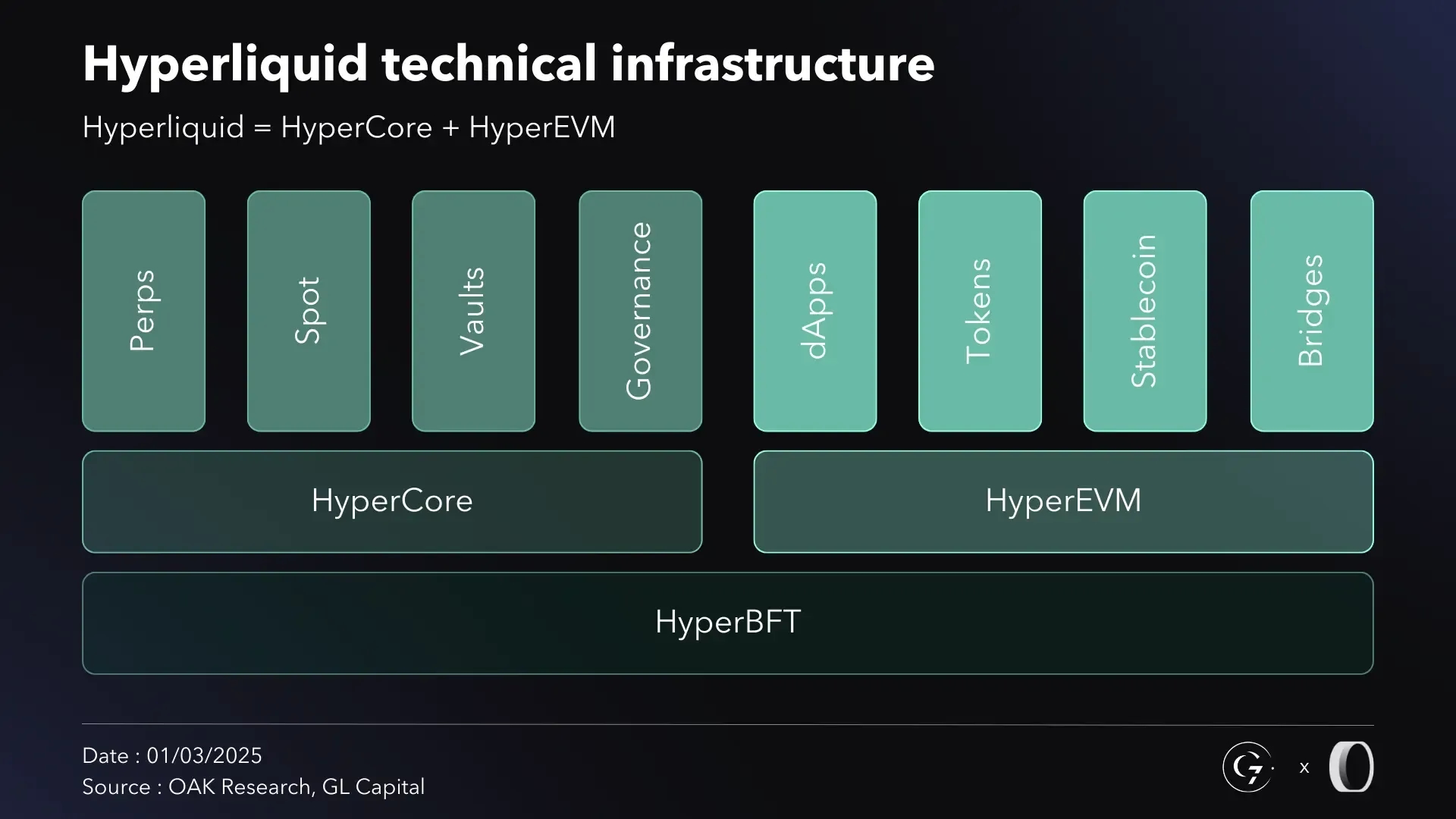

Speed, precision, and adaptability – these are the pillars of elite trading on Hyperliquid-Style Perps. The DeFi landscape is evolving at breakneck pace, and if you want to stay ahead of the pack, you need strategies that squeeze every drop of efficiency out of this next-gen perpetual DEX. Forget the old CEX playbook. On Hyperliquid, it’s all about leveraging decentralized infrastructure for lightning-fast execution without sacrificing transparency or security.

Mastering Order Execution: Limit Orders for Pinpoint Accuracy

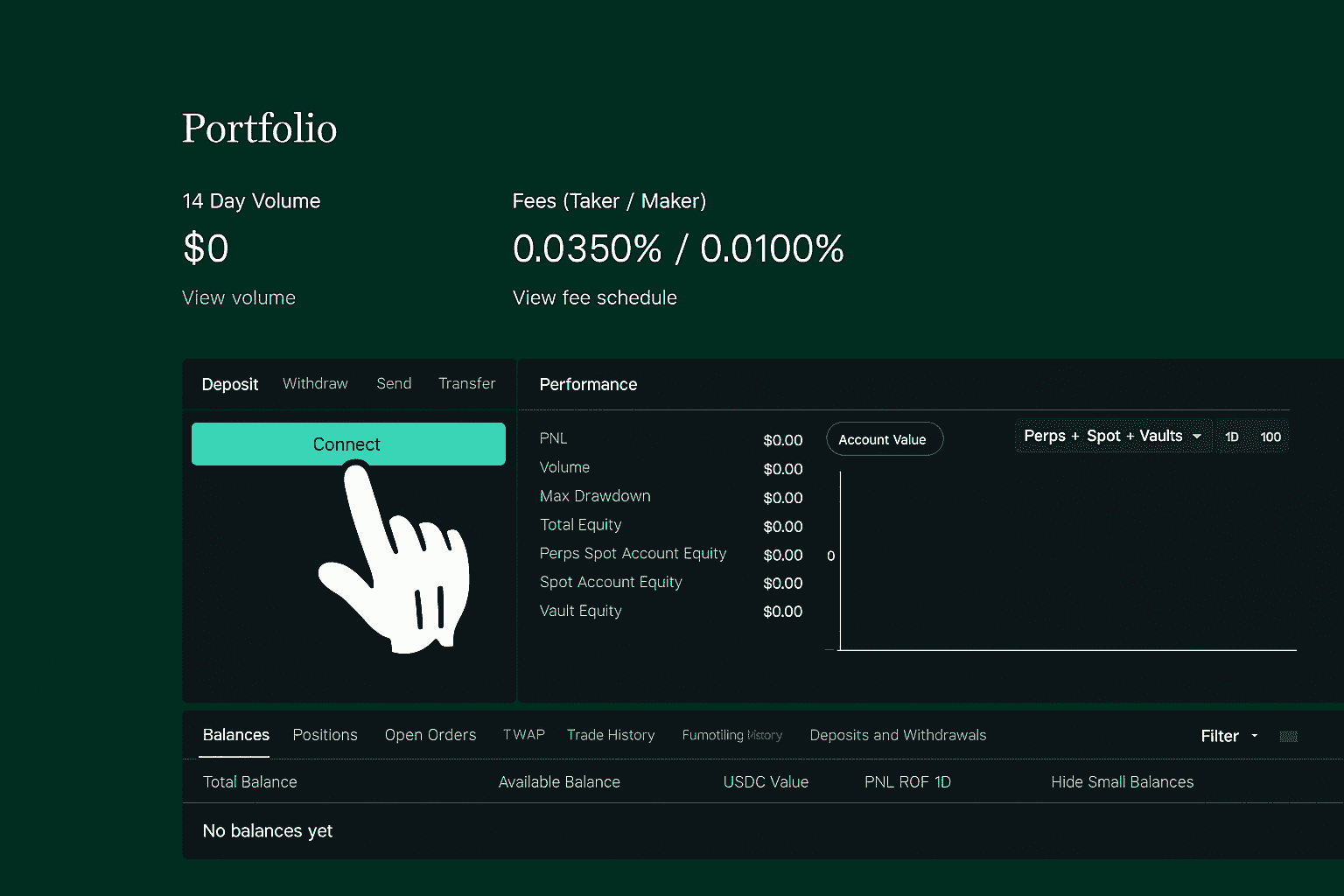

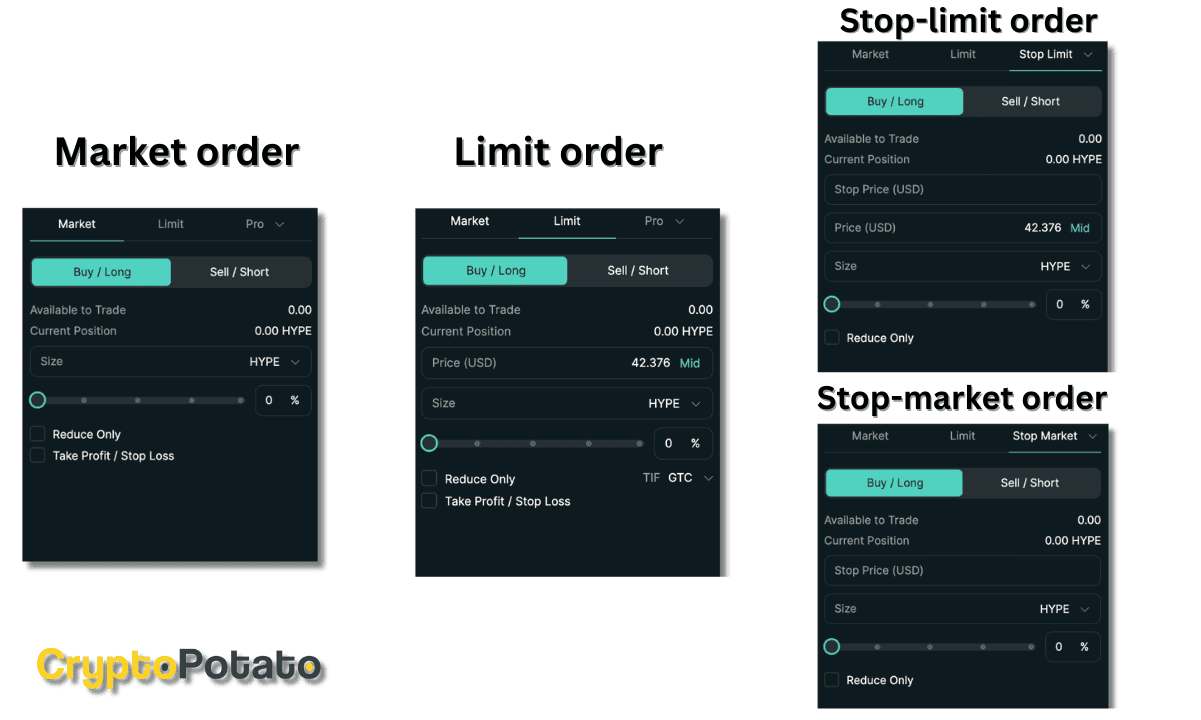

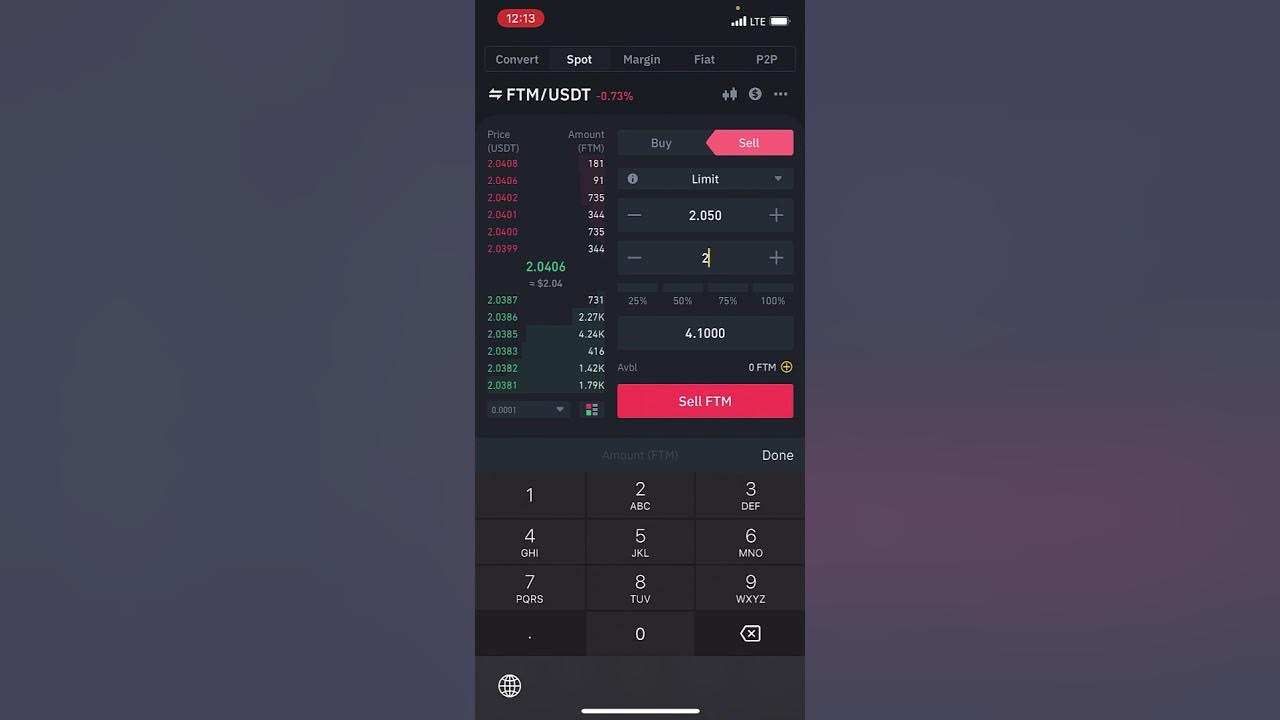

First up: Utilize Limit Orders for Precision and Reduced Slippage. In volatile DeFi markets, market orders can chew through your profits with unexpected slippage. On Hyperliquid-Style Perps, limit orders let you dictate your exact entry or exit price – no more surprises. Whether you’re laddering into a position or sniping a quick scalp, setting strategic limit orders helps you avoid getting picked off by bots or whales lurking in shallow order books.

Dynamic Position Sizing: Adapt to Volatility in Real Time

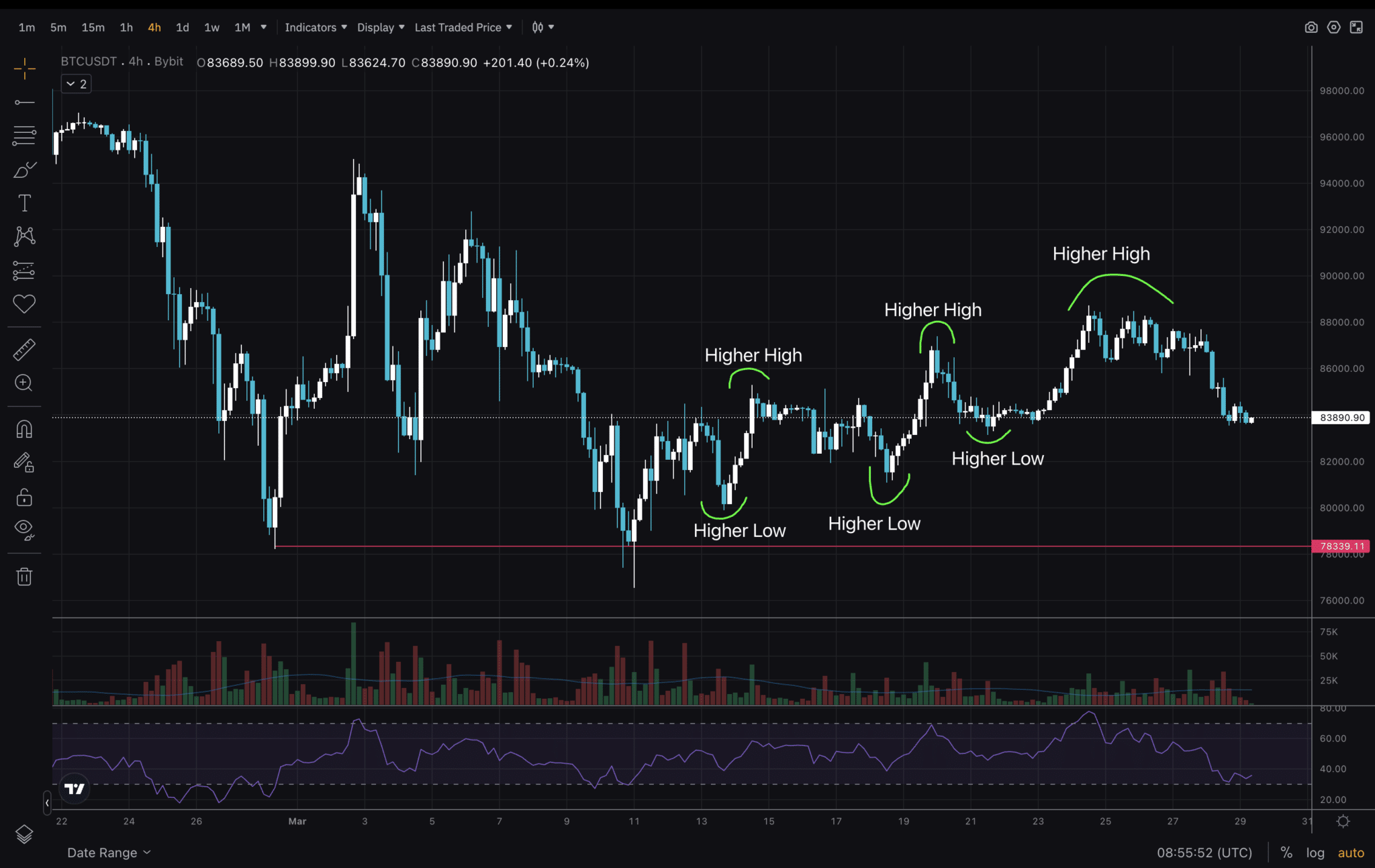

The second key move: Employ Dynamic Position Sizing Based on Volatility Metrics. Static position sizing is a relic from the slow days of legacy finance. On-chain volatility indicators give you real-time feedback on market conditions so you can size up or scale down positions instantly. When volatility spikes, dial back size to protect your capital from liquidation cascades. When things calm down, go bigger and press your edge.

5 Ways to Use Volatility Metrics for Dynamic Position Sizing

-

Utilize Limit Orders for Precision and Reduced Slippage: Place limit orders on platforms like Hyperliquid to control entry and exit prices, especially during high volatility. This minimizes slippage and ensures you only enter trades at your chosen price points.

-

Employ Dynamic Position Sizing Based on Volatility Metrics: Adjust your position size using volatility indicators such as Average True Range (ATR) or Historical Volatility. For example, reduce size during volatile swings and scale up when markets are calm to optimize risk and reward.

-

Leverage On-Chain Analytics for Real-Time Funding Rate Arbitrage: Use tools like Dune Analytics or DefiLlama to monitor funding rates across DEXs. Capitalize on discrepancies by dynamically sizing positions where negative funding rates offer recurring payments.

-

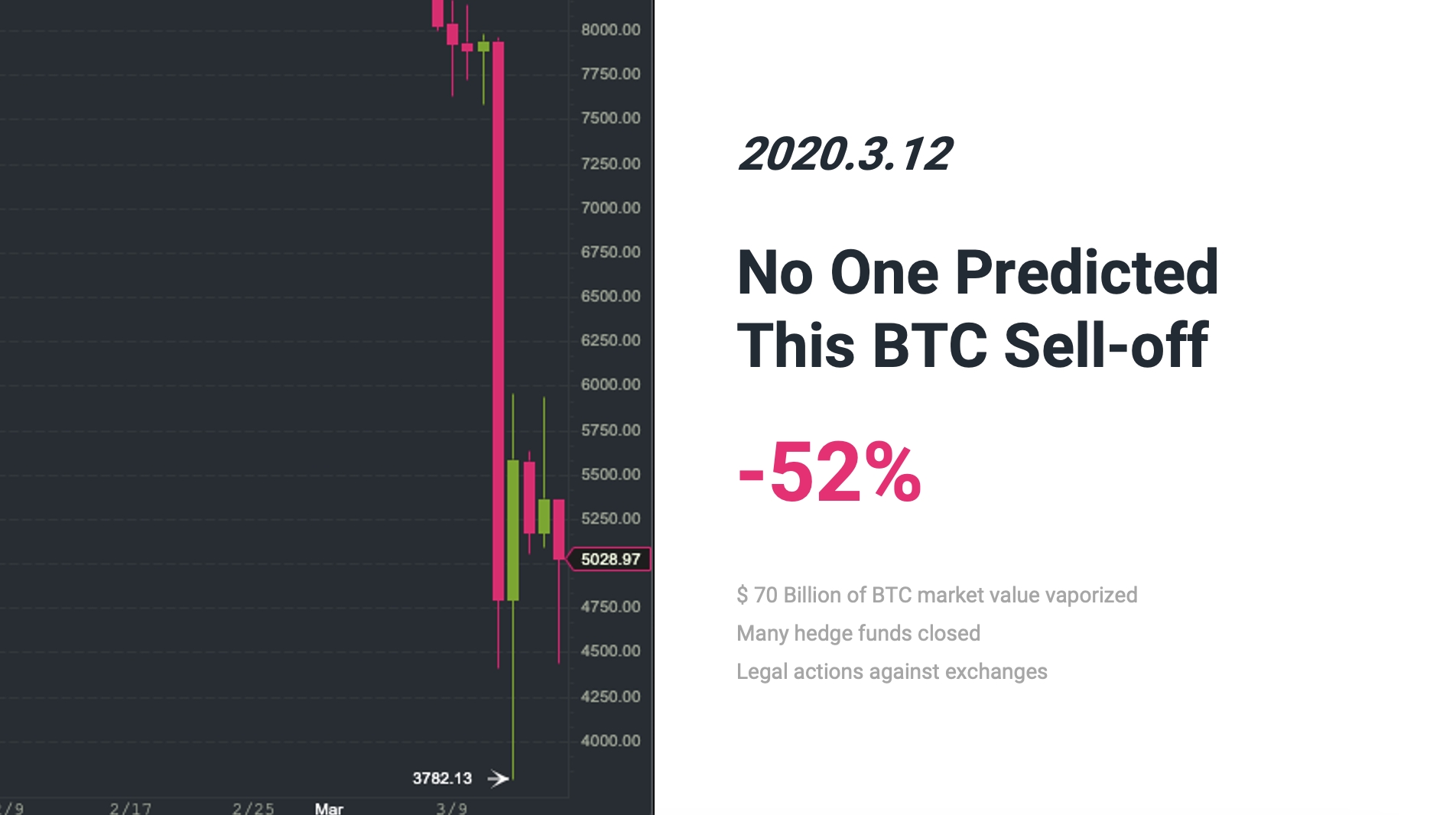

Implement Strict Risk Management with Automated Stop-Losses: Set automated stop-loss orders on Hyperliquid to protect capital. Combine with volatility-based triggers—wider stops during high volatility, tighter stops in stable periods—for smarter, dynamic risk control.

-

Monitor Order Book Depth to Optimize Entry and Exit Timing: Analyze order book depth using Hyperliquid’s real-time interface. Enter or exit trades when liquidity is deepest to minimize price impact, especially during volatile market moves.

Funding Rate Arbitrage: Exploit On-Chain Opportunities

Third on the list – and a favorite among advanced perps traders – is Leverage On-Chain Analytics for Real-Time Funding Rate Arbitrage. Funding rates are constantly shifting as sentiment whipsaws between bullish and bearish extremes. By tracking these rates across DeFi and CeFi venues using on-chain analytics tools, you can spot when Hyperliquid’s funding rate diverges from the broader market. This opens up pure alpha plays where you earn funding payments simply by holding the right side of the trade.

If you’re serious about maximizing efficiency in perpetual trading, these three strategies will put you miles ahead of most traders still stuck in outdated routines. But don’t stop here – risk management and timing are just as critical for sustainable success…

Automated Defense: Strict Risk Management with Stop-Losses

Fourth, let’s talk survival: Implement Strict Risk Management with Automated Stop-Losses. Even the sharpest strategies can get blindsided by a sudden wick or flash crash. Hyperliquid-Style Perps makes it seamless to set automated stop-loss orders that instantly cut your losses when price action turns against you. Don’t leave your capital exposed, define your risk per trade, set those stops, and let automation save you from emotional decision-making. Smart traders pre-plan their exits as carefully as their entries, ensuring every position has a clear invalidation point.

Order Book Mastery: Timing Your Move for Maximum Impact

The final piece: Monitor Order Book Depth to Optimize Entry and Exit Timing. On-chain order books are transparent but can be thin or fragmented during high-volatility surges. By actively monitoring real-time order book depth on Hyperliquid-Style Perps, you can anticipate where liquidity clusters and avoid getting front-run or slipping through illiquid zones. Scalpers and swing traders alike benefit from watching the book: enter when size is thick, exit before the crowd piles in. This is how you consistently get fills at your price, not someone else’s.

5 Advanced Strategies for Hyperliquid Perps Efficiency

-

Utilize Limit Orders for Precision and Reduced Slippage: Place limit orders on Hyperliquid to control your entry and exit prices, minimizing slippage and ensuring trades execute only at your desired levels. This is crucial in volatile markets and leverages Hyperliquid’s CEX-style order book for optimal execution.

-

Employ Dynamic Position Sizing Based on Volatility Metrics: Adjust your trade sizes in real time using volatility indicators (such as ATR or realized volatility) to manage risk exposure. This approach helps you scale positions up in stable periods and down during high volatility, optimizing capital efficiency.

-

Leverage On-Chain Analytics for Real-Time Funding Rate Arbitrage: Use on-chain analytics tools (like Dune Analytics or Token Terminal) to monitor funding rates across platforms. Identify and exploit discrepancies for funding rate arbitrage, earning from negative funding payments or premium index deviations on Hyperliquid perps.

-

Implement Strict Risk Management with Automated Stop-Losses: Set automated stop-loss orders on every trade to protect your capital from sharp market moves. Hyperliquid supports advanced order types, letting you automate risk controls and avoid emotional decision-making during periods of high volatility.

-

Monitor Order Book Depth to Optimize Entry and Exit Timing: Regularly analyze the order book depth on Hyperliquid to spot liquidity clusters and avoid thin markets. Timing your trades based on real-time depth data reduces market impact and improves fill quality, especially for larger positions.

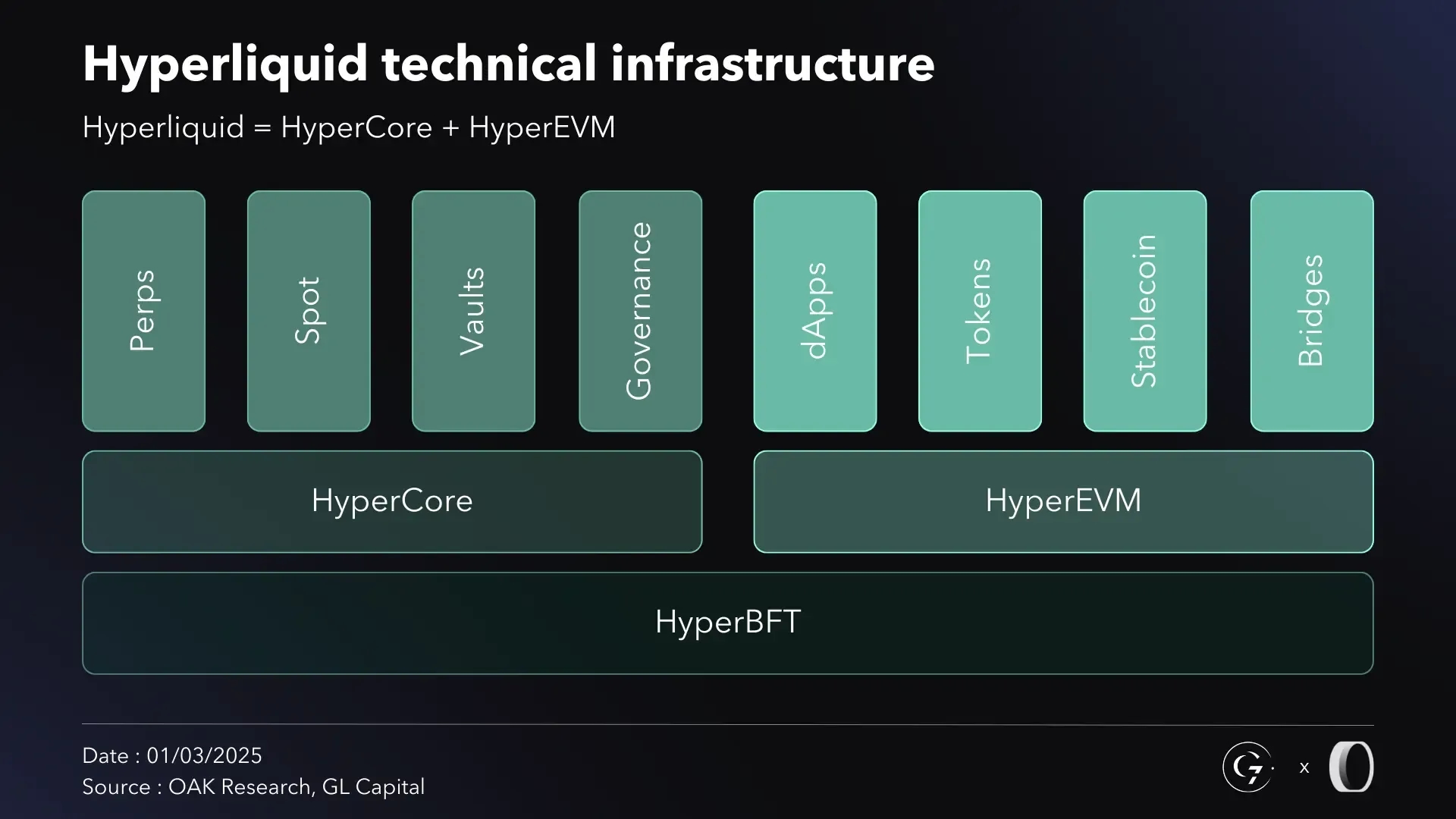

Hyperliquid’s architecture gives you the tools to execute these moves at blazing speeds, without centralized friction or gas headaches. Want to see these tactics in action? Check out how pro traders are stacking gains by combining all five strategies for an edge that compounds over time.

Timing is everything in the fast lane. The difference between a winning trade and a liquidation can be milliseconds, or one smartly placed stop-loss.

Ready to level up? Start with precision limit orders, size dynamically with volatility, pounce on funding rate arbitrage, defend every position with stops, and time your trades using live order book data. This isn’t just theory, it’s a playbook for dominating DeFi’s fastest perps DEX.