Perpetual contracts have revolutionized the decentralized finance (DeFi) landscape, offering traders a way to speculate on crypto assets without expiry dates. But what keeps these instruments trading in line with the underlying asset? The answer lies in funding rates, a critical mechanism that every trader on Hyperliquid-Style Perps must understand. With Hyperliquid processing over $2.5 trillion in cumulative volume, understanding how Hyperliquid-Style Perps funding rates work is essential for anyone seeking an edge in this high-speed, high-stakes ecosystem.

How Funding Rates Keep Perpetual Contracts Anchored

Unlike traditional futures, perpetual contracts (or “perps”) do not settle at a fixed date. Instead, they use funding rates: periodic payments exchanged between traders holding long and short positions, to ensure that the contract price stays close to the spot price of the underlying asset. On Hyperliquid, this mechanism is especially sophisticated: funding payments occur every hour, far more frequently than many other DEXs or centralized exchanges.

The core idea is simple: if the perp price trades above the spot (indicating bullish sentiment), those holding long positions pay a fee to shorts. If it trades below spot, shorts pay longs. This dynamic incentivizes traders to keep prices aligned and prevents prolonged dislocations that could otherwise be exploited for arbitrage.

The Formula Behind Hyperliquid’s Funding Rate

Hyperliquid’s approach stands out for its transparency and responsiveness. The platform calculates its funding rate using a blend of two components:

- Interest Rate Component: A fixed value of 0.01% every 8 hours (0.00125% per hour), reflecting the cost difference between borrowing USD and holding crypto.

- Premium Component: The average difference between the perp’s impact price and an external oracle-based spot price over each interval.

The formula is as follows:

Funding Rate (F) = Average Premium Index (P) and clamp(interest rate – Premium Index (P), -0.0005, 0.0005)

This structure ensures that rates are both predictable and closely tied to real market conditions. Notably, funding payments are made hourly, each payment representing one-eighth of the full 8-hour rate, allowing for rapid adaptation when markets move fast or liquidity shifts suddenly.

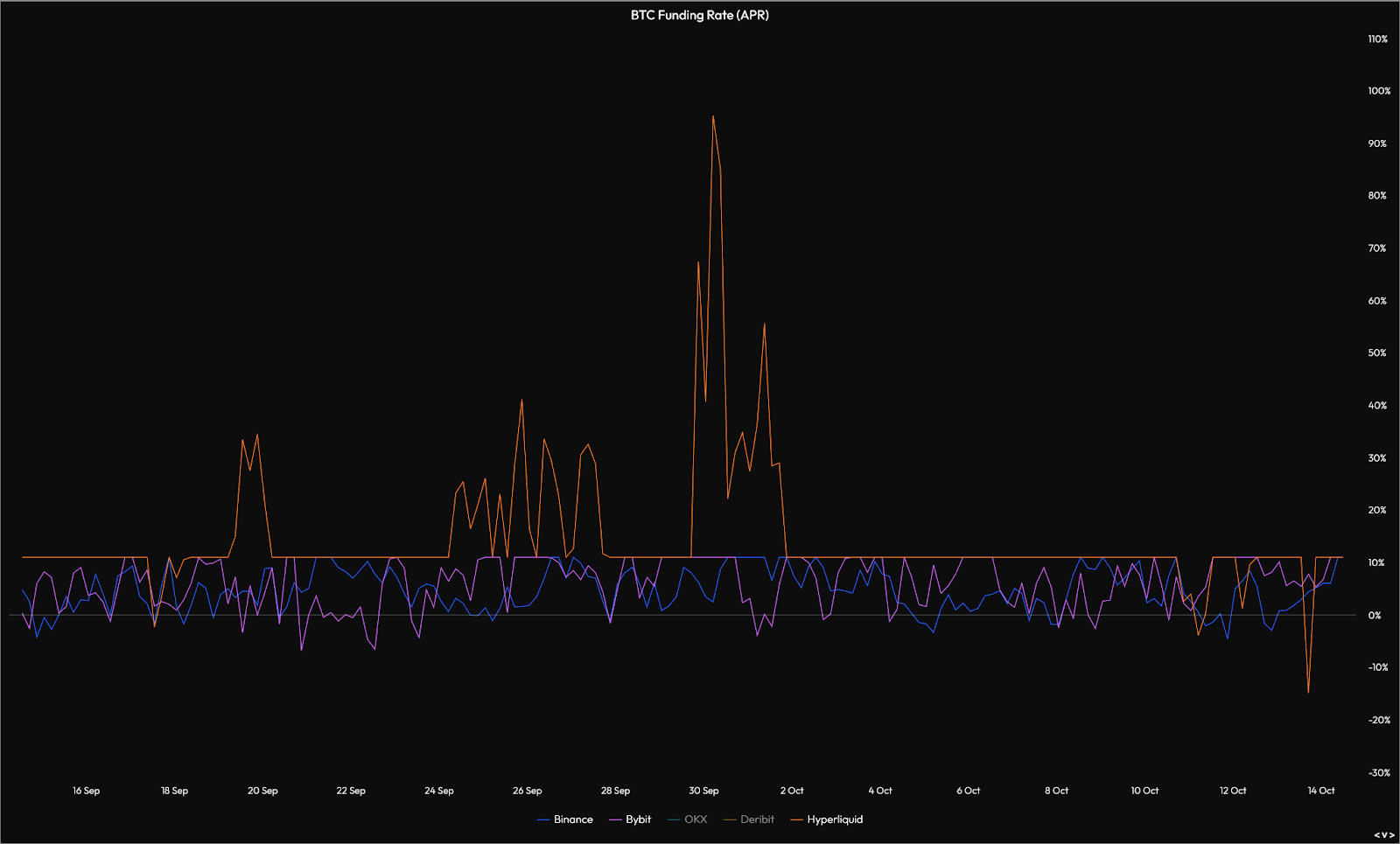

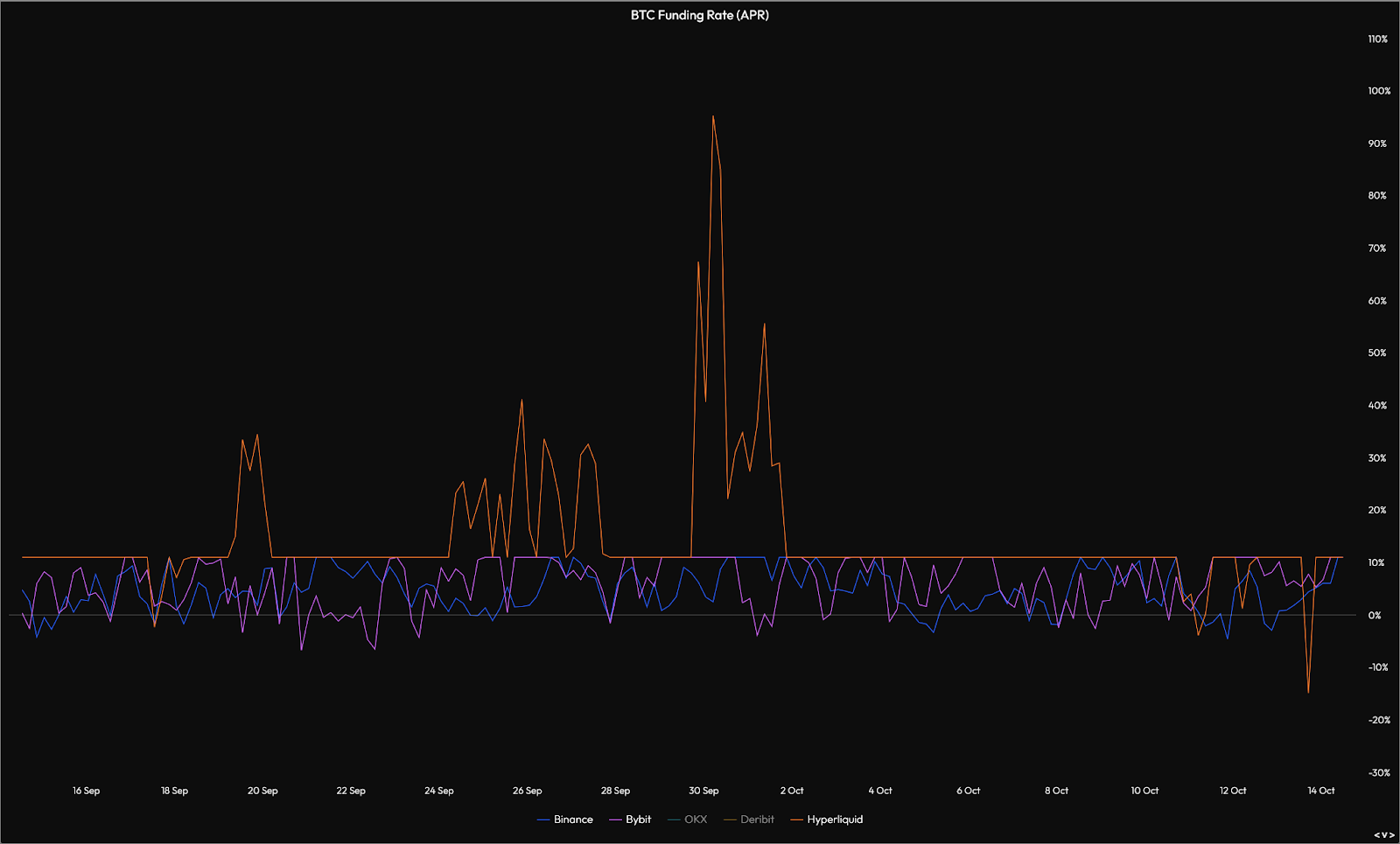

Key Differences: Hyperliquid vs. Other DEX Funding Mechanisms

-

Oracle-Based Pricing vs. Internal Spot Price: Hyperliquid determines its funding rates using external oracle prices, ensuring rates reflect the broader market and reducing susceptibility to internal price manipulation. In contrast, many DEXs like dYdX and GMX often rely on their own spot market prices, which can be more easily influenced by large trades or low liquidity.

-

Hourly Funding Payments: Hyperliquid collects and distributes funding every hour, allowing for rapid adjustments to market conditions. Most major DEXs, such as BitMEX and Binance, settle funding payments every 8 hours, which can delay price alignment with the spot market.

-

Dynamic Funding Rate Limits: In periods of high volatility, Hyperliquid’s funding rates can reach up to 4% per hour, enabling swift corrections when perp prices deviate significantly from spot prices. Other DEXs typically impose much lower caps on funding rates, limiting their responsiveness during extreme market moves.

-

Transparent and Predictable Funding Formula: Hyperliquid uses a clear formula that combines a fixed interest rate component with a premium index, and applies a clamp function to limit extreme values. This approach is openly documented and easily auditable, whereas some DEXs use less transparent or more complex mechanisms.

-

Arbitrage Opportunities from Rate Discrepancies: The difference in funding mechanisms creates arbitrage opportunities for traders. For example, in 2025, shorting SOLUSDT perps on BitMEX (with higher funding rates) and longing on Hyperliquid (with near-zero rates) yielded an annualized return of 15.6%. Such opportunities are less common on DEXs with similar or synchronized funding models.

Unique Features That Set Hyperliquid Apart

A few innovations make Hyperliquid’s perp funding model particularly robust:

- Oracle-Based Pricing: By using external oracles for spot prices rather than relying solely on internal order books, Hyperliquid reduces susceptibility to manipulation and better reflects broader market dynamics (source).

- High-Frequency Adjustments: Hourly settlements mean that traders face less lag when markets become volatile, an important advantage when large price swings can rapidly alter risk profiles (source).

- Extreme Funding Flexibility: In rare cases of severe dislocation, rates can spike up to 4% per hour, far higher than most platforms allow, enabling swift realignment of perp prices with underlying assets.

This unique combination empowers active traders while providing safeguards against manipulation and excessive divergence from fair value.