For years, decentralized exchanges (DEXs) have struggled to match the speed and efficiency of their centralized counterparts. High latency, unpredictable gas fees, and limited order types have long been pain points for professional DeFi traders. Today, however, Hyperliquid-style perpetual DEXs are rewriting the script by delivering low-latency trading and zero gas fees, two features fundamentally reshaping the landscape for both retail and institutional participants.

How Hyperliquid Achieves Sub-Second Execution

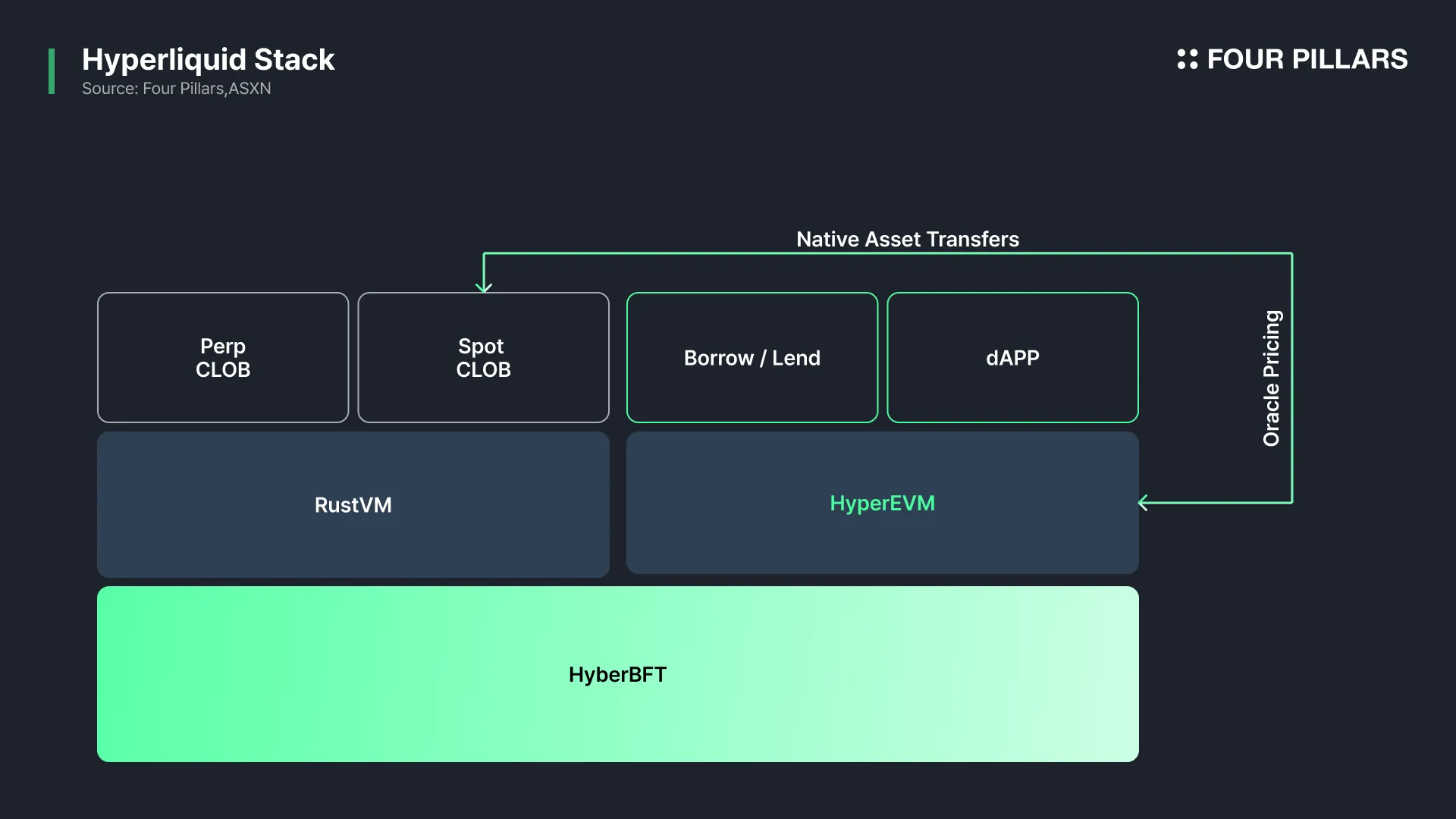

The backbone of Hyperliquid’s performance is its proprietary Layer 1 blockchain. Unlike most DEXs that rely on congested public chains, Hyperliquid is engineered for speed, processing up to 200,000 orders per second with sub-second transaction finality. This architecture brings a level of execution previously reserved for centralized exchanges directly on-chain. Every order, trade, and cancellation is transparently recorded, ensuring both auditability and front-running resistance.

This technical leap means traders can deploy latency-sensitive strategies, such as scalping or high-frequency market-making, without being hamstrung by network delays or prohibitive costs. For those focused on real-time execution crypto, this isn’t just an incremental improvement; it’s a paradigm shift.

The Zero Gas Fee Revolution: Maximizing Profitability in DeFi

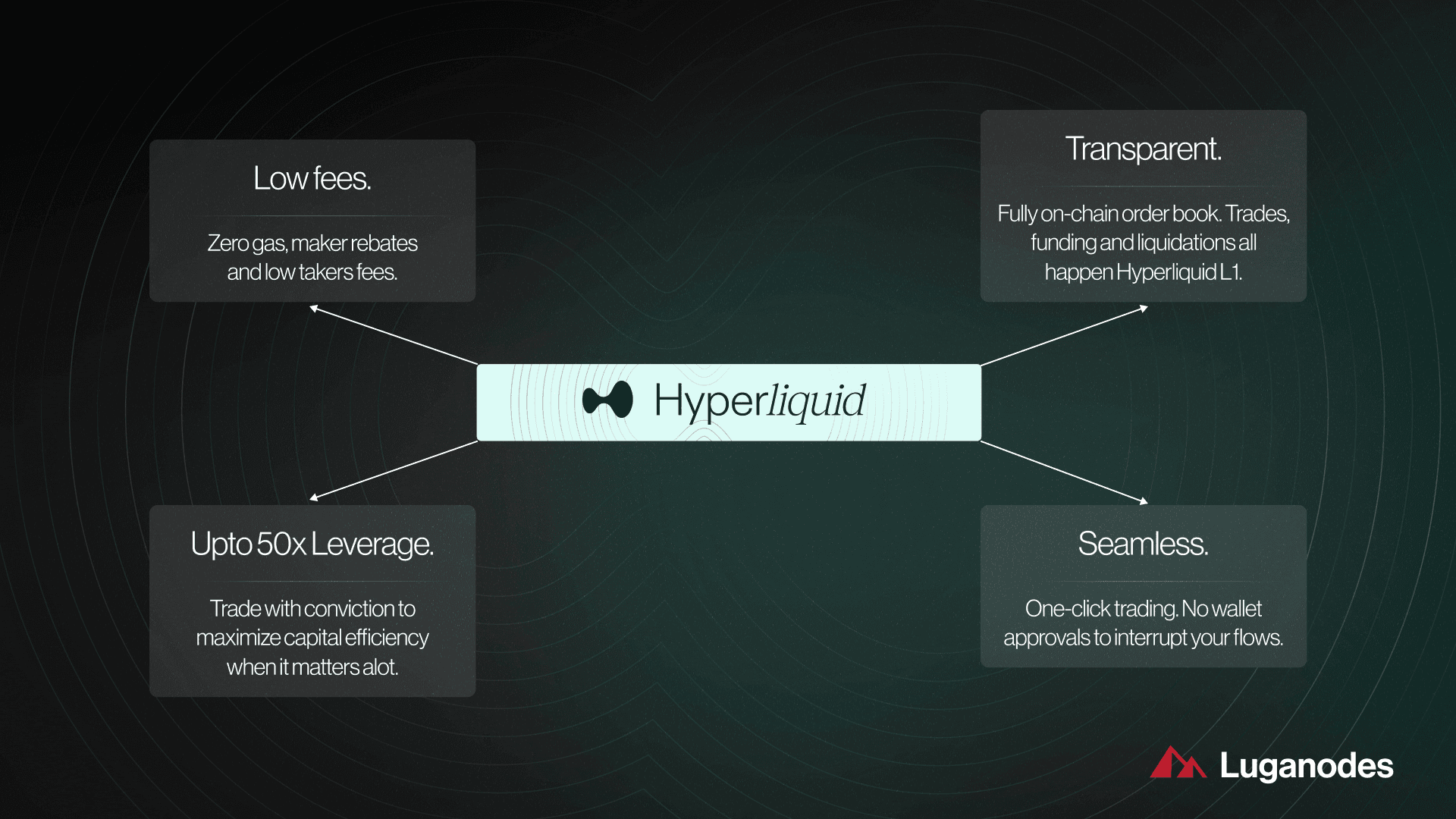

Traditional DEXs often saddle users with unpredictable gas costs that erode profits and deter active trading. Hyperliquid eliminates this friction point entirely: every trade is gas-free. Combined with nominal maker (0.01%) and taker (0.035%) fees, this structure empowers both high-volume professionals and smaller retail traders to execute frequent strategies without watching their margins disappear.

This cost efficiency isn’t just theoretical, it’s transforming how traders approach DeFi markets:

Key Benefits of Zero Gas Fee Perpetual Trading on Hyperliquid

-

Maximized Profitability for Active Traders: With zero gas fees on every trade, users retain more of their earnings—especially those employing high-frequency or frequent trading strategies. This cost efficiency is a major advantage over traditional DEXs, where gas costs can erode profits.

-

Seamless Scalability for High-Volume Trading: Hyperliquid’s proprietary Layer 1 blockchain processes up to 200,000 orders per second with sub-second finality. The absence of gas fees enables institutional-grade, high-volume trading without bottlenecks or unexpected costs.

-

Enhanced Accessibility for All Traders: By eliminating gas fees, Hyperliquid lowers the barrier to entry for both retail and professional users, making advanced perpetual trading strategies accessible without requiring large capital to offset network costs.

-

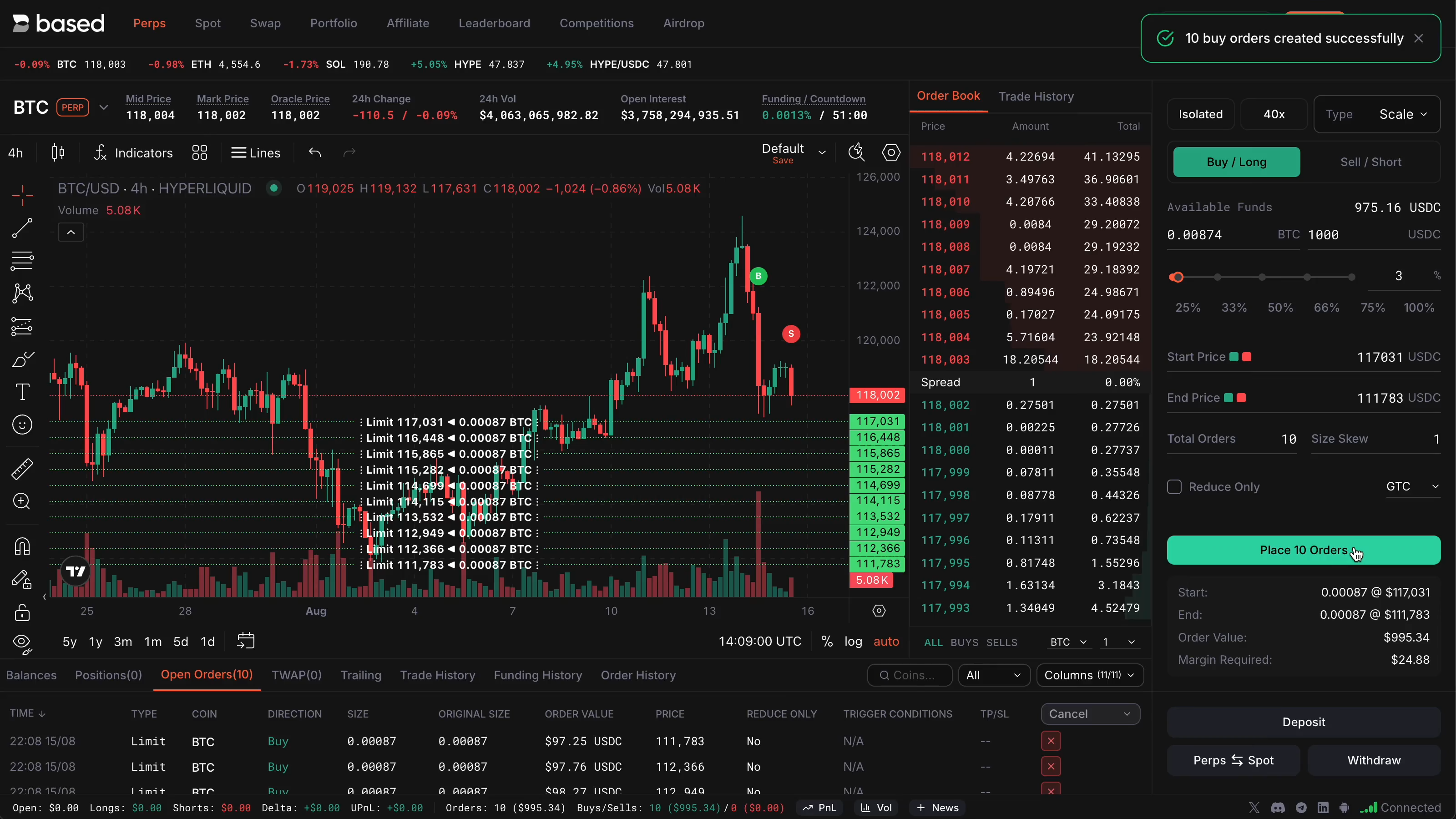

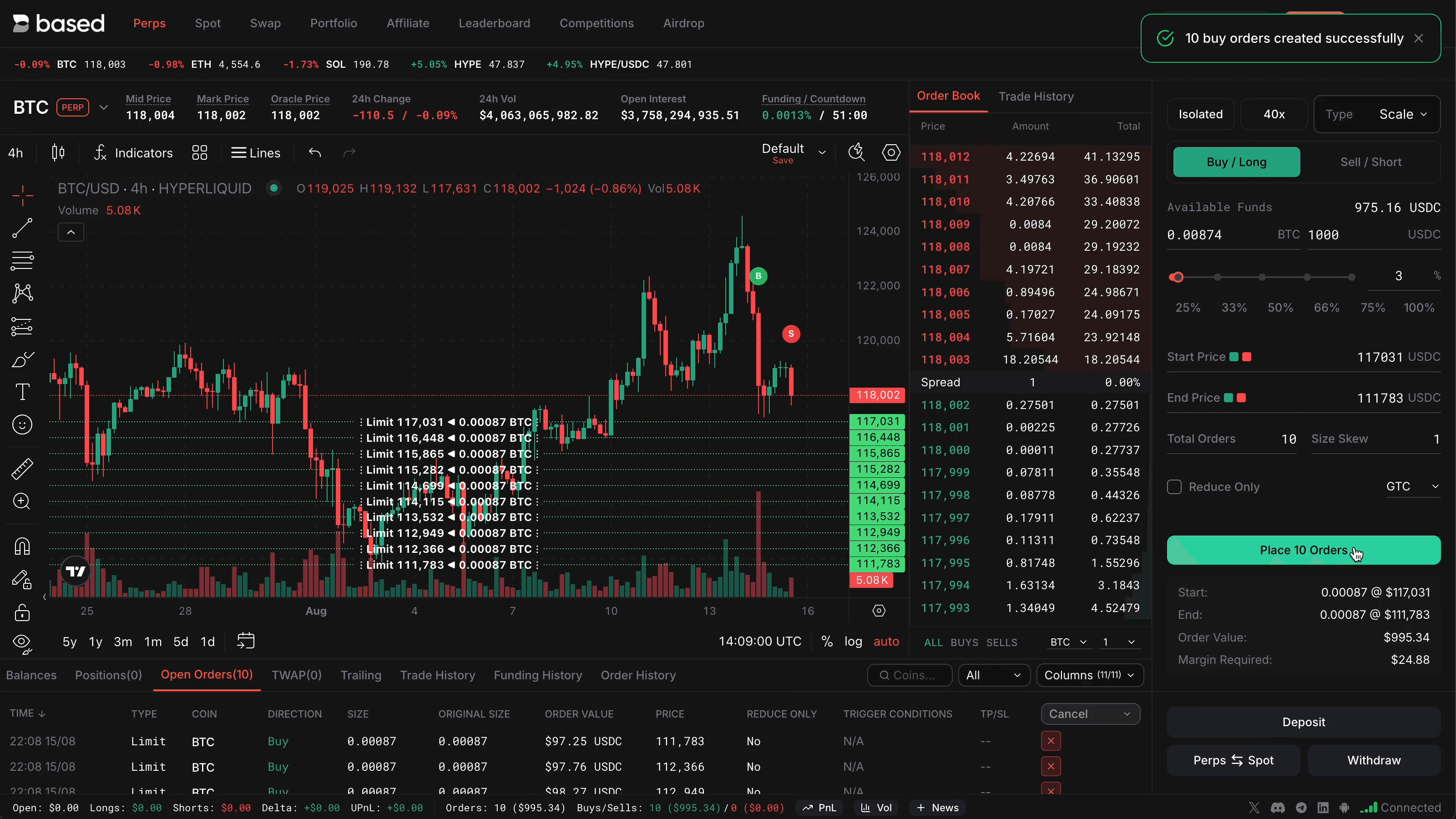

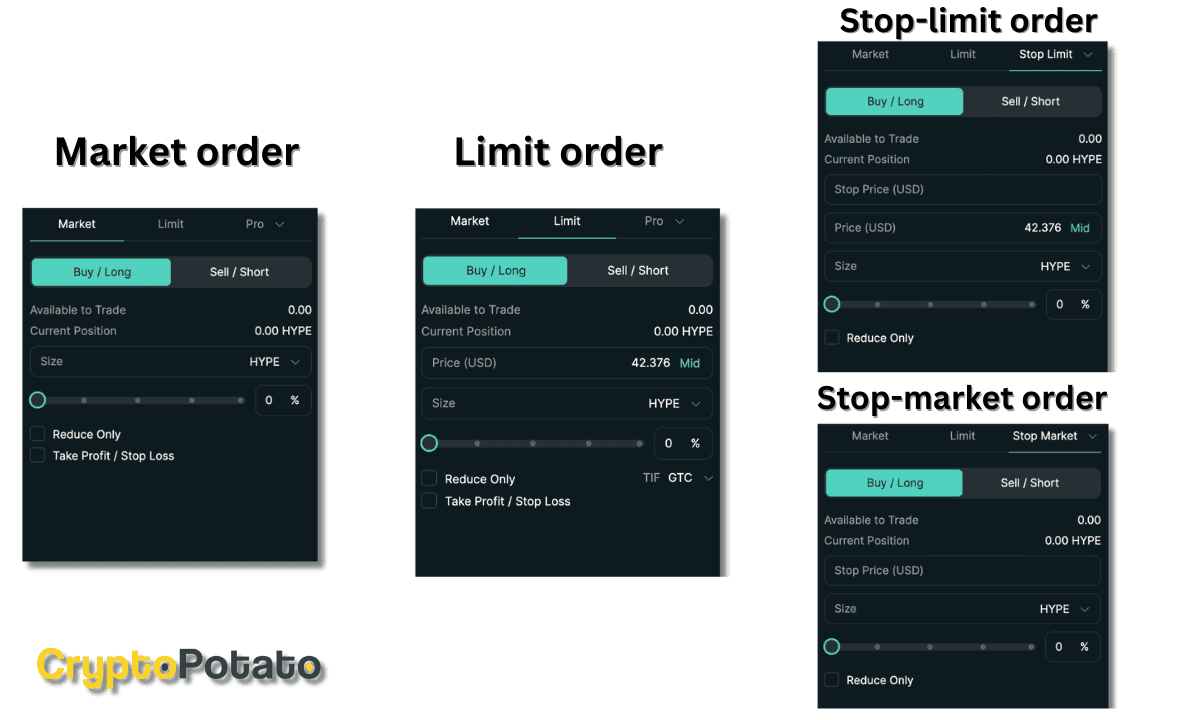

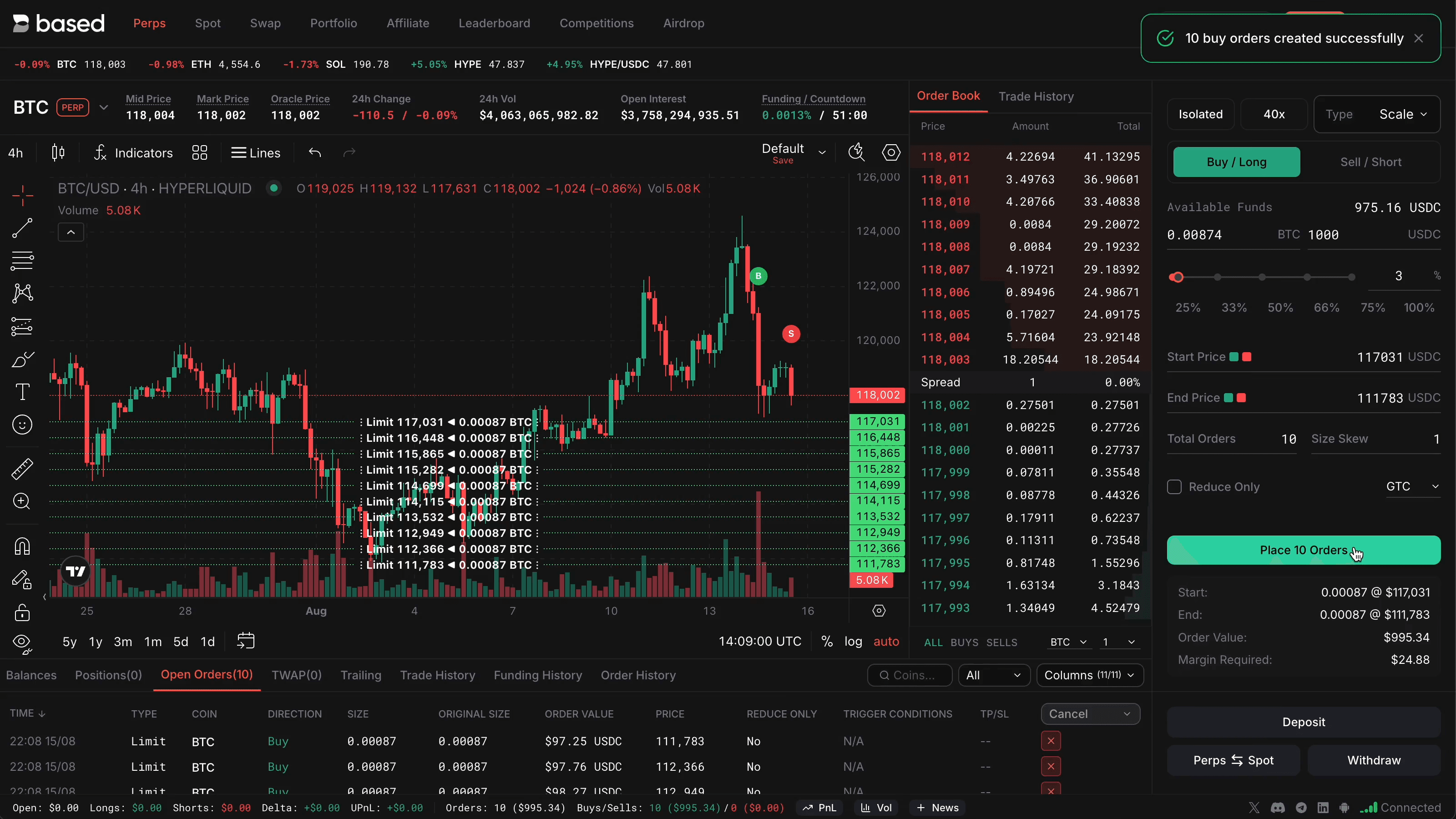

Improved Strategy Execution: Zero gas fees make it practical to use advanced order types—like TWAP, scale, and stop orders—without worrying about cumulative transaction costs, supporting sophisticated and algorithmic trading.

-

Transparent and Predictable Trading Costs: With no gas fees, traders only pay nominal maker (0.01%) and taker (0.035%) fees, ensuring full cost transparency and easy calculation of trading expenses.

By removing the persistent drag of gas costs, strategies like TWAP (time-weighted average price), grid trading, or rapid position adjustment become viable even at smaller sizes. The result? More participants can compete on a level playing field in deep liquidity environments.

The Institutional Edge: Deep Liquidity Meets Professional Tools

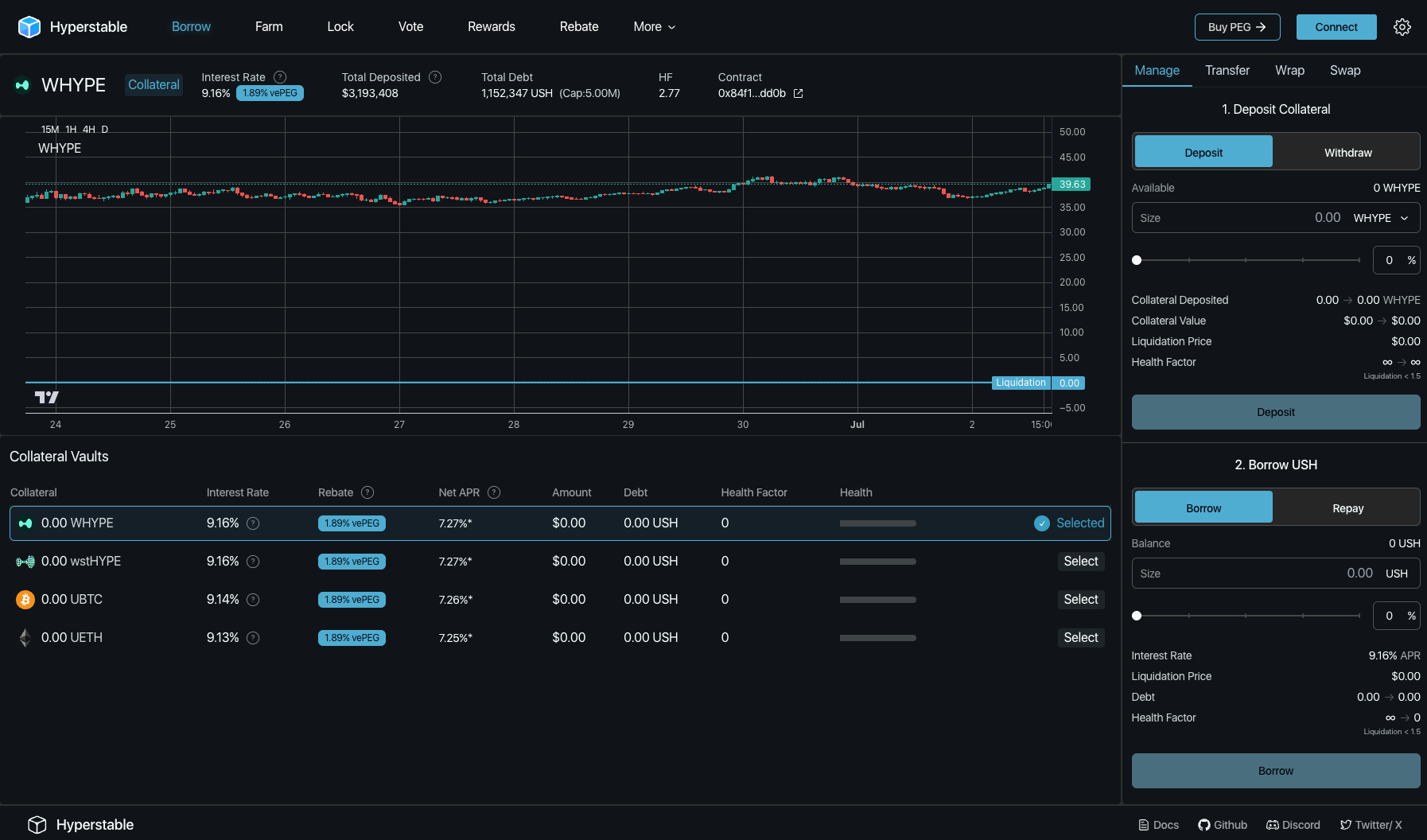

Hyperliquid perpetual DEX doesn’t just offer speed, it delivers institutional-grade depth across more than 130 perpetual contracts with leverage up to 50x. The platform’s transparent on-chain order book mirrors what professional traders expect from top-tier centralized venues but with the added security and transparency only blockchain can provide.

Advanced order types, including market, limit, stop-loss, scale orders, and TWAP, give users surgical precision in risk management and execution. For institutions seeking deep liquidity decentralized exchange solutions without sacrificing transparency or custody control, this blend is compelling.

Transparency is a core differentiator for Hyperliquid-style perpetual DEXs. Every action, from order placement to trade settlement, is immutably recorded on-chain. This not only prevents hidden slippage or off-book trades but also enables real-time auditability for compliance-focused institutions. The result is a trustless environment where performance and fairness are verifiable at all times.

The ability to process up to 200,000 orders per second means that even during periods of extreme market volatility, traders can rely on consistent execution and deep order book liquidity. This reliability is critical when managing risk in fast-moving markets, especially for those deploying algorithmic or high-frequency strategies.

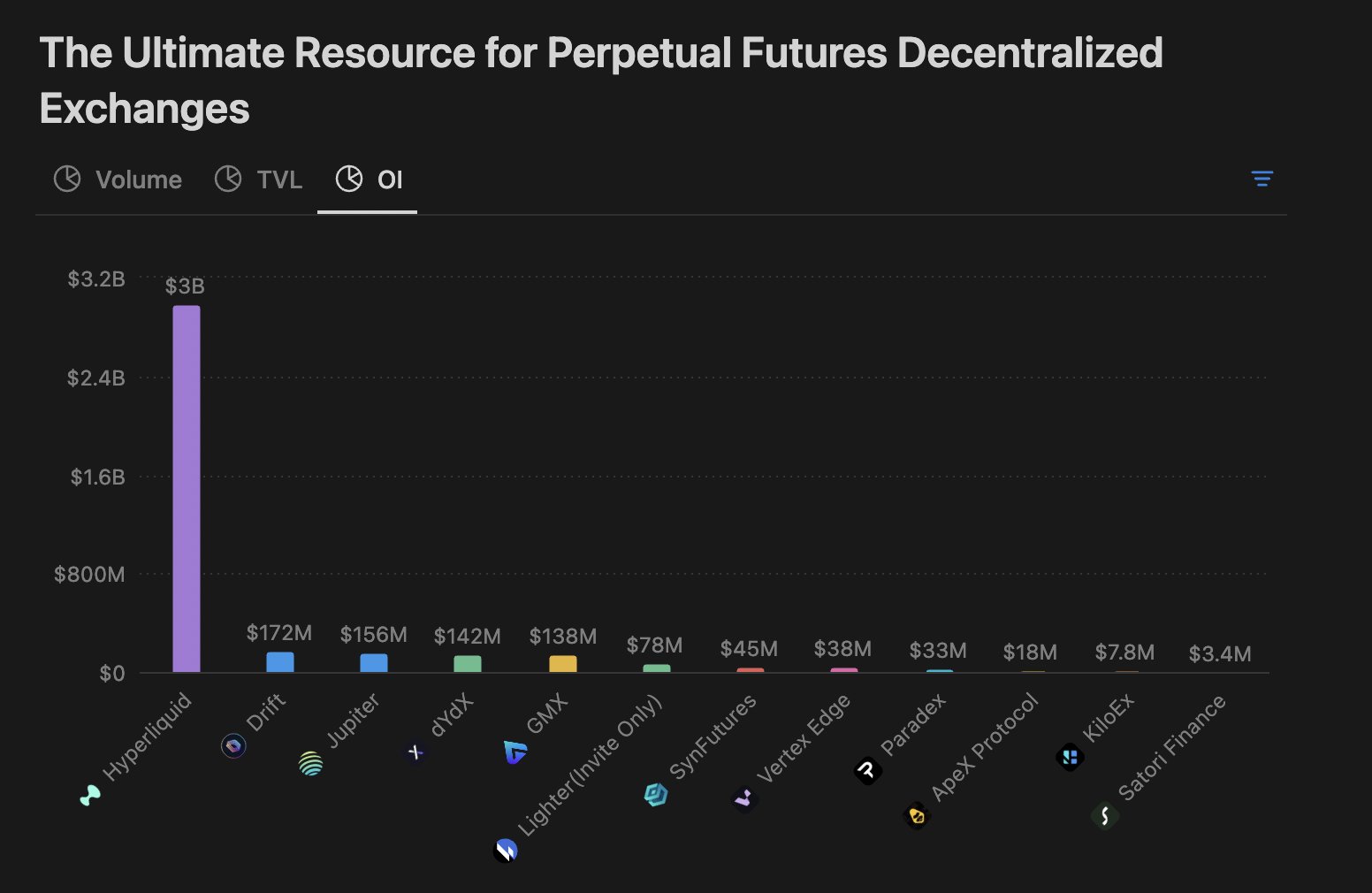

Comparing Perpetual Contract DEXs: Hyperliquid vs. Legacy Platforms

The perpetual contract DEX landscape has evolved rapidly, but most platforms still struggle with either high latency or unpredictable costs. In comparison, Hyperliquid’s architecture delivers:

Hyperliquid vs. Legacy Perpetual DEXs: Speed, Fees, Transparency

-

Speed & Latency: Hyperliquid processes up to 200,000 orders per second with sub-second finality, rivaling centralized exchanges. In contrast, legacy perpetual DEXs like dYdX (v3) and Perpetual Protocol typically experience higher latency due to reliance on Layer 2 or Layer 1 blockchains, leading to slower order execution and less responsive trading.

-

Trading Fees: Hyperliquid offers zero gas fees and low trading fees (maker: 0.01%, taker: 0.035%), maximizing profitability for active traders. Legacy DEXs such as Uniswap and dYdX often incur variable gas fees (especially on Ethereum mainnet) and higher trading fees, which can erode profits, particularly for frequent traders.

-

Transparency: Hyperliquid maintains a fully on-chain order book, recording every order, trade, and cancellation directly on its proprietary blockchain for maximum transparency. Legacy DEXs may use off-chain order books (as with dYdX v3) or AMM models (like Uniswap), which can obscure order flow and reduce auditability compared to Hyperliquid’s approach.

-

Advanced Trading Features: Hyperliquid supports a wide range of order types (market, limit, stop, TWAP, scale) and advanced tools like copy trading, catering to both retail and professional users. Many legacy perpetual DEXs offer more limited order types and fewer professional-grade features, making Hyperliquid more attractive for sophisticated trading strategies.

-

Market Coverage & Leverage: Hyperliquid lists over 130 perpetual contracts with leverage up to 50x, providing broad market access. Legacy DEXs may offer fewer trading pairs and lower leverage, limiting opportunities for traders seeking diverse exposure and higher risk/reward profiles.

Legacy solutions often force traders into tough choices between speed and decentralization or between cost efficiency and transparency. By removing these trade-offs, Hyperliquid sets a new benchmark for what professional DeFi trading can look like.

What’s Next? The Roadmap for Low-Latency DeFi

As more traders migrate from centralized venues in search of transparency and custody control, the demand for low-latency DeFi trading will only intensify. Platforms like Hyperliquid are already signaling the future: seamless user experience, institutional-grade tools, and truly permissionless access to global liquidity pools.

This shift isn’t just about faster trades or lower costs – it’s about fundamentally redefining what’s possible in decentralized finance. With zero gas fee perpetuals and real-time execution now a reality, the line between CeFi performance and DeFi ethos has never been thinner.