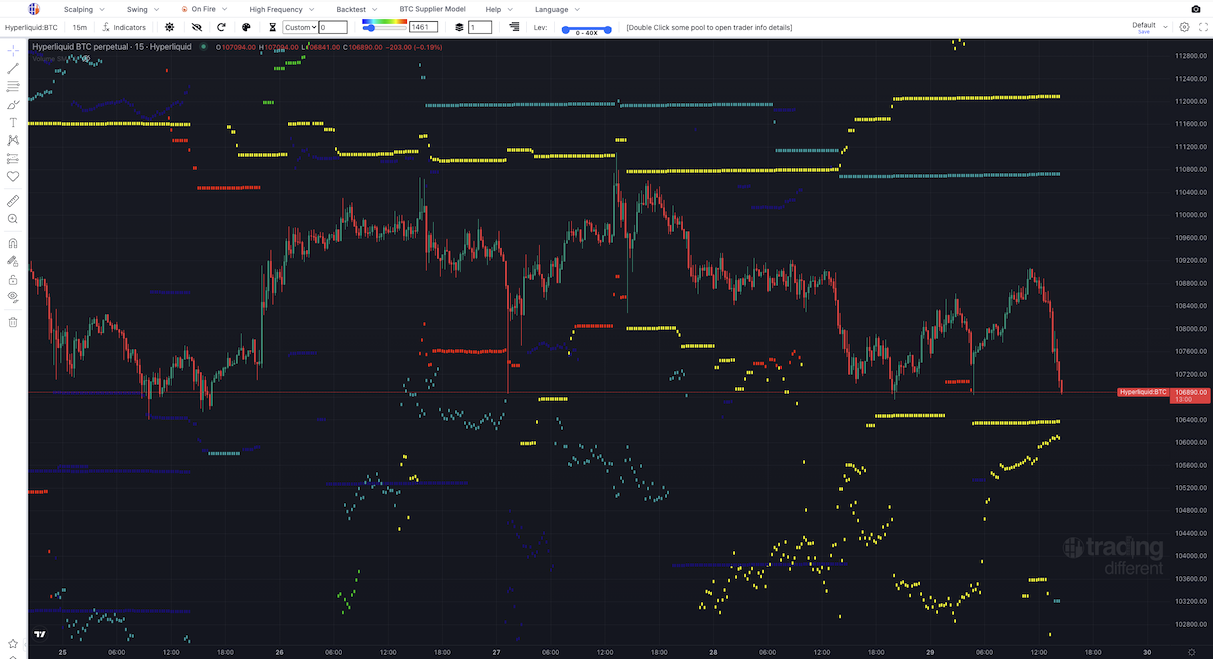

Speed and reliability are two qualities traders never want to compromise, especially in the fast-moving world of decentralized perpetual contracts. Hyperliquid-Style Perps has carved out its reputation as the ultra-low latency perpetual DEX of choice by delivering execution speeds that rival even the most advanced centralized exchanges. But what makes this possible? Let’s dive into the technology and design choices powering Hyperliquid’s edge in low latency DeFi trading.

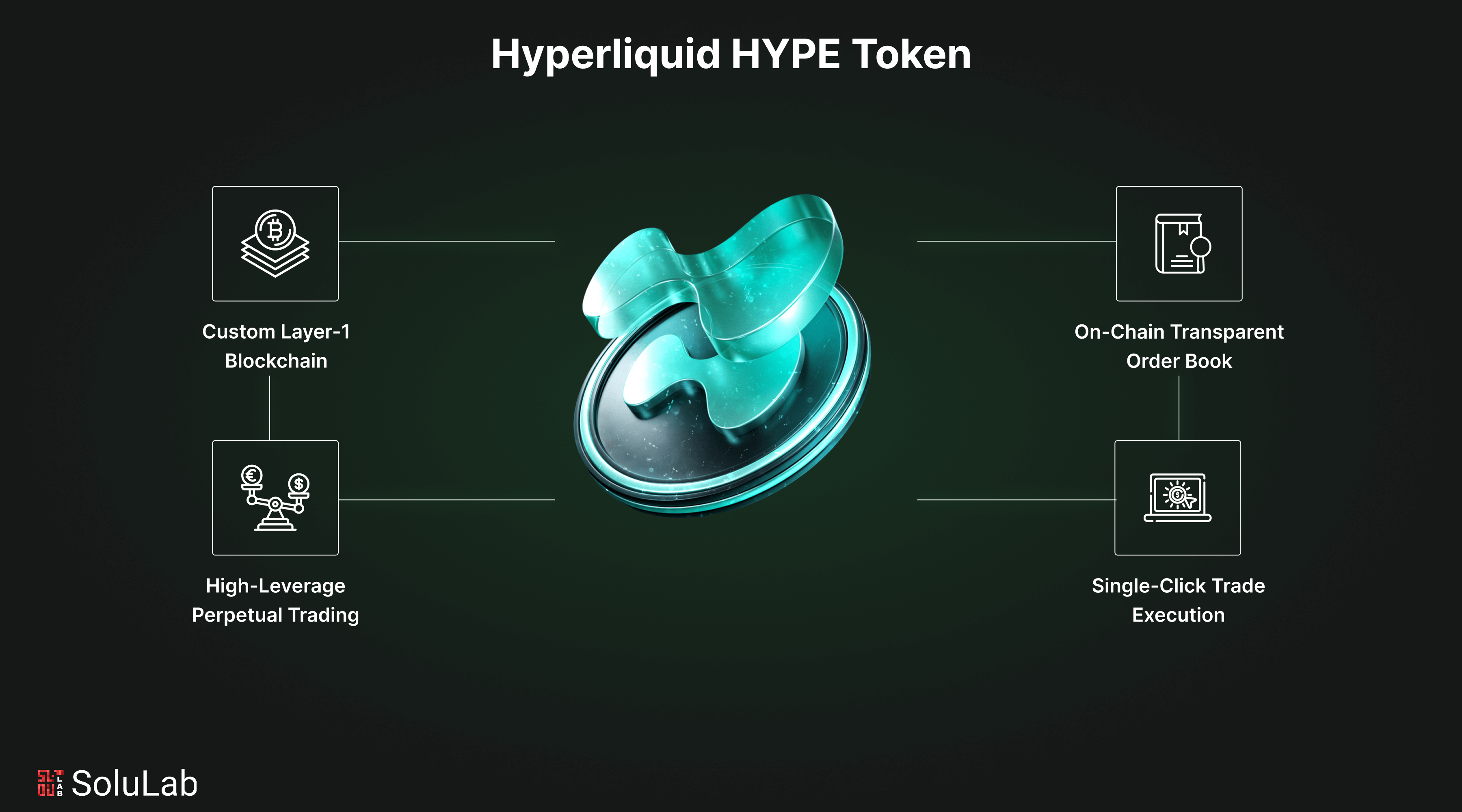

The Custom Layer 1 Blockchain: Built for Speed

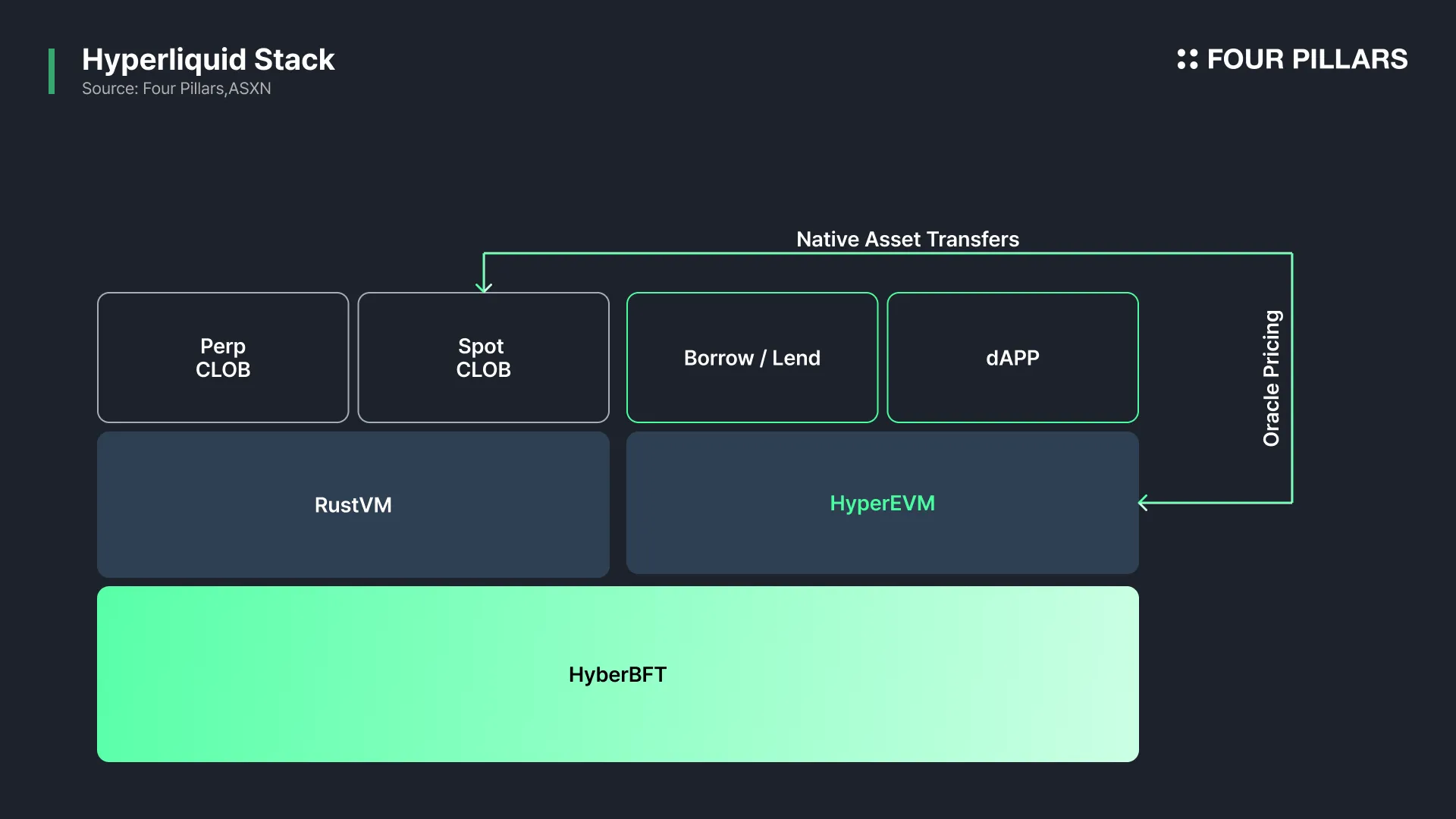

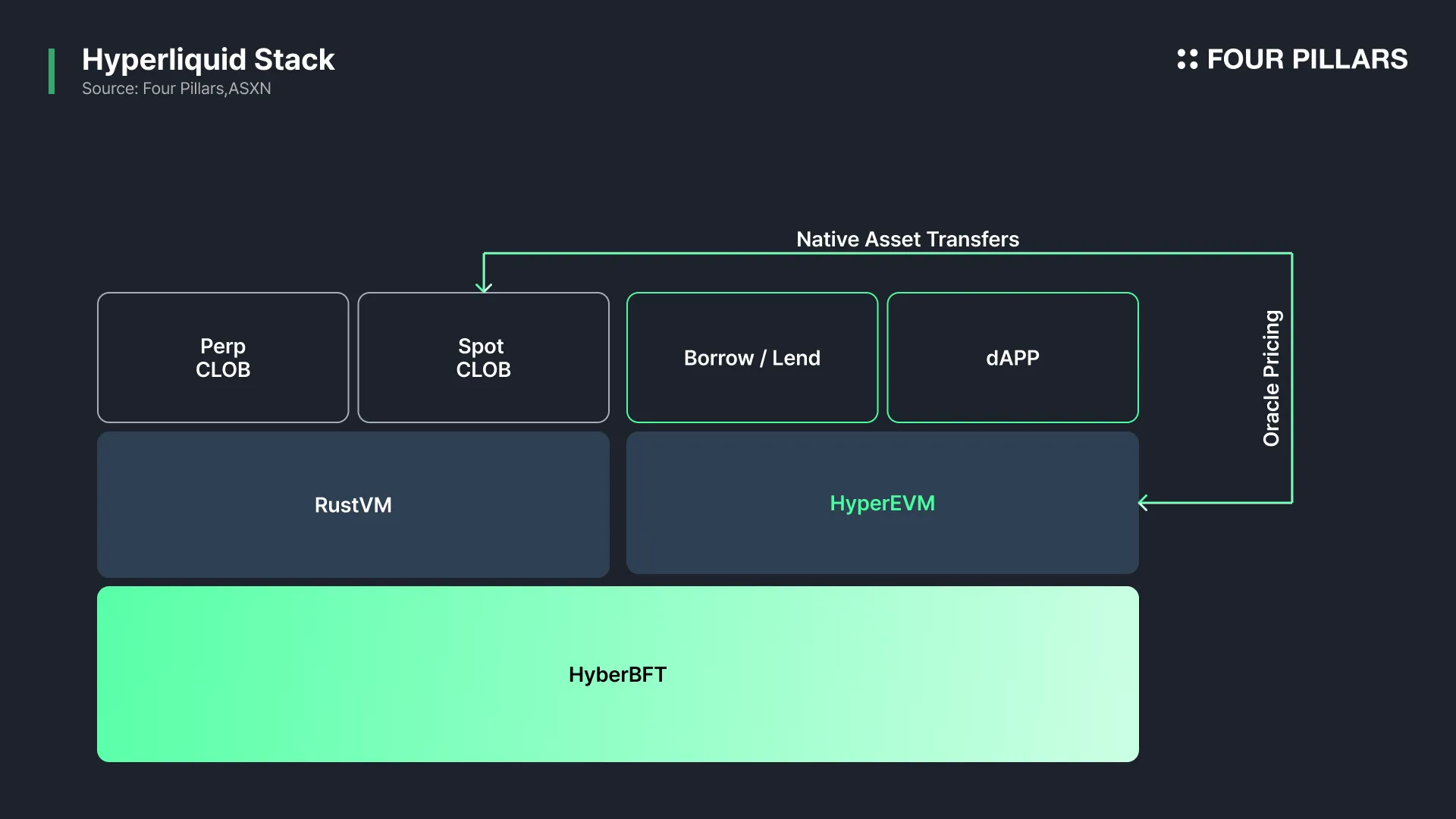

Most decentralized exchanges (DEXs) are built on general-purpose blockchains, which can introduce bottlenecks for high-frequency trading. Hyperliquid broke away from this mold by developing its own specialized Layer 1 blockchain, engineered from the ground up for perpetual contract trading. This bespoke chain prioritizes order-matching, cancellations, and position updates above all else, allowing for sub-second finality and throughput levels that simply aren’t possible on legacy chains.

The result? Traders experience near-instantaneous feedback when executing or canceling orders. This is a game-changer for strategies that depend on tight spreads and real-time market data. In fact, recent benchmarks show that Hyperliquid processes up to 100,000 transactions per second, setting a new standard for fast decentralized trading environments.

Key Features Powering Hyperliquid’s Ultra-Low Latency

-

Custom Layer 1 Blockchain: Hyperliquid is built on a purpose-designed Layer 1 blockchain, optimizing every aspect for high-speed trading and sub-second transaction finality.

-

HyperBFT Consensus Mechanism: The platform uses the HyperBFT proof-of-stake consensus, enabling secure and transparent processing of up to 100,000 transactions per second.

-

Fully On-Chain Order Book & Matching Engine: All order matching, cancellations, and updates occur directly on-chain, eliminating off-chain dependencies and reducing latency.

-

Prioritized Order Processing: The system is engineered to prioritize order-matching, cancellations, and position updates, ensuring rapid trade execution and real-time responsiveness.

-

Centralized Exchange-Level Performance: By integrating these innovations, Hyperliquid delivers a trading experience that rivals centralized exchanges in speed while maintaining DeFi transparency and security.

The HyperBFT Consensus Mechanism: Fast and Secure

A blockchain is only as fast as its consensus protocol. Hyperliquid employs an innovative proof-of-stake model called HyperBFT. Unlike traditional proof-of-work or even standard proof-of-stake systems, HyperBFT is tailored specifically to minimize confirmation times without sacrificing security or decentralization. Validators reach consensus in record time, ensuring that every trade is both final and tamper-proof within fractions of a second.

This isn’t just about raw speed. The robust design of HyperBFT means traders don’t have to worry about reorgs or delayed settlements, a critical consideration in volatile markets where every millisecond counts. The combination of speed and security is why many analysts still view Hyperliquid as the most investable decentralized perpetual exchange on the market today.

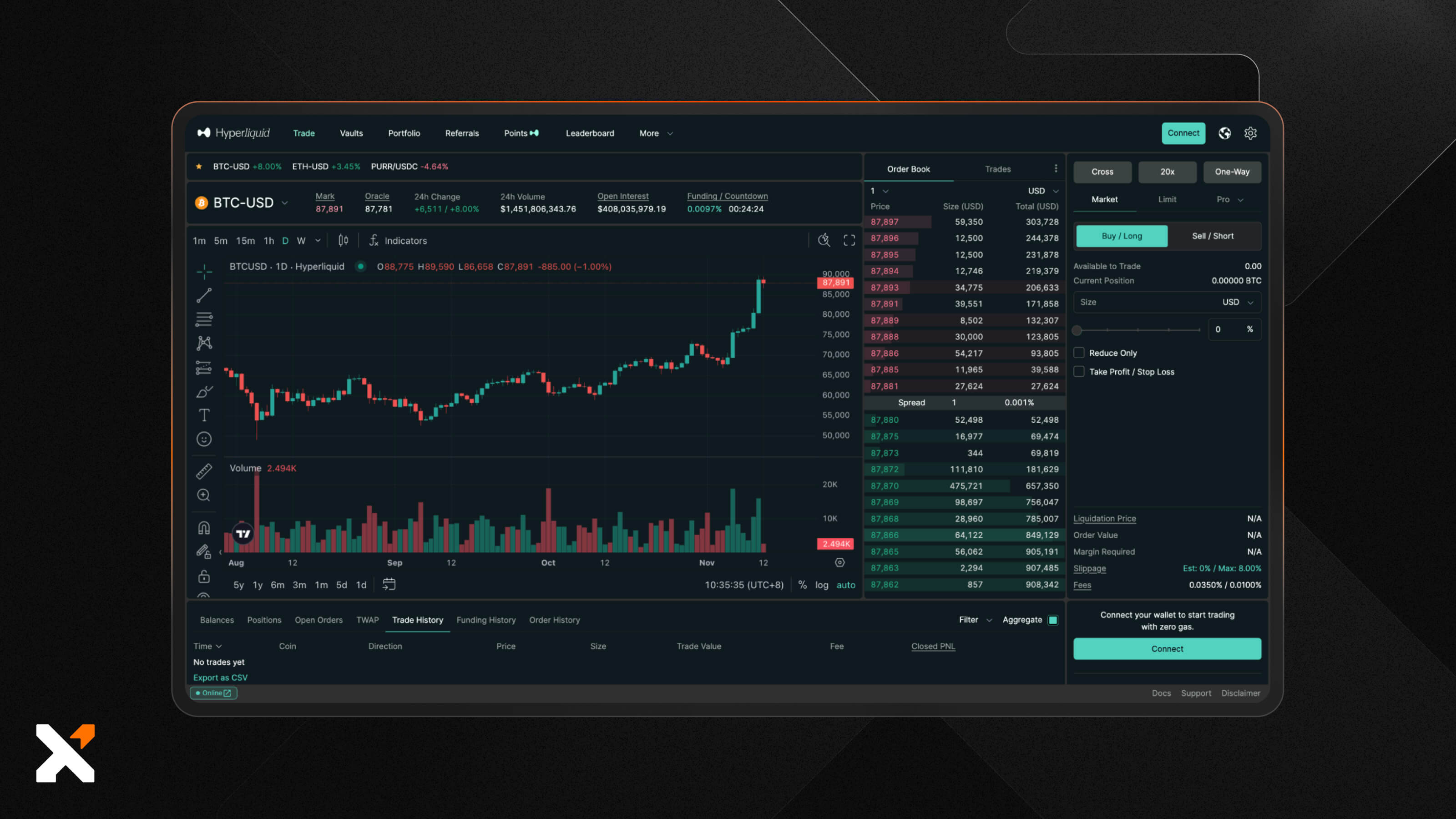

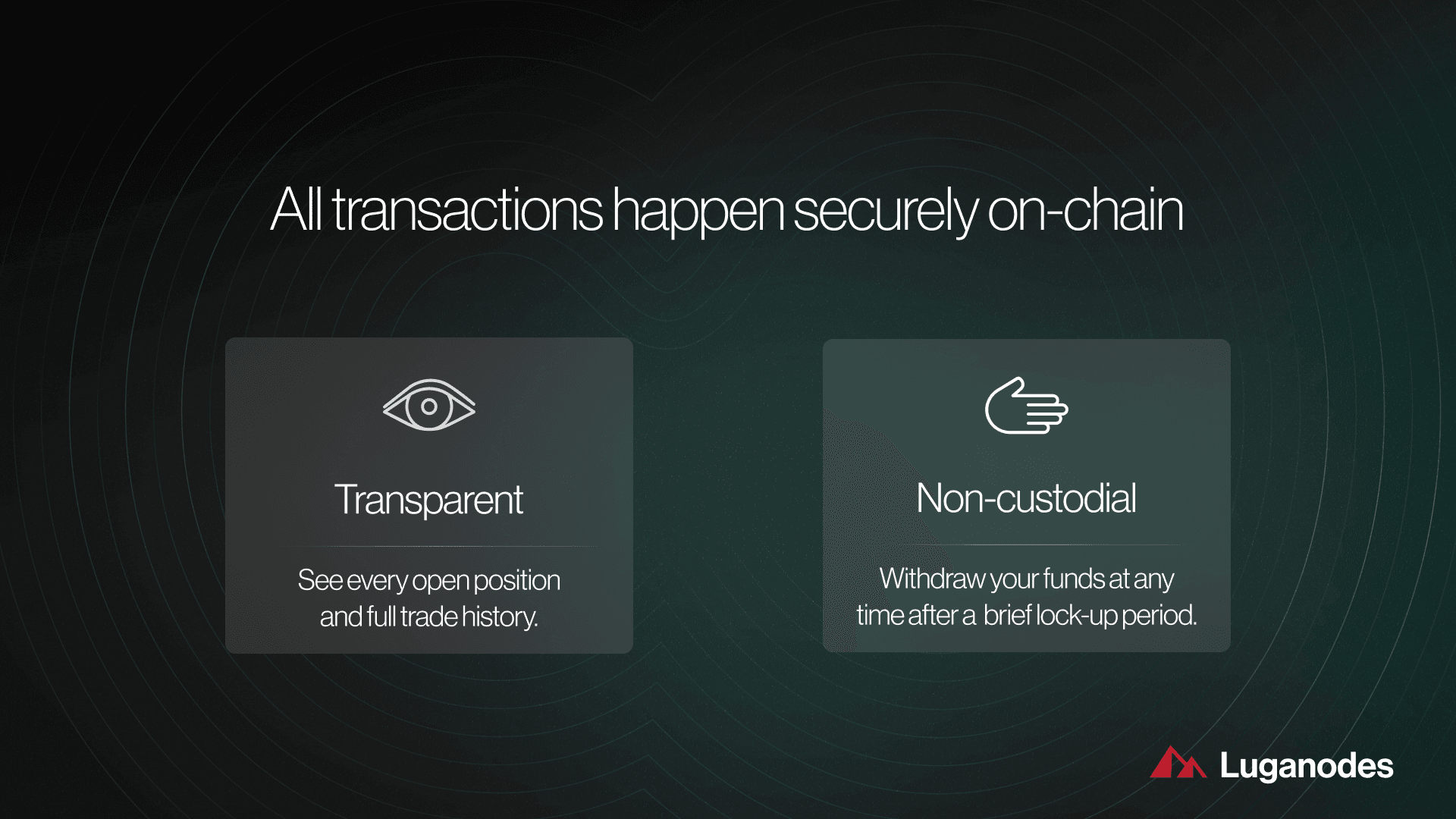

On-Chain Order Book and Matching Engine: No Off-Chain Shortcuts

A major differentiator for Hyperliquid is its commitment to a fully on-chain order book and matching engine. While some competitors offload matching logic to off-chain servers (introducing potential points of failure or opacity), every step of the trade lifecycle on Hyperliquid happens transparently on-chain. This not only enhances trust but also slashes latency by eliminating external dependencies.

This approach ensures that order books update in real-time and that liquidations occur instantly, even during periods of extreme volatility. Transparency isn’t just a buzzword here; it’s an operational reality that gives traders confidence their trades are executed fairly at blazing speeds.

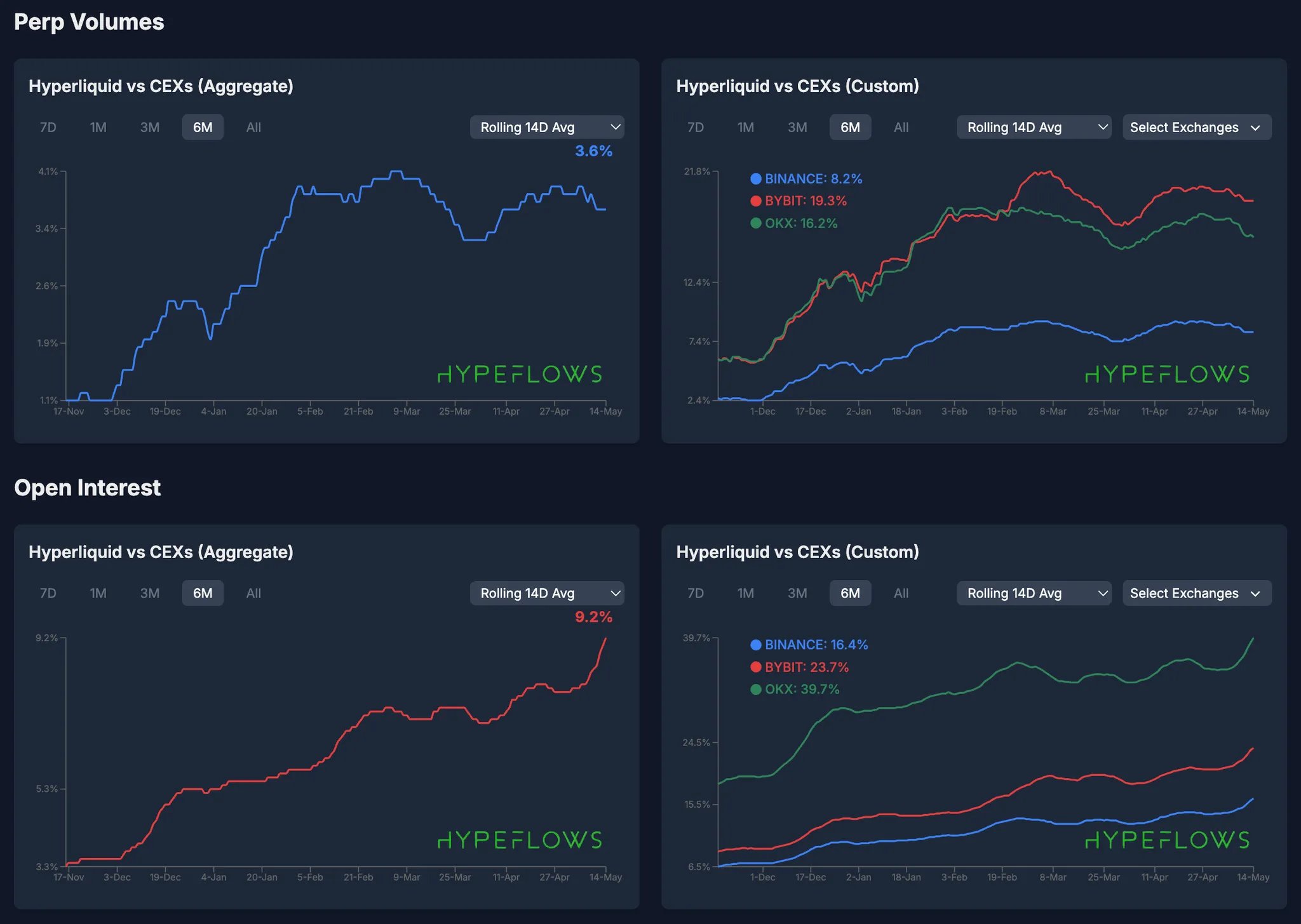

Such architectural choices have cemented Hyperliquid-Style Perps as a leader in ultra-low latency perpetual DEX design. But performance is only half the story. The platform’s ongoing battle for market share and its ability to maintain deep liquidity are equally critical to its sustained dominance in fast decentralized trading.

Liquidity Depth and Real-Time Execution: Why It Matters

Deep liquidity ensures that traders can enter or exit large positions without significant slippage, even during periods of heightened volatility. Hyperliquid’s custom Layer 1 and fully on-chain matching mean that liquidity providers and takers interact with transparent, up-to-the-millisecond order books. This transparency encourages more institutional and retail participation, reinforcing a virtuous cycle: more liquidity leads to tighter spreads, which in turn attracts more volume.

In 2025, daily trading volume on perpetual DEXs soared to $96,973 billion. Hyperliquid commands a significant portion of this activity thanks to its speed-centric infrastructure and reliable execution. Traders who rely on algorithmic strategies or need to hedge rapidly shifting positions benefit from knowing that their orders will be filled at expected prices, without hidden delays or reordering risks.

The User Experience Edge: Trading Without Compromise

The true test of any platform is the user experience it delivers under pressure. Hyperliquid-Style Perps’ interface is engineered for clarity and speed, ensuring that even during market surges or liquidations, users retain full control over their trades. The integration of real-time data feeds, customizable dashboards, and rapid notifications empowers both professionals and newcomers alike.

Moreover, non-custodial wallet integration means users always control their funds, no third-party risk or withdrawal delays. As DeFi matures, this blend of user sovereignty with centralized-exchange-level performance has become the gold standard for low latency DeFi trading.

Key Trader Benefits of Hyperliquid-Style Perps Speed

-

Sub-Second Trade Execution: Hyperliquid’s custom Layer 1 blockchain and HyperBFT consensus deliver near-instant order matching and position updates, giving traders an edge in fast-moving markets.

-

On-Chain Transparency and Security: All trades and order book operations occur fully on-chain, ensuring transparent execution without reliance on off-chain intermediaries or hidden order flows.

-

High Throughput for Active Trading: With the ability to process up to 100,000 transactions per second, Hyperliquid supports high-frequency strategies and large trading volumes without bottlenecks.

-

Reduced Slippage and Requotes: Ultra-low latency minimizes the risk of price slippage and order requotes, allowing traders to execute at expected prices even during volatility.

-

Centralized Exchange-Level Performance: Hyperliquid rivals the speed and reliability of leading centralized exchanges while maintaining the benefits of decentralized finance, such as non-custodial trading and self-custody.

Looking Ahead: The Future of Fast Decentralized Trading

With competition intensifying from platforms like Aster and dYdX, Hyperliquid’s commitment to continuous optimization remains vital. Upgrades to consensus algorithms, further reductions in block times, and innovative liquidity incentive programs are all part of the roadmap to ensure the platform continues leading the fast decentralized trading race.

The broader implication? As more traders demand instant execution and transparent markets for perpetual contracts, expect features pioneered by Hyperliquid, like sub-second finality and fully on-chain matching, to become industry benchmarks across DeFi.

If you’re seeking a platform where execution speed is measured in milliseconds rather than minutes, and where transparency isn’t sacrificed for performance, Hyperliquid-Style Perps sets the pace for what’s possible in decentralized finance today.

For a deeper dive into how these innovations work under the hood, check out our comprehensive guide at How Hyperliquid-Style Perps Achieves Ultra-Low Latency in Decentralized Perpetual Trading.