The perpetual DEX meta is entering a new phase of explosive growth, reshaping the decentralized finance (DeFi) landscape and offering early traders a wealth of opportunities. In 2025, perpetual decentralized exchanges (Perp DEXs) have become a cornerstone of DeFi, with market capitalization for decentralized derivatives surging an astonishing 654% year-over-year, from $2.5 billion in October 2024 to $18.9 billion by late August 2025. Most notably, perpetual protocols now account for over $17.9 billion of this market, underscoring their outsized influence and rapid adoption.

Why Perpetual DEX Meta Is Surging in 2025

Several converging factors are fueling the rise of the perpetual DEX meta. First, platforms like Hyperliquid are setting new benchmarks in capital efficiency and liquidity, with reported monthly volumes exceeding $350 billion and daily volumes often surpassing $30 billion. This has redefined what traders expect from decentralized protocols, speed, reliability, and deep liquidity are now table stakes.

Technological innovation is another key driver. Modern Perp DEXs rival centralized exchanges (CEXs) in execution quality: Hyperliquid supports sub-second finality and can process up to 100,000 orders per second while offering gasless trading and advanced on-chain order types. Meanwhile, new entrants like Lighter are leveraging Ethereum Layer 2 solutions with ZK circuits to further reduce latency and costs as trading activity surges past $1 trillion monthly.

Retail participation is also at an all-time high. Platforms such as Aster have not only achieved massive volume milestones provides $20.88 billion in 24-hour perpetual futures trading, but have also seen their native tokens soar by as much as 2,700% post-launch. User-friendly interfaces and strong community incentives are making it easier than ever for individuals to access leveraged trading without intermediaries or KYC requirements.

Opportunities for Early DeFi Traders

The current landscape presents a unique window for early DeFi traders to capitalize on the best perpetual DEX projects before broader adoption drives further growth, and competition.

- Diverse Trading Options: Perpetual DEXs offer extensive asset selection and leverage settings that allow traders to diversify strategies across crypto sectors.

- Yield-Generating Features: Platforms like AsterDEX enable the use of Liquid Staking Tokens (LSTs) or Liquid Restaking Tokens (LRTs) as margin collateral, so staked assets can remain productive while supporting leveraged trades.

- No-KYC and Transparent Settlement: Built on smart contracts, these protocols ensure transparent execution while letting users retain custody of their assets at all times, a significant draw amid ongoing regulatory scrutiny of centralized venues.

- Community Incentives: Many leading platforms implement points programs or referral bonuses that reward active participation with future token distributions or fee rebates, a powerful motivator for early adopters looking to maximize returns on both trading volume and community engagement.

This rapid innovation has led some analysts to suggest that the perpetual DEX narrative could be one of the defining stories of the next bull run, especially as more sophisticated products such as mobile-native interfaces (e. g. , Oraichain’s LFG!!!) and advanced hedging tools come online.

Current Market Data: Tracking Key Perpetual DEX Tokens

The numbers speak volumes about trader sentiment and platform traction:

| Token | Current Price | 24h Change |

|---|---|---|

| Uniswap (UNI) | $8.20 | and 4.73% |

| dYdX (DYDX) | $0.625634 | and 4.51% |

| GMX (GMX) | $15.84 | and 1.67% |

| Perpetual Protocol (PERP) | $0.300604 | and 3.75% |

This data reflects not just strong price action but also growing confidence in decentralized derivatives infrastructure overall.

For those seeking deeper analysis or project guides on the evolving perp DEX landscape, including risk considerations, I recommend reviewing this comprehensive breakdown from PinkBrains. io.

Uniswap (UNI), dYdX (DYDX), GMX (GMX), and Perpetual Protocol (PERP) Price Predictions 2026–2031

Professional outlook based on 2025 DeFi Perpetual DEX market trends, adoption, and risk factors

| Year | Token | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|---|

| 2026 | UNI | $6.50 | $9.20 | $13.00 | +12% | Market consolidation, strong DeFi use, but potential regulation headwinds |

| 2026 | DYDX | $0.47 | $0.78 | $1.20 | +25% | Continued growth but faces competition; L2 expansion critical |

| 2026 | GMX | $12.00 | $18.50 | $26.00 | +17% | Organic DEX growth, but new entrants pressure margins |

| 2026 | PERP | $0.22 | $0.39 | $0.75 | +18% | Protocol upgrades attract new users, but volatility remains |

| 2027 | UNI | $7.10 | $10.70 | $16.00 | +16% | Adoption of Uniswap v4, broader DEX narrative, ETH upgrades |

| 2027 | DYDX | $0.53 | $0.95 | $1.45 | +22% | Decentralized derivatives surge, but macro risks linger |

| 2027 | GMX | $13.50 | $22.00 | $32.00 | +19% | Demand for on-chain leverage persists, point farming incentives |

| 2027 | PERP | $0.26 | $0.48 | $1.05 | +23% | New trading pairs and LST/LRT integration boost activity |

| 2028 | UNI | $8.40 | $13.20 | $21.00 | +23% | Potential bull cycle, mainstream DeFi integrations |

| 2028 | DYDX | $0.65 | $1.25 | $2.10 | +32% | Cross-chain expansion, institutional adoption |

| 2028 | GMX | $16.00 | $27.80 | $41.00 | +26% | Perp DEXs capture larger CEX market share |

| 2028 | PERP | $0.33 | $0.62 | $1.45 | +29% | Sustained DeFi TVL growth, new incentive models |

| 2029 | UNI | $7.80 | $11.50 | $17.50 | -13% | Cycle correction, regulatory tightening, profit-taking |

| 2029 | DYDX | $0.59 | $1.10 | $1.85 | -12% | Volatility as derivatives mature, increased competition |

| 2029 | GMX | $14.00 | $23.50 | $33.00 | -15% | Market correction, but strong user retention |

| 2029 | PERP | $0.28 | $0.54 | $1.20 | -13% | Post-bull retracement, focus on protocol sustainability |

| 2030 | UNI | $9.00 | $14.80 | $25.00 | +29% | Renewed growth, cross-chain Uniswap, DeFi mainstream |

| 2030 | DYDX | $0.77 | $1.45 | $2.60 | +32% | Global derivatives adoption, regulatory clarity |

| 2030 | GMX | $17.50 | $29.80 | $46.00 | +27% | Heightened leverage demand, innovative protocol upgrades |

| 2030 | PERP | $0.37 | $0.72 | $1.85 | +33% | Perp DEXs dominate decentralized derivatives |

| 2031 | UNI | $10.50 | $18.60 | $32.00 | +26% | Peak cycle, DeFi becomes financial infrastructure |

| 2031 | DYDX | $0.97 | $1.92 | $3.30 | +32% | Sophisticated derivatives, global on-chain trading |

| 2031 | GMX | $20.50 | $37.00 | $62.00 | +24% | Top-tier DEX status, institutional adoption |

| 2031 | PERP | $0.48 | $0.95 | $2.60 | +32% | Protocol maturity, cross-chain markets, stable user growth |

Price Prediction Summary

The forecast for leading Perpetual DEX tokens—including Uniswap (UNI), dYdX (DYDX), GMX (GMX), and Perpetual Protocol (PERP)—is broadly bullish through 2031, punctuated by cyclical corrections typical of crypto markets. Perp DEXs are expected to further solidify their dominance in DeFi, underpinned by technological innovation, capital efficiency, and expanding retail/institutional adoption. However, volatility and regulatory risks will remain significant, especially during market corrections.

Key Factors Affecting Uniswap Price

- Rapid adoption of perpetual DEXs and derivatives in DeFi

- Technological innovation (L2s, ZK rollups, advanced order types)

- Regulatory developments in major markets (US, EU, Asia)

- Shifts in crypto market cycles (bull/bear phases)

- Integration of new assets (LSTs, LRTs, RWAs) as collateral

- Competition from new and existing DEX protocols

- Institutional entry and mainstream adoption of DeFi

- Security incidents and systemic risks in DEX infrastructure

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Next Wave: Technology and Community-Driven Growth

The next phase of growth will be driven by platforms that marry speed with security while delivering tangible value back to their communities through incentives and robust governance models.

As we watch innovations like ZK circuits on Ethereum L2 from Lighter or mobile-native experiences from Oraichain Labs’ LFG!!! gain traction, it’s clear that both institutional-grade technology and grassroots participation will shape which protocols lead, and which fade into obscurity.

The opportunity set remains vast for those willing to engage early with high-potential projects built around transparency, composability, and user empowerment, all hallmarks of the best perpetual DEX projects today.

Yet, with opportunity comes risk. Systemic vulnerabilities are an increasing concern as monthly trading volumes on some L2 Perp DEXs, like Lighter, surpass the $1 trillion mark. Analysts warn that while zero-knowledge circuits and gasless execution reduce friction, they may also introduce new attack surfaces or operational dependencies. For early DeFi traders, robust due diligence and adaptive risk management are essential, especially as protocol complexity increases and composability with other DeFi primitives deepens.

For those navigating the perpetual DEX meta, the following strategies can help capture upside while protecting capital:

Top 5 Early DeFi Trading Strategies on Perpetual DEXs

-

1. Point Farming on Leading Perp DEXs: Engage in high-volume trading or provide liquidity on platforms such as Hyperliquid, dYdX, and GMX to accumulate points. These points often translate into token airdrops or fee rebates, providing early traders with significant upside as platforms reward active participants.

-

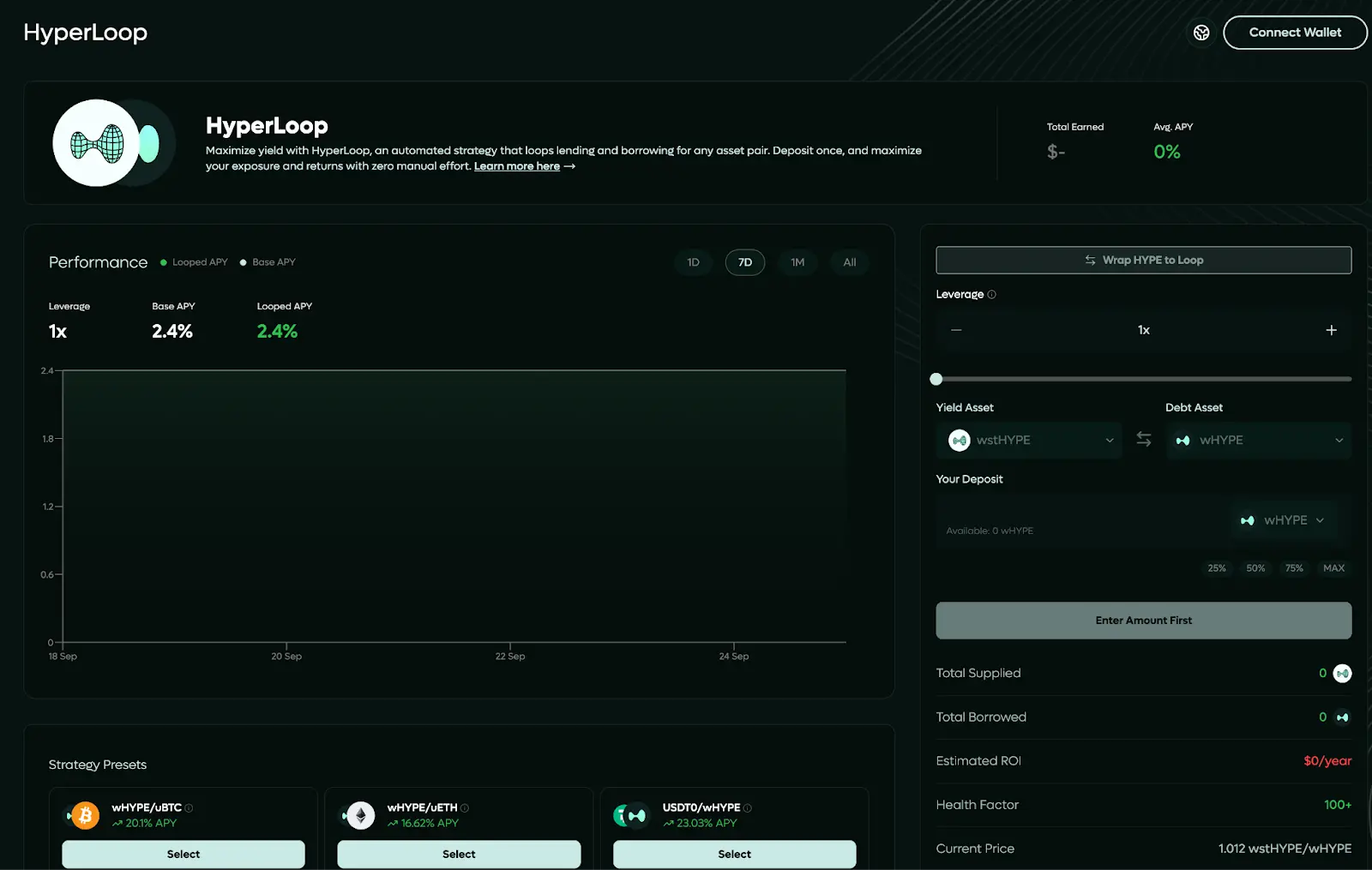

2. Leveraged Trading with Liquid Staking Tokens (LSTs) and Liquid Restaking Tokens (LRTs): Platforms like AsterDEX allow traders to use LSTs and LRTs as margin collateral, enabling users to earn yield from staked assets while taking leveraged positions on perpetual contracts. This dual utility amplifies capital efficiency for early adopters.

-

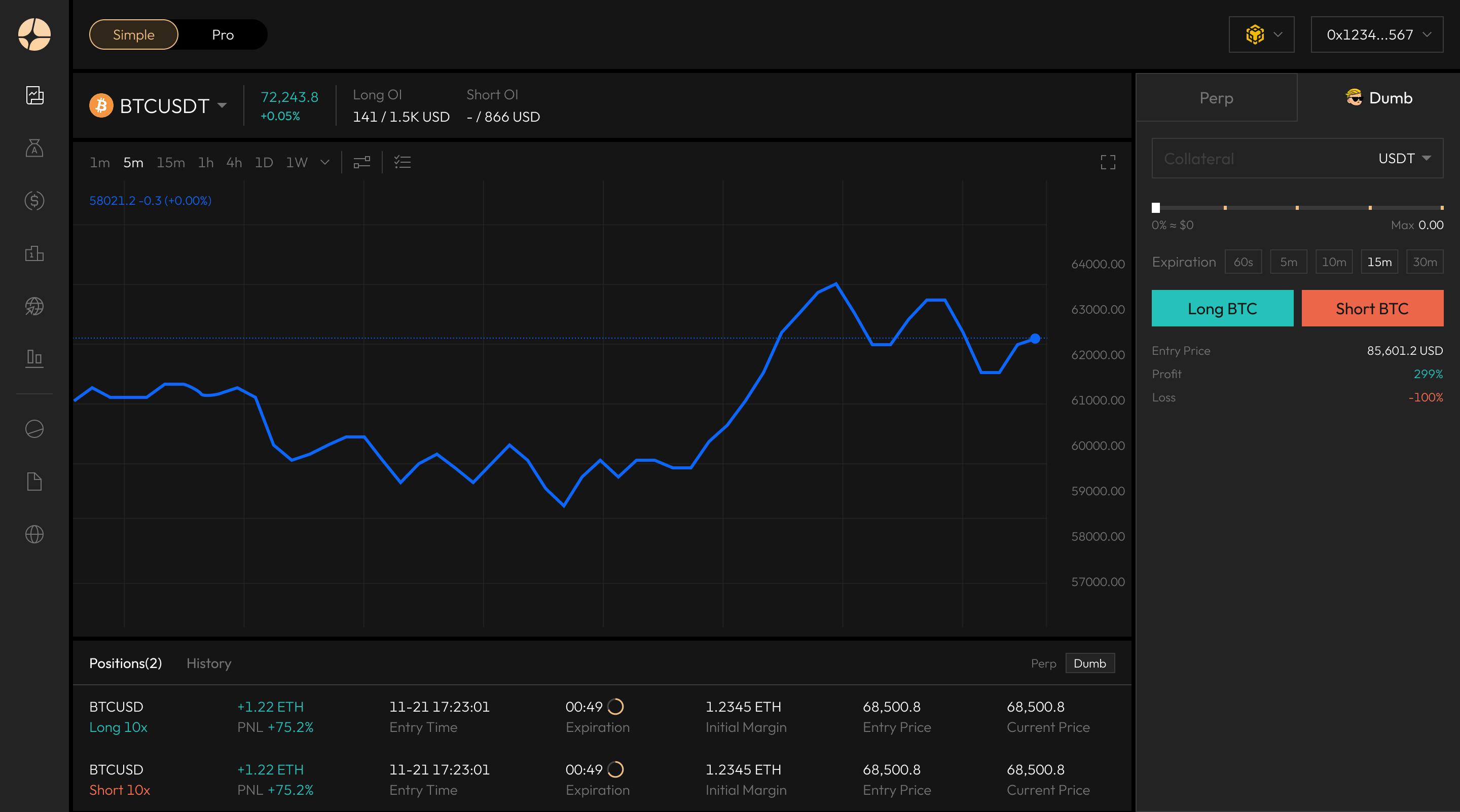

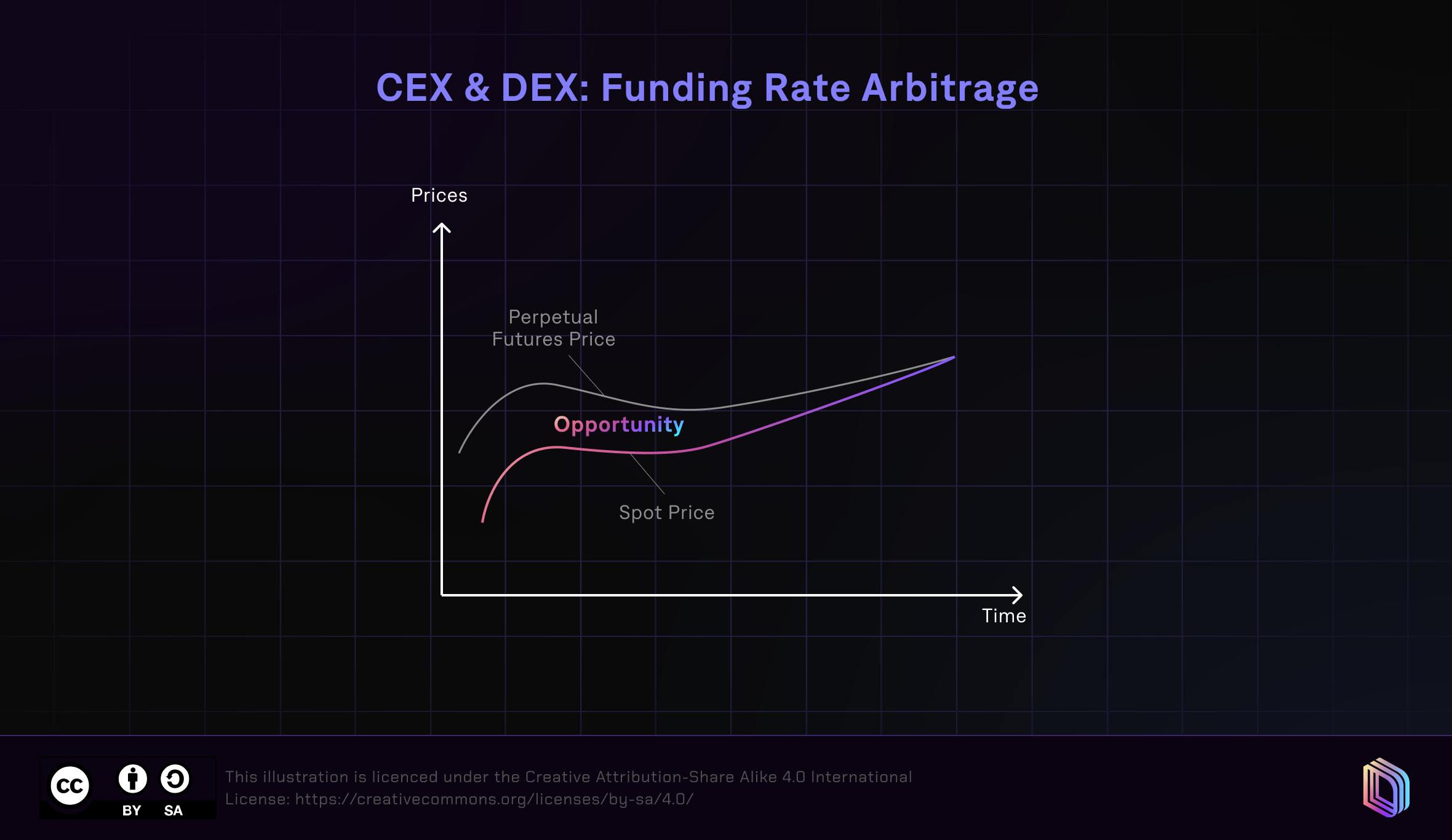

3. Arbitrage Between Centralized and Decentralized Perp Markets: Take advantage of price discrepancies between major perpetual DEXs (e.g., GMX, Perpetual Protocol) and centralized exchanges. The transparency and 24/7 access of DEXs make them ideal for executing cross-platform arbitrage strategies, especially during periods of high volatility.

-

4. Early Adoption of Layer 2 Perp DEX Innovations: Participate in new launches such as Lighter on Ethereum L2, which leverages ZK circuits for faster, cheaper trades. Early users benefit from reduced fees, innovative order types, and potential platform incentives as these protocols attract liquidity and volume.

-

5. Community and Referral Incentive Programs: Maximize rewards by joining referral and community incentive programs on platforms like dYdX and GMX. These programs offer bonus points, reduced trading fees, and exclusive access to platform events for active community members and early referrers.

First, prioritize platforms with proven uptime and transparent governance. Hyperliquid’s ability to process up to 100,000 orders per second with sub-second finality is not just a technical milestone, it signals operational resilience that can withstand surges in user activity or market volatility. Second, seek out projects offering innovative margining options (like LSTs/LRTs as collateral), which can enhance capital productivity without requiring asset un-staking. Third, take advantage of community incentive programs; early participation in points farming or referral schemes has historically yielded substantial token rewards ahead of major listings or airdrops.

Fourth, diversify across protocols and chains. While Ethereum-based solutions dominate volume today, Uniswap (UNI) at $8.20 and dYdX (DYDX) at $0.625634 remain bellwethers, newcomers on alternative L2s or Cosmos-based chains may offer asymmetric upside for those who move early. Finally, stay vigilant about evolving regulatory dynamics; the no-KYC nature of most Perp DEXs is attractive but could come under scrutiny as global policy frameworks mature.

What Sets Hyperliquid-Style Perps Apart?

In an increasingly crowded field, Hyperliquid-Style Perps distinguishes itself by relentlessly optimizing for both trader experience and protocol safety. The platform’s blend of gasless trading, advanced order types (including TWAP/VWAP), and deep liquidity pools has made it a preferred venue for both professional quants and retail users seeking real-time execution without centralized risk.

This focus on seamless UX is complemented by transparent on-chain settlement and sophisticated risk controls, a combination that appeals to traders who value both speed and security in volatile markets. As more competitors race to implement similar features or scale up their incentive structures, Hyperliquid’s established track record offers a benchmark for what next-generation perpetual DEXs must deliver.

Looking Ahead: Navigating the Evolving Perpetual DEX Meta

The trajectory for perpetual DEX opportunities remains steep as technology advances and liquidity deepens across protocols. With Uniswap (UNI) at $8.20, GMX (GMX) at $15.84, dYdX (DYDX) at $0.625634, and Perpetual Protocol (PERP) at $0.300604, all reflecting recent momentum, early adopters stand to benefit from both price appreciation and ecosystem rewards if they position strategically.

Ultimately, success in this meta will favor those who combine disciplined risk management with a willingness to experiment across new platforms, balancing yield generation with capital protection as the landscape matures.