecosystem: The Engine Behind Next-Gen Perpetuals

Aptos has emerged as a foundational layer for this evolution. Its lightning-fast consensus and composable infrastructure support a vibrant ecosystem of DeFi projects focused on perpetuals, spot, and yield. Decibel’s atomic matching, Kana Perps’ CLOB model, and cross-chain abstractions via NEAR Intents are all examples of how Aptos is enabling builders to push boundaries and deliver CEX-like performance within a fully transparent environment. For traders, this means real-time execution, deep liquidity, and seamless asset interoperability, without ever relinquishing custody.

Top On-Chain Perpetual DEXs on Aptos Leveraging Unified Collateral and Sub-Second Finality

-

Decibel — A cutting-edge on-chain trading engine on Aptos, Decibel offers unified liquidity, programmable automation, and real-time settlement. Its design leverages Aptos’ sub-second finality to provide a CEX-like trading experience with full on-chain transparency.

-

Econia — Econia utilizes Aptos’ atomic matching engine and lightning-fast sub-second finality to enable instant trade clearing. The platform supports unified collateral, allowing diverse assets to be used efficiently across spot and perpetual markets.

-

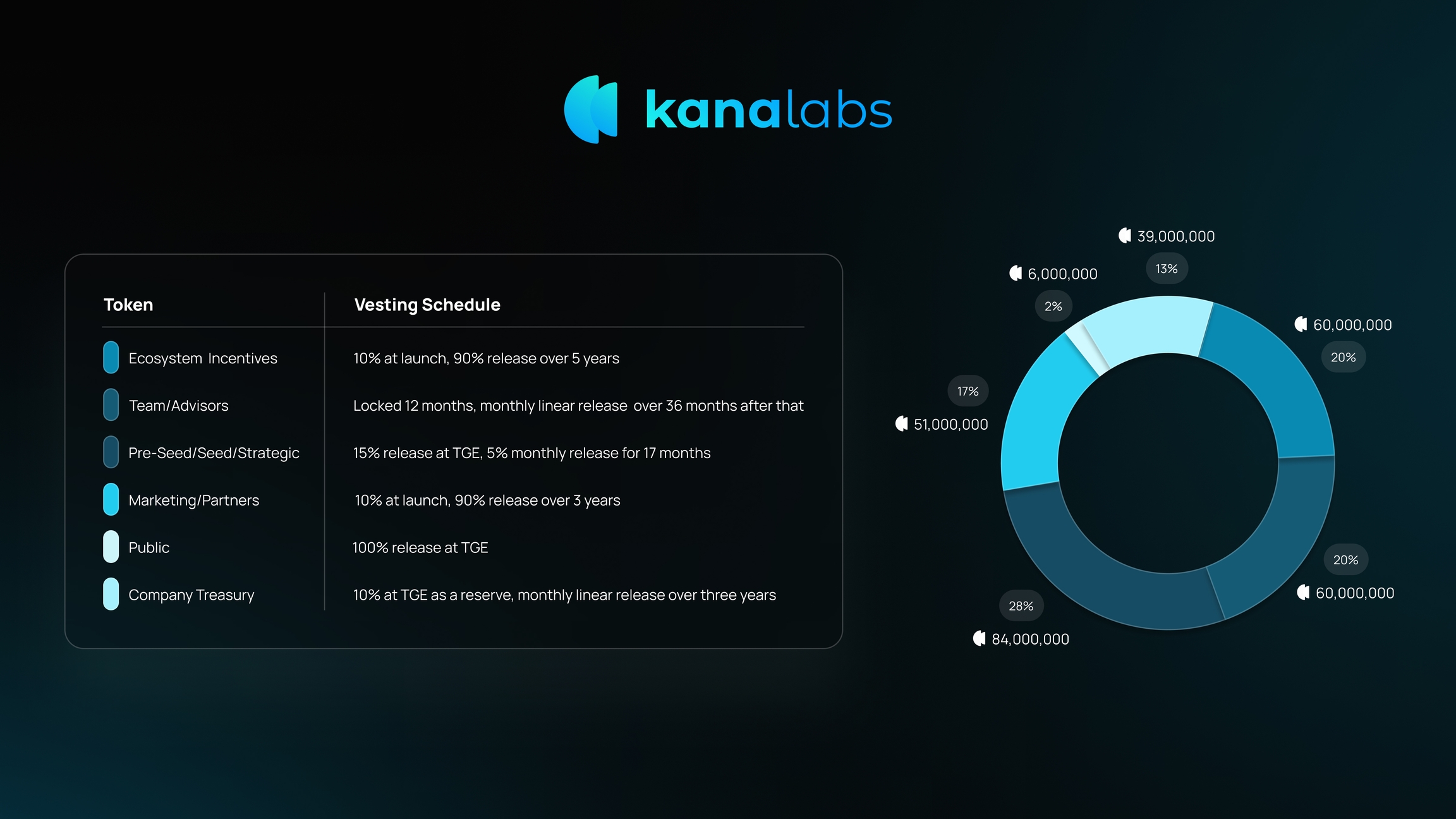

Kana Labs — Kana Perps, launched by Kana Labs, is the first fully on-chain perpetual DEX on Aptos. It aggregates liquidity and supports unified collateral, benefiting from Aptos’ under-650ms user finality for rapid trade execution.

-

Extended — Extended is developing a unified margin system that integrates perpetuals, spot trading, and lending under one collateral framework. This enables users to deposit various supported assets, including yield-bearing tokens, for enhanced capital efficiency.

-

Ethereal — Ethereal is integrating with Ethena’s USDe to deliver a seamless, unified margin experience for perpetual trading on Aptos. The platform combines CEX-like settlement speed with on-chain self-custody benefits.

Looking ahead, the convergence of these innovations points to an era where on-chain perpetual DEXs can rival, and in some cases surpass, their centralized counterparts. Expect further integration of yield strategies, cross-chain collateralization, and advanced privacy tools. As protocols continue to iterate on risk engines and settlement layers, the line between DeFi and TradFi will only become more indistinct.

For traders and liquidity providers, now is the time to engage with platforms pioneering unified collateral and sub-second finality. The competitive edge lies not only in technology but also in the ability to adapt to an environment where capital efficiency, privacy, and speed are no longer mutually exclusive. The future of real-time decentralized perps is here, and it is being built on-chain, block by block.