The decentralized perps DEX war is in full swing, and the battlefield has never been hotter. Four platforms are at the epicenter of this on-chain arms race: Hyperliquid, Aster DEX, SunPerp, and JupiterExchange. Each contender is gunning for dominance with bold innovations, razor-thin latency, and deep liquidity pools that leave centralized exchanges sweating. If you’re a trader chasing edge in 2025, it’s time to break down how these giants stack up, and where the next breakout might emerge.

The Titans of On-Chain Perpetuals: Who’s Leading the Charge?

Hyperliquid is the undisputed juggernaut right now. With a staggering 73% market share, $320 billion in trading volume for July 2025 alone, and $86.6 million in protocol revenue, Hyperliquid isn’t just setting records, it’s rewriting them. What gives it this edge? The platform runs on its own lightning-fast Layer 1 blockchain, purpose-built for low-latency trading. Even Solana can’t keep up with Hyperliquid’s seven-day fee totals lately (source). The HYPE token sits at $0.30684, holding steady as fee buybacks pump value back to holders.

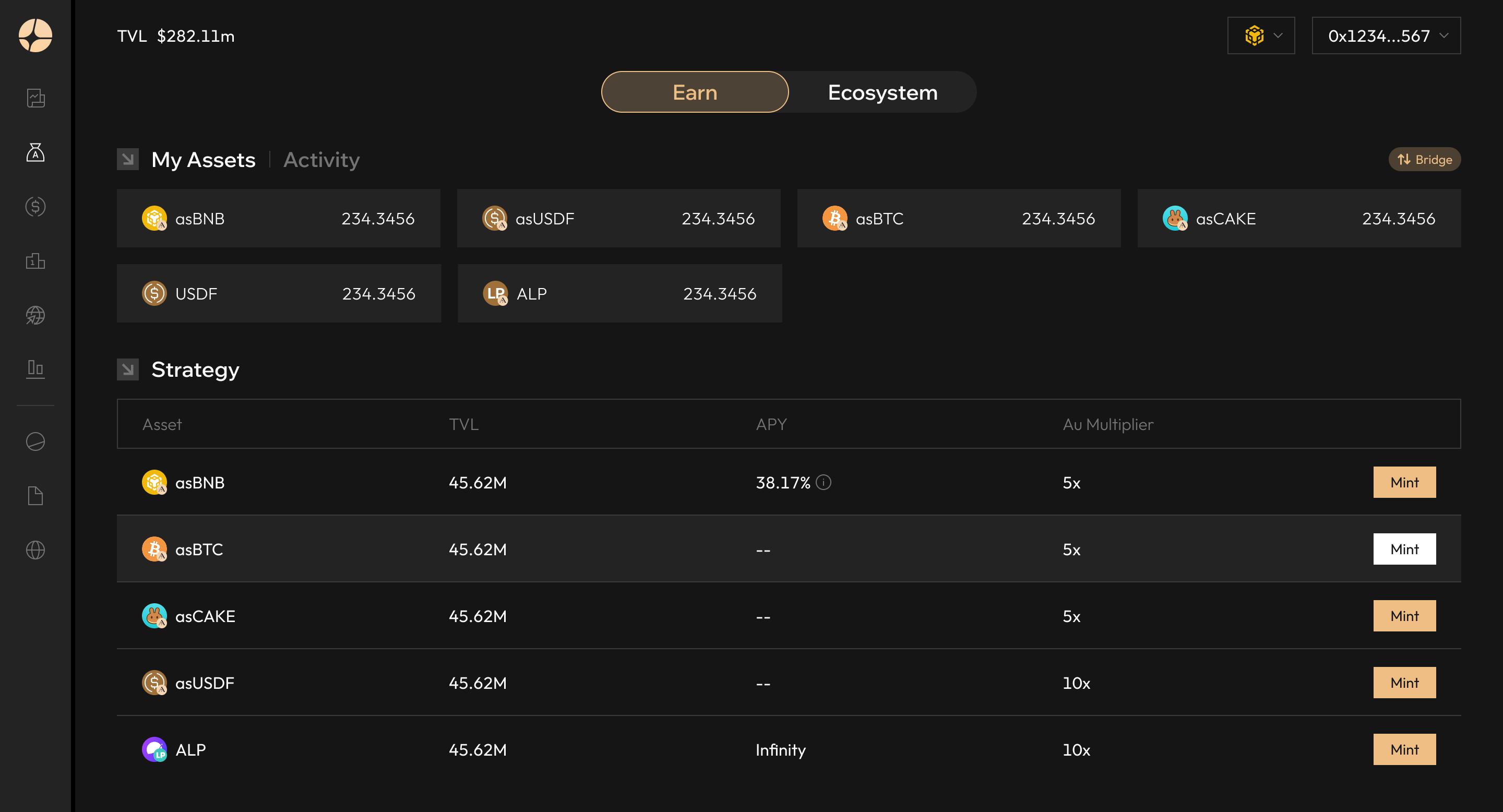

Aster DEX isn’t just playing catch-up, it’s coming out swinging. After a jaw-dropping 1,650% surge in ASTER token price post-launch (now at $1.95), Aster blitzed to nearly $2 billion market cap and locked over $1 billion TVL within its first day. Its secret sauce? A multi-chain strategy spanning BNB Chain, Ethereum, Solana, and Arbitrum, plus innovative features like hidden orders and dual-margin systems that blur the line between CEX speed and DeFi transparency (source). In just 24 hours post-launch: $1.5 billion platform volume and 330,000 new wallets onboarded.

Top 4 Perps DEXs Shaping the 2025 Market

-

Hyperliquid: The dominant force in Perps DEXs, Hyperliquid commands 73% market share with $320 billion in trading volume and $86.6 million protocol revenue in July 2025. Its native Layer 1 has surpassed Solana in fees, and 97% of fees go to an Assistance Fund for HYPE token buybacks. HYPE price: $0.30684 (+0.00013).

-

Aster DEX: Aster is the fastest-rising challenger, with its ASTER token surging 1,650% post-launch, reaching a $2 billion market cap. It features multi-chain support (BNB, Ethereum, Solana, Arbitrum), hidden orders, and dual-margin systems. Achieved $1.005B TVL and 330,000 new wallets in 24 hours. ASTER price: $1.95 (+1.03685).

-

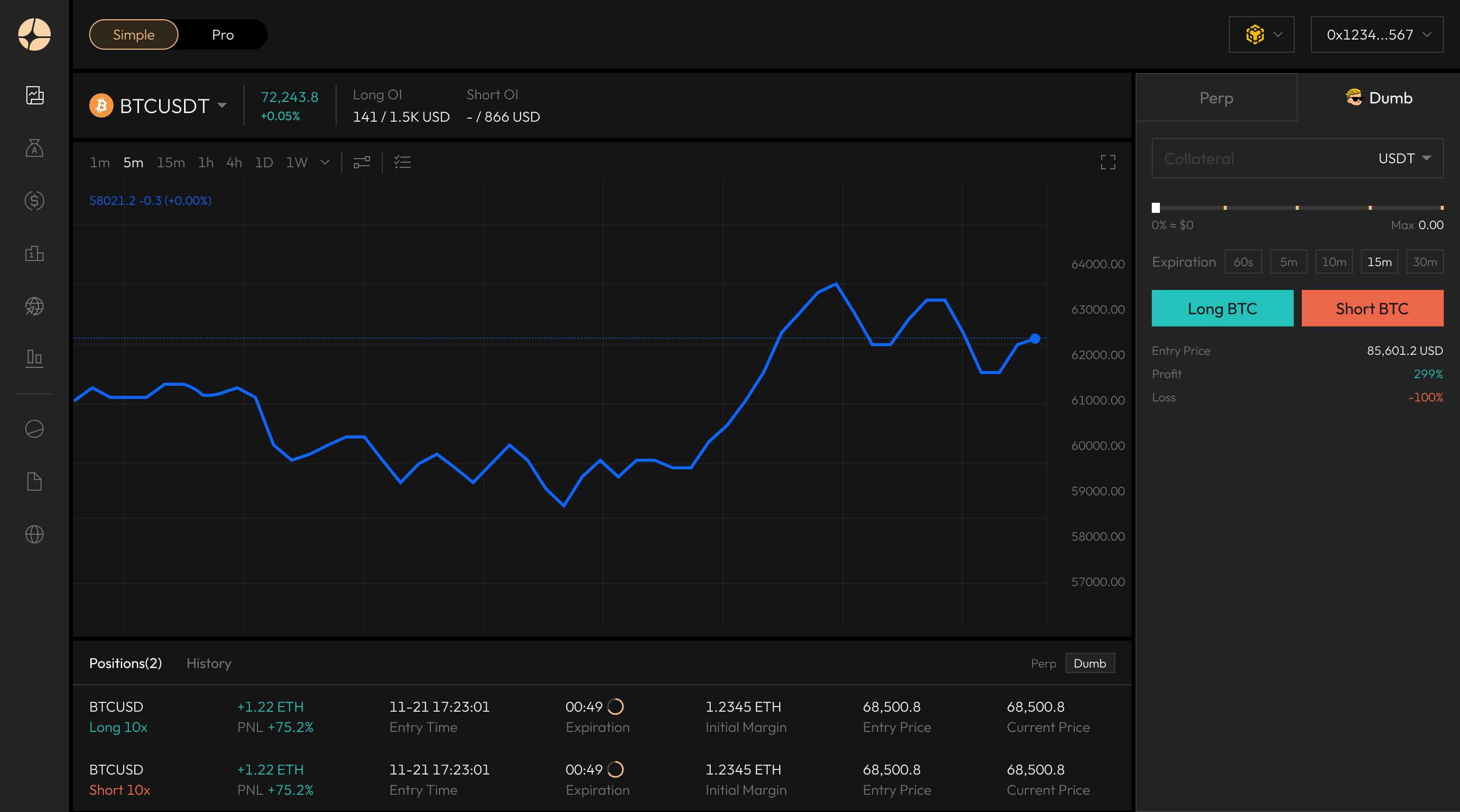

SunPerp: Backed by Justin Sun, SunPerp leverages the Tron ecosystem to offer seamless perpetual futures trading. Its integration with Tron aims to capture a large user base by providing fast, accessible perps contracts for Tron users.

-

JupiterExchange: JupiterExchange has overtaken Hyperliquid in 24-hour revenue, now the #2 fee-generating protocol. Built on Solana, it benefits from high throughput and low fees, reflecting Solana’s surge past Ethereum in recent DEX revenue. JUP price: $0.00097352 (-0.00013).

The Tron Gambit: SunPerp Eyes Mass Adoption

SunPerp, backed by Justin Sun himself, leverages Tron’s ecosystem to bring perpetual futures to an even wider audience. While concrete trading metrics are scarcer compared to its rivals (Tron loves opacity), SunPerp’s real weapon is seamless interoperability for Tron users, making it a default on-ramp for millions already active on the network (source). That strategic integration could be pivotal as retail flows increasingly migrate from CEXs to DeFi rails.

JupiterExchange: Solana’s Powerhouse Steps Up

Don’t sleep on JupiterExchange. In September 2025 it leapfrogged Hyperliquid in 24-hour protocol revenue, a seismic shift that signals Solana-based perps are grabbing serious mindshare (source). With JUP priced at $0.00097352, JupiterExchange is riding Solana’s explosive growth as Ethereum cedes ground in daily fee rankings.

This competitive landscape isn’t just about numbers, it’s about user experience at warp speed. Deep liquidity pools mean tighter spreads; custom margin systems unlock new strategies; multi-chain deployments invite fresh capital from every corner of DeFi.

Head-to-Head: Hyperliquid vs. Aster DEX vs. SunPerp vs. JupiterExchange

Let’s get tactical. Hyperliquid dominates with unmatched liquidity, but Aster DEX is clawing market share with its cross-chain agility and CEX-grade features, hidden orders and dual-margin are game-changers for active traders craving stealth and flexibility. Meanwhile, SunPerp is quietly onboarding the Tron faithful, leveraging a built-in user base that could explode if perpetuals catch fire in Asia’s retail markets. And JupiterExchange? It’s the dark horse with momentum, now outpacing even Hyperliquid in daily protocol revenue, a testament to Solana’s low fees and high throughput fueling real on-chain volume shifts.

6-Month Price Comparison: Leading Perpetual DEX Tokens and Major Cryptocurrencies

Performance of Hyperliquid (HYPE), Aster (ASTER), JupiterExchange (JUP), and Key Crypto Assets (as of 2025-09-21)

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Hyperliquid (HYPE) | $53.96 | $16.68 | +223.5% |

| Aster (ASTER) | $1.95 | $0.9157 | +112.9% |

| JupiterExchange (JUP) | $0.000976 | $0.001126 | -13.3% |

| Bitcoin (BTC) | $115,746.00 | $60,000.00 | +92.9% |

| Ethereum (ETH) | $4,486.72 | $3,000.00 | +49.6% |

| GMX (GMX) | $16.63 | $10.00 | +66.3% |

| dYdX (DYDX) | $0.7476 | $0.5000 | +49.5% |

| Perpetual Protocol (PERP) | $0.3150 | $0.2000 | +57.5% |

Analysis Summary

Over the past six months, Hyperliquid (HYPE) and Aster (ASTER) have significantly outperformed both major cryptocurrencies and other leading perpetual DEX tokens, with HYPE leading at +223.5% and ASTER at +112.9%. In contrast, JupiterExchange (JUP) has declined by 13.3%, despite the overall bullish market trend. Bitcoin and Ethereum posted strong gains, but were outpaced by the top-performing Perp DEX tokens.

Key Insights

- Hyperliquid (HYPE) posted the highest 6-month growth (+223.5%), reflecting its dominant market position and strong protocol revenue.

- Aster (ASTER) also delivered robust gains (+112.9%), driven by rapid adoption and innovative features.

- JupiterExchange (JUP) was the only asset in the comparison to decline over the period (-13.3%), despite its recent revenue milestones.

- Major assets like Bitcoin (+92.9%) and Ethereum (+49.6%) saw substantial growth, but were outperformed by the top Perp DEX tokens.

- Other Perp DEX tokens (GMX, dYdX, PERP) posted moderate gains, highlighting the outlier performance of HYPE and ASTER.

All prices and percentage changes are sourced directly from real-time market data as of September 21, 2025. The comparison uses the exact current and 6-month historical prices provided for each asset, ensuring accuracy and consistency.

Data Sources:

- Main Asset: https://www.coingecko.com/en/coins/hyperliquid

- Aster: https://www.coingecko.com/en/coins/aster

- JupiterExchange: https://www.coingecko.com/en/coins/jupiterexchange

- Bitcoin: https://www.coingecko.com/en/coins/bitcoin

- Ethereum: https://www.coingecko.com/en/coins/ethereum

- GMX: https://www.coingecko.com/en/coins/gmx

- dYdX: https://www.coingecko.com/en/coins/dydx

- Perpetual Protocol: https://www.coingecko.com/en/coins/perpetual-protocol

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

But numbers only tell half the story, what about the actual trading experience? Hyperliquid’s proprietary Layer 1 offers near-instant execution, which is gold for scalpers riding micro-volatility. Aster DEX’s multi-network approach means you’re never locked out of opportunity, wherever liquidity migrates next. SunPerp is all about frictionless onboarding for Tron users who want to trade perps without ever leaving their home turf. JupiterExchange delivers on speed and cost thanks to Solana’s tech stack, making it a magnet for traders sick of Ethereum gas wars.

Real-Time Edge: Deep Liquidity and Low-Latency Execution

If you’re measuring by pure trading firepower, Hyperliquid still holds the crown: $320 billion in July volume isn’t just a flex, it’s proof that deep liquidity attracts serious size and professional flow. But don’t ignore Aster DEX, whose rapid TVL growth signals that whales are already sniffing out new pools of alpha (source). As for SunPerp, its future depends on Tron ecosystem expansion, if Justin Sun can drive mass adoption, SunPerp could become a gateway for millions of new DeFi traders.

JupiterExchange, meanwhile, is showing what happens when you combine Solana speed with relentless fee competition: more traders are piling in as Ethereum-based rivals struggle to keep up with rising costs and slower confirmation times (source).

What Matters Most? User Experience and Incentives Rule the War

This decentralized perps DEX war isn’t just about protocol revenue or token price (though those matter provides $0.30684 HYPE, $1.95 ASTER, $0.00097352 JUP). It’s about who can deliver seamless trading at scale while rewarding loyal users along the way.

Top 4 Reasons Traders Flock to Leading Perps DEXs

-

Hyperliquid: Dominant Market Share & Fee Innovation — Hyperliquid commands 73% of the Perp DEX market, with a staggering $320 billion in trading volume and $86.6 million in protocol revenue for July 2025. Its unique fee buyback model (allocating 97% of fees to HYPE token buybacks) and a high-performance native Layer 1 chain—now surpassing Solana in seven-day fees—make it the go-to platform for serious traders. HYPE price: $0.30684

-

Aster DEX: Explosive Growth & Multi-Chain Flexibility — Aster DEX has witnessed a 1,650% surge in ASTER token price, hitting a market value near $2 billion. With a multi-chain strategy (BNB, Ethereum, Solana, Arbitrum), innovative features like hidden orders and dual-margin systems, and a record $1.005 billion TVL within 24 hours of launch, Aster is drawing massive user interest. ASTER price: $1.95

-

SunPerp: Tron-Powered Access & Ecosystem Integration — SunPerp leverages the Tron ecosystem to deliver perpetual futures trading to a vast user base. Its seamless integration with Tron offers easy access to perpetual contracts for TRX holders, positioning SunPerp as a strategic player in the Perp DEX race, especially for those already active in the Tron network.

-

JupiterExchange: Surging Revenue & Solana Advantage — JupiterExchange has surpassed Hyperliquid in 24-hour revenue, emerging as the second-highest fee-generating protocol in the market. Built on Solana, it benefits from the chain’s high throughput and low fees, with Solana recently overtaking Ethereum in 24-hour revenue—fueling JupiterExchange’s rapid ascent. JUP price: $0.00097352

The next phase? Expect more aggressive incentive programs (think point farming), deeper integrations across major blockchains, and new features that blur CEX/DEX boundaries even further, hidden orders today could mean fully programmable perps tomorrow.

If you’re chasing edge in 2025’s DeFi fast lane, keep your eyes glued to these four platforms, the battle lines are drawn, but victory favors those who move fastest when opportunity knocks.