Deep liquidity is the lifeblood of any high-performance perpetual DEX. Yet, for years, traders have been told that only centralized market makers could keep order books thick and spreads razor-tight. Hyperliquid-Style Perps flips this narrative on its head. By engineering a protocol-native liquidity engine, Hyperliquid delivers relentless depth and seamless execution, without ever ceding control to centralized whales or opaque desks.

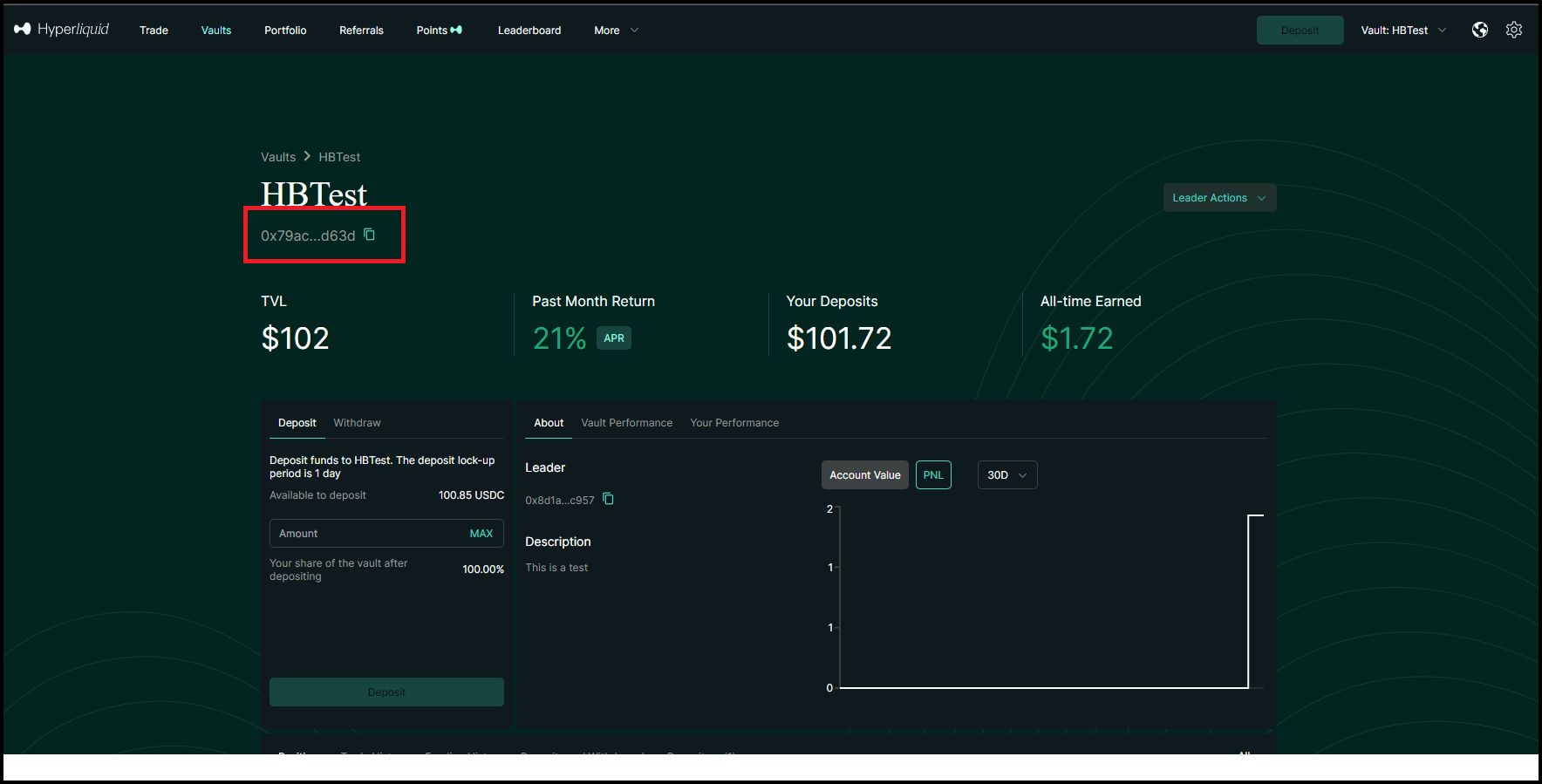

The HLP Vault: Protocol-Powered Market Making

At the heart of Hyperliquid-Style Perps’ liquidity mechanism is the Hyperliquidity Provider (HLP) vault, a decentralized pool that acts as the ultimate counterparty for unmatched trades and liquidations. When your limit order doesn’t immediately find a match, the HLP vault steps in, absorbing risk and keeping markets humming. No more waiting for some offshore desk to pick you off; every trade is instantly matched or backstopped by protocol-owned capital.

This isn’t just about speed, it’s about democratizing yield and risk. Anyone can deposit USDC into the HLP vault, earning a share of platform revenue and P and L. With yields reportedly reaching up to 17% APY, users are incentivized to provide liquidity directly to the protocol, not some shadowy third party. When volatility spikes and liquidations surge, the HLP vault absorbs positions smoothly, no flash crashes, no cliff-edge price drops.

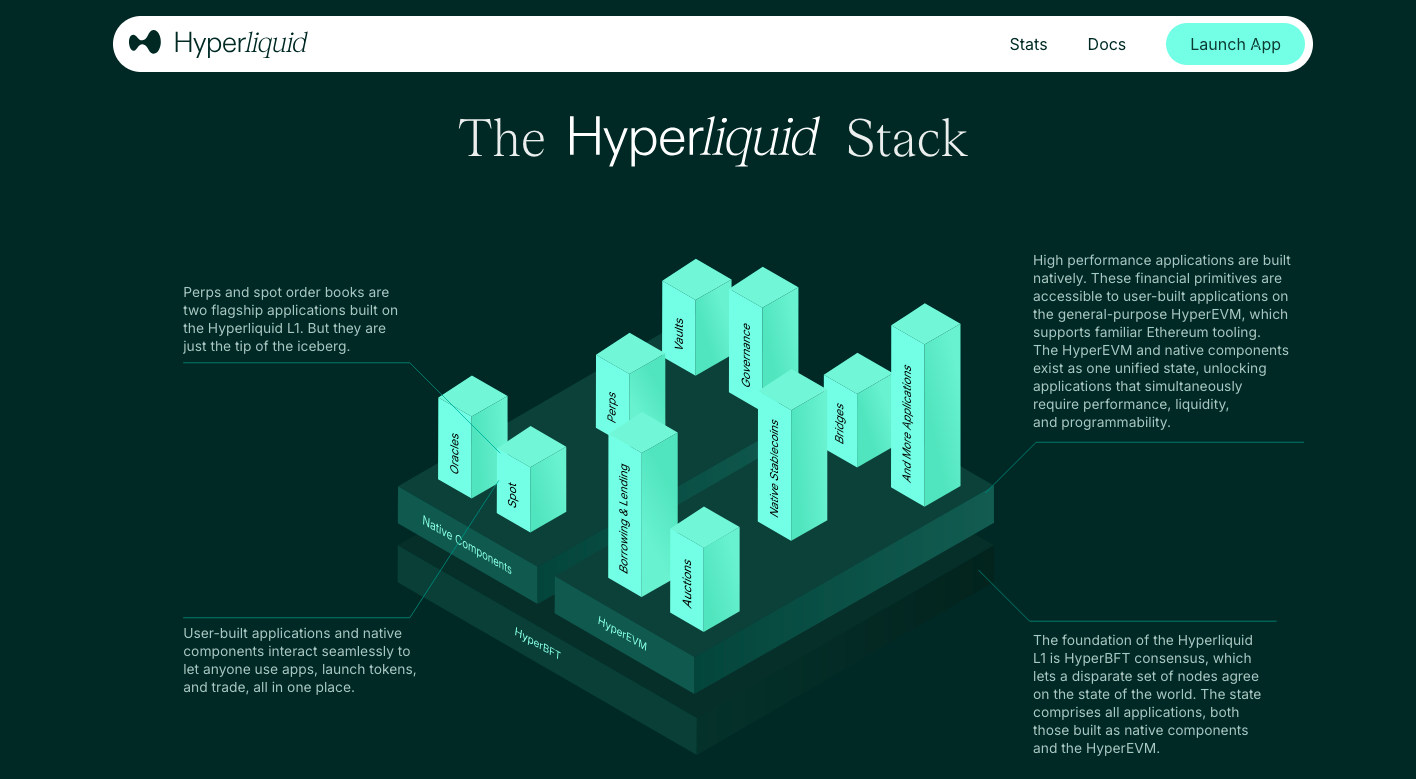

On-Chain Order Book: Full Transparency Meets CEX Performance

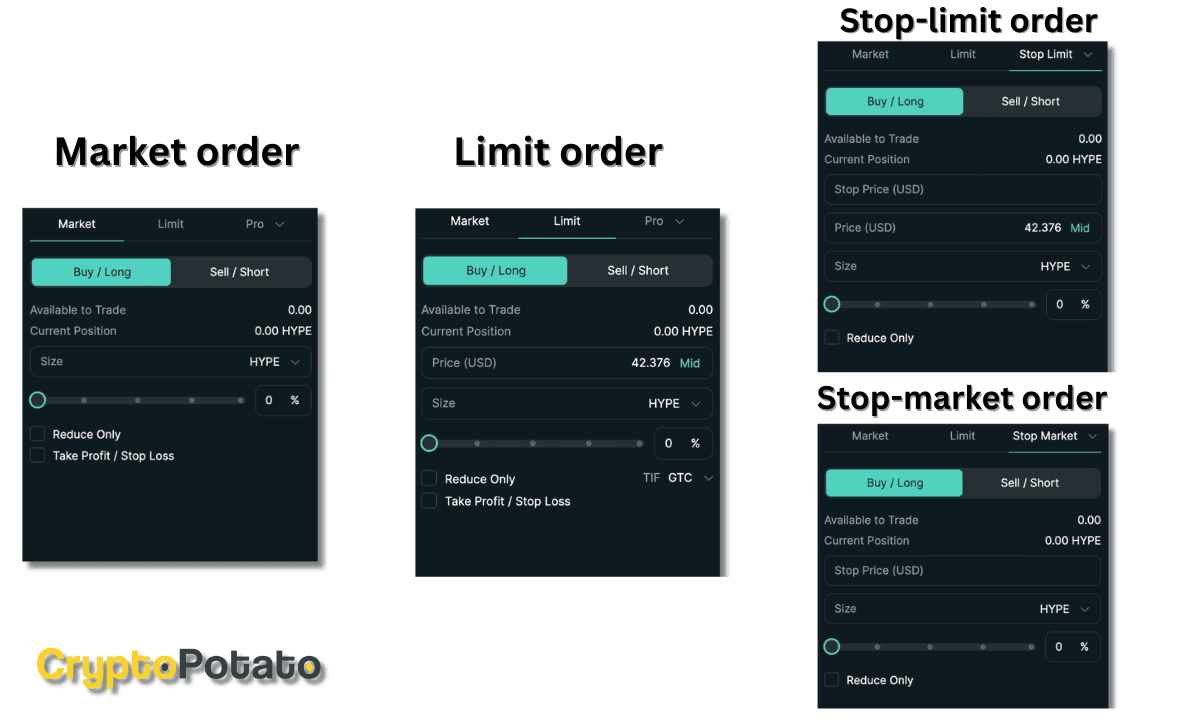

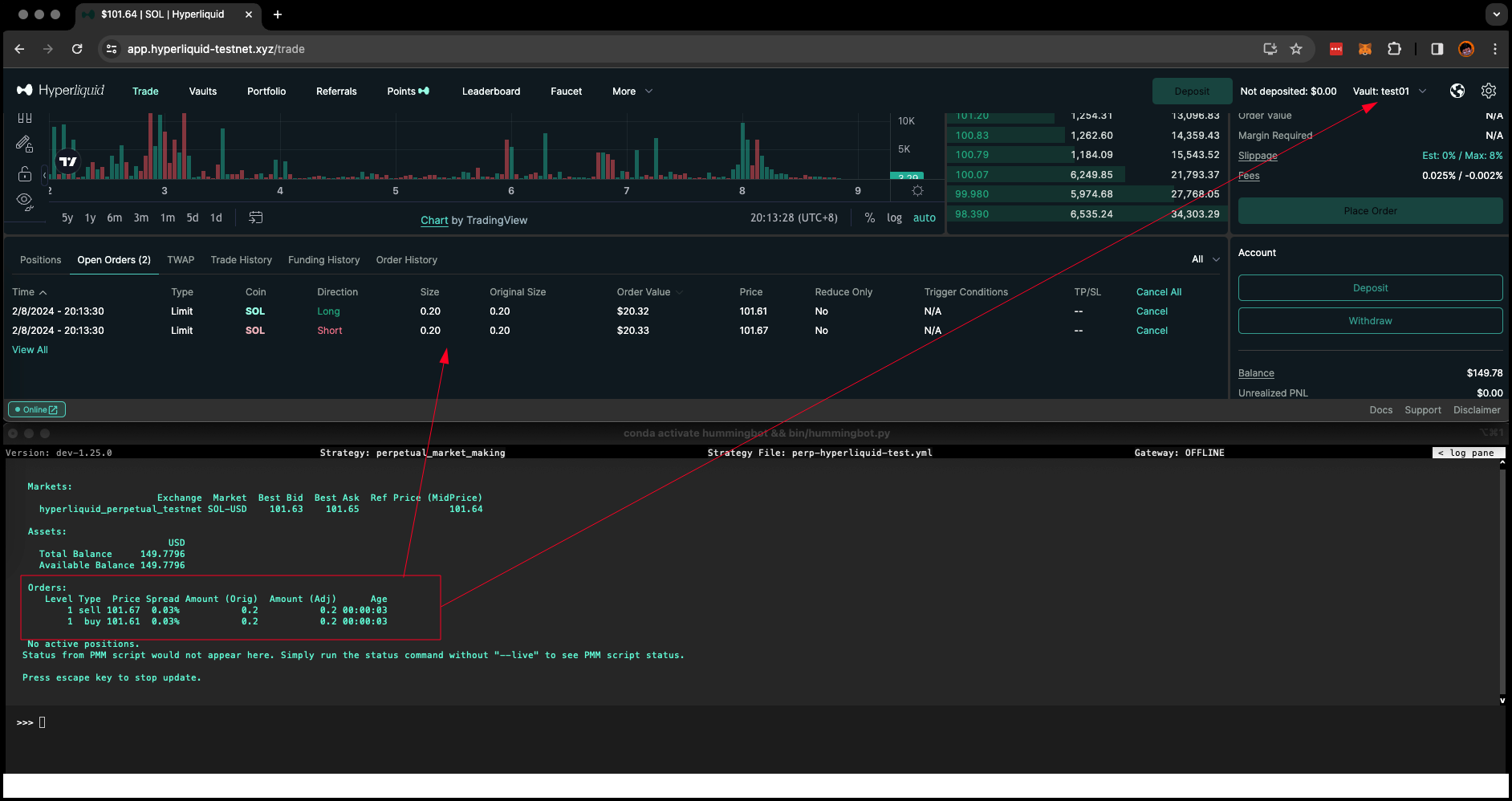

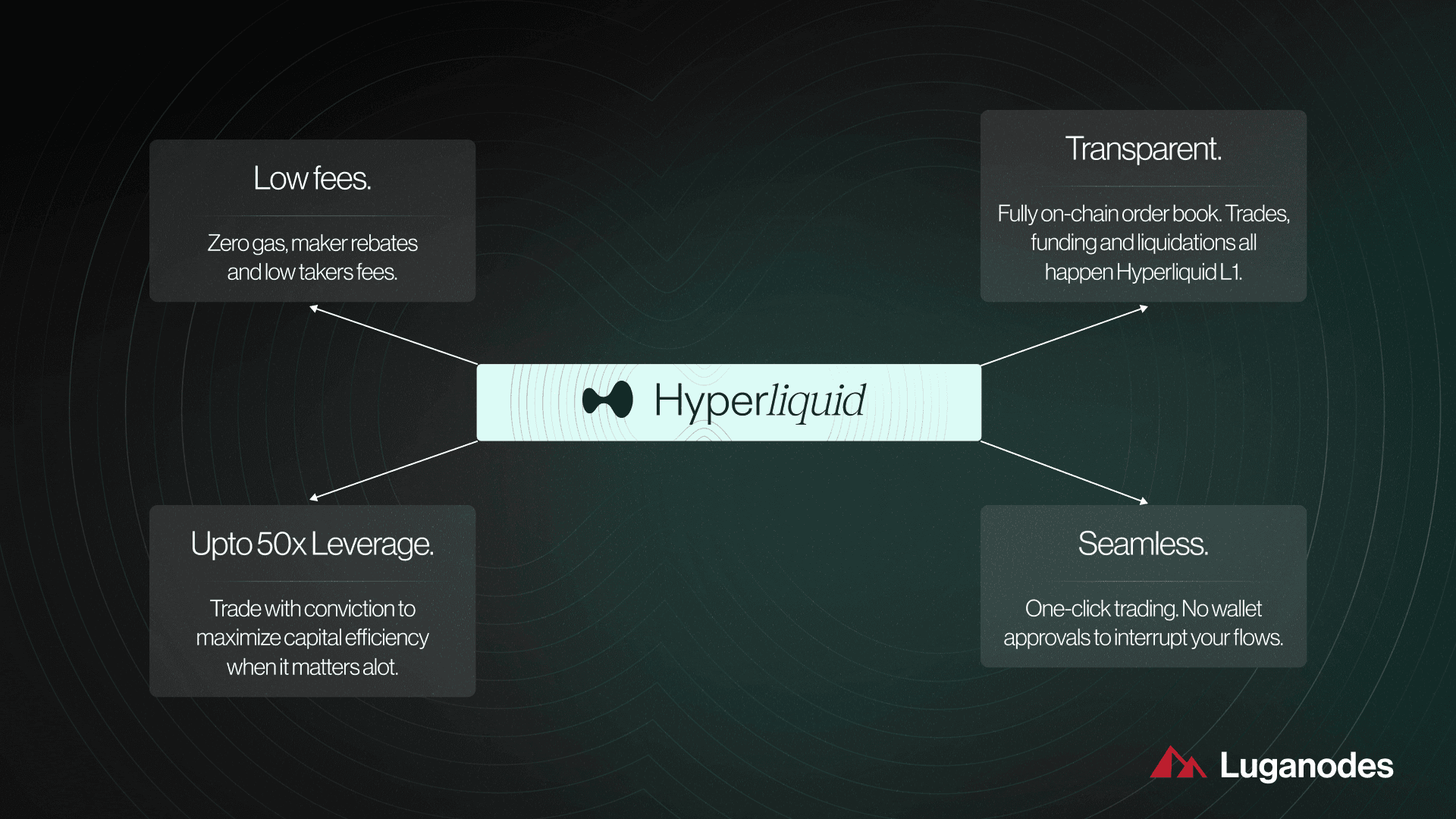

Forget black-box matching engines or backroom deals. Hyperliquid’s fully on-chain central limit order book (CLOB) brings radical transparency to every trade, quote, and fill. Liquidity providers can place bids and offers with surgical precision, managing their exposure in real time, just like on a top-tier centralized exchange.

The result? Order book depth DeFi has never seen before. Spreads stay tight even during heavy volume surges or wild price swings. Traders get best-in-class execution quality without sacrificing self-custody or composability. And because it’s all on-chain, every move is auditable by anyone at any time.

3 Advantages of Hyperliquid’s Decentralized Model

-

Protocol-Managed Liquidity (HLP Vault): Hyperliquid’s HLP vault acts as an always-on market maker, automatically providing deep liquidity and tight spreads—even during volatile markets. Users can earn up to 17% APY by supplying USDC, sharing in platform revenue and P&L, unlike CEXs where market making is exclusive to select firms.

-

Fully On-Chain Order Book: Hyperliquid uses a central limit order book (CLOB) that operates entirely on-chain. This ensures full transparency and allows traders and liquidity providers to manage risk with precision, matching the speed and efficiency of centralized exchanges but without opaque practices.

-

Community-Aligned Incentives & Governance: Hyperliquid redistributes protocol fees to benefit its community. Fees flow into the Assistance Fund for HYPE token buybacks and the HLP vault, aligning incentives between traders and liquidity providers—unlike CEXs where profits typically go to the platform alone.

Funding Rate Fairness: Aligning Perps With Reality

Sick of manipulated funding rates or wild price deviations? Hyperliquid-Style Perps solves this with an algorithmic funding rate pegged to external oracle prices, not internal gamesmanship. Funding is collected every eight hours (and can spike up to 4% per hour in extremes), ensuring that perp prices stay glued to spot reality, even when sentiment goes parabolic.

This mechanism keeps both longs and shorts honest while eliminating arbitrage opportunities for insiders, a crucial piece of sustainable perpetual DEX liquidity. The system isn’t just fair; it’s ruthlessly efficient at reflecting true market consensus.

But the magic doesn’t stop there. Hyperliquid’s approach to decentralized market making is reinforced by a game-changing fee structure and community-centric governance. Instead of siphoning profits off to a handful of privileged insiders, Hyperliquid routes a significant share of protocol fees back into the ecosystem, fueling both the HLP vault and the broader user base.

Every trade you make helps strengthen liquidity for everyone, not just a select few.

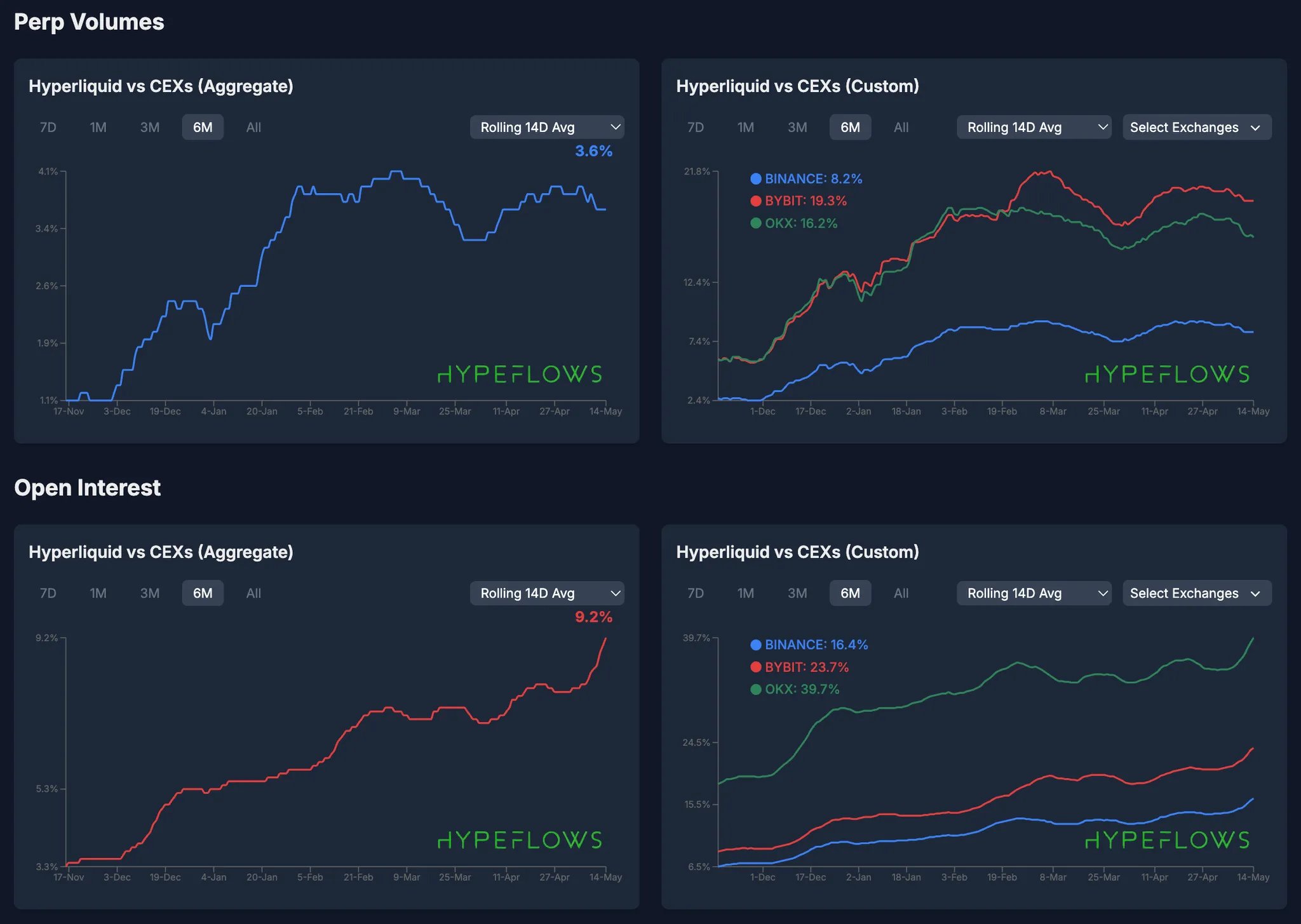

Fees collected from trading activity are split between two powerful engines: a portion flows into the Assistance Fund, which actively buys back and burns HYPE tokens (reducing supply and supporting token value), while the rest is redirected straight into the HLP vault. This means that as trading volume explodes, like we’ve seen with daily volumes now topping $30 billion: the incentives for liquidity providers only get juicier. (Read more about Hyperliquid’s explosive growth)

Community Power: Decentralized Governance in Action

Hyperliquid-Style Perps isn’t just another DeFi protocol with a slick UI. It’s governed by its users, with proposals and upgrades driven by community consensus. This ensures that protocol parameters: from funding intervals to listing new assets, aren’t dictated by centralized interests but evolve organically based on trader demand and market realities.

This decentralized approach has allowed Hyperliquid to outmaneuver legacy exchanges and even other upstart DEXs like Aster. The protocol can rapidly adapt to changing liquidity conditions, implement new risk controls, or tweak incentives, all without waiting for a boardroom sign-off or VC blessing. It’s DeFi at full throttle.

The Big Picture: Deep Liquidity Without Compromise

If you’re still clinging to the myth that only centralized market makers can deliver real depth, it’s time for an upgrade. Hyperliquid-Style Perps proves that you can have relentless execution speed, rock-solid order book depth, and bulletproof transparency, all without ceding control to shadowy desks or middlemen.

The numbers speak for themselves: capturing over 80% of decentralized perps market share and routinely processing $30 billion in daily volume isn’t luck, it’s architecture built for traders who demand more.

Whether you’re a high-frequency scalper or a casual degen hunting momentum plays, Hyperliquid offers an environment where your trades don’t just get filled, they help fuel an unstoppable flywheel of community-driven liquidity.

Ready to experience true decentralized market making? The future is already here, and it’s wide open.

Top Reasons Traders Are Switching to Hyperliquid-Style Perps

-

Deep, Continuous Liquidity via HLP Vault: Hyperliquid’s Hyperliquidity Provider (HLP) vault ensures tight spreads and instant order matching by actively market-making and handling liquidations—without centralized market makers. Users can earn up to 17% APY by depositing USDC into the vault.

-

Fully On-Chain Order Book Transparency: Hyperliquid operates a central limit order book (CLOB) entirely on-chain, providing unmatched transparency and execution quality that rivals centralized exchanges.

-

Fair Pricing with Oracle-Based Funding Rates: The platform uses an oracle-driven funding rate mechanism to keep perpetual prices in line with spot markets, protecting traders from manipulation and ensuring fair trades—even during volatile conditions.

-

Community-Aligned Incentives & Fee Distribution: Protocol fees are shared with the community—part goes to buy back and burn HYPE tokens, while the rest supports the HLP vault, aligning trader and liquidity provider interests for a robust ecosystem.

-

Performance & Security on a Custom Layer-1: Built on its own high-performance Layer-1 blockchain, Hyperliquid delivers CEX-level speed and reliability with the security and transparency of DeFi.