Perpetual DEX mini games are rapidly transforming the DeFi landscape, blending fast-paced trading with interactive, play-to-earn opportunities. As platforms like DeXFun and Perpetual Protocol roll out new campaigns, traders can now earn Perp Points not just for executing trades, but also for engaging in social activities, referrals, and competitive mini-games. With the current price of Perpetual Protocol (PERP) at $0.2936, understanding how to maximize your rewards through these mechanisms is more important than ever.

Perpetual Protocol (PERP) Price Prediction 2026-2031

Comprehensive Analyst Forecasts Based on Current Market Data and Emerging Trends (2025 Baseline: $0.2936)

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Potential Annual % Change (Avg) | Market Sentiment |

|---|---|---|---|---|---|

| 2026 | $0.22 | $0.34 | $0.55 | +15% | Cautiously Optimistic |

| 2027 | $0.19 | $0.42 | $0.82 | +23% | Neutral to Positive |

| 2028 | $0.15 | $0.53 | $1.10 | +26% | Positive |

| 2029 | $0.12 | $0.70 | $1.45 | +32% | Bullish |

| 2030 | $0.10 | $0.89 | $1.90 | +27% | Bullish |

| 2031 | $0.08 | $1.12 | $2.44 | +26% | Bullish with Volatility |

Price Prediction Summary

PERP is projected to show steady growth over the next six years, fueled by increasing DEX adoption, gamified trading incentives, and ongoing rewards programs. The minimum prices reflect potential bear market conditions or regulatory headwinds, while maximum prices consider strong adoption, DeFi growth, and broader crypto bull cycles. Average price predictions assume moderate adoption and continuous platform development. While short-term volatility is likely, especially given competition and evolving regulations, PERP’s focus on user engagement and innovative reward structures could help it significantly outperform during positive market cycles.

Key Factors Affecting Perpetual Protocol Price

- Expanding DEX and perpetual futures trading adoption across DeFi.

- Ongoing and future reward campaigns (e.g., Perp Trading Competition, Nekodex rewards) incentivizing holding and trading.

- Regulatory developments impacting DeFi and derivatives trading.

- Technological improvements in protocol security, performance, and user experience.

- Emerging competition from new perpetual DEX platforms (e.g., SunPerp, Lighter).

- General crypto market cycles and macroeconomic sentiment.

- Potential for new use cases and integrations within broader DeFi ecosystems.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

What Are Perp Points and Why Do They Matter?

Perp Points are reward tokens or credits distributed by perpetual decentralized exchanges (DEXs) to incentivize user participation. These points play a crucial role in gamified trading environments, where accumulating them can unlock exclusive rewards such as airdrops, fee discounts, or even governance rights in upcoming platform upgrades.

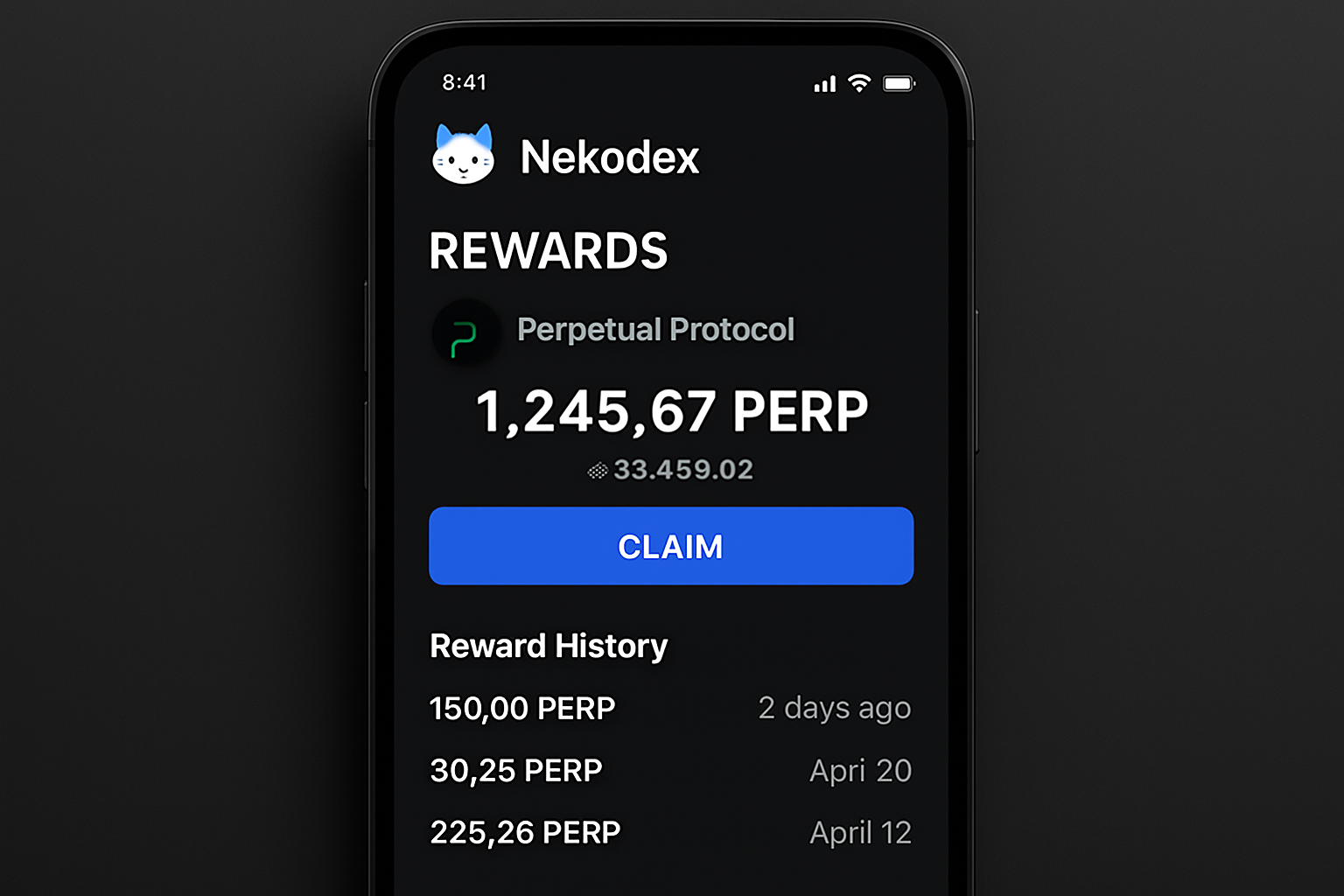

The recent surge in point-based rewards is fueled by ongoing campaigns like the Perp Trading Competition on Mode, which allocates 5 million Mode points daily based on trading volume across multiple platforms. Meanwhile, Perp Labs’ Nekodex app offers daily rewards to $PERP holders and traders, no staking or lockups required.

How to Earn Perp Points: Strategies That Work in 2025

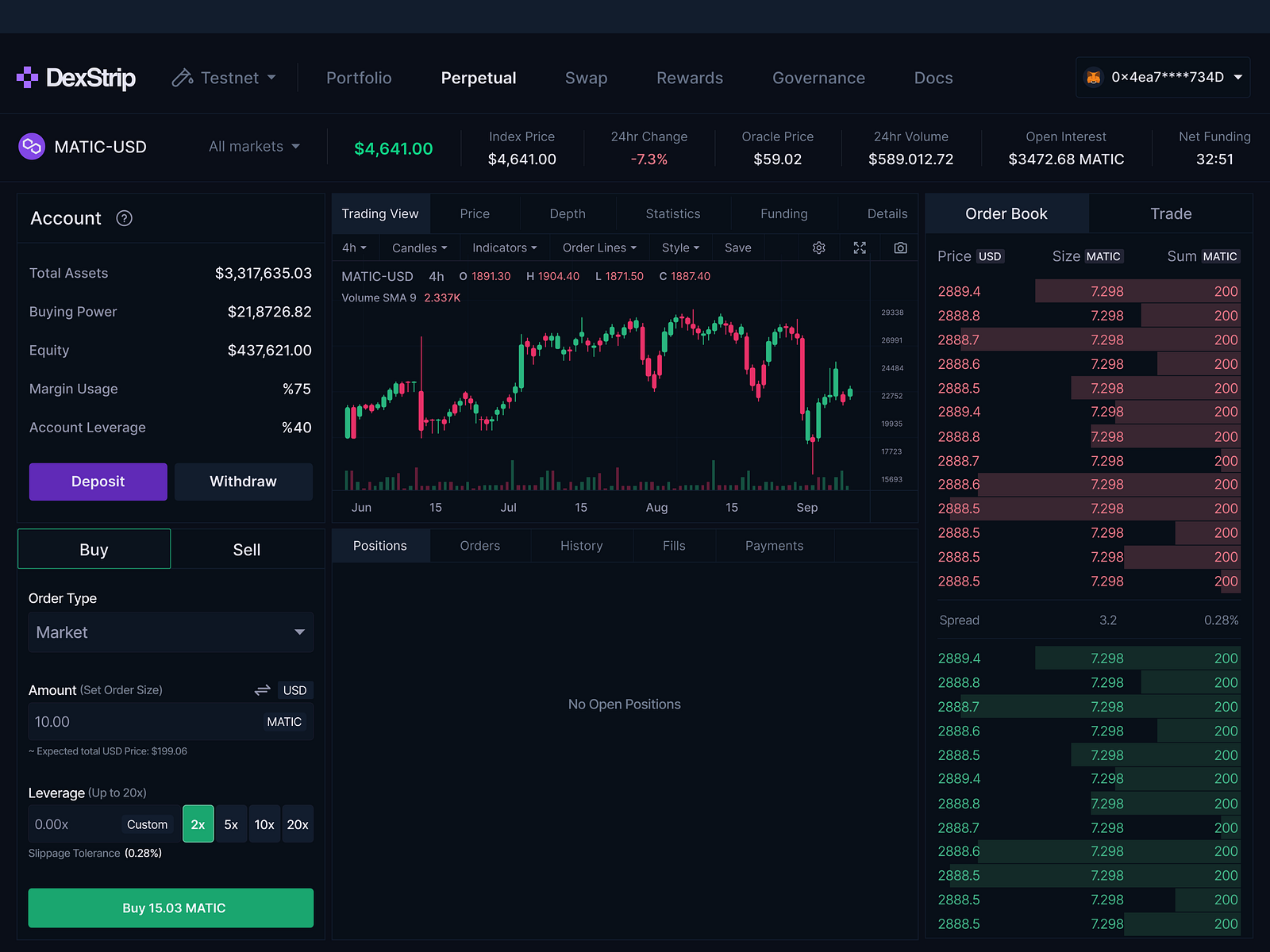

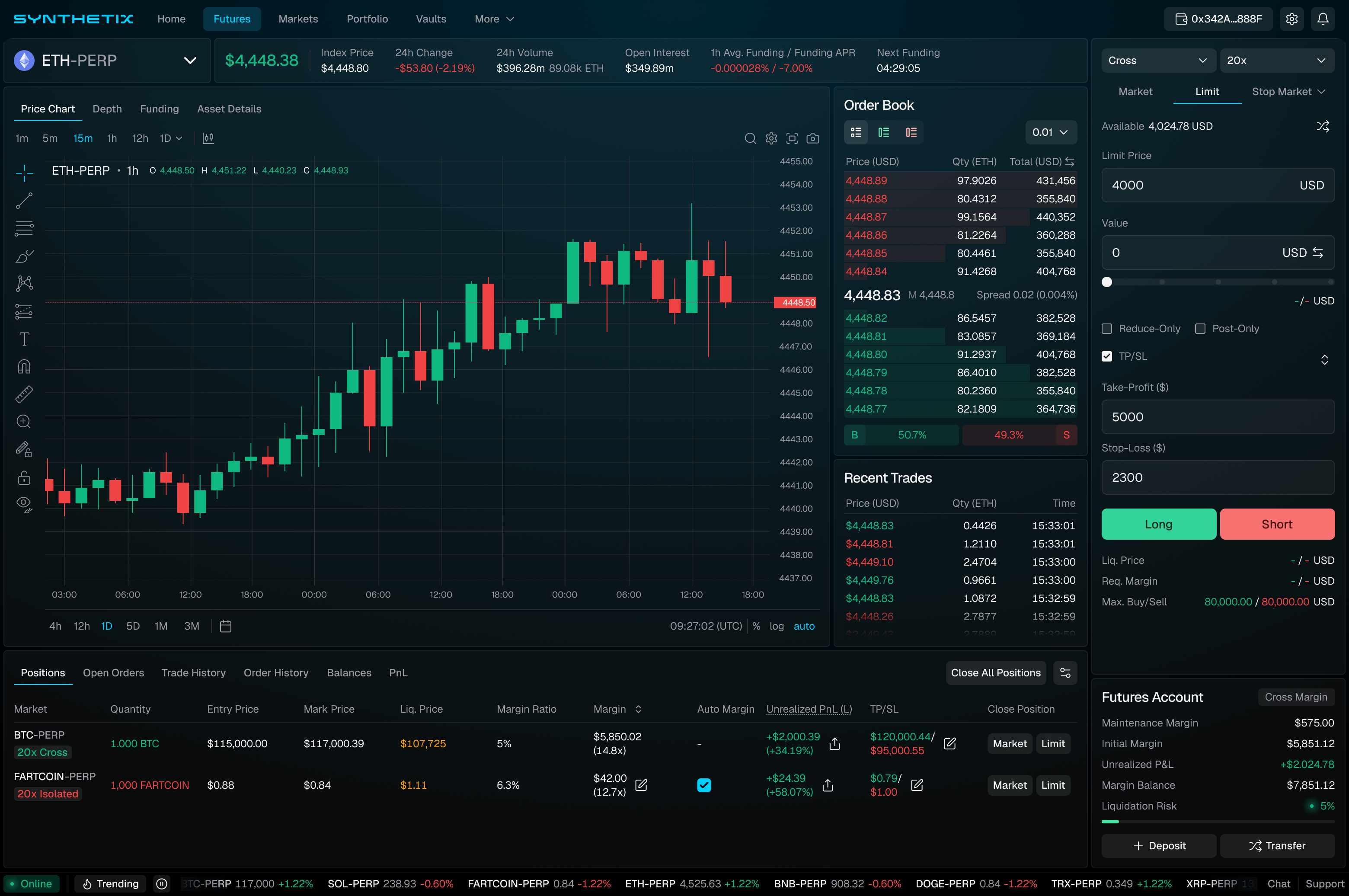

The most reliable way to earn Perp Points is by actively trading perpetual contracts on supported DEXs such as LogX, Print3r, BMX, ModeMax, and Lynx. Here’s how you can boost your points tally:

- Increase Your Trading Volume: Most point systems are proportional to your trade size and frequency. For example, during the Mode campaign, users who trade popular pairs like BTC and ETH accumulate more points. Daily calculations reset at 11: 00 AM UTC, timing your trades strategically can help maximize daily earnings.

- Participate in Mini Games: Platforms like DeXFun have introduced Telegram-based mini-games where users predict market movements or complete quests for extra points. These interactive features often offer short-term bonuses that stack with standard trading rewards.

- Refer Friends and Engage Socially: Many DEXs incentivize community growth by rewarding users who refer new traders or interact with official social media channels. For instance, following partner accounts or sharing posts on X (formerly Twitter) can net you bonus points during special events.

Top Ways to Earn Perp Points on Perpetual DEX Mini Games

-

Trade Perpetual Futures on Supported DEX Platforms: Earn Perp Points by actively trading perpetual futures on platforms like LogX, Print3r, BMX, ModeMax, and Lynx. Your trading volume on pairs such as BTC and ETH directly contributes to your daily point allocation, as highlighted in the Mode Perp Trading Competition.

-

Participate in the Mode Perp Trading Competition: Join the ongoing competition (launched August 15, 2024) where 5 million Mode points are distributed daily based on trading activity. Points are calculated daily at 11:00 AM UTC, so consistent participation boosts your rewards.

-

Hold $PERP Tokens to Qualify for Holder Rewards: By holding at least 5,000 $PERP tokens (current price: $0.2936 per token), you can earn up to 50% of the surplus distribution through campaigns like the Perp Labs Nekodex rewards. No staking or lockup is required for eligibility.

-

Engage with DeXFun Mini-Games and Social Quests: Platforms like DeXFun offer mini-games and Galxe quests where you can earn extra points by trading, referring friends, following social media accounts, and sharing posts. These activities not only boost your point tally but may also unlock additional campaign rewards.

-

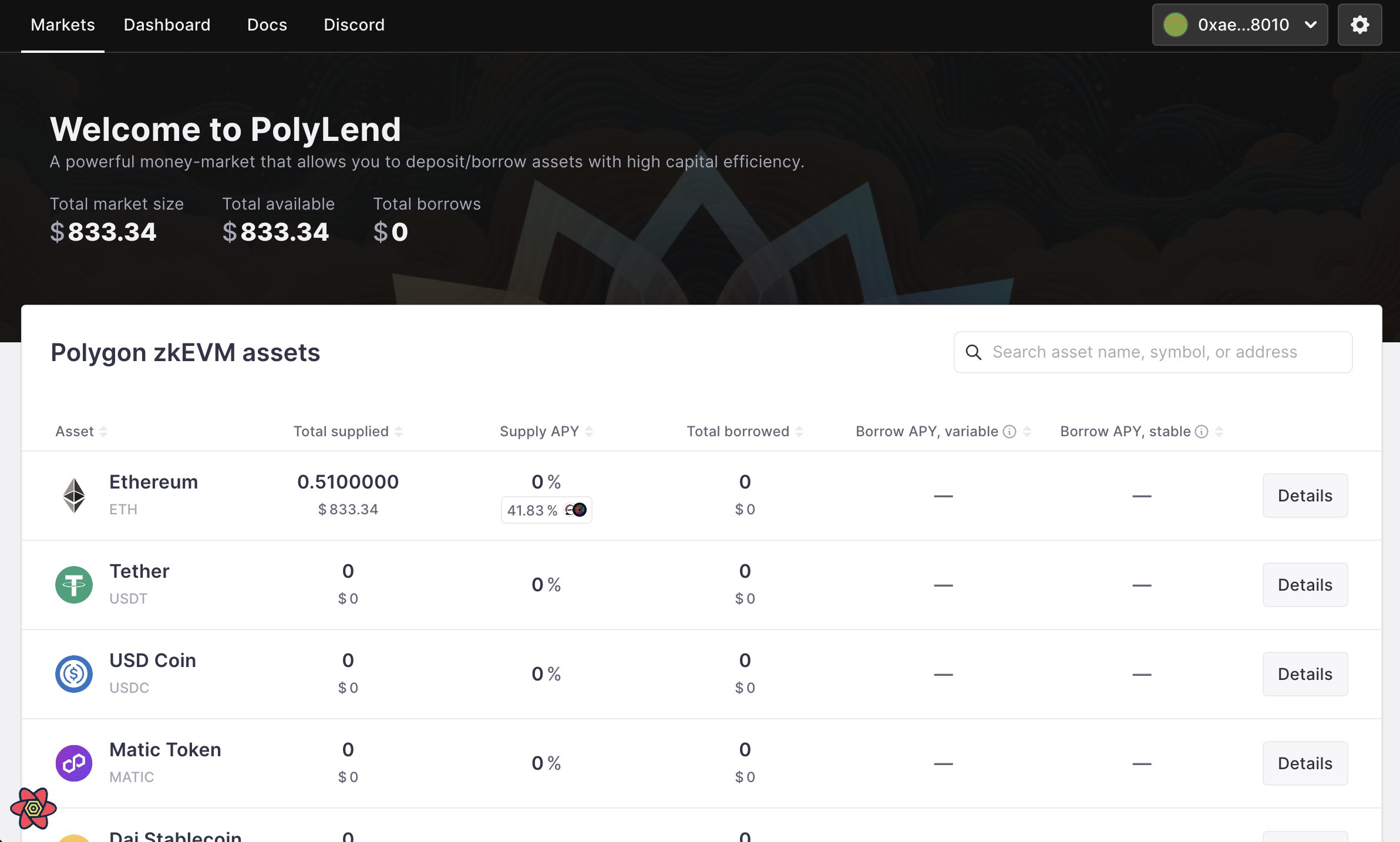

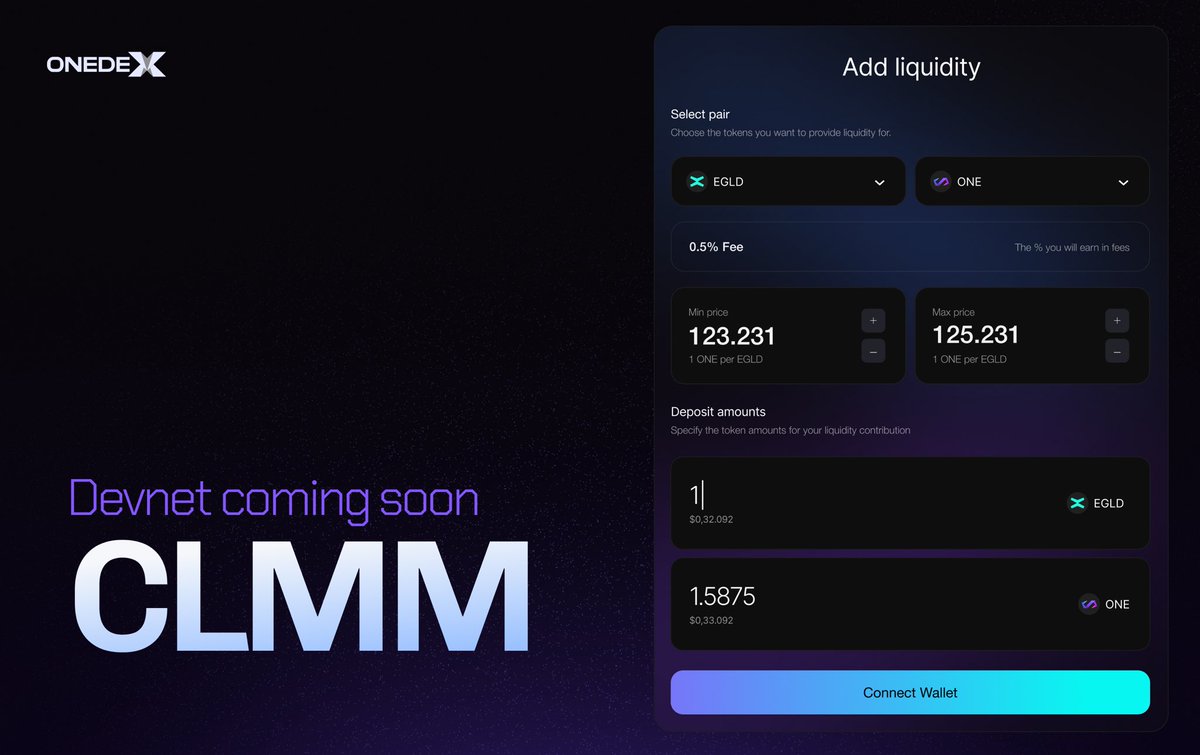

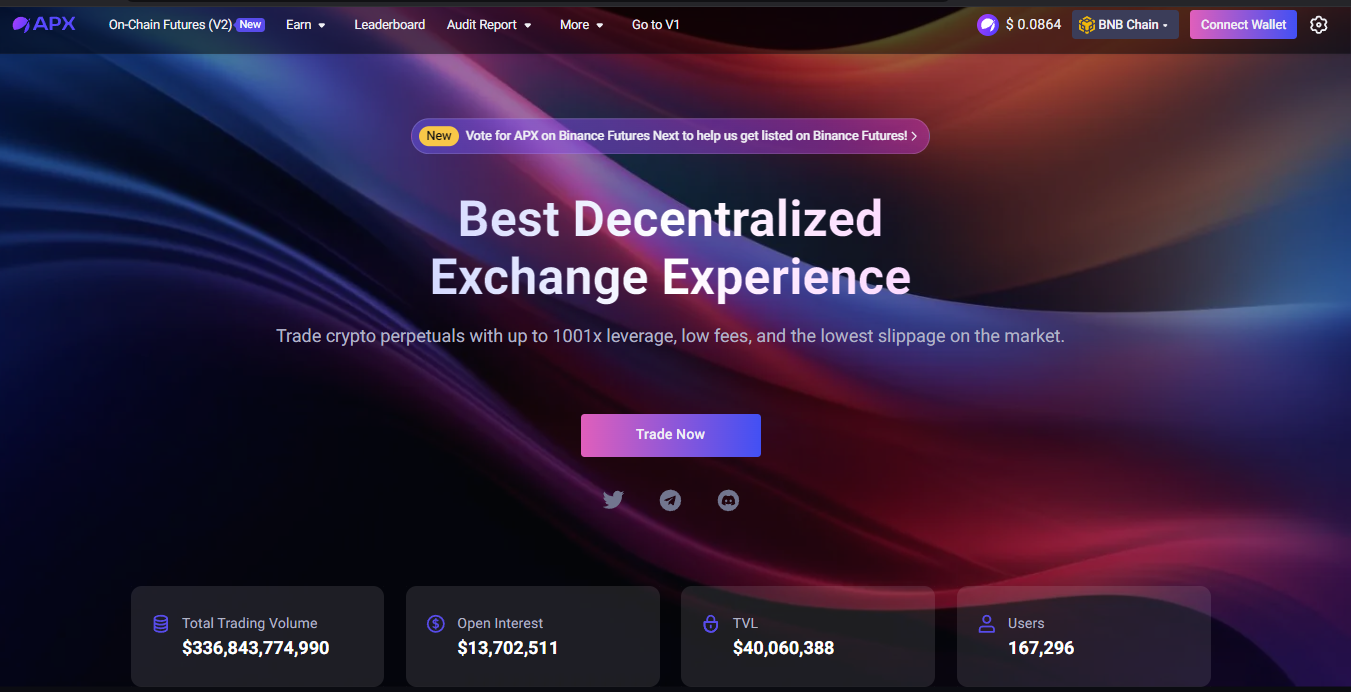

Provide Liquidity or Stake on Supported Perpetual DEXs: Some perpetual DEXs, such as APX Finance, reward users with points for providing liquidity or staking assets. In return for depositing tokens into liquidity pools, you receive LP tokens and become eligible for ongoing point distributions.

$PERP Price Snapshot: Why It Matters for Rewards

The value of your earned Perp Points is closely linked to the prevailing market price of $PERP tokens. As of now, $PERP trades at $0.2936, reflecting both recent volatility and ongoing reward distribution programs. Whether you’re farming points for direct token payouts or future governance influence, monitoring this price helps you gauge the real-world impact of your activity.

Perpetual Protocol (PERP) Price Prediction 2026-2031

Forecast based on current market data, ongoing DEX reward initiatives, and projected market cycles (as of Q4 2025)

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.21 | $0.33 | $0.52 | +12% | Continued DEX adoption; reward programs sustain interest but overall market volatility remains high. |

| 2027 | $0.26 | $0.41 | $0.68 | +24% | Improved DeFi user experience and potential regulatory clarity boost PERP demand; increased competition from new DEXs restrains upside. |

| 2028 | $0.31 | $0.54 | $0.87 | +32% | Bullish market cycle, wider use of perpetual DEXs, and more advanced gamified rewards drive up trading volumes and token value. |

| 2029 | $0.39 | $0.66 | $1.10 | +22% | Sustained DeFi growth; PERP benefits from maturing ecosystem and integrations with other blockchain networks. |

| 2030 | $0.48 | $0.80 | $1.38 | +21% | Mainstream adoption of DEXs and perpetual products; PERP possibly listed on more major exchanges and increased institutional interest. |

| 2031 | $0.59 | $0.97 | $1.66 | +21% | Technological advances, further regulatory clarity, and established leadership in the perpetual DEX sector support long-term price growth. |

Price Prediction Summary

PERP is positioned for gradual, sustainable growth from 2026 to 2031, supported by ongoing DEX gamification, user incentives, and sector expansion. While the minimum price in bearish scenarios reflects overall crypto market risk, the maximum projections assume successful adoption and favorable market cycles. Average prices show a logical, progressive increase, consistent with expanding DeFi use cases and technological improvements.

Key Factors Affecting Perpetual Protocol Price

- Continued innovation in DEX gamification and user rewards (e.g., mini-games, loyalty programs)

- Growth of the overall DeFi and perpetual trading sector

- Regulatory developments impacting DEXs and derivatives trading

- Competition from other perpetual DEX platforms and incentive programs

- Adoption by institutional and retail investors

- Integration with broader blockchain ecosystems and cross-chain functionality

- Market sentiment and macroeconomic factors affecting crypto assets overall

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Dive Into Gamified DeFi: Real-Time Community Insights

The play-to-earn dynamic is driving engagement across DeFi communities worldwide. Traders are increasingly sharing their strategies for maximizing Perpetual DEX rewards on social channels, from yield farming tips to leaderboard screenshots.

Beyond trading and referrals, perpetual DEX mini games are evolving with richer incentives and more interactive experiences. For example, DeXFun’s Galxe Quest rewards users for following partner X accounts, creating and sharing social content, or joining community channels. These off-chain activities often have a low barrier to entry, making them ideal for new users looking to earn their first Perp Points without significant capital.

Meanwhile, liquidity provision remains a tried-and-true strategy. By depositing assets into perpetual DEX liquidity pools, you not only support platform stability but also receive LP tokens that can be staked or used to farm additional rewards. While specific rates may vary across platforms, the compounding effect of trading fees and point-based incentives can significantly boost your yield over time.

Redeeming Perp Points: Turning Engagement Into Tangible Rewards

Once you’ve accumulated Perp Points through trading, mini games, or social engagement, the next step is redemption. Platforms typically offer several pathways:

- Airdrops: Many DEXs periodically distribute governance tokens or stablecoins to top point earners.

- Fee Discounts: Some exchanges allow points to be redeemed for reduced trading fees or exclusive access to premium features.

- Special NFTs and Badges: Gamified campaigns may reward high performers with limited-edition NFTs that confer status or further utility within the ecosystem.

The flexibility of these rewards is key. As campaigns like the Mode Trading Competition demonstrate, real-time point calculations and daily resets encourage consistent participation rather than one-off bursts of activity. This creates a dynamic environment where both casual players and professional traders can find value.

Top Redemption Options for Perp Points on Perpetual DEXs

-

Mode Trading Competition Rewards: Redeem your Perp Points for a share of 5 million Mode points distributed daily. Earned by trading on platforms like LogX, Print3r, BMX, ModeMax, and Lynx, these rewards are calculated based on your trading volume and confirmed daily at 11:00 AM UTC.

-

Nekodex Daily $PERP Holder Rewards: Use the Nekodex app to claim daily rewards as a $PERP holder or trader. Holding 5,000 or more $PERP tokens (current price: $0.2936 per token) can qualify you for up to 50% of the surplus distribution, with no staking or lockup required.

-

DeXFun Galxe Quest Points: Redeem points earned by participating in DeXFun’s Galxe Quest—including activities like following partner accounts, sharing posts, and joining community campaigns—for exclusive NFT badges and leaderboard rewards.

-

Perpetual Protocol Trading Competitions: Compete in official Perpetual Protocol trading competitions to redeem points for USDT, $PERP tokens, and exclusive NFTs. Rewards are typically based on trading performance and leaderboard placement.

-

Referral and Social Engagement Bonuses: Many perpetual DEX platforms, such as DeXFun, offer point redemption options for users who refer friends or engage on social media. These points can be exchanged for extra trading bonuses, fee discounts, or platform-specific rewards.

Tips for Maximizing Rewards: Stay Ahead in Play-to-Earn DeFi

If your goal is to maximize perpetual contracts rewards while enjoying the gamified experience:

- Diversify Participation: Don’t limit yourself to one campaign or platform. Engage with multiple mini games and trading competitions across leading DEXs.

- Monitor Campaign Rules: Stay updated on eligibility requirements, such as minimum $PERP holdings (currently $0.2936 per token): and timing windows for optimal point accrual.

- Engage With Community Channels: Follow official announcements on X (formerly Twitter) and Telegram for flash quests or bonus events that can multiply your earnings unexpectedly.

The decentralized exchange incentives landscape is only becoming more sophisticated as platforms compete for user attention. Staying informed about new reward structures, like those rolled out by Perp Labs via Nekodex, can make a measurable difference in your total return on effort.

Looking Forward: The Future of Mini Games on Perpetual DEXs

The intersection of gamification and DeFi is still in its early innings. As perpetual DEX platforms introduce more complex quests, customizable avatars, and cross-platform leaderboards, expect competition, and potential payouts, to increase accordingly. The current price of $PERP at $0.2936 anchors the value proposition for active participants; however, as adoption grows and reward mechanisms evolve, so too will the opportunities for savvy traders willing to engage deeply with these ecosystems.

No matter your level of experience, embracing both the technical aspects of perpetual contracts trading and the creative opportunities presented by mini games will position you well in this rapidly changing market. The key is consistency, trade actively, participate socially, redeem wisely, and always keep an eye on real-time price movements to capitalize on every advantage available within play-to-earn DeFi.